The financial world is rapidly evolving, driven by the increasing availability and sophistication of data analytics tools. This review delves into the landscape of these tools, examining their capabilities, applications, and impact on financial decision-making. We’ll explore how these technologies are transforming areas such as risk management, portfolio optimization, and fraud detection, providing insights into both their potential and their limitations.

From established tools like Excel and Tableau to the power of Python libraries, we’ll dissect the functionalities, strengths, and weaknesses of various options, offering a practical guide for finance professionals seeking to leverage data analytics effectively. We will also address crucial considerations such as data quality, security, and regulatory compliance, ensuring a comprehensive understanding of the entire data analytics ecosystem in finance.

Introduction to Data Analytics in Finance

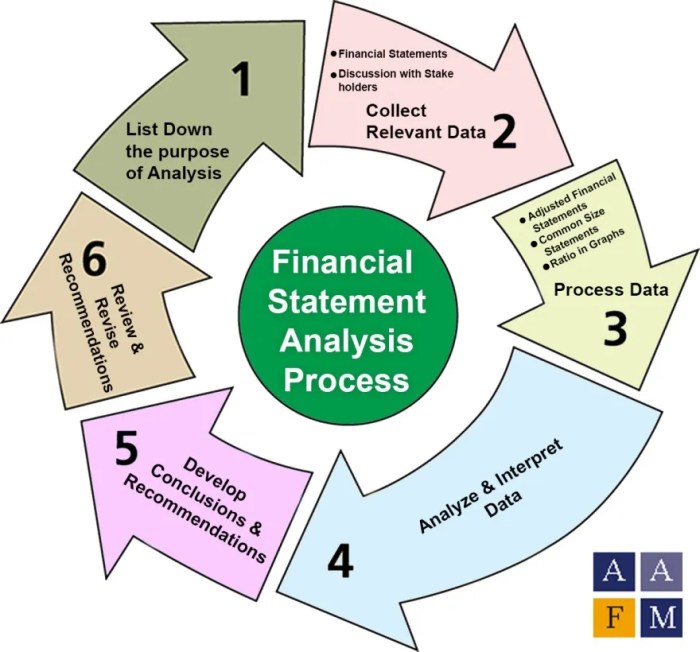

Data analytics has fundamentally reshaped the financial sector, transforming how institutions manage risk, make investment decisions, and interact with customers. Its impact spans across all areas of finance, from investment banking and asset management to regulatory compliance and fraud detection. The ability to extract meaningful insights from vast datasets has become a critical competitive advantage in today’s dynamic financial landscape.

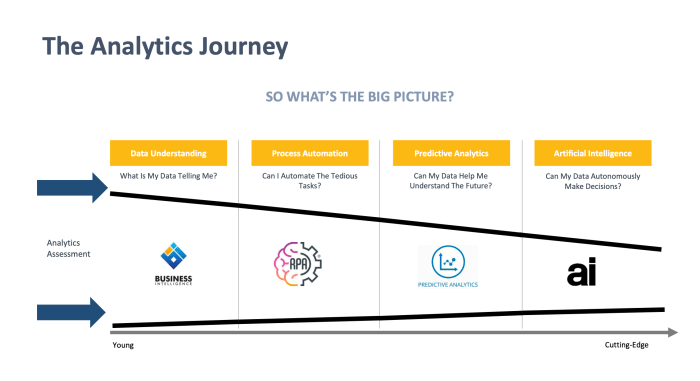

The integration of data analytics in finance has evolved significantly over time. Initially, basic statistical methods and spreadsheet software were the primary tools. The rise of relational databases in the 1980s and 1990s allowed for more sophisticated analysis, but the true revolution began with the advent of big data technologies and advanced analytical techniques in the 21st century. Today, financial institutions leverage powerful tools like machine learning algorithms, artificial intelligence, and cloud-based platforms to process and analyze unprecedented volumes of structured and unstructured data. This evolution has enabled a shift from reactive, rule-based decision-making to proactive, data-driven strategies.

Data Analytics Improves Financial Decision-Making

Data analytics significantly enhances financial decision-making across various aspects of the industry. For example, in investment management, algorithmic trading systems use real-time market data and predictive models to execute trades at optimal prices and minimize risk. Similarly, credit scoring models, powered by advanced statistical techniques and machine learning, assess the creditworthiness of individuals and businesses, enabling more accurate lending decisions and reducing defaults. In risk management, data analytics helps identify and quantify potential risks, such as market volatility, credit risk, and operational risk, allowing for better risk mitigation strategies. Furthermore, fraud detection systems utilize machine learning algorithms to identify suspicious transactions and patterns, preventing financial losses and protecting customers. The use of data analytics also allows for more personalized customer service and targeted marketing campaigns, leading to improved customer satisfaction and increased revenue. For instance, banks can use customer transaction data to offer tailored financial products and services, improving customer engagement and loyalty. The impact of data analytics on regulatory compliance is also noteworthy, as institutions can use data to monitor their operations for compliance with regulations, reducing the risk of penalties and legal issues.

Categorizing Finance Data Analytics Tools

The financial industry relies heavily on data analytics to make informed decisions, manage risk, and optimize performance. A wide array of tools are available, each with its own strengths and weaknesses, catering to different needs and user skill levels. Understanding these tools and their functionalities is crucial for effective data-driven decision-making in finance. This section categorizes popular data analytics tools based on their core functionalities within the finance sector.

Categorizing finance data analytics tools helps in selecting the most appropriate solution for specific tasks. The categorization below focuses on three key areas: reporting, forecasting, and risk management. While some tools might overlap functionalities, this classification provides a clear framework for understanding their primary applications.

Data Analytics Tools by Functionality

The following table presents a selection of popular data analytics tools used in finance, categorized by their primary function. Note that pricing models can vary based on factors such as user numbers, data volume, and specific features included.

| Tool Name | Key Features | Pricing Model | Target User Profile |

|---|---|---|---|

| Tableau | Data visualization, interactive dashboards, data blending, custom visualizations | Subscription-based, tiered pricing | Business analysts, financial analysts, data scientists |

| Power BI | Data visualization, interactive dashboards, data modeling, integration with Microsoft ecosystem | Subscription-based, tiered pricing | Business analysts, financial analysts, data scientists, Excel users |

| Python (with libraries like Pandas, NumPy, Scikit-learn) | Data manipulation, statistical analysis, machine learning, custom model building | Open-source (free), potential costs for cloud computing | Data scientists, quantitative analysts, developers |

| R (with libraries like ggplot2, dplyr) | Statistical computing, data visualization, machine learning, model building | Open-source (free), potential costs for cloud computing | Statisticians, data scientists, quantitative analysts |

| Bloomberg Terminal | Real-time market data, financial news, analytics, trading tools | Subscription-based, high cost | Professional traders, portfolio managers, investment analysts |

| FactSet | Financial data, analytics, research tools, portfolio management | Subscription-based, high cost | Investment professionals, research analysts |

| SAS | Advanced analytics, statistical modeling, predictive modeling, risk management | License-based, high cost | Data scientists, statisticians, risk managers |

| Alteryx | Data preparation, blending, and analysis; workflow automation | Subscription-based, tiered pricing | Data analysts, business analysts |

Strengths and Weaknesses of Tool Categories

Each category of finance data analytics tools offers distinct advantages and disadvantages. Understanding these nuances is crucial for selecting the right tools for specific tasks.

Reporting Tools (e.g., Tableau, Power BI): Strengths include ease of use, intuitive interfaces, and excellent data visualization capabilities. Weaknesses can include limitations in advanced analytics and the need for data preparation before visualization. For instance, while Tableau excels at creating interactive dashboards to present financial performance, it might require significant data cleaning and transformation before the data is suitable for visualization.

Forecasting Tools (e.g., Python with statistical libraries, R): Strengths lie in their ability to build sophisticated predictive models using advanced statistical techniques and machine learning algorithms. Weaknesses include the requirement for strong programming skills and the potential for model complexity to obscure insights. A well-built forecasting model in Python, for example, using time series analysis, can accurately predict future revenue, but requires expertise in coding and statistical modeling.

Risk Management Tools (e.g., SAS, specialized risk management software): Strengths include comprehensive risk assessment capabilities, scenario analysis, and regulatory compliance features. Weaknesses can be high costs, complexity, and the need for specialized expertise. SAS, for example, offers robust tools for credit risk modeling, but implementing and maintaining such systems requires significant investment and skilled personnel.

Specific Tool Deep Dives

This section delves into the core functionalities of Excel, Tableau, and select Python libraries (Pandas and Scikit-learn) within the context of financial data analysis. We will explore their capabilities through practical examples, highlighting their strengths and weaknesses for different analytical tasks.

Excel’s Role in Financial Data Analysis

Microsoft Excel, despite its age, remains a ubiquitous tool in finance. Its core functionalities relevant to financial data analysis include data import and cleaning, formula-based calculations (including financial functions like NPV, IRR, and XIRR), data visualization through charts and graphs, and basic statistical analysis. Its accessibility and widespread familiarity make it a valuable tool, especially for simpler analyses or initial data exploration.

Portfolio Optimization with Excel

A simple portfolio optimization can be demonstrated using Excel’s Solver add-in. This involves maximizing expected return for a given level of risk (or minimizing risk for a given return). The process involves setting up a spreadsheet with asset allocations, expected returns, standard deviations, and correlations. The Solver add-in then iteratively adjusts the asset allocations to optimize the objective function (e.g., Sharpe Ratio). This requires defining the objective function, constraints (e.g., total allocation equals 100%), and decision variables (asset weights). The Solver will then find the optimal asset allocation that maximizes the Sharpe ratio, given the constraints. For example, an investor might have data on the expected return and volatility of three assets (stocks A, B, and C). Using Excel’s Solver, they can find the optimal weights for each asset to maximize the portfolio’s Sharpe ratio, a measure of risk-adjusted return.

Tableau’s Capabilities in Financial Data Visualization

Tableau is a powerful data visualization tool particularly effective for presenting complex financial data in an easily understandable manner. Its strength lies in its ability to create interactive dashboards and visualizations, allowing users to explore data dynamically and uncover trends and insights. Key functionalities include data connectivity to various sources, drag-and-drop interface for visualization creation, and advanced features like interactive filtering and drill-downs.

Fraud Detection with Tableau

Tableau’s interactive nature makes it ideal for fraud detection. By connecting to a database containing transactional data, a Tableau dashboard can be created to visualize potentially fraudulent activities. For instance, unusual transaction patterns (e.g., large transactions from unusual locations) can be highlighted through interactive maps and charts. Users can then filter and drill down into specific transactions to investigate further. Imagine a bank using Tableau to visualize transaction data. They might create a dashboard showing transaction amounts by location, highlighting outliers that warrant further investigation. This allows for a quick visual identification of potentially fraudulent activities.

Python (Pandas and Scikit-learn) in Advanced Financial Analysis

Python, with libraries like Pandas and Scikit-learn, provides a powerful environment for advanced financial data analysis. Pandas offers data manipulation and analysis capabilities similar to Excel but on a much larger scale and with greater flexibility. Scikit-learn provides a comprehensive suite of machine learning algorithms suitable for tasks such as predictive modeling and risk assessment.

Credit Risk Modeling with Python (Pandas and Scikit-learn)

A credit risk model can be built using Python. Pandas can be used to clean and preprocess the data (e.g., historical loan data including borrower characteristics and repayment history). Scikit-learn’s logistic regression or other classification algorithms can then be used to build a model that predicts the probability of loan default based on borrower characteristics. The model’s performance can be evaluated using metrics such as accuracy, precision, and recall. This allows for a more sophisticated assessment of credit risk than simpler methods. For example, a bank could use this model to predict the likelihood of default for new loan applications, allowing them to make more informed lending decisions.

Tool Comparison

| Feature | Excel | Tableau | Python (Pandas & Scikit-learn) |

|---|---|---|---|

| Ease of Use | High | Medium | Low |

| Learning Curve | Low | Medium | High |

| Cost-Effectiveness | Low (if already licensed) | Medium | Low (open-source libraries) |

| Scalability | Low | Medium | High |

| Analytical Capabilities | Basic | Visualization focused | Advanced |

Data Visualization in Financial Analytics

Effective data visualization is paramount in financial analytics. It transforms complex datasets into easily understandable and actionable insights, facilitating better decision-making and clearer communication with stakeholders. Without clear visualization, even the most sophisticated analysis can remain inaccessible and ultimately useless. The right chart type can dramatically improve comprehension and impact.

Data visualization techniques allow for the rapid identification of trends, outliers, and correlations within financial data. This accelerates the analytical process, enabling quicker responses to market changes and more informed strategic planning. Furthermore, well-designed visualizations can effectively communicate complex financial information to both technical and non-technical audiences, fostering collaboration and buy-in across departments.

Chart Types for Financial Metrics

Choosing the appropriate chart type is crucial for effective communication. Different chart types are best suited to different types of data and analytical goals. For example, line charts are ideal for illustrating trends over time, while bar charts are better for comparisons between different categories. Other useful chart types include scatter plots for identifying correlations, pie charts for showing proportions, and heatmaps for visualizing large datasets.

Visualization Examples

Financial visualizations should be clear, concise, and insightful. Below are descriptions of three distinct visualizations and the insights they provide.

Example 1: Line Chart Showing Revenue Growth

This line chart displays a company’s quarterly revenue over a five-year period. The X-axis represents the time period (quarters), and the Y-axis represents revenue in millions of dollars. The line itself shows the trend of revenue growth. The visualization reveals a consistent upward trend with some seasonal fluctuations, indicating overall strong growth and potential areas for further analysis regarding seasonal patterns. The target audience for this visualization is upper management and investors interested in the company’s overall financial health and growth trajectory. Specific data points could include revenue figures for each quarter, allowing for precise analysis of growth rates and identifying periods of particularly strong or weak performance.

Example 2: Bar Chart Comparing Investment Portfolio Performance

This bar chart compares the performance of three different investment portfolios (e.g., high-growth, balanced, conservative) over a one-year period. The X-axis represents the portfolio type, and the Y-axis represents the percentage return. The bars visually represent the return for each portfolio. This visualization clearly shows the relative performance of each portfolio, highlighting which strategy yielded the highest return and which had the lowest risk. The target audience is investment advisors and clients who need to quickly assess the performance of different investment strategies. The chart could include additional data such as standard deviation to show risk alongside return.

Example 3: Scatter Plot Showing Correlation Between Marketing Spend and Sales

This scatter plot illustrates the relationship between marketing expenditure and sales revenue for a particular product line. The X-axis represents marketing spend (in thousands of dollars), and the Y-axis represents sales revenue (in thousands of dollars). Each point on the plot represents a specific month’s data. The visualization reveals a positive correlation between marketing spend and sales revenue, suggesting that increased marketing investment leads to higher sales. The target audience is marketing and sales teams looking to optimize their marketing budget and understand the return on investment (ROI) of marketing campaigns. The chart could include a trend line to better visualize the correlation and quantify its strength.

Addressing Challenges and Risks in Using Data Analytics Tools

Implementing data analytics tools in finance offers significant advantages, but it also presents considerable challenges. Successfully leveraging these tools requires a proactive approach to risk management and a deep understanding of potential pitfalls. Ignoring these challenges can lead to inaccurate insights, regulatory violations, and even financial losses.

Data quality issues, security vulnerabilities, and regulatory compliance are among the most significant hurdles. These risks, if not properly addressed, can undermine the credibility and effectiveness of data-driven decision-making within financial institutions. This section will explore these challenges and Artikel strategies for mitigation.

Data Quality Issues

High-quality data is the foundation of effective data analytics. Inaccurate, incomplete, or inconsistent data will inevitably lead to flawed analyses and unreliable conclusions. Financial data, particularly, is often sourced from multiple systems and departments, increasing the likelihood of discrepancies and errors. Data cleansing and validation processes are crucial to ensuring data integrity. This involves identifying and correcting errors, handling missing values, and standardizing data formats across different sources. Without rigorous data quality management, the insights derived from analytics tools will be questionable at best and potentially disastrous at worst. For example, a bank using flawed credit scoring data might inadvertently approve loans to high-risk borrowers, resulting in significant losses.

Security Concerns

Financial data is highly sensitive and subject to stringent security regulations. Data breaches can have severe consequences, including financial losses, reputational damage, and legal penalties. Data analytics tools often require access to large datasets, increasing the potential attack surface. Robust security measures are therefore essential, including data encryption, access controls, and regular security audits. Furthermore, employees need to be trained on secure data handling practices to prevent accidental or malicious data leaks. A notable example is the Equifax data breach in 2017, where the personal information of millions of customers was exposed due to vulnerabilities in the company’s data analytics systems. This breach resulted in significant financial losses and reputational damage for Equifax.

Regulatory Compliance

The financial industry is heavily regulated, and data analytics tools must comply with relevant regulations such as GDPR, CCPA, and Dodd-Frank. These regulations impose requirements on data privacy, security, and reporting. Failure to comply can result in hefty fines and legal repercussions. Financial institutions need to ensure that their data analytics processes are designed and implemented in a way that meets all applicable regulatory requirements. This involves implementing appropriate data governance frameworks, documenting data processing activities, and conducting regular compliance audits. For instance, a firm failing to comply with GDPR by not obtaining proper consent for data processing could face substantial penalties.

Strategies for Mitigating Challenges

Effective mitigation strategies involve a multi-faceted approach. This includes establishing clear data governance policies, investing in robust data security infrastructure, and providing comprehensive training to employees. Regular data quality audits, independent validation of analytical results, and ongoing monitoring of compliance are also crucial. A strong risk management framework should be implemented, encompassing identification, assessment, response, and monitoring of risks associated with data analytics tools. Moreover, fostering a culture of data responsibility and ethical data use within the organization is vital.

Future Trends in Financial Data Analytics Tools

The financial industry is undergoing a rapid transformation driven by advancements in data analytics. The integration of artificial intelligence (AI) and machine learning (ML) is reshaping how financial institutions manage risk, make investment decisions, and interact with clients. This section explores the key emerging trends and their profound implications for the future of finance.

The increasing volume, velocity, and variety of financial data are fueling the adoption of sophisticated analytics tools. This necessitates a shift towards more automated and intelligent systems capable of handling the complexity and scale of modern financial data. AI and ML are at the forefront of this evolution, offering the potential to unlock unprecedented insights and improve decision-making across various financial domains.

Artificial Intelligence and Machine Learning in Finance

AI and ML algorithms are being deployed to automate tasks such as fraud detection, algorithmic trading, and credit scoring. Machine learning models can analyze vast datasets to identify patterns and anomalies that would be impossible for humans to detect manually. For example, AI-powered systems can analyze millions of transactions in real-time to identify potentially fraudulent activities, significantly reducing financial losses. Furthermore, sophisticated algorithms are used to predict market movements, optimize investment portfolios, and personalize financial advice for individual clients. The application of reinforcement learning allows for the development of automated trading strategies that adapt and learn from market conditions in real-time, potentially outperforming traditional methods.

Impact on the Financial Industry

The widespread adoption of AI and ML in finance will lead to increased efficiency, improved risk management, and enhanced customer experiences. Automation will streamline operations, reducing costs and freeing up human analysts to focus on higher-value tasks such as strategic planning and complex problem-solving. AI-powered risk management systems can identify and mitigate potential risks more effectively, leading to greater financial stability. Personalized financial advice, driven by AI-powered insights, can empower individuals to make better financial decisions. However, the integration of AI also raises concerns regarding data privacy, algorithmic bias, and the potential displacement of human workers. Robust regulatory frameworks and ethical guidelines will be crucial to mitigate these risks and ensure responsible innovation.

Skills and Knowledge for Adapting to Change

Finance professionals need to adapt to the evolving landscape by acquiring new skills and knowledge in data science, AI, and ML. This includes developing a strong understanding of statistical modeling, data visualization, and programming languages such as Python or R. Furthermore, professionals need to understand the ethical implications of using AI and ML in finance and be able to interpret and explain the outputs of complex algorithms. Continuous learning and professional development will be essential for finance professionals to remain competitive and relevant in this rapidly changing environment. The ability to critically evaluate AI-driven insights and integrate them with human judgment will be a crucial skill for future success in the financial industry. Specialized training programs and certifications in data science and AI are becoming increasingly important for career advancement.

Ultimate Conclusion

Ultimately, mastering data analytics tools is no longer optional for finance professionals; it’s essential for navigating the complexities of the modern financial landscape. This review has provided a foundational understanding of the key tools, their applications, and the associated challenges. By embracing these technologies responsibly and ethically, financial institutions can unlock valuable insights, improve decision-making, and ultimately enhance their competitive advantage in an increasingly data-driven world.

Answers to Common Questions

What are the ethical considerations when using data analytics in finance?

Ethical considerations include data privacy, bias in algorithms, transparency in decision-making processes, and responsible use of predictive models to avoid discriminatory outcomes.

How much does it typically cost to implement data analytics tools in a financial institution?

Costs vary greatly depending on the chosen tools, required infrastructure, internal expertise, and the scale of implementation. Smaller firms might utilize free or low-cost tools, while larger institutions may invest significantly in enterprise-level solutions and specialized personnel.

What are the most common data quality issues encountered in financial data analysis?

Common issues include missing data, inconsistent data formats, inaccuracies, and data silos preventing a holistic view. Data cleansing and validation are crucial steps to address these issues.