Navigating the complex world of taxes can be daunting, making expert guidance invaluable. This review delves into the multifaceted landscape of tax consulting services, exploring the needs of diverse clients, the services offered by firms, and the crucial factors to consider when selecting a consultant. We’ll examine pricing models, ethical considerations, and the role of technology in shaping the future of this vital profession.

From understanding individual versus business client needs to evaluating consultant expertise and navigating the ethical complexities, this review provides a holistic perspective. We’ll analyze the impact of technology, future trends, and the importance of client feedback in ensuring high-quality service. The aim is to empower individuals and businesses to make informed decisions when seeking professional tax assistance.

Understanding Client Needs in Tax Consulting

Effective tax consulting hinges on a deep understanding of client needs. This involves recognizing the diverse situations clients face, the factors influencing their consultant choices, and the specific tax issues they encounter. By tailoring services to these individual needs, tax consultants can provide valuable and relevant support.

Diverse Client Needs in Tax Consulting

Clients seeking tax consulting services exhibit a wide range of needs, shaped by their individual circumstances and financial situations. These needs can encompass simple tax return preparation, complex tax planning strategies for high-net-worth individuals, or specialized guidance for businesses navigating intricate tax regulations. Some clients might require assistance with tax audits, while others need help resolving tax disputes with governmental agencies. The complexity and scope of these needs vary significantly.

Factors Clients Consider When Choosing a Tax Consultant

Several key factors influence a client’s decision when selecting a tax consultant. Expertise and experience in the relevant tax area are paramount, especially for complex situations like international taxation or estate planning. Credibility and reputation, often demonstrated through professional certifications (like CPA or Enrolled Agent) and positive client testimonials, build trust and confidence. Accessibility and responsiveness are also critical; clients need consultants who are readily available to answer questions and provide timely advice. Finally, cost and fee structure play a significant role, with clients seeking a balance between affordability and the value received from the services.

Types of Tax Issues Clients Commonly Face

Clients face a variety of tax issues, from relatively straightforward to exceptionally complex. Common individual tax issues include navigating deductions and credits, managing capital gains and losses, and understanding the implications of retirement savings plans. Businesses, on the other hand, grapple with issues such as payroll tax compliance, sales tax calculations, corporate income tax planning, and navigating international tax regulations. Additionally, both individuals and businesses may encounter issues related to tax audits, tax penalties, and resolving tax discrepancies.

Comparison of Individual and Business Client Needs

| Feature | Individual Clients | Business Clients |

|---|---|---|

| Primary Tax Concerns | Income tax, deductions, credits, retirement planning, estate planning | Corporate income tax, payroll tax, sales tax, international taxation, tax credits for businesses |

| Complexity of Needs | Ranges from simple to moderately complex depending on income and assets | Generally more complex due to various business structures and transactions |

| Frequency of Service | Annually for tax return preparation; potentially more frequently for planning | Ongoing needs for payroll and sales tax compliance; annual tax planning and reporting |

| Key Decision Factors | Cost, reputation, ease of communication, personal service | Expertise in specific industry, experience with relevant tax regulations, proactive planning capabilities |

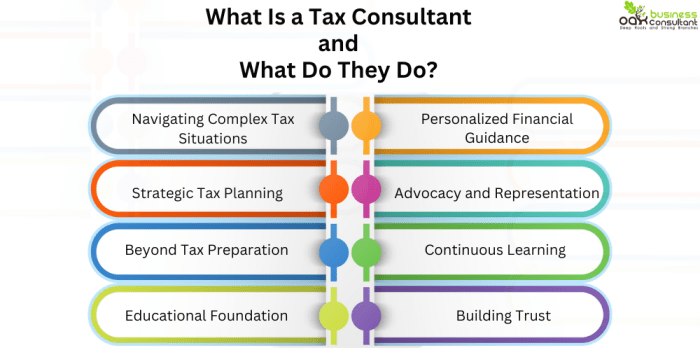

Services Offered by Tax Consulting Firms

Tax consulting firms offer a wide array of services designed to help individuals and businesses navigate the complexities of tax laws and regulations. These services range from basic tax preparation to highly specialized strategic tax planning, ensuring compliance and optimizing tax outcomes. The specific services offered often depend on the firm’s size, specialization, and the client’s individual needs.

Tax consulting firms provide a diverse portfolio of services catering to a wide spectrum of clients, from individuals to multinational corporations. Understanding the core offerings is crucial for selecting the right firm to meet specific tax needs.

Core Services of Tax Consulting Firms

The core services provided by most tax consulting firms can be broadly categorized. These services are fundamental to ensuring tax compliance and maximizing tax efficiency.

- Tax Preparation and Filing: This is the most common service, involving the preparation and filing of individual and business tax returns. This includes gathering necessary financial information, accurately calculating tax liabilities, and ensuring timely submission to the relevant tax authorities.

- Tax Planning: This proactive service focuses on minimizing tax liabilities through strategic financial planning. This may involve structuring transactions to optimize tax outcomes, utilizing available deductions and credits, and exploring tax-efficient investment strategies.

- Tax Compliance: This encompasses all aspects of ensuring adherence to tax laws and regulations. It includes maintaining accurate tax records, responding to tax audits, and resolving tax disputes with tax authorities.

- Tax Advisory: This service provides expert guidance on various tax-related matters, offering advice on complex tax issues, changes in tax laws, and strategic tax decisions.

Specializations of Tax Consultants

Different tax consultants specialize in various areas, offering expertise tailored to specific client needs. These specializations allow for a deeper understanding of complex tax regulations and a more effective approach to tax planning and compliance.

- Individual Tax Consultants: These professionals specialize in the tax affairs of individuals, focusing on income tax returns, estate planning, and retirement planning.

- Corporate Tax Consultants: These consultants focus on the tax complexities of businesses, including corporate income tax, mergers and acquisitions, international taxation, and transfer pricing.

- International Tax Consultants: These specialists navigate the intricate world of international tax laws, assisting businesses with cross-border transactions, foreign tax credits, and compliance with international tax regulations. They often possess in-depth knowledge of tax treaties and double taxation agreements.

- Real Estate Tax Consultants: Experts in this area handle the tax implications of real estate transactions, including property taxes, capital gains taxes, and depreciation deductions. They assist clients in optimizing their tax strategies related to real estate investments.

The Process of a Typical Tax Consultation

A typical tax consultation involves several key steps to ensure a thorough and effective outcome. The process is iterative, allowing for adjustments based on the client’s specific needs and evolving circumstances.

- Initial Consultation: This involves discussing the client’s tax situation, identifying their goals, and outlining the scope of services required.

- Data Gathering: The consultant gathers the necessary financial information from the client, including income statements, balance sheets, and tax returns.

- Tax Analysis: The consultant analyzes the gathered data to determine the client’s tax liability and identify opportunities for tax optimization.

- Recommendation and Planning: Based on the analysis, the consultant develops a tailored tax plan to minimize tax liabilities and achieve the client’s objectives.

- Implementation: The consultant assists in implementing the tax plan, which may involve preparing tax returns, structuring transactions, or making other necessary adjustments.

- Review and Monitoring: The consultant regularly reviews the tax plan’s effectiveness and makes necessary adjustments to adapt to changes in tax laws or the client’s circumstances.

Tax Planning Engagement Flowchart

The following describes a flowchart illustrating the steps in a tax planning engagement. This visual representation helps clarify the sequential nature of the process.

The flowchart would begin with a “Start” box. This would be followed by a box representing the “Initial Client Meeting,” where objectives and scope are defined. Next, a “Data Gathering” box would depict the collection of financial information. This leads to a “Tax Analysis” box, where the data is processed. A “Tax Planning Strategies Development” box would follow, outlining potential strategies. This is followed by a “Client Presentation and Approval” box, where the plan is presented and approved. Finally, “Implementation and Monitoring” and “End” boxes would conclude the flowchart, illustrating the ongoing nature of tax planning.

Evaluating the Quality of Tax Consulting Services

Choosing the right tax consultant is crucial for ensuring accurate tax filings and maximizing tax benefits. A thorough evaluation process, considering several key factors, will significantly reduce the risk of errors and potential financial penalties. This section Artikels criteria to help you make an informed decision.

Assessing Consultant Expertise and Experience

Evaluating a tax consultant’s expertise requires looking beyond just their stated qualifications. A strong candidate will demonstrate a deep understanding of relevant tax laws and regulations, possess extensive experience handling cases similar to yours, and showcase a proven track record of successful outcomes. Consider the complexity of your tax situation and ensure the consultant has the specific knowledge and experience to handle it effectively. For instance, a consultant specializing in international taxation would be better suited for handling global income streams than one primarily focused on individual tax returns. Years of experience are valuable, but equally important is the demonstration of consistently positive results for clients.

Red Flags to Watch Out for When Selecting a Tax Consultant

Several red flags can indicate a potentially problematic tax consultant. Unrealistic promises of significantly higher refunds than expected, a lack of transparency in fees and services, and an unwillingness to provide references are all serious concerns. Furthermore, a consultant who pressures you into making quick decisions without providing sufficient information or who displays a lack of knowledge about current tax laws should be avoided. Finally, be wary of consultants who operate solely online with minimal verifiable information about their background and credentials. A lack of a physical office or a history of complaints filed against them should raise serious doubts about their credibility.

The Importance of Certifications and Professional Memberships

Certifications and professional memberships are strong indicators of a tax consultant’s commitment to professional standards and ongoing education. Designations such as Certified Public Accountant (CPA), Enrolled Agent (EA), or Chartered Financial Analyst (CFA) demonstrate a high level of expertise and adherence to ethical codes of conduct. Membership in professional organizations like the National Association of Tax Professionals (NATP) or the American Institute of CPAs (AICPA) also suggests a dedication to continuing professional development and staying abreast of the latest tax regulations. While these credentials are not guarantees of perfect service, they do provide a measure of confidence in the consultant’s qualifications.

Questions to Ask Potential Tax Consultants

Before engaging a tax consultant, it’s vital to ask pertinent questions to gauge their suitability. Inquiring about their experience with cases similar to yours, their fee structure and payment terms, and their process for handling client information are crucial. Asking about their continuing professional development efforts, their approach to resolving tax disputes, and their availability for communication throughout the tax season provides further insight into their capabilities and commitment to client service. Finally, requesting references from past clients allows you to gather firsthand accounts of their professionalism, expertise, and overall client experience. A thorough questioning process is an essential part of due diligence when selecting a tax professional.

Cost and Pricing Structures of Tax Consulting Services

Understanding the cost of tax consulting services is crucial for businesses and individuals alike. The price you pay depends on several factors, and choosing the right pricing model can significantly impact your overall expenses. This section will explore the various pricing models employed by tax consulting firms, compare their cost-effectiveness, and detail the factors influencing the final cost.

Various Pricing Models for Tax Consulting Services

Tax consulting firms typically utilize several pricing models, each with its own advantages and disadvantages. The most common are hourly rates, project-based fees, and retainer agreements. Hourly rates are straightforward, charging a predetermined amount for each hour of work. Project-based fees involve a fixed price for a defined scope of work, offering greater predictability. Retainer agreements offer ongoing support for a set monthly or annual fee. The best model depends on the complexity and scope of the tax services required.

Cost-Effectiveness of Different Tax Consulting Services

The cost-effectiveness of different tax consulting services is not solely determined by the pricing model. It’s also influenced by the expertise required, the complexity of the tax issues, and the potential tax savings generated. For example, while a simple tax return preparation might be more cost-effective with an hourly rate, complex tax planning often benefits from a project-based fee to ensure transparency and control over costs. Similarly, businesses with ongoing tax needs may find retainer agreements more cost-effective than constantly negotiating project-based fees. The optimal choice depends on individual circumstances.

Factors Influencing the Overall Cost of Tax Consulting

Several factors contribute to the overall cost of tax consulting services. These include the complexity of the tax situation, the level of expertise required, the time spent on the engagement, the geographic location of the firm, and the client’s specific needs. For instance, a large multinational corporation will naturally incur higher costs than a small business with simple tax needs. Similarly, specialized expertise in areas like international taxation or mergers and acquisitions will command higher fees. The urgency of the task can also impact costs; expedited services typically come with a premium.

Typical Cost Ranges for Different Types of Tax Consulting Services

The following table provides a general overview of typical cost ranges for various tax consulting services. It’s important to note that these are estimates, and actual costs can vary significantly based on the factors discussed above.

| Service Type | Cost Range (USD) | Pricing Model | Notes |

|---|---|---|---|

| Individual Tax Return Preparation (Simple) | $150 – $500 | Project-Based or Hourly | May vary significantly based on complexity |

| Individual Tax Return Preparation (Complex) | $500 – $2,000+ | Project-Based or Hourly | Includes significant deductions or investments |

| Small Business Tax Return Preparation | $500 – $5,000+ | Project-Based or Hourly | Depends on business structure and complexity |

| Tax Planning & Consulting (Annual) | $1,000 – $10,000+ | Retainer or Project-Based | Price varies significantly based on business size and complexity |

Client Testimonials and Reviews of Tax Consulting Services

Client testimonials and reviews are invaluable assets for any tax consulting firm. They provide potential clients with firsthand accounts of the service quality and build trust and credibility. Positive reviews highlight successes and expertise, while negative reviews, when handled correctly, offer opportunities for improvement and demonstrate a commitment to client satisfaction.

Positive Client Testimonials: Examples

Positive testimonials often focus on specific aspects of the service experience. For example, one client might praise the firm’s efficiency and speed in processing their tax returns, stating something like, “I was amazed at how quickly they handled my taxes. It was a significant relief, especially during the busy season.” Another client might emphasize the firm’s personalized attention and expert advice, perhaps commenting, “The consultant took the time to explain everything clearly, answering all my questions patiently. I felt completely confident in their advice.” A third testimonial might highlight the firm’s proactive approach to tax planning, with a statement like, “They didn’t just file my taxes; they helped me develop a long-term tax strategy to minimize my future liabilities. This was invaluable.” These examples demonstrate the varied aspects of service that clients value and appreciate.

Addressing and Improving Upon Negative Reviews

Negative reviews, while undesirable, offer crucial insights into areas needing improvement. A common negative review might concern communication issues, such as infrequent updates or unclear explanations. Addressing this involves implementing better communication protocols, such as regular email updates and scheduled client calls. Another frequent complaint might involve perceived high costs. This requires a careful review of pricing structures and potentially offering more transparent and flexible payment options. Responding directly to negative reviews with empathy and a plan of action is also crucial. For instance, a firm might respond to a negative review about a missed deadline by acknowledging the error, apologizing for the inconvenience, and outlining the steps taken to prevent similar occurrences in the future. This demonstrates accountability and a commitment to improvement.

The Importance of Client Feedback in Improving Service Quality

Client feedback, both positive and negative, is essential for continuous improvement. Regularly soliciting feedback through surveys, email communications, or post-service calls allows the firm to gauge client satisfaction and identify areas for enhancement. Analyzing this feedback can reveal trends and patterns that point to systemic issues. For example, consistent complaints about a particular consultant might indicate a need for additional training or a different assignment strategy. This data-driven approach to improvement ensures that changes are targeted and effective.

Using Client Feedback to Enhance the Overall Client Experience

Implementing changes based on client feedback directly impacts the overall client experience. For instance, if feedback consistently highlights a need for more accessible communication methods, the firm might introduce online portals or scheduling tools for easier interaction. Similarly, if clients express a desire for more proactive tax planning services, the firm can expand its service offerings to meet this demand. By actively incorporating client feedback into its operations, a tax consulting firm demonstrates a commitment to client satisfaction and builds stronger, more trusting relationships. This, in turn, leads to increased client loyalty and positive word-of-mouth referrals.

The Role of Technology in Tax Consulting

Technology has fundamentally reshaped the tax consulting landscape, significantly impacting both the efficiency and accuracy of services provided. The integration of various software and tools has streamlined processes, reduced errors, and enabled consultants to offer more comprehensive and timely advice to their clients. This increased efficiency translates to cost savings and improved client satisfaction.

Technology’s impact on efficiency and accuracy manifests in several ways. Automation of routine tasks, such as data entry and calculation, frees up consultants to focus on higher-level analysis and strategic planning. Sophisticated software can identify potential tax savings opportunities that might be missed through manual processes. Real-time data access and analysis facilitates quicker decision-making and more responsive client service. Furthermore, the use of technology minimizes human error, leading to more accurate tax filings and reduced risk of audits.

Tax Software and Tools Used by Tax Consultants

Tax consultants utilize a wide range of software and tools to manage their workload and provide services to clients. These range from basic tax preparation software to highly specialized applications for complex tax planning and compliance. The choice of software depends on factors such as the size and type of clients served, the complexity of tax issues handled, and the budget available. Examples include tax preparation software like TurboTax or TaxAct for individual returns, and more advanced platforms such as GoDaddy Bookkeeping or Xero for small business accounting and tax management. Larger firms may utilize enterprise resource planning (ERP) systems integrated with specialized tax modules for comprehensive client management and data analysis. Additionally, many consultants use data analytics tools to identify trends and patterns in client data, informing their advice and improving their services.

Advantages and Disadvantages of Different Tax Software

The selection of tax software involves weighing the advantages and disadvantages of different options. Cloud-based solutions offer accessibility from anywhere with an internet connection and often facilitate collaboration among team members. However, reliance on internet connectivity can be a drawback, and security concerns related to data storage in the cloud need careful consideration. Desktop-based software, on the other hand, offers greater control over data and may be preferred by consultants who prioritize data security above all else. However, desktop software lacks the flexibility and collaborative features of cloud-based solutions. Specialized software designed for specific tax areas, such as international taxation or estate planning, offers in-depth features but may come with a higher price tag and a steeper learning curve. General-purpose tax preparation software provides broader coverage but may lack the advanced capabilities needed for complex cases.

Technology’s Role in Maintaining Tax Compliance

Technology plays a critical role in ensuring tax consultants remain compliant with ever-evolving tax laws and regulations. Software updates and integrated compliance modules ensure that tax returns are prepared using the latest rules and regulations. Real-time access to tax law changes through online databases and subscription services enables consultants to provide timely and accurate advice to their clients. Furthermore, technology facilitates the efficient management of client data, helping consultants maintain proper record-keeping and meet legal requirements for data security and privacy. The use of secure communication channels and encryption techniques protects sensitive client information from unauthorized access. Automated audit trail features in many tax software programs further enhance compliance by providing a clear record of all actions taken during the tax preparation process.

Ethical Considerations in Tax Consulting

Tax consulting, while focused on navigating complex tax laws, necessitates a strong ethical foundation. The actions of tax consultants directly impact their clients’ financial well-being and compliance with legal obligations. Maintaining high ethical standards is paramount to building trust, ensuring professional integrity, and upholding the reputation of the profession.

Ethical Responsibilities of Tax Consultants

Tax consultants bear a significant responsibility to act with honesty, integrity, and objectivity in all their professional dealings. This includes providing accurate and complete information to clients, adhering to all applicable laws and regulations, and avoiding any actions that could be perceived as a conflict of interest. They must prioritize the client’s best interests while upholding their professional duty to act with fairness and transparency. Furthermore, continuous professional development is crucial to stay updated on evolving tax laws and ethical guidelines, ensuring that services rendered are always in compliance.

Potential Conflicts of Interest and Avoidance Strategies

Conflicts of interest can arise when a tax consultant’s personal interests or those of a third party clash with their duty to serve the client’s best interests. Examples include representing competing clients with conflicting interests or accepting gifts or favors from clients that could influence professional judgment. To mitigate these risks, consultants should establish clear policies regarding client acceptance, disclosing any potential conflicts of interest upfront, and employing measures such as using independent reviewers or creating firewalls to separate conflicting engagements. Maintaining meticulous records of all communications and transactions is also vital for transparency and accountability.

Maintaining Client Confidentiality

Client confidentiality is a cornerstone of the tax consulting profession. Tax consultants are entrusted with sensitive financial information, and breaching this trust can have severe legal and reputational consequences. Confidentiality extends to all aspects of the client relationship, including tax returns, financial records, and strategic planning documents. Strict adherence to data protection regulations and the use of secure data storage and transmission methods are crucial. Exceptions to confidentiality exist only in limited circumstances, such as legal requirements to report suspicious activities or when required by court order.

Consequences of Unethical Behavior

Unethical behavior in tax consulting can lead to a range of serious consequences. These include disciplinary action by professional organizations, such as suspension or revocation of licenses; legal repercussions, such as lawsuits for negligence or fraud; reputational damage, leading to loss of clients and business; and criminal charges in severe cases of tax evasion or fraud. The consequences can extend beyond the individual consultant, impacting the firm’s reputation and potentially leading to significant financial losses. Maintaining ethical conduct is therefore not only a moral imperative but also a crucial factor in ensuring the long-term sustainability and success of a tax consulting practice.

Future Trends in Tax Consulting

The tax consulting landscape is in constant flux, driven by technological advancements, evolving regulations, and shifting client needs. Understanding these future trends is crucial for tax consultants seeking to remain competitive and provide valuable services. This section explores key emerging trends, potential challenges and opportunities, and the impact of evolving tax laws on the profession.

The increasing complexity of tax laws globally, coupled with technological disruptions, presents both significant challenges and exciting opportunities for tax consultants. Adaptability and a commitment to continuous learning are paramount for navigating this dynamic environment.

Impact of Evolving Tax Laws

Changes in tax legislation, both domestically and internationally, significantly impact the tax consulting profession. For example, the increasing focus on digital taxation requires consultants to understand and advise clients on the implications of new rules regarding the taxation of digital services and cross-border transactions. Similarly, ongoing shifts in environmental regulations, such as carbon taxes, demand expertise in sustainable tax planning and compliance. The introduction of new reporting requirements, like those related to BEPS (Base Erosion and Profit Shifting) initiatives, necessitate continuous updates to knowledge and expertise to ensure accurate and compliant advice. Failure to adapt to these changes can lead to missed opportunities and potential legal issues for both the consultant and their clients.

Technological Advancements in Tax Consulting

Technology is reshaping the tax consulting industry, automating tasks, improving efficiency, and enhancing data analysis capabilities. Artificial intelligence (AI) and machine learning (ML) are playing increasingly important roles in tax preparation, compliance, and advisory services. AI-powered tools can automate tasks such as data entry, tax form completion, and basic tax calculations, freeing up consultants to focus on higher-value activities like strategic tax planning and client relationship management. The use of cloud-based platforms facilitates collaboration, data security, and accessibility. However, the adoption of these technologies also requires significant investment in training and infrastructure, as well as careful consideration of data security and ethical implications. For instance, a large multinational corporation might use AI-powered tax software to process millions of transactions, identifying potential discrepancies and areas for optimization far faster than a manual review.

Challenges and Opportunities for Tax Consultants

The increasing complexity of tax laws and the rapid pace of technological change present significant challenges for tax consultants. Competition is intensifying, with both large firms and specialized niche players vying for clients. Maintaining a high level of expertise and staying abreast of evolving regulations requires continuous professional development and significant investment in training. However, these challenges also create opportunities. Consultants who can effectively leverage technology, demonstrate specialized expertise in emerging areas such as digital taxation or sustainable tax planning, and build strong client relationships are well-positioned to thrive. For example, a consultant specializing in international tax could capitalize on the growing need for expertise in navigating cross-border tax regulations, while a firm focusing on sustainable tax strategies could attract environmentally conscious businesses.

Importance of Continuous Professional Development

Continuous professional development (CPD) is no longer optional for tax consultants; it is essential for survival and success. The rapid evolution of tax laws, technology, and client needs necessitates ongoing learning and skill enhancement. CPD activities can include attending conferences and seminars, completing online courses, pursuing advanced certifications, and engaging in professional networking. By staying updated on the latest developments and best practices, tax consultants can ensure they provide high-quality, relevant advice and maintain their professional competence. This commitment to CPD not only benefits individual consultants but also strengthens the reputation and credibility of the tax consulting profession as a whole. A consultant might choose to pursue a specialized certification in international taxation to enhance their expertise and marketability, or participate in regular workshops on emerging technologies to stay ahead of the curve.

Ultimate Conclusion

Ultimately, choosing the right tax consultant is a critical decision with significant financial and legal implications. By carefully considering the factors Artikeld in this review – client needs, service offerings, quality evaluation, cost structures, ethical considerations, and technological advancements – individuals and businesses can confidently select a professional who meets their specific requirements. Proactive engagement and informed decision-making are key to navigating the tax landscape successfully.

Questions Often Asked

What is the difference between a tax preparer and a tax consultant?

Tax preparers primarily focus on completing and filing tax returns. Tax consultants offer broader services, including tax planning, strategic advice, and representation during audits.

How can I find a reputable tax consultant?

Seek referrals, check online reviews, verify credentials (e.g., CPA, EA), and ask potential consultants about their experience and expertise in your specific tax situation.

Are tax consulting services worth the cost?

The value depends on individual circumstances. For complex tax situations or high-net-worth individuals, professional advice can significantly reduce tax liabilities and prevent costly mistakes. The cost is an investment in financial well-being.

What should I expect during a tax consultation?

Expect a thorough review of your financial information, a discussion of your tax goals, and tailored recommendations to optimize your tax position. Transparency regarding fees and a clear explanation of the process are essential.