Budgeting Strategies Comparison: Forget the boring spreadsheets and embrace the joyous journey of financial freedom! This isn’t your grandma’s budgeting guide; we’re diving headfirst into the wacky world of saving money, exploring methods ranging from the meticulously organized Zero-Based Budget to the delightfully carefree 50/30/20 rule. Prepare for a rollercoaster of financial enlightenment, punctuated by witty observations and enough practical advice to make your wallet sing (a happy tune, of course).

We’ll dissect the pros and cons of various approaches, comparing and contrasting them with the comedic timing of a seasoned stand-up comedian. From envelope budgeting’s charmingly retro appeal to the futuristic efficiency of budgeting apps, we’ll leave no financial stone unturned. Get ready to laugh your way to a brighter financial future!

Introduction to Budgeting Strategies

Ah, budgeting. The word itself can conjure images of spreadsheets, weeping willows, and the faint scent of impending financial doom. But fear not, dear reader! Budgeting doesn’t have to be a soul-crushing experience. In fact, with the right approach, it can be surprisingly empowering, even…dare we say…fun? This section will explore several budgeting methods, revealing their core principles and showcasing how they can help you tame your finances like a financial lion tamer (but with less risk of injury).

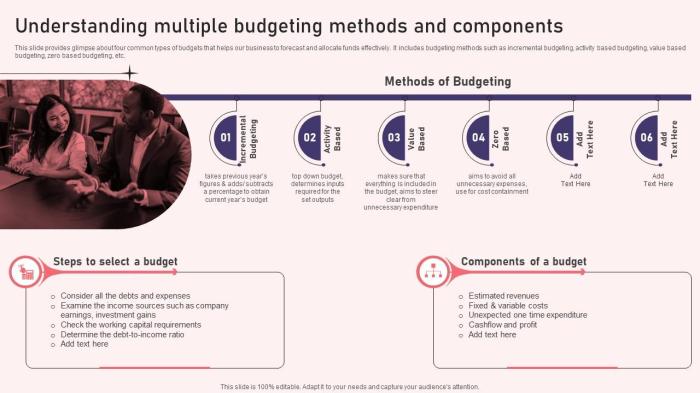

Budgeting strategies are essentially different approaches to tracking and managing your income and expenses. They range from simple to complex, depending on your financial needs and personal preferences. The core principle behind any successful budgeting method is to gain a clear understanding of your financial inflows (money coming in) and outflows (money going out), allowing you to make informed decisions about your spending habits and achieve your financial goals. Think of it as a financial GPS, guiding you towards your desired destination – whether it’s a down payment on a house, a luxurious vacation, or simply a more relaxed relationship with your bank account.

The 50/30/20 Budget

This popular method divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Needs include essentials like rent, groceries, and utilities. Wants encompass things like entertainment, dining out, and new clothes. The 20% allocated to savings and debt repayment helps build a financial safety net and tackle any outstanding debts. For example, if you earn $5,000 after tax, you would allocate $2,500 to needs, $1,500 to wants, and $1,000 to savings and debt. This provides a clear structure and helps prioritize essential spending.

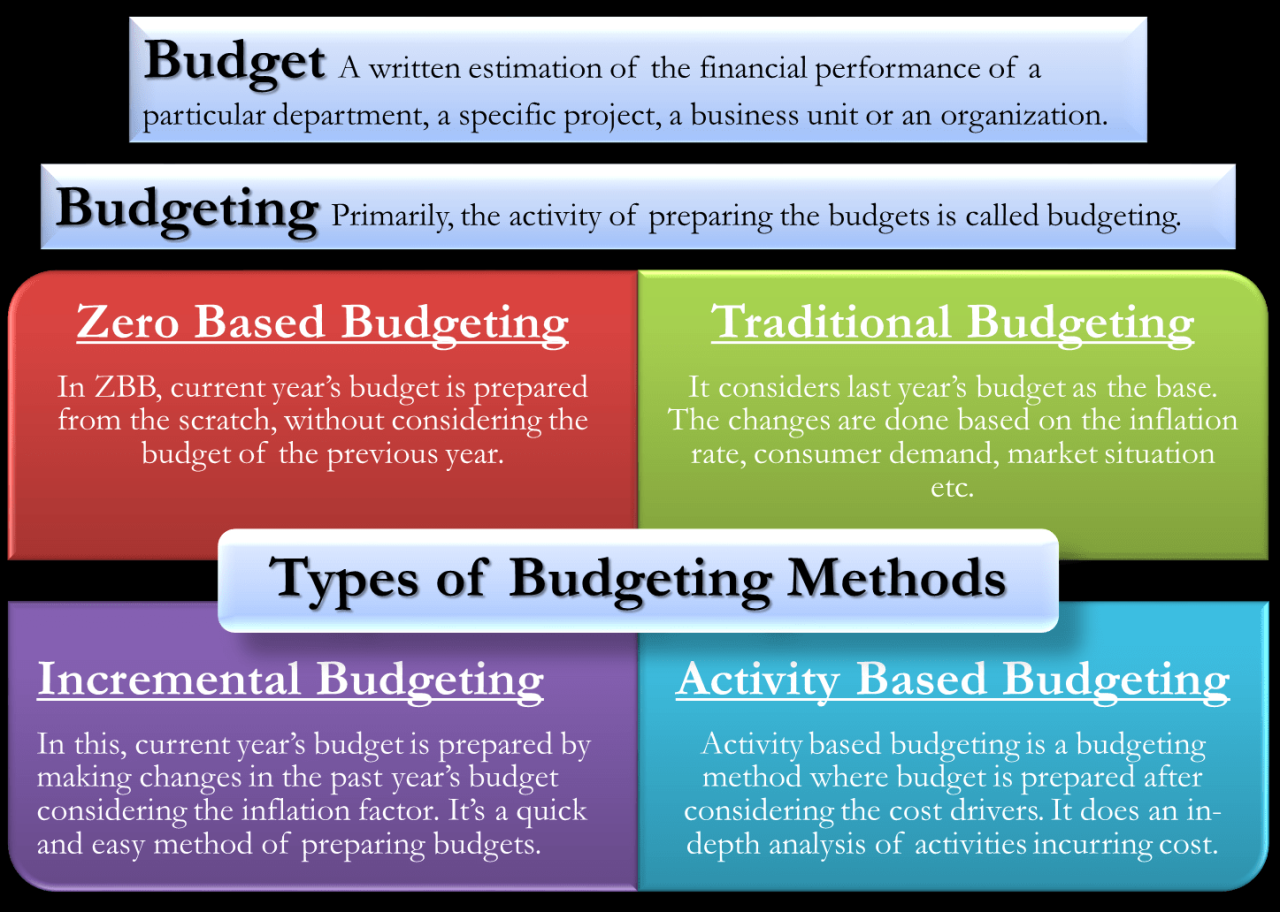

Zero-Based Budgeting

This approach, as the name suggests, aims to allocate every dollar of your income to a specific category. This means that every penny is accounted for, ensuring you don’t end up with unexplained discrepancies. It requires careful planning and tracking, but it provides a high degree of control over your finances. Imagine it as meticulously building a financial Lego castle – every brick (dollar) has its designated place. The beauty lies in its precision, leaving no room for financial surprises (except maybe the pleasant surprise of having more money than you anticipated).

Envelope System

This classic method involves assigning cash to different spending categories and placing it in separate envelopes. Once the cash in an envelope is gone, that’s it for that category until the next budgeting period. This physical approach can help you visualize your spending and prevent overspending. It’s a tangible way to keep track of your money, offering a delightful tactile experience in the otherwise digital world of finance. Imagine the satisfying thud of placing your grocery money into its designated envelope – a small victory in the war against overspending.

The 60/40 Budget

This method splits your income into 60% for living expenses (needs and some wants) and 40% for debt repayment, savings, and other financial goals. It’s a slightly more flexible variation of the 50/30/20 budget, offering more room for discretionary spending while still prioritizing savings and debt reduction. It’s a more forgiving approach than the strict 50/30/20, allowing for a little more wiggle room in your financial planning.

Zero-Based Budgeting

Zero-based budgeting (ZBB) is a budgeting approach where every expense must be justified for each new period. Unlike traditional budgeting, which often starts with the previous year’s budget as a baseline, ZBB forces you to start from scratch, evaluating every single line item as if the budget were being created for the first time. Think of it as a financial spring cleaning, but instead of dusting, you’re scrutinizing every penny.

Zero-based budgeting isn’t for the faint of heart – it demands significant time and effort. However, the potential rewards, particularly in terms of cost control and financial clarity, can be substantial. It’s like a financial boot camp for your wallet.

Creating a Zero-Based Budget

The process of creating a zero-based budget involves a systematic review and justification of every expense. It’s a meticulous process, but the result is a budget that’s finely tuned to your current needs and financial goals. This isn’t about simply cutting expenses; it’s about prioritizing them based on their value and necessity. Think of it as a financial triage – what’s essential, what’s desirable, and what’s completely expendable?

Advantages of Zero-Based Budgeting

ZBB offers several compelling advantages. By forcing a justification for every expense, it helps identify unnecessary spending and promotes a more conscious approach to financial management. This often leads to significant cost savings and improved resource allocation. Additionally, it enhances transparency and accountability, providing a clear picture of where your money is going and why. It’s like having a financial magnifying glass, revealing hidden spending habits.

Disadvantages of Zero-Based Budgeting

While ZBB offers significant benefits, it also presents challenges. The most significant is the time and effort required to meticulously review every expense. This can be particularly demanding for individuals or businesses with complex financial structures. Furthermore, the process can be quite disruptive, especially if implemented without proper planning and training. It’s like a major financial overhaul – expect some temporary disruption.

Implementing a Zero-Based Budget: A Step-by-Step Guide

Implementing a zero-based budget effectively requires a structured approach. Here’s a step-by-step guide to help you navigate the process:

- Define Your Goals: Clearly articulate your short-term and long-term financial objectives. What are you saving for? What expenses are non-negotiable?

- Categorize Expenses: Group your expenses into meaningful categories (e.g., housing, transportation, food, entertainment). This provides a structured framework for analysis.

- Gather Financial Data: Collect all necessary financial information, including income, expenses, and savings. This forms the foundation of your budget.

- Evaluate Each Expense: Critically assess each expense item. Is it essential? Does it align with your financial goals? Can it be reduced or eliminated?

- Prioritize and Allocate: Based on your evaluation, prioritize your expenses and allocate funds accordingly. Ensure that your budget reflects your financial priorities.

- Regularly Review and Adjust: ZBB isn’t a one-time exercise. Regularly review your budget to ensure it remains aligned with your goals and circumstances. Adjust as needed.

Sample Zero-Based Budget, Budgeting Strategies Comparison

This table illustrates a simplified zero-based budget. Remember to tailor your own budget to your specific income and expenses.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Salary | $4000 | Housing | $1500 |

| Side Hustle | $500 | Transportation | $300 |

| Total Income | $4500 | Food | $500 |

| Utilities | $200 | ||

| Entertainment | $200 | ||

| Savings | $1300 | ||

| Total Expenses | $4500 |

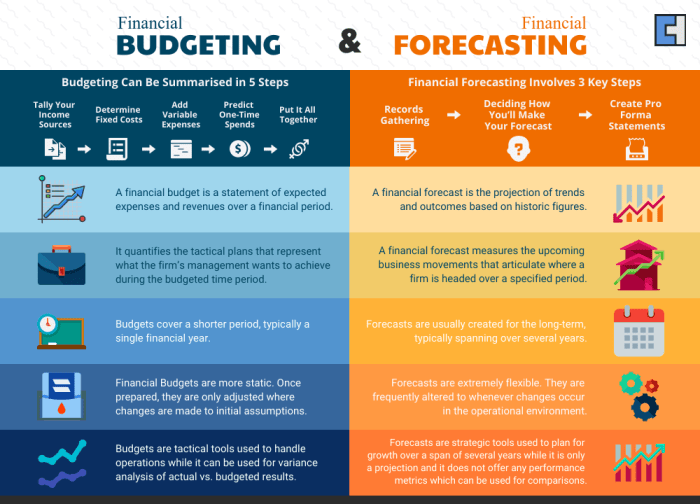

50/30/20 Budgeting Rule

The 50/30/20 budgeting rule, a delightfully simple yet surprisingly effective method, divides your after-tax income into three distinct categories: needs, wants, and savings. Think of it as a financial triathlon, where you strive for balance across these vital areas. It’s a straightforward approach, perfect for those who crave clarity without getting bogged down in complex spreadsheets.

The 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Needs encompass essential expenses like rent or mortgage payments, groceries, utilities, transportation, and healthcare. Wants, on the other hand, include things like dining out, entertainment, and new clothes – the enjoyable but non-essential aspects of life. Finally, the 20% allocated to savings and debt repayment should be prioritized to build your financial security and reduce debt. This seemingly simple formula can significantly impact your financial well-being.

Comparison to Other Budgeting Methods

Unlike the zero-based budgeting approach, which requires meticulously tracking every single expense, the 50/30/20 rule offers a more relaxed, high-level view of your finances. It’s less demanding in terms of time and effort, making it accessible to a wider range of individuals. Compared to envelope budgeting, which involves physically allocating cash to different envelopes for various expenses, the 50/30/20 rule provides a more flexible framework, easily adaptable to digital banking and online transactions. It avoids the slightly archaic feel of dealing with physical cash.

Limitations of the 50/30/20 Rule

While the 50/30/20 rule offers simplicity and ease of use, it’s not without its limitations. Its primary weakness lies in its inflexibility. The percentages are guidelines, not rigid rules, and may not suit everyone’s individual circumstances. For instance, individuals with high housing costs might find the 50% allocation for needs too restrictive, requiring adjustments to the other categories. Similarly, those with significant student loan debt might need to allocate a larger percentage to debt repayment, impacting the amount available for savings or wants. It’s crucial to remember that this is a framework, not a one-size-fits-all solution.

Practical Examples of Implementing the 50/30/20 Rule

Let’s imagine Sarah, a young professional with a monthly after-tax income of $3,000. Applying the 50/30/20 rule, she allocates $1,500 to needs (rent, groceries, transportation), $900 to wants (dining out, entertainment), and $600 to savings and debt repayment. Alternatively, consider Mark, a family with two children and a combined monthly after-tax income of $6,000. They might allocate $3,000 to needs (mortgage, groceries, childcare), $1,800 to wants (family outings, occasional restaurant meals), and $1,200 to savings and debt repayment, prioritizing a larger savings amount for their family’s future. These examples illustrate how adaptable the 50/30/20 rule can be. The key is to adjust the percentages based on your individual financial situation and priorities. It’s about finding a balance that works for *you*, not rigidly adhering to fixed numbers.

Envelope Budgeting System

Ah, the envelope system! A budgeting method as old as…well, as old as envelopes. Before digital wallets and automatic bill pay, this was the gold standard of financial organization, and it still holds its own today. Think of it as a charmingly analog approach to keeping your spending in check.

The envelope system involves assigning specific cash amounts to different spending categories and placing that cash into clearly labeled envelopes. Each envelope represents a budget category (groceries, entertainment, gas, etc.). Once the cash in an envelope is gone, that’s it for that category until the next budgeting period. It’s a delightfully tactile way to visualize your budget and avoid overspending. No more swiping a card and wondering where your money went – you see exactly how much you have left in each category.

Envelope System Compared to Digital Budgeting Apps

Digital budgeting apps, on the other hand, offer a sleek, modern approach. They automatically track transactions, categorize spending, and provide detailed reports. While undeniably convenient, they lack the immediate, visceral feedback of the envelope system. Seeing an empty envelope is a powerful motivator; scrolling through a digital spreadsheet… not so much. The app might *tell* you you’re over budget, but the empty envelope *shows* you.

Benefits of the Envelope System

The envelope system’s greatest strength lies in its simplicity and visual clarity. It makes budgeting tangible and accessible, even for those less comfortable with technology. It fosters mindful spending by forcing you to confront your spending limits directly. The physical act of taking cash from an envelope creates a sense of accountability that digital systems often miss. It’s also fantastic for those who struggle with impulse purchases; no cash, no impulse buys!

Drawbacks of the Envelope System

Naturally, this old-school method isn’t without its limitations. It’s less convenient for recurring bills or online purchases. Managing cash can be cumbersome, and there’s a risk of loss or theft. Tracking spending across multiple envelopes requires diligence, and it’s not ideal for those who prefer the automated tracking and analysis provided by digital tools. Furthermore, it can be less flexible than digital systems when unexpected expenses arise.

Comparison of Budgeting Approaches

| Budgeting Method | Pros | Cons | Best For |

|---|---|---|---|

| Zero-Based Budgeting | Highly disciplined, maximizes savings | Time-consuming, requires meticulous tracking | Highly disciplined individuals, those seeking maximum savings |

| 50/30/20 Rule | Simple, easy to understand and implement | Less flexible, may not suit all financial situations | Beginners, those seeking a basic framework |

| Envelope System | Tangible, visual, promotes mindful spending | Inconvenient for recurring bills, risk of loss or theft | Visual learners, those seeking increased spending awareness |

| Digital Budgeting Apps | Automated tracking, detailed reports, flexible | Requires technology, can be overwhelming for some | Tech-savvy individuals, those needing detailed analysis |

Pay Yourself First Budgeting: Budgeting Strategies Comparison

Paying yourself first is a budgeting philosophy that prioritizes saving and debt repayment before allocating funds to other expenses. It’s like being the CEO of your own financial empire – you get paid first, ensuring your long-term financial health is taken care of before anything else. Think of it as a pre-emptive strike against future financial woes, a proactive approach to building wealth rather than reacting to emergencies.

This method involves setting aside a predetermined percentage of your income for savings and debt repayment before allocating the remaining amount to other expenses. It’s not about deprivation; it’s about strategic allocation of resources, making sure your future self doesn’t get shortchanged. It’s a powerful tool, but like a finely tuned sports car, it requires careful handling.

Integrating Savings and Debt Repayment

Integrating savings and debt repayment into the pay-yourself-first method requires a clear understanding of your financial goals. First, determine your savings goals (emergency fund, down payment, retirement) and your debt repayment strategy (snowball or avalanche method). Then, allocate a percentage of your income to each, ensuring that both are consistently funded. For example, you might allocate 20% to savings and 10% to debt repayment before addressing other expenses. The key is consistency; small, regular contributions over time can build significant wealth. Think of it as a slow and steady tortoise winning the race against the impulsive hare.

Prioritizing Savings Within a Budget

Prioritizing savings involves strategically allocating funds to different savings goals. This requires a disciplined approach and a clear understanding of your financial priorities. It’s about making conscious decisions to prioritize long-term financial well-being over immediate gratification.

- Emergency Fund: Aim for 3-6 months’ worth of living expenses in a readily accessible account. This acts as a safety net, preventing you from going into debt during unexpected events. Imagine the peace of mind knowing you can handle a job loss or unexpected medical bill without panic.

- Debt Repayment: Allocate funds to aggressively pay down high-interest debt. Prioritize high-interest debts to minimize interest payments and save money in the long run. This strategy can significantly reduce your financial burden and improve your credit score.

- Retirement Savings: Contribute regularly to retirement accounts such as 401(k)s or IRAs. Take advantage of employer matching contributions to maximize your returns. Your future self will thank you for this foresight, ensuring a comfortable retirement.

- Specific Goals: Allocate funds towards specific goals such as a down payment on a house, a new car, or a dream vacation. Setting aside money for these goals regularly helps make them a reality without relying on credit cards or loans. Visualize that dream vacation – it’s much sweeter when you’ve saved for it.

Allocating Funds for Different Savings Goals

The allocation of funds will depend on your individual circumstances and financial goals. However, a sample allocation could look like this:

- Emergency Fund: 20%

- Debt Repayment: 10%

- Retirement Savings: 15%

- Down Payment (House): 5%

Remember, these percentages are just examples. Adjust them to fit your own financial situation and goals. The most important aspect is to consistently allocate funds to your savings goals, no matter how small the amount.

Budgeting Apps and Software

Ah, budgeting apps – the digital saviors of our sometimes-chaotic financial lives. Gone are the days of painstakingly balancing checkbooks (unless you’re a nostalgic masochist, of course). These handy tools offer a streamlined approach to managing your money, transforming the often-dreaded task of budgeting into something almost…enjoyable. Almost.

The sheer variety of budgeting apps and software available can be overwhelming, like choosing a flavor of ice cream at a gourmet parlor with 500 options. Each app boasts unique features, catering to different budgeting styles and technological proclivities. This section will delve into the functionalities and features of several popular options, helping you navigate this digital financial jungle and find the perfect app for your needs.

Popular Budgeting Apps: A Comparison

Choosing the right budgeting app is a bit like choosing a superhero sidekick – you need one that complements your strengths and covers your weaknesses. Some are all about simple tracking, while others offer advanced features like investment tracking and debt payoff planning. Let’s examine some of the most popular contenders.

- Mint: A free, all-in-one personal finance app that aggregates accounts, tracks spending, and provides credit score monitoring. Think of it as your friendly neighborhood financial superhero, always on the lookout for suspicious activity (like unexpected charges).

- YNAB (You Need A Budget): This app employs a zero-based budgeting method, requiring you to allocate every dollar you earn. It’s a bit more hands-on, but it teaches you to be more mindful of your spending habits. Consider it the strict but ultimately helpful financial drill sergeant.

- Personal Capital: A powerful tool for those with more complex financial needs, offering investment tracking, retirement planning, and fee analysis alongside budgeting features. This is your sophisticated financial advisor, helping you strategize for long-term wealth.

- PocketGuard: This app focuses on helping users stay within their budget by showing them how much “safe-to-spend” money they have left after essential expenses are covered. Think of it as your personal financial safety net.

Budgeting App Features: A Detailed Look

While each app offers unique strengths, several common features help users manage their finances effectively. Understanding these features will help you choose an app that aligns with your needs and preferences. We’ll examine some key features, highlighting their importance in the budgeting process.

| App | Account Aggregation | Budgeting Methods | Reporting & Analysis | Subscription Cost |

|---|---|---|---|---|

| Mint | Yes | Various | Good | Free (with ads) |

| YNAB | Yes | Zero-Based | Excellent | Subscription |

| Personal Capital | Yes | Various | Excellent | Free (with premium options) |

| PocketGuard | Yes | Goal-Oriented | Good | Free (with premium options) |

Visualizing Budgeting Data

Let’s face it, staring at a spreadsheet full of numbers is about as exciting as watching paint dry. But visualizing your budget data? That’s where the fun begins! Turning those cold, hard figures into vibrant charts and graphs can transform your understanding of your finances, making budgeting less of a chore and more of a… well, maybe not a party, but definitely less of a headache.

Visualizing your financial data offers a powerful way to grasp complex information quickly and intuitively. Instead of sifting through endless rows of numbers, a well-designed visual representation can instantly highlight trends, areas for improvement, and potential pitfalls. Think of it as giving your budget a much-needed makeover – from drab to fab!

Chart and Graph Types for Budget Visualization

Several chart and graph types are particularly well-suited for representing budget data. Pie charts, for example, effectively illustrate the proportion of your income allocated to different expense categories. Bar charts are ideal for comparing expenses across different time periods, while line graphs beautifully showcase trends in income and spending over time. Scatter plots can reveal correlations between different variables, such as income and savings. Choosing the right chart depends on the specific insights you want to extract from your data.

Benefits of Visualizing Financial Data

Visualizations are not just pretty pictures; they are powerful tools for financial clarity. A clear visual representation can significantly improve your understanding of your spending habits, allowing you to identify areas where you might be overspending. Moreover, visualizing your progress towards your financial goals – be it saving for a down payment or paying off debt – provides a much-needed dose of motivation and keeps you on track. Seeing your progress visually is far more rewarding than just looking at numbers in a spreadsheet.

Creating Effective Budget Visualizations

Creating effective visualizations requires careful planning and execution. Start by identifying the key aspects of your budget you want to highlight. Then, select the chart type that best suits your data and the message you want to convey. Keep your visualizations simple and easy to understand, avoiding clutter and unnecessary details. Use clear labels, titles, and a consistent color scheme. Remember, the goal is to communicate your financial picture clearly and concisely, not to create a data-driven masterpiece of abstract art.

Example: Annual Income vs. Expenses Visualization

Imagine a bar chart illustrating income and expenses over a year. The horizontal axis represents the months (January to December), while the vertical axis displays the monetary value. Two sets of bars are used – one for income (perhaps a vibrant green) and one for expenses (a slightly less cheerful red). The height of each bar corresponds to the income or expense amount for that particular month. A clear legend distinguishes between income and expenses. At a glance, this chart instantly reveals monthly income fluctuations, peak spending periods, and overall financial health throughout the year. For instance, you might see higher income during the summer months balanced by increased expenses due to vacation travel. This visual representation allows for a quick and easy comparison, highlighting potential areas for adjustments in your spending habits.

Adapting Budgeting Strategies to Different Life Stages

Life, much like a particularly stubborn stain on your favorite shirt, refuses to remain static. It throws curveballs – marriage, kids, career changes – all demanding adjustments to your carefully crafted budget. Think of your budget not as a rigid, unyielding structure, but as a flexible friend who adapts to your ever-evolving needs. Failing to adapt your budgeting strategy to these life changes is like trying to navigate a rollercoaster with training wheels – it’s going to be a bumpy ride.

Budgeting isn’t a one-size-fits-all endeavor; it’s a personalized journey that requires regular recalibration. What worked brilliantly during your carefree single years might feel like a straitjacket once you’re juggling mortgage payments and tiny humans demanding organic kale smoothies. The key is to embrace the fluidity of life and your budget, adapting your strategies as your circumstances change. Think of it as a game of financial Jenga – carefully removing and replacing blocks as needed to avoid a catastrophic collapse.

Budgeting Adjustments for Marriage

Combining finances after marriage requires careful planning and open communication. This isn’t just about pooling resources; it’s about merging spending habits and financial goals. Couples should create a joint budget that reflects both partners’ income and expenses, setting clear expectations for shared costs (rent/mortgage, utilities, groceries) and individual spending allowances. Consider creating a shared spreadsheet or using budgeting software to track expenses and ensure transparency. A successful merger requires honest conversations about spending habits and financial priorities, which, while potentially uncomfortable, are crucial for long-term financial harmony. For example, if one partner is accustomed to lavish weekend brunches while the other prefers budget-friendly home-cooked meals, finding a compromise that balances both preferences is essential.

Budgeting Adjustments for Parenthood

Ah, parenthood – the joyous journey of sleep deprivation and exponentially increasing expenses. The arrival of a child dramatically alters financial priorities. Expect significant increases in spending related to childcare, healthcare, diapers, food, and clothing. Parents may need to adjust their saving goals temporarily, prioritizing immediate needs over long-term investments. Re-evaluating existing budgeting strategies, perhaps incorporating the 50/30/20 rule with a greater emphasis on the “needs” category, becomes essential. For instance, a family might need to temporarily reduce contributions to retirement accounts to cover the costs of daycare, but should aim to resume these contributions as soon as financially feasible.

Budgeting Adjustments for Career Changes

A career change, whether a promotion, a job loss, or a complete career pivot, necessitates a budget overhaul. A promotion typically brings increased income, allowing for greater savings and investment opportunities. However, a job loss demands immediate and drastic budget adjustments, focusing on reducing expenses and potentially seeking additional income streams. Regardless of the nature of the change, creating a realistic budget that reflects the new income level and associated expenses is crucial. For example, a person transitioning from a high-paying corporate job to self-employment might need to adjust their budget to account for fluctuating income and increased self-employment taxes. They might explore strategies like the envelope budgeting system to better manage their cash flow during periods of uncertainty.

The Importance of Flexibility and Adjustment in Long-Term Budgeting

Long-term financial success hinges on the ability to adapt. Life is unpredictable; unexpected expenses (car repairs, medical emergencies) are inevitable. A rigid budget, inflexible and resistant to change, is a recipe for financial stress. Regularly reviewing and adjusting your budget, perhaps quarterly or annually, allows you to anticipate and address potential challenges proactively. This flexibility ensures your budget remains a useful tool, guiding you towards your financial goals, rather than becoming a source of frustration. Think of your budget as a living document, constantly evolving to meet the ever-changing landscape of your life. The key is to maintain a healthy balance between planning and adaptability, allowing for adjustments without losing sight of your long-term financial aspirations.

Closing Notes

So, there you have it – a whirlwind tour through the surprisingly fun world of budgeting! While each strategy boasts unique strengths and weaknesses, the ultimate key to success lies in finding the method that best suits your personality and financial goals. Remember, budgeting isn’t about deprivation; it’s about empowered spending and achieving those dreams, whether it’s a tropical vacation or finally paying off that pesky student loan. Embrace the chaos, conquer your finances, and may your bank account always be overflowing (or at least, not empty!).

FAQ Insights

What if I hate spreadsheets?

Fear not! Many budgeting apps offer user-friendly interfaces and even fun visualizations to make tracking your finances less of a chore and more of an interactive game.

Can I use multiple budgeting methods simultaneously?

Absolutely! A hybrid approach, combining elements of different strategies, might be the perfect solution for your unique financial landscape. Experiment and find what works best for you.

What if my income fluctuates?

Flexible budgeting methods, like zero-based budgeting, are designed to accommodate fluctuating income. Adjust your budget regularly to reflect your current financial reality. Don’t let unexpected income changes derail your progress!