Taking control of your finances can feel daunting, but mastering personal finance management is key to achieving financial security and peace of mind. This review delves into the essential aspects of effectively managing your money, from creating a budget and tracking expenses to managing debt, saving, investing, and planning for retirement. We’ll explore practical strategies and tools to help you navigate the complexities of personal finance and build a solid financial foundation.

This guide provides a structured approach to understanding and implementing effective personal finance strategies. We cover a range of topics, from budgeting and debt management to investing and retirement planning, offering actionable advice and resources to help you achieve your financial goals. Whether you’re just starting out or looking to refine your existing financial practices, this review will equip you with the knowledge and tools to take charge of your financial future.

Introduction to Personal Finance Management

Personal finance management encompasses all the activities related to acquiring, managing, and growing one’s financial resources. It’s about making informed decisions about your money to achieve your financial goals, whether that’s buying a house, retiring comfortably, or simply ensuring financial security. Effective management ensures you have control over your finances and are prepared for both expected and unexpected events.

Personal finance management involves a holistic approach, considering various interconnected aspects of your financial life. It’s not just about tracking income and expenses; it’s about strategically planning for the future and mitigating potential risks. A well-structured system empowers individuals to take charge of their financial well-being.

Key Components of a Robust Personal Finance Management System

A robust personal finance management system integrates several key components working in harmony. These components contribute to a comprehensive understanding of one’s financial situation and facilitate informed decision-making. A lack in any one area can significantly impact the effectiveness of the overall system.

- Budgeting: Creating and adhering to a budget is foundational. This involves tracking income and expenses to understand where your money is going and identify areas for potential savings. A realistic budget allows for allocating funds towards various financial goals, such as savings, investments, and debt repayment.

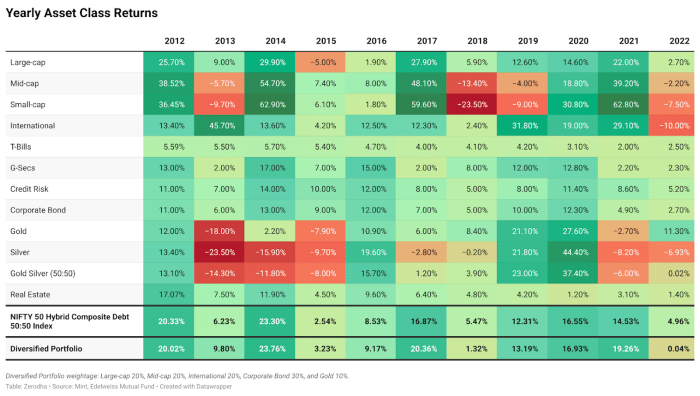

- Saving and Investing: Saving provides a financial safety net for unexpected expenses and forms the basis for future investments. Investing involves putting your money to work to generate returns over the long term. Diversification across different asset classes, such as stocks, bonds, and real estate, is crucial to manage risk.

- Debt Management: High levels of debt can severely hamper financial progress. Effective debt management involves strategies to reduce and eventually eliminate debt, prioritizing high-interest debts first. This might involve debt consolidation, balance transfers, or negotiating with creditors.

- Financial Goal Setting: Defining clear and achievable financial goals is crucial for motivation and progress. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Examples include saving for a down payment on a house, paying off student loans, or building a retirement nest egg.

- Insurance Planning: Protecting oneself against unforeseen events is essential. This involves securing adequate insurance coverage, such as health, life, disability, and property insurance, to mitigate potential financial losses.

- Tax Planning: Understanding tax laws and strategies is crucial for minimizing tax liability and maximizing after-tax income. This involves utilizing tax-advantaged accounts, claiming deductions, and making informed decisions about investments with tax implications.

Benefits of Effective Personal Finance Management

The advantages of effectively managing personal finances are numerous and far-reaching. It’s an investment in one’s future well-being, offering both short-term and long-term benefits.

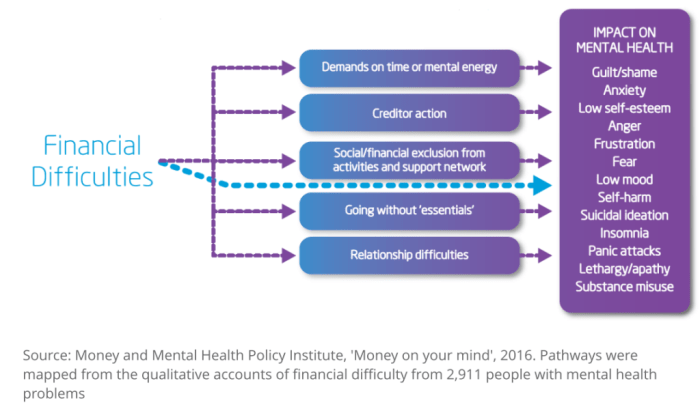

- Reduced Financial Stress: Knowing where your money is going and having a plan for the future reduces anxiety and uncertainty about finances. This contributes to overall mental and emotional well-being.

- Achieving Financial Goals: A well-structured plan allows you to systematically work towards your financial goals, whether it’s buying a home, funding your children’s education, or retiring comfortably.

- Increased Financial Security: Effective management creates a safety net against unexpected events, such as job loss or medical emergencies. This provides peace of mind and stability.

- Improved Credit Score: Responsible financial behavior, such as paying bills on time and managing debt effectively, positively impacts your credit score, which is crucial for obtaining loans and credit at favorable terms.

- Greater Financial Independence: Effective management empowers individuals to take control of their financial lives, reducing dependence on others and fostering a sense of self-reliance.

Budgeting and Expense Tracking

Effective budgeting and expense tracking are fundamental to achieving your financial goals. Understanding where your money goes is the first step towards controlling spending and building a secure financial future. This section will explore various budgeting methods and practical techniques to help you gain mastery over your finances.

Sample Budget Template

A well-structured budget provides a clear picture of your income and expenses. The following template incorporates common income and expense categories, adaptable to individual needs.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Salary/Wages | $XXXX | Housing (Rent/Mortgage) | $XXXX |

| Investment Income | $XXXX | Utilities (Electricity, Water, Gas) | $XXXX |

| Side Hustle Income | $XXXX | Groceries | $XXXX |

| Other Income | $XXXX | Transportation (Car Payment, Gas, Public Transit) | $XXXX |

| Total Income | $XXXX | Healthcare (Insurance, Medical Expenses) | $XXXX |

| Debt Payments (Loans, Credit Cards) | $XXXX | ||

| Entertainment | $XXXX | ||

| Savings & Investments | $XXXX | ||

| Other Expenses | $XXXX | ||

| Total Expenses | $XXXX | ||

| Net Income (Income – Expenses) | $XXXX |

Replace the “XXXX” placeholders with your actual figures. Regularly reviewing and adjusting your budget is crucial to ensure it aligns with your financial situation and goals.

Expense Tracking Methods

Effective expense tracking requires consistent effort and the right tools. Several methods facilitate this process. Spreadsheets offer customizable tracking, allowing for detailed categorization and analysis. Budgeting apps, on the other hand, often provide automated features, such as transaction import and insightful visualizations. Choosing the right method depends on personal preferences and technological comfort.

Comparison of Budgeting Methods

Different budgeting methods cater to various financial styles and priorities. The 50/30/20 rule and zero-based budgeting are two popular approaches.

| Method Name | Description | Pros | Cons |

|---|---|---|---|

| 50/30/20 Rule | Allocates 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. | Simple and easy to understand; provides a clear framework for spending. | May not be suitable for everyone; lacks flexibility for unexpected expenses; doesn’t explicitly address debt management beyond the 20% allocation. |

| Zero-Based Budgeting | Assigns every dollar of income to a specific category, ensuring that income equals expenses. | Promotes mindful spending; helps identify areas for savings; effective for debt reduction. | Requires more time and effort; can be complex to implement initially; may feel restrictive to some. |

Both methods offer valuable frameworks; the best choice depends on individual financial circumstances and personal preferences. Experimentation is key to finding the most effective approach.

Debt Management Strategies

Tackling debt effectively requires a strategic approach. Understanding different debt management strategies and creating a personalized repayment plan are crucial steps towards financial freedom. Choosing the right strategy depends on your individual circumstances, including the amount of debt, interest rates, and your overall financial situation.

Debt management strategies aim to systematically reduce debt while minimizing interest payments and the overall time it takes to become debt-free. Two popular approaches are the debt snowball and debt avalanche methods. Both involve consistent payments, but they prioritize debts differently.

Debt Snowball Method

The debt snowball method focuses on paying off the smallest debt first, regardless of its interest rate. The psychological benefit of quickly eliminating a debt can provide motivation to continue the process. Once the smallest debt is paid, the monthly payment amount is then added to the payment of the next smallest debt, creating a “snowball” effect of increasing payments. This method prioritizes momentum and psychological satisfaction. For example, if you owe $500 on a credit card, $1000 on a personal loan, and $2000 on a student loan, you would focus on paying off the $500 credit card debt first, then roll that payment into the next smallest debt.

Debt Avalanche Method

The debt avalanche method prioritizes debts with the highest interest rates first. This approach aims to minimize the total interest paid over the long run, leading to potential savings. While it might not offer the same immediate psychological boost as the snowball method, it’s mathematically more efficient. Using the same example, you would first tackle the $2000 student loan with the highest interest rate, then move to the next highest interest debt.

Creating a Debt Repayment Plan

A well-structured debt repayment plan is essential for success. This plan should include a clear overview of all debts, their interest rates, minimum payments, and a strategy for accelerated repayment.

- List all debts: Compile a comprehensive list of all your debts, including the creditor, balance, interest rate, and minimum payment amount.

- Choose a strategy: Decide whether to use the debt snowball or debt avalanche method. Consider your personal preferences and financial goals.

- Allocate extra funds: Identify any extra funds you can allocate towards debt repayment. This could involve reducing expenses, increasing income, or utilizing bonuses.

- Create a repayment schedule: Based on your chosen strategy and available funds, create a detailed repayment schedule outlining how much you will pay each month towards each debt.

- Monitor progress and adjust: Regularly track your progress and make adjustments to your plan as needed. Life circumstances can change, so flexibility is key.

Understanding Interest Rates and Their Impact

Interest rates significantly impact the total cost of debt and the time it takes to repay. Higher interest rates mean you pay more in interest over the life of the loan, increasing the total amount repaid. Understanding the annual percentage rate (APR) is crucial.

The APR represents the annual cost of borrowing, including fees and interest.

For instance, a $10,000 loan with a 5% APR will cost significantly less in total interest over the life of the loan than a similar loan with a 15% APR. This difference can amount to thousands of dollars over several years. Prioritizing high-interest debts first, as in the debt avalanche method, helps minimize the overall interest paid.

Saving and Investing for the Future

Securing your financial future requires a proactive approach to saving and investing. This involves understanding different savings vehicles and investment options, aligning them with your risk tolerance, and leveraging the power of long-term growth. Careful planning in this area can significantly impact your financial well-being in the years to come.

Types of Savings Accounts and Their Features

Choosing the right savings account depends on your financial goals and access needs. Several options cater to various preferences, each with its own set of advantages and disadvantages.

- Regular Savings Accounts: These offer easy access to your funds, typically with debit cards and online banking features. Interest rates are generally low, but they provide liquidity and security for emergency funds.

- High-Yield Savings Accounts: These accounts offer higher interest rates than regular savings accounts, making them suitable for building savings more rapidly. Access to funds might be slightly less convenient compared to regular accounts.

- Money Market Accounts (MMAs): MMAs offer higher interest rates than regular savings accounts and often come with check-writing privileges. However, they may have minimum balance requirements.

- Certificates of Deposit (CDs): CDs provide a fixed interest rate for a specific term (e.g., 6 months, 1 year, 5 years). While they offer potentially higher returns than savings accounts, accessing your money before maturity typically incurs penalties.

Investment Options Based on Risk Tolerance

Investment strategies should be tailored to your individual risk tolerance. A higher risk tolerance generally allows for potentially higher returns but also carries a greater chance of losses.

- Low-Risk Investments: These include savings accounts, money market accounts, and government bonds. They offer stability and capital preservation, but returns are typically modest.

- Moderate-Risk Investments: This category includes a diversified portfolio of stocks and bonds, potentially including mutual funds or exchange-traded funds (ETFs). These provide a balance between growth potential and risk.

- High-Risk Investments: Options such as individual stocks, options trading, and cryptocurrency investments offer the potential for significant returns but also come with substantial risk of loss. These are generally suitable only for investors with a high risk tolerance and a long-term investment horizon.

Benefits of Long-Term Investing and Compound Interest

Long-term investing, combined with the power of compound interest, is a cornerstone of wealth building. Compound interest is the interest earned on both the principal amount and accumulated interest.

The longer your money is invested, the more time it has to grow exponentially through compounding. For example, investing $10,000 at an annual return of 7% will grow to approximately $19,671.51 after 10 years and $40,995.83 after 20 years. This illustrates the significant impact of compounding over time.

The formula for compound interest is: A = P (1 + r/n)^(nt) where: A = the future value of the investment/loan, including interest; P = the principal investment amount (the initial deposit or loan amount); r = the annual interest rate (decimal); n = the number of times that interest is compounded per year; t = the number of years the money is invested or borrowed for.

Retirement Planning

Securing a comfortable retirement requires careful planning and proactive saving. This involves understanding your financial goals, choosing appropriate savings vehicles, and consistently contributing to your retirement accounts. Effective retirement planning minimizes financial anxieties later in life and ensures a smoother transition into retirement.

Retirement planning is a multifaceted process that needs to be started early to allow for the power of compounding returns. The earlier you start saving, the less you’ll need to save each month to reach your retirement goals. This section will cover key steps, savings vehicles, and strategies to help you plan for your future.

Retirement Planning Checklist

A systematic approach to retirement planning is crucial. This checklist Artikels key steps to guide you through the process. Regular review and adjustments are vital as your circumstances change.

- Determine Your Retirement Goals: Define your desired lifestyle in retirement, including expenses and desired income level. Consider factors such as healthcare costs, travel, and leisure activities.

- Estimate Retirement Expenses: Project your monthly and annual expenses in retirement. Account for inflation and potential changes in healthcare needs.

- Calculate Your Retirement Savings Needs: Use online calculators or consult a financial advisor to estimate how much you need to save to meet your retirement goals.

- Choose Retirement Savings Vehicles: Select appropriate savings plans, such as 401(k)s, IRAs, or other investment options, based on your income, tax bracket, and risk tolerance.

- Develop a Savings Plan: Create a budget that allocates funds to your retirement savings goals. Automate contributions whenever possible.

- Regularly Review and Adjust Your Plan: Monitor your progress, adjust your contributions as needed, and seek professional advice if necessary.

Retirement Savings Vehicles

Several vehicles exist to facilitate retirement savings, each offering different benefits and tax advantages. Understanding these options is key to selecting the best fit for your individual financial situation.

- 401(k) Plans: Employer-sponsored retirement savings plans that often include employer matching contributions. Contributions are typically pre-tax, reducing your current taxable income. Investment options are usually provided by the employer.

- Individual Retirement Accounts (IRAs): Individual retirement accounts allow for tax-advantaged savings. Traditional IRAs offer tax deductions on contributions, while Roth IRAs offer tax-free withdrawals in retirement. Contribution limits apply.

- Other Retirement Accounts: Other options may include 403(b) plans (for non-profit employees), SEP IRAs (for self-employed individuals), and others. Each plan has its specific rules and regulations.

Strategies for Maximizing Retirement Savings

Several strategies can significantly enhance your retirement savings. Implementing these strategies can improve your financial security in retirement.

- Maximize Employer Matching Contributions: If your employer offers matching contributions to your 401(k), contribute at least enough to receive the full match. This is essentially free money.

- Increase Contributions Regularly: Gradually increase your contributions over time, even if it’s just a small percentage each year. This takes advantage of the power of compounding.

- Invest Wisely: Diversify your investments across different asset classes to manage risk and potentially maximize returns. Consider consulting a financial advisor for personalized investment advice.

- Reduce Debt: High-interest debt can significantly impact your ability to save for retirement. Prioritize paying down high-interest debt before maximizing retirement contributions.

- Consider Tax-Advantaged Accounts: Utilize tax-advantaged accounts like 401(k)s and IRAs to reduce your tax burden and maximize your savings.

Financial Goal Setting and Achievement

Effective financial goal setting is crucial for achieving long-term financial well-being. By defining clear, measurable objectives, you can create a roadmap to navigate your financial future and make informed decisions about your money. This section will explore the process of setting SMART financial goals and provide practical strategies for staying motivated and achieving them.

Setting SMART financial goals provides a structured approach to achieving your financial aspirations. It ensures your goals are well-defined and attainable, increasing your likelihood of success. Without a clear plan, it’s easy to lose focus and drift from your objectives.

SMART Financial Goal Setting

The SMART acronym provides a framework for setting effective financial goals: Specific, Measurable, Achievable, Relevant, and Time-bound. Let’s break down each element.

- Specific: Clearly define your goal. Instead of “save more money,” aim for “save $10,000 for a down payment on a house.” The more precise your goal, the easier it is to track your progress.

- Measurable: Quantify your goal. How will you know when you’ve achieved it? Using numerical targets makes progress easily trackable. For example, “reduce my credit card debt by $5,000” is measurable.

- Achievable: Ensure your goal is realistic and attainable within a reasonable timeframe. Setting overly ambitious goals can lead to discouragement. For instance, aiming to pay off $50,000 in credit card debt within a year might be unrealistic for someone with a limited income, while paying off $5,000 might be more achievable.

- Relevant: Ensure your goal aligns with your overall financial objectives and life priorities. A goal should be meaningful to you and contribute to your overall well-being. For example, saving for a vacation is relevant if travel is a priority.

- Time-bound: Set a deadline for achieving your goal. This creates a sense of urgency and helps you stay focused. Examples include: “pay off my student loans within 3 years” or “save $500 per month for 6 months to purchase a new laptop.”

Maintaining Motivation and Achieving Financial Goals

Staying motivated towards long-term financial goals can be challenging. Several strategies can help maintain momentum.

- Regularly Review Progress: Track your progress and celebrate milestones along the way. This reinforces positive behavior and keeps you motivated.

- Visualize Success: Regularly imagine yourself achieving your goal. This can help boost your commitment and determination.

- Seek Support: Share your goals with friends, family, or a financial advisor for encouragement and accountability.

- Reward Yourself (Moderately): Reward yourself for reaching milestones, but avoid excessive spending that could hinder your progress.

- Adjust as Needed: Life throws curveballs. Be prepared to adjust your goals and timeline as circumstances change. Flexibility is key to long-term success.

Examples of Short-Term and Long-Term Financial Goals

Short-term goals are typically achievable within one year, while long-term goals extend beyond a year.

- Short-Term Examples: Saving for a vacation, paying off a small debt, building an emergency fund.

- Long-Term Examples: Buying a house, funding a child’s education, retiring comfortably.

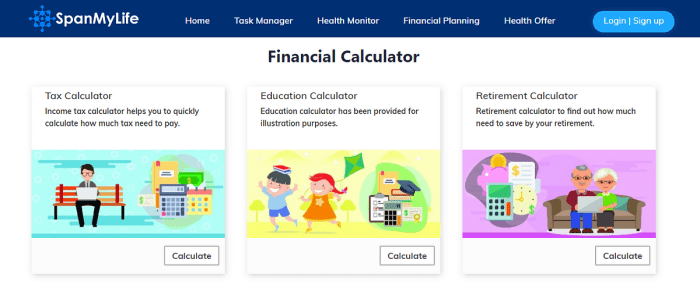

Utilizing Financial Tools and Resources

Navigating the world of personal finance can feel overwhelming, but thankfully, numerous tools and resources are available to simplify the process and empower individuals to take control of their financial well-being. These range from user-friendly apps to comprehensive online courses and the expertise of financial advisors. Understanding the benefits and limitations of each can help you choose the best approach for your specific needs and goals.

Effective personal finance management relies heavily on leveraging the right tools and resources. These tools can automate tasks, provide insightful analysis, and offer educational content, ultimately streamlining the process of budgeting, saving, investing, and debt management. However, it’s crucial to carefully evaluate each tool to ensure it aligns with your individual financial situation and comfort level with technology.

Personal Finance Apps and Software

Many personal finance apps and software programs are designed to help individuals track expenses, create budgets, and manage investments. Popular examples include Mint, Personal Capital, and YNAB (You Need A Budget). These platforms often offer features such as automated transaction categorization, bill payment reminders, and investment portfolio tracking. However, it’s important to consider potential drawbacks. Privacy concerns regarding data security are paramount; users should carefully review an app’s privacy policy before sharing sensitive financial information. Furthermore, reliance on any single app can lead to a lack of diversification and a potential single point of failure if the app malfunctions or goes out of business. The user experience can also vary greatly, with some apps being more intuitive and user-friendly than others. Finally, free versions of many apps often have limited functionality, requiring a paid subscription to unlock more advanced features.

Reputable Online Resources for Personal Finance Education

The internet offers a wealth of information on personal finance, but it’s essential to discern credible sources from unreliable ones. Reputable websites and organizations often provide free educational resources, including articles, videos, and interactive tools. Examples include the websites of the Consumer Financial Protection Bureau (CFPB), the National Foundation for Credit Counseling (NFCC), and Investopedia. These resources often cover a wide range of topics, from budgeting and saving to investing and retirement planning. However, it’s important to be aware that not all online information is accurate or unbiased. Always cross-reference information from multiple sources and be wary of websites promoting specific products or services without clear disclosure. Furthermore, the quality and depth of information can vary significantly across different resources.

The Role of Financial Advisors

Financial advisors provide personalized guidance and support in managing personal finances. They can help individuals develop comprehensive financial plans, create investment strategies, and navigate complex financial decisions. Certified Financial Planners (CFPs) and Chartered Financial Analysts (CFAs) are professionals with rigorous training and ethical standards. The primary benefit of working with a financial advisor is access to personalized expertise and tailored strategies based on individual circumstances. However, engaging a financial advisor typically involves fees, which can range from hourly rates to percentage-based commissions on investments. It is crucial to carefully research and select a qualified advisor who aligns with your values and financial goals, ensuring transparency regarding fees and potential conflicts of interest. Not all financial advisors are created equal, and their advice should be considered alongside your own research and understanding.

Protecting Your Financial Well-being

Securing your financial future isn’t just about saving and investing; it’s also about safeguarding what you’ve worked so hard to accumulate. Protecting your financial well-being involves mitigating risks and building a resilient foundation that can withstand unexpected life events. This includes securing appropriate insurance coverage, proactively defending against identity theft, and establishing a robust financial safety net.

The Importance of Insurance

Insurance acts as a crucial safety net, protecting your assets and financial stability against unforeseen circumstances. Various types of insurance address different potential risks. Health insurance covers medical expenses, preventing catastrophic debt from illness or injury. Life insurance provides financial security for your dependents in the event of your death, helping them maintain their lifestyle and meet future financial obligations. Disability insurance replaces a portion of your income if you become unable to work due to illness or injury, ensuring continued financial support. The appropriate level of coverage for each type of insurance depends on individual circumstances, including age, income, family size, and existing assets. For example, a young single professional might prioritize health insurance and a smaller life insurance policy, while a married individual with children might require more extensive life insurance and disability coverage.

Identity Theft Prevention

Identity theft, the fraudulent acquisition and use of someone’s personal information, poses a significant threat to financial security. Protecting yourself involves implementing several key strategies. Regularly monitor your credit reports for any unauthorized activity. Choose strong, unique passwords for all online accounts and enable two-factor authentication whenever possible. Be cautious about sharing personal information online or over the phone, and shred sensitive documents before discarding them. Consider using a credit freeze or fraud alert to further protect your credit. In the event of identity theft, promptly report the incident to the relevant authorities and credit bureaus, taking steps to rectify the situation and prevent further damage. For instance, promptly contacting your bank to report fraudulent transactions is crucial to minimize financial losses.

Building a Strong Financial Safety Net

A strong financial safety net provides a buffer against unexpected expenses and income disruptions. This typically involves maintaining an emergency fund, ideally equivalent to three to six months’ worth of living expenses, in a readily accessible account. This fund can cover unexpected costs such as medical bills, job loss, or home repairs. Beyond the emergency fund, diversification of assets, including savings accounts, investments, and possibly alternative assets, contributes to resilience. Having multiple sources of income, such as a side hustle or rental property, also strengthens financial security. Furthermore, establishing a budget and consistently tracking expenses allows for proactive financial management, enabling better allocation of resources and identification of areas for potential savings. For example, someone facing potential job loss might prioritize building their emergency fund more aggressively.

Illustrative Examples of Personal Finance Scenarios

Understanding personal finance principles is greatly enhanced by examining real-world applications. The following scenarios illustrate how different individuals and families navigate various financial situations, highlighting the importance of budgeting, saving, and planning.

A Young Professional’s Financial Management

This scenario depicts Sarah, a 28-year-old marketing professional earning a comfortable salary. She prioritizes building a strong financial foundation while enjoying her lifestyle. Her financial plan involves careful budgeting, consistent saving, and strategic debt management.

| Income | Amount |

|---|---|

| Monthly Salary | $5,000 |

| Expenses | Amount |

| Rent | $1,500 |

| Utilities | $200 |

| Groceries | $400 |

| Transportation | $300 |

| Entertainment | $300 |

| Student Loan Payment | $200 |

| Savings | $1,100 |

| Total Expenses & Savings | $5,000 |

Sarah’s budget demonstrates a clear understanding of her income and expenses, allowing her to save a significant portion of her earnings while still enjoying a fulfilling life. Her consistent savings contribute to her long-term financial goals, such as purchasing a home or investing for retirement.

Planning for a Child’s College Education

The Johnsons, a family with a young child, are proactively planning for their child’s future college education. Understanding the rising cost of higher education, they’ve established a dedicated college savings plan. They contribute regularly to a 529 plan, taking advantage of tax benefits and potential investment growth. Their plan also includes exploring scholarship opportunities and considering various college options to minimize overall expenses. Their proactive approach minimizes financial strain when their child reaches college age. They regularly review their plan, adjusting contributions as needed based on investment performance and their changing financial circumstances.

Impact of Unexpected Expenses

Unexpected expenses can significantly impact personal finances. Consider the example of David, who experienced an unexpected car repair bill of $1,500. This expense, exceeding his monthly budget, forced him to dip into his emergency fund and temporarily adjust his spending habits. This scenario underscores the importance of having an emergency fund to cover unforeseen circumstances and the need for flexible budgeting to adapt to unexpected financial challenges. Without the emergency fund, David would have likely needed to resort to high-interest debt, significantly impacting his long-term financial health.

Ultimate Conclusion

Effective personal finance management is not merely about accumulating wealth; it’s about building a secure and fulfilling financial life. By understanding and implementing the strategies discussed – from budgeting and saving to investing and planning for the future – you can gain control of your finances and work towards achieving your financial aspirations. This review serves as a starting point; continuous learning and adaptation are crucial to navigating the ever-evolving financial landscape. Remember to seek professional advice when needed to tailor strategies to your specific circumstances.

Essential FAQs

What is the difference between the debt snowball and debt avalanche methods?

The debt snowball method prioritizes paying off the smallest debts first for motivational purposes, regardless of interest rates. The debt avalanche method prioritizes paying off the debts with the highest interest rates first to minimize total interest paid.

How often should I review my budget?

Ideally, you should review your budget monthly to track progress, adjust spending as needed, and ensure you’re staying on track towards your financial goals.

What are some signs I need professional financial advice?

Signs include significant debt, complex financial situations, difficulty achieving financial goals, or a lack of understanding of investment options.

What is the importance of an emergency fund?

An emergency fund provides a financial safety net for unexpected expenses, preventing debt accumulation and ensuring financial stability during unforeseen circumstances.