Economic Forecasting Methods Review: Predicting the future of economies is a notoriously tricky business, a bit like trying to herd cats while blindfolded. This review delves into the fascinating world of economic forecasting, exploring the evolution of methods from gut feelings and tea leaves (okay, maybe not tea leaves) to sophisticated quantitative models and the increasingly important role of big data. We’ll examine the strengths and weaknesses of various approaches, from qualitative methods relying on expert opinions to quantitative techniques like time series analysis and econometric modeling. Get ready to unravel the mysteries (and occasional absurdities) of predicting economic trends!

This exploration will cover a range of forecasting horizons – short-term, medium-term, and long-term – highlighting the unique challenges and opportunities presented by each. We’ll also discuss the limitations inherent in any forecasting method, the impact of unforeseen events, and the exciting potential of emerging technologies like machine learning and artificial intelligence to revolutionize the field. Prepare for a journey into the sometimes chaotic, always intriguing world of economic prediction!

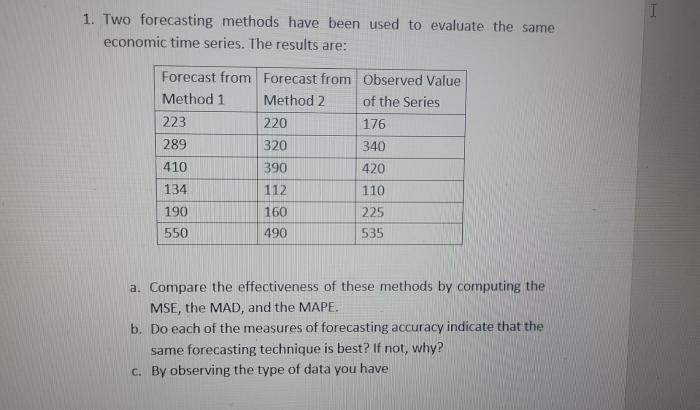

Introduction to Economic Forecasting Methods

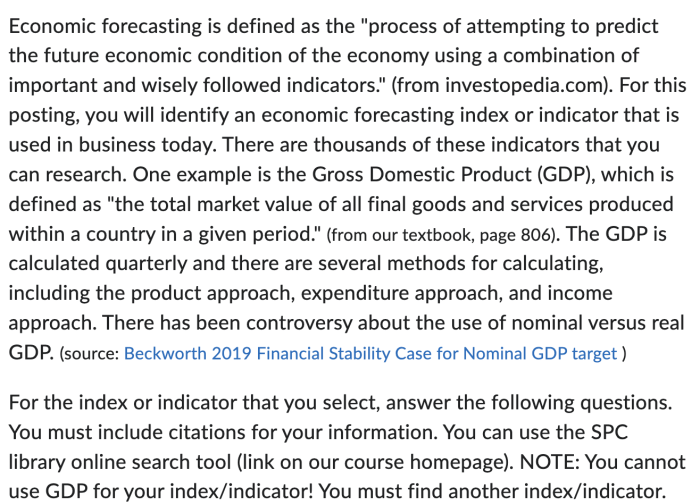

Predicting the future of the economy – it sounds like a fool’s errand, doesn’t it? Yet, economic forecasting, despite its inherent uncertainties, is a vital tool for businesses, governments, and even individuals trying to make sense of the fluctuating tides of market forces. Accurate forecasts can inform crucial decisions, from investment strategies to policy interventions, ultimately influencing the prosperity (or otherwise) of nations and individuals alike. Think of it as trying to predict the weather – you’re not always right, but you’re far better off with a forecast than without one.

Economic forecasting methodologies have evolved dramatically over time, moving from rudimentary guesswork (yes, really!) to sophisticated mathematical models incorporating vast datasets and complex algorithms. Early methods relied heavily on simple extrapolations of past trends, a bit like predicting tomorrow’s weather based solely on today’s conditions. This approach, while simple, often missed crucial turning points and external shocks. The advent of econometrics in the 20th century brought a more rigorous approach, utilizing statistical techniques to analyze economic data and build predictive models. Today, we’re seeing the integration of machine learning and artificial intelligence, promising even greater accuracy (though still no guarantees, alas!).

Real-World Applications of Economic Forecasting

Economic forecasts are not just academic exercises; they have tangible real-world impacts. Central banks, for instance, use forecasts to guide monetary policy decisions, adjusting interest rates to control inflation and promote economic growth. Businesses rely on forecasts to make informed decisions about investment, production, and hiring. Governments use them to plan budgets, allocate resources, and develop social programs. For example, accurate predictions of energy demand can help governments formulate effective energy policies, and forecasts of agricultural yields are crucial for food security planning. Even individual investors can benefit from macroeconomic forecasts when making decisions about their portfolios. In short, economic forecasting underpins a wide array of critical decisions that shape our world.

Comparison of Forecasting Horizons

The accuracy and methods used in economic forecasting vary significantly depending on the time horizon. Understanding these differences is crucial for interpreting forecasts effectively.

| Forecasting Horizon | Time Frame | Typical Methods | Examples of Applications |

|---|---|---|---|

| Short-Term | Up to 1 year | Time series analysis, leading indicators | Inventory management, short-term investment decisions |

| Medium-Term | 1-5 years | Econometric models, input-output analysis | Capital investment planning, long-term budget projections |

| Long-Term | 5+ years | Scenario planning, long-term growth models | Retirement planning, infrastructure development |

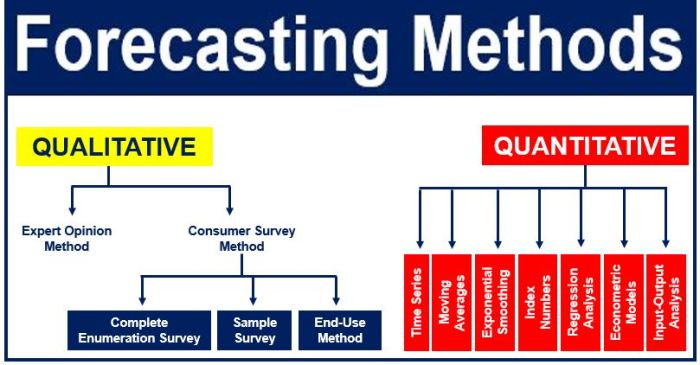

Qualitative Forecasting Methods

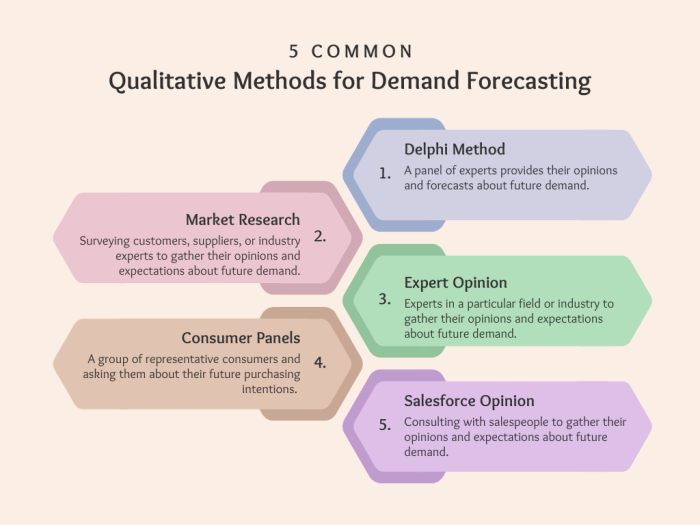

Predicting the future of the economy isn’t just about crunching numbers; sometimes, you need to tap into the wisdom of the crowds (or at least, a very select, and hopefully insightful, crowd). Qualitative forecasting methods rely on subjective judgments and expert opinions, offering a valuable counterpoint to the quantitative approaches. While less precise, they can illuminate factors that purely numerical models might miss – think sudden shifts in consumer sentiment or unexpected geopolitical events. These methods, therefore, provide crucial context and nuance to economic predictions.

The Delphi Method, Economic Forecasting Methods Review

The Delphi method is like a sophisticated, anonymous focus group on steroids. Experts provide their forecasts independently, their responses are aggregated and fed back to them anonymously, and then they’re given the opportunity to revise their opinions based on the collective wisdom (or lack thereof). This iterative process continues until a consensus (or at least, a reasonably stable range of predictions) emerges. The beauty of the Delphi method lies in its ability to minimize the influence of dominant personalities and encourage more thoughtful consideration. However, it’s not without its flaws. Reaching a true consensus can be elusive, and the method is time-consuming and expensive. Furthermore, the selection of experts significantly influences the outcome; a biased panel will likely produce a biased forecast. For example, if you were forecasting the future of the electric vehicle market and only consulted experts from the traditional automotive industry, your results might be considerably less insightful than if you also included experts from the renewable energy sector and tech startups.

Expert Opinions and Surveys in Economic Forecasting

Expert opinions, often gathered through surveys or interviews, provide valuable insights into future economic trends. These opinions, however, need to be treated with a healthy dose of skepticism. Experts, like the rest of us, are susceptible to biases and can be influenced by current events or their own vested interests. Consider, for instance, surveys conducted during periods of high economic uncertainty. The responses might reflect a heightened sense of pessimism, even if the underlying economic fundamentals remain relatively strong. Therefore, careful consideration of the context and potential biases is crucial when interpreting expert opinions. The use of diverse panels of experts can help mitigate some of these risks, ensuring a wider range of perspectives are considered. A balanced panel might include economists, business leaders, and even sociologists, providing a more holistic view of potential future trends.

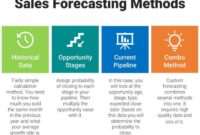

Comparison of Qualitative and Quantitative Methods

Qualitative and quantitative forecasting methods offer complementary perspectives. Quantitative methods, which rely on statistical analysis of historical data, provide precise, numerical forecasts. However, they often struggle to account for unforeseen events or qualitative factors, such as changes in consumer confidence or government policy. Qualitative methods, on the other hand, excel at incorporating these less quantifiable aspects. They are, however, inherently less precise. The ideal approach often involves a combination of both, leveraging the strengths of each to create a more robust and nuanced forecast. Think of it like baking a cake: quantitative methods provide the precise measurements and instructions, while qualitative methods add the essential touch of culinary intuition and artistry.

Hypothetical Scenario for Qualitative Methods

Imagine a scenario where a new, disruptive technology is poised to significantly impact a particular industry. Predicting the precise economic consequences using purely quantitative methods would be extremely challenging, given the lack of historical data. However, a qualitative approach, such as the Delphi method involving experts in the technology, the affected industry, and related fields, could offer valuable insights into the potential market disruption, the likely adoption rate, and the resulting economic effects. This approach would allow for the consideration of factors like consumer acceptance, regulatory hurdles, and competitive responses, all of which are difficult to quantify but crucial to understanding the overall impact. For example, the early days of the internet provided such a scenario. Predicting its impact on the economy would have been difficult using only historical data, but expert opinions could have provided valuable insights into its transformative potential.

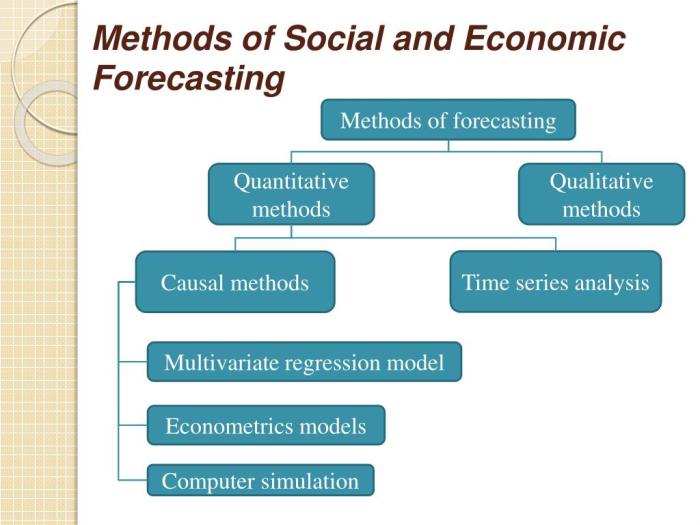

Quantitative Forecasting Methods

Predicting the future of the economy is a bit like predicting the weather – sometimes you nail it, sometimes you get soaked. But unlike weather forecasting, which at least has the decency to be visually dramatic, economic forecasting often relies on less glamorous, though equally powerful, quantitative methods. These methods use numerical data to build models that attempt to unravel the mysteries of economic behavior. Prepare yourselves for a whirlwind tour of some seriously clever (and sometimes surprisingly simple) techniques!

Quantitative forecasting methods offer a more structured and mathematically rigorous approach compared to their qualitative counterparts. They leverage historical data and statistical techniques to generate predictions, allowing for a more objective assessment of potential economic outcomes. This doesn’t mean they’re infallible; even the most sophisticated models can be thrown off by unforeseen events (like a global pandemic or a rogue squirrel short-circuiting the stock market). But they offer a powerful framework for understanding economic trends and making informed decisions.

Time Series Analysis

Time series analysis is all about examining data points collected over time. Think of it as creating a detective story where the clues are economic figures, meticulously recorded and analyzed to reveal the underlying patterns. These patterns, once identified, can then be extrapolated to predict future values. This isn’t just about drawing a line through points; it involves sophisticated statistical techniques designed to capture complex relationships within the data.

ARIMA Models and Exponential Smoothing

ARIMA (Autoregressive Integrated Moving Average) models are a particularly popular type of time series analysis. They use past values of a variable, along with past forecast errors, to predict future values. Imagine it as a sophisticated crystal ball that learns from its past mistakes. The “AR” part refers to the autoregressive component, which uses past values of the variable itself; the “I” component deals with differencing (adjusting for trends), and the “MA” part uses past forecast errors. The specific parameters (p, d, q) in an ARIMA(p,d,q) model are chosen based on the data characteristics.

Exponential smoothing, on the other hand, is a simpler yet effective method. It assigns exponentially decreasing weights to older data points, giving more importance to recent observations. Think of it as a memory that fades over time, focusing more on what’s fresh and relevant. Different variations of exponential smoothing exist, each with its own strengths and weaknesses. For example, simple exponential smoothing is best suited for data with no trend or seasonality, while Holt-Winters exponential smoothing accounts for both trend and seasonality.

Econometric Modeling

Econometric modeling takes time series analysis to the next level by incorporating relationships between multiple economic variables. It’s like building a complex puzzle where each piece represents a different economic factor (e.g., interest rates, inflation, consumer confidence). By understanding how these pieces interact, we can create models that predict how changes in one variable will affect others.

Assumptions Underlying Regression Analysis

Regression analysis, a cornerstone of econometric modeling, relies on several key assumptions. These assumptions, if violated, can lead to inaccurate or misleading results. These include: linearity (the relationship between variables is linear), independence of errors (errors are not correlated), homoscedasticity (the variance of errors is constant), and normality of errors (errors are normally distributed). Failing to meet these assumptions can lead to some truly hilarious (and inaccurate) predictions.

Comparison of Econometric Models

Choosing the right econometric model is crucial for accurate forecasting. The best model depends on the specific economic question being addressed and the characteristics of the available data.

Here’s a comparison of some common econometric models:

- Simple Linear Regression: Simple, easy to interpret, but limited in its ability to capture complex relationships. Think of it as a trusty bicycle – reliable, but not built for speed or rough terrain.

- Multiple Linear Regression: More flexible than simple linear regression, capable of incorporating multiple variables. It’s like upgrading to a car – more power and versatility.

- Vector Autoregression (VAR): Handles multiple time series variables simultaneously, capturing their interdependencies. Think of it as a powerful sports utility vehicle (SUV) – robust and capable of handling complex situations.

- Autoregressive Distributed Lag (ARDL): Combines features of ARIMA and regression models, useful for analyzing long-run relationships between variables. It’s the ultimate forecasting machine – a highly sophisticated and powerful tool for complex economic analysis.

Leading Indicators and Economic Indices

Predicting the future is a fool’s errand, unless you’re an economist, in which case it’s your job description. Economic forecasting relies heavily on leading indicators and economic indices, essentially trying to divine the economy’s next move from its subtle hints and whispers. These indicators, much like cryptic fortune cookies, offer glimpses into the future, but interpreting them requires a healthy dose of skepticism and a strong stomach for ambiguity.

Leading indicators are economic variables that tend to change *before* broader economic trends. They’re the canaries in the coal mine, warning us of potential booms or busts. Think of them as the economy’s early warning system, albeit one that sometimes screams “wolf!” unnecessarily. Understanding these indicators and their interplay is crucial for effective economic forecasting, even if the accuracy is, shall we say, “optimistically approximate.”

A Selection of Leading Economic Indicators and Their Significance

Several leading indicators provide valuable insights into the future state of the economy. Their individual significance can vary depending on the specific economic context and the forecasting model being used. Misinterpreting these indicators can lead to wildly inaccurate predictions, highlighting the need for careful analysis and consideration of multiple factors.

- Building Permits: A surge in building permits often suggests increased investment and future economic growth. It’s like seeing blueprints for a new skyscraper – a sign that things are about to get built (and hopefully, not collapse).

- Manufacturing New Orders: Companies don’t order goods unless they anticipate future demand. A rise in new orders points towards expanding production and potential employment growth. This is a good indicator, unless those orders are for self-destructing paperclips.

- Stock Market Prices: While volatile, stock market performance can often act as a leading indicator of investor confidence and future economic activity. A booming stock market usually reflects positive expectations, but remember, bubbles burst spectacularly.

- Consumer Confidence Index: This measures consumer optimism about the economy. High consumer confidence often translates to increased spending and economic growth, while low confidence can signal a looming recession. It’s a measure of faith, not necessarily fact.

- Interest Rate Spreads: The difference between long-term and short-term interest rates can predict future economic activity. A widening spread often suggests an impending recession, while a narrowing spread can signal economic expansion. This is a bit like reading tea leaves, but with numbers.

Limitations of Using Leading Indicators for Forecasting

Despite their usefulness, leading indicators are not perfect predictors of the future. Their limitations stem from various factors, making them a tool to be used cautiously rather than a crystal ball.

- Lagging Effects: The time lag between the change in a leading indicator and the actual economic change can vary and is not always consistent.

- False Signals: Leading indicators can sometimes give false signals, leading to inaccurate predictions. Think of it as the economy playing a prank.

- External Shocks: Unforeseen events like natural disasters or global crises can significantly impact the economy, rendering leading indicators less reliable.

- Data Revisions: Initial data on leading indicators are often revised, potentially altering the initial forecast.

- Interdependence of Indicators: The relationship between leading indicators and economic variables can be complex and change over time, requiring careful interpretation.

Composite Indices: Construction and Interpretation

Composite indices, like the Purchasing Managers’ Index (PMI), combine multiple leading indicators to provide a more comprehensive picture of the economy. They’re like a delicious economic stew, with each ingredient (indicator) adding its own flavor (information). The PMI, for example, is based on a survey of purchasing managers, providing insights into manufacturing activity, employment, and inventory levels. A PMI above 50 generally indicates expansion, while a PMI below 50 suggests contraction. It’s a simplified view, but often useful for a quick assessment.

Application of the Consumer Price Index (CPI) in Predicting Inflation

The Consumer Price Index (CPI) measures the average change in prices paid by urban consumers for a basket of consumer goods and services. While not strictly a leading indicator, changes in CPI are a strong indicator of current inflation. For example, a sustained increase in CPI can signal inflationary pressures, potentially leading central banks to adjust monetary policy (like raising interest rates) to curb inflation. A significant and sustained rise in the CPI in the early 2020s, for instance, signaled a period of rising inflation across many countries. This prompted central banks worldwide to take action, resulting in interest rate hikes designed to slow down the economy and cool inflation. It’s a reactive measure, but a crucial one.

Forecasting Challenges and Limitations

Predicting the future of the economy is, to put it mildly, a bit like trying to herd cats while riding a unicycle – challenging, unpredictable, and occasionally hilarious. Even the most sophisticated models can fall flat, and understanding why is crucial for interpreting economic forecasts responsibly. This section delves into the inherent difficulties and potential pitfalls of economic forecasting.

Economic forecasts, despite their best intentions (and often impressive mathematical prowess), are not crystal balls. They are susceptible to a variety of biases and errors, leading to deviations from actual economic outcomes. The inherent complexity of economic systems, coupled with the influence of unpredictable events, makes perfect accuracy an elusive goal, more akin to winning the lottery than a predictable outcome.

Sources of Bias and Error in Economic Forecasts

Several factors contribute to inaccuracies in economic forecasts. These range from methodological limitations to the unpredictable nature of human behavior and global events. Data limitations, model misspecification, and the inherent difficulty in capturing all relevant variables contribute significantly to forecast errors. For instance, a model relying heavily on historical data might fail to account for a paradigm shift in consumer behavior or technological innovation, leading to significant forecast deviations. Furthermore, the subjective choices made by forecasters, such as the selection of variables and the weighting of different factors, can introduce bias into the final predictions.

Impact of Unexpected Events

The unpredictable nature of global events dramatically impacts forecasting accuracy. The COVID-19 pandemic, for example, served as a stark reminder of the fragility of even the most carefully constructed economic models. The sudden and unprecedented disruption to global supply chains, consumer behavior, and government policies led to widespread forecast inaccuracies across various sectors. Similarly, geopolitical events like wars or significant political upheavals can trigger unforeseen economic consequences, rendering previous forecasts obsolete practically overnight. The 2008 financial crisis, triggered by the subprime mortgage crisis, offers another compelling example of the limitations of forecasting in the face of unexpected and systemic shocks. These events highlight the need for robust contingency planning and the acknowledgement of inherent uncertainty in economic projections.

Challenges of Forecasting in Volatile Economic Environments

Forecasting becomes exponentially more challenging in volatile economic environments characterized by high levels of uncertainty. Rapid changes in interest rates, inflation, and exchange rates create a dynamic and unpredictable landscape, making it difficult to establish reliable trends and patterns. The inherent complexity of interconnected global markets further exacerbates this challenge. A sudden shift in one region’s economy can have ripple effects across the globe, making it difficult to isolate the causes and predict the consequences accurately. These situations necessitate the use of more sophisticated forecasting techniques, and even then, the inherent uncertainty often results in wide confidence intervals and less precise predictions.

Summary of Sources of Error in Different Forecasting Methods

| Forecasting Method | Data Related Errors | Model Related Errors | External Shock Related Errors |

|---|---|---|---|

| Time Series Analysis (e.g., ARIMA) | Inaccurate or incomplete historical data; outliers | Incorrect model specification; parameter instability | Unexpected economic shocks (e.g., pandemics); policy changes |

| Econometric Modeling (e.g., Regression) | Measurement error in variables; omitted variable bias | Misspecification of functional form; multicollinearity | Unforeseen changes in economic relationships; external events |

| Qualitative Methods (e.g., Delphi) | Bias in expert opinions; limited data availability | Subjectivity in interpretation; lack of rigorous quantification | Significant shifts in underlying assumptions due to external events |

Future Directions in Economic Forecasting: Economic Forecasting Methods Review

The crystal ball of economic forecasting is getting a serious tech upgrade. Gone are the days of relying solely on gut feelings and historical data; the future of prediction is bright, bold, and brimming with algorithms. This section explores the exciting advancements shaping the next generation of economic forecasts, promising more accurate predictions and a deeper understanding of the economic landscape.

Big Data and Machine Learning in Economic Forecasting

The sheer volume of data now available – from transaction records to social media chatter – is staggering. Machine learning algorithms, with their ability to sift through this data deluge and identify subtle patterns invisible to the human eye, are revolutionizing forecasting accuracy. For instance, analyzing massive datasets of consumer spending habits can provide much finer-grained predictions of future economic activity than traditional methods. These algorithms can identify non-linear relationships and complex interactions between economic variables that were previously impossible to detect, leading to more nuanced and accurate predictions. Think of it as having a super-powered magnifying glass for economic trends. The increased accuracy allows for more precise policy responses, minimizing economic shocks and maximizing growth potential. One notable example is the use of machine learning in predicting stock market movements, where algorithms consistently outperform traditional models in certain market conditions.

Agent-Based Modeling of Complex Economic Systems

Forget simple linear models; the real world is messy. Agent-based modeling (ABM) offers a powerful alternative by simulating the interactions of individual economic agents (consumers, firms, etc.) within a complex system. This approach allows for a richer understanding of emergent behavior and the ripple effects of policy changes. Imagine a simulation where each individual consumer makes purchasing decisions based on their own unique circumstances and preferences, interacting with businesses that also act strategically. The resulting aggregate behavior reflects the complex interplay of these individual actions, offering insights into macroeconomic trends that are difficult to capture with traditional models. This is particularly useful in analyzing the impact of policy interventions on specific sectors or demographics. For example, ABM can be used to simulate the impact of a tax cut on consumer spending, considering different income levels and consumer behaviors.

Integration of Alternative Data Sources in Forecasting

The economic world doesn’t exist in a vacuum. Alternative data sources, such as social media sentiment, satellite imagery (tracking construction activity), and web scraping (analyzing online searches), provide valuable real-time insights that complement traditional economic indicators. Social media sentiment analysis, for example, can offer a quick pulse check on consumer confidence, revealing shifts in sentiment that might not be immediately reflected in traditional surveys. This data, combined with traditional economic data, creates a more comprehensive and dynamic picture of the economic landscape, allowing for more timely and responsive forecasting. For example, a sudden surge in negative sentiment around a particular industry on social media might signal impending trouble, prompting a reassessment of economic forecasts.

Advancements in Computational Power and Economic Forecasting

Faster computers and more powerful algorithms are a match made in forecasting heaven. The ability to process massive datasets and run complex simulations in a fraction of the time previously needed unlocks new possibilities. This allows economists to explore more sophisticated models, incorporate more data points, and conduct more robust sensitivity analyses. The increased computational power also enables the use of advanced statistical techniques, leading to more accurate and reliable forecasts. The development of quantum computing holds even greater promise, potentially revolutionizing the speed and accuracy of economic modeling and prediction in the future. The increased speed and capacity allows for real-time monitoring and forecasting, enabling more timely policy interventions and better management of economic risks.

Last Point

In conclusion, while predicting the future remains an inherently uncertain endeavor, a nuanced understanding of various economic forecasting methods is crucial for informed decision-making. From the subjective insights of qualitative methods to the rigorous analysis of quantitative approaches, each technique offers unique advantages and limitations. The integration of big data, machine learning, and alternative data sources promises to enhance forecasting accuracy, but vigilance against inherent biases and unexpected events remains paramount. So, while we might not be able to predict the next economic boom or bust with perfect accuracy, armed with the knowledge gained here, we can navigate the economic landscape with a bit more foresight (and perhaps a slightly less wobbly step).

Questions Often Asked

What are the ethical considerations in using economic forecasts?

Economic forecasts can influence policy decisions with significant societal impact. Ethical considerations include transparency in methodology, acknowledging limitations, and avoiding the misuse of forecasts to manipulate markets or public opinion.

How can I improve my own economic forecasting skills?

Continuously learning about new methods, practicing data analysis, understanding economic theory, and critically evaluating forecasts from different sources are key to improving forecasting skills. Remember to embrace uncertainty and learn from mistakes!

What’s the difference between leading, lagging, and coincident indicators?

Leading indicators predict future economic activity, lagging indicators confirm past trends, and coincident indicators reflect current economic conditions. Understanding these distinctions is vital for accurate interpretation of economic data.