Financial Goal Setting Template Download: Embark on a thrilling journey towards financial freedom! This isn’t your grandpappy’s budgeting; we’re talking sleek templates, dazzling spreadsheets, and the exhilarating pursuit of fiscal fitness. Forget counting pennies – let’s strategize like Wall Street wolves (but with better hair). This guide will equip you with the tools to conquer your financial aspirations, whether it’s a down payment on a llama farm or early retirement sipping margaritas on a beach. Prepare for a whirlwind of financial enlightenment, peppered with just the right amount of witty financial wisdom.

We’ll delve into the diverse world of financial goal-setting templates, from short-term savings sprints to marathon retirement plans. Discover the secrets to crafting a template that’s both visually stunning and functionally fabulous. We’ll explore the benefits of using a template over scribbling on napkins (though, let’s be honest, napkin math has its own charm), and equip you with the knowledge to select the perfect template from the digital jungle. Get ready to unleash your inner financial guru!

Understanding User Search Intent Behind “Financial Goal Setting Template Download”

The search query “Financial Goal Setting Template Download” reveals a user deeply committed to achieving financial success, but perhaps lacking the time or inclination to design their own planning system from scratch. These individuals are pragmatic and value efficiency; they recognize the power of a well-structured plan but prefer a ready-made solution to jumpstart their financial journey. Let’s delve into the motivations and needs driving this search.

The diverse motivations behind this search stem from a desire for structured financial planning, ranging from simple budgeting to complex long-term investments. Users aren’t just looking for a template; they’re seeking a tool to help them organize their thoughts, track their progress, and ultimately, achieve their financial aspirations. This implies a range of financial literacy levels, from beginners seeking basic budgeting tools to experienced investors looking for sophisticated portfolio trackers.

User Needs and Motivations

Users searching for downloadable financial goal-setting templates have a variety of needs and motivations. Some are driven by a desire for improved organization and clarity in their financial lives. Others are motivated by specific financial goals, such as saving for a down payment, paying off debt, or planning for retirement. Still others might be seeking a way to track their progress towards these goals and stay accountable. The common thread is a proactive approach to financial management, coupled with a preference for a structured, readily available tool.

Types of Financial Goals

The types of financial goals users are pursuing are as varied as the individuals themselves. This includes short-term goals like paying off credit card debt or saving for a vacation, as well as long-term goals such as purchasing a home, funding a child’s education, or securing a comfortable retirement. For example, a young professional might download a template to track their savings for a down payment, while a seasoned investor might use a template to meticulously manage their investment portfolio. The diversity of financial goals reflects the broad appeal of a well-structured planning tool.

Characteristics of Users Seeking Downloadable Templates

Users searching for downloadable templates often exhibit certain key characteristics. They tend to be technologically savvy, comfortable navigating online resources and downloading digital files. They value convenience and efficiency, preferring a ready-made solution to building a financial planning system from the ground up. These users are often self-motivated and proactive in managing their finances, demonstrating a clear understanding of the importance of financial planning. They may also be budget-conscious, preferring free or low-cost resources. For example, a small business owner might utilize a free template to track their company’s expenses, while a student might download a budget template to manage their limited funds effectively.

Types of Financial Goal Setting Templates

Ah, financial goal setting – the thrilling pursuit of fiscal freedom! It’s less about counting pennies and more about strategically catapulting your money towards your dreams. And what better way to do this than with a well-crafted template? Think of it as your financial GPS, guiding you through the sometimes-treacherous terrain of budgeting and saving.

Choosing the right template can be the difference between a well-oiled financial machine and a chaotic pile of receipts. Different goals require different approaches, and luckily, there’s a template for practically every financial aspiration, from conquering debt to cruising into retirement in style.

Template Types and Their Characteristics

Below is a table detailing various financial goal setting templates. Remember, the best template is the one that best suits *your* unique financial personality and ambitions. Don’t be afraid to mix and match elements from different templates to create your own masterpiece of financial planning!

| Template Type | Description | Key Features | Example Goal |

|---|---|---|---|

| Short-Term Goal Template | Focuses on goals achievable within a year. Think small wins, big motivation! | Specific deadlines, smaller savings targets, regular progress tracking. | Save $1,000 for a down payment on a used car within six months. |

| Long-Term Goal Template | For those grand, ambitious dreams that require years of planning and saving. Patience, young Padawan! | Long-term projections, investment strategies, regular review and adjustment. | Save $100,000 for a down payment on a house within five years. |

| Debt Reduction Template | Conquering debt is a marathon, not a sprint. This template helps you strategize your victory. | Debt listing, minimum payment tracking, extra payment allocation strategies (e.g., snowball or avalanche method). | Pay off $5,000 in credit card debt within 12 months using the avalanche method. |

| Investment Goal Template | Ready to make your money work for you? This template helps you navigate the world of investing. | Investment asset allocation, risk tolerance assessment, diversification strategies, return projections. | Invest $500 per month in a diversified portfolio aiming for a 7% annual return over 10 years. |

| Retirement Goal Template | Planning for a comfortable retirement is key. This template helps you ensure your golden years are truly golden. | Retirement savings projections, contribution calculations, estimated retirement income, Social Security benefits estimation. | Accumulate $1 million in retirement savings by age 65. |

Components of a Comprehensive Financial Goal Setting Template

A truly comprehensive template should be more than just a pretty spreadsheet. It’s your financial roadmap, and as such, it needs the right navigational tools. Think of it as a Swiss Army knife for your finances.

A robust template typically includes sections for:

* Goal Setting: Clearly defined goals, both short-term and long-term, with specific, measurable, achievable, relevant, and time-bound (SMART) objectives.

* Budgeting: A detailed breakdown of income and expenses, allowing you to see where your money is going and identify areas for improvement. Think of it as a financial fitness tracker for your spending habits.

* Savings Allocation: A plan for how much to save for each goal, and where to allocate those savings (e.g., high-yield savings accounts, investment accounts).

* Debt Management: A strategy for paying down debt, including methods like the debt snowball or avalanche method.

* Investment Strategy: If applicable, a plan for investing your savings, including asset allocation and risk tolerance.

* Progress Tracking: A system for monitoring your progress towards your goals and making adjustments as needed. Think of it as your financial report card – showing you how you’re doing!

* Contingency Planning: A plan for unexpected events that may impact your finances, such as job loss or medical emergencies.

Template Formats: Spreadsheet vs. Word Document vs. Printable PDF

The format you choose is largely a matter of personal preference and technical skill.

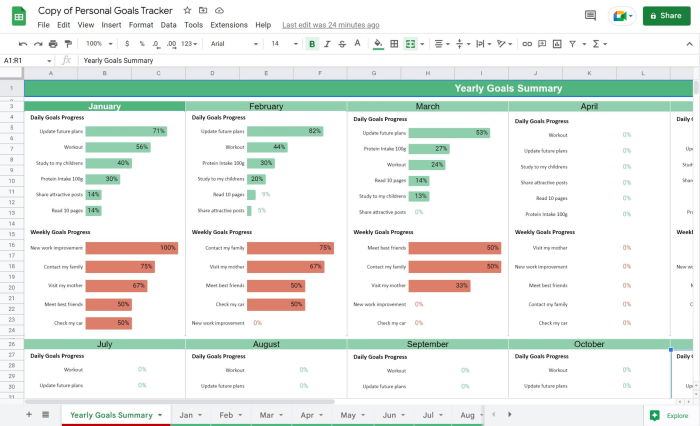

* Spreadsheet (e.g., Excel, Google Sheets): Offers excellent functionality for calculations, data analysis, and charting. Ideal for those comfortable with spreadsheets and who want to track progress visually. Think dynamic, constantly updating financial dashboard.

* Word Document (e.g., Microsoft Word, Google Docs): Provides a more flexible format for incorporating text, tables, and images. Good for those who prefer a less technical approach and want a visually appealing document.

* Printable PDF: Provides a convenient, portable format for reviewing your goals offline. Ideal for those who prefer a hard copy or want to share their plan with others.

Benefits of Using a Financial Goal Setting Template: Financial Goal Setting Template Download

Let’s face it, staring at a blank spreadsheet while trying to conjure a foolproof financial plan can be about as thrilling as watching paint dry. A financial goal setting template, however, is your trusty sidekick in this often-daunting quest for fiscal freedom. It’s the difference between a chaotic scramble and a well-orchestrated financial symphony. Using a template offers significant advantages over manually crafting your financial future from scratch.

Templates provide a structured framework, guiding you through the essential steps of financial planning with the elegance of a seasoned conductor leading an orchestra. Unlike the free-for-all of manual planning, templates offer a clear path, ensuring you don’t miss crucial aspects like budgeting, debt management, or investment strategies. This organized approach drastically reduces the likelihood of overlooking critical details and allows you to focus on the big picture—your financial aspirations. The result? A clearer, more comprehensive, and ultimately more successful financial plan.

Improved Organization and Clarity in Financial Planning

A well-designed template acts as a central hub for all your financial information. Imagine it as a meticulously organized filing cabinet, but for your money. Instead of scattered notes, receipts, and half-remembered account balances, a template provides designated sections for income, expenses, assets, liabilities, and goals. This structured approach eliminates the confusion and frustration of searching through a mountain of paperwork (or digital files) to find the information you need. With everything neatly categorized, you gain a crystal-clear overview of your financial situation, making informed decisions significantly easier. For example, a template might include dedicated sections for tracking monthly expenses, categorizing them into necessities and discretionary spending, allowing you to quickly identify areas where you can cut back and reallocate funds towards your savings goals. This clarity allows for a more strategic and effective approach to financial management.

Facilitating Progress Tracking Towards Financial Goals

Templates aren’t just for organizing; they’re also powerful tools for monitoring your progress. Many templates include built-in mechanisms for tracking your achievements against your financial objectives. For instance, a section might be dedicated to charting your savings progress towards a down payment on a house or a specific investment target. Visual representations, such as graphs or charts, can dramatically improve your understanding of your progress and motivate you to stay on track. Consider the satisfaction of watching your savings steadily climb towards your goal – a clear visual representation provided by the template can significantly boost your motivation and commitment to achieving your financial dreams. This constant monitoring helps you stay accountable and make necessary adjustments along the way, increasing your chances of success.

Creating a High-Quality Financial Goal Setting Template

Crafting a truly excellent financial goal-setting template is less about rocket science and more about understanding the user’s needs – and, let’s be honest, making it pretty enough to actually *use*. A poorly designed template is like a leaky bucket; your financial aspirations will just drain away before you even start. A well-designed one, however, is your trusty steed, carrying you towards financial freedom.

Sample Financial Goal Setting Template

Let’s whip up a sample template that’s both functional and aesthetically pleasing (because who says spreadsheets can’t be stylish?). We’ll use an HTML table for clarity and organization. Remember, this is just a starting point; tailor it to your specific needs!

| Goal Description | Target Amount | Timeline (Start Date – End Date) | Strategies | Progress Tracking (Amount Saved/Achieved) |

|---|---|---|---|---|

| Pay off credit card debt | $5,000 | 2024-03-15 – 2024-09-15 | Increase income by taking on freelance work; reduce unnecessary spending by tracking expenses with a budgeting app. | $0 / $5,000 |

| Save for a down payment on a house | $20,000 | 2024-01-01 – 2025-12-31 | Automate savings transfers; explore high-yield savings accounts; cut back on eating out. | $0 / $20,000 |

| Fund a child’s college education | $50,000 | 2024-04-01 – 2034-04-01 | Invest in a 529 plan; explore other investment options; consider educational savings bonds. | $0 / $50,000 |

Organizing Template Elements for User-Friendliness

A user-friendly template is intuitive and easy to navigate. Think of it like a well-organized pantry – you can find what you need quickly and efficiently, without rummaging through a chaotic mess. Clear headings, logical section breaks, and consistent formatting are crucial. Consider using color-coding to visually separate different sections, perhaps using a pastel palette for a calming effect. A well-organized template is your financial sanity’s best friend.

Incorporating Visual Aids, Financial Goal Setting Template Download

Visuals don’t just add pizzazz; they make complex financial data digestible. Imagine a simple bar chart in our template, dynamically updating as you track your progress. The bars would represent each goal, growing taller as you get closer to your target amount. A pie chart could visually illustrate your income and expenses, helping you identify areas for improvement. For the college fund example, a line graph could show projected growth based on different investment strategies. These visual aids act as a motivational boost, transforming dry numbers into an engaging story of your financial journey. Think of it as a financial progress report that actually makes you *want* to look at it.

Resources for Downloading Financial Goal Setting Templates

Embarking on your financial planning journey can feel like navigating a minefield of spreadsheets and jargon. But fear not, intrepid budgeter! The internet offers a treasure trove of financial goal setting templates, ready to rescue you from the chaos. Choosing wisely, however, requires a discerning eye and a healthy dose of skepticism. Let’s explore where to find these digital lifesavers and how to avoid those pesky digital landmines.

Finding the perfect financial goal-setting template is like searching for the Holy Grail of personal finance – it’s out there, but you need the right map. Reputable websites and platforms offer a variety of templates catering to different needs and skill levels. But be warned, not all templates are created equal. Some are free, some are paid, some are user-friendly, and some… well, let’s just say they require a PhD in Excel.

Reputable Sources for Financial Goal Setting Templates

Several established websites offer high-quality, downloadable financial goal setting templates. These platforms often have user reviews and ratings, allowing you to gauge the quality and usefulness of a template before committing your precious time (and potentially your money). Examples include well-known personal finance websites that offer free downloadable resources as part of their educational content. Think of websites known for their comprehensive guides on budgeting, investing, and debt management. These sites often prioritize user experience and provide templates that are both effective and easy to use. Another source could be reputable template marketplaces, where templates are created and sold by independent designers and businesses. However, carefully vetting the credibility of the seller is crucial in this case.

Factors to Consider When Selecting a Template

Selecting the right template is paramount to your financial success. Consider the template’s format (Excel, Google Sheets, PDF, etc.), its level of detail (basic or advanced), its features (charts, graphs, calculations), and its compatibility with your existing software. A template that’s overly complex might overwhelm you, while one that’s too simplistic might not provide the necessary tools for effective planning. Furthermore, user reviews can provide invaluable insights into a template’s usability and effectiveness. A template with numerous positive reviews from satisfied users suggests a higher probability of success in your financial planning.

Evaluating the Credibility of Template Providers

Navigating the digital landscape requires a healthy dose of skepticism. Before downloading a template, check the website’s security (look for “https” in the URL), read the terms of service, and verify the provider’s contact information. A lack of transparency or a poorly designed website should raise a red flag. Additionally, look for websites with established reputations and positive user reviews. Beware of templates promising unrealistic results or requiring excessive personal information. Remember, if something seems too good to be true, it probably is. Your financial security is worth the extra due diligence.

Tips for Effective Goal Setting and Template Utilization

Conquering your financial future isn’t about wishing on a star; it’s about crafting a meticulously planned assault on your financial goals. A financial goal-setting template is your weapon of choice, but even the sharpest sword is useless without proper technique. Let’s sharpen your skills.

Setting SMART financial goals isn’t rocket science (unless your goal involves funding a space mission, in which case, good luck!), but it does require a clear strategy. A well-structured template ensures you don’t accidentally stumble into a financial Bermuda Triangle. Remember, a plan is only as good as its execution, and regular review is crucial for navigating the unpredictable seas of personal finance.

SMART Goal Setting

Defining SMART goals ensures your financial aspirations are clear, measurable, and achievable. Specificity eliminates ambiguity; measurability allows for progress tracking; achievability prevents setting yourself up for failure; relevance aligns your goals with your overall financial picture; and time-bound goals provide a sense of urgency. For example, instead of vaguely aiming to “save more money,” a SMART goal would be: “Save $5,000 for a down payment on a house within 18 months by consistently contributing $250 per month to a high-yield savings account.” This clear, measurable, achievable, relevant, and time-bound goal provides a roadmap to success.

Effective Template Utilization

A financial goal-setting template isn’t just a pretty spreadsheet; it’s your financial command center. Begin by meticulously filling in every section. This includes outlining your current financial situation (income, expenses, assets, debts), identifying your short-term and long-term financial goals, and creating a detailed action plan for achieving each goal. Categorizing expenses, for example, can reveal areas for improvement. Imagine discovering that your monthly coffee habit is costing you more than your monthly savings contributions! Your template should also include sections for tracking progress, adjusting strategies, and celebrating milestones.

Regular Review and Updates

Life throws curveballs; your financial plan should be able to handle them. Regularly reviewing and updating your financial goals and the template itself is paramount. This isn’t just about checking numbers; it’s about adapting to changing circumstances. Perhaps you received a raise, experienced an unexpected expense, or your financial priorities shifted. Regular review (at least quarterly) allows you to recalibrate your strategies, ensuring your plan remains relevant and effective. For instance, if you’ve achieved a significant milestone earlier than anticipated, you can adjust your savings rate or target a more ambitious goal. Conversely, unforeseen events might necessitate a temporary adjustment to your savings plan, but the template allows you to track these changes and keep your financial trajectory on course.

Ultimate Conclusion

So, there you have it – a comprehensive guide to conquering your financial future with the help of a downloadable financial goal-setting template. Remember, the key is not just downloading a template, but using it strategically and consistently. Treat your financial goals like a well-trained ferret – focused, determined, and ultimately, rewarding. Go forth, conquer your finances, and may your spreadsheets always be balanced (or at least mostly balanced).

Essential Questionnaire

What if I don’t have any financial goals?

Then you’re in luck! This guide will help you *discover* exciting financial goals you never knew you had. Maybe it’s a pet iguana, a vintage tuba collection, or world domination – the possibilities are endless!

Are these templates only for serious investors?

Absolutely not! Whether you’re saving for a coffee machine upgrade or a private island, these templates are for anyone who wants to take control of their finances. Even if your biggest financial worry is running out of avocado toast.

Can I use a crayon to fill out the template?

While we admire your artistic spirit, we recommend a pen or pencil for optimal readability. Crayons might make your financial plan look festive, but they’re less ideal for spreadsheets.