The world of digital payments is rapidly evolving, transforming how we conduct financial transactions. From contactless payments at the grocery store to international money transfers across continents, digital systems have revolutionized commerce. This comparison delves into the various types of digital payment systems, exploring their underlying technologies, security features, user experiences, and regulatory landscapes. We will analyze the strengths and weaknesses of leading platforms, highlighting key differences in transaction fees, security protocols, and user accessibility.

Understanding the nuances of these systems is crucial for both consumers and businesses. This comprehensive analysis will equip readers with the knowledge to make informed decisions about choosing and using digital payment methods, considering factors like security, convenience, and cost-effectiveness. We’ll also examine future trends and innovations shaping the future of digital finance, including the potential impact of blockchain and Central Bank Digital Currencies (CBDCs).

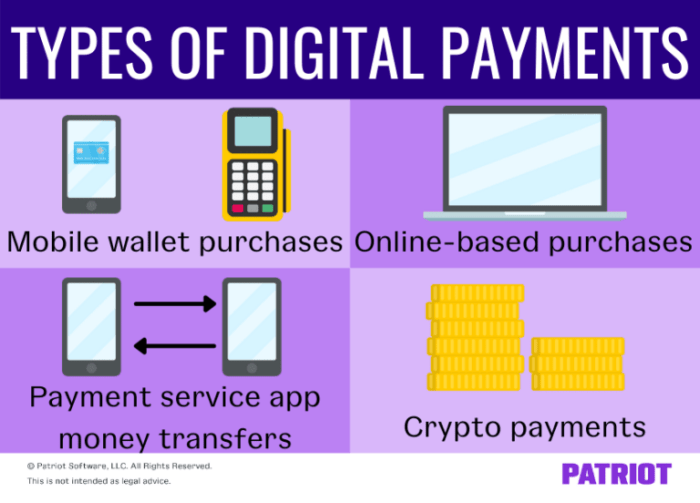

Types of Digital Payment Systems

The rapid evolution of technology has dramatically reshaped how we conduct financial transactions. Digital payment systems have become increasingly prevalent, offering convenience, speed, and security compared to traditional methods. Understanding the different types and their underlying mechanisms is crucial for both consumers and businesses navigating the modern financial landscape.

Mobile Wallets

Mobile wallets are software applications that store payment information, such as credit card details, debit card details, and bank account information, on a mobile device. This allows users to make payments by simply scanning a QR code, tapping their phone against a contactless terminal, or entering a PIN. The underlying technology typically involves near-field communication (NFC) for contactless payments, secure element technology for data protection, and cloud-based servers for transaction processing. Popular examples include Apple Pay (global reach), Google Pay (global reach), and Samsung Pay (global reach). These services offer varying degrees of integration with other apps and services.

Online Banking

Online banking platforms allow users to manage their finances and make payments directly through their bank’s website or mobile app. These systems rely on secure server connections, encryption protocols (like SSL/TLS), and robust authentication mechanisms (like multi-factor authentication) to ensure the security of transactions. Users can transfer funds, pay bills, and make online purchases directly from their accounts. Most major banks worldwide offer online banking services, with features and accessibility varying depending on the institution and location.

Peer-to-Peer (P2P) Payments

P2P payment systems facilitate the transfer of money between individuals, often using mobile apps. These systems typically rely on mobile device connectivity, user authentication, and secure payment gateways. They often integrate with bank accounts or other payment methods. Examples include Venmo (primarily US), Zelle (primarily US), and PayPal (global reach). The ease and speed of P2P payments have made them increasingly popular for personal transactions.

Contactless Payments

Contactless payments utilize near-field communication (NFC) technology to enable payments by tapping a payment card or mobile device against a contactless terminal. The underlying technology involves secure data transmission using NFC, encryption to protect payment information, and tokenization to replace sensitive card details with unique identifiers. This method is widely adopted globally, with most major credit and debit card providers offering contactless functionality. Apple Pay, Google Pay, and Samsung Pay are examples of mobile wallets that support contactless payments.

Comparison of Digital Payment Systems

The following table compares five prominent digital payment systems across key aspects:

| Payment System | Transaction Fees | Security Features | User Accessibility |

|---|---|---|---|

| PayPal | Varies depending on transaction type and location | Encryption, fraud monitoring, buyer/seller protection | Widely accessible globally, multiple platforms |

| Apple Pay | Generally no fees for consumers | Tokenization, biometric authentication, device encryption | High accessibility for iOS users in supported regions |

| Google Pay | Generally no fees for consumers | Tokenization, encryption, multi-factor authentication | High accessibility for Android users in supported regions |

| Venmo | Generally no fees for most transactions | Encryption, fraud detection, account monitoring | High accessibility within the US, primarily for social payments |

| Zelle | Generally no fees for consumers | Encryption, fraud detection, bank account verification | High accessibility within the US, integrated with many banks |

Security and Fraud Prevention

The security of digital payment systems is paramount, given the sensitive financial information they handle. A robust security framework is essential to build user trust and prevent significant financial losses. This section explores the common threats, prevention mechanisms, and security protocols employed to safeguard digital transactions.

Common Security Threats

Digital payment systems face a multitude of security threats, ranging from relatively simple attacks to sophisticated, targeted breaches. These threats exploit vulnerabilities in the system’s infrastructure, user behavior, or the payment processing pipeline. Understanding these threats is the first step towards effective mitigation. Examples include phishing attacks, malware infections targeting user devices, data breaches exposing customer information, and man-in-the-middle attacks intercepting transaction data. Furthermore, vulnerabilities in the payment gateway itself can be exploited by malicious actors. The consequences can range from unauthorized access to funds to identity theft and reputational damage for the payment provider.

Fraud Prevention Mechanisms

Various mechanisms are employed to prevent and detect fraudulent activities within digital payment systems. These range from technological solutions to procedural safeguards. Many systems utilize advanced fraud detection algorithms that analyze transaction data in real-time, identifying suspicious patterns indicative of fraudulent behavior. These algorithms consider factors such as transaction amounts, location, frequency, and the user’s past transaction history. Additionally, many systems employ multi-factor authentication, requiring users to verify their identity through multiple channels, such as a password, one-time code, or biometric scan. Another common technique is address verification, ensuring the billing address matches the user’s registered address. Transaction monitoring and review processes, often involving human intervention, further enhance fraud prevention efforts. Real-time monitoring of transactions and suspicious activity allows for immediate intervention and potential blocking of fraudulent transactions.

Comparison of Security Protocols

Different digital payment systems utilize various security protocols to protect transactions. Encryption, a fundamental security measure, scrambles data, making it unreadable without the decryption key. Symmetric encryption uses the same key for encryption and decryption, while asymmetric encryption employs separate keys for each process. Tokenization replaces sensitive data, like credit card numbers, with non-sensitive substitutes, reducing the risk of data breaches. Biometric authentication, using unique biological traits like fingerprints or facial recognition, adds another layer of security. For example, PayPal utilizes encryption and tokenization extensively, while Apple Pay relies heavily on tokenization and device-specific security features. The specific implementation and combination of these protocols vary across different payment systems, reflecting differing risk profiles and technological capabilities.

Secure Digital Payment Transaction Flowchart

A simplified flowchart depicting a secure digital payment transaction would follow these steps:

1. Customer initiates payment: The customer selects a digital payment method and enters payment information.

2. Payment gateway request: The merchant’s system sends a request to the payment gateway.

3. Authentication and authorization: The payment gateway verifies the customer’s identity and the validity of the payment information using multi-factor authentication and fraud detection systems.

4. Transaction processing: The payment gateway processes the transaction and communicates with the acquiring bank.

5. Funds transfer: Funds are transferred from the customer’s account to the merchant’s account.

6. Confirmation and notification: The customer and merchant receive confirmation of the successful transaction.

7. Transaction logging and monitoring: The entire transaction is logged and monitored for any suspicious activity. This log is then used for fraud detection and investigation purposes. This stage often incorporates machine learning algorithms for improved accuracy and efficiency.

User Experience and Adoption

The widespread adoption of digital payment systems hinges on a positive user experience. Factors influencing adoption vary significantly across demographics, driven by technological literacy, trust in security measures, and the perceived convenience compared to traditional methods. Understanding these nuances is crucial for designing and implementing systems that achieve mass appeal.

Factors influencing adoption are complex and interconnected. Age, for instance, often correlates with technological comfort. Younger demographics generally exhibit higher adoption rates due to familiarity with smartphones and online transactions. Conversely, older generations may require more intuitive interfaces and robust customer support to overcome potential barriers. Socioeconomic factors also play a role; access to reliable internet and mobile devices is a prerequisite for many digital payment systems. Trust in security protocols and data privacy is another key driver; concerns about fraud or data breaches can significantly deter adoption, particularly among less tech-savvy users. Finally, the perceived convenience and efficiency compared to cash or checks significantly impacts adoption rates. A seamless and speedy transaction process is a crucial selling point.

Factors Influencing Digital Payment System Adoption

Several key factors influence the adoption of digital payment systems across different demographics. Technological literacy plays a significant role, with younger generations generally more comfortable using digital technologies. Trust in security measures is also paramount; users need confidence that their financial information is safe. The convenience and speed of digital payments compared to traditional methods are major drivers of adoption. Finally, the availability and accessibility of the technology, including internet access and suitable devices, significantly impacts adoption rates, especially in underserved communities. Marketing efforts that target specific demographics and address their unique concerns can also improve adoption rates.

User-Friendly Design Features in Popular Digital Payment Applications

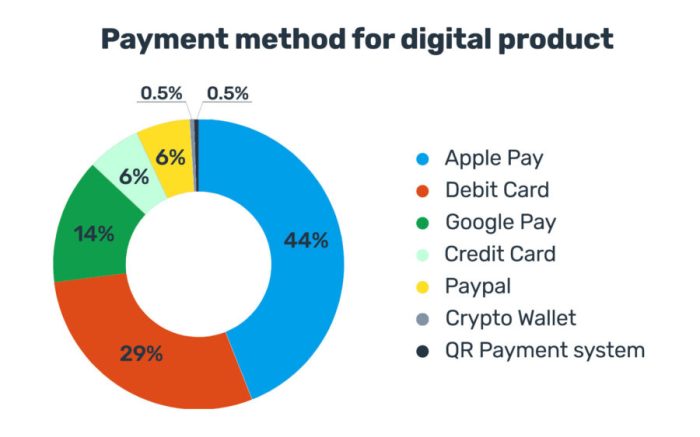

Many popular digital payment applications prioritize user-friendly design to maximize adoption. Apple Pay, for example, leverages the familiar interface of Apple devices, integrating seamlessly with existing functionalities. Its simplified one-touch payment process minimizes friction. Similarly, Google Pay offers a clean and intuitive interface, emphasizing ease of use and quick access to payment options. Both applications employ biometric authentication, such as fingerprint or facial recognition, adding an extra layer of security while streamlining the payment process. PayPal, a pioneer in online payments, boasts a robust and established system, continuously improving its interface to remain user-friendly despite its complexity. Clear visual cues, straightforward navigation, and helpful prompts are consistently employed across these applications.

Comparative User Interface and Experiences

Comparing Apple Pay, Google Pay, and PayPal reveals distinct user interface (UI) and user experience (UX) approaches. Apple Pay prioritizes speed and simplicity, offering a minimalist interface integrated tightly with Apple devices. Google Pay mirrors this streamlined approach, focusing on quick transactions and seamless integration with Android devices and other Google services. PayPal, catering to a broader audience and a wider range of transaction types, presents a more complex interface with features such as peer-to-peer payments, merchant services, and account management. While Apple Pay and Google Pay excel in speed and ease of use for simple transactions, PayPal offers more comprehensive functionality, potentially at the cost of some UI complexity.

Features Contributing to a Positive User Experience

A positive user experience with digital payments is built on several key features. Intuitive interfaces, clear instructions, and minimal steps for completing transactions are paramount. Robust security measures, including encryption and fraud prevention systems, build user trust and confidence. Reliable customer support channels, readily accessible through multiple means (phone, email, chat), are crucial for addressing any issues or questions. Accessibility features, such as support for screen readers and adjustable text sizes, are essential for inclusivity and ensuring that users with disabilities can access and use the system effectively. Furthermore, offering multilingual support caters to a diverse user base and promotes wider adoption. Finally, personalized features, such as transaction summaries and budgeting tools, enhance user engagement and provide value beyond basic payment functionality.

Regulatory Landscape and Compliance

The global regulatory landscape for digital payment systems is complex and fragmented, varying significantly across jurisdictions. These differences stem from diverse national priorities, levels of technological advancement, and existing financial infrastructure. Understanding these regulatory frameworks is crucial for both businesses operating in the digital payments space and consumers seeking to protect their financial data and transactions.

The regulatory approach to digital payments often focuses on balancing innovation with consumer protection and financial stability. This involves establishing clear rules regarding licensing, data security, anti-money laundering (AML) and counter-terrorist financing (CTF) measures, and consumer dispute resolution mechanisms. Furthermore, the rapid evolution of technology necessitates a flexible regulatory environment that can adapt to emerging payment methods and associated risks.

International Regulatory Frameworks

Many international organizations, such as the Financial Stability Board (FSB) and the Basel Committee on Banking Supervision (BCBS), play a significant role in shaping global standards for digital payments. These organizations issue guidelines and recommendations, influencing national regulatory frameworks and fostering greater consistency across borders. However, the implementation and enforcement of these standards remain largely the responsibility of individual countries. For example, the FSB’s work on addressing risks related to fintech and digital finance informs national regulatory approaches to areas like stablecoins and cross-border payments. The BCBS sets capital adequacy standards for banks handling digital payments, influencing their risk management practices.

National Regulatory Frameworks: A Comparison

The United States employs a multi-agency approach, with bodies like the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Consumer Financial Protection Bureau (CFPB) each overseeing different aspects of digital payments. The European Union, on the other hand, has adopted a more harmonized approach through regulations like the Payment Services Directive 2 (PSD2), which aims to create a single market for payment services within the EU. This directive standardizes licensing requirements, customer authentication methods, and data protection rules for payment service providers. In contrast, countries like Singapore have implemented a more technology-neutral approach, focusing on promoting innovation while establishing robust risk management frameworks. This approach prioritizes agility in responding to technological advancements, while still ensuring the safety and security of the financial system.

The Role of Central Banks and Financial Regulators

Central banks play a crucial role in overseeing the stability and integrity of digital payment systems. They often set monetary policy, manage payment systems infrastructure, and monitor systemic risk. Financial regulators, such as the aforementioned CFPB in the US, ensure compliance with consumer protection laws, data privacy regulations, and AML/CTF requirements. Their oversight is vital in fostering trust and confidence in the digital payment ecosystem, and preventing financial crime. For example, central banks might conduct stress tests on payment systems to assess their resilience to disruptions, while financial regulators might investigate instances of fraud or data breaches.

Data Privacy and Consumer Protection Regulations

Regulations like the General Data Protection Regulation (GDPR) in the EU and the California Consumer Privacy Act (CCPA) in the US place significant emphasis on protecting consumer data in the digital payment sector. These regulations establish strict rules around data collection, processing, and storage, requiring companies to obtain explicit consent and provide transparency about their data practices. They also grant consumers rights to access, correct, and delete their personal data. Failure to comply with these regulations can result in substantial fines and reputational damage. For instance, a payment processor failing to adequately secure customer data and leading to a data breach could face significant penalties under both GDPR and CCPA, depending on where the data is processed and the customers’ locations.

Future Trends and Innovations

The digital payments landscape is in constant flux, driven by rapid technological advancements and evolving consumer expectations. Innovation is not merely an option; it’s a necessity for survival in this competitive market. The integration of emerging technologies promises to reshape how we transact, offering greater efficiency, security, and inclusivity.

The convergence of several technological forces is poised to redefine the future of digital payments. Blockchain technology, with its inherent security and transparency, is rapidly gaining traction. Artificial intelligence (AI) is enhancing fraud detection and personalization, while biometrics are providing more secure and convenient authentication methods. These advancements, coupled with the potential impact of Central Bank Digital Currencies (CBDCs), present both significant opportunities and challenges for businesses and consumers alike.

Impact of Emerging Technologies

Blockchain technology offers a decentralized and transparent alternative to traditional payment systems. Its immutable ledger ensures secure and verifiable transactions, reducing the risk of fraud and enhancing trust. Examples include the use of stablecoins pegged to fiat currencies for faster and cheaper cross-border payments, and the development of decentralized finance (DeFi) platforms that offer alternative financial services. AI is revolutionizing fraud detection by analyzing vast datasets to identify suspicious patterns and prevent fraudulent transactions in real-time. Biometric authentication, such as fingerprint or facial recognition, offers a more secure and user-friendly alternative to passwords, improving both security and convenience. The combination of these technologies promises a more secure, efficient, and inclusive payment ecosystem.

Challenges and Opportunities in the Evolving Landscape

The rapid pace of technological change presents both opportunities and challenges. Maintaining security in the face of sophisticated cyber threats is paramount. Ensuring interoperability between different payment systems and technologies is crucial for seamless user experience. The regulatory landscape needs to adapt to the rapid pace of innovation, striking a balance between fostering innovation and protecting consumers. Opportunities lie in expanding financial inclusion by providing access to digital payment systems for underserved populations, and in creating innovative payment solutions tailored to specific industries and consumer needs. For example, the growth of mobile payment solutions in emerging markets demonstrates the potential to bridge the financial inclusion gap.

The Potential Impact of Central Bank Digital Currencies (CBDCs)

The introduction of CBDCs, digital versions of fiat currencies issued by central banks, could significantly impact existing payment systems. CBDCs offer the potential for faster and cheaper transactions, increased financial inclusion, and improved monetary policy effectiveness. However, their implementation also raises challenges related to privacy, security, and the potential disruption to existing financial institutions. The design and implementation of CBDCs require careful consideration of these factors to ensure their successful integration into the existing financial ecosystem. China’s digital yuan, already in pilot programs, provides a real-world example of a CBDC’s potential impact. It demonstrates both the opportunities for enhanced efficiency and the challenges in managing privacy concerns.

Key Innovations Shaping the Future of Digital Payments

The future of digital payments will be shaped by several key innovations:

- Increased use of biometrics for authentication: Moving beyond passwords to more secure and convenient biometric authentication methods like facial recognition and fingerprint scanning.

- Wider adoption of blockchain technology for secure and transparent transactions: Leveraging blockchain’s decentralized and immutable nature to enhance security and trust in payment systems.

- Advancements in AI-powered fraud detection and prevention: Utilizing AI’s capabilities to analyze large datasets and identify fraudulent activities in real-time.

- Growth of real-time payment systems: Enabling instant transfers of funds, improving efficiency and convenience for users.

- Expansion of embedded finance and buy-now-pay-later options: Integrating financial services directly into other platforms and offering flexible payment options to consumers.

International Payments and Cross-Border Transactions

International payments, while increasingly facilitated by digital systems, remain more complex and costly than domestic transactions. The differences stem from factors like currency conversion, regulatory hurdles, and the involvement of multiple intermediaries. This section will explore the nuances of international digital payments, comparing various systems and highlighting key challenges.

Cost and Complexity Comparisons

The cost of international payments varies significantly depending on the chosen digital payment system. Wire transfers, while widely available, often incur substantial fees from both the sending and receiving banks, alongside potential intermediary bank charges. These fees can be disproportionately high for smaller transactions. In contrast, newer systems like PayPal or Wise (formerly TransferWise) generally offer more transparent and often lower fees, though they might still charge a percentage of the transaction amount or a fixed fee depending on the transfer size and currency. The complexity also varies; wire transfers require meticulous attention to detail regarding beneficiary information, while platforms like Wise offer streamlined user interfaces and automated processes, simplifying the payment process. The overall time taken for the transfer to complete is another key differentiator; wire transfers can be significantly slower than some specialized digital platforms.

Foreign Exchange Rates and Currency Conversion

Foreign exchange rates are a crucial component of international transactions. The rate at which one currency is exchanged for another directly impacts the final amount received. Different digital payment systems use varying methods for determining exchange rates, and these rates can fluctuate throughout the day. Some systems offer mid-market exchange rates (the theoretical exchange rate based on supply and demand), while others add a markup or margin, impacting the overall cost. Transparency regarding the exchange rate used is vital for users to understand the true cost of their international payment. Currency conversion fees, charged separately from the transfer fee, can further increase the overall expense. For example, using a credit card for an international transaction often results in less favorable exchange rates and higher conversion fees than dedicated international payment platforms.

Regulatory Compliance Challenges

Navigating the regulatory landscape for international digital payments presents significant challenges. Each country has its own set of financial regulations, including anti-money laundering (AML) and know-your-customer (KYC) rules, that must be adhered to. This often involves extensive documentation and verification processes, potentially slowing down the transaction. Furthermore, complying with sanctions and embargoes adds another layer of complexity, requiring payment providers to screen transactions against international sanctions lists. The lack of harmonization across international regulations necessitates careful consideration of the legal framework in both the sending and receiving countries to ensure full compliance. Non-compliance can lead to significant penalties for both the sender and the payment provider.

Examples of Digital Payment Solutions for International Transactions

Several digital payment solutions are specifically designed to optimize international transactions. Wise, as mentioned earlier, focuses on transparency and low fees, utilizing a network of local bank accounts to facilitate faster and cheaper transfers. PayPal offers international payment capabilities but might have higher fees compared to Wise, depending on the transaction specifics. Other examples include Western Union and Ria Money Transfer, though their fee structures and speed might be less competitive than newer digital platforms. Each platform caters to different needs and priorities; some prioritize speed, others prioritize cost-effectiveness, and some emphasize specific features such as multi-currency accounts. The choice of platform depends on the individual’s specific requirements and risk tolerance.

Merchant Integration and Processing

Integrating digital payment systems into a merchant’s operations is crucial for accepting electronic payments and streamlining transactions. This process involves several steps, from choosing the right payment gateway to ensuring secure data handling and managing associated fees. Successful integration can significantly boost sales and improve the customer experience.

The Process of Integrating Digital Payment Systems

Integrating a digital payment system typically begins with selecting a payment processor or gateway. This involves evaluating different providers based on factors such as fees, supported payment methods, security features, and integration capabilities. Once a processor is chosen, the merchant will need to apply for an account and provide necessary business information. The next step involves integrating the payment gateway’s API (Application Programming Interface) into the merchant’s point-of-sale (POS) system. This might involve working with developers to customize the integration or using pre-built plugins or modules. Finally, the merchant needs to test the integration thoroughly to ensure all transactions are processed correctly and securely. This includes testing various payment methods and handling potential error scenarios.

Comparison of Fees and Services Offered by Payment Processors

Payment processors offer varying fee structures and services. Common fees include transaction fees (a percentage of each transaction), monthly fees, setup fees, and chargeback fees (fees incurred when a customer disputes a charge). Services offered vary widely, including features like recurring billing, fraud prevention tools, customer support, and advanced reporting capabilities. For example, Stripe offers a flexible pricing model with transaction fees, while Square offers a tiered pricing structure with varying monthly fees and transaction fees depending on the plan. PayPal offers a combination of transaction fees and monthly fees, depending on the chosen plan and features. The choice of processor will depend on the specific needs and volume of transactions of the merchant.

Security Considerations Involved in Merchant Integration

Security is paramount during merchant integration. Merchants must ensure that their chosen payment processor adheres to industry security standards like PCI DSS (Payment Card Industry Data Security Standard). This involves protecting sensitive customer data, implementing robust encryption, and regularly updating security protocols. Secure coding practices during API integration are also essential to prevent vulnerabilities. Furthermore, merchants should implement fraud prevention measures, such as address verification and transaction monitoring, to minimize the risk of fraudulent transactions. Regular security audits and penetration testing can help identify and address potential weaknesses in the system.

Examples of Successful Merchant Integration Strategies

Many businesses have successfully integrated digital payment systems to enhance their operations. A small cafe might use Square for its ease of use and integrated POS system, accepting credit cards, mobile payments, and even offering loyalty programs through the platform. A large e-commerce store might use a more complex solution like Stripe, allowing them to process payments from various countries and integrate with multiple shipping and inventory management systems. A subscription-based service could utilize Recurly for automated billing and robust customer management features. These examples highlight the importance of choosing a payment processor that aligns with the merchant’s specific business model and needs.

Final Thoughts

In conclusion, the landscape of digital payment systems is dynamic and multifaceted. While offering unparalleled convenience and efficiency, these systems also present unique security challenges and regulatory complexities. This comparison has highlighted the diverse range of options available, from mobile wallets and online banking to peer-to-peer transfers and contactless payments. By understanding the strengths and weaknesses of each system, consumers and businesses can make informed choices that align with their individual needs and risk tolerances. As technology continues to advance, the future of digital payments promises even greater innovation and integration into our daily lives.

FAQ Resource

What are the risks associated with using digital payment systems?

Risks include fraud (e.g., phishing, card cloning), data breaches leading to identity theft, and unauthorized access to accounts. However, robust security measures mitigate many of these risks.

How do I choose the right digital payment system for my needs?

Consider factors such as transaction fees, security features, international transfer capabilities, user interface, and the specific needs of your business or personal use. Research different options and compare their features before making a decision.

Are digital payment systems safe for international transactions?

Security depends on the specific system and its security protocols. Reputable systems utilize strong encryption and fraud prevention measures. However, additional risks related to currency exchange rates and cross-border regulations exist.