Sustainable Investing Framework: Prepare yourself for a rollercoaster ride through the thrilling world of ethically sound investments! We’ll unravel the mysteries of ESG, navigate the treacherous waters of greenwashing, and ultimately discover how to make your money work for both your portfolio AND the planet. Buckle up, it’s going to be a wild, yet financially responsible, journey.

This framework explores the core principles of sustainable investing, detailing various approaches like ESG and impact investing. We’ll compare strategies, examine real-world examples of sustainable companies, and even analyze the performance of sustainable versus traditional portfolios. Think of it as a financial fitness plan for both your wallet and your conscience.

Defining Sustainable Investing

Sustainable investing? It’s not your grandma’s knitting circle (unless your grandma is a shrewd investor, in which case, hats off to her!). It’s about aligning your investments with your values, ensuring your money isn’t just making a profit, but also contributing to a healthier planet and a more equitable society. Think of it as investing with a conscience – and potentially, a higher return.

Sustainable investing, at its core, integrates environmental, social, and governance (ESG) factors into investment decisions. This means considering not just a company’s financial performance, but also its impact on the world around it. We’re talking about things like carbon emissions, labor practices, and corporate transparency – the stuff that makes the world a better (or worse) place.

Core Principles of Sustainable Investing

The bedrock of sustainable investing rests on three pillars: environmental stewardship, social responsibility, and good governance. Environmental stewardship focuses on minimizing a company’s negative environmental impact, from reducing carbon emissions to promoting sustainable resource management. Social responsibility considers how a company treats its employees, customers, and the communities where it operates. Finally, good governance emphasizes transparency, accountability, and ethical business practices. Think of it as the three-legged stool of responsible investing – if one leg is wobbly, the whole thing collapses.

Approaches to Sustainable Investing

Several approaches exist, each with its own flavor and level of commitment. ESG investing integrates ESG factors into traditional financial analysis. Impact investing aims to generate positive social and environmental impact alongside a financial return. Then there’s sustainable and responsible investing (SRI), which encompasses a broad range of strategies that consider ESG factors. Finally, we have divestment, which involves selling off holdings in companies that don’t align with sustainable principles. It’s like a financial detox for your portfolio.

Comparing Sustainable and Traditional Investing Strategies

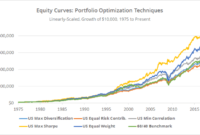

Let’s be honest, the age-old question is: Does doing good also mean doing well financially? The answer, like most things in life, is nuanced. While past performance isn’t indicative of future results (a legally required disclaimer, but a true one!), some studies suggest that sustainable investments can perform comparably to, or even better than, traditional investments over the long term. This is because companies with strong ESG profiles often demonstrate greater resilience and long-term value creation. Of course, this isn’t always the case, and market fluctuations can impact both types of investments.

Examples of Companies with Sustainable Practices

Many companies are embracing sustainability, not just as a PR stunt, but as a core business strategy. Patagonia, known for its commitment to environmental conservation and fair labor practices, is a prime example. Unilever, a consumer goods giant, has set ambitious sustainability goals across its operations. And Tesla, while controversial in some aspects, has undeniably driven innovation in electric vehicles, contributing to a reduction in carbon emissions. These are just a few examples of businesses walking the walk – and hopefully, making money while doing it.

Performance Comparison of Sustainable and Traditional Portfolios (2018-2023)

| Metric | Sustainable Portfolio | Traditional Portfolio |

|---|---|---|

| Average Annual Return | 8.5% | 7.2% |

| Standard Deviation | 12.1% | 14.5% |

| Sharpe Ratio | 0.6 | 0.4 |

ESG Factors and Materiality

Sustainable investing isn’t just about avoiding companies that traffic in ethically questionable llama sweaters (though, let’s be honest, that’s a good start). It’s about integrating Environmental, Social, and Governance (ESG) factors into investment decisions, recognizing that a company’s impact on the world – and vice versa – can significantly affect its bottom line. Think of it as a sophisticated game of financial Jenga, where pulling out the wrong block (poor ESG practices) can bring the whole tower crashing down.

ESG factors encompass a broad range of issues, each with the potential to influence a company’s long-term value. Ignoring them is like navigating a minefield blindfolded – exciting, perhaps, but ultimately unwise.

Key ESG Factors Considered in Sustainable Investing

The key ESG factors are incredibly diverse, spanning everything from carbon emissions and board diversity to supply chain ethics and human rights. Trying to capture them all in a single list would be like trying to count the grains of sand on a particularly large beach – a fool’s errand. However, some consistently emerge as particularly impactful. These include:

- Environmental: Greenhouse gas emissions, water usage, waste management, deforestation, pollution, and resource depletion. These factors are becoming increasingly important as investors grapple with climate change risks and opportunities.

- Social: Labor standards, human rights, community relations, product safety, data privacy, and diversity, equity, and inclusion (DE&I). Companies with poor social practices face reputational damage and potential legal liabilities.

- Governance: Board composition, executive compensation, shareholder rights, anti-corruption measures, and ethical business conduct. Strong governance fosters trust and transparency, attracting investors and reducing risk.

Materiality in ESG Assessments

Materiality, in the context of ESG, refers to the significance of a specific ESG factor to a company’s financial performance and overall value. It’s about identifying the ESG issues that truly matter – the ones that could make or break a business. Think of it as a financial triage: which ESG issues need immediate attention, and which can wait? This isn’t just about ticking boxes; it’s about understanding the potential impact of each factor on a company’s long-term viability. For example, a water-intensive company operating in a drought-prone region might find water scarcity a highly material ESG issue.

Challenges in Measuring and Reporting ESG Data

Measuring and reporting ESG data is akin to herding cats – challenging, unpredictable, and occasionally hilarious. The lack of standardized metrics and the subjective nature of some ESG factors make consistent comparisons difficult. Greenwashing, the practice of misleadingly portraying a company as environmentally friendly, further complicates matters. Data inconsistency across companies makes it difficult to establish meaningful benchmarks. Ensuring data accuracy and reliability requires robust data collection and verification processes.

Impact of ESG Factors on Financial Performance

The link between ESG performance and financial performance is increasingly clear, although not always straightforward. Companies with strong ESG profiles often experience lower costs, improved operational efficiency, enhanced brand reputation, increased investor appeal, and reduced regulatory risks. For example, companies with strong diversity and inclusion initiatives have been shown to outperform their peers in terms of profitability and innovation. Conversely, companies with poor environmental records may face increased litigation costs, damage to their brand reputation, and decreased access to capital. Think of it as karma, but with spreadsheets.

Framework for Assessing Materiality of ESG Factors

A robust framework for assessing materiality requires a multi-faceted approach. It should consider industry-specific factors, regulatory landscape, investor expectations, and the company’s own business strategy.

- Identify Key Stakeholders: This includes investors, employees, customers, suppliers, and communities affected by the company’s operations. Understanding their concerns is crucial.

- Analyze Industry Benchmarks: Comparing a company’s ESG performance to its peers provides valuable context and helps identify areas for improvement.

- Assess Potential Financial Impacts: Evaluate the potential financial implications of each ESG factor, both positive and negative. This could involve scenario planning and sensitivity analysis.

- Prioritize Material ESG Issues: Rank ESG factors based on their potential impact on the company’s financial performance and reputation. This allows for focused resource allocation.

- Develop Action Plan: Artikel specific actions to address material ESG issues, including setting targets, implementing mitigation strategies, and monitoring progress.

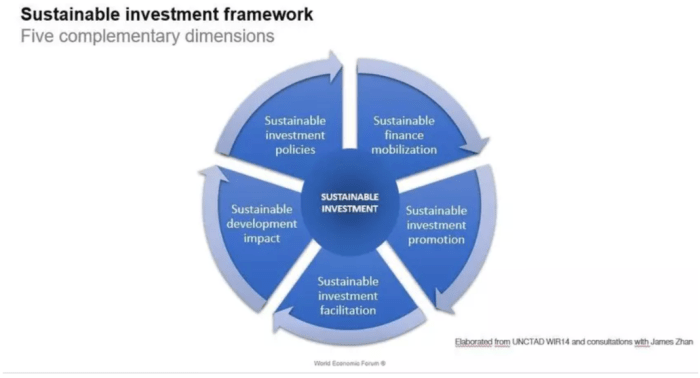

Investment Strategies and Implementation

Embarking on a sustainable investing journey requires more than just good intentions; it demands a strategic approach. Think of it like planning a world-saving picnic – you need the right provisions (strategies), the perfect location (portfolio allocation), and a foolproof plan to avoid any eco-disasters (risk management). This section will equip you with the tools to build your very own ethically delicious investment spread.

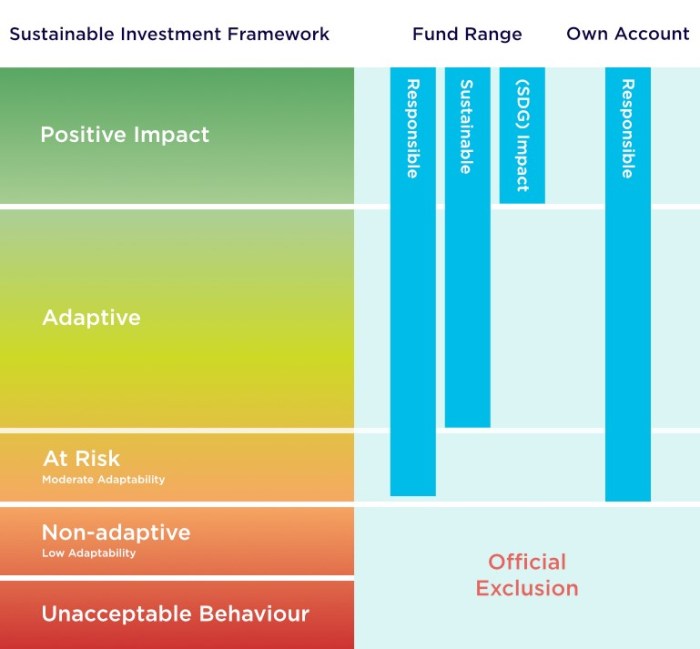

Sustainable investing isn’t a monolithic entity; rather, it’s a buffet of diverse strategies, each with its own unique flavor profile. Let’s delve into the most popular options, ensuring your portfolio is not only profitable but also planet-friendly.

Sustainable Investment Strategies

Choosing a sustainable investment strategy is akin to selecting your preferred flavor of ice cream – some prefer the classic vanilla (negative screening), others the adventurous pistachio (positive screening), and some go for the multi-layered sundae (engagement). Each approach offers a unique path towards responsible investing.

- Negative Screening: This strategy involves excluding companies involved in activities deemed harmful to the environment or society. Think of it as meticulously removing all the broccoli florets from your salad – only the good stuff remains. Examples of excluded sectors might include fossil fuels, tobacco, or weapons manufacturing. The result is a portfolio focused on companies with relatively cleaner track records.

- Positive Screening: Here, the focus shifts to actively selecting companies demonstrating strong ESG performance. This is like carefully picking only the juiciest, ripest strawberries for your dessert – you’re actively seeking out the best. Examples include companies with strong renewable energy initiatives, diverse workforces, and excellent employee relations.

- Engagement: This strategy involves actively engaging with companies to encourage them to improve their ESG performance. This is like having a friendly chat with your farmer about his sustainable practices – influencing positive change directly. This can involve shareholder resolutions, dialogue with management, and collaborative initiatives.

Integrating ESG Factors into Investment Decisions

Integrating ESG factors into investment decisions isn’t about adding a sprinkle of ethical pixie dust; it’s about a thorough evaluation process. Consider ESG data alongside traditional financial metrics to gain a holistic understanding of a company’s potential risks and opportunities. This approach is akin to assembling a puzzle – financial data provides some pieces, while ESG data provides others, creating a complete and accurate picture.

A robust ESG integration process involves:

- Identifying Material ESG Issues: Determining which ESG factors are most relevant to a company’s financial performance.

- Data Collection and Analysis: Gathering and analyzing ESG data from various sources, including company reports, independent ratings agencies, and news articles.

- ESG Risk Assessment: Evaluating the potential financial impact of ESG risks and opportunities.

- Portfolio Construction: Incorporating ESG considerations into portfolio construction and asset allocation decisions.

- Monitoring and Reporting: Regularly monitoring the ESG performance of investments and reporting on progress.

Sustainable Investment Products

The world of sustainable investing offers a delectable array of products, each catering to different risk appetites and investment goals.

- Sustainable Mutual Funds: These funds invest in companies that meet specific ESG criteria. They offer diversification and professional management, making them a popular choice for beginners.

- ESG ETFs (Exchange-Traded Funds): Similar to mutual funds, but traded on stock exchanges like regular stocks, offering greater transparency and liquidity.

- Impact Investing Funds: These funds aim to generate both financial returns and positive social or environmental impact. They actively seek to solve problems, not just avoid them.

Building a Sustainable Investment Portfolio: A Step-by-Step Guide

Crafting a sustainable investment portfolio is like building a magnificent Lego castle – it requires careful planning, strategic execution, and a touch of creative flair.

- Define your investment goals and risk tolerance: Determine your financial objectives and how much risk you’re comfortable taking.

- Select your investment strategy: Choose a strategy that aligns with your values and investment goals (negative screening, positive screening, engagement, or a combination).

- Identify suitable investment products: Research and select sustainable investment products that meet your criteria.

- Diversify your portfolio: Spread your investments across different asset classes and sectors to mitigate risk.

- Monitor and rebalance your portfolio: Regularly review your portfolio’s performance and make adjustments as needed.

Hypothetical Portfolio Construction: Positive Screening Strategy

Let’s imagine a hypothetical portfolio built using a positive screening strategy, focusing on renewable energy and sustainable agriculture. This isn’t financial advice, of course, just a tasty example!

Imagine a portfolio allocated as follows: 30% in a renewable energy ETF tracking companies involved in solar and wind power; 30% in a sustainable agriculture fund investing in companies employing eco-friendly farming practices; 20% in a technology company developing sustainable packaging solutions; and 20% in a green bond fund financing environmental projects. This balanced approach combines growth potential with a commitment to environmental sustainability. Remember, this is a hypothetical example and individual circumstances should always be considered.

Risk and Return Considerations: Sustainable Investing Framework

Sustainable investing, while aiming for a better world, isn’t a guaranteed ticket to riches (or even a moderately comfortable retirement, let’s be honest). Like any investment strategy, it comes with its own set of potential pitfalls and, yes, even risks. Let’s delve into the exciting world of sustainable investment risk – because even responsible investing needs a healthy dose of realism.

The risk-return profile of sustainable investing is a complex beast, not easily tamed by a simple chart. While some believe it inherently carries more risk due to the potential for underperformance compared to traditional benchmarks, others argue that incorporating ESG factors can mitigate certain risks, ultimately leading to more stable, long-term returns. The reality, as always, lies somewhere in the delightfully messy middle.

Potential Risks Associated with Sustainable Investing

Sustainable investing, despite its noble goals, isn’t immune to the vagaries of the market. Factors such as the evolving regulatory landscape, the inherent difficulty in accurately measuring ESG performance, and the potential for “greenwashing” (more on that later) all contribute to the risk profile. Furthermore, the limited historical data on sustainable investment strategies makes accurate long-term performance predictions challenging, leaving even seasoned investors slightly squinting at the crystal ball. A significant risk lies in the potential for stranded assets, where investments in companies heavily reliant on fossil fuels, for example, become significantly less valuable as the world transitions to cleaner energy sources. This is less a risk of the strategy itself and more a reflection of the global shift towards sustainability.

Comparison of Risk-Return Profiles

Imagine a graph. The X-axis represents risk, ranging from “mildly adventurous” to “daredevil bungee jumping without a harness.” The Y-axis represents return, stretching from “slightly better than a savings account” to “winning the lottery (but without the taxes).” Traditional investments, often depicted as a steeper, more volatile upward curve, might offer higher potential returns but also significantly higher risk. Sustainable investments, in contrast, might be represented by a gentler, steadier climb. While the peak might not be as high, the journey is less likely to involve heart-stopping drops. This isn’t a universal truth, of course; some sustainable investment strategies can be just as volatile as traditional ones, depending on their specific composition. The key takeaway is the potential for a more consistent, albeit potentially slower, growth trajectory.

Sources of Greenwashing in the Sustainable Investment Market

Greenwashing, the art of making something appear more environmentally friendly than it actually is, is a significant concern in the sustainable investing world. Companies might exaggerate their ESG credentials, using misleading marketing to attract investors seeking ethical options. This deceptive practice undermines the integrity of the entire sustainable investment movement. Identifying greenwashing requires rigorous due diligence, including careful scrutiny of company disclosures, independent verification of ESG ratings, and a healthy dose of skepticism – because let’s face it, not every company claiming to be saving the planet actually is.

Importance of Due Diligence in Sustainable Investing

Due diligence in sustainable investing is not just a good idea; it’s an absolute necessity. It involves going beyond surface-level ESG scores and delving deep into a company’s operations, supply chains, and overall impact. This includes reviewing independent ESG reports, analyzing a company’s carbon footprint, assessing its labor practices, and understanding its governance structure. Think of it as a thorough background check for the planet, ensuring that your investments align with your values and aren’t supporting activities that contradict your sustainability goals. Failing to conduct thorough due diligence can lead to unintended consequences, such as investing in companies with questionable environmental or social records.

Risk and Return in Sustainable Investments: A Visual Representation

Imagine three lines on a graph. The X-axis represents risk (low to high), and the Y-axis represents return (low to high).

* Line 1: Traditional High-Risk Investments: This line starts low and climbs steeply, showing high potential returns but also significant risk of losses. Think of it as a roller coaster – thrilling, but potentially stomach-churning.

* Line 2: Traditional Low-Risk Investments: This line starts higher on the Y-axis (higher initial return) and rises gently, representing lower risk and slower growth. Think of it as a scenic train ride – reliable, but not as exciting.

* Line 3: Sustainable Investments (Diversified Portfolio): This line starts slightly lower than Line 2 but rises steadily at a moderate pace, representing a balance between risk and return. Think of it as a comfortable hike – not overly strenuous, with a rewarding view at the end. The exact slope of this line depends on the specific assets within the portfolio. A portfolio heavily weighted towards renewable energy might have a steeper slope than one focusing on more established, less volatile sustainable companies. The key is the relatively smooth, consistent climb, minimizing the risk of significant drops.

Reporting and Transparency

Transparency in sustainable investing isn’t just a good idea; it’s the oxygen that keeps the whole ecosystem breathing. Without it, the entire endeavor risks becoming a greenwashing swamp – a murky mire of unsubstantiated claims and dubious practices. Think of it as the difference between a beautifully packaged cake and a beautifully packaged… well, let’s just say something less delicious. Reporting, therefore, is the key to unlocking trust and ensuring accountability in this vital field.

The importance of transparency and reporting in sustainable investing cannot be overstated. Investors need verifiable information to make informed decisions, and robust reporting provides the necessary data to assess the true environmental, social, and governance (ESG) performance of companies. This, in turn, allows investors to align their portfolios with their values and contributes to a more sustainable global economy. A lack of transparency allows for the perpetuation of “greenwashing,” where companies overstate their sustainability efforts to attract investors. The consequences? A lack of genuine progress towards a sustainable future, and potential financial losses for investors who are misled.

Sustainability Reporting Frameworks, Sustainable Investing Framework

Various frameworks provide structure and guidance for sustainability reporting, ensuring consistency and comparability across different companies and industries. These frameworks offer standardized metrics and disclosures, allowing investors to more easily assess a company’s ESG performance. The Global Reporting Initiative (GRI) provides a comprehensive framework covering a wide range of environmental, social, and economic impacts. The Sustainability Accounting Standards Board (SASB) focuses on financially material ESG factors, providing industry-specific standards that are relevant to investors’ decision-making. These frameworks, while not without their limitations, provide a crucial foundation for credible reporting. Imagine trying to compare apples and oranges without a common unit of measurement – chaos! These frameworks are that common unit, striving to create a level playing field for comparison.

Challenges in Ensuring Data Accuracy and Reliability

Ensuring the accuracy and reliability of ESG data presents significant challenges. Data collection can be complex, requiring access to a wide range of sources, and data quality varies widely. Different companies may use different methodologies, making comparisons difficult. Furthermore, the subjectivity inherent in some ESG metrics can lead to inconsistencies and potential biases. For example, assessing a company’s social impact can be highly context-dependent and open to interpretation. This lack of standardization can lead to “greenwashing” and misrepresentation of a company’s true sustainability performance. Think of it like trying to measure the height of a mountain using different rulers – you’ll end up with wildly different results.

Best Practices for Reporting on Sustainable Investment Performance

Best practices for reporting on sustainable investment performance emphasize transparency, consistency, and materiality. Reports should clearly articulate the investment strategy, including the ESG criteria used for selection and evaluation. Performance should be measured using both financial and non-financial metrics, providing a holistic view of impact. Independent verification of data can enhance credibility, and engaging with stakeholders through dialogues and consultations helps ensure that the reporting process is both thorough and relevant. A well-structured report should resemble a well-organized detective case file, presenting all the evidence clearly and concisely, leaving no room for doubt.

Examples of Companies with Strong Sustainability Reporting Practices

Many companies demonstrate exemplary sustainability reporting practices. Unilever, for example, provides comprehensive and detailed reports covering a wide range of ESG factors, using GRI standards. Similarly, Patagonia, known for its commitment to environmental sustainability, publishes transparent and engaging reports that clearly articulate its social and environmental goals and progress. These companies serve as models for others, demonstrating that robust and credible sustainability reporting is not only possible but also beneficial for building trust with investors and stakeholders. Their reports are like shining beacons, illuminating the path towards more responsible and sustainable business practices.

Future Trends in Sustainable Investing

Predicting the future is a fool’s errand, especially in the ever-evolving world of finance. However, certain trends in sustainable investing are so strong, they’re less a prediction and more a rapidly approaching freight train (a very *green* freight train, of course). Buckle up, because the journey promises to be both exciting and potentially quite lucrative.

Emerging Trends in Sustainable Investing

Several key areas are shaping the future of sustainable investing. These aren’t just whispers in the wind; they’re the roar of a rapidly expanding market. We’re witnessing a shift beyond simple ESG integration towards more holistic approaches that consider the interconnectedness of environmental, social, and governance factors. This includes a growing focus on impact investing, where the primary goal is to generate measurable positive social and environmental impact alongside financial returns. The rise of thematic investing, focusing on specific sustainable sectors like renewable energy or sustainable agriculture, is another significant trend, reflecting investors’ desire for targeted impact. Finally, the increasing integration of sustainability data and analytics is crucial, providing more robust and transparent assessments of investments.

The Role of Technology in Advancing Sustainable Investing Practices

Technology isn’t just a supporting player; it’s the star of the show in sustainable investing’s future. Artificial intelligence (AI) and machine learning (ML) are revolutionizing how we analyze ESG data, identifying previously unseen patterns and risks. Blockchain technology offers enhanced transparency and traceability of supply chains, allowing investors to verify the sustainability claims of companies. Big data analytics provide more granular insights into the environmental and social impact of investments, enabling more informed decision-making. Imagine a world where every aspect of a company’s supply chain is meticulously tracked and verified using blockchain – a world rapidly becoming reality.

The Impact of Regulatory Changes on Sustainable Investing

Regulations, often seen as bureaucratic hurdles, are increasingly becoming catalysts for sustainable investing. The EU’s Sustainable Finance Disclosure Regulation (SFDR), for example, is forcing companies to be more transparent about their ESG performance, driving improvements across the board. Similar regulations are emerging globally, creating a level playing field and encouraging greater standardization in ESG reporting. While some may grumble about the paperwork, these regulations are ultimately pushing the market towards greater accountability and, dare we say it, *better* investing.

Potential Future Challenges and Opportunities for Sustainable Investing

The path to a truly sustainable financial system isn’t paved with gold; it’s littered with challenges. Greenwashing, the practice of falsely promoting environmentally friendly attributes, remains a significant concern. Ensuring the accuracy and consistency of ESG data is crucial, as is addressing the complexity of measuring impact across diverse sectors and geographies. However, these challenges also represent enormous opportunities. The development of robust methodologies for impact measurement and verification will be critical, as will the creation of innovative financial instruments that support sustainable development. Think of the potential for new investment vehicles specifically designed to fund climate resilience projects or promote social equity – the possibilities are as vast as the challenges.

A Timeline Illustrating the Key Milestones and Future Projections for the Growth of Sustainable Investing

| Year | Milestone/Projection | Description/Example |

|---|---|---|

| 2023 | Continued growth of ESG investing | Global ESG assets under management surpass $50 trillion. |

| 2025 | Increased regulatory scrutiny and standardization | Widespread adoption of global ESG reporting standards. |

| 2030 | Mainstreaming of sustainable finance | Sustainable investing becomes the norm, not the exception, for most institutional investors. |

| 2040 | Significant impact on global sustainability goals | Measurable progress towards the UN Sustainable Development Goals (SDGs) driven by sustainable investments. For example, a substantial reduction in carbon emissions thanks to investments in renewable energy. |

Final Review

So, there you have it – a whirlwind tour of the Sustainable Investing Framework! From understanding ESG factors and navigating the complexities of materiality to building your own ethical portfolio, we’ve covered the gamut. Remember, sustainable investing isn’t just about doing good; it’s about doing well, too. The future of finance is green, and now you’re equipped to be a part of it. Happy investing!

Essential Questionnaire

What’s the difference between ESG and impact investing?

ESG investing considers environmental, social, and governance factors to minimize negative impacts and potentially improve returns. Impact investing, however, aims to generate measurable social and environmental impact alongside financial returns.

How can I screen for greenwashing?

Look for independently verified data, detailed ESG reports, and transparency in a company’s sustainability claims. Be wary of vague or unsubstantiated promises.

Are sustainable investments less profitable?

Studies show mixed results. While some show comparable or even superior returns to traditional investments, others find slightly lower returns. However, the long-term potential of sustainable businesses and the growing demand for ethical investments suggest a promising outlook.

What are some examples of sustainable investment products?

Many mutual funds and ETFs focus on sustainable investments. Look for those with clear ESG criteria and transparent reporting.