Taking control of your finances can feel daunting, but understanding the fundamentals of personal finance empowers you to build a secure financial future. This guide explores the key aspects of Keuangan Pribadi, from budgeting and debt management to investing and protecting your financial well-being. We’ll break down complex concepts into manageable steps, providing practical strategies and actionable advice to help you achieve your financial goals.

Whether you’re just starting out or looking to refine your existing financial habits, this comprehensive resource will equip you with the knowledge and tools to make informed decisions about your money. From creating a realistic budget to understanding investment options, we’ll cover everything you need to know to navigate the world of personal finance with confidence.

Understanding Personal Finance Basics (“Keuangan Pribadi”)

Effective personal finance management is crucial for achieving financial security and fulfilling your life goals. Understanding fundamental principles and implementing a well-structured plan are key to building a strong financial foundation. This section Artikels the core components of personal finance management, guiding you towards creating a personalized financial plan.

Fundamental Principles of Personal Finance Management

Successful personal finance hinges on several key principles. These include budgeting to track income and expenses, saving consistently to build a financial safety net and achieve long-term goals, and investing wisely to grow your wealth over time. Managing debt effectively, including minimizing high-interest debt and strategically using credit, is also vital. Finally, regular review and adjustment of your financial plan ensure it remains aligned with your evolving needs and circumstances.

Key Components of a Personal Budget

A personal budget is a crucial tool for tracking income and expenses, enabling informed financial decisions. It typically includes a detailed breakdown of income sources (salary, investments, etc.) and expense categories (housing, food, transportation, entertainment, etc.). By comparing income against expenses, you can identify areas for potential savings and adjustments. A well-structured budget provides a clear picture of your financial health and facilitates better financial control.

Creating a Personal Financial Plan: A Step-by-Step Guide

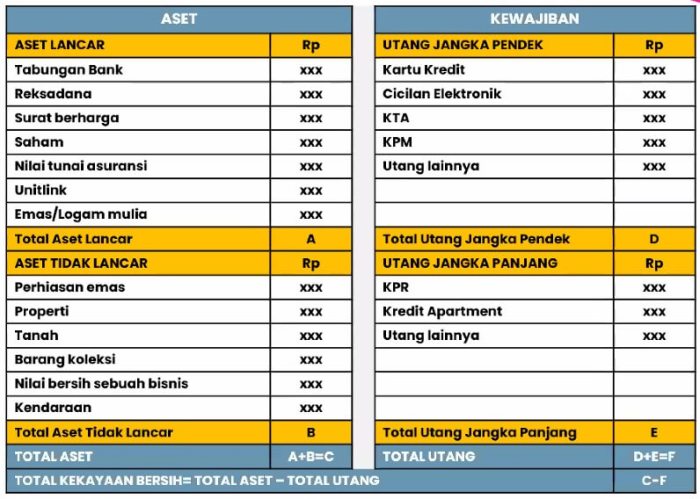

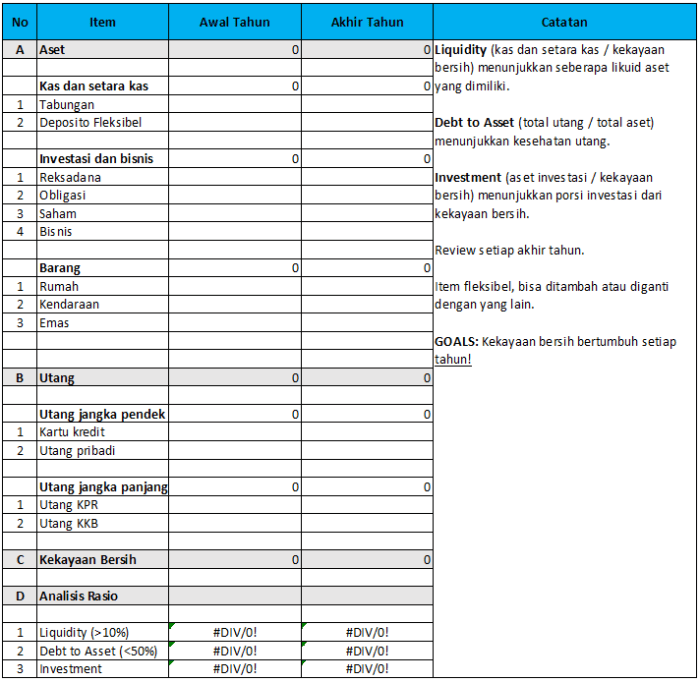

Developing a comprehensive personal financial plan involves a structured approach. First, define your short-term and long-term financial goals (e.g., paying off debt, saving for a down payment, retirement planning). Next, assess your current financial situation, including assets, liabilities, and income. Then, create a realistic budget, allocating funds towards your goals. Regularly monitor your progress, making necessary adjustments to stay on track. Finally, consider seeking professional financial advice if needed.

Examples of Common Financial Goals

Many individuals share common financial aspirations. Saving for retirement is a primary goal, often achieved through employer-sponsored retirement plans (401k, pension) and individual retirement accounts (IRA). Buying a house is another significant goal, requiring careful planning and saving for a down payment and understanding mortgage options. Other common goals include paying off student loans, funding a child’s education, and building an emergency fund to cover unexpected expenses.

Personal Finance Plan Components

| Component | Description | Example | Actionable Steps |

|---|---|---|---|

| Budgeting | Tracking income and expenses to understand spending habits. | Monthly income of $5000, expenses of $4000, leaving $1000 for savings and debt repayment. | Use budgeting apps or spreadsheets to record all income and expenses. Categorize expenses to identify areas for potential savings. |

| Saving | Setting aside a portion of income for future goals. | Saving 20% of monthly income for retirement. | Automate savings transfers to a separate account. Consider high-yield savings accounts for better returns. |

| Investing | Growing wealth over time through various investment vehicles. | Investing in a mix of stocks, bonds, and real estate. | Research different investment options, considering risk tolerance and financial goals. Consult a financial advisor if needed. |

| Debt Management | Strategies for minimizing and paying off debt. | Prioritizing high-interest debt repayment using the debt avalanche or snowball method. | Create a debt repayment plan, focusing on high-interest debts first. Explore debt consolidation options if necessary. |

Budgeting and Expense Tracking

Effective budgeting and expense tracking are fundamental to achieving your financial goals. Understanding where your money goes is the first step towards making informed financial decisions and building a secure financial future. This section will guide you through creating a budget, exploring different budgeting methods, and utilizing effective expense tracking techniques.

Sample Monthly Budget Template

A well-structured budget helps visualize income and expenses, facilitating better financial management. The following table provides a sample monthly budget template. Remember to adjust categories and amounts to reflect your individual circumstances.

| Income | Amount |

|---|---|

| Salary/Wages | $XXXX |

| Other Income (e.g., Investments, Side Hustle) | $XXX |

| Total Income | $XXXX |

| Expenses | Amount |

| Housing (Rent/Mortgage) | $XXX |

| Utilities (Electricity, Water, Gas) | $XXX |

| Transportation (Car Payment, Gas, Public Transport) | $XXX |

| Groceries | $XXX |

| Dining Out | $XXX |

| Entertainment | $XXX |

| Clothing | $XXX |

| Healthcare | $XXX |

| Debt Payments (Loans, Credit Cards) | $XXX |

| Other Expenses | $XXX |

| Total Expenses | $XXXX |

| Savings | Amount |

| Emergency Fund | $XXX |

| Retirement Savings | $XXX |

| Other Savings Goals | $XXX |

| Total Savings | $XXX |

Different Budgeting Methods

Several budgeting methods cater to different financial styles and goals. The 50/30/20 rule and zero-based budgeting are two popular approaches.

The 50/30/20 rule suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. For example, if your after-tax income is $4000, you would allocate $2000 to needs, $1200 to wants, and $800 to savings and debt.

The 50/30/20 rule provides a simple framework for budgeting, but its effectiveness depends on individual circumstances and financial goals.

Zero-based budgeting involves starting each month with a clean slate, allocating every dollar to a specific category. This method encourages mindful spending and prevents overspending. For instance, instead of having a general “entertainment” category, you might allocate specific amounts to movies, concerts, and dining out.

Expense Tracking App Comparison

Various expense tracking apps and methods offer different features and levels of convenience. Spreadsheet software, such as Microsoft Excel or Google Sheets, allows for customized tracking, but requires manual data entry. Dedicated budgeting apps, on the other hand, often offer automated features like bank account linking and spending categorization. The effectiveness of each method depends on individual preferences and technical skills. Some apps offer features like expense categorization, visual representations of spending habits, and goal-setting tools.

Effective Expense Categorization

Categorizing expenses provides valuable insights into spending patterns. Effective categorization involves grouping similar expenses together (e.g., “Groceries,” “Transportation,” “Entertainment”). Detailed subcategories can offer even more granular analysis (e.g., under “Transportation,” you could track “Gas,” “Public Transport,” and “Car Maintenance”). This allows for identification of areas where spending can be optimized.

Tips for Effective Expense Tracking

Effective expense tracking requires consistent effort and attention to detail. Here are some helpful tips:

- Track expenses daily or weekly to maintain accuracy.

- Use a method that suits your lifestyle and technical skills (app, spreadsheet, notebook).

- Categorize expenses consistently to facilitate analysis.

- Review your spending regularly to identify areas for improvement.

- Set realistic financial goals and track your progress.

Debt Management Strategies

Effective debt management is crucial for achieving long-term financial well-being. Understanding different strategies and their implications can significantly impact your ability to reduce debt and improve your financial health. This section explores various approaches to debt management, highlighting their benefits and drawbacks.

Debt Management Methods

Several strategies exist for tackling debt, each with its own advantages and disadvantages. The most common are the debt snowball and debt avalanche methods. Choosing the right method depends on your personality and financial situation.

| Debt Management Method | Description | Pros | Cons |

|---|---|---|---|

| Debt Snowball | Pay off the smallest debts first, regardless of interest rate, to build momentum and motivation. | Provides psychological boosts by quickly eliminating debts, leading to increased motivation. | May take longer to pay off high-interest debts, resulting in higher overall interest paid. |

| Debt Avalanche | Pay off the debts with the highest interest rates first, minimizing the total interest paid. | Minimizes total interest paid over the long term, saving money. | Can be less motivating initially, as the payoff process for larger debts might take longer. |

Implications of High-Interest Debt

High-interest debt, such as credit card debt, can significantly hinder financial progress. The high interest rates quickly accumulate, increasing the total amount owed and making it difficult to pay off the debt. This can lead to a cycle of debt, where minimum payments barely cover the interest, leaving the principal balance largely untouched. For example, a $5,000 credit card balance with a 20% interest rate can quickly balloon to a much larger amount if only minimum payments are made. This can severely limit your ability to save, invest, and achieve other financial goals.

Negotiating with Creditors

Negotiating with creditors can be a powerful tool in managing debt. It’s often possible to negotiate lower interest rates, reduced monthly payments, or even debt settlement. Approaching creditors with a respectful and well-prepared plan increases the chances of a successful negotiation. This plan should include your current financial situation, proposed payment terms, and a commitment to consistent payments. Documentation of your income and expenses can strengthen your negotiation position. Remember to document any agreements reached in writing.

Common Pitfalls in Debt Management

Several common pitfalls can hinder effective debt management. Ignoring high-interest debt, relying solely on minimum payments, and failing to create a realistic budget are major obstacles. Additionally, taking on new debt while struggling to manage existing debt can exacerbate the problem. Avoid impulse purchases and carefully consider the long-term implications before incurring new debt. Lack of financial planning and budgeting can also lead to repeated cycles of debt accumulation. Finally, neglecting to seek professional help when overwhelmed by debt can delay a solution and potentially worsen the situation.

Investing and Saving for the Future

Securing your financial future requires a proactive approach to saving and investing. It’s not just about putting money aside; it’s about strategically growing your wealth over time to achieve your long-term goals, whether that’s buying a home, funding your children’s education, or ensuring a comfortable retirement. Understanding different investment options and managing risk is crucial for building a strong financial foundation.

Investing wisely involves understanding your risk tolerance and diversifying your portfolio to mitigate potential losses. Diversification spreads your investments across different asset classes, reducing the impact of poor performance in any single area. A well-diversified portfolio balances risk and reward, aiming for steady growth over the long term.

Diversification of Investments

Diversification is a cornerstone of successful investing. It’s the practice of spreading your investments across different asset classes to reduce the overall risk of your portfolio. Instead of putting all your eggs in one basket, you spread them across several, minimizing the impact of any single basket breaking. For example, investing solely in technology stocks could be lucrative during a tech boom, but devastating during a downturn. A diversified portfolio, however, might include technology stocks, but also bonds, real estate, and other assets, softening the blow of any sector-specific downturn. This approach helps to cushion against market volatility and improve the chances of achieving consistent returns.

Investment Options Based on Risk Tolerance

Different investment options cater to varying levels of risk tolerance.

- Stocks (Equities): Stocks represent ownership in a company. They offer high growth potential but also carry higher risk. Stock prices can fluctuate significantly, leading to potential losses. For example, investing in a rapidly growing tech company could yield substantial returns, but it also carries a higher risk of significant losses if the company underperforms.

- Bonds: Bonds are essentially loans you make to a government or corporation. They generally offer lower returns than stocks but are considered less risky. Bonds provide a more stable income stream, making them suitable for investors seeking lower risk and predictable returns. A government bond, for instance, is typically considered a safer investment than a corporate bond.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management, making them a convenient option for beginners. Mutual funds provide a way to access a wider range of investments than you might be able to afford individually, reducing risk through diversification.

Opening a Savings Account or Investment Portfolio

Establishing a savings account or investment portfolio is a straightforward process.

- Choose a Financial Institution: Select a reputable bank or brokerage firm that meets your needs and offers competitive rates and services.

- Gather Necessary Documents: You’ll typically need identification documents, proof of address, and potentially other information depending on the institution and the type of account.

- Complete the Application: Fill out the application form accurately and completely. Be sure to understand the terms and conditions before signing.

- Fund Your Account: Deposit the initial amount you want to invest. You can typically transfer funds electronically or make a deposit in person.

- Begin Investing (if applicable): If opening an investment portfolio, research and select investments that align with your risk tolerance and financial goals.

Maximizing Investment Returns While Minimizing Risk

While high returns are desirable, minimizing risk is equally important.

- Dollar-Cost Averaging: Invest a fixed amount regularly regardless of market fluctuations. This strategy reduces the impact of market timing.

- Long-Term Investing: Invest for the long term (5-10 years or more) to allow your investments to grow and ride out market downturns.

- Rebalance Your Portfolio Regularly: Periodically adjust your portfolio to maintain your desired asset allocation and risk level. This helps to ensure you’re not overexposed to any single asset class.

- Seek Professional Advice: Consider consulting a financial advisor to help you create a personalized investment plan based on your individual circumstances and goals. A financial advisor can provide guidance on diversification, risk management, and investment strategies tailored to your needs.

Resources for Learning More About Investing

Numerous resources are available to expand your knowledge of investing.

- Investopedia: A comprehensive online resource offering definitions, articles, and tutorials on various investment topics.

- Books on Investing: Many excellent books provide detailed information on investment strategies and financial planning.

- Financial Literacy Websites: Many websites offer free resources and educational materials on personal finance and investing.

- Financial Advisors: Consult with a financial advisor for personalized guidance and support.

Protecting Your Financial Well-being

Securing your financial future requires more than just budgeting and investing; it necessitates proactive measures to protect your hard-earned wealth from unforeseen circumstances and potential threats. This involves safeguarding against risks and building a resilient financial foundation capable of weathering life’s unexpected storms. This section will explore key strategies for protecting your financial well-being.

The Importance of Insurance

Insurance acts as a crucial safety net, mitigating the financial burden of unexpected events. Health insurance provides coverage for medical expenses, preventing catastrophic debt from illness or injury. Life insurance offers financial security to dependents in the event of the policyholder’s death, ensuring their continued well-being. Property insurance protects your assets – home, car, etc. – from damage or loss due to accidents, theft, or natural disasters. The premiums paid are a small price to pay compared to the potential financial devastation these events could cause.

Benefits of an Emergency Fund

An emergency fund is a readily accessible pool of money designed to cover unexpected expenses, preventing you from resorting to high-interest debt. This fund should ideally cover 3-6 months of living expenses. Having this financial cushion offers peace of mind, allowing you to handle job loss, medical emergencies, or home repairs without jeopardizing your long-term financial goals. For example, a sudden car repair costing $1,000 would be easily manageable with an emergency fund, but could lead to debt if you lack this safety net.

Strategies for Protecting Against Identity Theft

Identity theft, the fraudulent use of someone’s personal information, can have devastating consequences. Protecting yourself involves vigilance and proactive measures. This includes regularly monitoring your credit reports for suspicious activity, using strong and unique passwords for online accounts, shredding sensitive documents before disposal, and being cautious about phishing scams – emails or messages designed to trick you into revealing personal information. Consider using credit monitoring services to further enhance your protection.

Common Financial Scams and Avoidance Strategies

Numerous financial scams target unsuspecting individuals. Common examples include investment schemes promising unrealistically high returns, advance-fee fraud (where upfront payment is required for a promised service that never materializes), and phishing scams disguised as legitimate organizations. To avoid these scams, be wary of unsolicited investment offers, thoroughly research any investment opportunity before committing funds, and never share sensitive personal information via email or phone unless you initiated the contact and are certain of the recipient’s legitimacy.

Responding to Financial Emergencies

A flowchart can provide a structured approach to handling financial emergencies:

[Imagine a flowchart here. The flowchart would begin with a “Financial Emergency?” box. A “Yes” branch would lead to boxes for “Assess the Situation,” “Utilize Emergency Fund,” “Seek Financial Assistance (family, friends, credit union),” “Explore Debt Consolidation/Management Options,” and finally “Review Budget and Spending Habits.” A “No” branch would simply loop back to the beginning. Each box would have connecting arrows to illustrate the flow.]

Financial Goal Setting and Achievement

Achieving financial well-being requires a clear understanding of your aspirations and a structured plan to reach them. Setting and achieving financial goals provides direction and motivation, transforming abstract financial desires into concrete, measurable progress. This section will Artikel the process of setting effective financial goals and provide strategies for staying motivated throughout the journey.

Setting SMART financial goals is a crucial first step. This involves defining goals that are Specific, Measurable, Achievable, Relevant, and Time-bound. By following this framework, you can create goals that are both ambitious and realistic.

SMART Goal Setting

The SMART framework provides a practical method for creating effective financial goals. A Specific goal clearly defines what you want to achieve, leaving no room for ambiguity. A Measurable goal includes quantifiable metrics to track progress. Achievable goals are realistic, considering your current financial situation and resources. Relevant goals align with your overall financial objectives and values. Finally, Time-bound goals include a specific deadline, adding urgency and accountability. For example, instead of setting a vague goal like “save more money,” a SMART goal might be “save $5,000 for a down payment on a car within 18 months.”

Progress Tracking Methods

Several methods can effectively track progress toward financial goals. Regularly monitoring your progress is essential for staying on track and making necessary adjustments.

- Spreadsheet Tracking: A simple spreadsheet can effectively track income, expenses, and savings progress towards various goals. Categorizing expenses allows for easy identification of areas for improvement.

- Budgeting Apps: Numerous budgeting apps provide automated tracking and analysis of financial data, offering visual representations of progress and potential areas for improvement. Many offer goal-setting features integrated directly into their systems.

- Financial Goal Journals: A dedicated journal can help visualize progress and provide a space for reflection and adjustments to the plan. This method allows for a more holistic approach, incorporating both financial and emotional aspects of goal achievement.

Examples of Financial Goals

Financial goals can range from short-term, easily attainable objectives to long-term, significant milestones.

- Short-Term Goals (within 1 year): Paying off a credit card balance, saving for a vacation, building an emergency fund.

- Long-Term Goals (5+ years): Buying a house, funding a child’s education, securing retirement savings.

Strategies for Maintaining Motivation and Overcoming Obstacles

Staying motivated throughout the process is crucial for achieving financial goals. Challenges are inevitable, so having strategies in place to overcome obstacles is vital. Regularly reviewing your progress, celebrating milestones, and adjusting your plan as needed are essential components of long-term success. Seeking advice from a financial advisor can also provide valuable support and guidance.

Motivational Techniques

Consistent motivation is key to long-term financial success. Employing various motivational techniques can significantly increase the likelihood of achieving your goals.

- Visualize Success: Regularly visualizing the achievement of your goals can create a powerful sense of motivation and anticipation.

- Reward System: Celebrate milestones with small rewards to reinforce positive behavior and maintain momentum.

- Accountability Partner: Sharing your goals with a trusted friend or family member can provide encouragement and support.

- Regular Review and Adjustment: Periodically reviewing your progress and making necessary adjustments keeps your plan relevant and effective.

- Focus on the “Why”: Remembering your reasons for pursuing your financial goals can provide renewed motivation when facing challenges.

Illustrating Financial Concepts

Understanding key financial concepts is crucial for effective personal finance management. This section will illustrate several important principles through detailed examples and calculations. These examples will help solidify your understanding and allow you to apply these concepts to your own financial planning.

Compound Interest

Compound interest is the interest earned on both the principal amount and the accumulated interest from previous periods. It’s the power of earning interest on interest, leading to exponential growth over time. Let’s consider an example:

Suppose you invest $1,000 at an annual interest rate of 5%, compounded annually. After one year, you’ll have $1,000 * 1.05 = $1,050. In the second year, you’ll earn interest not only on the initial $1,000 but also on the $50 interest earned in the first year. This means you’ll have $1,050 * 1.05 = $1,102.50. This process continues year after year, resulting in significantly larger returns than simple interest. After 10 years, your investment will grow to approximately $1,628.89. The formula for compound interest is: A = P (1 + r/n)^(nt), where A is the future value, P is the principal amount, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years.

Inflation’s Impact on Purchasing Power

Inflation is the rate at which the general level of prices for goods and services is rising, and, consequently, the purchasing power of currency is falling. This means that the same amount of money will buy fewer goods and services in the future than it does today.

Let’s say a loaf of bread costs $2 today. If inflation averages 3% per year, in 10 years, that same loaf of bread might cost approximately $2 * (1.03)^10 ≈ $2.69. This illustrates how inflation erodes the purchasing power of your money over time. A salary increase that doesn’t outpace inflation actually results in a decrease in real purchasing power.

Time Value of Money

The time value of money (TVM) is the concept that money available at the present time is worth more than the same amount in the future due to its potential earning capacity. This is because money can earn interest or returns over time.

For example, if you have $100 today and can invest it at a 5% annual interest rate, you will have $105 in one year. The $100 today is worth more than the $105 received in a year because of its potential to earn interest. The formula for calculating future value (FV) is: FV = PV * (1 + r)^n, where PV is the present value, r is the interest rate, and n is the number of periods. Therefore, the future value of $100 invested at 5% for 5 years is: FV = $100 * (1 + 0.05)^5 ≈ $127.63.

Saving versus Investing

Saving and investing are both crucial for building wealth, but they differ significantly in their approach and potential returns.

Saving typically involves placing money in low-risk accounts like savings accounts or money market accounts that offer a relatively low return but provide easy access to your funds. For example, depositing $1000 in a savings account with a 1% annual interest rate will earn you $10 in interest after one year. Investing, on the other hand, involves putting money into assets like stocks, bonds, or real estate with the expectation of higher returns over the long term. However, investments carry higher risk, and there’s a potential for losses. For example, investing $1000 in a stock that appreciates by 10% in a year would result in a $100 gain, but it could also decrease in value.

Closing Summary

Mastering Keuangan Pribadi is a journey, not a destination. By consistently applying the principles Artikeld in this guide—budgeting effectively, managing debt responsibly, and investing wisely—you can build a solid financial foundation for a secure and prosperous future. Remember, proactive financial planning and consistent effort are key to achieving your financial aspirations. Start small, stay consistent, and celebrate your progress along the way.

Helpful Answers

What is the difference between saving and investing?

Saving focuses on preserving capital with low-risk options like savings accounts, emphasizing security and accessibility. Investing involves taking on more risk for potentially higher returns through assets like stocks and bonds, aiming for long-term growth.

How often should I review my budget?

Ideally, review your budget monthly to track progress, identify areas for improvement, and adjust spending as needed. Regular reviews ensure your budget remains aligned with your financial goals.

What is the best way to pay off debt?

The best approach depends on your individual circumstances. The debt avalanche method prioritizes high-interest debts, while the debt snowball method focuses on paying off the smallest debts first for motivational purposes. Consider consulting a financial advisor for personalized guidance.

How much should I contribute to my emergency fund?

Aim for 3-6 months’ worth of essential living expenses in your emergency fund. This provides a safety net for unexpected events and reduces financial stress.