Pajak, the Indonesian tax system, is a fascinating beast – a complex web of regulations that somehow manages to both fund national development and inspire creative accounting. This exploration delves into the intricacies of Indonesian taxation, from its historical roots to its impact on the economy, offering a blend of informative detail and lighthearted observations. Prepare to be both enlightened and entertained as we navigate the world of Indonesian taxes.

We’ll unravel the mysteries of various tax types, from the ever-present income tax to the VAT that quietly adds to your shopping bill. We’ll compare Indonesia’s approach to its Southeast Asian neighbours, examine the role of the DJP (the Indonesian tax authority), and even delve into the art (and ethics) of tax planning. Think of it as a tax safari, but instead of lions and elephants, we’ll encounter tax brackets and compliance procedures.

Understanding “Pajak” (Tax) in Indonesia

The Indonesian tax system, a fascinating blend of historical influences and modern economic necessities, is a subject worthy of both scholarly analysis and, let’s be honest, a healthy dose of bewildered amusement. Navigating its intricacies can feel like attempting to solve a Rubik’s Cube blindfolded while riding a unicycle – challenging, but not entirely without its quirky charm.

A Brief History of Indonesian Taxation

Indonesia’s tax history is a long and winding road, paved with good intentions (and sometimes, less-than-good implementation). Early systems were largely based on traditional practices and often lacked the consistency and structure of modern tax regimes. The colonial era saw the introduction of more formalized systems, primarily designed to benefit the colonizers. Post-independence, the Indonesian government has worked tirelessly (and sometimes hilariously) to build a more equitable and efficient system, grappling with issues of compliance, corruption, and the sheer diversity of the Indonesian archipelago. The journey has been, shall we say, eventful.

Types of Taxes Levied in Indonesia

Indonesia levies a variety of taxes, each with its own unique quirks and challenges. Income tax (Pajak Penghasilan or PPh) applies to individuals and corporations, with varying rates and deductions that can make even the most seasoned accountant scratch their head. Value Added Tax (VAT, or Pajak Pertambahan Nilai or PPN) is a broad-based consumption tax, affecting almost everything from your morning kopi to your evening nasi goreng. Property tax (Pajak Bumi dan Bangunan or PBB) is levied on land and buildings, adding another layer to the already complex tax landscape. Other taxes include luxury goods taxes and various import/export duties. It’s a veritable tax buffet, though not always a palatable one.

Comparison of Indonesian Tax Laws with Other Southeast Asian Countries, Pajak

Comparing Indonesian tax laws with those of its Southeast Asian neighbors reveals a complex tapestry of similarities and differences. While many countries in the region utilize similar tax structures (income tax, VAT, etc.), the specific rates, exemptions, and enforcement mechanisms vary significantly. For example, some countries have simpler tax systems with lower rates, while others mirror Indonesia’s complexity. Factors such as economic development, political stability, and administrative capacity all play a role in shaping each nation’s unique tax landscape. It’s a regional tax Olympics, and Indonesia is definitely a contender for most creatively complicated system.

Individual Income Tax Brackets in Indonesia

The Indonesian individual income tax system is, shall we say, tiered. The rates vary depending on your taxable income. Here’s a simplified representation (note: tax laws are subject to change, so always consult official sources for the most up-to-date information):

| Taxable Income (IDR) | Tax Rate (%) |

|---|---|

| 0 – 50,000,000 | 5 |

| 50,000,001 – 250,000,000 | 15 |

| 250,000,001 – 500,000,000 | 25 |

| > 500,000,000 | 30 |

Tax Compliance in Indonesia

Navigating the Indonesian tax system can feel like a thrilling rollercoaster ride – exhilarating highs of deductions and potentially terrifying plunges into penalties. But fear not, intrepid taxpayer! Understanding compliance is key to avoiding a tax-induced heart attack. This section will illuminate the paths to tax righteousness (and the pitfalls of tax wickedness).

Methods of Tax Compliance

Individuals and businesses in Indonesia employ various methods to ensure compliance with tax regulations. For individuals, this often involves diligently keeping records of income and expenses, utilizing approved tax software to file returns accurately, and seeking professional assistance from tax consultants when necessary. Businesses, on the other hand, face a more complex landscape, requiring robust accounting systems, regular tax audits (both internal and potentially external), and often the engagement of specialized tax firms to navigate the intricate web of regulations. Many businesses utilize electronic filing systems provided by the Indonesian tax authority, Direktorat Jenderal Pajak (DJP), to streamline the process and reduce administrative burdens. Proactive engagement with tax authorities, including attending seminars and workshops, also aids in maintaining compliance. Remember, proactive compliance is cheaper than reactive penalties!

The Role of the Indonesian Tax Authority (DJP)

The Indonesian Directorate General of Taxes (DJP), the nation’s tax collector, is a fascinating beast. Think of it as a highly organized, albeit sometimes slightly intimidating, financial zookeeper, responsible for wrangling the nation’s tax revenue. Its effectiveness, like a well-trained orangutan balancing a coconut on its head, is a subject of ongoing discussion and, let’s be honest, occasional exasperated sighs.

The DJP’s structure mirrors the complexity of the Indonesian archipelago itself – a layered system of offices across the country, from the central office in Jakarta to regional and local branches. This decentralized approach aims to ensure closer contact with taxpayers, a strategy that can be as effective as it is challenging, much like herding cats (but with higher stakes). At the top, you have the Director General and their team, setting the strategic direction. Below that, various directorates handle specific aspects of tax administration, enforcement, and taxpayer services. The system is designed to be efficient, but like any bureaucracy, it occasionally requires the patience of a saint (or a very strong cup of kopi).

DJP’s Key Responsibilities in Tax Collection and Enforcement

The DJP’s primary responsibility is, unsurprisingly, collecting taxes. This involves everything from processing tax returns to conducting audits, all while attempting to maintain a level of fairness that would make even Solomon envious. They are also tasked with enforcing tax laws, which involves investigating cases of tax evasion, a delicate balancing act requiring both a keen eye for detail and a certain level of diplomatic finesse. Think of it as a high-stakes game of financial chess, where every move needs careful consideration to avoid checkmate (or a hefty fine). Furthermore, the DJP is responsible for educating taxpayers about their obligations, a role that requires a blend of patience and the ability to explain complex regulations in a way that even your grandma could understand.

Online Resources and Services Provided by the DJP for Taxpayers

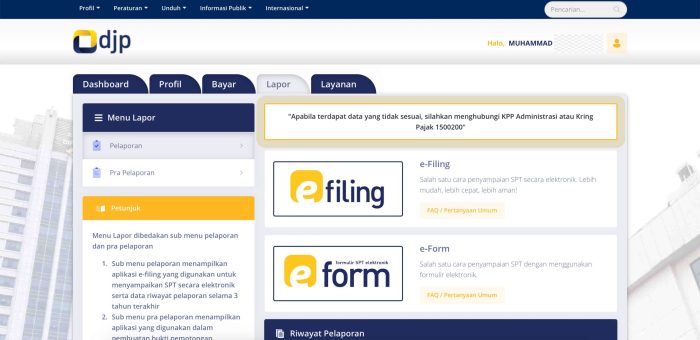

The DJP offers a range of online services designed to make tax compliance less of a headache and more of a… slightly less painful experience. These services aim to streamline processes, making everything from filing tax returns to checking your tax status a relatively painless endeavor (relatively being the key word here).

The DJP’s website, along with its mobile application, offers access to a wealth of information, including tax regulations, forms, and guides. Taxpayers can also submit their tax returns online, track their payments, and access their tax records through these digital platforms. While the user experience may not always be perfect, the aim is to make navigating the Indonesian tax system as user-friendly as possible, a goal as ambitious as climbing Mount Everest in flip-flops.

Comparison of DJP Effectiveness with Other Tax Authorities

Comparing the DJP’s effectiveness to other tax authorities globally is a complex undertaking. Many factors influence a tax authority’s performance, including the size and complexity of the economy, the level of taxpayer compliance, and the resources available to the authority itself. While Indonesia has made significant strides in improving its tax administration, challenges remain, such as increasing tax compliance among small and medium-sized enterprises (SMEs) and combating tax evasion. A direct comparison with, say, the IRS in the United States or HMRC in the United Kingdom would require a detailed analysis accounting for vast differences in economic structures and enforcement mechanisms. However, it’s safe to say that the DJP, like all tax authorities worldwide, is constantly striving for greater efficiency and effectiveness in its mission to collect taxes and ensure fairness within the system.

Impact of “Pajak” on the Indonesian Economy

The Indonesian tax system, while sometimes feeling like a playful game of “hide-and-seek” with your hard-earned Rupiah, plays a surprisingly crucial role in the nation’s economic health. Think of it as the invisible hand that guides (and sometimes gently nudges) the country’s development. Without it, the vibrant tapestry of Indonesian economic growth would unravel rather quickly.

Tax revenue forms the lifeblood of government spending, fueling vital projects that underpin Indonesia’s progress. It’s not just about collecting money; it’s about strategically allocating resources to build a better future.

Government Spending and Infrastructure Development

Tax revenue directly contributes to the Indonesian government’s ability to fund crucial infrastructure projects. Imagine the Trans-Java Toll Road, a monumental undertaking that connects the island’s bustling cities and facilitates trade. This, and countless other infrastructure initiatives – from modernizing airports to expanding electricity grids – are significantly funded by tax revenue. Without sufficient tax collection, these ambitious plans would be severely hampered, resulting in slower economic growth and reduced connectivity. This isn’t just about building roads; it’s about building opportunities. The efficient movement of goods and people translates to a more productive and competitive economy.

Effects of Tax Policies on Economic Growth and Investment

Tax policies act as powerful levers influencing economic growth and investment. For instance, a decrease in corporate tax rates can incentivize businesses to invest more, leading to job creation and increased productivity. Conversely, higher taxes on certain goods or services can discourage consumption and potentially curb economic expansion. Finding the right balance is a delicate act, requiring careful consideration of various economic factors and the potential social impact. For example, a tax incentive program aimed at promoting renewable energy investment might stimulate innovation and reduce the country’s carbon footprint while simultaneously boosting the green technology sector.

Impact of Tax Reforms on Different Segments of the Indonesian Population

Tax reforms can have a profound impact on various segments of the Indonesian population. For example, the introduction of a value-added tax (VAT) affects consumers across the board, although the impact might be felt more acutely by lower-income households. On the other hand, tax breaks for small and medium-sized enterprises (SMEs) can stimulate entrepreneurship and job creation, benefiting a wide range of individuals. The government continually strives to design tax policies that are both efficient in generating revenue and equitable in their impact on the population, aiming to achieve a balance between economic growth and social welfare. This is a constant balancing act, a high-stakes game of economic Jenga.

Main Economic Sectors Most Affected by Tax Policies

Tax policies significantly influence various economic sectors. Understanding their effects is vital for strategic economic planning.

- Energy: Tax incentives or penalties related to fossil fuels or renewable energy sources heavily impact this sector, shaping investment choices and energy consumption patterns.

- Manufacturing: Corporate tax rates and import/export duties directly influence the competitiveness of Indonesian manufacturers in the global market.

- Agriculture: Tax policies related to agricultural inputs and outputs can significantly affect food prices and the livelihoods of farmers.

- Tourism: Taxes on tourism-related services can influence tourist spending and the overall viability of the tourism industry.

- Finance: Taxation of financial institutions and investment vehicles directly impacts capital flows and investment decisions.

Tax Planning and Optimization in Indonesia

Navigating the Indonesian tax system can feel like a thrilling jungle adventure – full of unexpected twists and turns, but with potentially lucrative rewards for those who play their cards right. Proper tax planning isn’t about dodging taxes; it’s about legally minimizing your tax burden and maximizing your financial well-being. Think of it as a strategic game, where understanding the rules is the key to winning.

Tax planning in Indonesia involves proactively structuring your financial affairs to reduce your tax liability within the bounds of the law. It’s a blend of careful record-keeping, strategic investments, and a healthy dose of understanding the intricacies of Indonesian tax regulations. Remember, the goal is smart financial management, not tax evasion.

Legitimate Tax Planning Strategies for Individuals and Businesses

Effective tax planning requires a multi-faceted approach, tailoring strategies to individual circumstances and business structures. For individuals, this might involve maximizing deductions for eligible expenses, such as education costs or charitable donations. Businesses, on the other hand, might explore strategies such as optimizing depreciation schedules for assets or strategically structuring business transactions. Careful consideration of various tax incentives offered by the government is also crucial. For example, certain investments might qualify for tax breaks, effectively reducing the overall tax burden.

Ethical Considerations in Tax Planning

While tax optimization is perfectly legal and even encouraged, it’s vital to maintain the highest ethical standards. The line between clever tax planning and outright tax evasion is thin, and crossing it can have severe consequences. Ethical tax planning prioritizes transparency, full disclosure, and compliance with all applicable laws and regulations. It’s about finding the legal loopholes, not creating them. Think of it as playing by the rules, but playing them smartly.

Best Practices for Minimizing Tax Liabilities While Remaining Compliant

Maintaining meticulous records is paramount. Think of it as your shield against any potential audit. Accurate and organized documentation can save you headaches and potentially significant financial penalties. Regular consultations with a qualified tax advisor are also essential. They can provide personalized guidance, keeping you updated on changes in tax laws and helping you develop a tailored strategy. Proactive planning, rather than reactive problem-solving, is the key to minimizing tax liabilities and avoiding costly mistakes. Remember, prevention is always better (and cheaper!) than cure.

Calculating Tax Payable on Different Types of Income

The calculation of tax payable in Indonesia varies depending on the type of income. For salaried employees, the tax is typically withheld at source by their employer based on their annual income. This is calculated using progressive tax brackets, meaning higher income levels are taxed at higher rates. For example, if an individual earns 500 million Rupiah annually, they would fall into a higher tax bracket compared to someone earning 100 million Rupiah. The exact calculation involves applying the relevant tax rates to each income bracket. For business income, the calculation is more complex and depends on the business structure (sole proprietorship, limited liability company, etc.) and the applicable tax regulations. This often involves deducting allowable business expenses from gross income to arrive at taxable income, then applying the relevant tax rates.

Taxable Income = Gross Income – Allowable Deductions

Tax Payable = Taxable Income x Applicable Tax Rate

Note: These are simplified examples. Actual tax calculations can be more intricate and may require the assistance of a tax professional.

The Future of “Pajak” in Indonesia

The Indonesian tax system, much like a stubborn but lovable uncle, is undergoing a significant transformation. While it might grumble about change, the future of “Pajak” in Indonesia is poised for a fascinating evolution, driven by technology and a desire for greater efficiency and fairness. This journey promises smoother tax filing, more robust revenue collection, and ultimately, a more prosperous nation.

Technological Advancements in Tax Administration

Technological advancements are revolutionizing tax administration in Indonesia. The Directorate General of Taxes (DJP) is actively embracing digitalization, aiming to create a more efficient and transparent system. This includes expanding online tax filing platforms, improving data analytics capabilities for identifying tax evasion, and utilizing artificial intelligence to automate processes like tax assessment and audit selection. Imagine a future where submitting your tax return is as simple as ordering a Gojek – quick, easy, and maybe even a little bit exciting (okay, maybe not exciting, but definitely less stressful). This digital shift is expected to reduce the administrative burden on both taxpayers and the DJP, leading to increased compliance and revenue collection. For example, the implementation of e-Faktur, Indonesia’s electronic invoicing system, has already significantly streamlined the VAT reporting process.

Challenges Facing the Indonesian Tax System and Proposed Solutions

Indonesia’s tax system faces several persistent challenges. A significant one is the informal economy, where a large portion of economic activity goes untaxed. This necessitates strategies to bring these businesses into the formal sector through incentives, simplification of tax regulations, and enhanced enforcement. Another challenge is the complexity of the tax code itself, which can be daunting for both individuals and businesses. Streamlining tax regulations and providing clear, accessible information are crucial steps toward improving compliance. Furthermore, building public trust in the tax system is paramount. This can be achieved through greater transparency, accountability, and effective communication from the DJP. A comprehensive public awareness campaign, explaining the benefits of paying taxes and how tax revenue is utilized for public services, would significantly boost public support.

Government Plans for Future Tax Reforms and Anticipated Effects

The Indonesian government has Artikeld ambitious plans for future tax reforms. These include simplifying the tax structure, broadening the tax base, and improving tax administration. The aim is to create a more equitable and efficient tax system that supports sustainable economic growth. These reforms are anticipated to increase tax revenue, reduce tax avoidance, and improve the overall efficiency of the tax system. Specific reforms may include adjustments to tax rates, the introduction of new taxes (or modifications to existing ones), and further investment in digital infrastructure for tax administration. For example, the government might focus on increasing the tax compliance of small and medium-sized enterprises (SMEs) by providing tailored support and simplified tax procedures. The expected outcome is a healthier fiscal position for the government, enabling increased investment in public services like education, healthcare, and infrastructure.

Projected Changes to Indonesian Tax Laws (5-10 Year Timeline)

The following timeline illustrates projected changes to Indonesian tax laws over the next 5-10 years. These projections are based on current government plans and trends, and should be considered tentative.

| Year | Projected Changes | Anticipated Effects |

|---|---|---|

| 2024-2025 | Further digitalization of tax administration; simplification of tax regulations for SMEs. | Increased tax compliance among SMEs; reduced administrative burden on taxpayers and the DJP. |

| 2026-2027 | Implementation of new tax incentives for investment in renewable energy; potential adjustments to corporate income tax rates. | Increased investment in renewable energy; improved competitiveness of Indonesian businesses. |

| 2028-2030 | Expansion of the digital economy tax regime; enhanced measures to combat tax evasion. | Increased tax revenue from the digital economy; strengthened tax enforcement. |

| 2031-2033 | Potential introduction of a carbon tax or other environmental levies; further simplification of personal income tax. | Increased revenue for environmental initiatives; improved ease of tax compliance for individuals. |

Note: This timeline represents projections based on current policy trends and may be subject to change based on economic conditions and government priorities. The actual implementation and effects of these changes may vary.

Conclusion: Pajak

So, there you have it – a whirlwind tour of Pajak, the Indonesian tax system. While navigating this landscape might seem daunting, understanding the rules of the game can empower both individuals and businesses. From mastering tax compliance to strategically planning for the future, knowledge is your most powerful weapon. Remember, a little understanding can go a long way in turning tax season from a dreaded event into a manageable (and perhaps even slightly less stressful) one. Happy tax planning!

Questions Often Asked

What happens if I don’t file my taxes in Indonesia?

Expect penalties, ranging from fines to potential legal action. It’s best to comply; the DJP isn’t known for its sense of humour.

Can I deduct charitable donations from my taxable income?

Possibly! Check the DJP’s guidelines for specifics on eligible charities and deduction limits. It’s always best to consult a tax professional.

How often are tax laws in Indonesia updated?

Regularly! Keep an eye on the DJP website and official government announcements for the latest changes. It’s a dynamic field.