Microfinance Impact Analysis Report: Prepare yourselves, dear readers, for a journey into the surprisingly hilarious world of microfinance! We’ll explore the surprisingly impactful ripple effects of tiny loans, examining everything from poverty reduction (hooray!) to the unexpected environmental consequences (uh oh!). Buckle up, it’s going to be a wild ride.

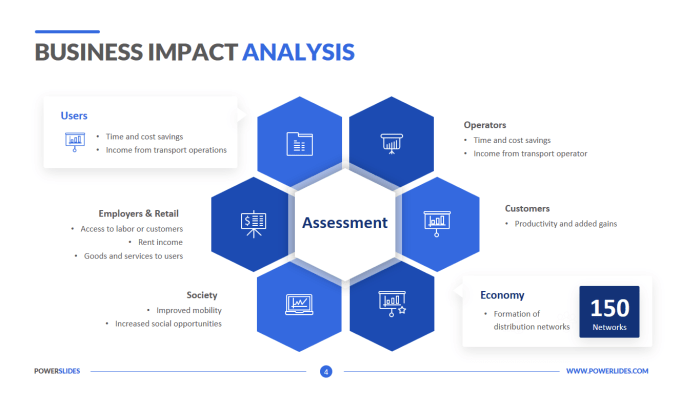

This report meticulously examines the multifaceted impacts of microfinance initiatives. We delve into the methodologies used to assess their effectiveness, dissecting both quantitative and qualitative approaches with the precision of a seasoned financial surgeon. From the economic benefits of increased income and entrepreneurship to the social empowerment of women and the surprising environmental implications, no stone will be left unturned (except maybe the really dusty ones – we’re not *that* thorough).

Introduction to Microfinance

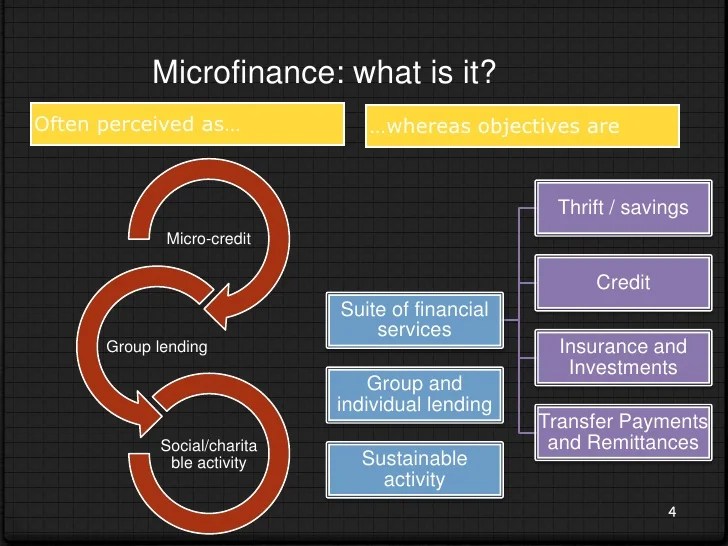

Microfinance, in its simplest form, is the provision of financial services to low-income individuals or groups who lack access to traditional banking systems. Think of it as the financial equivalent of a friendly neighborhood superhero, swooping in to save the day for those often overlooked by mainstream finance. Its core principles revolve around accessibility, affordability, and sustainability, aiming to empower individuals and communities through economic inclusion. It’s not just about handing out money; it’s about fostering self-reliance and sustainable growth.

Microfinance didn’t just magically appear; it has a fascinating history. Early forms existed for centuries, often rooted in community-based lending and rotating savings and credit associations (ROSCAs). However, the modern microfinance movement gained significant momentum in the 1970s and 80s, largely fueled by the pioneering work of Muhammad Yunus and the Grameen Bank in Bangladesh. Their success in providing small loans to impoverished women for income-generating activities demonstrated the transformative potential of microcredit, proving that even tiny loans could have a massive impact. This success sparked a global wave of microfinance initiatives, evolving from its humble beginnings to the complex and diverse landscape we see today.

Types of Microfinance Institutions and Operational Models

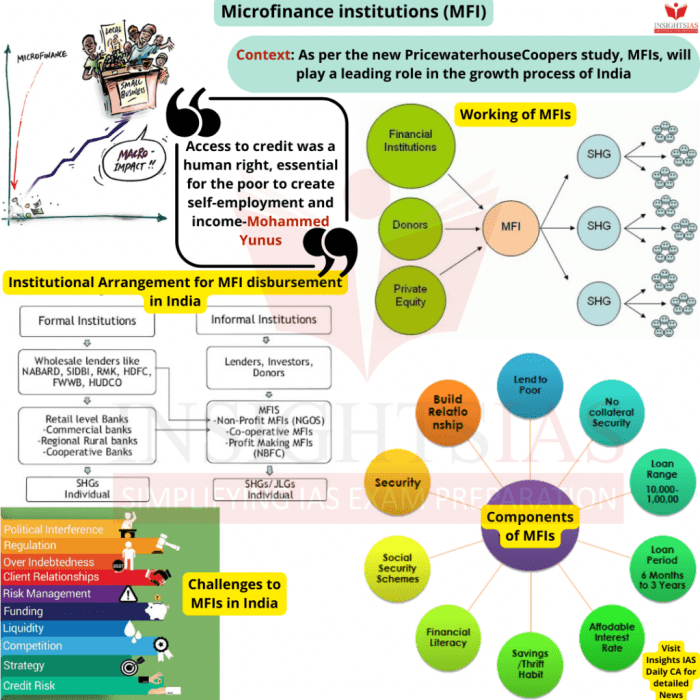

The microfinance world isn’t a monolith; it’s a vibrant ecosystem of diverse institutions operating under various models. Understanding these differences is crucial for comprehending the nuances of microfinance’s impact. These institutions range from large, internationally recognized NGOs to small, community-based organizations. They use different approaches to reach their clients and manage their operations.

- Non-Governmental Organizations (NGOs): These are often non-profit organizations that prioritize social impact over profit maximization. They frequently focus on specific development goals, such as women’s empowerment or rural development, and often utilize a participatory approach to lending and capacity building. Examples include BRAC in Bangladesh and CARE International.

- Microfinance Banks (MFBs): These are for-profit institutions regulated as banks, offering a wider range of financial services beyond just credit, such as savings accounts, insurance, and money transfers. They are often larger and more sophisticated than NGOs, with a stronger focus on financial sustainability and return on investment. Many MFBs operate in developing countries and are subject to local regulatory frameworks.

- Credit Unions/Cooperatives: These member-owned financial institutions operate on a cooperative model, with members sharing both the risks and the rewards. They often focus on building community solidarity and promoting financial literacy among their members. Credit unions offer a democratic approach to financial services, placing control in the hands of their members.

The operational models of MFIs also vary significantly. Some utilize group lending approaches, where borrowers are organized into groups and collectively responsible for loan repayments, promoting peer monitoring and social capital. Others employ individual lending models, focusing on the creditworthiness of individual borrowers. Some MFIs emphasize financial literacy training and business development services alongside credit provision, while others focus primarily on loan disbursement. The optimal model often depends on the specific context, target population, and available resources.

Methodology of Impact Assessment: Microfinance Impact Analysis Report

Evaluating the effectiveness of microfinance programs isn’t just about counting beans; it’s a delicate dance between hard numbers and nuanced human stories. Getting it right requires a multifaceted approach, a bit like assembling a particularly finicky piece of IKEA furniture – you need the right tools and a lot of patience.

This section delves into the diverse methodologies used to assess the impact of microfinance initiatives, exploring both the quantitative rigor of numbers and the qualitative richness of lived experiences. We’ll examine how these approaches complement each other, ultimately creating a more complete and insightful picture.

Approaches to Evaluating Microfinance Program Effectiveness

Several approaches exist for evaluating the effectiveness of microfinance programs, each offering unique perspectives on the impact. These methods often work best in combination, offering a more holistic understanding than any single approach could provide. Think of it as a well-rounded orchestra, where each instrument contributes to the overall harmony.

- Impact Evaluation: This approach rigorously assesses the causal link between microfinance interventions and specific outcomes, often employing econometric techniques to isolate the program’s effect. For instance, a randomized controlled trial (RCT) might compare outcomes for individuals who received microloans with those who didn’t, controlling for other factors.

- Process Evaluation: This focuses on understanding how a microfinance program is implemented and whether it’s reaching its intended target population. It might involve surveys of program staff and beneficiaries, examining program design and operational efficiency. Imagine it as a quality control check, ensuring the program is running smoothly.

- Outcome Mapping: This method tracks changes in the broader context, tracing how the program’s activities contribute to broader changes in the community. It emphasizes the indirect and long-term effects of the program, moving beyond simple loan repayment rates. This is akin to observing the ripple effects of a stone thrown into a pond.

Quantitative and Qualitative Methods for Impact Analysis

The choice between quantitative and qualitative methods isn’t an “either/or” proposition; it’s more of a “both/and” situation. Quantitative methods provide the hard data, while qualitative methods offer context and depth. They are like two sides of the same coin, essential for a complete understanding.

- Quantitative Methods: These methods use numerical data to measure impact. Examples include statistical analysis of loan repayment rates, income levels, and business growth. Think spreadsheets, graphs, and statistical software – the tools of the data-driven analyst.

- Qualitative Methods: These methods focus on understanding the experiences and perspectives of program participants. Techniques such as interviews, focus groups, and case studies provide rich insights into the social and economic changes brought about by microfinance. These are the stories behind the numbers, adding human dimension to the data.

Framework for a Comprehensive Impact Assessment

A robust impact assessment requires a well-structured framework, guiding the data collection and analysis process. This framework should be flexible enough to adapt to the specific context of the microfinance program, but it needs to be rigorous enough to ensure the results are reliable and meaningful. It’s the blueprint for our impact assessment project.

| Indicator Category | Key Indicators | Data Source |

|---|---|---|

| Financial Performance | Loan repayment rate, average loan size, interest rates, profit margins | Program records, client surveys |

| Economic Impact | Household income, business growth, employment creation, poverty reduction | Household surveys, business records |

| Social Impact | Improved health, education levels, women’s empowerment, social capital | Household surveys, focus groups, case studies |

| Environmental Impact | Resource use, pollution levels, environmental sustainability | Environmental impact assessments, observations |

Data Collection and Analysis for a Microfinance Impact Study

Data collection and analysis are the heart of any impact assessment. This process needs to be carefully planned and executed to ensure the data is reliable and the analysis is valid. Think of it as a carefully orchestrated detective investigation, piecing together clues to uncover the truth.

- Define Objectives and Indicators: Clearly articulate the research questions and identify the key indicators that will be used to measure impact.

- Develop Data Collection Instruments: Design appropriate surveys, interview guides, and data collection tools.

- Collect Data: Implement the data collection plan, ensuring data quality and integrity.

- Analyze Data: Employ appropriate statistical techniques and qualitative analysis methods to interpret the data.

- Report Findings: Clearly communicate the results of the impact assessment, including limitations and recommendations.

Economic Impacts of Microfinance

Microfinance, that delightful dance between tiny loans and monumental impact, has sparked a lively debate about its economic effects. While some sing its praises as a poverty-busting superhero, others raise a cautious eyebrow, questioning its overall effectiveness. This section, however, aims to delve into the fascinating economic consequences of microfinance, separating fact from fiction with the precision of a seasoned accountant (who also happens to enjoy a good pun).

Let’s get down to brass tacks: the economic impact of microfinance is a complex tapestry woven from threads of income generation, poverty reduction, and entrepreneurial growth. It’s not a simple case of “give a loan, get rich,” but rather a nuanced story shaped by factors like the specific context of implementation, the characteristics of the borrowers, and the overall economic climate. We’ll unravel this story, one thread at a time, providing a clear and hopefully humorous look at the economic reality.

Poverty Reduction Through Microfinance

Microfinance initiatives demonstrably contribute to poverty reduction, although the extent varies significantly depending on context. Studies show that access to credit, even in small amounts, allows individuals to invest in income-generating activities, boosting their household incomes and lifting them out of poverty. For instance, a woman in rural Bangladesh who receives a small loan might invest in chickens, increasing her egg sales and providing a more stable source of income for her family. This improved financial stability can lead to better nutrition, improved healthcare, and increased educational opportunities for children, effectively breaking the cycle of poverty. The effect isn’t magic; it’s the result of empowered individuals taking control of their financial destinies.

Income Generation and Household Welfare

The impact of microfinance on income generation and household welfare is undeniable, though it’s not always a dramatic overnight transformation. Microloans often facilitate the creation or expansion of small businesses, leading to increased income and improved living standards. This increased income can translate to better housing, improved nutrition, and greater access to essential services like healthcare and education. For example, a small loan might enable a farmer to purchase improved seeds or tools, leading to a larger harvest and higher profits. This improved income isn’t just about money; it’s about improved quality of life, reduced vulnerability to shocks, and increased household resilience.

Microfinance and Entrepreneurial Development

Microfinance plays a pivotal role in fostering entrepreneurship and business development, particularly among marginalized populations. By providing access to credit and business training, microfinance institutions empower individuals to start and grow their own businesses, creating jobs and stimulating economic activity. This is particularly important in regions with limited access to traditional financial services. The entrepreneurial spirit ignited by microfinance is not just about individual success; it’s about creating a ripple effect of economic growth and development within communities. It’s a testament to the power of small loans to unleash enormous potential.

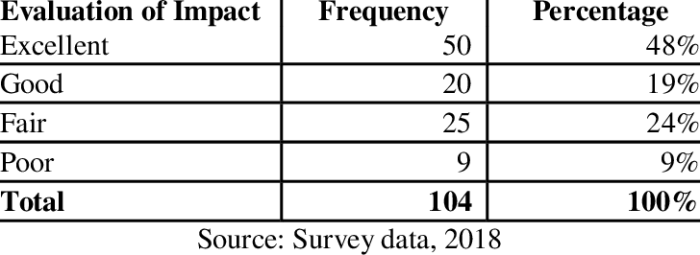

Comparative Economic Impacts of Microfinance

The economic impacts of microfinance vary considerably across different regions and demographics. The following table provides a simplified comparison, highlighting the diverse nature of its effects:

| Region/Demographic | Poverty Reduction | Income Generation | Entrepreneurial Development |

|---|---|---|---|

| Rural Bangladesh (Women) | Significant, particularly in agricultural activities | Moderate to high, depending on business type | High, leading to increased self-employment |

| Urban India (Youth) | Moderate, often supplementing existing income | Moderate, with higher potential for scaling businesses | High, with focus on service-based enterprises |

| Sub-Saharan Africa (Farmers) | Variable, highly dependent on climate and market conditions | Moderate, often focused on agricultural improvements | Moderate, with challenges related to infrastructure and market access |

| Latin America (Small Businesses) | Moderate to high, with focus on existing business expansion | High, often leading to job creation and economic growth | High, with strong potential for business scaling and innovation |

Social Impacts of Microfinance

Microfinance, while often lauded for its economic benefits, also wields a surprisingly potent social wand, weaving its magic into the fabric of communities worldwide. Its impact extends far beyond mere monetary gains, subtly yet significantly altering social structures and improving lives in ways that are both heartwarming and, dare we say, occasionally hilarious (in a good way, of course!). Let’s delve into the unexpectedly delightful social consequences.

Women’s Empowerment Through Microfinance

Microfinance initiatives frequently target women, who often lack access to traditional financial services. Providing them with small loans empowers them economically, granting them a level of financial independence that ripples outwards, affecting their families and communities. This newfound autonomy allows women to participate more fully in decision-making processes within their households, challenging traditional gender roles and fostering a more equitable dynamic. The increased income often translates to better nutrition, healthcare, and educational opportunities for their children – a triple win that would make even the most seasoned superhero envious. For example, studies in Bangladesh have shown a marked increase in women’s self-confidence and decision-making power after participation in microfinance programs. One could almost hear the collective sigh of relief from generations of women finally taking the reins of their own destinies!

Microfinance’s Influence on Access to Education and Healthcare

The improved financial standing resulting from microfinance often directly translates to better access to education and healthcare. Families can afford school fees, uniforms, and other educational necessities, enabling children to pursue their studies and break the cycle of poverty. Similarly, access to healthcare improves, as families can afford medical expenses, preventative care, and even nutritional supplements. Imagine a community where previously insurmountable healthcare hurdles are now cleared with the simple act of receiving a small loan – it’s a testament to the power of empowerment. In rural areas of India, for instance, microfinance has been instrumental in increasing vaccination rates and reducing child mortality. It’s a win-win, with a dash of heartwarming heroism thrown in for good measure.

Community Development and Social Capital Enhancement

Microfinance isn’t just about individual empowerment; it’s a community builder. The formation of self-help groups and the collaborative nature of many microfinance programs foster a sense of community and shared responsibility. These groups often provide a platform for social interaction, information sharing, and mutual support, strengthening social capital and creating a more cohesive community. It’s like a social network, but instead of cat videos, you get economic empowerment and a stronger sense of belonging. In many developing countries, microfinance initiatives have fostered a sense of collective action, leading to improvements in infrastructure, sanitation, and other community-level projects. It’s a heartwarming example of how individual empowerment can lead to collective progress.

Addressing Social Issues Through Microfinance: Case Studies

Microfinance has proven to be a surprisingly versatile tool in addressing various social issues. In regions plagued by high rates of child labor, for example, microfinance has helped families generate sufficient income to afford to send their children to school instead of work. Similarly, in areas affected by natural disasters, microfinance has provided crucial financial assistance for recovery and rebuilding efforts. The sheer adaptability of microfinance is quite remarkable, acting as a social safety net and a catalyst for positive change. Consider the case of Grameen Bank in Bangladesh, whose pioneering work in microfinance has not only alleviated poverty but also significantly contributed to women’s empowerment and community development. It’s a tale of triumph that proves even the smallest loan can create the biggest impact.

Environmental Impacts of Microfinance

Microfinance, while lauded for its poverty-alleviating prowess, isn’t without its ecological footprint. Like a mischievous leprechaun leaving a trail of glitter and gold, it can have both positive and negative effects on the environment, depending largely on how it’s implemented and managed. Let’s delve into the surprisingly verdant world of microfinance’s environmental impact.

Microfinance’s contribution to sustainable environmental practices is, thankfully, not a myth. It can empower individuals and communities to adopt eco-friendly practices, particularly in agriculture and renewable energy. By providing access to credit, microfinance institutions (MFIs) can facilitate investments in sustainable technologies, such as efficient irrigation systems, improved farming techniques, and solar-powered equipment. Imagine a farmer, previously stuck with inefficient methods, suddenly able to invest in water-saving drip irrigation – it’s a win-win for both the farmer’s bottom line and the planet’s water resources.

Positive Environmental Impacts of Microfinance, Microfinance Impact Analysis Report

The positive environmental impacts of microfinance are not mere figments of our imagination. Access to credit enables investments in sustainable agriculture, renewable energy, and waste management initiatives. This leads to reduced carbon emissions, improved resource management, and enhanced biodiversity. For example, a microloan might help a community establish a biogas digester, transforming agricultural waste into clean energy and reducing reliance on fossil fuels. This isn’t just a fairy tale; it’s a real-world solution implemented in many developing countries.

Potential Negative Environmental Impacts and Mitigation Strategies

Unfortunately, the idyllic picture isn’t always complete. Uncontrolled expansion of microfinance can lead to environmental degradation. For instance, increased agricultural production, fueled by microloans, could result in deforestation or overexploitation of natural resources if not managed sustainably. However, implementing rigorous environmental safeguards and promoting sustainable practices during loan appraisal and disbursement can mitigate these risks. This involves thorough environmental impact assessments and providing borrowers with training on sustainable resource management. Think of it as responsible lending – a necessary check and balance to the microfinance boom.

Microfinance and Climate Change Adaptation or Mitigation

Microfinance plays a crucial role in both adapting to and mitigating climate change. By providing access to finance for climate-resilient agriculture, renewable energy, and disaster preparedness, MFIs can help communities cope with the impacts of climate change. Consider a community facing increasing drought – a microloan could help them invest in drought-resistant crops or water harvesting techniques. Similarly, investments in renewable energy can reduce greenhouse gas emissions, contributing to climate change mitigation. This is not just a pipe dream; these initiatives are already being implemented globally.

Best Practices for Environmentally Sustainable Microfinance

The path to environmentally sustainable microfinance requires careful planning and execution. It’s not simply about throwing money at the problem; it’s about thoughtful investment.

- Conduct thorough environmental impact assessments before loan disbursement.

- Provide training to borrowers on sustainable resource management and environmental protection.

- Prioritize loans for environmentally friendly projects, such as renewable energy and sustainable agriculture.

- Develop and enforce clear environmental standards and guidelines for loan applications.

- Promote the use of environmentally friendly technologies and practices.

- Integrate environmental considerations into all aspects of microfinance operations.

Challenges and Limitations of Microfinance

Microfinance, while lauded for its potential to alleviate poverty, isn’t without its quirks and complexities. Like a particularly stubborn jigsaw puzzle, it presents a fascinating array of challenges that require careful consideration. Let’s delve into the nitty-gritty, exploring the hurdles that microfinance institutions (MFIs) face and the limitations inherent in assessing their impact.

Key Challenges Faced by MFIs

MFIs often grapple with a multitude of obstacles in their quest to empower borrowers. These challenges range from operational difficulties to broader systemic issues, impacting their ability to achieve their stated objectives.

- High Operational Costs: Reaching remote and underserved populations often necessitates significant investment in infrastructure and personnel, pushing up operational costs and potentially hindering profitability. This can be particularly true in regions with poor infrastructure, where the cost of delivering services can be significantly higher than in urban areas.

- Loan Default Rates: Despite rigorous screening processes, loan defaults remain a persistent concern. Economic downturns, unforeseen circumstances, or simply poor financial management on the part of borrowers can lead to defaults, impacting the MFI’s financial health and its ability to lend to others.

- Regulatory Hurdles: Navigating the regulatory landscape can be a minefield for MFIs. Varying regulations across different regions and countries can create complexities and increase compliance costs, diverting resources away from core lending activities.

- Over-indebtedness: In some instances, borrowers have been found to be over-indebted, taking out loans from multiple MFIs simultaneously. This can lead to financial distress and raise ethical concerns about responsible lending practices. For example, a study in [Insert Country/Region] showed that X% of borrowers were indebted to more than one MFI, highlighting the need for better coordination and information sharing amongst institutions.

Limitations of Traditional Impact Assessment Methodologies

Measuring the true impact of microfinance is surprisingly tricky. Traditional methods, while useful, often fall short of capturing the full picture.

Traditional impact assessments often rely on quantitative data, such as income levels and loan repayment rates. However, these metrics may not fully reflect the broader social and environmental impacts of microfinance. For instance, a seemingly successful loan repayment rate might mask underlying issues such as increased household workload or environmental degradation resulting from the financed activity. A more holistic approach, incorporating qualitative data and considering unintended consequences, is crucial for a comprehensive understanding.

Ethical Considerations in Microfinance Practices

The ethical dimensions of microfinance cannot be ignored. Ensuring fair and responsible lending practices is paramount.

“The pursuit of profit should never overshadow the fundamental goal of poverty alleviation.”

Issues such as high interest rates, aggressive marketing tactics, and a lack of transparency can raise ethical concerns. The potential for exploitation of vulnerable populations requires careful consideration and the implementation of robust ethical guidelines. For example, the practice of charging exorbitant interest rates, especially to those with limited financial literacy, can lead to a cycle of debt and perpetuate rather than alleviate poverty. The development and enforcement of clear ethical codes of conduct are essential to mitigate such risks.

Examples of Setbacks and Criticism

Microfinance hasn’t always had a smooth ride; it’s faced its share of criticism and setbacks.

The Andhra Pradesh crisis in India, where high levels of indebtedness led to widespread suicides among borrowers, serves as a stark reminder of the potential pitfalls of microfinance. This event highlighted the need for responsible lending practices, improved regulation, and greater attention to the social and psychological impact of microfinance on borrowers. The crisis prompted a reassessment of microfinance practices and led to stricter regulations in some regions. Similarly, concerns have been raised about the environmental impact of some microfinance initiatives, particularly those supporting activities that lead to deforestation or unsustainable resource use. For example, the financing of small-scale mining operations without adequate environmental safeguards can have detrimental consequences for local ecosystems.

Case Studies of Microfinance Impact

The world of microfinance is a fascinating tapestry woven with threads of success, failure, and everything in between. Analyzing specific case studies allows us to dissect the intricate workings of these initiatives, revealing the secrets behind their triumphs and the pitfalls that led to their downfall. This section will delve into a few compelling examples, showcasing the diverse impacts of microfinance across various contexts and illuminating the crucial factors influencing their success.

Grameen Bank’s Impact in Bangladesh

Grameen Bank, arguably the most famous microfinance institution, provides a compelling case study. Its pioneering model of lending to impoverished women, particularly in rural Bangladesh, has been lauded for its poverty-alleviating effects. The bank’s success can be attributed to several factors: its focus on group lending, which minimizes default risk; its emphasis on empowering women, fostering economic independence and social change; and its innovative approach to reaching remote and underserved populations. The bank’s impact is demonstrable through increased household incomes, improved living standards, and a significant reduction in poverty rates among its borrowers. However, criticisms exist regarding its sustainability and potential for over-indebtedness among borrowers. Grameen Bank’s story, therefore, is a complex one, illustrating both the transformative potential and inherent challenges of microfinance.

A Failed Microfinance Initiative in Sub-Saharan Africa

Conversely, let’s examine a less successful initiative in a Sub-Saharan African nation (hypothetical for illustrative purposes). This particular program failed due to several factors: inadequate risk assessment leading to high default rates; a lack of appropriate training and support for borrowers; and a top-down approach that disregarded local cultural nuances and economic realities. The initiative’s failure underscores the critical importance of contextual factors in microfinance design and implementation. Effective microfinance programs must be tailored to the specific needs and circumstances of the communities they serve, recognizing the unique challenges and opportunities present in each context. This highlights the necessity of thorough due diligence and a participatory approach involving local communities in the design and implementation phases.

Comparison of Group Lending and Individual Lending Models

The comparison between group lending and individual lending models reveals interesting differences in their impact. Group lending, exemplified by Grameen Bank, leverages peer pressure and social capital to reduce risk and encourage repayment. Individual lending, on the other hand, offers greater flexibility and potentially caters to a wider range of borrowers. However, individual lending often carries higher administrative costs and a greater risk of default. The optimal model depends heavily on the specific context, including the social fabric of the community, the level of trust among borrowers, and the capacity of the microfinance institution to manage risk effectively. Ultimately, a balanced approach, considering the advantages and disadvantages of each model, may be the most effective strategy.

Visual Representation: A Successful Microfinance Case Study

Imagine a bar graph. The X-axis represents time (years), and the Y-axis represents household income. One bar represents the average household income of a control group (non-microfinance borrowers) showing a slow, steady increase. A second, much taller bar, represents the average household income of a group of microfinance borrowers, demonstrating a significantly steeper increase over the same period. The difference in height between the bars visually represents the positive impact of the microfinance initiative on household income. Additional data points could be included, such as improved access to education, healthcare, or housing, further illustrating the multifaceted impact of successful microfinance. The graph’s title would be: “Impact of Microfinance on Household Income: A Case Study of [Name of Specific Initiative]”. The legend clearly identifies the control and microfinance groups. This visual representation effectively communicates the positive effects of a successful microfinance initiative in a clear and concise manner.

Future Directions of Microfinance

The microfinance landscape, once a quaint village, is rapidly transforming into a bustling metropolis of innovation and opportunity. While the core mission – empowering the impoverished – remains steadfast, the methods and technologies employed are undergoing a fascinating evolution, driven by technological advancements and a growing understanding of the complexities of financial inclusion. This section explores the exciting future paths of microfinance, highlighting emerging trends and offering recommendations for sustained impact.

Emerging Trends and Innovations in Microfinance

The microfinance sector is witnessing a surge of innovative approaches, moving beyond traditional loan disbursement. For example, the rise of mobile money platforms has revolutionized access to financial services, particularly in remote areas with limited banking infrastructure. This allows for faster and more efficient transactions, reducing reliance on physical cash and enhancing transparency. Furthermore, the integration of digital lending platforms with sophisticated credit scoring algorithms allows for faster loan approvals and reduced operational costs, ultimately benefiting both lenders and borrowers. Another notable trend is the increasing focus on financial literacy programs, recognizing that access to credit is only one piece of the puzzle. Empowering individuals with the knowledge to manage their finances effectively is crucial for long-term economic stability.

The Role of Technology in Enhancing Microfinance Services

Technology isn’t just a helpful tool; it’s becoming the backbone of modern microfinance. Consider the impact of blockchain technology, which offers secure and transparent transaction records, reducing the risk of fraud and improving accountability. Artificial intelligence (AI) is also making inroads, enabling more accurate credit scoring and personalized financial advice, leading to better risk management and tailored services. Furthermore, the use of big data analytics allows microfinance institutions (MFIs) to better understand the needs of their clients and design more effective programs. For instance, data analysis can reveal patterns in loan repayment behavior, informing the development of targeted interventions to support borrowers experiencing financial difficulties. Imagine a future where AI proactively identifies borrowers at risk of default and offers customized support before problems escalate – a scenario rapidly becoming reality.

Financial Inclusion and its Connection to Microfinance

Financial inclusion, the process of ensuring access to appropriate and affordable financial services for all, is intrinsically linked to microfinance. Microfinance serves as a critical engine for financial inclusion, extending its reach to underserved populations often excluded from traditional banking systems. This, in turn, has a ripple effect on economic growth and poverty reduction. For example, access to microloans enables entrepreneurs to start or expand their businesses, creating jobs and stimulating economic activity. The empowerment provided by access to financial services goes beyond mere economic benefits; it fosters greater self-reliance and social mobility, breaking the cycle of poverty. Governments and international organizations are increasingly recognizing the vital role of microfinance in achieving broader financial inclusion goals, leading to increased investment and support for the sector. The success stories of microfinance initiatives in Bangladesh and other developing nations are testament to its transformative potential.

Recommendations for Improving the Effectiveness and Sustainability of Microfinance Programs

To ensure the long-term effectiveness and sustainability of microfinance programs, several key recommendations are crucial. First, a focus on client protection is paramount. This includes transparent lending practices, fair interest rates, and robust mechanisms for addressing client grievances. Second, strengthening institutional capacity within MFIs is essential. This involves investing in training and development for staff, improving risk management systems, and adopting sound governance practices. Third, fostering collaboration and partnerships between MFIs, governments, and other stakeholders is crucial for creating a supportive ecosystem for microfinance to thrive. Finally, ongoing monitoring and evaluation are essential to track progress, identify challenges, and adapt programs to meet evolving needs. By addressing these critical aspects, microfinance can continue to play a vital role in promoting economic empowerment and social progress globally.

End of Discussion

So, there you have it – the surprisingly complex, often hilarious, and ultimately impactful world of microfinance laid bare. While the challenges are real, and the occasional ethical quagmire awaits, the potential for positive change is undeniable. Let’s raise a glass (of fair-trade, sustainably sourced water, of course) to the continued evolution and positive impact of this fascinating field.

Answers to Common Questions

What are the ethical concerns surrounding microfinance?

Ethical concerns include potential over-indebtedness of borrowers, exploitative interest rates by some MFIs, and lack of transparency in loan agreements. It’s a bit like a financial Wild West, but with slightly less gunplay.

How does technology impact microfinance?

Technology, like mobile banking and digital lending platforms, can significantly improve access to microfinance services, especially in remote areas. Think of it as bringing the Wild West into the digital age, but with better banking.

Can microfinance truly alleviate poverty?

While microfinance can be a powerful tool for poverty reduction, its effectiveness depends on various factors, including appropriate program design, responsible lending practices, and supportive government policies. It’s not a magic bullet, but it can be a pretty powerful slingshot.