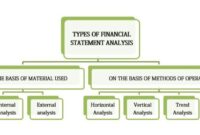

Understanding a company’s financial health is crucial for informed decision-making, whether you’re an investor, creditor, or manager. Financial statement analysis provides the tools to dissect a company’s performance, revealing its strengths and weaknesses. This guide delves into the core techniques of financial statement analysis, equipping you with the knowledge to interpret key financial data and make sound judgments.

From examining balance sheets and income statements to mastering ratio analysis and trend forecasting, we explore the various methods used to assess a company’s liquidity, solvency, profitability, and efficiency. We will also address the limitations of relying solely on quantitative data, emphasizing the importance of incorporating qualitative factors for a holistic understanding.

Introduction to Financial Statement Analysis

Financial statement analysis is a crucial process for understanding a company’s financial health and performance. It involves examining a company’s financial statements – primarily the balance sheet, income statement, and cash flow statement – to assess its profitability, liquidity, solvency, and overall financial position. This information is vital for various stakeholders, including investors, creditors, management, and regulatory bodies, to make informed decisions. Effective analysis allows for the identification of trends, strengths, and weaknesses, ultimately contributing to better strategic planning and risk management.

Key Financial Statements Used in Analysis

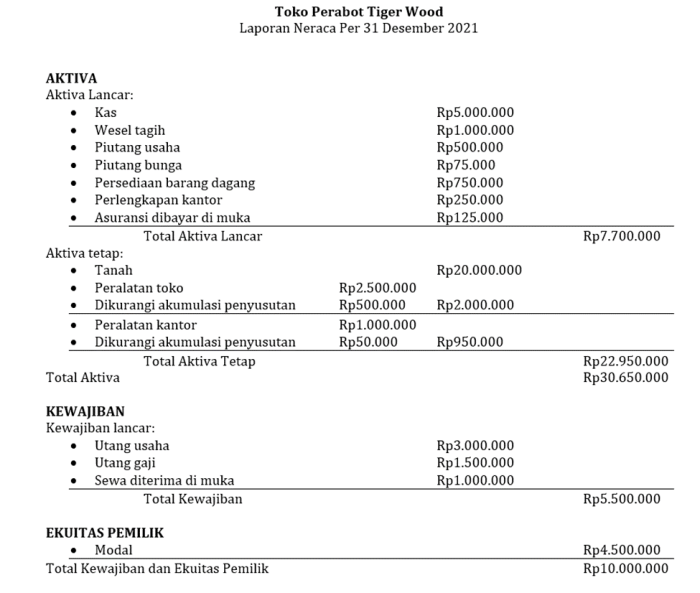

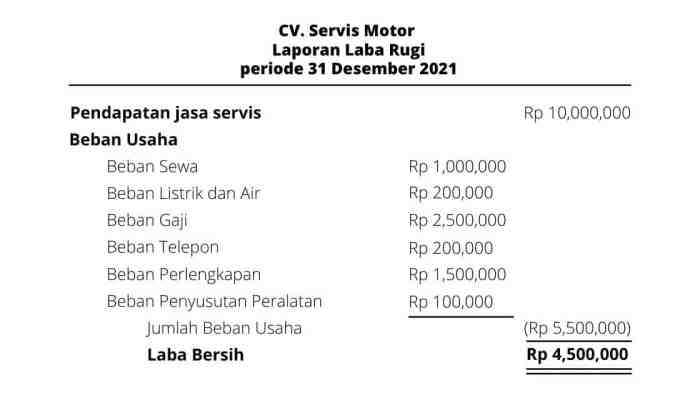

The three primary financial statements used in analysis provide a comprehensive view of a company’s financial activities. The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It shows what a company owns (assets), what it owes (liabilities), and the residual interest belonging to the owners (equity). The income statement, on the other hand, summarizes a company’s revenues and expenses over a specific period, revealing its profitability. It shows the company’s revenue generated, the costs incurred, and the resulting net income or loss. Finally, the statement of cash flows tracks the movement of cash both into and out of the company during a specific period, highlighting the sources and uses of cash. This statement provides insights into the company’s liquidity and ability to meet its short-term and long-term obligations.

Obtaining and Preparing Financial Statements for Analysis

Securing and preparing financial statements for analysis typically involves a few key steps. First, identify the company whose financial health you want to assess. Next, locate their financial statements. Publicly traded companies are required to file these statements with regulatory bodies (like the SEC in the US), making them readily accessible online through databases such as EDGAR or company websites. For privately held companies, obtaining the statements might require direct requests to the company. Once obtained, the statements should be reviewed for completeness and consistency. This might involve checking for any unusual entries or discrepancies. Finally, the statements can be prepared for analysis by organizing the data in a user-friendly format, possibly using spreadsheet software to facilitate calculations and comparisons. It’s crucial to ensure that all figures are in the same currency and accounting period for accurate comparison.

Comparison of Financial Statement Analysis Ratios

Various ratios are derived from financial statements to provide a more in-depth understanding of a company’s financial performance. These ratios can be broadly categorized, allowing for a more targeted analysis based on specific aspects of financial health. The following table provides a comparison of different types of financial statement analysis ratios:

| Ratio Category | Ratio Name | Formula | Interpretation |

|---|---|---|---|

| Liquidity | Current Ratio | Current Assets / Current Liabilities | Measures a company’s ability to pay its short-term obligations. A higher ratio indicates better liquidity. |

| Solvency | Debt-to-Equity Ratio | Total Debt / Total Equity | Measures the proportion of a company’s financing that comes from debt. A higher ratio indicates higher financial risk. |

| Profitability | Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | Indicates the percentage of revenue remaining after deducting the direct costs of producing goods or services. |

| Efficiency | Inventory Turnover | Cost of Goods Sold / Average Inventory | Measures how efficiently a company manages its inventory. A higher ratio suggests efficient inventory management. |

Ratio Analysis Techniques

Ratio analysis is a crucial tool in financial statement analysis, providing insights into a company’s financial health and performance. By examining the relationships between different line items within the financial statements, we can gain a more comprehensive understanding than simply looking at individual figures. This analysis allows for both internal comparisons over time and external comparisons with competitors or industry averages. Several key categories of ratios offer different perspectives on a company’s financial standing.

Liquidity Ratios

Liquidity ratios assess a company’s ability to meet its short-term obligations. These ratios indicate whether a company has enough readily available assets to cover its immediate debts. A low liquidity ratio might signal potential financial distress. Conversely, a very high liquidity ratio might suggest inefficient use of assets.

- Current Ratio: This is calculated by dividing current assets by current liabilities. A current ratio of 1.0 or higher generally indicates the company can meet its short-term obligations. For example, if a company has current assets of $100,000 and current liabilities of $80,000, its current ratio is 1.25.

- Quick Ratio (Acid-Test Ratio): This is a more stringent measure than the current ratio, excluding inventories from current assets. The formula is (Current Assets – Inventories) / Current Liabilities. This provides a clearer picture of a company’s ability to meet its immediate obligations without relying on the sale of inventory.

Solvency Ratios

Solvency ratios gauge a company’s ability to meet its long-term obligations. These ratios are vital in assessing the long-term financial stability and risk profile of a company. High levels of debt relative to equity can indicate higher financial risk.

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its total equity. It’s calculated as Total Debt / Total Equity. A high ratio suggests a greater reliance on debt financing and potentially higher financial risk.

- Times Interest Earned Ratio: This ratio measures a company’s ability to cover its interest expense with its earnings. It’s calculated as Earnings Before Interest and Taxes (EBIT) / Interest Expense. A higher ratio indicates greater ability to meet interest payments.

Profitability Ratios

Profitability ratios measure a company’s ability to generate profits from its operations. These ratios are crucial in evaluating the efficiency and effectiveness of a company’s business model. Analyzing trends in these ratios over time can reveal valuable insights into a company’s performance.

- Gross Profit Margin: This ratio shows the percentage of revenue remaining after deducting the cost of goods sold. It’s calculated as (Revenue – Cost of Goods Sold) / Revenue. A higher margin suggests greater efficiency in production or pricing.

- Net Profit Margin: This ratio shows the percentage of revenue remaining after all expenses, including taxes and interest, are deducted. It’s calculated as Net Income / Revenue. This is a key indicator of overall profitability.

- Return on Equity (ROE): This ratio measures the return generated on the shareholders’ investment. It’s calculated as Net Income / Shareholders’ Equity. A higher ROE indicates better utilization of shareholder funds.

Efficiency Ratios

Efficiency ratios assess how effectively a company manages its assets and liabilities to generate sales and profits. These ratios help identify areas for improvement in operational efficiency.

- Inventory Turnover Ratio: This ratio measures how many times a company sells and replaces its inventory during a period. It’s calculated as Cost of Goods Sold / Average Inventory. A higher ratio generally indicates efficient inventory management.

- Days Sales Outstanding (DSO): This ratio measures the average number of days it takes a company to collect its receivables. It’s calculated as (Average Accounts Receivable / Revenue) * Number of Days in the Period. A lower DSO suggests efficient credit and collection practices.

Example: Hypothetical Company “XYZ Corp”

Let’s assume XYZ Corp has the following financial data for the year:

| Item | Amount ($) |

|---|---|

| Revenue | 1,000,000 |

| Cost of Goods Sold | 600,000 |

| Operating Expenses | 200,000 |

| Interest Expense | 50,000 |

| Taxes | 50,000 |

| Current Assets | 200,000 |

| Current Liabilities | 100,000 |

| Inventory | 50,000 |

| Total Debt | 300,000 |

| Total Equity | 500,000 |

* Gross Profit Margin: (1,000,000 – 600,000) / 1,000,000 = 40%

* Net Profit Margin: (1,000,000 – 600,000 – 200,000 – 50,000 – 50,000) / 1,000,000 = 10%

* Current Ratio: 200,000 / 100,000 = 2.0

* Debt-to-Equity Ratio: 300,000 / 500,000 = 0.6

These ratios provide a snapshot of XYZ Corp’s financial health. The high current ratio indicates good short-term liquidity, while the debt-to-equity ratio suggests a moderate level of financial leverage. The profitability ratios show a reasonable gross profit margin but a relatively low net profit margin, suggesting potential areas for cost reduction.

Trend Analysis and Forecasting

Trend analysis involves examining historical financial data to identify patterns and predict future performance. This technique is crucial for informed decision-making, allowing businesses to anticipate challenges and capitalize on opportunities. By understanding past trends, companies can make more accurate projections and develop effective strategies.

Performing Trend Analysis Using Historical Financial Data

Trend analysis utilizes historical data to identify consistent patterns in a company’s financial performance. This often involves calculating growth rates over several periods, typically years. For example, one might calculate the year-over-year growth rate of revenue, net income, or other key financial metrics. These growth rates can then be plotted on a graph to visually represent the trends. Analyzing these trends can reveal whether a company is experiencing consistent growth, decline, or cyclical patterns. The selection of the appropriate time period is crucial, as shorter periods may show more volatility while longer periods may mask important short-term fluctuations. The choice depends on the specific analysis and the nature of the business.

Forecasting Future Financial Performance Using Trend Analysis Techniques

Once trends have been identified, forecasting future performance involves extrapolating these trends into the future. Simple methods involve assuming a constant growth rate, while more sophisticated techniques might incorporate factors such as market conditions, industry trends, and company-specific events. For example, if a company has consistently grown its revenue at an average annual rate of 10% over the past five years, a simple forecast might assume continued 10% growth in the coming years. However, this assumption needs careful consideration; it’s essential to acknowledge that external factors could influence future growth. More complex forecasting models may incorporate regression analysis to account for multiple variables impacting financial performance.

Limitations and Challenges of Trend Analysis and Forecasting

Trend analysis and forecasting, while valuable tools, have inherent limitations. One significant challenge is the assumption that past trends will continue into the future. Unforeseen events, such as economic downturns, technological disruptions, or changes in consumer preferences, can significantly alter a company’s trajectory. Furthermore, the accuracy of forecasts depends heavily on the quality and reliability of the historical data used. Inaccurate or incomplete data can lead to misleading projections. Another limitation is the potential for oversimplification. Reducing complex financial relationships to simple trends can overlook important nuances and details. Finally, the chosen forecasting method itself can influence the results, highlighting the importance of selecting an appropriate technique.

Hypothetical Company Financial Performance and Trend Analysis

The following table illustrates a hypothetical company’s financial performance over five years, along with trend analysis calculations. Note that this is a simplified example and real-world analyses are far more complex.

| Year | Revenue (in millions) | Net Income (in millions) | Revenue Growth Rate (%) | Net Income Growth Rate (%) |

|---|---|---|---|---|

| 2019 | 10 | 1 | – | – |

| 2020 | 12 | 1.5 | 20% | 50% |

| 2021 | 15 | 2 | 25% | 33.33% |

| 2022 | 18 | 2.5 | 20% | 25% |

| 2023 | 21 | 3 | 16.67% | 20% |

Cash Flow Analysis

Analyzing a company’s cash flow statement is crucial for understanding its financial health and future prospects. Unlike the accrual-based income statement, the cash flow statement provides a clear picture of the actual cash inflows and outflows during a specific period. This allows for a more realistic assessment of a company’s liquidity, solvency, and overall financial strength, going beyond the accounting profits or losses shown on the income statement. A comprehensive cash flow analysis provides insights unavailable through other financial statements alone.

Key Indicators of Cash Flow Health

The statement of cash flows categorizes cash flows into operating, investing, and financing activities. Analyzing these categories reveals important insights into a company’s financial well-being. Strong positive cash flow from operations generally indicates a healthy and sustainable business model. Significant capital expenditures in the investing activities section may suggest growth opportunities but could also indicate a strain on cash resources. Finally, the financing activities section highlights how the company is funding its operations and investments, revealing its reliance on debt or equity.

Direct and Indirect Methods of Cash Flow Reporting

Companies can report their cash flows using either the direct or indirect method. The direct method directly reports cash inflows and outflows from operating activities. For example, cash received from customers and cash paid to suppliers would be explicitly listed. The indirect method, on the other hand, starts with net income and adjusts it for non-cash items (like depreciation and changes in working capital) to arrive at cash flow from operating activities. While both methods ultimately arrive at the same net cash flow, the direct method offers a more transparent view of the cash generated from core business operations. The indirect method, while less transparent, is more commonly used due to its simpler accounting requirements.

Using Cash Flow Analysis to Assess Liquidity and Solvency

Cash flow analysis is instrumental in assessing a company’s liquidity and solvency.

- Liquidity: Analyzing cash flow from operations helps determine a company’s ability to meet its short-term obligations. A consistently positive cash flow from operations suggests strong liquidity. Conversely, negative cash flow from operations might indicate liquidity problems and the need for external financing. For instance, a company with high accounts receivable turnover but low cash flow from operations may face challenges in meeting its immediate payment obligations.

- Solvency: Analyzing the overall cash flow statement, including investing and financing activities, helps assess a company’s long-term ability to meet its financial obligations. A company with consistently strong positive cash flow from operations and strategic investments, coupled with prudent financing, demonstrates strong solvency. For example, a company consistently investing in new equipment while maintaining positive free cash flow (cash flow from operations minus capital expenditures) displays good long-term solvency. Conversely, a company relying heavily on debt financing to cover operating losses signals potential solvency issues.

Comparative Analysis

Comparative analysis is a crucial tool in financial statement analysis, providing valuable insights into a company’s performance relative to its competitors and the industry as a whole. By comparing a company’s financial metrics to those of its peers, investors and analysts can gain a deeper understanding of its strengths, weaknesses, and overall competitive position. This analysis goes beyond simply looking at a company’s numbers in isolation; it places those numbers within a broader context, enabling more informed decision-making.

Benefits of Comparing a Company’s Financial Performance to its Industry Peers

Comparing a company’s financial performance to its industry peers offers several significant advantages. It allows for a realistic assessment of a company’s efficiency, profitability, and overall financial health. This benchmarking process reveals whether a company is outperforming, underperforming, or performing in line with its competitors, providing a crucial context for interpreting its financial statements. Identifying areas of strength and weakness relative to peers allows for strategic planning and improvement initiatives. Furthermore, this comparative approach helps in assessing the company’s risk profile and predicting its future performance based on the performance of similar companies.

Identifying Comparable Companies for Analysis

Selecting truly comparable companies is essential for meaningful comparative analysis. Several factors must be considered. First, companies should operate within the same industry, producing similar products or services. Second, the companies should have comparable size and market capitalization, avoiding skewed comparisons between a large multinational and a small, regional player. Third, the companies should have similar business models and strategies, ensuring that the financial metrics being compared are truly reflective of similar operations. Fourth, companies should have a similar geographic scope of operations to avoid distortions due to regional economic differences. Finally, access to consistent and reliable financial data for all chosen companies is crucial for a robust analysis. Often, industry reports and databases provide standardized financial data for many publicly traded companies.

Benchmarking Financial Performance Against Industry Averages

Benchmarking involves comparing a company’s key financial ratios to industry averages. These averages are typically derived from industry reports or databases that collect and aggregate financial data from a large number of companies within a specific sector. Common ratios used for benchmarking include profitability ratios (gross profit margin, net profit margin, return on assets, return on equity), liquidity ratios (current ratio, quick ratio), solvency ratios (debt-to-equity ratio, times interest earned), and efficiency ratios (inventory turnover, accounts receivable turnover). By comparing a company’s ratios to the industry averages, analysts can identify areas where the company excels or lags behind its peers. This provides a valuable framework for assessing the company’s relative financial strength and identifying potential areas for improvement.

Comparative Analysis Table: Hypothetical Example

The following table compares the key financial ratios of a hypothetical company, “Alpha Corp,” to the average ratios of its industry peers for the year 2023. Note that these figures are purely illustrative.

| Ratio | Alpha Corp | Industry Average | Difference |

|---|---|---|---|

| Gross Profit Margin (%) | 35% | 30% | +5% |

| Net Profit Margin (%) | 10% | 8% | +2% |

| Return on Assets (%) | 15% | 12% | +3% |

| Return on Equity (%) | 20% | 18% | +2% |

| Current Ratio | 1.8 | 1.5 | +0.3 |

| Debt-to-Equity Ratio | 0.7 | 0.9 | -0.2 |

Limitations of Financial Statement Analysis

Financial statement analysis, while a powerful tool for assessing a company’s financial health and performance, is not without its limitations. Over-reliance on these statements alone can lead to inaccurate conclusions and poor decision-making. A comprehensive analysis requires a nuanced understanding of these limitations and the incorporation of qualitative factors.

Financial statement analysis relies heavily on historical data presented in a structured format. However, the inherent nature of this data, coupled with accounting practices and external factors, introduces several potential biases and limitations that must be carefully considered.

Accounting Policies and Standards Influence

The choice of accounting methods significantly impacts the figures reported in financial statements. Different accounting standards (e.g., IFRS, GAAP) allow for variations in depreciation methods, inventory valuation, and revenue recognition, leading to different financial pictures for companies operating under different frameworks. For instance, a company using accelerated depreciation will show lower net income and assets in the short term compared to a company using straight-line depreciation, even if both companies have identical underlying assets and operations. Consistent application of a single accounting standard within a company over time is essential for meaningful trend analysis; however, even this consistency doesn’t eliminate the influence of the standard itself. Furthermore, changes in accounting standards over time can make comparisons across different periods challenging.

Qualitative Factors and Their Impact

Quantitative data from financial statements only tells part of the story. Qualitative factors, such as management quality, employee morale, brand reputation, and competitive landscape, are crucial for a complete assessment. For example, a company with strong financial ratios might be facing an impending lawsuit or significant regulatory changes that are not reflected in its financial statements. Similarly, a company with seemingly weak financial performance might be undergoing a successful restructuring or have a highly innovative product pipeline that promises future growth. Ignoring these qualitative aspects can lead to flawed interpretations of the financial data.

Situations Where Financial Statement Analysis Might Be Misleading

Several situations can render financial statement analysis potentially misleading:

- Creative Accounting Practices: Companies might engage in aggressive accounting practices to manipulate their financial statements and present a more favorable picture than reality. This could involve manipulating revenue recognition, understating expenses, or overstating assets. For example, a company might recognize revenue prematurely, boosting short-term earnings but jeopardizing long-term sustainability.

- Window Dressing: Companies might engage in short-term actions to improve their financial statements before reporting periods, such as accelerating collections or delaying payments. This can temporarily improve the appearance of liquidity and profitability but doesn’t reflect the underlying financial health.

- Lack of Comparability: Comparing companies with different sizes, industries, and accounting practices can be misleading. Direct comparisons without proper adjustments and contextualization can lead to erroneous conclusions. For example, comparing a small, rapidly growing technology company with a large, established manufacturing company based solely on profitability ratios might be inaccurate due to differences in capital structure and growth strategies.

- Ignoring Inflation: Financial statements typically don’t adjust for inflation, leading to an overestimation of the value of assets and profitability in periods of high inflation. This can make comparisons across different time periods challenging and potentially misleading.

- Off-Balance Sheet Financing: Companies might use off-balance sheet financing techniques to hide liabilities and debt, making their financial position appear stronger than it actually is. This can significantly distort the financial ratios and lead to inaccurate assessments.

Visualizing Financial Data

Effective visualization is crucial for understanding complex financial data. Transforming raw numbers into compelling visual representations allows for quicker identification of trends, patterns, and anomalies, facilitating better decision-making. Different chart types offer unique strengths, making the selection of the appropriate chart vital for clear communication.

Bar Charts

Bar charts are ideal for comparing discrete data points across different categories. For example, a bar chart could effectively illustrate the revenue generated by different product lines over a specific period. The length of each bar directly represents the value, making comparisons straightforward. Strengths include their simplicity and ease of interpretation; weaknesses include their limited use for showing trends over time and their potential for cluttering when dealing with numerous categories.

Line Graphs

Line graphs excel at depicting trends and changes in data over time. For instance, a line graph can clearly showcase a company’s revenue growth or profit margins over several years. The continuous line visually connects data points, highlighting the direction and rate of change. Strengths lie in their ability to illustrate trends and patterns; weaknesses arise when dealing with a large number of data series, potentially leading to a cluttered and difficult-to-interpret chart. A simple solution to this is to use multiple line graphs, each dedicated to a subset of the data.

Pie Charts

Pie charts are best suited for showing the proportion of different parts to a whole. For example, a pie chart could effectively represent the allocation of a company’s assets among various categories like cash, accounts receivable, and fixed assets. Each slice of the pie represents a proportion of the total. Strengths include their intuitive representation of proportions; weaknesses include their limitations in representing more than a few categories and their difficulty in precisely comparing different slices.

Scatter Plots

Scatter plots are used to illustrate the relationship between two variables. For instance, a scatter plot could show the correlation between marketing expenditure and sales revenue. Each point represents a data pair, and the overall pattern of points reveals the relationship between the variables. Strengths lie in visualizing correlation; weaknesses include difficulty in interpreting dense clusters of data points and the need for a relatively large dataset to reveal meaningful patterns. A clear trend line can be added to enhance interpretation.

Final Thoughts

Mastering financial statement analysis empowers individuals and organizations to make data-driven decisions. By understanding the intricacies of balance sheets, income statements, and cash flow statements, and by skillfully applying ratio analysis, trend forecasting, and comparative analysis, a clear picture of a company’s financial health emerges. Remember, while financial analysis provides valuable insights, it’s essential to consider qualitative factors and acknowledge the inherent limitations of relying solely on quantitative data for a comprehensive assessment.

Helpful Answers

What is the difference between liquidity and solvency ratios?

Liquidity ratios measure a company’s ability to meet its short-term obligations, while solvency ratios assess its ability to meet its long-term obligations.

How can I find comparable companies for benchmarking?

Identify companies within the same industry, with similar size and business models. Industry databases and financial news sources can assist in this process.

What are some qualitative factors to consider alongside financial data?

Consider management quality, competitive landscape, industry trends, regulatory environment, and potential legal risks.

What are the limitations of using only historical financial data for forecasting?

Past performance is not necessarily indicative of future results. Unexpected economic shifts, changes in management, or unforeseen events can significantly impact future performance.