The financial world is awash in data. Understanding and leveraging this information effectively is crucial for informed decision-making, and the tools available for doing so are constantly evolving. This review delves into the landscape of financial data analytics tools, exploring their capabilities, functionalities, and implications for businesses of all sizes. We’ll examine everything from basic spreadsheet software to sophisticated, specialized platforms, comparing their strengths, weaknesses, and suitability for various analytical tasks.

From data import and cleaning to advanced techniques like regression analysis and time series forecasting, we’ll dissect the key features that define these tools. We’ll also address crucial aspects such as data integration, user interface design, security and compliance, and the various pricing models available. Ultimately, this review aims to provide a comprehensive understanding of the current state of financial data analytics tools and guide readers in selecting the optimal solution for their specific needs.

Introduction to Financial Data Analytics Tools

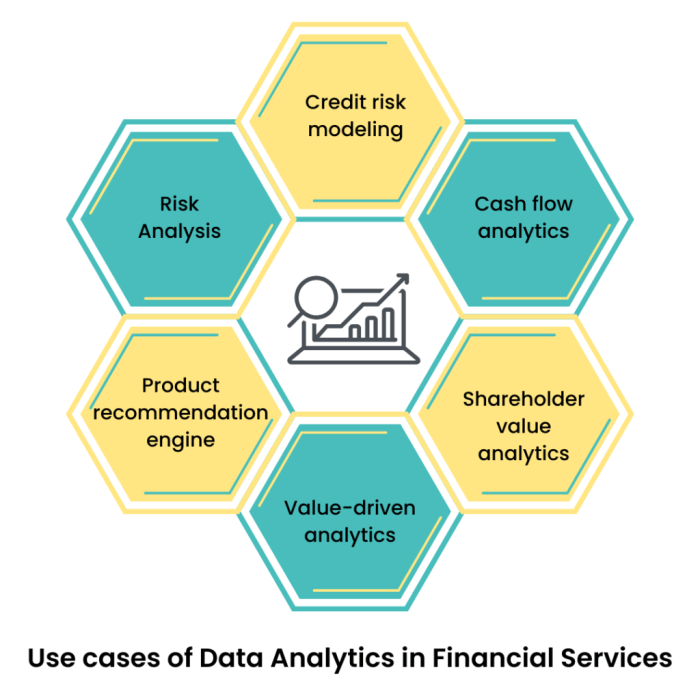

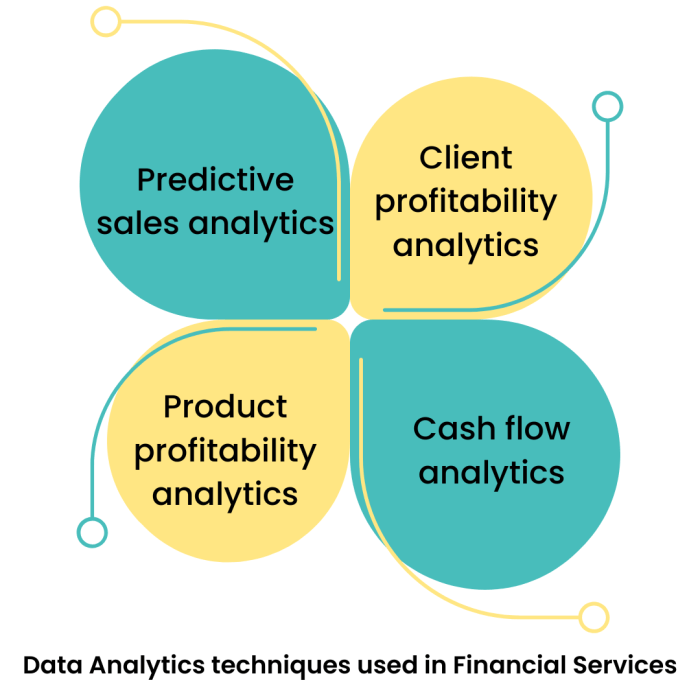

The landscape of financial data analytics tools has undergone a dramatic transformation, evolving from simple spreadsheets to sophisticated, AI-powered platforms. This evolution has significantly impacted financial decision-making, enabling more informed strategies, improved risk management, and enhanced profitability. This review explores the key features and functionalities of various tools available to financial professionals.

Financial data analytics tools have revolutionized the way financial institutions and individuals analyze and interpret data. Early reliance on manual calculations and basic spreadsheet software has given way to advanced platforms capable of handling massive datasets, performing complex calculations, and generating insightful visualizations. This shift has enabled quicker, more accurate analysis, leading to better-informed investment decisions, more effective risk mitigation, and improved operational efficiency.

Categories of Financial Data Analytics Tools

Financial data analytics tools can be broadly categorized into several groups, each serving different needs and levels of sophistication. Spreadsheet software, such as Microsoft Excel and Google Sheets, provides a foundational level of analysis for smaller datasets and simpler tasks. However, as data volume and complexity increase, specialized platforms become necessary. These platforms often incorporate advanced statistical modeling, machine learning algorithms, and robust visualization capabilities. Examples include dedicated financial modeling software, statistical packages like R or Python with financial libraries, and cloud-based platforms offering comprehensive data analytics solutions. Finally, there are integrated suites that combine data management, analytics, and reporting functionalities within a single environment.

Comparison of Three Prominent Tools

The following table compares three prominent financial data analytics tools: Microsoft Excel, Tableau, and Bloomberg Terminal. Each tool offers distinct advantages depending on the user’s specific needs and technical expertise.

| Feature | Microsoft Excel | Tableau | Bloomberg Terminal |

|---|---|---|---|

| Data Handling Capacity | Suitable for smaller datasets; limitations with very large datasets. | Handles large datasets efficiently; connects to various data sources. | Handles extremely large datasets; real-time data feeds. |

| Analytical Capabilities | Basic statistical functions; requires manual formula creation for complex analysis. | Drag-and-drop interface; built-in functions for advanced analytics and visualization. | Extensive analytical tools; integrates with financial models and market data. |

| Visualization Capabilities | Basic charting and graphing capabilities; limited customization options. | Highly customizable dashboards and visualizations; interactive exploration of data. | Customizable visualizations; integrates with market data for dynamic displays. |

| Cost | Relatively inexpensive; widely accessible. | Subscription-based; pricing varies depending on features and user licenses. | High subscription cost; typically used by professional financial institutions. |

Key Features and Functionalities

Financial data analytics tools offer a diverse range of features designed to streamline the process of extracting insights from complex financial datasets. These tools go beyond basic spreadsheet capabilities, providing sophisticated functionalities for data manipulation, analysis, and visualization. A robust toolset is crucial for efficient and accurate financial analysis, enabling informed decision-making across various financial applications.

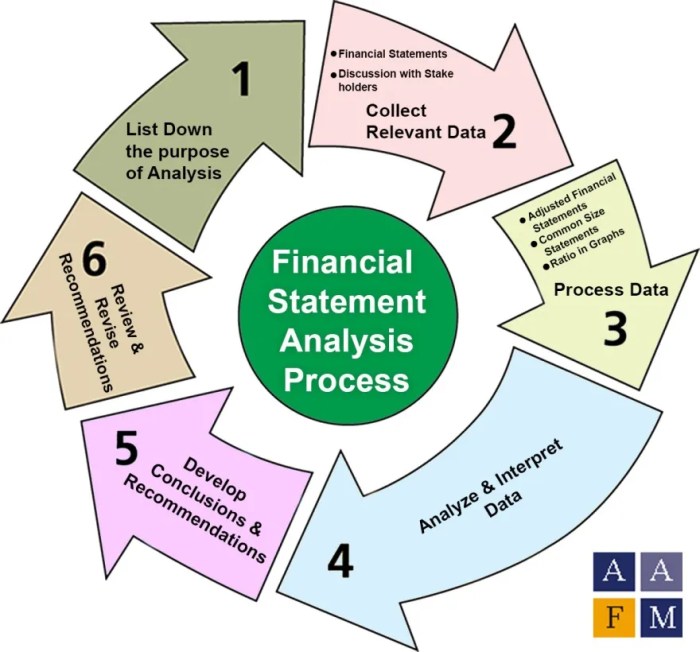

The core functionality of these tools revolves around several key stages of the analytical process: data import, cleaning, transformation, and visualization, culminating in the application of advanced analytical techniques. Each stage presents its own set of challenges and opportunities, and the effectiveness of the chosen tool often hinges on its ability to efficiently handle each one. The choice of tool will depend heavily on the specific analytical tasks and the user’s technical expertise.

Data Import and Cleaning

Data import capabilities vary significantly across different tools. Some tools offer seamless integration with various data sources, including databases, spreadsheets, and APIs. Others may require more manual intervention or the use of intermediary software. Data cleaning, a critical initial step, involves identifying and correcting errors, inconsistencies, and missing values within the dataset. Effective tools often provide automated features for handling missing data, such as imputation techniques (e.g., mean imputation, k-nearest neighbors), and tools to detect and remove outliers. The ability to efficiently handle large datasets and various data formats is paramount. For example, a tool might offer functionalities to automatically detect and correct date format inconsistencies across a large spreadsheet, saving significant time and effort compared to manual correction.

Data Transformation and Manipulation

Once data is imported and cleaned, it often needs transformation to be suitable for analysis. This might involve creating new variables, aggregating data, or reshaping the data structure. Many tools offer functionalities for data manipulation, such as creating calculated fields, pivoting tables, and merging datasets. The ability to perform these operations efficiently is crucial for preparing data for advanced analytical techniques. For instance, a tool might allow the user to easily calculate a moving average of stock prices over a specified period, transforming raw price data into a smoothed trend for easier interpretation.

Data Visualization

Effective visualization is essential for communicating analytical findings clearly and concisely. Modern financial data analytics tools offer a wide range of visualization options, including charts, graphs, and dashboards. The ability to create interactive visualizations that allow users to explore data dynamically is particularly valuable. A strong visualization component allows for the identification of patterns and trends that might be missed in raw data. For example, a tool might allow the creation of interactive charts showing the correlation between different economic indicators, allowing the user to dynamically filter the data and explore different relationships.

Advanced Analytics Techniques

Beyond basic descriptive statistics, many tools support advanced analytical techniques, crucial for extracting deeper insights from financial data. These include regression analysis (e.g., linear regression, multiple regression) for modeling relationships between variables, time series forecasting (e.g., ARIMA, exponential smoothing) for predicting future values, and machine learning algorithms (e.g., classification, clustering) for identifying patterns and making predictions. The availability and ease of use of these advanced techniques can significantly impact the depth and sophistication of the analysis. For example, a tool might allow a user to easily build and evaluate a time series model to forecast future sales based on historical data, using pre-built algorithms and automated model selection tools.

Strengths and Weaknesses of Different Tools

The optimal tool for financial data analysis depends heavily on the specific needs of the user and the complexity of the analytical task. Some tools excel in data visualization, while others offer more sophisticated statistical modeling capabilities. Some tools are better suited for large datasets, while others are more user-friendly for those with less technical expertise. It’s important to consider factors such as ease of use, scalability, integration with other systems, and the availability of technical support when selecting a tool. For example, a tool might be excellent for exploratory data analysis and visualization but lack the advanced statistical modeling capabilities needed for sophisticated financial forecasting.

Crucial Functionalities for Effective Financial Data Analysis

The following functionalities are essential for effective financial data analysis:

- Seamless data import from various sources (databases, spreadsheets, APIs).

- Robust data cleaning and preprocessing capabilities (handling missing data, outlier detection).

- Powerful data transformation and manipulation features (creating calculated fields, data aggregation).

- A wide range of visualization options (interactive charts, dashboards).

- Support for advanced analytical techniques (regression analysis, time series forecasting, machine learning).

- Scalability to handle large datasets efficiently.

- User-friendly interface and good documentation.

- Integration with other business intelligence tools.

Data Sources and Integration

Financial data analytics tools are only as good as the data they can access and process. Effective integration of diverse data sources is crucial for generating meaningful insights. This section explores how various financial data sources are integrated into these tools, the methods employed for connection, common data formats, and a comparison of integration capabilities across popular platforms.

The process of connecting to and integrating data involves several steps, beginning with identifying the relevant sources and determining the appropriate connection method. This often requires understanding the data structure and format of each source. Once a connection is established, the data is typically extracted, transformed, and loaded (ETL) into the analytics tool for processing and analysis.

Data Source Connection Methods

Connecting to various financial data sources usually involves utilizing specific connection methods tailored to the data source’s structure and accessibility. Databases, such as SQL Server or Oracle, are typically accessed using database connectors that adhere to established protocols like ODBC or JDBC. Application Programming Interfaces (APIs), increasingly common for accessing real-time market data or financial news, require coding expertise to handle authentication, data retrieval, and error handling. Other data sources, such as spreadsheets or flat files, can be imported directly using built-in functionalities within the analytical tool.

Common Financial Data Formats

Financial data comes in various formats. Comma Separated Values (CSV) files are ubiquitous for their simplicity and broad compatibility. Extensible Markup Language (XML) is used for structured data, offering better organization and metadata capabilities than CSV. JavaScript Object Notation (JSON), a lightweight format ideal for web-based APIs, is increasingly popular for its human-readability and ease of parsing.

Comparison of Data Integration Capabilities

The following table compares the data integration capabilities of three popular financial data analytics tools: Tableau, Power BI, and Alteryx. Note that specific capabilities may vary depending on the version and licensing.

| Feature | Tableau | Power BI | Alteryx |

|---|---|---|---|

| Database Connectors | Supports a wide range of databases, including SQL Server, Oracle, and MySQL. | Connects to various databases, including SQL Server, Oracle, and Azure SQL Database. | Offers robust database connectivity with support for a large variety of databases. |

| API Integration | Integrates with APIs via custom connectors or scripting. | Supports API integration using Power Query and custom connectors. | Provides tools for interacting with APIs and handling JSON and XML data. |

| File Import | Imports various file formats, including CSV, Excel, JSON, and XML. | Supports importing diverse file formats, similar to Tableau. | Handles a wide array of file formats, including those commonly used in financial analysis. |

| Data Transformation | Offers built-in data transformation capabilities. | Provides powerful data transformation features within Power Query. | Features a comprehensive suite of data transformation tools. |

User Interface and Experience

A user-friendly interface is crucial for the effective utilization of financial data analytics tools. The design directly impacts a user’s ability to efficiently analyze data, derive insights, and ultimately, make informed financial decisions. A poorly designed interface can lead to frustration, errors, and wasted time, while a well-designed interface can empower users to unlock the full potential of the tool.

The ease of use and the learning curve associated with these tools vary significantly. Some platforms boast intuitive drag-and-drop interfaces and pre-built templates, making them accessible to users with limited technical expertise. Others require a steeper learning curve, demanding a stronger understanding of programming languages or statistical concepts. This difference significantly impacts the adoption and effectiveness of the tools across different user groups.

Intuitive Design Elements

Several design elements contribute to a positive user experience. Clear visual hierarchies, using size, color, and contrast to highlight important information, are essential. Effective use of interactive elements, such as tooltips and contextual help, can guide users and reduce the need for extensive training. Consistent use of terminology and visual cues across the entire platform minimizes cognitive load and improves workflow efficiency. For instance, a consistent color-coding system for different data types or financial metrics makes it easier to quickly interpret complex datasets. Furthermore, customizable dashboards allow users to tailor their workspace to their specific needs and preferences, increasing both efficiency and satisfaction.

User Interface Complexity Categorization

The following table categorizes several hypothetical financial data analytics tools based on their user interface complexity. This categorization is for illustrative purposes and the actual complexity may vary depending on the specific version and features of each tool.

| Tool Name | Complexity Level | Target User | Key UI Features |

|---|---|---|---|

| FinAlytics Pro | High | Experienced analysts, data scientists | Customizable scripting, advanced visualization options, complex data manipulation capabilities. |

| DataWise | Medium | Financial analysts, business users | Drag-and-drop interface, pre-built templates, intuitive charting tools. |

| QuickFinance | Low | Beginner users, non-technical staff | Simplified interface, limited functionalities, pre-set reports. |

| InvestView | Medium-High | Financial advisors, portfolio managers | Integration with various data sources, advanced reporting features, some customizability. |

Security and Compliance

Protecting sensitive financial data is paramount when using data analytics tools. The security measures implemented and the level of compliance with relevant regulations vary significantly between different platforms. Understanding these aspects is crucial for selecting a tool that aligns with your organization’s risk tolerance and legal obligations.

The security of financial data analytics tools relies on a multi-layered approach encompassing data encryption, robust access controls, and comprehensive audit trails. Compliance with regulations like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) necessitates adherence to specific data handling practices, including data minimization, purpose limitation, and individual rights. Failure to meet these standards can result in significant financial penalties and reputational damage.

Data Encryption Methods and Their Effectiveness

Effective data encryption is a cornerstone of financial data security. Different tools employ various encryption methods, such as AES-256 (Advanced Encryption Standard with 256-bit key), to protect data both in transit and at rest. The strength of the encryption algorithm and the key management practices are crucial factors determining the effectiveness of the protection. For example, a tool employing AES-256 encryption with robust key management practices will offer significantly stronger protection compared to a tool using a weaker encryption algorithm or poor key management. Some tools also incorporate techniques like homomorphic encryption, allowing computations on encrypted data without decryption, further enhancing security.

Access Controls and User Authentication

Robust access controls are vital to limit access to sensitive financial data only to authorized personnel. Many tools implement role-based access control (RBAC), allowing administrators to assign specific permissions to different user roles based on their job responsibilities. Multi-factor authentication (MFA), requiring users to provide multiple forms of authentication (e.g., password, one-time code from an authenticator app), adds an extra layer of security, making it harder for unauthorized individuals to gain access. Tools often integrate with existing identity and access management (IAM) systems within an organization, streamlining user management and enhancing security. For instance, a tool integrating with an organization’s Active Directory can leverage existing user accounts and permissions, simplifying administration and improving security.

Audit Trails and Monitoring Capabilities

Maintaining comprehensive audit trails is essential for tracking data access, modifications, and other activities. These trails provide a record of who accessed what data, when, and what actions were performed. This information is invaluable for identifying security breaches, investigating suspicious activities, and complying with regulatory requirements. Effective tools provide detailed audit logs that can be easily searched and analyzed. Real-time monitoring capabilities, such as alerts for unusual activity or potential security threats, further enhance the security posture. For example, a tool might generate an alert if a user attempts to access data outside their authorized permissions or if a large volume of data is downloaded in a short period.

Compliance with GDPR and CCPA

Compliance with GDPR and CCPA necessitates a focus on data subject rights, data minimization, and data security. Tools compliant with these regulations typically offer features to facilitate data subject access requests (DSARs), allowing individuals to access, correct, or delete their personal data. They also incorporate mechanisms to minimize data collection and retention, adhering to the principle of purpose limitation. Furthermore, they implement strong security measures to protect personal data from unauthorized access, use, or disclosure. For example, a tool might offer features to automatically anonymize or pseudonymize sensitive data, reducing the risk of privacy violations.

Pricing and Licensing Models

Understanding the pricing and licensing models of financial data analytics tools is crucial for businesses of all sizes. The cost can vary significantly depending on several factors, impacting budget allocation and return on investment. Choosing the right model depends on factors such as the scale of operations, required features, and long-term financial planning.

Financial data analytics tools typically employ subscription-based or perpetual licensing models. Subscription models involve recurring payments for access to the software and its features, often including updates and support. Perpetual licenses, on the other hand, involve a one-time purchase granting permanent access to the software, but usually without ongoing updates or support unless purchased separately. The choice between these models depends on the business’s need for the latest features and the level of ongoing support required.

Factors Influencing Cost

Several factors significantly impact the overall cost of financial data analytics tools. The number of users requiring access directly affects the price, with additional licenses incurring extra costs. The specific features and functionalities included in the chosen package also play a vital role; more advanced tools with broader capabilities naturally command higher prices. Finally, the level of support offered by the vendor is another key cost driver; comprehensive support packages often come at a premium. For example, a tool offering real-time data streaming and sophisticated predictive modeling capabilities will likely be more expensive than a basic reporting tool.

Examples of Pricing Models and Their Implications

Consider a small investment firm needing basic financial reporting and analysis. A subscription-based model with a limited number of user licenses and a standard support package might be cost-effective. Conversely, a large multinational corporation with extensive data analysis needs across multiple departments would likely benefit from a more comprehensive enterprise solution, potentially opting for a perpetual license or a customized subscription plan offering advanced features and extensive support. The perpetual license may be more economical in the long run if the corporation plans to use the tool for many years without requiring frequent updates. However, the lack of automatic updates and support may necessitate additional costs in the long run.

Pricing Comparison Table

The following table provides a simplified comparison of hypothetical pricing and features for three different financial data analytics tools. Note that actual pricing varies considerably depending on the vendor, specific features, and contract terms.

| Tool Name | Licensing Model | Starting Price (USD/year) | Key Features |

|---|---|---|---|

| Analytica Pro | Subscription | 5000 | Real-time data streaming, predictive modeling, advanced reporting |

| FinanceWise | Subscription | 2000 | Basic reporting, data visualization, some predictive capabilities |

| DataStream Classic | Perpetual | 10000 (one-time) | Robust data integration, comprehensive reporting, limited predictive capabilities |

Case Studies and Best Practices

The successful application of financial data analytics tools hinges on strategic implementation and a clear understanding of their capabilities. This section explores real-world examples of how organizations leverage these tools, highlighting best practices and the benefits achieved. We will examine diverse applications, from risk management to fraud detection, illustrating the impact of data-driven decision-making.

Financial Forecasting and Budgeting at a Retail Chain

A large retail chain implemented a financial data analytics tool to improve its forecasting and budgeting processes. By integrating sales data from various stores, economic indicators, and marketing campaign performance, the tool generated more accurate sales projections. This allowed the company to optimize inventory levels, improve resource allocation, and enhance its overall profitability. The tool’s predictive modeling capabilities significantly reduced forecasting errors, resulting in a 15% improvement in budget accuracy compared to previous manual methods. This improved accuracy translated directly into reduced waste and increased operational efficiency. The successful implementation involved a phased approach, starting with a pilot program in a select group of stores before a company-wide rollout. Regular training sessions ensured staff proficiency in using the tool’s functionalities.

Fraud Detection and Prevention in a Banking Institution

A major banking institution used a financial data analytics tool to enhance its fraud detection capabilities. The tool analyzed transaction data, identifying unusual patterns and anomalies indicative of fraudulent activity. This proactive approach allowed the bank to detect and prevent millions of dollars in potential losses. The system’s machine learning algorithms continuously adapted to evolving fraud tactics, improving its accuracy over time. Specifically, the tool’s ability to detect sophisticated schemes involving multiple accounts and geographies significantly improved the bank’s security posture. The implementation involved a rigorous data quality assessment and the development of clear protocols for handling alerts generated by the system.

Risk Management and Portfolio Optimization for an Investment Firm

An investment firm employed a financial data analytics tool to improve its risk management and portfolio optimization strategies. The tool analyzed market data, economic indicators, and portfolio performance to identify potential risks and optimize investment allocations. This resulted in a more diversified portfolio with reduced volatility and improved returns. The tool’s scenario analysis capabilities allowed the firm to assess the potential impact of various market events on its portfolio, enabling proactive risk mitigation strategies. The successful implementation involved close collaboration between data scientists, financial analysts, and investment managers. This ensured the tool’s output was effectively integrated into the firm’s investment decision-making process. The tool’s ability to perform complex simulations and stress tests allowed the firm to make more informed investment decisions, ultimately leading to a 10% increase in annual returns.

Selecting the Appropriate Financial Data Analytics Tool

Choosing the right tool depends heavily on specific business needs and organizational capabilities. Several key factors should be considered.

These factors include:

- Data volume and complexity: The tool should be able to handle the volume and variety of data generated by the organization.

- Specific analytical needs: The tool should provide the functionalities needed to perform the desired analyses (e.g., forecasting, risk management, fraud detection).

- Integration capabilities: The tool should seamlessly integrate with existing systems and data sources.

- User experience and training requirements: The tool should be user-friendly and easy to learn, minimizing the need for extensive training.

- Security and compliance: The tool should meet the organization’s security and compliance requirements.

- Cost and licensing models: The tool should fit within the organization’s budget and licensing requirements.

A thorough evaluation of different tools, involving proof-of-concept testing and user feedback, is crucial for making an informed decision. This process should involve representatives from different departments to ensure the tool meets the needs of all stakeholders.

Future Trends and Developments

The field of financial data analytics is experiencing rapid evolution, driven by advancements in technology and the increasing availability of data. This section explores emerging trends, their impact on the financial industry, and the challenges and opportunities that lie ahead. We will focus specifically on the transformative role of artificial intelligence and machine learning, and their implications for the future of financial decision-making.

The integration of AI and machine learning is fundamentally reshaping financial data analytics. These technologies offer unprecedented capabilities for processing vast datasets, identifying complex patterns, and generating actionable insights. This leads to more efficient risk management, improved fraud detection, and enhanced investment strategies. The impact is already visible in areas such as algorithmic trading, personalized financial advice, and regulatory compliance.

AI and Machine Learning Integration in Financial Data Analytics

AI and machine learning are no longer futuristic concepts; they are actively transforming how financial institutions operate. Machine learning algorithms, for example, can analyze historical market data to predict future price movements with increasing accuracy. AI-powered systems can automate tasks such as portfolio optimization, risk assessment, and regulatory reporting, freeing up human analysts to focus on more strategic initiatives. This increased efficiency and accuracy translates directly into improved profitability and reduced operational costs. Furthermore, AI’s ability to identify subtle patterns and anomalies in large datasets enables the early detection of fraudulent activities, mitigating financial losses. The use of natural language processing (NLP) within AI systems allows for the automated analysis of news articles, social media sentiment, and other unstructured data sources, providing valuable context for investment decisions. For instance, a fund manager might use an AI-powered system to analyze news reports about a specific company, instantly assessing the potential impact on its stock price and adjusting their portfolio accordingly.

Impact on the Financial Industry

The impact of these technological advancements is far-reaching. Increased automation leads to significant cost savings and improved operational efficiency. More accurate predictive models enable better risk management and more informed investment decisions. Personalized financial advice, tailored to individual client needs, becomes a reality. Enhanced fraud detection mechanisms protect financial institutions and consumers from financial crimes. The ability to analyze vast datasets allows for a deeper understanding of market dynamics and customer behavior, enabling the development of innovative financial products and services. Consider, for example, the rise of robo-advisors – AI-powered platforms that provide automated investment management services at a fraction of the cost of traditional advisors. This is a direct result of the integration of AI and machine learning into financial data analytics.

Future Challenges and Opportunities

While the future looks bright, several challenges need to be addressed. Data security and privacy remain paramount concerns. The ethical implications of AI-driven decision-making, such as algorithmic bias, require careful consideration. The need for skilled professionals capable of developing, implementing, and interpreting AI-powered analytics tools is growing rapidly. However, these challenges also present significant opportunities. The development of robust and secure AI systems will create new markets and job opportunities. Addressing ethical concerns will build trust and ensure responsible innovation. Investing in education and training programs will create a skilled workforce capable of harnessing the power of AI in finance.

Potential Future Developments

The potential for future advancements is substantial. Below is a list highlighting some key areas:

- Increased use of Explainable AI (XAI): Making AI decision-making more transparent and understandable.

- Advanced natural language processing (NLP) for sentiment analysis: More nuanced understanding of market sentiment from various sources.

- Integration of blockchain technology: Enhancing data security and transparency in financial transactions.

- Hyper-personalization of financial services: Tailoring financial products and services to individual customer needs with unprecedented precision.

- Development of more sophisticated risk management models: Better anticipating and mitigating financial risks through advanced predictive analytics.

Closing Summary

In conclusion, the selection of a financial data analytics tool is a strategic decision that demands careful consideration of various factors. From the ease of use and data integration capabilities to security protocols and compliance with industry regulations, the optimal choice will vary depending on the specific requirements of each organization. By understanding the strengths and limitations of different tools, businesses can leverage the power of data analytics to gain valuable insights, enhance decision-making, and ultimately achieve a competitive advantage in the dynamic financial landscape. This review has provided a framework for this critical evaluation process, highlighting key considerations and best practices for successful implementation.

FAQ Explained

What is the difference between descriptive and predictive analytics in finance?

Descriptive analytics summarizes past financial data to understand trends and patterns. Predictive analytics uses historical data to forecast future outcomes, such as market movements or credit risk.

How important is data security when choosing a financial data analytics tool?

Data security is paramount. Financial data is highly sensitive, and choosing a tool with robust encryption, access controls, and compliance with relevant regulations (e.g., GDPR, CCPA) is essential to protect against breaches and maintain regulatory compliance.

What are some common challenges in implementing financial data analytics tools?

Challenges include data quality issues, integrating disparate data sources, ensuring data accuracy, managing user adoption, and justifying the return on investment (ROI).