Anti-Money Laundering Regulations: Ever wondered how the world’s most sophisticated criminals try to hide their ill-gotten gains? This isn’t your grandpappy’s bank robbery; we’re talking intricate webs of shell corporations, offshore accounts, and cryptocurrency transactions – all designed to make Scrooge McDuck look like a penny-pincher. This guide navigates the surprisingly funny world of preventing money laundering, exploring the regulations, the technology, and the sheer audacity of those who try to outsmart the system. Buckle up, it’s going to be a wild ride!

From understanding Know Your Customer (KYC) procedures – which are basically like super-powered background checks – to navigating the complexities of Suspicious Activity Reporting (SAR), we’ll delve into the essential elements of AML compliance. We’ll even explore the increasingly important role of technology in combating financial crime, including the use of AI – which, let’s be honest, is probably more likely to catch a typo than a mastermind criminal.

Overview of Anti-Money Laundering (AML) Regulations: Anti-Money Laundering Regulations

The world of finance, it turns out, isn’t just about making money; it’s also about preventing the *wrong* kind of money from entering the system. Enter Anti-Money Laundering (AML) regulations, the unsung heroes of financial integrity. These regulations are a global effort to combat the insidious practice of money laundering, a process that essentially cleans dirty money, making it look legitimate. Think of it as a high-stakes game of financial hide-and-seek, with AML regulations acting as the ever-vigilant referee.

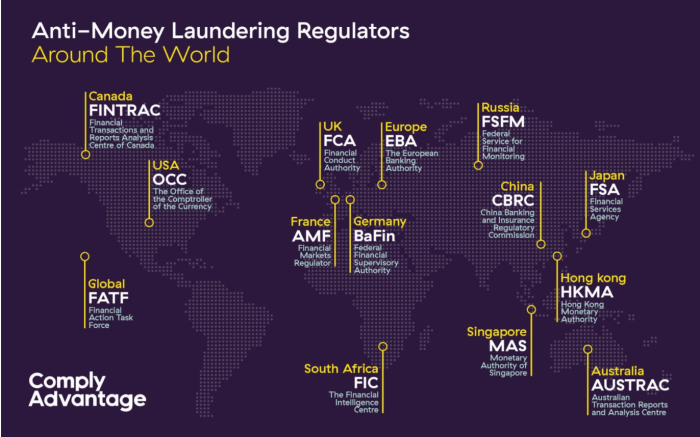

AML regulations didn’t spring up overnight. Their history is a fascinating (and slightly dramatic) journey, fueled by escalating concerns about drug trafficking, terrorism financing, and other illicit activities. Early efforts were fragmented and lacked global coordination, leading to a patchwork of national laws. However, international cooperation, driven by organizations like the Financial Action Task Force (FATF), has led to a more harmonized approach, albeit with regional variations. The fight against money laundering is an ongoing battle, with regulations constantly evolving to stay ahead of the ever-changing tactics of criminals.

Key Objectives of AML Compliance Programs

The primary goal of AML compliance programs is simple: to prevent the financial system from being used to launder money or finance terrorism. This involves a multi-pronged approach that includes robust customer due diligence (CDD), transaction monitoring, suspicious activity reporting (SAR), and employee training. Think of it as a sophisticated security system designed to identify and flag potentially suspicious activities. Effective AML compliance is not just about ticking boxes; it’s about building a culture of vigilance and responsibility within a financial institution. A robust AML program acts as a deterrent, making it harder for criminals to operate within the legitimate financial system.

Consequences of Non-Compliance with AML Regulations

Failing to comply with AML regulations can lead to a range of serious consequences, from hefty fines and reputational damage to criminal prosecution. The penalties can be financially crippling for institutions, and the reputational damage can be long-lasting. Imagine the headlines: “[Financial Institution Name] Accused of Facilitating Money Laundering!” Not exactly a positive brand endorsement. Beyond the financial penalties, the legal ramifications can be severe, leading to criminal charges against individuals and institutions. It’s a costly game of chance with very high stakes – and the odds are definitely not in favor of non-compliance. For example, in 2012, HSBC Holdings plc was fined $1.9 billion by US authorities for failing to prevent money laundering.

Comparison of AML Regulations Across Jurisdictions, Anti-Money Laundering Regulations

The specifics of AML regulations vary across jurisdictions, reflecting different legal systems and priorities. However, the underlying principles remain consistent. The following table offers a simplified comparison of AML regulations in the USA, UK, and EU. Note that this is a high-level overview and does not cover all aspects of these complex regulations.

| Jurisdiction | Key Legislation | Supervisory Authority | Notable Features |

|---|---|---|---|

| USA | Bank Secrecy Act (BSA), USA PATRIOT Act | Financial Crimes Enforcement Network (FinCEN) | Strong emphasis on customer due diligence (CDD) and suspicious activity reporting (SAR). Significant penalties for non-compliance. |

| UK | Proceeds of Crime Act 2002 | Financial Conduct Authority (FCA), HM Revenue & Customs (HMRC) | Focus on risk-based approach to AML compliance. Emphasis on collaboration between financial institutions and law enforcement. |

| EU | Anti-Money Laundering Directive (AMLD) | Various national authorities | Harmonization of AML regulations across member states. Focus on combating money laundering and terrorist financing. |

Know Your Customer (KYC) Procedures

Knowing your customer—it sounds simple, right? Like a friendly chat over coffee. But in the thrilling world of anti-money laundering, KYC is a serious business, a carefully choreographed dance between compliance and customer service. Think of it as a high-stakes game of “Spot the Suspicious Character,” where the stakes are millions (or billions!) of dollars.

KYC procedures are the bedrock of any effective AML program. They’re the first line of defense against financial criminals attempting to launder their ill-gotten gains, transforming dirty money into seemingly legitimate funds. A robust KYC program helps financial institutions identify and mitigate risks associated with money laundering, terrorist financing, and other illicit activities. It’s less about being nosy and more about being diligently cautious.

Core Components of a Robust KYC Program

A truly effective KYC program isn’t a one-size-fits-all affair. It’s a dynamic process that requires a combination of elements, working together like a well-oiled (and highly regulated) machine. These core components ensure a comprehensive approach to identifying and verifying customer identities and activities. Think of it as a multi-layered security system, protecting against a variety of threats. A weak link in the chain could compromise the entire system.

- Customer Identification Program (CIP): This involves establishing the identity of a customer using reliable, independent sources of information. This might include verifying a passport, driver’s license, or national ID card.

- Risk Assessment: This crucial step involves evaluating the risk posed by each customer based on factors such as their location, business activities, and transaction patterns. High-risk customers may require more intensive scrutiny.

- Ongoing Monitoring: KYC isn’t a one-time event. Ongoing monitoring involves continuously reviewing customer activity to detect any suspicious patterns or transactions. It’s like having a watchful eye on your accounts, always on the lookout for unusual behavior.

- Record Keeping: Maintaining accurate and up-to-date records of all KYC procedures and customer information is paramount. This is essential for audits and investigations. Think of it as your detailed, meticulously maintained ledger of customer interactions.

Customer Due Diligence (CDD) Levels

Customer Due Diligence (CDD) isn’t a one-size-fits-all approach. The level of scrutiny applied depends on the inherent risk associated with the customer and their activities. Think of it as a sliding scale of investigation, with low-risk customers receiving a quick once-over, and high-risk customers facing a more thorough investigation.

- Simplified Due Diligence (SDD): Applied to low-risk customers, SDD involves a streamlined approach to customer identification and verification. Think of it as a quick check-in, ensuring the basics are covered.

- Standard Due Diligence (CDD): This is the standard level of due diligence for most customers, involving a more thorough assessment of their identity, background, and activities. This is the standard procedure for the average customer.

- Enhanced Due Diligence (EDD): Reserved for high-risk customers, EDD involves a significantly more rigorous investigation, often involving independent verification of information and ongoing monitoring. Think of it as a thorough background check, leaving no stone unturned.

Documentation Required for Customer Verification

The types of documentation required for customer verification can vary depending on the jurisdiction and the risk level of the customer. However, some common documents include:

- Government-issued identification: Passport, driver’s license, national ID card. These are your primary pieces of evidence, proving who the customer is.

- Proof of address: Utility bill, bank statement, rental agreement. This helps verify where the customer resides.

- Business registration documents: Articles of incorporation, business license. Required for businesses and corporate entities.

- Beneficial ownership information: Details about the ultimate owners of a business. This is crucial for transparency and identifying potential hidden owners.

KYC Onboarding Process Flowchart

Imagine a flowchart, a visual representation of the steps involved in onboarding a new client. It begins with the client application, moves through various verification steps, and concludes with account activation. Each step represents a crucial checkpoint, ensuring compliance and accuracy. This is a simplified example, and the specific steps might vary depending on the institution and the risk level of the client.

(Descriptive Text instead of actual flowchart image): The flowchart would start with a “Client Application Received” box, leading to a “Customer Identification Verification” box (requiring government-issued ID and proof of address). This would then branch to a “Risk Assessment” box, determining whether Simplified, Standard, or Enhanced Due Diligence is required. Each branch would lead to its own set of verification steps (e.g., additional documentation checks for EDD). Following successful verification, a “Compliance Review” box would be next, followed by “Account Activation” and finally, “Ongoing Monitoring.” Any failure at any stage would lead to a “Rejection” box.

Suspicious Activity Reporting (SAR)

Filing a Suspicious Activity Report (SAR) isn’t exactly a walk in the park, but it’s a crucial part of the fight against money laundering. Think of it as being a financial crime-fighting superhero, albeit one who fills out rather lengthy forms. The process is designed to alert authorities to potentially illegal activities, allowing them to investigate and, hopefully, bring the bad guys to justice (and recover some of that ill-gotten loot!).

SARs are filed when financial institutions detect transactions or activities that appear suspicious and potentially linked to money laundering, terrorist financing, or other financial crimes. The criteria for filing are fairly broad, emphasizing the importance of reporting anything that raises even a slight red flag. It’s better to err on the side of caution; after all, a false positive is far less damaging than missing a genuine case of financial skullduggery.

SAR Filing Criteria

The decision to file a SAR hinges on a variety of factors, but essentially, it boils down to whether the transaction or activity deviates significantly from the customer’s established pattern of behavior or raises reasonable suspicion of illegal activity. This often involves considering the amount of money involved, the frequency of transactions, the complexity of the transaction structure, and the overall context of the customer’s relationship with the institution. Think of it as a financial detective’s checklist, meticulously examining every detail.

SAR Submission Process

Submitting a SAR involves completing a standardized form provided by the relevant financial intelligence unit (FIU) – think of it as the official “report a crime” form for financial misdeeds. The form typically requires detailed information about the suspicious activity, the involved parties, and the institution’s own internal investigation into the matter. Accuracy and thoroughness are paramount. Once completed, the SAR is electronically submitted to the FIU. The process is designed to be secure and confidential, protecting both the institution and the individuals involved from potential retaliation.

Examples of Suspicious Activities

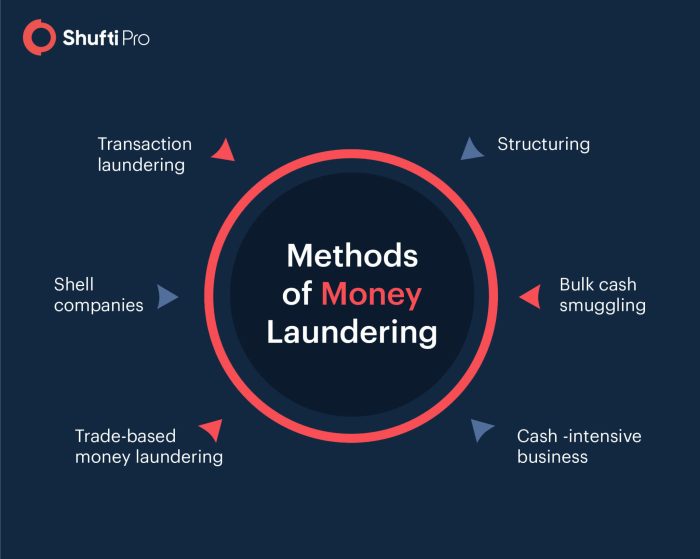

The world of financial crime is remarkably creative, but some common red flags include unusually large cash deposits, complex wire transfers involving multiple jurisdictions, and transactions that seem designed to obscure the origin or destination of funds. For example, a sudden influx of cash from an unknown source into an account with a history of small, regular transactions would definitely raise eyebrows. Similarly, a series of seemingly unrelated transactions that, when pieced together, reveal a larger pattern of suspicious activity would warrant a SAR.

- Structuring transactions to avoid reporting thresholds (the classic “smurfing” technique).

- Using shell companies or other anonymous entities to conceal the true owners of assets.

- Engaging in unusually frequent or large international wire transfers.

- Conducting transactions that are inconsistent with the customer’s known business or financial profile.

Best Practices for Handling Suspicious Transactions

Proactive measures are key to effective AML compliance. Documenting every step of the process is crucial. Maintaining thorough records allows for a clear audit trail and aids in SAR preparation should it become necessary. Regular training for staff on AML regulations and suspicious activity identification is essential. A well-trained workforce is the first line of defense against financial crime.

- Implement a robust transaction monitoring system to automatically flag suspicious activity.

- Develop clear internal procedures for handling and investigating suspicious transactions.

- Provide regular AML training to all employees to enhance their ability to identify suspicious activity.

- Maintain detailed records of all suspicious activity investigations and SAR filings.

AML Compliance Technologies and Tools

The world of Anti-Money Laundering (AML) compliance isn’t exactly known for its thrilling action sequences, but the technology used to fight financial crime is surprisingly sophisticated – and sometimes, hilariously complex. Think of it as a high-stakes game of digital whack-a-mole, where the moles are cunning money launderers, and the whackers are… well, very expensive software programs.

Technology plays a crucial role in AML compliance, acting as the digital Sherlocks Holmes of the financial world. It allows institutions to process vast amounts of data, identify suspicious patterns, and ultimately, prevent criminals from using the financial system for nefarious purposes. Without it, compliance would be a Sisyphean task, a never-ending battle fought with spreadsheets and weary eyes.

Transaction Monitoring Systems

Transaction monitoring systems are the workhorses of AML compliance. These systems analyze transactions in real-time or near real-time, flagging suspicious activity based on pre-defined rules and algorithms. Imagine them as tireless, data-crunching robots, scanning for red flags like unusually large transactions, frequent small transactions that add up to a large sum (think of a determined squirrel collecting acorns), or transactions involving high-risk jurisdictions. Different systems vary in their sophistication, some using simple rule-based approaches, while others employ more advanced techniques like machine learning to identify complex patterns that might otherwise go unnoticed. For example, a system might flag a series of seemingly innocuous transactions that, when viewed together, suggest money laundering. This is where the “aha!” moment comes in, and the investigators get to put on their detective hats.

KYC Platforms

Know Your Customer (KYC) platforms automate the process of verifying customer identities. These systems streamline the often tedious task of collecting and verifying identification documents, comparing them against sanction lists and other databases. They can also help to manage the ongoing monitoring of customer relationships, ensuring that institutions stay on top of any changes that might increase their risk exposure. Think of these platforms as highly efficient digital receptionists, diligently checking IDs and ensuring only legitimate clients are allowed entry into the financial system. One example is a system that automatically verifies a customer’s address by cross-referencing it with multiple data sources, eliminating the need for manual verification.

Comparison of AML Technologies

Transaction monitoring systems focus on the *flow* of money, identifying suspicious patterns in transactions. KYC platforms focus on the *source* of the money, verifying the identities of customers and ensuring they are not involved in illicit activities. While distinct, these technologies are often integrated, creating a comprehensive AML compliance solution. A strong KYC process reduces the workload on the transaction monitoring system by filtering out lower-risk customers. Conversely, a robust transaction monitoring system can highlight suspicious activity that might warrant further KYC scrutiny. It’s a beautiful synergy, a technological ballet of AML compliance.

Advantages and Disadvantages of AI in AML Compliance

The use of Artificial Intelligence (AI) in AML compliance is rapidly growing, offering both significant advantages and some potential drawbacks.

- Advantages:

- Improved accuracy in identifying suspicious activity: AI algorithms can analyze vast datasets and identify complex patterns that humans might miss.

- Increased efficiency: AI can automate many manual tasks, freeing up human analysts to focus on more complex cases.

- Reduced false positives: AI can be trained to reduce the number of false alarms, saving time and resources.

- Adaptability to evolving threats: AI systems can be continuously updated to adapt to new money laundering techniques.

- Disadvantages:

- High initial investment costs: Implementing AI-powered AML systems can be expensive.

- Data dependency: AI systems require large amounts of high-quality data to be effective.

- Explainability and transparency: Understanding why an AI system flagged a particular transaction can be challenging.

- Risk of bias: AI algorithms can inherit biases present in the data they are trained on, potentially leading to unfair or discriminatory outcomes.

Challenges and Emerging Trends in AML

The world of Anti-Money Laundering (AML) compliance is a thrilling rollercoaster ride – a constant game of cat and mouse between regulators, financial institutions, and the ever-evolving ingenuity of criminals. While the goal remains simple (stop the bad guys from hiding their ill-gotten gains), the methods required are anything but. Let’s delve into the fascinating, and sometimes frustrating, challenges and trends shaping the AML landscape.

Key Challenges Faced by Organizations in Complying with AML Regulations

Meeting AML regulatory requirements presents a formidable obstacle course for organizations of all sizes. The sheer volume and complexity of regulations, varying across jurisdictions, create a significant compliance burden. This is further complicated by limited resources, particularly for smaller institutions that often lack the dedicated personnel and advanced technology needed for effective AML monitoring. Furthermore, the constant evolution of money laundering techniques requires organizations to stay perpetually vigilant, adapting their strategies to counter emerging threats. The cost of compliance, including software, training, and ongoing monitoring, can also be substantial, placing a strain on budgets. Finally, maintaining a balance between robust compliance and the need to avoid disrupting legitimate business operations is a delicate act of high-wire walking.

The Impact of Emerging Technologies on AML Compliance

The rise of cryptocurrencies and other decentralized technologies has dramatically altered the AML landscape. These technologies offer anonymity and speed, making them attractive tools for money launderers. The decentralized and borderless nature of cryptocurrencies poses significant challenges for traditional AML monitoring systems, which are often designed for centralized financial systems. Tracking transactions across multiple blockchains and exchanges requires sophisticated technology and international collaboration. Furthermore, the use of anonymizing tools and mixers further complicates the task of identifying suspicious activity. While blockchain technology itself offers potential for enhanced transparency, its effective use in AML compliance requires innovative solutions and a global effort to establish clear regulatory frameworks.

The Evolving Nature of Financial Crime and its Implications for AML Strategies

Financial crime is a constantly evolving beast, adapting and innovating to stay ahead of the curve. The methods used by criminals are becoming increasingly sophisticated, employing techniques such as layering, smurfing, and the use of shell corporations to obscure the origin and destination of funds. The rise of cybercrime and online fraud further complicates the picture, creating new avenues for money laundering and other illicit activities. This necessitates a dynamic and proactive approach to AML compliance, requiring organizations to constantly update their strategies and technologies to counter emerging threats. For example, the increase in ransomware attacks, which often result in the laundering of cryptocurrency payments, necessitates a deeper understanding of this intersection of cybercrime and AML.

The Effects of Regulatory Changes on AML Compliance Programs

Regulatory changes are a constant feature of the AML landscape, reflecting the ongoing battle against financial crime. These changes can range from minor updates to significant overhauls of existing regulations, requiring organizations to adapt their compliance programs accordingly. The implementation of new regulations often requires significant investment in technology, training, and personnel, adding to the already substantial cost of compliance. Furthermore, the lack of harmonization across different jurisdictions can create confusion and inconsistencies, making it challenging for organizations operating in multiple countries to maintain consistent compliance. For instance, the introduction of new sanctions regimes or changes to customer due diligence requirements necessitate immediate and thorough adjustments to internal procedures.

Sanctions Compliance and AML

The relationship between sanctions compliance and anti-money laundering (AML) is as close as a pair of well-worn slippers – practically inseparable. Both aim to prevent illicit financial activity, but sanctions compliance focuses on preventing the flow of funds to sanctioned entities or individuals, while AML targets the broader spectrum of money laundering schemes, some of which might involve sanctioned parties. Think of sanctions compliance as a specialized subset of AML, a particularly grumpy uncle within the larger, boisterous AML family.

Sanctions compliance and AML regulations often overlap, requiring financial institutions to implement robust due diligence procedures to identify and prevent transactions involving sanctioned individuals or entities. Failing to do so can lead to significant financial penalties and reputational damage – a situation far less fun than a board game night gone wrong.

Customer Screening Against Sanctions Lists

The process of screening customers against sanctions lists involves using specialized software to compare customer data (names, addresses, dates of birth, etc.) against regularly updated lists maintained by various international organizations and government agencies, such as the Office of Foreign Assets Control (OFAC) in the United States, the European Union, and the United Nations. This process, while seemingly straightforward, requires careful attention to detail, as slight variations in spelling or aliases can lead to missed matches. Imagine trying to find a needle in a haystack, only the haystack is made of millions of meticulously-recorded names and addresses. It’s a job that requires both precision and patience. A false negative (missing a sanctioned individual) is far more problematic than a false positive (flagging an innocent individual).

Examples of Sanctions Violations and Consequences

Violating sanctions can result in severe penalties. For example, a bank that knowingly processed a transaction for a sanctioned individual could face hefty fines, criminal charges against its officers, and even the suspension or revocation of its operating license. In one memorable case, a large financial institution paid billions of dollars in fines for violating sanctions against certain countries. Their celebratory Christmas party that year was noticeably smaller. Other examples include individuals facing criminal prosecution for evading sanctions, or companies losing contracts and facing reputational damage. The consequences can be financially crippling and professionally devastating.

Types of Sanctions and Their Implications

| Sanctions Type | Description | Implications for Financial Institutions | Implications for Individuals/Entities |

|---|---|---|---|

| Embargoes | Prohibition of trade or other commercial activities with a specific country or region. | Inability to process transactions related to the embargoed country; potential fines and legal action. | Restrictions on trade, travel, and financial transactions; potential criminal charges. |

| Targeted Sanctions | Restrictions imposed on specific individuals, entities, or groups, often linked to terrorism, human rights abuses, or proliferation of weapons. | Obligation to screen customers against sanctions lists; potential fines for non-compliance. | Asset freezes, travel bans, and restrictions on financial transactions. |

| Sectoral Sanctions | Restrictions targeting specific industries or sectors within a country, such as oil or banking. | Restrictions on transactions with entities in the targeted sectors; potential reputational damage. | Limited access to international markets and financing. |

| Arms Embargoes | Prohibition on the export or import of weapons and related materials. | Strict compliance requirements regarding the transportation and financing of arms-related transactions; severe penalties for non-compliance. | Restrictions on acquiring and selling weapons; potential criminal charges. |

AML Training and Employee Awareness

Let’s face it, nobody wants to spend their Friday afternoon learning about money laundering. But ensuring your employees are AML-savvy isn’t just about ticking boxes; it’s about protecting your business from hefty fines, reputational damage, and the general unpleasantness of a regulatory investigation. Think of it as a thrilling adventure in compliance – the stakes are high, but the rewards (avoiding a financial catastrophe) are even higher.

Effective AML training is the bedrock of a robust compliance program. It equips employees with the knowledge and skills to identify, report, and prevent money laundering activities. A well-trained workforce is your first line of defense against financial crime, acting as vigilant guardians of your institution’s financial integrity. Ignoring this crucial aspect is like leaving the front door unlocked – you’re practically inviting trouble.

Key Topics Covered in AML Training Programs

A comprehensive AML training program should cover a range of crucial topics, going beyond the basics and delving into practical applications. This ensures that employees are not only aware of the regulations but also capable of applying their knowledge in real-world scenarios. It’s not enough to simply know the rules; you need to know how to use them.

- Overview of AML Regulations: A refresher on the legal framework, including specific acts and regulations relevant to the institution’s operations and jurisdiction. This section shouldn’t just be a dry recitation of the law; it should highlight the practical implications of non-compliance.

- Know Your Customer (KYC) Procedures: Detailed explanation of KYC principles, including customer due diligence, enhanced due diligence for high-risk customers, and ongoing monitoring. This section should include practical examples of identifying suspicious activities, such as unusually large transactions or inconsistencies in customer information.

- Suspicious Activity Reporting (SAR): A thorough guide on recognizing suspicious transactions and filing accurate and timely SARs. This includes understanding the reporting thresholds, the required information, and the potential consequences of failing to report suspicious activity. Think of this as your institution’s “emergency button” for financial crime.

- AML Compliance Technologies and Tools: An introduction to the various technologies used to monitor transactions and detect suspicious activity. This section should include a demonstration of the institution’s specific AML software and tools, emphasizing their practical use in day-to-day operations.

- Sanctions Compliance and AML: A discussion on the intersection of AML and sanctions compliance, highlighting the importance of screening customers against sanctions lists and the procedures for handling sanctioned individuals or entities. This isn’t just about avoiding fines; it’s about upholding ethical standards and contributing to global security.

Effective AML Training Methods

Simply lecturing employees on AML regulations is unlikely to foster genuine understanding and retention. Effective training utilizes diverse methods to cater to different learning styles and keep employees engaged. Think of it as a theatrical production – you need a compelling plot, memorable characters (the regulations!), and a satisfying resolution (compliance!).

- Interactive Workshops: Hands-on sessions with case studies, role-playing, and group discussions to reinforce learning and promote active participation. Think of this as a collaborative detective game – everyone works together to solve the “mystery” of suspicious transactions.

- E-learning Modules: Online courses with interactive elements, quizzes, and progress tracking to provide flexible and accessible learning. This is your 24/7 compliance academy – accessible anytime, anywhere.

- Scenario-Based Training: Presenting employees with realistic scenarios involving suspicious activity to test their knowledge and decision-making skills. This is like a compliance fire drill – preparing employees for real-world situations.

- Regular Refresher Courses: Periodic updates on new regulations, emerging threats, and best practices to keep employees’ knowledge current and relevant. Think of this as a compliance tune-up – keeping the machine running smoothly.

Sample AML Training Module: Suspicious Transaction Reporting

This module focuses on a critical aspect of AML compliance: recognizing and reporting suspicious transactions. It uses a scenario-based approach to engage learners and enhance their understanding of practical application.

| Scenario | Suspicious Indicators | Action Required |

|---|---|---|

| A customer deposits $50,000 in cash, a significant increase from their usual transactions, with no clear explanation for the source of funds. | Large cash deposit, unusual activity for the customer, lack of explanation for the source of funds. | File a SAR, conduct enhanced due diligence. |

| A series of small transactions, totaling $100,000, are made from different accounts to a single beneficiary, followed by a large wire transfer to an offshore account. | Structuring (smurfing), unusual activity pattern, transfer to a high-risk jurisdiction. | File a SAR, investigate further, potentially freeze the accounts. |

| A customer attempts to open an account with falsified identification documents. | Identity theft, fraudulent activity. | Refuse to open the account, file a SAR, report to law enforcement. |

The Role of Financial Institutions in AML Compliance

Financial institutions, those bastions of responsible lending (mostly!), are on the front lines of the fight against money laundering. Their role isn’t just about avoiding hefty fines; it’s about upholding the integrity of the global financial system and preventing the funding of illicit activities, like that time someone tried to buy a small island nation with Monopoly money (we’re not saying it happened, but…). Their responsibilities are multifaceted and require a robust, proactive approach, not just a “check-the-box” mentality.

Financial institutions have a crucial responsibility to prevent money laundering by implementing and maintaining effective AML compliance programs. This involves understanding and adhering to relevant regulations, conducting thorough due diligence on customers, and reporting suspicious activities promptly. Failure to do so can result in significant legal and reputational damage, not to mention the moral implications of inadvertently aiding nefarious activities. Think of it as being the financial world’s superhero, stopping the bad guys before they even get close to their ill-gotten gains.

Responsibilities of Financial Institutions in Preventing Money Laundering

Financial institutions are legally obligated to implement comprehensive AML programs. These programs typically include customer due diligence (CDD), transaction monitoring, suspicious activity reporting (SAR), and employee training. The specific requirements vary depending on the type of institution and its risk profile, but the core principle remains the same: know your customer and report anything fishy. Imagine a detective, but instead of chasing criminals, they’re meticulously scrutinizing transactions, looking for any hint of a money-laundering scheme.

Importance of a Strong AML Compliance Culture

A strong AML compliance culture is not just about ticking boxes; it’s about embedding AML principles into the very fabric of the institution. This requires leadership commitment, clear policies and procedures, regular training, and a system for reporting and investigating suspicious activity. A culture of compliance fosters a proactive approach, where employees feel empowered to raise concerns without fear of reprisal. This creates an environment where AML compliance is seen not as a burden, but as an integral part of the institution’s success. Think of it as a well-oiled machine, where every part works together seamlessly to prevent money laundering.

Best Practices for AML Compliance in Different Financial Institutions

Banks, for example, might utilize advanced transaction monitoring systems to identify unusual patterns in large volumes of transactions. Investment firms, on the other hand, might focus on enhanced due diligence for high-risk clients and complex transactions. Each institution must tailor its AML program to its specific risks and regulatory environment. A one-size-fits-all approach simply won’t cut it in this dynamic landscape. It’s like choosing the right tool for the job; a hammer is great for nails, but not so much for delicate surgery.

Framework for Assessing the Effectiveness of an AML Compliance Program

An effective framework for assessing AML compliance should include regular audits, independent reviews, and key risk indicators (KRIs). This allows institutions to identify weaknesses in their programs and make necessary improvements. The framework should also encompass regular testing of systems and procedures, and a mechanism for tracking and analyzing SARs. Regularly reviewing and updating the AML program based on these assessments is crucial to maintaining its effectiveness. Think of it as a regular health check-up for your AML program – keeping it healthy and strong to fight off the bad guys.

Summary

So, there you have it – a whirlwind tour of the often-absurd world of Anti-Money Laundering Regulations. While the subject matter is serious, the methods used to circumvent the regulations can be hilariously inventive. From cleverly disguised transactions to elaborate offshore schemes, the battle against money laundering is a constant game of cat and mouse. Hopefully, this guide has provided a clear, engaging, and perhaps even slightly amusing overview of this critical area of compliance. Remember, even the most cunning criminal eventually gets caught – usually by a well-placed comma in a suspicious transaction report.

FAQ Section

What happens if my company doesn’t comply with AML regulations?

The consequences can be severe, ranging from hefty fines and reputational damage to criminal charges and even imprisonment for individuals involved.

Are there any exceptions to KYC requirements?

Yes, certain low-risk transactions may be exempt, but this is usually subject to specific regulatory guidelines and internal risk assessments.

How long do I need to keep AML-related records?

Retention periods vary by jurisdiction, but typically range from five to ten years, and sometimes even longer.

What constitutes a “suspicious transaction”?

This is subjective and depends on various factors, including transaction size, frequency, customer profile, and any known links to criminal activity. Generally, anything that raises a red flag should be reported.