Financial Planning Tools Review: Forget spreadsheets and tears! This isn’t your grandma’s budgeting; we’re diving headfirst into the wild, wonderful world of financial planning tools. From apps that track your spending like a hawk (but in a friendly way, we promise) to investment platforms that practically beg you to become a millionaire, we’ll explore the best tools to tame your finances. Prepare for witty insights and a healthy dose of financial enlightenment – because managing money doesn’t have to be a snoozefest.

This review covers the gamut of financial planning, from budgeting apps that’ll make your inner accountant sing (even if you don’t have one) to retirement planners that’ll help you visualize your future self lounging on a beach, sipping margaritas (responsibly, of course). We’ll compare features, pricing, and user-friendliness with the humor and precision of a seasoned financial comedian. Get ready to laugh your way to financial freedom!

Introduction to Financial Planning Tools

Navigating the often-treacherous waters of personal finance can feel like trying to assemble IKEA furniture blindfolded – frustrating, confusing, and potentially leading to a pile of regret. Luckily, we live in an age where technology offers a helping hand (or perhaps a well-organized toolbox). Financial planning tools are designed to make managing your money less of a headache and more of a… well, less of a headache. They come in various shapes and sizes, catering to different needs and levels of financial sophistication.

Financial planning tools are software applications or online platforms designed to assist individuals and families in managing their finances effectively. These tools provide a range of functionalities, from simple budgeting and expense tracking to sophisticated investment analysis and tax preparation. Choosing the right tool depends largely on your individual financial goals, comfort level with technology, and, of course, your budget (because even financial planning tools can cost money!).

Types of Financial Planning Tools

Financial planning tools span a broad spectrum, offering solutions for almost every aspect of personal finance. Budgeting apps help you track income and expenses, providing insights into your spending habits. Investment platforms allow you to buy and sell stocks, bonds, and other investments, often with helpful features like portfolio tracking and automated investing. Tax software simplifies the often-daunting process of filing your taxes, ensuring you claim all eligible deductions and credits. Other specialized tools exist for retirement planning, debt management, and estate planning. The possibilities, much like the potential for financial growth, are seemingly endless.

Comparison of Popular Financial Planning Tools

Choosing the right tool can feel overwhelming, so we’ve compiled a comparison of four popular options. Remember, features and pricing can change, so always check the provider’s website for the most up-to-date information.

| Tool | Key Features | Pricing | Best For |

|---|---|---|---|

| Mint | Budgeting, expense tracking, bill payment reminders, credit score monitoring | Free (with optional paid features) | Beginner budgeters and those seeking a simple, free option. |

| Personal Capital | Financial aggregation, investment management, retirement planning, tax planning | Free (with optional paid advisory services) | Individuals with more complex financial needs, especially those with investment portfolios. |

| YNAB (You Need A Budget) | Zero-based budgeting, goal setting, expense tracking, and community support | Paid subscription | Users who prefer a structured budgeting approach and value community features. |

| TurboTax | Tax preparation, filing, and guidance | Paid (pricing varies by complexity of return) | Taxpayers of all levels, particularly those needing assistance with complex tax situations. |

Budgeting and Expense Tracking Tools

Ah, budgeting. The very word conjures images of spreadsheets, frantic calculations, and the gnawing realization that your avocado toast habit is slightly more expensive than a small island nation. Fear not, fellow fiscal adventurers! Modern budgeting apps are here to rescue us from the clutches of financial chaos, transforming the once-dreaded task into something almost…enjoyable. (Almost.) These digital wizards offer a variety of features designed to tame even the wildest spending sprees.

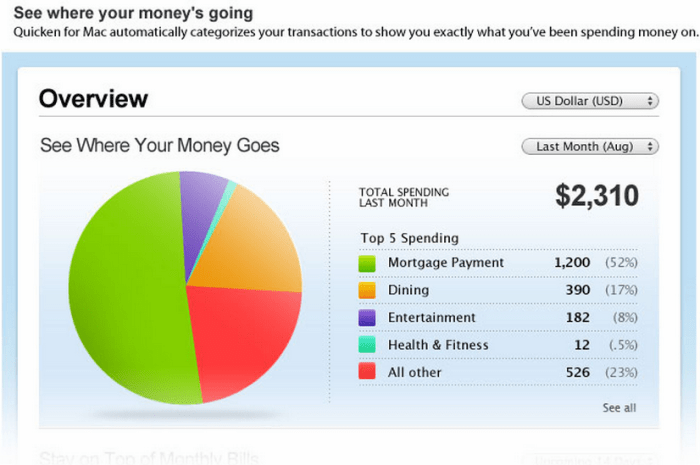

Budgeting apps, at their core, are digital accounting assistants that help you track income and expenses, categorize transactions, and ultimately, help you understand where your money is going (and, perhaps more importantly, where it’s *not* going). They leverage technology to streamline the process, automating many of the tedious steps involved in manual budgeting. This allows for a more accurate picture of your financial health and facilitates informed decision-making regarding your finances. From simple expense trackers to sophisticated tools offering personalized financial advice, there’s an app for every level of financial sophistication (or, let’s be honest, financial avoidance).

Budgeting App Features and Functionalities

Most budgeting apps share a common set of features, but the level of sophistication varies widely. Many offer basic expense tracking, allowing users to manually input transactions or link the app to bank accounts for automatic import. More advanced features include:

- Categorization: Apps automatically categorize transactions, although manual adjustments are often possible. This helps users visualize spending patterns.

- Budgeting Methods: Support for various budgeting methods such as the 50/30/20 rule, zero-based budgeting, and envelope budgeting.

- Goal Setting: Ability to set and track financial goals, such as saving for a down payment or paying off debt.

- Reporting and Visualization: Graphs and charts that present financial data in an easily digestible format, highlighting spending trends and areas for improvement.

- Bill Reminders: Alerts to remind users about upcoming bill payments, preventing late fees and potential financial distress.

- Debt Management Tools: Features specifically designed to help users track and manage their debt, such as debt snowball or avalanche methods.

Advantages and Disadvantages of Different Budgeting Methods

Different budgeting methods suit different personalities and financial situations. Let’s explore some popular approaches and their pros and cons:

| Budgeting Method | Advantages | Disadvantages |

|---|---|---|

| 50/30/20 Rule | Simple to understand and implement; provides a good framework for balancing needs and wants. | Can be too rigid for some; doesn’t account for unexpected expenses. |

| Zero-Based Budgeting | Forces mindful spending; helps identify areas where spending can be reduced. | Requires more time and effort; can feel restrictive. |

| Envelope Budgeting | Visual and tangible; helps control impulsive spending. | Can be inconvenient to manage physically; requires discipline. |

Step-by-Step Guide to Using a Budgeting App

Let’s assume you’ve chosen a budgeting app and are ready to conquer your finances. Here’s a simplified process:

- Download and Setup: Download the app and create an account. Link your bank accounts (optional, but highly recommended for automation).

- Input Income: Enter your monthly income from all sources.

- Create a Budget: Allocate your income across different categories (housing, food, transportation, etc.) based on your chosen budgeting method.

- Track Expenses: The app will automatically categorize many transactions, but you’ll need to manually input any that are miscategorized or not automatically imported.

- Monitor and Adjust: Regularly review your spending patterns. Adjust your budget as needed to stay on track.

Investment Planning and Portfolio Management Tools

Investing your hard-earned cash can feel like navigating a minefield of jargon and confusing choices. Luckily, a plethora of digital tools are here to help you, turning the daunting task of investment planning into something almost… enjoyable (almost!). These tools offer various features designed to simplify the process, from assessing your risk tolerance to actively managing your portfolio. Let’s delve into the wonderful world of investment planning and portfolio management tools.

These digital assistants offer a range of services, from simple tracking of your investments to sophisticated algorithms that help you optimize your portfolio based on your goals and risk profile. Choosing the right tool depends heavily on your individual needs and investment experience. Some cater to beginners with simple interfaces and limited investment options, while others are powerhouses packed with advanced features that would make a seasoned Wall Street veteran blush.

Comparison of Investment Platforms

Investment platforms vary considerably in their fees, investment options, and user interface. A crucial aspect to consider is the fee structure. Some platforms charge flat fees, others charge percentage-based fees on your investments, and some even employ a hybrid model. For example, a platform might charge a small annual fee plus a percentage commission on each trade. The range of investment options is another key differentiator. Some platforms primarily focus on stocks and bonds, while others offer access to a wider array of assets, including ETFs, mutual funds, options, and even alternative investments like cryptocurrency (proceed with caution on that last one!). Finally, the user interface significantly impacts the user experience. A user-friendly interface can make investing a breeze, while a clunky and confusing one can make even the most seasoned investor want to throw their laptop out the window. Consider platforms like Fidelity, Schwab, and Vanguard, each offering different interfaces, fee structures, and investment options to suit varying investor needs and preferences.

Risk Tolerance Assessment in Investment Planning

A cornerstone of any successful investment strategy is understanding your risk tolerance. Investment planning tools often incorporate questionnaires and assessments to gauge your comfort level with potential losses. These assessments typically involve questions about your investment timeline, financial goals, and emotional response to market fluctuations. For example, a question might ask how you’d feel if your investments dropped by 20% in a single year. A high-risk tolerance suggests you’re comfortable with potentially higher returns accompanied by greater volatility, while a low-risk tolerance indicates a preference for stability and lower potential returns. This assessment is crucial because it informs the tool’s recommendations for portfolio allocation, ensuring the suggested investments align with your comfort level and financial goals. Ignoring your risk tolerance can lead to significant anxiety and potentially poor investment decisions.

Essential Features for Effective Portfolio Management

A truly effective portfolio management tool should offer a suite of features designed to streamline the investment process and provide valuable insights. The following features are essential:

A robust portfolio management tool should provide a clear and concise overview of your investment holdings, including their current value, performance, and diversification. This allows you to monitor your investments effectively and make informed adjustments as needed. Furthermore, features like automated rebalancing, tax-loss harvesting, and performance reporting can significantly enhance your investment outcomes.

- Real-time Portfolio Valuation: Knowing the current worth of your investments is crucial for making informed decisions.

- Performance Tracking and Reporting: Monitor your investment’s progress and identify areas for improvement.

- Automated Rebalancing: Maintain your desired asset allocation effortlessly.

- Tax-Loss Harvesting Capabilities: Minimize your tax burden by strategically selling losing investments.

- Diversification Analysis: Assess the risk and return characteristics of your portfolio.

- Customizable Dashboards: Tailor your view to focus on the metrics that matter most to you.

- Goal Setting and Progress Tracking: Align your investments with your long-term financial objectives.

Retirement Planning Tools

Planning for retirement can feel like navigating a minefield blindfolded – a terrifying prospect, unless you have the right tools. Retirement planning tools offer a crucial lifeline, helping you visualize your golden years and ensure you don’t end up sipping lukewarm tea on a park bench instead of enjoying a luxurious cruise. These digital wizards crunch numbers, project scenarios, and offer personalized advice, taking the guesswork (and the potential for financial disaster) out of the equation.

Retirement planning tools use sophisticated algorithms to project your future financial situation based on your current savings, expected income, and anticipated expenses. They consider factors like inflation, investment returns (which can be volatile, hence the need for a crystal ball…or a sophisticated algorithm!), and even taxes. The resulting projections give you a clear picture of whether you’re on track to meet your retirement goals or if adjustments are needed. Think of it as a financial GPS, guiding you toward your desired retirement destination.

Key Factors in Choosing a Retirement Planning Tool

Selecting the right retirement planning tool requires careful consideration. Several key factors influence the choice, ensuring the tool aligns with individual needs and financial sophistication. A tool’s ease of use, the comprehensiveness of its features, and the accuracy of its projections are paramount. Cost is another factor, with some tools offering free basic plans while others charge subscription fees for advanced features. Finally, the level of personalization and the quality of customer support also play significant roles. A user-friendly interface and reliable support can make the difference between a smooth planning process and a frustrating experience.

Retirement Projection Calculation Methods

These tools typically employ Monte Carlo simulations to generate multiple possible retirement scenarios. A Monte Carlo simulation uses random sampling to model the probability of different outcomes. Imagine a dartboard representing your potential retirement nest egg. The simulation throws thousands of darts (representing different market conditions and investment returns), and the distribution of where the darts land shows the range of possible outcomes. The tool then presents you with a probability distribution showing the likelihood of achieving different retirement income levels. The more sophisticated tools might also incorporate stochastic modeling, which considers the uncertainties and interdependencies of different variables. For example, a model might incorporate correlations between inflation and interest rates, giving a more nuanced picture of potential future scenarios.

Retirement Planning Scenarios and Visualization

Let’s consider two scenarios. Scenario A: A 35-year-old with a current savings of $50,000, aiming for a retirement age of 65, contributing $500 monthly to a retirement account with an average annual return of 7%. A retirement planning tool could project their potential retirement income, showing a range of possible outcomes based on different market conditions. This visualization might be presented as a graph or a table, clearly illustrating the probability of achieving their desired retirement income.

Scenario B: A 50-year-old with $200,000 in savings, aiming for retirement at 65, and contributing $1000 monthly, with a more conservative average annual return of 5% due to risk aversion. The tool could show that even with a higher contribution, the lower return might necessitate adjustments, such as delaying retirement or increasing contributions, to reach their desired income level. These scenarios highlight how retirement planning tools help users visualize the impact of different financial decisions on their future. The tools can also incorporate adjustments for unexpected events, such as job loss or medical expenses, showcasing the importance of contingency planning. This allows for informed decision-making, potentially preventing financial anxieties later in life.

Tax Planning and Preparation Tools

Navigating the often-bewildering world of taxes can feel like trying to solve a Rubik’s Cube blindfolded. Fortunately, a plethora of tax planning and preparation tools exist to help you avoid a tax-induced headache and potentially even unearth some extra cash. These digital assistants can transform the usually dreaded tax season into something…dare we say…almost enjoyable? (Almost.)

Tax software offers a multitude of benefits beyond simply filling out forms. These tools not only guide you through the process step-by-step, ensuring you don’t miss crucial deductions or credits, but they also perform complex calculations with accuracy far exceeding that of a human prone to late-night pizza-induced calculation errors. They can also help you strategize for future tax years, optimizing your financial decisions to minimize your tax burden. Think of it as having a highly-trained, caffeine-fueled accountant working for you 24/7, without the hefty bill.

Tax Deductions and Credits Identified by Tax Software

Tax software programs are adept at identifying various tax deductions and credits you might otherwise overlook. These tools often incorporate up-to-date tax laws and regulations, ensuring you claim everything you’re entitled to. For example, they can help identify deductions for charitable contributions, medical expenses, student loan interest, and home mortgage interest, among many others. Similarly, they can help you find and claim valuable credits like the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Tax Credit, which can significantly reduce your tax liability. The software’s algorithms are designed to analyze your financial information and flag potential deductions and credits based on your specific circumstances. This proactive approach can result in substantial savings.

Tax Preparation Document Checklist

Before you embark on your tax preparation journey using tax software, gather the necessary documents. A well-organized approach will significantly streamline the process. Imagine it like prepping for a culinary masterpiece – you wouldn’t start cooking without your ingredients, would you?

- W-2 Forms (Wage and Tax Statement): Received from your employer(s), detailing your earnings and withholdings.

- 1099 Forms (Miscellaneous Income): Received for income from freelance work, investments, or other sources outside of traditional employment.

- 1098 Forms (Mortgage Interest Statement): Shows the amount of mortgage interest you paid during the year.

- Receipts for Charitable Donations: Keep detailed records of your charitable contributions, including dates, amounts, and recipient organizations.

- Medical Expense Documentation: Keep records of medical bills, insurance payments, and other related expenses.

- Social Security Number (SSN) and Other Identifying Information: This is essential for accurate filing.

- Prior Year’s Tax Return: This can be helpful for comparison and reference.

Having these documents readily available will make the tax preparation process much smoother and less stressful. Remember, accuracy is key! A small mistake can lead to a significant headache later on.

Debt Management Tools

Ah, debt. That delightful little financial companion that never seems to leave your side, unless you actively work to banish it. Thankfully, we live in an age of technological marvels, and debt management tools are here to help you wrestle this financial kraken into submission. These tools offer a range of features designed to tame your debt, from simple tracking to sophisticated repayment strategies. Think of them as your personal debt-slaying squad, ready to help you conquer those outstanding balances.

Debt management tools primarily function by providing a centralized location to input and track all your debts. This includes the creditor, the balance, the interest rate, and minimum payment. This clear, consolidated view gives you a much-needed overview of your debt landscape, transforming the daunting mountain of debt into something more manageable – a series of smaller, conquerable hills. Many tools also allow you to project future balances based on your repayment plans, offering a glimpse into a debt-free future. The visual representation of your progress can be surprisingly motivating.

Debt Repayment Strategies

Different debt repayment strategies are often compared and contrasted within debt management tools. Two popular methods are the debt snowball and the debt avalanche methods. The debt snowball method prioritizes paying off the smallest debt first, regardless of interest rate. This approach provides early psychological wins, boosting motivation. The debt avalanche method, on the other hand, focuses on paying off the debt with the highest interest rate first, resulting in less overall interest paid over time. Both methods have their advantages and disadvantages; the best approach depends on individual circumstances and psychological needs. Some tools allow users to simulate both methods, showing the projected timeline and total interest paid for each, allowing for a personalized choice.

Creating a Debt Repayment Plan with a Debt Management Tool

Let’s imagine you’re using a hypothetical debt management tool called “DebtDestroyer 5000.” First, you would input all your debts: a credit card with a $2,000 balance and 18% APR, a personal loan of $5,000 at 10% APR, and a student loan of $10,000 at 6% APR. DebtDestroyer 5000 would then calculate your total debt, interest payments, and available funds after essential expenses. You could then select either the snowball or avalanche method. Let’s choose avalanche. The tool would automatically prioritize the credit card due to its high interest rate. You would input your planned monthly payment amount. DebtDestroyer 5000 would then generate a repayment schedule, showing the projected payoff date for each debt and the total interest saved by using the avalanche method. This schedule would also account for minimum payments on other debts, providing a comprehensive and realistic plan. The tool might even offer graphs charting your progress over time, providing visual reinforcement of your hard work. This clear, visual representation makes sticking to your plan far easier. Seeing your debt steadily decrease can be incredibly rewarding and motivating.

Illustrative Examples of Financial Planning Tools in Action

Financial planning tools aren’t just for Wall Street wizards; they’re for everyone looking to wrangle their finances and achieve their financial goals. Let’s peek behind the curtain and see how these digital marvels can transform your relationship with money, from budgeting battles to retirement bliss. These examples aren’t just theoretical; they’re grounded in the realities of everyday financial life, illustrating the practical power of these tools.

The following scenarios showcase how different financial planning tools can help individuals navigate various financial challenges and achieve their goals. These are not isolated incidents; rather, they represent common experiences made significantly easier with the right technology.

Budgeting App Prevents Overspending

Imagine Amelia, a freelance graphic designer with a penchant for artisanal coffee and vintage vinyl. Her income fluctuates, making budgeting a constant struggle. Enter “BudgetBuddy 3000” (a fictional budgeting app, but representative of many real-world options). Amelia connects her bank accounts and credit cards. BudgetBuddy 3000 automatically categorizes her transactions, creating a clear picture of her spending habits. She sets a monthly budget for each category – coffee (sadly, reduced!), groceries, rent, and client expenses. The app sends her alerts when she’s nearing her limits for a category, preventing impulsive purchases. For instance, when Amelia’s coffee spending approaches her limit, the app sends a friendly (but firm!) notification, reminding her of her budget and offering tips for cutting back. This simple feature helps Amelia stay within her means, avoid credit card debt, and build a healthy financial cushion.

Investment Platform Builds a Diversified Portfolio

Let’s meet Ben, a young professional eager to start investing but overwhelmed by the choices. He uses “InvestWise,” a robo-advisor platform (again, a fictional example, but representative of many available platforms). InvestWise assesses Ben’s risk tolerance, investment goals (e.g., buying a house in five years, early retirement), and time horizon through a quick online questionnaire. Based on his answers, the platform automatically creates a diversified portfolio of low-cost index funds and ETFs, allocating assets across different asset classes (stocks, bonds, etc.) according to his risk profile. The platform automatically rebalances the portfolio periodically, ensuring it stays aligned with Ben’s goals and risk tolerance. This hands-off approach removes the intimidation factor, allowing Ben to participate in the market without requiring extensive financial knowledge. The platform also provides regular performance reports, keeping Ben informed about his investments’ progress.

Retirement Planning Tool Secures a Comfortable Retirement

Meet Sarah, a teacher nearing retirement. She’s unsure if her savings will be enough to maintain her lifestyle. She uses “RetireSmart,” a retirement planning tool that projects her future income and expenses based on her current savings, anticipated retirement age, and estimated healthcare costs. RetireSmart helps Sarah explore different retirement scenarios:

- Scenario 1: Retiring at age 62 – The tool shows a potential shortfall in her retirement income, highlighting the need to adjust her savings or retirement age.

- Scenario 2: Retiring at age 65 – This scenario shows a more comfortable retirement, suggesting she’s on track to meet her financial goals.

- Scenario 3: Increasing her annual savings by 5% – This scenario demonstrates how a small increase in savings can significantly improve her retirement security.

RetireSmart provides personalized recommendations, such as increasing her savings contributions or delaying her retirement by a few years to bridge the gap and ensure a comfortable retirement. This allows Sarah to make informed decisions and adjust her plans accordingly, avoiding potential financial anxieties in her later years. It empowers her to actively shape her future, rather than passively waiting for it.

Security and Privacy Considerations

Navigating the world of personal finance can feel like traversing a minefield – one wrong step and *boom*! Your hard-earned cash could vanish faster than a magician’s rabbit. Thankfully, reputable financial planning tools offer a safer path, but understanding the security and privacy aspects is crucial to avoiding a financial catastrophe. Let’s delve into the safeguards you should expect and the precautions you should take.

Protecting your financial data is paramount. After all, these tools hold the keys to your financial kingdom, from bank accounts to investment portfolios. A breach could lead to identity theft, financial fraud, and a whole heap of unpleasantness. This isn’t a matter of “if” something might go wrong, but “when” and “how” you’ll be prepared.

Data Encryption and Secure Transmission

Reputable financial planning tools utilize robust encryption methods, like AES-256, to scramble your data during transmission and storage. Imagine your financial information as a top-secret message, only decipherable with a highly complex code. This ensures that even if intercepted, your data remains unintelligible to unauthorized eyes. Many also employ HTTPS, ensuring secure communication between your device and their servers – think of it as a heavily guarded, encrypted tunnel protecting your data’s journey.

Multi-Factor Authentication and Access Controls

Think of multi-factor authentication as a triple-locked vault for your financial data. It’s not just about your password; it often involves additional verification steps like one-time codes sent to your phone or email, or biometric authentication. This layered approach makes it exponentially harder for unauthorized individuals to gain access, even if they manage to snag your password. Access controls further refine security by limiting who can view and modify specific data, adding another layer of protection.

Regular Security Audits and Updates, Financial Planning Tools Review

The digital landscape is constantly evolving, with new threats emerging regularly. To stay ahead of the game, reputable financial planning tools undergo regular security audits, rigorously testing their systems for vulnerabilities. They also release frequent software updates to patch any identified security flaws, akin to reinforcing the walls of your financial fortress against potential invaders. This proactive approach ensures your data remains shielded from the latest threats.

Data Storage and Backup Procedures

Where your data is stored and how it’s backed up is crucial. Reputable providers often utilize secure data centers with redundant systems, meaning your data is safely stored in multiple locations, protected from single points of failure – like a distributed network of financial fortresses. Robust backup procedures ensure that even in the event of a catastrophic event, your data can be quickly and safely restored.

User Best Practices for Protecting Personal Financial Information

Choosing strong, unique passwords for each account is crucial. Think of passwords as the keys to your financial kingdom – don’t use the same key for every door! Using a password manager can help you generate and securely store complex passwords. Regularly reviewing your account activity for any unauthorized transactions is also essential – think of it as a regular security patrol of your financial kingdom. Being vigilant is your best defense against unauthorized access. Finally, only use trusted financial planning tools from established providers with a proven track record of security.

Wrap-Up: Financial Planning Tools Review

So, there you have it – a whirlwind tour of the best financial planning tools the digital world has to offer. While mastering your finances might not be as instantly gratifying as winning the lottery, using the right tools can make the journey significantly less painful (and maybe even a little fun). Remember, choosing the right tool is like picking the perfect pair of shoes – it’s all about finding the right fit for your financial personality. Happy planning!

Key Questions Answered

What if I hate spreadsheets?

Fear not! Most of these tools are designed to be user-friendly and intuitive, eliminating the need for complex spreadsheets. Many offer visual dashboards and easy-to-understand reports.

Are these tools safe?

Reputable financial planning tools employ robust security measures to protect your data. However, always do your research and choose tools from trusted providers.

How much do these tools cost?

Pricing varies greatly depending on the tool and its features. Many offer free plans with limited functionality, while others charge monthly or annual subscriptions.

Can I use multiple tools together?

Absolutely! Many users find it beneficial to combine different tools to manage various aspects of their finances. For example, using a budgeting app alongside an investment platform.