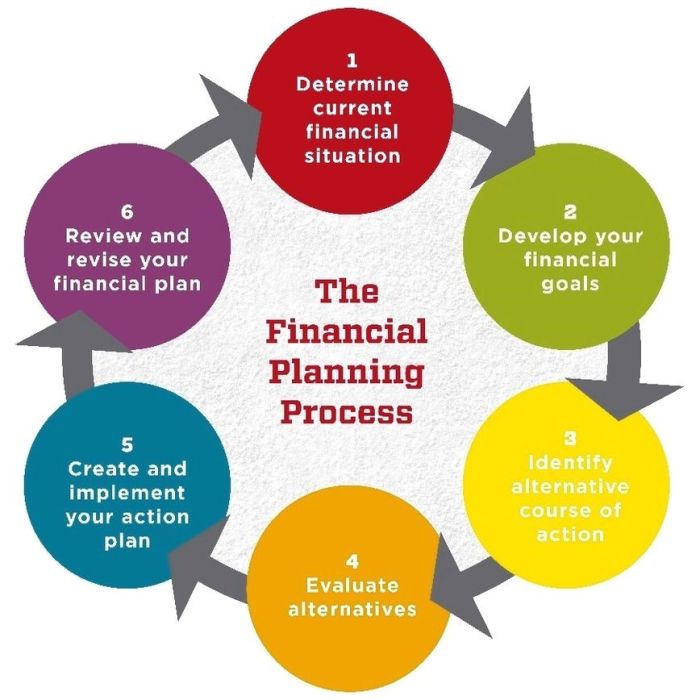

Regularly reviewing your financial plan is crucial for long-term financial success. This process, far from being a mere formality, offers a dynamic opportunity to assess your current situation, identify emerging risks and opportunities, and refine your strategy to align with your evolving goals and circumstances. Whether you’re navigating a career change, planning for retirement, or simply aiming for improved financial well-being, a thorough review ensures your plan remains relevant and effective.

This comprehensive guide delves into the intricacies of a financial planning process review, covering everything from data collection and analysis to the development and implementation of actionable recommendations. We’ll explore both proactive and reactive approaches, offering practical strategies and best practices to help you optimize your financial future.

Defining the Scope of a Financial Planning Process Review

A financial planning process review is a critical step in ensuring your financial strategy remains aligned with your evolving goals and circumstances. Regular reviews help identify areas needing adjustment, mitigate potential risks, and maximize opportunities for growth. This process involves a systematic examination of your current financial plan, comparing it to your current situation, and making necessary modifications.

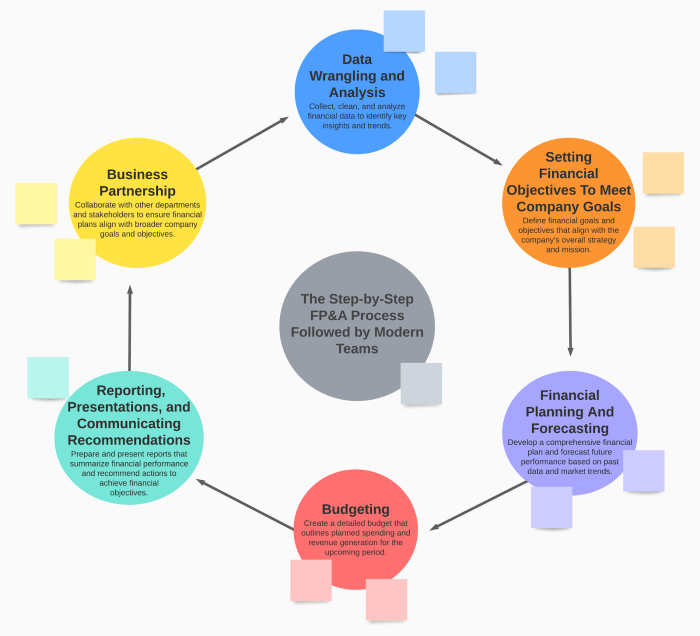

Components of a Comprehensive Financial Planning Process

A comprehensive financial plan typically encompasses several key areas. These include: goal setting (short-term and long-term objectives), asset allocation (investments, real estate, etc.), risk management (insurance, estate planning), retirement planning, tax planning, and debt management. Each component interacts with the others, creating a holistic strategy. A robust plan considers all aspects of your financial life and how they contribute to your overall financial well-being. Understanding these interconnected elements is crucial for effective review.

Routine Review vs. Comprehensive Overhaul

The key difference between a routine review and a comprehensive overhaul lies in the depth and breadth of the analysis. A routine review typically involves a less intensive examination, focusing on monitoring progress toward existing goals, adjusting asset allocation based on market conditions, and reviewing recent tax legislation. A comprehensive overhaul, on the other hand, involves a more in-depth reassessment of the entire financial plan, often triggered by significant life changes or unforeseen circumstances. This might include a complete re-evaluation of goals, risk tolerance, and the overall strategic direction of the plan.

Circumstances Necessitating a Financial Planning Process Review

Several situations necessitate a review of your financial planning process. These include significant life events such as marriage, divorce, birth of a child, job loss, inheritance, or retirement. Market fluctuations, changes in tax laws, and the achievement of major milestones (like paying off a mortgage) also warrant a review. Furthermore, a periodic review (even in the absence of significant life events) is essential to ensure the plan remains relevant and effective.

Examples of Situations Requiring a Review

Consider these scenarios: A couple expecting their first child may need to adjust their savings goals and insurance coverage. Someone inheriting a substantial sum of money needs to integrate this new asset into their overall investment strategy. A significant market downturn could necessitate a re-evaluation of risk tolerance and asset allocation. Retirement necessitates a comprehensive review of income sources, healthcare costs, and estate planning. Each situation calls for a tailored review to ensure the plan adapts to the changing circumstances.

Proactive vs. Reactive Review Approaches

| Approach | Trigger | Frequency | Key Considerations |

|---|---|---|---|

| Proactive | Regular intervals (e.g., annually), planned milestones | Annual or semi-annual | Monitoring progress, adjusting for minor changes, identifying potential future issues. |

| Reactive | Significant life events, market shocks, unexpected financial setbacks | As needed, triggered by specific events | Addressing immediate concerns, adapting to major changes, potentially requiring significant plan revisions. |

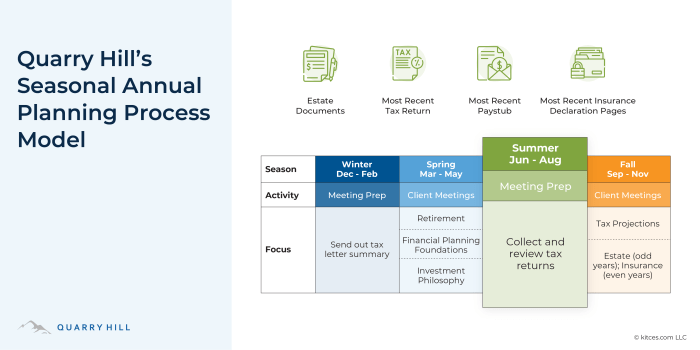

Gathering and Analyzing Client Data

Gathering and analyzing client data is a critical step in a financial planning review, forming the bedrock for developing effective and personalized strategies. Accurate and comprehensive data ensures the recommendations are relevant and beneficial to the client’s specific circumstances. This process requires careful planning, secure methods, and a robust system for maintaining confidentiality.

Essential Data Points for Collection

This section Artikels the key data points necessary for a thorough financial planning review. The specific data required will vary depending on the client’s circumstances and goals, but a comprehensive approach ensures no crucial information is overlooked.

Essential Client Data Points

A robust data collection process should encompass various aspects of a client’s financial life. This includes income and expenses, assets and liabilities, insurance coverage, estate planning documents, tax information, and investment holdings. Detailed information on retirement goals, education planning, and legacy planning should also be collected. Furthermore, gathering information on the client’s risk tolerance and investment timeline is essential for crafting a suitable investment strategy. Finally, understanding the client’s overall financial goals and objectives is paramount.

Securely Obtaining and Verifying Client Information

Protecting client data is paramount. Methods for securely obtaining information include utilizing encrypted email, secure client portals, and physically secured document storage. Verification involves comparing data from multiple sources where possible, such as bank statements, tax returns, and insurance policies. Independent verification steps should be taken to confirm the accuracy of self-reported information.

Organizing Client Data for Efficient Analysis

Efficient data organization is crucial for a smooth analysis. A well-structured system, whether digital or physical, allows for easy retrieval and analysis of information. This could involve using dedicated financial planning software, spreadsheets, or a combination of both. Data should be categorized logically, with clear labeling and indexing to facilitate quick access. For example, all income-related documents could be filed under one category, while asset information is categorized separately. Regular data backups are also essential to prevent data loss.

Maintaining Client Confidentiality and Data Privacy

Client confidentiality and data privacy are of utmost importance. Adherence to relevant data protection regulations, such as GDPR or CCPA, is crucial. This involves implementing robust security measures, limiting access to sensitive data to authorized personnel only, and using secure data storage and transmission methods. Regular security audits and employee training on data protection best practices are essential components of maintaining client confidentiality.

Data Collection Form Design

A well-designed data collection form ensures completeness and accuracy. The form should be clear, concise, and easy to understand. It should guide the client through the necessary information, using clear prompts and instructions. Including space for additional notes or comments allows for flexibility. The form should also clearly state the purpose of data collection and how it will be used, emphasizing the commitment to confidentiality and data protection. An example could include sections for personal information, income and expenses, assets and liabilities, investment holdings, insurance details, and goals and objectives. A clear statement regarding the use and protection of data should be prominently displayed.

Assessing Current Financial Situation

A comprehensive assessment of a client’s current financial situation is crucial for developing an effective financial plan. This involves a detailed review of various aspects, allowing for a holistic understanding of their financial health and identifying areas for improvement or potential risks. This evaluation forms the foundation upon which future financial strategies are built.

Key Aspects of a Client’s Financial Situation

Evaluating a client’s financial situation requires a multifaceted approach. Key areas of focus include income and expenses, assets and liabilities, investment portfolio performance, debt levels, and retirement preparedness. A thorough understanding of these elements provides a clear picture of the client’s overall financial well-being. Analyzing these components allows the financial planner to identify strengths, weaknesses, and opportunities for optimization.

Investment Portfolio Analysis

Analyzing an investment portfolio involves evaluating its asset allocation and performance. Asset allocation refers to the proportion of different asset classes (stocks, bonds, real estate, etc.) within the portfolio. A well-diversified portfolio typically spreads investments across various asset classes to mitigate risk. Performance analysis examines the portfolio’s returns over time, considering factors like market fluctuations and investment strategies. For example, a portfolio heavily weighted in technology stocks might perform exceptionally well in a bull market but experience significant losses during a downturn. Analyzing historical performance helps determine the effectiveness of the current investment strategy and informs future adjustments.

Debt Assessment and Management Strategies

Assessing a client’s debt involves identifying all sources of debt (mortgages, credit cards, student loans, etc.), calculating the total debt amount, and evaluating the debt-to-income ratio (DTI). The DTI is a crucial indicator of a client’s ability to manage their debt. A high DTI ratio may signal financial strain and potential difficulties in meeting debt obligations. Debt management strategies focus on developing plans to reduce debt, such as debt consolidation, balance transfers, or accelerated repayment plans. For instance, a client with high-interest credit card debt might benefit from a balance transfer to a lower-interest card to reduce overall interest payments.

Retirement Readiness Evaluation

Several methods exist for evaluating retirement readiness. One common approach is to project future retirement income based on current savings, anticipated investment growth, and estimated retirement expenses. This projection helps determine whether the client’s savings are sufficient to support their desired lifestyle in retirement. Another method involves using retirement calculators or financial planning software to model various scenarios and assess the likelihood of achieving retirement goals. For example, a Monte Carlo simulation can show the probability of running out of funds before the end of retirement based on different market conditions. Additionally, comparing the client’s projected retirement income to their estimated retirement expenses provides a clear picture of potential shortfalls or surpluses.

Net Worth and Cash Flow Calculation

Calculating net worth involves subtracting total liabilities (debts) from total assets (possessions). The formula is:

Net Worth = Total Assets – Total Liabilities

. Total assets include liquid assets (cash, checking accounts, savings accounts), investments (stocks, bonds, mutual funds), real estate, and other valuable possessions. Total liabilities include mortgages, loans, credit card balances, and other outstanding debts. Calculating cash flow involves subtracting total expenses from total income over a specific period (monthly, annually). The formula is:

Cash Flow = Total Income – Total Expenses

. Positive cash flow indicates that income exceeds expenses, while negative cash flow suggests expenses exceed income. Regularly monitoring net worth and cash flow provides valuable insights into a client’s financial health and helps identify areas for improvement.

Identifying Opportunities and Risks

A thorough financial plan review isn’t just about assessing the current state; it’s about proactively identifying areas for improvement and mitigating potential risks. This involves a careful examination of your existing strategies, considering market conditions, and exploring opportunities to optimize your financial health. This section focuses on uncovering both the potential pitfalls and the avenues for growth within your financial landscape.

This process involves a detailed analysis of your investment portfolio, expense patterns, and overall financial strategy, comparing it against your goals and risk tolerance. We’ll explore how changes in legislation or market fluctuations can impact your plan and how to adapt accordingly. By identifying and addressing these aspects, we can strengthen your financial position and work towards achieving your long-term objectives more effectively.

Potential Areas for Improvement in Financial Plans

Identifying areas for improvement requires a comprehensive review of your existing financial plan. This might involve analyzing your investment allocation to ensure it aligns with your risk tolerance and long-term goals. It could also include reviewing your expense patterns to pinpoint areas where savings can be achieved. For instance, a detailed analysis might reveal opportunities to refinance debt at lower interest rates, consolidate high-interest loans, or negotiate lower premiums on insurance policies. Another area to examine is the efficiency of your tax planning strategies, looking for ways to minimize your tax burden legally and effectively. Finally, a review of your estate planning documents ensures they remain current and align with your current circumstances and wishes.

Strategies for Mitigating Financial Risks

Effective risk mitigation involves proactively addressing potential threats to your financial well-being. This includes diversifying your investment portfolio to reduce exposure to market volatility, employing strategies to protect against inflation, and ensuring adequate insurance coverage to safeguard against unforeseen events. For example, maintaining an emergency fund can cushion the impact of unexpected expenses, while diversifying investments across different asset classes reduces the risk of significant losses. Regularly reviewing and adjusting your investment strategy in response to market changes is crucial for mitigating risk and maximizing returns.

Examples of Opportunities for Enhancing Investment Returns or Reducing Expenses

Opportunities for improvement exist across various aspects of your financial life. Investing in tax-advantaged accounts like 401(k)s or IRAs can significantly reduce your tax burden while simultaneously building wealth. Negotiating lower interest rates on loans or exploring debt consolidation options can free up cash flow and reduce overall interest payments. Similarly, actively seeking ways to reduce recurring expenses, such as identifying cheaper alternatives for utilities or streamlining subscription services, can free up significant resources. Careful planning and implementation of these strategies can lead to considerable financial benefits.

Incorporating Changes in Legislation or Market Conditions

The financial landscape is constantly evolving, influenced by changes in legislation and market conditions. For instance, changes in tax laws can significantly impact investment strategies and retirement planning. Similarly, fluctuations in interest rates can affect borrowing costs and investment returns. Adapting to these changes requires ongoing monitoring and adjustments to your financial plan. This may involve re-balancing your investment portfolio, revising your retirement savings strategy, or adjusting your asset allocation to reflect the new market realities. Staying informed about relevant legislation and market trends is vital for maintaining a robust and adaptable financial plan.

Common Financial Risks and Mitigation Strategies

Understanding common financial risks and developing effective mitigation strategies is crucial for long-term financial stability.

- Risk: Market Volatility. Mitigation: Diversification across asset classes (stocks, bonds, real estate) and a long-term investment horizon.

- Risk: Inflation. Mitigation: Investing in assets that historically outpace inflation (e.g., real estate, equities) and adjusting spending habits.

- Risk: Unexpected Expenses (Medical emergencies, job loss). Mitigation: Maintaining an emergency fund (3-6 months of living expenses) and adequate insurance coverage.

- Risk: High Debt Levels. Mitigation: Debt consolidation, budgeting, and prioritizing high-interest debt repayment.

- Risk: Lack of Retirement Savings. Mitigation: Contributing consistently to retirement accounts (401(k), IRA), and exploring additional savings vehicles.

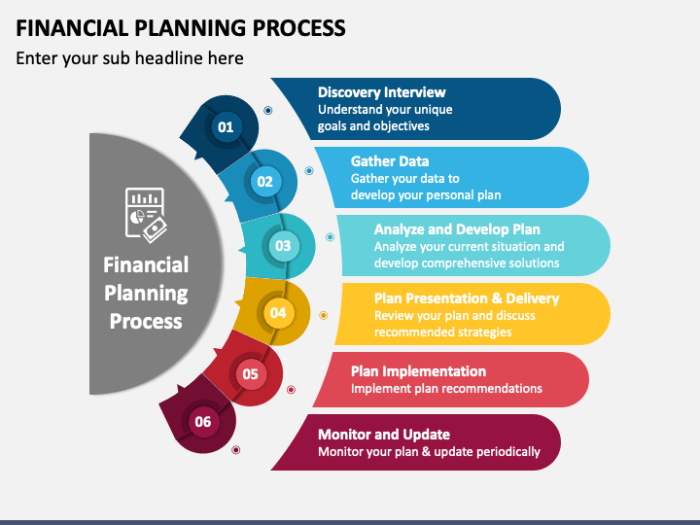

Developing Recommendations and Action Plans

Developing actionable recommendations and a comprehensive action plan is crucial for translating the identified opportunities and risks into tangible improvements in the client’s financial situation. This involves prioritizing recommendations based on their urgency and potential impact, designing SMART goals, and selecting an appropriate communication style for presenting the plan to the client. A well-structured and visually appealing presentation is key to ensuring the client understands and accepts the proposed plan.

Translating Opportunities and Risks into Actionable Recommendations

Converting identified opportunities and risks into actionable recommendations requires careful consideration. For each opportunity, we need to define specific steps the client can take to capitalize on it. For each risk, we need to Artikel mitigation strategies to minimize its potential negative impact. For example, if an opportunity is to increase investment returns, a recommendation might be to reallocate a portion of the portfolio to higher-growth assets. If a risk is insufficient retirement savings, a recommendation could be to increase contributions to a retirement account by a specific percentage each year. These recommendations must be realistic and tailored to the client’s individual circumstances, risk tolerance, and financial goals.

Designing a Clear and Concise Action Plan with SMART Goals

A well-defined action plan is crucial for successful implementation. Each recommendation should translate into a SMART goal: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of “improve retirement savings,” a SMART goal might be “Increase annual retirement contributions by 5% within the next six months, reaching a total contribution of $10,000 annually.” This clarity allows for effective monitoring and progress tracking. The action plan should also Artikel the steps needed to achieve each goal, including timelines and assigned responsibilities (if applicable).

Prioritizing Recommendations Based on Urgency and Impact

Not all recommendations carry the same weight. Prioritization is essential. We can use a simple matrix plotting urgency (high/low) against impact (high/low). High-urgency, high-impact recommendations should be addressed immediately. For example, addressing a significant debt with high interest rates would fall into this category. Low-urgency, low-impact recommendations can be deferred to a later stage. This prioritization ensures that the most critical issues are addressed first, maximizing the positive impact of the financial plan.

Communication Styles for Presenting Recommendations to Clients

Effective communication is vital for client acceptance and adherence to the plan. The chosen communication style should be tailored to the client’s personality and communication preferences. Some clients prefer a detailed, data-driven approach, while others prefer a more concise and summary-oriented presentation. Regardless of style, clarity, empathy, and active listening are crucial. Using visuals like charts and graphs can enhance understanding and engagement. A clear explanation of the rationale behind each recommendation is essential to build trust and encourage buy-in.

Organizing Recommendations in a Visually Appealing Format

The final recommendations should be presented in a clear, concise, and visually appealing format. Using bullet points, headings, and subheadings improves readability and makes it easier for clients to grasp the key points. A table summarizing the recommendations, their associated SMART goals, timelines, and responsible parties (if any) can be highly effective. For instance, a table could include columns for Recommendation, Goal (SMART), Timeline, and Next Steps. This structured approach ensures the client has a clear understanding of the proposed plan and the steps needed to implement it successfully.

Implementing and Monitoring the Revised Plan

Successfully implementing a revised financial plan requires a structured approach and consistent monitoring. This phase moves beyond theory and into practical application, ensuring the strategies developed are effectively put into action and adjusted as needed. It’s a crucial step to achieving the client’s long-term financial goals.

Steps Involved in Implementing the Revised Financial Plan

Implementing the revised plan involves a series of concrete actions. These actions translate the strategic recommendations into tangible steps, making the plan a reality. A clear timeline, as detailed later, is essential for effective implementation.

- Account Setup and Transfers: This involves opening new accounts (if necessary), transferring assets, and initiating any necessary changes to existing accounts to align with the revised plan.

- Investment Allocation: This step focuses on executing the revised asset allocation strategy. This may involve buying, selling, or rebalancing investments across various asset classes.

- Debt Management Strategies: Implementing debt reduction strategies, such as debt consolidation or accelerated repayment plans, is crucial. This requires actively managing debt and sticking to the repayment schedule.

- Insurance Review and Adjustments: This involves reviewing existing insurance policies to ensure adequate coverage and making any necessary adjustments to premiums or policy types.

- Tax Planning Implementation: This involves taking concrete steps to implement the recommended tax strategies, such as making tax-advantaged contributions or adjusting withholding to optimize tax liability.

Progress Tracking Methods

Regular monitoring is vital to ensure the plan remains on track. Various methods can be employed to track progress against the established goals, allowing for timely adjustments.

- Regular Client Meetings: Scheduled meetings allow for open communication, review of progress, and identification of potential roadblocks. These meetings should include a thorough review of performance against goals.

- Performance Reporting: Providing regular reports (e.g., quarterly or annually) detailing investment performance, asset allocation, and progress towards goals. These reports should be easily understandable for the client.

- Financial Dashboard: Creating a personalized financial dashboard that provides a clear, at-a-glance view of key financial metrics, including net worth, investment performance, and debt levels.

- Goal Tracking Spreadsheet: A spreadsheet that tracks progress toward specific financial goals, such as retirement savings, debt reduction, or college funding, allowing for easy visualization of progress and identification of areas needing attention.

Plan Adjustments Based on Performance and Changing Circumstances

The financial landscape is dynamic. The ability to adapt the plan to changing circumstances and performance is crucial for long-term success.

For example, a significant market downturn might necessitate a recalibration of the investment strategy, possibly shifting towards more conservative investments. Similarly, an unexpected job loss might require adjustments to the cash flow projections and debt management plan. Regular reviews and open communication are vital for timely adjustments.

Examples of Effective Monitoring Tools and Techniques

Several tools and techniques can enhance the monitoring process.

- Financial Planning Software: Software applications can automate many aspects of monitoring, providing real-time data and generating reports automatically.

- Budgeting Apps: These apps facilitate tracking income and expenses, providing a clear picture of cash flow and helping identify areas for improvement.

- Investment Portfolio Tracking Websites: These websites provide detailed information on investment performance, allowing for easy monitoring of portfolio growth and risk exposure.

Timeline for Implementing Key Aspects of the Revised Plan

A sample timeline, which should be customized to the individual client’s situation, might look like this:

| Task | Timeline |

|---|---|

| Account Setup and Transfers | Within 30 days |

| Investment Allocation Adjustments | Within 60 days |

| Debt Management Strategy Implementation | Ongoing |

| Insurance Review and Adjustments | Within 90 days |

| First Progress Review Meeting | After 90 days |

Documentation and Communication

Thorough documentation and clear communication are crucial for a successful financial planning process review. These elements ensure transparency, accountability, and a strong client-advisor relationship, ultimately leading to better financial outcomes. Effective documentation protects both the client and the advisor, providing a detailed record of the process and decisions made. Clear communication ensures the client understands the review’s findings and the recommended action plan.

Maintaining comprehensive records is paramount. These records serve as a reference point for future reviews, demonstrate the advisor’s due diligence, and protect against potential disputes. The documentation should include all client interactions, data gathered, analyses performed, recommendations made, and the client’s acceptance or rejection of those recommendations. This detailed record allows for easy tracking of progress and facilitates efficient follow-up.

Best Practices for Documenting the Review Process

Best practices for documenting the review process involve using a standardized template to ensure consistency and completeness. This template should include sections for client identification, initial goals, data gathered (including sources), analysis performed, recommendations, action plans, and a record of client communication. All documents should be securely stored, ideally using a cloud-based system with appropriate access controls to maintain client confidentiality. Version control is essential to track changes and revisions made throughout the process. Regular backups of all documents are also crucial to prevent data loss.

Communicating Review Findings and Recommendations to Clients

Effective communication of review findings and recommendations involves tailoring the communication style to the client’s preferences and understanding. Using clear, concise language, avoiding jargon, and presenting information visually are all helpful strategies. The communication should clearly Artikel the current financial situation, identify key opportunities and risks, explain the rationale behind the recommendations, and detail the potential benefits and drawbacks of each recommendation. A follow-up meeting should be scheduled to answer any questions and address any concerns the client may have.

Examples of Effective Communication Tools and Strategies

Several tools and strategies can enhance communication effectiveness. For example, using visual aids like charts and graphs can simplify complex financial information. Presenting a summary of key findings and recommendations upfront can help clients quickly grasp the main points. Providing clients with a written report summarizing the review’s findings, recommendations, and action plan allows them to review the information at their own pace. Regular email updates can keep clients informed of progress and upcoming steps. Video conferencing can facilitate interactive discussions and address questions in real-time.

Final Report Format and Portfolio Change Examples

The final report should be organized professionally and be easy for the client to understand. It should begin with an executive summary that highlights the key findings and recommendations. Subsequent sections should detail the current financial situation, identified opportunities and risks, the rationale behind the recommendations, and a clear action plan. The report should conclude with a summary of next steps and contact information. A visually appealing layout with clear headings, bullet points, and charts enhances readability.

The report should include a section detailing potential portfolio changes, using bullet points for clarity. For example:

- Increase allocation to equities: Shift 15% of portfolio from bonds to a diversified equity index fund to capture higher growth potential, considering the client’s long-term time horizon and risk tolerance.

- Rebalance asset allocation: Adjust portfolio weights to align with the client’s updated risk profile and financial goals. This may involve reducing exposure to high-risk assets and increasing allocation to more conservative investments.

- Diversify holdings: Introduce exposure to alternative asset classes such as real estate or commodities to reduce overall portfolio volatility and enhance returns.

- Reduce high-expense ratio funds: Replace existing high-expense mutual funds with lower-cost index funds or ETFs to improve long-term investment performance.

- Tax loss harvesting: Implement a tax-loss harvesting strategy to offset capital gains and reduce overall tax liability.

Ultimate Conclusion

By systematically reviewing your financial plan, you gain a clear perspective on your current standing, allowing for proactive adjustments to mitigate risks and seize opportunities. This proactive approach fosters a continuous improvement cycle, ensuring your financial plan remains a robust and reliable roadmap to achieving your long-term financial aspirations. Remember, a well-maintained financial plan isn’t static; it’s a living document that evolves alongside your life and circumstances.

FAQ Compilation

What is the ideal frequency for a financial planning review?

The ideal frequency depends on individual circumstances, but annual reviews are generally recommended. More frequent reviews may be necessary during times of significant life changes.

How much does a financial planning process review typically cost?

The cost varies greatly depending on the complexity of the plan, the advisor’s fees, and the scope of the review. It’s best to consult with financial advisors for specific pricing information.

What if I don’t have a formal financial plan?

A financial planning process review can still be beneficial. The process can help you identify your financial goals, assess your current situation, and create a personalized plan moving forward.

Can I conduct a financial planning review myself?

While you can gather and analyze some information independently, seeking professional guidance from a qualified financial advisor is highly recommended to ensure a comprehensive and objective review.