Financial Statement Analysis Tools: Forget tedious spreadsheets and cryptic formulas! Unlock the secrets hidden within balance sheets, income statements, and cash flow statements with the help of these powerful digital assistants. We’re not talking about mere number-crunching; we’re talking about transforming raw financial data into actionable insights that can make or break a business – or at least help you avoid a very embarrassing board meeting.

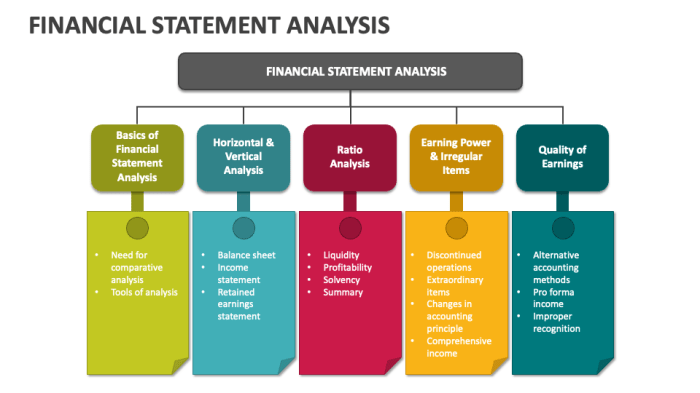

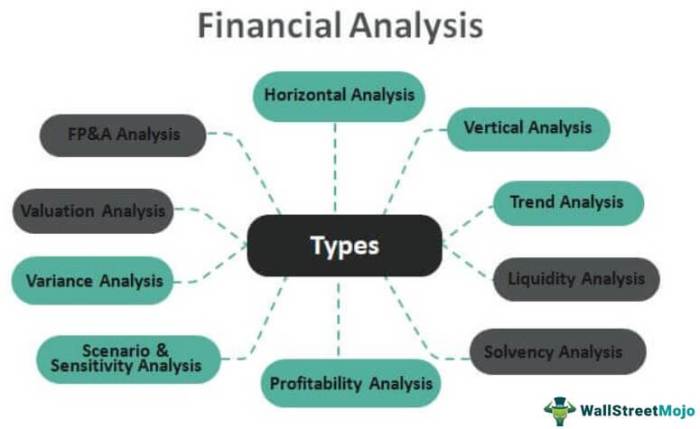

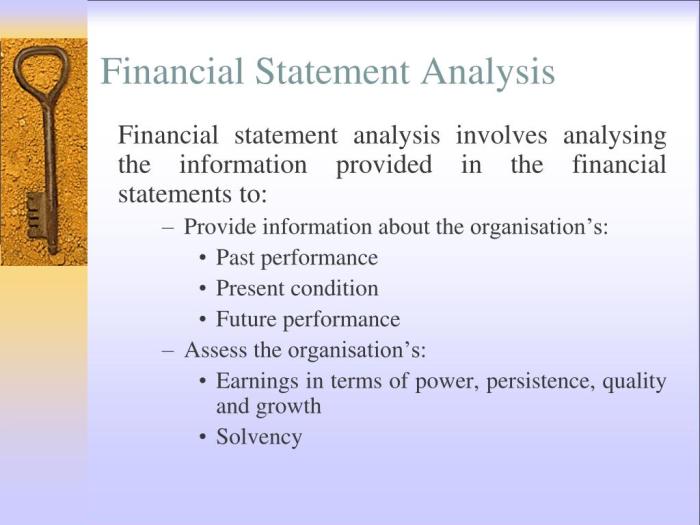

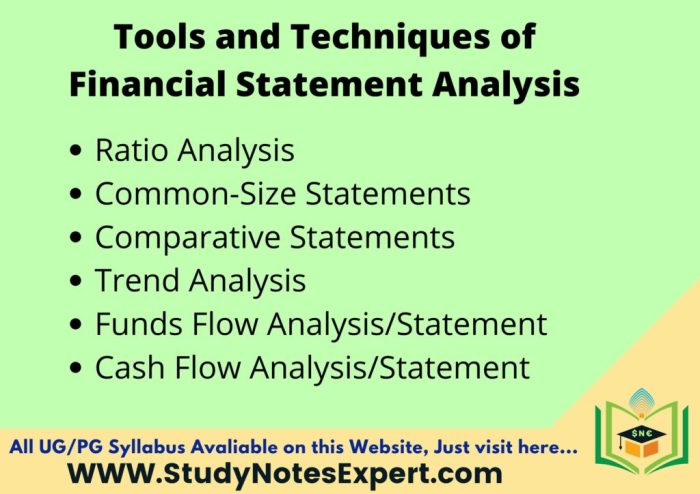

This exploration delves into the fascinating world of financial statement analysis tools, examining their core functionalities, diverse applications across industries, and the clever methods they employ to decipher the financial health of any organization. We’ll uncover the magic behind ratio analysis, trend analysis, and other techniques, while also addressing potential pitfalls and future trends in this ever-evolving field. Prepare for a journey into the heart of financial data, where numbers tell tales of triumph and tribulation.

Introduction to Financial Statement Analysis Tools

Financial statement analysis tools are, quite simply, the digital Swiss Army knives of the accounting world. They’re software applications and platforms designed to crunch the numbers from a company’s financial statements, transforming raw data into insightful, actionable intelligence. Think of them as your friendly neighborhood accountant, but without the annoying habit of always smelling faintly of coffee.

Using these tools is crucial for making informed, data-driven decisions. Whether you’re a seasoned investor sniffing out the next big thing, a small business owner trying to navigate the choppy waters of profitability, or a financial analyst striving to impress your boss (and maybe snag that corner office), these tools are your secret weapon. They help identify trends, spot potential risks, and ultimately, make your financial life significantly less stressful (and possibly more lucrative).

Types of Financial Statements Analyzed

These indispensable tools dissect three primary financial statements: the balance sheet, the income statement, and the cash flow statement. The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time – think of it as a financial selfie. The income statement, on the other hand, reveals a company’s revenue, expenses, and profit over a period, offering a glimpse into its performance. Finally, the cash flow statement tracks the movement of cash both into and out of the business, highlighting the sources and uses of funds. Together, these three statements tell a compelling story about a company’s financial health, and our analysis tools help us decipher that narrative.

Comparison of Financial Statement Analysis Tools

The market offers a plethora of options, each with its own unique strengths and weaknesses. Choosing the right tool depends heavily on your specific needs and budget. Below is a comparison of four popular choices, showcasing their features, pricing, and target users. Remember, these are just examples, and the specific features and pricing can change. Always check the latest information from the software providers.

| Tool | Key Features | Pricing (Approximate) | Target Users |

|---|---|---|---|

| Financial Statement Analyzer Pro (Fictional Example) | Automated ratio analysis, forecasting, customizable dashboards, integration with accounting software. | $99/month – $499/month | Small to medium-sized businesses, financial analysts. |

| Accountant’s Delight (Fictional Example) | Basic ratio analysis, trend analysis, simple reporting features. | $29/month – $149/month | Small businesses, individual accountants. |

| BigData Financials (Fictional Example) | Advanced analytics, machine learning capabilities, predictive modeling, integration with large datasets. | $499/month – $2000+/month | Large corporations, investment firms. |

| Spreadsheet Software (e.g., Excel, Google Sheets) | Manual calculations, basic charting, limited automation. | Free (basic) – Subscription based (premium features) | Individuals, small businesses with limited analytical needs. |

Key Features and Functionalities

Financial statement analysis tools, while varying in bells and whistles, share a common goal: to wrest meaning from the often-bewildering world of financial data. Think of them as the intrepid explorers of the accounting jungle, charting a course through dense foliage (balance sheets) and treacherous terrain (cash flow statements) to uncover hidden treasures (profitable insights). These tools aren’t just for seasoned accountants; they’re for anyone who wants to understand the financial health of a business, from budding entrepreneurs to seasoned investors.

Data visualization is the key to unlocking the secrets held within those financial statements. Raw numbers are like uncooked ingredients – they have potential, but they need to be transformed to be truly appreciated. Effective visualization takes those raw numbers and transforms them into digestible, insightful narratives.

Data Visualization in Financial Statement Analysis

Imagine trying to understand the growth trajectory of a company solely from a table of yearly revenues. Sleep-inducing, right? Now picture a vibrant line graph, clearly showing the upward (or downward, sadly) trend, punctuated by key milestones. That’s the power of visualization. Bar charts can effectively compare different line items across periods, while pie charts offer a compelling visual representation of the composition of assets or liabilities. Heatmaps can highlight areas of strength or weakness within a financial statement, revealing potential issues or opportunities at a glance. For example, a heatmap showing a company’s profitability ratios over several years might immediately reveal a period of consistently low margins, prompting further investigation.

Advanced Features in Financial Statement Analysis Tools

Beyond the basics, some tools offer advanced features that turn financial analysis from a tedious task into a strategic advantage. Forecasting, for instance, allows users to project future financial performance based on historical data and various assumptions. This isn’t crystal ball gazing; it’s informed speculation, allowing businesses to proactively plan for potential challenges and capitalize on opportunities. Scenario planning builds on this, allowing users to model different “what-if” scenarios (e.g., a sudden increase in raw material costs or a decrease in sales). Benchmarking, a feature often overlooked, is crucial for competitive analysis. By comparing a company’s performance to industry averages or competitors, users can identify areas where they excel and areas needing improvement. For example, a tool might compare a company’s return on assets (ROA) to the average ROA of its competitors in the same industry, immediately highlighting areas of relative strength or weakness.

Hypothetical User Interface Design

Our hypothetical tool, “Financially Fit,” boasts a clean, intuitive interface. The dashboard displays key financial metrics – such as revenue, profit margin, and debt-to-equity ratio – in easily digestible charts and graphs. Users can easily switch between different reporting periods and drill down into specific line items. A dedicated “Scenario Planning” module allows users to adjust key variables (e.g., sales growth, operating expenses) and instantly see the impact on projected financial statements. A “Benchmarking” section provides comparisons against industry peers, allowing users to quickly identify areas for improvement. The interface is designed to be both powerful and user-friendly, accessible to both financial experts and those with less experience. Imagine a clean, modern design, with interactive charts that respond to user clicks, revealing underlying data and further analysis. The color scheme is calming yet vibrant, avoiding overwhelming the user with information. The overall design emphasizes clarity and ease of navigation, allowing users to focus on the financial insights rather than the tool itself.

Methods and Techniques Employed

Financial statement analysis isn’t just about staring at numbers until your eyes cross (though that might happen sometimes). It’s about wielding powerful tools to uncover the hidden stories within a company’s financial life. These tools, much like a detective’s kit, allow us to analyze, interpret, and ultimately, understand a company’s financial health, its strengths, and its… well, let’s just say its “areas for improvement.”

Ratio Analysis: A Deep Dive into the Numbers

Ratio analysis is like a financial microscope, allowing us to zoom in on specific aspects of a company’s performance. By comparing different line items from the balance sheet and income statement, we create ratios that tell a compelling narrative. For example, the current ratio (Current Assets / Current Liabilities) reveals a company’s ability to meet its short-term obligations. A high ratio suggests ample liquidity, while a low ratio might signal potential trouble brewing. Another classic is the debt-to-equity ratio (Total Debt / Total Equity), which reveals how much a company relies on debt financing compared to equity. A high ratio suggests a riskier financial structure. Other commonly used ratios include profitability ratios (like gross profit margin and net profit margin), efficiency ratios (like inventory turnover and asset turnover), and market value ratios (like price-to-earnings ratio). Each ratio provides a different piece of the puzzle, allowing for a more comprehensive understanding of the company’s financial standing. Remember, though, context is key! A single ratio in isolation rarely tells the whole story.

Ratio Analysis Examples

Let’s say Company A has a current ratio of 2.5, while Company B has a current ratio of 0.8. This suggests Company A is in a much stronger short-term liquidity position. However, we need to investigate further. Perhaps Company B operates in an industry with exceptionally quick payment cycles, making its lower current ratio perfectly acceptable. The key is to compare ratios within the same industry and over time to gain meaningful insights. It’s like comparing apples to apples (or, in this case, companies to companies within the same industry).

Trend Analysis: Spotting the Patterns

Trend analysis involves tracking a company’s financial performance over time. By charting key financial metrics such as revenue, net income, and cash flow, we can identify trends and patterns. This is like creating a financial time-lapse video of a company’s journey. A consistent upward trend in revenue, for instance, is a good sign, while a downward trend might warrant a closer look. Trend analysis helps us predict future performance and assess the effectiveness of a company’s strategies. It’s crucial to use consistent accounting methods and adjust for inflation when performing trend analysis across multiple years, to avoid drawing inaccurate conclusions from apples-to-oranges comparisons.

Trend Analysis Steps

First, gather the financial statements for the desired period. Second, select the key financial metrics you want to analyze. Third, plot these metrics on a graph or chart. Finally, analyze the trends. Are there any significant upward or downward trends? Are there any points of inflection? This analysis helps to identify whether the company’s financial performance is improving, deteriorating, or remaining stable.

Comparing Financial Health Evaluation Methods

Several methods exist to assess a company’s financial health, each focusing on different aspects. Profitability ratios measure a company’s ability to generate profits, liquidity ratios assess its ability to meet short-term obligations, and solvency ratios examine its ability to meet long-term obligations. Each type of ratio provides a unique perspective, and a holistic assessment requires considering all three. For example, a company might have high profitability but low liquidity, suggesting it’s profitable but struggles with cash flow management. This highlights the importance of a comprehensive analysis that doesn’t just focus on one aspect of financial health. It’s like examining a car – you wouldn’t just look at the engine; you’d check the tires, brakes, and everything else too!

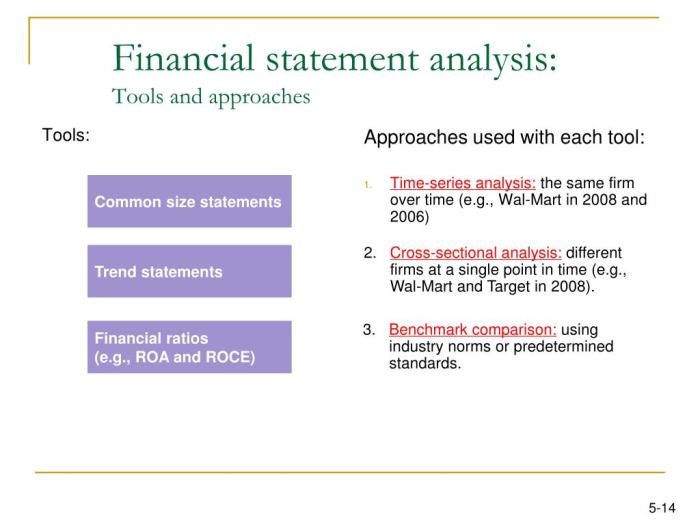

Vertical and Horizontal Analysis: A Step-by-Step Guide

Vertical analysis expresses each line item on a financial statement as a percentage of a base figure. For the income statement, the base is usually revenue; for the balance sheet, it’s usually total assets. This allows for comparisons across different companies or time periods, even if their sizes differ significantly. Horizontal analysis, on the other hand, compares each line item across different periods, showing the percentage change from one year to the next. This reveals trends in the company’s financial performance. Think of vertical analysis as a snapshot, and horizontal analysis as a movie.

Vertical Analysis Steps

First, obtain the company’s financial statements. Second, choose a base figure (revenue for the income statement, total assets for the balance sheet). Third, divide each line item by the base figure and multiply by 100 to express it as a percentage.

Horizontal Analysis Steps

First, obtain the company’s financial statements for multiple periods. Second, select the base period (usually the earliest period). Third, for each line item, calculate the percentage change from the base period to each subsequent period using the formula:

[(Current Year Value – Base Year Value) / Base Year Value] * 100

.

Applications Across Industries

Financial statement analysis tools aren’t just for accountants hiding in dimly lit offices; they’re the unsung heroes of countless industries, quietly powering better decisions and – let’s be honest – preventing some spectacular financial meltdowns. These tools, armed with ratios and metrics, offer insights that go far beyond the balance sheet’s dry numbers, transforming data into actionable intelligence. Their applications are as diverse as the industries themselves, revealing hidden strengths and weaknesses with the precision of a seasoned financial detective.

The versatility of these tools shines through in their applications across various sectors, providing invaluable insights for strategic planning, risk management, and performance evaluation. From the bustling world of retail to the intricate workings of the banking sector, their impact is undeniable.

Financial Statement Analysis in Banking

The banking industry, a realm of intricate transactions and substantial risk, relies heavily on financial statement analysis. Banks utilize these tools to assess the creditworthiness of loan applicants, scrutinizing financial statements to identify potential red flags and evaluate the borrower’s ability to repay. For instance, a bank might use the debt-to-equity ratio to determine a company’s financial leverage and assess its risk profile. A high debt-to-equity ratio could indicate a higher risk of default, prompting the bank to adjust lending terms or decline the loan application. Similarly, analyzing profitability ratios like Return on Assets (ROA) and Return on Equity (ROE) helps banks understand the financial health and performance of their clients, informing lending decisions and risk management strategies. Sophisticated models incorporating various financial ratios, combined with macroeconomic indicators, are commonly used to predict default probabilities.

Financial Statement Analysis in Manufacturing

In the manufacturing sector, financial statement analysis plays a crucial role in evaluating operational efficiency, cost management, and overall profitability. For example, companies might use tools to analyze inventory turnover ratios to identify potential issues with inventory management. A slow inventory turnover could indicate obsolete inventory or inefficient production processes, prompting management to investigate and implement corrective measures. Similarly, the analysis of production costs and gross profit margins helps manufacturers identify areas for cost reduction and process improvement. By analyzing these metrics over time, manufacturers can track their progress and make informed decisions about pricing strategies, production capacity, and resource allocation. Identifying trends and comparing performance against industry benchmarks allows for strategic planning and competitive advantage.

Financial Statement Analysis in Retail

The retail industry, characterized by high competition and fluctuating consumer demand, benefits significantly from robust financial statement analysis. Retailers use these tools to assess the effectiveness of their marketing campaigns, track sales trends, and manage inventory levels. For example, the analysis of sales growth, gross profit margin, and inventory turnover provides insights into the efficiency of operations and the effectiveness of pricing strategies. Furthermore, retailers use financial statement analysis to evaluate the profitability of individual stores or product lines, allowing for data-driven decisions on store closures, product discontinuation, or resource allocation. Analyzing customer data alongside financial statements provides a holistic view of performance and customer behavior, informing future marketing and operational strategies.

Financial Statement Analysis in Investment Analysis

Investment analysts are the Sherlock Holmes of the financial world, and financial statement analysis is their magnifying glass. They meticulously examine a company’s financial statements to evaluate its profitability, solvency, and overall investment potential. Ratios like the Price-to-Earnings (P/E) ratio, which compares a company’s stock price to its earnings per share, are crucial for determining whether a stock is overvalued or undervalued. Analyzing cash flow statements helps investors assess a company’s ability to generate cash, pay dividends, and fund future growth. By comparing a company’s financial performance to its peers and industry benchmarks, investors can make more informed decisions about investment opportunities. Analyzing trends over several years can also provide insights into the company’s long-term sustainability and growth potential.

Financial Statement Analysis in Credit Risk Assessment

Credit risk assessment is all about predicting the likelihood of a borrower defaulting on a loan. Financial statement analysis plays a pivotal role in this process, helping lenders assess the borrower’s financial health and ability to repay the debt. Credit scoring models often incorporate various financial ratios, such as the debt-to-income ratio, to quantify the risk associated with a particular loan application. By analyzing a company’s financial statements, lenders can identify potential risks, such as high leverage, declining profitability, or deteriorating cash flow. This information is crucial in determining appropriate lending terms, setting interest rates, and mitigating potential losses. Sophisticated models, incorporating both quantitative and qualitative factors, are used to predict default probabilities and inform credit decisions.

Financial Statement Analysis for Internal Management and Performance Evaluation

Beyond external stakeholders, financial statement analysis is a vital tool for internal management and performance evaluation. Companies use these tools to monitor their financial performance, track progress towards strategic goals, and identify areas for improvement. Analyzing key performance indicators (KPIs) derived from financial statements allows management to assess the effectiveness of various business strategies and operational processes. By comparing actual performance to budgets and forecasts, management can identify variances and take corrective actions. Regular internal analysis helps companies stay financially healthy, adapt to market changes, and achieve long-term success. This internal focus ensures efficient resource allocation and informed strategic decision-making.

Limitations and Considerations

Financial statement analysis tools, while incredibly powerful, aren’t magic eight-balls that predict the future of a company with 100% accuracy. Like any analytical tool, they have limitations and require careful interpretation to avoid drawing misleading conclusions. Remember, numbers only tell part of the story; the rest is woven into the fabric of qualitative factors and potential pitfalls.

Interpreting the output of these tools requires a healthy dose of skepticism and a deep understanding of the underlying business. Relying solely on quantitative data can be as perilous as navigating a minefield blindfolded – you might find some treasures, but you’re also likely to stumble upon some nasty surprises.

Qualitative Factors and Their Importance

Quantitative data from financial statements provides a numerical snapshot of a company’s performance. However, ignoring qualitative factors is akin to judging a book by its cover – you might miss the compelling narrative within. These qualitative factors, such as management quality, industry trends, competitive landscape, and regulatory environment, provide crucial context for interpreting the numbers. For example, a company with strong financial ratios might still be facing a significant threat from disruptive technologies, rendering those positive numbers less meaningful in the long run. A seemingly successful company might be masking underlying problems through aggressive accounting practices, which quantitative analysis alone might not reveal.

Best Practices for Interpreting Results

Effective interpretation involves a multi-faceted approach. Firstly, always compare the company’s financial performance to its industry peers. Using benchmarks allows for a more objective assessment. Secondly, analyze trends over time. A single year’s performance might be an outlier; examining several years reveals more consistent patterns. Thirdly, consider the economic climate. A company’s performance during a recession might look different than during an economic boom. Finally, and perhaps most importantly, cross-reference the quantitative data with available qualitative information to gain a holistic view. This could include news articles, industry reports, and management discussions and analyses.

Potential Sources of Error or Bias

The accuracy of financial statement analysis hinges on the reliability of the underlying data. Several factors can introduce errors or bias:

- Accounting Practices: Different companies may use different accounting methods, making direct comparisons challenging. For example, one company might use LIFO (Last-In, First-Out) inventory accounting while another uses FIFO (First-In, First-Out), leading to significant differences in reported cost of goods sold and inventory values.

- Management Manipulation: Companies might engage in earnings management to present a more favorable picture to investors. This can involve aggressive revenue recognition or creative accounting practices.

- Data Errors and Omissions: Simple mistakes in data entry or reporting can significantly distort the analysis. Missing data points can also hinder a comprehensive assessment.

- Analyst Bias: Analysts might unconsciously favor certain companies or industries, leading to biased interpretations of financial data. A strong understanding of one’s own biases is crucial to mitigating this risk.

- External Factors: Unforeseen events like natural disasters or economic downturns can significantly impact a company’s financial performance, making it difficult to isolate the impact of internal management decisions.

Future Trends and Developments: Financial Statement Analysis Tools

The world of financial statement analysis is anything but static; it’s a dynamic landscape constantly reshaped by technological advancements and evolving business needs. Just as the abacus gave way to the spreadsheet, we’re witnessing a breathtaking evolution in the tools used to dissect company finances. Prepare yourselves for a future where algorithms do the heavy lifting, freeing up analysts to focus on the truly strategic aspects of financial decision-making.

The integration of cutting-edge technologies promises to revolutionize how we analyze financial data, making the process faster, more accurate, and – dare we say it – even enjoyable. This isn’t just about making existing processes more efficient; it’s about unlocking entirely new levels of insight and predictive power.

The Impact of Artificial Intelligence and Machine Learning, Financial Statement Analysis Tools

AI and machine learning are poised to transform financial statement analysis by automating tedious tasks, identifying patterns invisible to the human eye, and generating predictive models with unprecedented accuracy. Imagine a software that not only flags potential red flags in a company’s balance sheet but also predicts the likelihood of a default based on thousands of historical data points and complex algorithms. This is no longer science fiction; companies like Moody’s and S&P are already incorporating AI into their credit rating models, improving their accuracy and efficiency. These algorithms can sift through vast datasets to uncover subtle correlations between financial metrics and future performance, helping investors and analysts make more informed decisions. For example, an AI-powered tool might identify a previously unnoticed trend in a company’s inventory turnover that signals a potential slowdown in sales, well before it shows up in official reports. This predictive capability represents a significant leap forward in proactive risk management.

The Role of Big Data and Cloud Computing

The sheer volume of financial data available today is staggering. Big data technologies, coupled with the scalability of cloud computing, are essential for handling this deluge of information effectively. Cloud-based platforms provide the necessary infrastructure to store, process, and analyze massive datasets, enabling sophisticated analytics that were previously impractical. Imagine accessing real-time financial data from thousands of companies globally, instantly comparing their performance metrics, and generating interactive visualizations—all from a single, user-friendly interface. This real-time access to comprehensive data is not merely convenient; it’s crucial for making timely investment decisions in today’s rapidly changing markets. The ability to perform complex simulations and stress tests on financial models becomes significantly easier and more efficient with the power of big data and cloud computing.

A Hypothetical Innovative Feature

Let’s imagine a future financial statement analysis tool with a feature called “Scenario Planner Pro.” This tool would go beyond simple what-if analysis. It would use AI to generate multiple plausible future scenarios for a company based on various macroeconomic factors, industry trends, and company-specific data. For each scenario, it would provide a detailed projection of key financial metrics, highlighting potential risks and opportunities. For example, it might model the impact of a sudden interest rate hike on a particular company’s profitability, showing different outcomes based on the company’s debt structure and other variables. This would empower analysts to develop more robust and nuanced strategies, mitigating risks and maximizing potential returns. It would also provide a clear visual representation of the potential outcomes, making complex information easily understandable, even for those without extensive financial expertise. Essentially, it would transform financial forecasting from a somewhat hazy art into a more precise and data-driven science.

Last Recap

From unraveling the mysteries of profitability ratios to predicting future financial performance, financial statement analysis tools have emerged as indispensable assets for businesses of all sizes. While these tools offer powerful capabilities, remember that they are but one piece of the puzzle. A balanced approach, incorporating qualitative factors alongside quantitative data, remains crucial for sound financial decision-making. So, embrace the power of these tools, but always remember to exercise your own financial acumen – your business’s future depends on it!

User Queries

What is the difference between vertical and horizontal analysis?

Vertical analysis compares line items within a single financial statement (e.g., expressing each line item as a percentage of total revenue on the income statement). Horizontal analysis compares line items across multiple periods (e.g., showing the percentage change in revenue from one year to the next).

Are these tools suitable for small businesses?

Absolutely! Many tools offer tiered pricing plans, catering to businesses of all sizes. Even basic tools can significantly improve financial oversight for smaller enterprises.

Can these tools predict the future with certainty?

No tool can predict the future with absolute certainty. However, advanced features like forecasting and scenario planning allow for more informed projections based on historical data and various assumptions.

What about data security and privacy?

Reputable financial analysis tools prioritize data security and comply with relevant regulations. Always check a tool’s security protocols and privacy policy before using it.