Navigating the complex world of insurance can feel overwhelming, but a well-structured plan provides crucial financial security. This Insurance Planning Guide Review delves into the essential aspects of personal and family insurance, empowering you to make informed decisions about your coverage. We’ll explore various insurance types, policy comparisons, and the importance of integrating insurance into your overall financial strategy. From understanding your risk tolerance to working effectively with insurance professionals, this guide provides a clear pathway to securing your future.

We’ll examine the critical factors involved in selecting the right insurance plans, including a detailed look at premiums, deductibles, and coverage limits. The guide also offers practical advice on identifying gaps in your existing coverage, avoiding common pitfalls, and building a robust insurance portfolio tailored to your unique needs and circumstances. Real-world scenarios will illustrate the financial implications of both adequate and inadequate insurance protection.

Understanding Insurance Needs

Securing the right insurance coverage is crucial for individuals and families to protect their financial well-being against unforeseen circumstances. A comprehensive understanding of available options and a clear assessment of personal risk tolerance are essential steps in building a robust insurance plan. This section will guide you through the process of identifying your insurance needs.

Types of Insurance Coverage

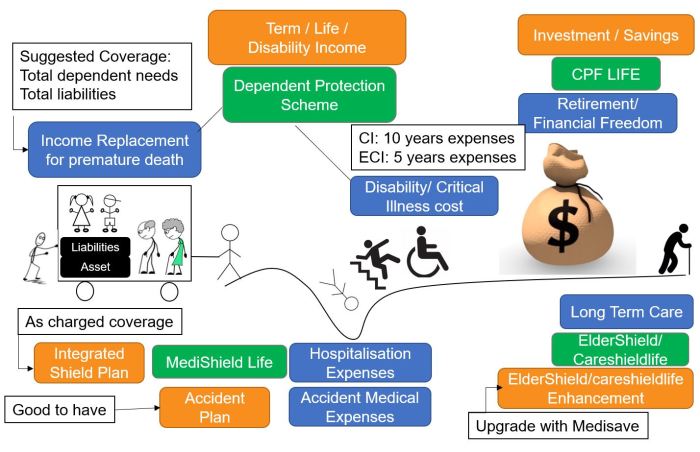

Various insurance products cater to different aspects of life’s uncertainties. Common types include health insurance, covering medical expenses; life insurance, providing financial security for dependents after death; disability insurance, replacing income lost due to injury or illness; auto insurance, protecting against vehicle damage and liability; home insurance, safeguarding against property damage and liability; and liability insurance, covering legal costs and damages resulting from accidents or negligence. Additional specialized insurance may include travel insurance, pet insurance, and umbrella liability insurance for broader coverage. The specific needs for each type will vary depending on individual circumstances.

Factors Influencing Insurance Plan Selection

Several key factors influence the selection of appropriate insurance plans. These include age, health status, income level, family size, asset ownership, risk tolerance, and financial goals. For example, a young, healthy individual might opt for a high-deductible health plan to lower premiums, while a family with young children may prioritize comprehensive coverage with lower out-of-pocket costs. Similarly, a homeowner will require home insurance, while a renter may focus on renter’s insurance. The specific needs will also vary significantly based on location, considering factors like the frequency of natural disasters in a particular area.

Assessing Personal Risk Tolerance and Insurance Needs

A systematic approach is vital for effectively assessing personal risk tolerance and insurance needs. This involves a multi-step process:

- Identify Assets and Liabilities: List all significant assets (home, car, investments) and liabilities (mortgages, loans). This provides a clear picture of what needs protection.

- Evaluate Potential Risks: Consider potential risks affecting your assets and liabilities. This includes health risks, accidents, job loss, property damage, and legal liabilities.

- Determine Risk Tolerance: Assess your comfort level with financial uncertainty. Are you willing to accept higher deductibles for lower premiums, or do you prefer comprehensive coverage with higher costs?

- Estimate Insurance Needs: Based on your assets, liabilities, risks, and risk tolerance, estimate the amount of insurance coverage needed for each area. This might involve consulting with a financial advisor or insurance professional.

- Compare Insurance Plans: Once you have an estimate of your needs, compare different insurance plans from various providers to find the best fit for your budget and coverage requirements.

Sample Insurance Needs Questionnaire

This questionnaire aims to help individuals identify their insurance requirements. Answering these questions honestly will provide a clearer understanding of your needs.

| Question | Answer |

|---|---|

| What is your age and health status? | |

| What are your major assets (home, car, investments)? | |

| What are your significant liabilities (mortgages, loans)? | |

| What are your biggest financial concerns? | |

| What is your family structure (spouse, children, dependents)? | |

| What is your annual income? | |

| What is your risk tolerance (high, medium, low)? | |

| What is your current insurance coverage (if any)? |

Policy Review and Comparison

Regularly reviewing and comparing your insurance policies is crucial for ensuring you have the right coverage at the best price. This process involves understanding your policy features, identifying gaps in coverage, and comparing offerings from different providers. Failing to do so could leave you vulnerable to significant financial losses in the event of an unforeseen circumstance.

Comparing Policy Features

Different insurance policies offer varying levels of coverage and cost structures. A key aspect of policy review involves comparing premiums, deductibles, and coverage limits across different policies to determine the best fit for your individual needs and risk tolerance. The following table illustrates this comparison using hypothetical examples:

| Policy | Annual Premium | Deductible | Coverage Limit |

|---|---|---|---|

| Policy A | $1,200 | $500 | $100,000 |

| Policy B | $1,500 | $1,000 | $250,000 |

| Policy C | $900 | $1,500 | $75,000 |

Note: These are hypothetical examples and actual premiums, deductibles, and coverage limits will vary significantly based on factors such as age, location, coverage type, and risk assessment.

Thorough Policy Document Review

Before signing any insurance policy, meticulously review the entire document. Pay close attention to the fine print, including exclusions, limitations, and conditions. Understanding these details will help you make an informed decision and avoid unexpected surprises later. Misunderstanding policy terms can lead to disputes and denied claims. For instance, a homeowner’s insurance policy might exclude flood damage, requiring separate flood insurance.

Identifying Coverage Gaps

Identifying gaps in your existing insurance coverage is a critical step in ensuring comprehensive protection. This involves assessing your assets, liabilities, and potential risks. For example, if you own a valuable piece of jewelry, you might need a separate rider to your homeowner’s insurance policy to cover its full value. Similarly, if you have significant business assets, you’ll need comprehensive business insurance coverage beyond standard liability insurance. A thorough review of your current policies against your current assets and potential liabilities will help to highlight these gaps.

Common Policy Exclusions and Implications

Insurance policies often contain exclusions, which are specific events or circumstances not covered by the policy. Understanding these exclusions is crucial to avoid disappointment. Common examples include acts of God (earthquakes, floods), intentional acts, and wear and tear. For instance, if your home is damaged by a flood, and your homeowner’s insurance policy excludes flood damage, you won’t receive any compensation unless you have a separate flood insurance policy. Another example would be a car insurance policy excluding coverage for damage caused while driving under the influence of alcohol. These exclusions can have significant financial implications if an excluded event occurs.

Financial Planning and Insurance

Integrating insurance planning into your overall financial strategy is crucial for securing your future and mitigating potential financial setbacks. A comprehensive approach ensures that you have the necessary protection against unforeseen events while simultaneously working towards your long-term financial goals. This involves carefully assessing your risk tolerance and financial objectives to determine the appropriate level and types of insurance coverage.

Insurance acts as a safety net, protecting your financial well-being against a range of risks. It safeguards your assets and income streams from the potentially devastating financial consequences of illness, disability, or death. By transferring the risk of significant financial losses to an insurance company, you can maintain financial stability and prevent unexpected events from derailing your plans.

Insurance and Long-Term Financial Goals

Insurance plays a vital role in supporting various long-term financial goals. For instance, life insurance can provide financial security for your dependents in the event of your death, ensuring they can maintain their lifestyle and meet future expenses, such as education costs or mortgage payments. Disability insurance provides income replacement should you become unable to work due to illness or injury, allowing you to continue paying bills and supporting your family. Long-term care insurance can help cover the significant costs associated with long-term care needs in old age, preventing the depletion of your retirement savings. Finally, health insurance mitigates the potentially catastrophic financial burden of unexpected medical expenses.

Illustrative Scenario: Inadequate Insurance Coverage

Consider Sarah, a 35-year-old single mother with a young child. She works as a freelance graphic designer, earning a decent income but lacking comprehensive health and disability insurance. One day, she’s involved in a car accident, resulting in serious injuries that prevent her from working for six months. Without disability insurance, her income ceases, leaving her struggling to pay rent, her child’s daycare fees, and mounting medical bills. The lack of adequate health insurance exacerbates the situation, leading to significant debt. This hypothetical scenario highlights the devastating financial consequences that can arise from inadequate insurance coverage. Had Sarah secured appropriate insurance policies, the financial burden would have been significantly lessened, allowing her to focus on her recovery rather than financial distress.

Specific Insurance Types and Considerations

Understanding the various types of insurance and their nuances is crucial for effective financial planning. This section will delve into the key features, benefits, and considerations for life, health, auto, and home insurance, providing a framework for making informed decisions. We’ll explore how these policies can be tailored to individual needs and circumstances, along with examples of common claims and their associated processes.

Life Insurance

Life insurance provides a financial safety net for your loved ones in the event of your death. The payout, or death benefit, helps cover expenses like funeral costs, outstanding debts, and ongoing living expenses for dependents. There are several types of life insurance, including term life (coverage for a specific period), whole life (permanent coverage with a cash value component), and universal life (flexible premiums and death benefits).

- Factors to consider: Your age, health, financial goals, and the number of dependents you have significantly impact the type and amount of life insurance you need.

- Policy tailoring: You can adjust the death benefit to align with your family’s needs and financial obligations. Adding riders, such as accidental death benefit or long-term care riders, can further customize your policy.

- Claim example: Upon the insured’s death, beneficiaries submit a claim with the death certificate and policy documents. The insurer verifies the claim and processes the death benefit payment.

Health Insurance

Health insurance protects you from the potentially crippling financial burden of medical expenses. It covers various healthcare services, including doctor visits, hospital stays, surgeries, and prescription drugs. Different plans offer varying levels of coverage, deductibles, and co-pays. Understanding the terms of your policy is vital.

- Factors to consider: Your health status, pre-existing conditions, and the type of healthcare you anticipate needing all influence your health insurance choice. Consider the network of doctors and hospitals included in your plan.

- Policy tailoring: Choosing between HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and POS (Point of Service) plans allows you to tailor your coverage to your preferences and access to healthcare providers.

- Claim example: After receiving medical care, you submit claims with supporting documentation to your insurance provider. The insurer reviews the claim, assesses coverage, and reimburses you or the provider according to the policy terms.

Auto Insurance

Auto insurance is legally mandated in most jurisdictions and protects you financially in the event of an accident. It covers damages to your vehicle and other people’s property, as well as medical expenses resulting from accidents. Different coverage levels and options are available.

- Factors to consider: Your driving history, the type of vehicle you drive, and your location affect your auto insurance premiums. Consider liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

- Policy tailoring: You can adjust your coverage limits to suit your needs and risk tolerance. Adding optional coverages, like roadside assistance or rental car reimbursement, can enhance your protection.

- Claim example: If you’re involved in an accident, you report it to your insurer, providing details of the incident and any injuries or damages. The insurer investigates, assesses liability, and processes claims for repairs or medical expenses.

Home Insurance

Home insurance protects your home and its contents from various perils, such as fire, theft, and natural disasters. It provides financial compensation to repair or rebuild your home and replace your belongings in the event of covered losses.

- Factors to consider: The location of your home, its value, and the level of coverage you require are crucial factors. Consider coverage for dwelling, personal property, liability, and additional living expenses.

- Policy tailoring: You can adjust coverage limits to reflect the value of your home and possessions. Adding endorsements, such as flood or earthquake insurance, can broaden your protection against specific risks.

- Claim example: If your home is damaged by a covered peril, you report the incident to your insurer, providing details and documentation of the damage. The insurer assesses the damage, determines the payout, and facilitates repairs or replacement.

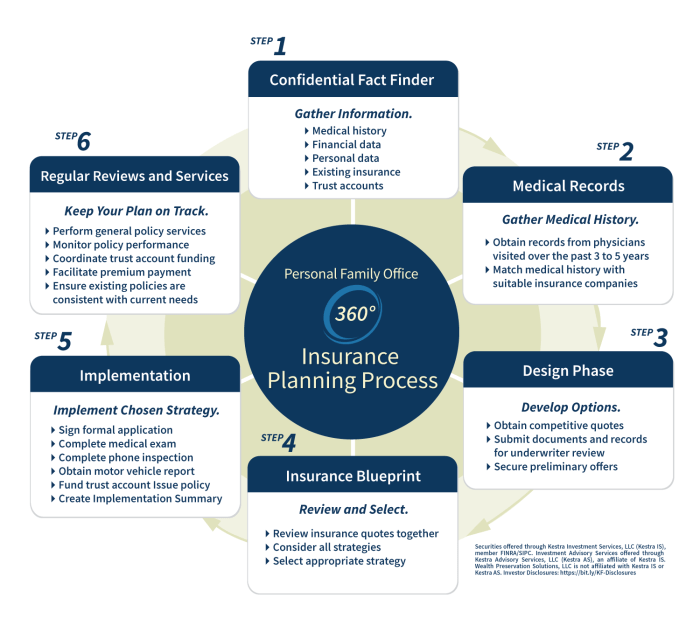

Finding and Working with Insurance Professionals

Navigating the world of insurance can be complex, making the guidance of a qualified professional invaluable. Choosing the right insurance professional can significantly impact the effectiveness and cost-efficiency of your insurance planning. Understanding their roles and how to select a trustworthy advisor is crucial for securing the best coverage for your needs.

Selecting a qualified and trustworthy insurance professional requires careful consideration. Different professionals offer varying levels of expertise and services, impacting the overall experience and outcome of your insurance planning.

Roles and Responsibilities of Insurance Professionals

Insurance agents and brokers both assist individuals in obtaining insurance coverage, but their roles differ significantly. Insurance agents typically represent a single insurance company, offering only the products and services provided by that company. In contrast, insurance brokers act as independent intermediaries, representing a wide range of insurance companies and offering a broader selection of policies to their clients. This allows for more comprehensive comparisons and potentially better coverage options tailored to individual needs. Agents generally receive commissions from the insurance companies they represent, while brokers often receive commissions from the insurers whose policies they sell.

Selecting a Qualified and Trustworthy Insurance Professional

The process of choosing an insurance professional involves several key steps. Firstly, thorough research is vital. Seek recommendations from trusted sources, such as family, friends, or financial advisors. Online reviews and professional directories can also provide valuable insights into the reputation and expertise of potential candidates. Secondly, verify their credentials and licensing. Ensure they possess the necessary licenses and certifications to operate legally and ethically within your jurisdiction. Thirdly, assess their experience and specialization. Consider whether their expertise aligns with your specific insurance needs. For example, if you require complex business insurance, you should seek a professional specializing in commercial insurance. Finally, schedule consultations with several professionals to compare their approaches, fees, and services before making a final decision. This allows you to assess their communication style and determine if you feel comfortable working with them.

Effective Communication with Insurance Providers

Maintaining clear and open communication with insurance providers is crucial for a successful insurance planning process. Clearly articulate your needs and concerns, asking specific questions about policy details and coverage options. Maintain detailed records of all communications, including emails, phone calls, and meetings. This documentation serves as valuable proof of your interactions and can be helpful in resolving disputes or misunderstandings. Promptly respond to any requests for information from your insurance provider, ensuring a smooth and efficient process. Should you encounter difficulties, do not hesitate to escalate the matter through appropriate channels, such as contacting a supervisor or filing a formal complaint.

Checklist of Questions for Insurance Professionals

Before engaging an insurance professional, it is beneficial to prepare a list of questions to guide your consultations. This ensures you obtain all the necessary information to make an informed decision. The questions should cover aspects such as their experience, qualifications, fees, the range of insurance products they offer, their claims handling process, and their availability for communication. For example, you could inquire about their experience handling claims similar to your specific needs or their approach to policy renewals. Asking about their commission structure and any potential conflicts of interest can ensure transparency and help you assess their suitability. Finally, clarifying their communication procedures and response times is crucial for managing expectations and ensuring efficient service.

Illustrative Examples

This section provides practical scenarios to illustrate how insurance planning principles apply in real-life situations. Understanding these examples will help you better assess your own insurance needs and make informed decisions. We will examine a family’s insurance choices, the impact of a major life event, adjustments based on changing circumstances, and finally, a well-structured insurance portfolio.

Family Insurance Needs and Coverage Selection

The Miller family, consisting of John (45), Mary (42), and their two children, Tom (10) and Sarah (7), are planning their insurance needs. They want to ensure adequate protection for their family’s future financial security.

- Life Insurance: John and Mary opted for a combined term life insurance policy of $1 million, providing financial security for their children in case of their untimely death. The rationale is to cover outstanding mortgage, children’s education, and living expenses until the children become self-sufficient.

- Health Insurance: They chose a comprehensive family health plan with a low deductible and co-pay to cover medical emergencies and routine checkups. This is crucial to manage potential healthcare costs, especially for children who may require frequent medical attention.

- Disability Insurance: John, the primary breadwinner, secured a disability insurance policy to replace his income if he becomes unable to work due to illness or injury. This protects the family’s financial stability in case of his long-term disability.

- Homeowners Insurance: They obtained homeowners insurance to protect their house and belongings from damage caused by fire, theft, or natural disasters. This safeguards their most significant asset and minimizes financial losses in case of unforeseen events.

- Auto Insurance: They purchased comprehensive auto insurance for their vehicles, covering liability, collision, and comprehensive coverage. This is a legal requirement and protects them financially in case of accidents.

Impact of Job Loss on Insurance Needs

Sarah, a 30-year-old graphic designer, experienced a job loss due to company restructuring. This significantly impacted her insurance needs.

- Health Insurance: She immediately investigated options for COBRA continuation coverage or finding a new employer-sponsored plan to avoid a lapse in health insurance coverage. Maintaining health insurance is crucial even without a job, as unexpected medical expenses can be devastating.

- Disability Insurance: She recognized the increased importance of disability insurance, even though she didn’t have it previously. She explored individual disability insurance options to protect herself from future income loss due to disability.

- Life Insurance: While not immediately urgent, she reevaluated her life insurance needs considering her reduced income and potential difficulty securing new coverage in the future. A review of her policy or a search for more affordable options was deemed necessary.

Adjusting Insurance Coverage to Reflect Changing Circumstances

David and Emily, a couple expecting their first child, adjusted their insurance coverage accordingly.

- Health Insurance: They upgraded their health insurance plan to include maternity coverage, anticipating the increased healthcare costs associated with childbirth and the newborn’s care. This is crucial for managing medical expenses related to pregnancy and the baby’s health.

- Life Insurance: They increased their life insurance coverage to account for the added financial responsibility of raising a child. This ensures adequate financial support for the child in case of the parents’ death.

- Disability Insurance: They reviewed their disability insurance policies, ensuring adequate coverage for both parents to protect their family’s financial stability if either becomes disabled.

Example of a Well-Structured Insurance Portfolio

A well-structured insurance portfolio balances risk protection with affordability. Consider the following example:

- Term Life Insurance: Provides substantial coverage at a relatively low cost for a specific period, aligning with the need to cover mortgage and other financial obligations during a critical period of life.

- Health Savings Account (HSA): Paired with a high-deductible health plan, an HSA allows tax-advantaged savings for healthcare expenses, providing a cost-effective way to manage healthcare costs while building long-term savings.

- Disability Income Insurance: Replaces a portion of income lost due to disability, protecting against the financial consequences of long-term illness or injury. This ensures continued income during periods of inability to work.

- Long-Term Care Insurance: Protects against the high costs of long-term care, providing financial support for nursing home care or in-home assistance if needed in later life. This is a prudent decision considering the rising cost of long-term care.

- Umbrella Liability Insurance: Provides additional liability protection beyond the limits of other policies, safeguarding against significant financial losses from lawsuits or accidents. This is important for broader liability protection beyond basic policies.

Closing Summary

Ultimately, this Insurance Planning Guide Review emphasizes the proactive role individuals play in securing their financial well-being. By understanding your insurance needs, comparing policies effectively, and working collaboratively with qualified professionals, you can create a comprehensive plan that protects you and your family against life’s uncertainties. Remember, securing your future is an investment worth making, and this guide provides the tools and knowledge to help you do just that. Take control of your financial security; start planning today.

Questions and Answers

What is the difference between an insurance agent and a broker?

Agents represent a specific insurance company, while brokers work independently and can compare policies from multiple insurers.

How often should I review my insurance policies?

Ideally, review your policies annually or whenever significant life changes occur (marriage, birth, job change, etc.).

What if I can’t afford comprehensive insurance coverage?

Prioritize essential coverage (health, liability) and gradually increase coverage as your financial situation improves. Consider exploring affordable options or government assistance programs.

What are some common reasons for insurance claims being denied?

Common reasons include failing to meet policy requirements, providing inaccurate information, or the claim falling outside the policy’s coverage.