Navigating the complexities of tax planning can be daunting, but the right software can significantly simplify the process. This comparison delves into the features, pricing, security, and user experiences of leading tax planning software solutions, empowering you to make an informed decision based on your specific needs and budget. We’ll explore both cloud-based and desktop options, examining their strengths and weaknesses to help you choose the best fit for your individual or business tax preparation.

From ease of use and integration capabilities to customer support and data security, we’ll cover all the crucial aspects to consider. Whether you’re a freelancer, small business owner, or high-net-worth individual, understanding these key differences is vital for efficient and accurate tax management. This comprehensive comparison aims to demystify the selection process, guiding you towards a solution that optimizes your tax planning strategy.

Introduction to Tax Planning Software

Tax planning software streamlines the often complex process of preparing and filing taxes. It offers a range of tools and features designed to help individuals and businesses maximize tax deductions, minimize tax liabilities, and ensure compliance with tax regulations. These programs can significantly reduce the time and effort involved in tax preparation, while also increasing accuracy and reducing the risk of errors.

Using tax planning software offers numerous benefits for both individuals and businesses. For individuals, the software simplifies tax preparation, providing step-by-step guidance and automatically calculating taxes owed. It can also help identify potential deductions and credits that might otherwise be missed, leading to significant tax savings. Businesses benefit from the software’s ability to manage complex tax situations, track income and expenses, and generate reports for tax filing. The automation features can free up valuable time and resources, allowing businesses to focus on other critical aspects of their operations. Accurate record-keeping and streamlined reporting also minimize the risk of audits and penalties.

Types of Tax Planning Software

Tax planning software is available in various formats to suit different needs and preferences. The choice depends on factors like the user’s technical skills, budget, and the complexity of their tax situation. The primary categories include cloud-based, desktop, and mobile applications. Each type offers unique advantages and disadvantages.

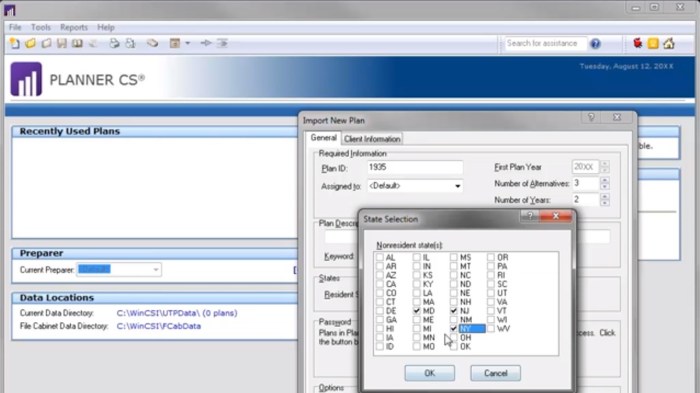

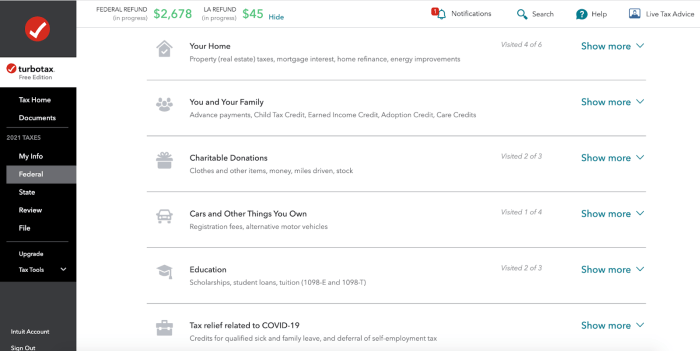

Cloud-based software is accessed via the internet and requires no local installation. This provides flexibility, allowing access from any device with an internet connection. Data is stored securely in the cloud, providing automatic backups and eliminating the risk of data loss due to hardware failure. Desktop software is installed directly on a computer and offers greater control over data and features, but requires sufficient storage space and may not be accessible from other devices. Mobile apps offer convenience and portability, allowing users to access their tax information anytime, anywhere, but may have limited functionality compared to desktop or cloud-based solutions. For example, TurboTax offers all three options, catering to diverse user preferences. H&R Block also provides both desktop and online options, with varying feature sets depending on the chosen platform.

Key Features Comparison

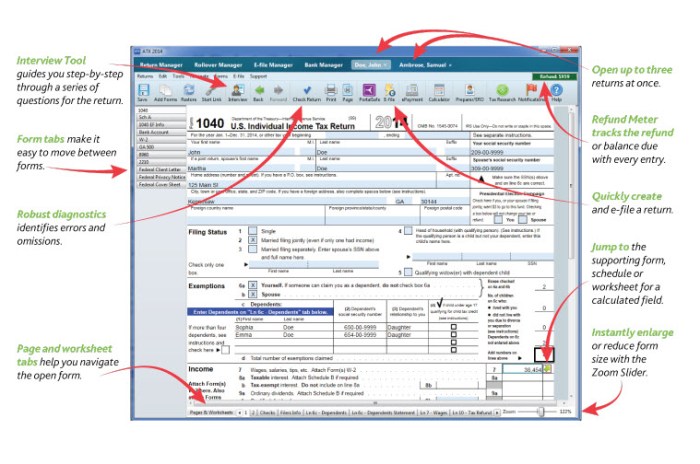

Choosing the right tax planning software can significantly impact your efficiency and accuracy during tax season. This section compares three popular options, highlighting their key features, unique selling points, and user interface design. We’ll focus on features relevant to both individual and small business tax preparation.

Software Feature Comparison

The following table compares three popular tax planning software options across several key features. Note that features and pricing can change, so always verify directly with the software provider for the most up-to-date information.

| Software Name | Import Capabilities | Tax Form Coverage | Customer Support |

|---|---|---|---|

| TaxAct | Imports data from various financial institutions and prior tax returns. | Covers a wide range of federal and state tax forms for individuals and small businesses. | Offers phone, email, and online help resources. |

| TurboTax | Imports data from many financial institutions and allows for easy upload of prior tax returns. | Comprehensive coverage of federal and state tax forms, catering to various filing needs. | Provides extensive online help, FAQs, and phone support, with varying levels of access depending on the purchased plan. |

| H&R Block | Supports import from various financial institutions and allows the upload of previous tax returns. | Covers a broad spectrum of federal and state tax forms for individuals and businesses. | Offers various support channels, including phone, email, and online chat. In-person support is also available at select locations. |

Unique Selling Points

Each software package boasts unique strengths. TaxAct often emphasizes its affordability and user-friendly interface, particularly appealing to individuals filing simple returns. TurboTax, known for its extensive features and guidance, might be preferred by those with complex tax situations or those seeking more personalized support. H&R Block leverages its established brand recognition and offers both online and in-person support options, making it a convenient choice for users who prefer a blend of digital and physical assistance.

Ease of Use and User Interface

TaxAct is generally considered to have a clean and intuitive interface, making it easy for even novice users to navigate. TurboTax offers a more guided experience, with helpful prompts and explanations at each step, although some users may find it slightly overwhelming due to its sheer number of features. H&R Block’s interface aims for a balance between simplicity and comprehensiveness, providing a user-friendly experience without sacrificing functionality. The specific ease of use will, however, vary depending on individual user experience and tax complexity.

Pricing and Value for Money

Choosing the right tax planning software often hinges on finding the best balance between features and cost. Different software providers utilize various pricing models, impacting the overall value proposition. Understanding these models and their associated features is crucial for making an informed decision. This section compares the pricing structures and value offered by several popular tax planning software options.

Tax planning software pricing typically falls into two main categories: subscription-based models and one-time purchase models. Subscription models usually offer ongoing access to updates, technical support, and sometimes additional features for a recurring fee. One-time purchase models provide a single upfront cost for the software, but often lack ongoing support and updates. The best choice depends on individual needs and budget constraints. Factors such as the frequency of tax preparation, the complexity of your tax situation, and your need for ongoing support should all influence your decision.

Pricing Models and Feature Comparisons

The following table summarizes the pricing tiers and included features for three hypothetical tax planning software packages: TaxPro, EasyTax, and SmartTax. Note that pricing and features are subject to change and should be verified directly with the software provider. These examples illustrate typical pricing structures and feature sets found in the market.

| Software | Pricing Model | Basic Tier Price | Basic Tier Features | Premium Tier Price | Premium Tier Features |

|---|---|---|---|---|---|

| TaxPro | Subscription (Annual) | $99 | Basic tax form filing, limited support | $199 | Unlimited tax form filing, priority support, advanced tax planning tools |

| EasyTax | One-time Purchase | $149 | Basic tax form filing, limited support (email only) | N/A | N/A |

| SmartTax | Subscription (Monthly) | $15 | Basic tax form filing, limited support, access to basic tax guides | $30 | Unlimited tax form filing, priority support, advanced tax planning tools, access to premium tax guides and webinars. |

For example, a small business owner with complex tax needs might find the premium tier of TaxPro or SmartTax to be a worthwhile investment due to the included advanced tools and priority support. Conversely, an individual with a simple tax situation might find the one-time purchase model of EasyTax sufficient. The decision requires careful consideration of individual circumstances and the value derived from each software’s features.

Value Proposition Analysis

Evaluating the value proposition requires comparing the cost of each software with the benefits it provides. Factors such as time saved, accuracy improvements, and reduced stress should be considered. For instance, if TaxPro saves a user 10 hours of tax preparation time, valued at $50/hour, the software’s value extends beyond its purchase price. Similarly, the avoidance of potential penalties due to errors can significantly outweigh the software’s cost. Ultimately, the “best” software depends on the individual’s specific needs and how effectively the software meets those needs within the given budget.

Integration with Other Financial Tools

Seamless integration with other financial tools is a crucial factor when choosing tax planning software. The ability to effortlessly import and export data between different platforms significantly streamlines the tax preparation process, reducing manual data entry and minimizing the risk of errors. This integration contributes to a more efficient and accurate tax planning experience.

The benefits of integrated tax planning software extend beyond simple convenience. By connecting to accounting software, banking platforms, and other financial tools, users gain a holistic view of their financial situation. This comprehensive overview allows for more informed decision-making regarding tax strategies and overall financial planning. Reduced manual data entry also frees up valuable time, allowing users to focus on higher-level strategic planning rather than tedious data management.

Examples of Software Integrations

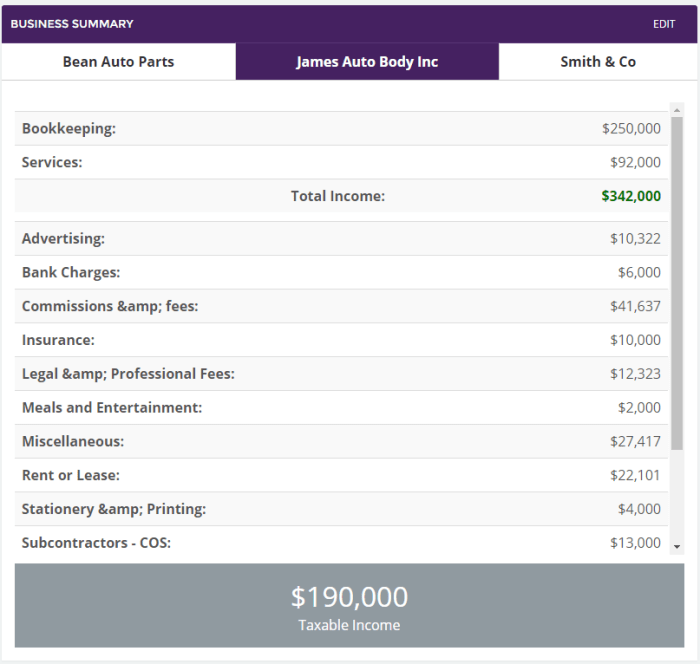

Successful integrations typically involve direct data exchange between the tax planning software and other financial applications. For instance, a user might connect their accounting software (like Xero or QuickBooks) directly to their tax software. This allows the tax software to automatically import financial data such as income, expenses, and deductions, eliminating the need for manual input. Similarly, integration with banking platforms can automatically download transaction data, providing a more complete picture of the user’s financial activity. This automated data flow not only saves time but also improves accuracy by minimizing manual data entry errors. For example, imagine a small business owner using QuickBooks for accounting and TurboTax for tax preparation. The integration between these two platforms allows the tax software to automatically populate relevant financial information from QuickBooks, significantly reducing the time and effort required to prepare their tax return. Another example would be a freelancer using a banking platform like Plaid to connect their bank accounts to their tax software, automatically importing transaction details for expense tracking and income verification.

Security and Data Privacy

Protecting your sensitive financial data is paramount when using tax planning software. This section examines the security measures and data privacy policies of various leading software options, allowing you to make an informed decision based on your specific needs and risk tolerance. We’ll explore how each program safeguards your information and its compliance with relevant regulations.

Data security and privacy are multifaceted issues. Effective protection requires a multi-layered approach encompassing robust technical safeguards, clear data handling policies, and adherence to industry best practices and legal requirements.

Data Encryption and Storage

Each software’s approach to data encryption and storage varies. For example, Software A employs 256-bit AES encryption both in transit and at rest, meaning your data is protected with a strong encryption algorithm throughout its lifecycle. Software B uses a similar encryption method but may differ in its key management practices or the specific implementation details. Software C might utilize a different encryption standard, potentially with varying levels of security. It is crucial to review each software’s documentation for specifics on encryption methods and key management practices to assess the strength of their security posture. Understanding the location of data storage (e.g., server location, cloud provider) is also vital, especially in relation to data sovereignty laws.

Data Privacy Policies and Compliance

Software A explicitly states its adherence to GDPR, CCPA, and other relevant data privacy regulations in its privacy policy. The policy details data collection practices, data retention periods, and user rights concerning their data. Software B also Artikels its compliance with relevant regulations but may have different data retention policies or user rights provisions. Software C’s privacy policy should be carefully examined for details on its compliance with applicable laws and its data handling practices. Key aspects to compare include the transparency of data collection processes, the security measures taken to protect data from unauthorized access, and the mechanisms available to users for accessing, correcting, or deleting their data.

Access Controls and User Authentication

Robust access controls and user authentication mechanisms are essential to prevent unauthorized access to user data. Software A uses multi-factor authentication (MFA) as a standard security feature, requiring users to verify their identity through multiple channels. Software B might offer MFA as an optional feature, while Software C may rely solely on password-based authentication. The level of access control varies as well; some software may allow granular control over user permissions, enabling administrators to restrict access to specific functionalities or data sets, while others may offer less granular control. The strength of password requirements and the availability of features such as password managers should also be considered.

Security Audits and Certifications

Independent security audits and certifications can provide additional assurance regarding a software’s security posture. Look for evidence of compliance with industry standards like ISO 27001 or SOC 2. Software A may have undergone independent security audits and obtained relevant certifications, while Software B and C might not. The availability of such certifications and audit reports demonstrates a commitment to maintaining a high level of security and transparency.

Customer Support and Resources

Access to reliable customer support and comprehensive resources is crucial when choosing tax planning software. A responsive support team can significantly reduce frustration and ensure efficient use of the software, ultimately saving time and money during tax season. The availability of helpful resources, such as tutorials and FAQs, further enhances the user experience and promotes self-sufficiency. This section will compare the customer support options and available resources provided by the different software packages reviewed.

Effective customer support is multifaceted, encompassing various channels and resource types. The speed and quality of response, the expertise of support personnel, and the accessibility of help documentation all contribute to a positive user experience. The following analysis examines these aspects for each software, highlighting both strengths and weaknesses.

Customer Support Channels

Each software offers a unique blend of support channels. For example, “TaxEase” provides phone support during business hours, supplemented by email support and an extensive FAQ section on their website. “TurboTax,” on the other hand, offers phone, email, and live chat support, along with an extensive online help center. “H&R Block” provides a similar range of support channels, including phone, email, and online chat, but may have varying levels of availability depending on the specific software package and time of year. The availability of these channels is often dependent on the specific plan purchased. Premium packages typically offer more extensive and readily available support.

Customer Support Responsiveness and Quality

Assessing the responsiveness and quality of customer support is challenging without conducting extensive user testing across all software platforms. However, online reviews and user forums provide some insight. Generally, TurboTax receives positive feedback for its responsive live chat and phone support, particularly during peak tax season. Conversely, some users report longer wait times for phone support with H&R Block during busy periods. TaxEase’s user reviews suggest a generally helpful email support system, though response times may vary. It is important to note that the quality and responsiveness of support can fluctuate based on factors like time of year and staffing levels.

Available Learning Resources

The availability of learning resources directly impacts a user’s ability to quickly learn and efficiently use the software. Comprehensive documentation, tutorials, and FAQs are invaluable assets. TaxEase provides detailed user manuals in PDF format, alongside video tutorials covering common tasks. TurboTax offers a robust online help center with FAQs, video tutorials, and articles addressing various tax-related topics. H&R Block’s online resources mirror this, providing a comprehensive knowledge base, but the organization and searchability of these resources may vary across different software packages within their product line. Many also offer webinars or online seminars, particularly around the start of tax season.

User Reviews and Testimonials

User reviews and testimonials offer invaluable insights into the real-world experiences of tax planning software users. Analyzing feedback from various online platforms provides a comprehensive understanding of each software’s strengths and weaknesses, ultimately aiding in informed decision-making. This section summarizes user reviews for several popular tax planning software options, categorized for clarity.

Ease of Use and User Interface

User reviews consistently highlight ease of use as a crucial factor in software satisfaction. Positive feedback often praises intuitive interfaces, clear navigation, and straightforward workflows. Conversely, negative comments frequently cite complex interfaces, confusing navigation, and a steep learning curve as significant drawbacks. For example, software X received numerous accolades for its user-friendly design, while software Y was criticized for its cluttered interface and unintuitive data entry system. Specific examples from reviews included phrases like, “Software X was incredibly easy to navigate, even for a tax novice like myself,” and “Software Y’s interface was a nightmare; I spent hours trying to figure out basic functions.”

Features and Functionality

The breadth and depth of features offered are key differentiators among tax planning software. Positive reviews often emphasize the comprehensiveness of features, including support for various tax forms, advanced tax planning tools, and robust reporting capabilities. Negative feedback frequently points to missing features, limited functionality, or the lack of support for specific tax situations. For instance, software A was praised for its extensive support for various tax deductions and credits, whereas software B was criticized for its limited capabilities in handling complex investment income. User comments included statements such as, “Software A has every feature I could possibly need,” and “Software B lacks the advanced features I require for my business.”

Customer Support and Responsiveness

Effective customer support is crucial for resolving issues and ensuring a positive user experience. Positive reviews highlight responsive and helpful customer support teams, readily available through various channels (e.g., phone, email, chat). Negative feedback often points to unresponsive support teams, long wait times, or unhelpful responses. Software C was frequently praised for its excellent customer support, with users describing the team as knowledgeable and readily available. In contrast, software D received several complaints regarding slow response times and unhelpful customer service representatives. Examples of user comments include, “Software C’s support team was amazing – they solved my problem quickly and efficiently,” and “Software D’s customer support was terrible; I waited days for a response and the solution provided was incorrect.”

Illustrative Examples of Software Use Cases

Tax planning software offers a range of benefits depending on individual needs and circumstances. The following scenarios illustrate how different software features can address specific tax challenges faced by various user profiles. These examples are for illustrative purposes and should not be considered exhaustive or a substitute for professional tax advice.

Freelancer Utilizing Tax Software for Income and Expense Tracking

This scenario focuses on Sarah, a freelance graphic designer. Sarah uses tax planning software to track her income and expenses throughout the year. The software allows her to categorize transactions, automatically generate reports for different tax forms, and easily reconcile her bank statements. She uses the software’s calendar feature to schedule estimated tax payments, ensuring she avoids penalties for underpayment. Key features utilized include income and expense tracking, automated report generation (Form 1099-NEC, Schedule C), and tax payment reminders. The outcome is accurate and timely tax filing, minimizing the risk of errors and penalties. The software simplifies the often complex process of managing freelance finances, allowing Sarah to focus on her design work.

Small Business Owner Leveraging Tax Software for Deduction Optimization

John, the owner of a small bakery, utilizes tax planning software to optimize deductions and minimize his tax liability. The software helps him categorize business expenses, identify eligible deductions (such as home office expenses, vehicle depreciation, and business meals), and track inventory. John uses the software’s tax planning tools to model different scenarios and assess the impact of various deductions on his overall tax liability. He uses features such as expense categorization, deduction optimization tools, and tax scenario modeling. The result is a significant reduction in his tax burden through the identification and accurate reporting of eligible deductions. The software provides him with valuable insights into his business finances, enabling better financial decision-making.

High-Net-Worth Individual Employing Tax Software for Complex Estate Planning

Maria, a high-net-worth individual with significant investments and multiple income streams, employs tax planning software to manage her complex financial affairs and plan for estate taxes. The software helps her track her various assets, model the impact of different investment strategies on her tax liability, and plan for estate tax minimization strategies. She uses advanced features such as capital gains tax calculation, estate tax planning tools, and portfolio optimization functionalities. The outcome is a comprehensive understanding of her tax implications across different asset classes and a proactive strategy to minimize her overall tax burden while optimizing her investment portfolio. The software provides her with the tools necessary to make informed decisions regarding her financial future and legacy.

Ending Remarks

Ultimately, selecting the right tax planning software depends on individual needs and priorities. While features and pricing are important considerations, factors like ease of use, integration capabilities, and customer support play equally crucial roles. By carefully weighing these elements and considering the insights presented in this comparison, you can confidently choose a software solution that streamlines your tax planning, minimizes errors, and ultimately saves you time and money. Remember to always prioritize data security and compliance with relevant regulations when making your selection.

Key Questions Answered

What is the difference between cloud-based and desktop tax software?

Cloud-based software is accessed online and requires an internet connection, offering accessibility from anywhere. Desktop software is installed on your computer and doesn’t require an internet connection, but is limited to that specific machine.

Can I import data from other financial tools?

Many tax planning software solutions offer integration with various accounting software and banking platforms, enabling seamless data transfer and reducing manual input.

What kind of customer support is typically offered?

Support varies but often includes email, phone, and online chat options, along with online tutorials and FAQs.

How secure is my data with these software solutions?

Reputable tax software providers employ robust security measures, including encryption and data backups, to protect user information. However, always review their specific security and privacy policies.