Cryptocurrency Market Trends: Prepare for a rollercoaster! This isn’t your grandma’s stock market; we’re diving headfirst into the exhilarating, terrifying, and occasionally baffling world of digital currencies. From Bitcoin’s meteoric rises and gut-wrenching plunges to the rise of DeFi and the NFT craze, we’ll unravel the mysteries (and the madness) behind the fluctuating fortunes of crypto. Buckle up, it’s going to be a bumpy ride.

We’ll explore the wild swings in price, the influence of technological breakthroughs (some brilliant, some…questionable), the ever-shifting regulatory landscape (think government officials trying to lasso a greased pig), and the key players shaping this digital gold rush. We’ll also delve into the adoption rates, uncovering who’s buying in and why (and who’s wisely staying on the sidelines with a large glass of wine). Get ready to navigate the complexities, the controversies, and the sheer entertainment value of this volatile yet fascinating market.

Market Volatility and Price Fluctuations

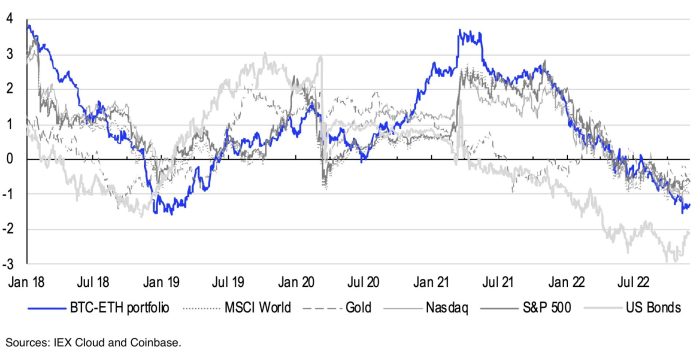

The cryptocurrency market, a thrilling rollercoaster of fortunes and misfortunes, is renowned for its dramatic price swings. Unlike the relatively sedate world of traditional finance, crypto’s volatility is a defining characteristic, both its allure and its bane. This inherent instability stems from a confluence of factors, ranging from regulatory uncertainty to the speculative nature of the market itself. Understanding this volatility is crucial for anyone venturing into this wild west of finance.

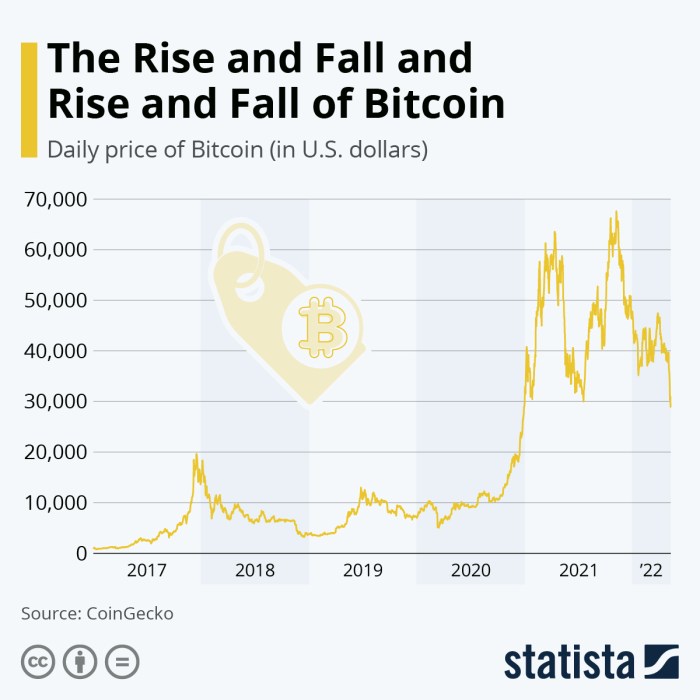

The historical volatility of major cryptocurrencies like Bitcoin and Ethereum is nothing short of legendary. Think of a particularly caffeinated squirrel on a sugar rush – that’s a pretty accurate representation. Bitcoin, the granddaddy of crypto, has experienced periods of meteoric rises followed by heart-stopping plunges. Remember the 2017 bull run, when Bitcoin soared to nearly $20,000, only to crash spectacularly in the following year? Ethereum, too, has mirrored this rollercoaster ride, showcasing its own brand of dramatic price fluctuations, often correlated with, but not always dictated by, Bitcoin’s movements.

Significant Price Swings and Contributing Factors

Several factors contribute to these dramatic price swings. News events, both positive and negative, can trigger massive market reactions. For example, positive regulatory announcements in a specific jurisdiction can lead to a surge in price, while negative news, such as a major exchange hack or a government crackdown, can send prices plummeting. Market sentiment, driven by social media hype and FOMO (fear of missing out), plays a significant role, creating self-fulfilling prophecies of both bullish and bearish trends. Furthermore, macroeconomic factors, such as inflation and interest rate changes, can influence investor behavior and consequently, cryptocurrency prices. The limited supply of certain cryptocurrencies also contributes to price volatility, creating a dynamic interplay of supply and demand that can lead to extreme price fluctuations. For instance, the halving events for Bitcoin, which reduce the rate of new Bitcoin creation, have historically been followed by periods of increased price volatility.

Regulatory Announcements and Market Volatility

Regulatory announcements have a profound and often immediate impact on cryptocurrency markets. Positive pronouncements from governments, indicating a more accepting or supportive stance towards cryptocurrencies, can lead to significant price increases. Conversely, negative news, such as bans or strict regulations, can trigger sharp declines. The regulatory landscape is constantly evolving, adding another layer of uncertainty and contributing to the market’s overall volatility. A clear example is the differing regulatory approaches taken by various countries, leading to varied market responses and price fluctuations.

Predicting Short-Term and Long-Term Price Movements, Cryptocurrency Market Trends

Predicting short-term and long-term price movements in the cryptocurrency market is notoriously difficult, bordering on impossible. While technical analysis and fundamental analysis can provide insights, they are far from foolproof. Short-term price movements are particularly susceptible to manipulation and driven by sentiment, making accurate prediction extremely challenging. Long-term predictions are slightly more reliable, often based on broader technological adoption, regulatory developments, and macroeconomic trends. However, even long-term forecasts carry significant uncertainty. It’s a bit like trying to predict the weather in a hurricane – you can make educated guesses, but surprises are almost guaranteed.

Volatility Comparison of Cryptocurrencies

| Cryptocurrency | Average Daily Volatility (Past Year) | Highest Single-Day Change (Past Year) | Lowest Single-Day Change (Past Year) |

|---|---|---|---|

| Bitcoin (BTC) | (Data Source Required – e.g., 2.5%) | (Data Source Required – e.g., +10%) | (Data Source Required – e.g., -8%) |

| Ethereum (ETH) | (Data Source Required – e.g., 3.0%) | (Data Source Required – e.g., +12%) | (Data Source Required – e.g., -11%) |

| Solana (SOL) | (Data Source Required – e.g., 4.2%) | (Data Source Required – e.g., +15%) | (Data Source Required – e.g., -15%) |

| Cardano (ADA) | (Data Source Required – e.g., 3.8%) | (Data Source Required – e.g., +10%) | (Data Source Required – e.g., -9%) |

Influence of Technological Advancements: Cryptocurrency Market Trends

The cryptocurrency market, a wild west of digital assets, isn’t just driven by speculation; it’s fueled by innovation. Technological advancements are the lifeblood of this volatile yet fascinating ecosystem, constantly reshaping its landscape and influencing market trends in ways both predictable and delightfully chaotic. We’ll explore how these advancements are not only altering the game but also rewriting the rulebook.

Blockchain Scalability Solutions

The inherent limitations of some early blockchain technologies, particularly in terms of transaction speed and processing capacity, have been a significant bottleneck. Think of it like trying to manage a bustling city’s traffic with a single, overworked traffic light. The emergence of Layer-2 scaling solutions, such as Lightning Network for Bitcoin and various sharding mechanisms for Ethereum, aims to alleviate this congestion. These solutions essentially create secondary networks that handle transactions off the main blockchain, significantly increasing throughput and reducing transaction fees. The impact is substantial: faster, cheaper transactions translate to increased user adoption and a more robust, user-friendly ecosystem, thereby positively influencing market sentiment and potentially driving price increases. The success of these scaling solutions is directly tied to the market’s ability to handle increased transaction volume without compromising security or decentralization.

Decentralized Finance (DeFi)

DeFi, the audacious attempt to rebuild traditional financial systems on a blockchain foundation, has undeniably shaken things up. Imagine a financial world without intermediaries, where loans, borrowing, and trading occur directly between users. This is the promise of DeFi. The emergence of decentralized exchanges (DEXs), lending platforms, and yield farming opportunities has not only created new investment avenues but has also injected a considerable amount of liquidity into the cryptocurrency market. However, the DeFi space also carries risks, with smart contract vulnerabilities and regulatory uncertainties presenting potential pitfalls. The growth and stability of DeFi will significantly shape the future trajectory of the cryptocurrency market, impacting both price volatility and overall adoption.

Emerging Technologies: NFTs and the Metaverse

Non-Fungible Tokens (NFTs) have burst onto the scene, transforming digital art, collectibles, and even gaming. Picture a digital certificate of authenticity for unique digital assets, allowing for verifiable ownership and trade. The Metaverse, a persistent, shared virtual world, presents another exciting frontier. Imagine a digital realm where users can interact, transact, and own virtual assets – all powered by cryptocurrencies. The market impact of these technologies is still unfolding, but their potential to create entirely new markets and drive demand for cryptocurrencies is immense. The success of projects in these spaces will undoubtedly have a ripple effect on the overall cryptocurrency market.

Adoption Rates of Different Blockchain Technologies

The cryptocurrency landscape isn’t monolithic; different blockchain technologies boast varying degrees of adoption and market share. Bitcoin, the original cryptocurrency, maintains a dominant position, largely due to its established network effect and brand recognition. Ethereum, with its smart contract capabilities, has become a powerhouse, supporting a vast ecosystem of decentralized applications. Other blockchains, like Solana and Cardano, are vying for market share, each with its unique strengths and weaknesses in terms of scalability, security, and developer communities. The competitive landscape among these technologies will continue to influence market trends, as user preference and technological advancements drive shifts in adoption rates.

Key Technological Advancements and Their Influence on Cryptocurrency Adoption

The following advancements are key drivers of cryptocurrency adoption:

- Improved Scalability: Faster and cheaper transactions lead to increased usability and broader adoption.

- Enhanced Security: Robust security measures build trust and confidence in the system.

- Decentralized Applications (dApps): Innovative applications built on blockchain technology expand the utility of cryptocurrencies.

- Regulatory Clarity: Clearer regulatory frameworks reduce uncertainty and encourage institutional investment.

- Increased Institutional Adoption: The entry of large financial institutions lends credibility and stability to the market.

Regulatory Landscape and Government Policies

The cryptocurrency world, a land of decentralized dreams and volatile fortunes, isn’t exactly known for its adherence to traditional rules. Governments, however, are rather fond of rules, leading to a fascinating (and often hilarious) game of cat and mouse. Let’s delve into the wonderfully complex regulatory landscape of cryptocurrencies, where the lines between innovation and intervention are constantly being redrawn.

The regulatory approaches to cryptocurrencies vary wildly across the globe, ranging from enthusiastic embrace to outright bans. Some nations see crypto as the future of finance, actively promoting its development and creating favorable regulatory frameworks. Others view it with suspicion, fearing its potential for illicit activities and instability, leading to heavy restrictions or complete prohibitions. This difference in approach creates a fascinating geopolitical chess match, with countries vying for a position of influence in this burgeoning new economic frontier.

Varying Regulatory Approaches Across Countries

Different countries have adopted vastly different approaches to regulating cryptocurrencies, reflecting their unique economic priorities and levels of technological sophistication. For instance, some jurisdictions have implemented comprehensive regulatory frameworks, licensing exchanges and setting clear guidelines for cryptocurrency trading and use. Others have taken a more hands-off approach, allowing the market to largely self-regulate while maintaining a watchful eye for potential risks. Still others, as mentioned, have banned cryptocurrencies altogether, fearing their disruptive potential. This patchwork of regulations creates both opportunities and challenges for businesses and investors alike.

Examples of Government Regulations Impacting Cryptocurrency Markets

China’s 2021 crackdown on cryptocurrency mining and trading serves as a stark example of how government intervention can significantly impact market prices. The sudden announcement led to a dramatic drop in Bitcoin’s value, highlighting the considerable influence governments wield. Conversely, El Salvador’s adoption of Bitcoin as legal tender in 2021, while initially generating excitement, also faced considerable challenges and market volatility, demonstrating the unpredictable nature of government-driven crypto adoption. These examples underscore the crucial interplay between governmental decisions and cryptocurrency market dynamics.

Potential Effects of Future Regulatory Changes on Market Stability

The future of cryptocurrency regulation remains uncertain, with ongoing debates about how best to balance innovation with consumer protection and financial stability. Increased regulatory clarity could lead to greater market stability and attract more institutional investment. However, overly restrictive regulations could stifle innovation and drive cryptocurrency activity underground. A globally harmonized approach would be ideal, but the likelihood of such an outcome remains low, given the diverse perspectives and interests of different nations. Imagine a world where the rules for crypto are as consistent as international driving laws – a utopian dream, perhaps.

Challenges and Opportunities Presented by Regulatory Uncertainty

Regulatory uncertainty presents significant challenges for businesses operating in the cryptocurrency space. The lack of clear guidelines can make it difficult to plan for the future, secure funding, and comply with evolving regulations. However, this uncertainty also presents opportunities for innovative companies that can adapt quickly to changing regulatory landscapes. Those who can navigate this complex terrain effectively may gain a significant competitive advantage, akin to finding a hidden treasure map in a bureaucratic jungle.

Summary of Regulatory Stances

| Country | Regulatory Approach | Key Regulations | Impact on Market |

|---|---|---|---|

| United States | Mixed, evolving | Varying state-level regulations, SEC oversight of securities-based tokens | Increased scrutiny, potential for future clarity |

| China | Restrictive | Ban on cryptocurrency trading and mining | Significant market impact, reduced activity |

| European Union | Developing comprehensive framework | MiCA (Markets in Crypto-Assets) regulation | Increased regulatory clarity expected |

| Singapore | Balanced approach | Licensing framework for cryptocurrency exchanges | Attracts institutional investment, relatively stable market |

Adoption and Usage Patterns

The cryptocurrency world, once a niche playground for tech enthusiasts and libertarian dreamers, is rapidly expanding its horizons. From being a whispered secret amongst the digitally savvy to a topic of conversation at family dinners (albeit sometimes fraught with tension), the adoption of cryptocurrencies is a fascinating, and occasionally hilarious, journey. Let’s delve into the fascinating, and sometimes perplexing, patterns of its growth.

The growth of cryptocurrency adoption across various demographics paints a picture of both rapid expansion and surprising limitations. While younger generations, particularly millennials and Gen Z, have shown a higher propensity for crypto investment and usage, older demographics are gradually entering the arena, albeit often with a healthy dose of skepticism (and perhaps a grandchild’s enthusiastic guidance). This isn’t a uniform global trend, however; cultural nuances and access to technology play significant roles.

Real-World Use Cases for Cryptocurrencies

Cryptocurrencies are moving beyond the speculative realm and finding practical applications. Payments are a significant use case, with some businesses accepting Bitcoin and other cryptocurrencies directly. For example, online retailers specializing in niche goods or services often accept crypto as payment, bypassing traditional payment processors and their fees. Furthermore, cryptocurrencies are increasingly used for cross-border transactions, offering a potentially faster and cheaper alternative to traditional banking systems. Investment, of course, remains a dominant use case, with cryptocurrencies acting as an asset class alongside stocks, bonds, and real estate. However, it’s crucial to remember that crypto investments carry significant risk.

Factors Driving Increased Adoption

Several factors contribute to the surge in cryptocurrency adoption. The increasing accessibility of crypto exchanges and wallets makes it easier for individuals to buy, sell, and hold cryptocurrencies. The growing awareness of cryptocurrencies through media coverage and social media also plays a role, although this often comes with a generous helping of hype and misinformation. Furthermore, the perceived benefits of decentralization and financial independence, particularly in regions with unstable or unreliable financial systems, are powerful drivers of adoption. Finally, the development of new technologies, such as decentralized finance (DeFi) applications, is expanding the utility and appeal of cryptocurrencies.

Challenges Hindering Wider Cryptocurrency Adoption

Despite the growing adoption, significant hurdles remain. Volatility is a major concern for many potential users, as the price fluctuations can be dramatic and unpredictable. The complexity of the technology and the lack of user-friendly interfaces can also deter mainstream adoption. Regulatory uncertainty in many jurisdictions creates a climate of apprehension, impacting both investors and businesses. Finally, the environmental concerns associated with some cryptocurrencies, particularly those using energy-intensive proof-of-work consensus mechanisms, are increasingly under scrutiny.

Global Adoption Rate of Cryptocurrencies Over Time

Imagine a line graph. The x-axis represents time, from, say, 2010 to the present. The y-axis represents the percentage of the global population who either own cryptocurrency or have actively used it for a transaction. The line itself would start low, near zero in 2010, showing a gradual incline until around 2017, then a sharp increase, followed by periods of slower growth punctuated by spikes corresponding to market booms and busts. The overall trend, however, shows an upward trajectory, indicating a steady, albeit uneven, rise in global cryptocurrency adoption. The graph would also show regional variations, with some countries displaying significantly higher adoption rates than others, reflecting differences in technological infrastructure, regulatory environments, and economic conditions.

Major Players and Market Dynamics

The cryptocurrency market, a wild west of decentralized finance, isn’t just a collection of fluctuating numbers; it’s a complex ecosystem teeming with influential players, each vying for a piece of the digital gold rush. Understanding their roles and interactions is crucial to navigating this volatile landscape, and, let’s be honest, to avoiding a crypto-calypse.

The cryptocurrency market isn’t just about Bitcoin; it’s a vibrant tapestry woven from the threads of various actors, each playing a unique, and often hilarious, role in the grand scheme of things. Their interplay creates a dynamic and unpredictable environment, where fortunes are made and lost faster than you can say “blockchain.”

Roles of Market Participants

The cryptocurrency market is populated by a colorful cast of characters, each with their own motivations and methods. Miners, the tireless digital prospectors, expend considerable computing power to validate transactions and add new blocks to the blockchain, earning cryptocurrency as a reward. Exchanges, the bustling marketplaces, facilitate the buying, selling, and trading of cryptocurrencies, acting as crucial intermediaries for investors. Investors, ranging from seasoned whales to enthusiastic retail traders, speculate on price movements, hoping to ride the waves of volatility to profit. Each group influences the others, creating a fascinating feedback loop of supply, demand, and speculation.

Influential Companies and Their Impact

Several companies have significantly shaped the cryptocurrency market. Coinbase, a publicly traded exchange, has played a pivotal role in increasing accessibility to cryptocurrencies for retail investors, influencing adoption rates and price discovery. Binance, another major exchange, boasts impressive trading volume, impacting liquidity and price volatility. MicroStrategy’s substantial Bitcoin investment, a bold bet on the long-term value of Bitcoin, has influenced the perception of Bitcoin as a store of value among institutional investors. These companies, through their actions and market presence, act as powerful forces, shaping narratives and market trends.

Competitive Landscape and Potential for Consolidation/Disruption

The cryptocurrency market is fiercely competitive. Exchanges constantly battle for market share, offering diverse features and services to attract users. Mining operations compete for hashing power, influencing the security and efficiency of various blockchains. New projects and cryptocurrencies continuously emerge, challenging established players and vying for investor attention. This intense competition fosters innovation, but also creates a breeding ground for potential consolidation as larger players acquire smaller ones, or disruptive technologies that completely redefine the landscape. Imagine a future where a single, dominant exchange controls the majority of the market—a chilling thought, even for seasoned crypto veterans!

Interrelationship Between Major Players and Market Trends

A simplified flow chart illustrating the interrelationship could be visualized as follows: The central node represents “Market Price.” Radiating outwards are nodes representing “Miners,” “Exchanges,” and “Investors.” Arrows connect these nodes to the central node, indicating the influence each group exerts on the price. For example, an arrow from “Miners” to “Market Price” indicates that increased mining activity can impact price through increased supply. Arrows also connect the nodes to each other, representing their interactions. For instance, an arrow from “Investors” to “Exchanges” shows that investor activity drives trading volume on exchanges. The arrows would be bi-directional, highlighting the cyclical and interconnected nature of the market. The flow chart visually demonstrates the complex interplay between these major players and the resulting market trends, emphasizing the dynamic and interdependent nature of the cryptocurrency ecosystem. It’s a constant dance of supply and demand, influenced by speculation, regulation, and technological innovation – a thrilling, if slightly terrifying, spectacle.

Summary

So, there you have it: a whirlwind tour of the cryptocurrency market. While predicting the future of crypto is about as reliable as predicting the weather in Scotland, understanding the underlying trends is crucial. Whether you’re a seasoned investor, a curious observer, or just someone who enjoys a good financial roller coaster, we hope this exploration has shed some light (or perhaps, some dramatically fluctuating candlelight) on this ever-evolving digital frontier. Remember, always do your own research, and maybe keep a spare pair of pants handy for those unexpected market dips.

Answers to Common Questions

What is the best cryptocurrency to invest in?

There’s no single “best” cryptocurrency. Investment decisions should be based on thorough research, risk tolerance, and financial goals. Consult a financial advisor before making any investment decisions.

Is cryptocurrency safe?

The security of cryptocurrency depends on various factors, including the exchange used, the individual’s security practices, and the overall stability of the blockchain technology. Risks include hacking, scams, and regulatory uncertainty.

How can I buy cryptocurrency?

Cryptocurrency can be purchased through various exchanges, often requiring verification and adherence to Know Your Customer (KYC) regulations. It’s crucial to choose reputable exchanges.

What is the future of cryptocurrency?

Predicting the future of cryptocurrency is inherently speculative. Factors influencing its future include technological advancements, regulatory changes, and overall market adoption.