Financial Advisor Services Review: Navigating the sometimes-bewildering world of financial advisors requires careful consideration. Are you ready to unravel the mysteries of fee structures, decipher the jargon, and ultimately, find the perfect financial guru to shepherd your hard-earned cash towards a brighter, more financially secure future? This review dives headfirst into the often-murky waters of financial planning, armed with wit, wisdom, and a healthy dose of skepticism. Prepare for a rollercoaster ride of revelations, from the surprisingly diverse landscape of advisor types to the sometimes-dubious nature of online reviews.

We’ll explore the various services offered, from the straightforward to the surprisingly complex, examining different fee structures and helping you understand the fine print. We’ll also dissect the art of evaluating advisor qualifications, navigating the maze of certifications, and spotting those tell-tale red flags that scream “run for the hills!” We’ll even delve into the crucial importance of building a strong advisor-client relationship—because let’s face it, trust is the bedrock of any successful financial partnership. Get ready to become a financially savvy superhero!

Defining “Financial Advisor Services”

Navigating the world of personal finance can feel like trying to solve a Rubik’s Cube blindfolded – tricky, to say the least. Thankfully, financial advisors are there to help unscramble your financial future, offering a range of services designed to make your money work smarter, not harder. But what exactly *is* a financial advisor, and what do they actually *do*? Let’s dive in.

Financial advisor services encompass a broad spectrum of activities aimed at helping individuals and families achieve their financial goals. These goals can range from the seemingly mundane (paying off debt) to the wildly ambitious (early retirement on a tropical island). Think of a financial advisor as your personal financial Sherpa, guiding you through the sometimes treacherous terrain of investments, retirement planning, and estate management. They provide expert advice and often manage your assets, tailoring strategies to your specific needs and risk tolerance.

Types of Financial Advisors

Financial advisors aren’t a monolithic group; they come in various flavors, each with its own approach to fees and services. Understanding these differences is crucial to finding the right advisor for your unique circumstances. The primary distinction lies in how they’re compensated: fee-only, commission-based, or a hybrid model.

Fee-only advisors charge a direct fee for their services, typically based on an hourly rate, a percentage of assets under management (AUM), or a flat fee for a specific project. This structure ensures transparency and eliminates potential conflicts of interest stemming from commission incentives. Commission-based advisors, on the other hand, earn a commission on the financial products they sell you, such as insurance policies or mutual funds. This model can create potential conflicts of interest if the advisor prioritizes commission generation over your best interests. Hybrid advisors blend both fee-based and commission-based compensation, creating a more complex, and potentially less transparent, fee structure.

Examples of Comprehensive Financial Planning Services

Comprehensive financial planning goes beyond simply investing your money. It’s a holistic approach that considers all aspects of your financial life. Think of it as building a sturdy financial house, brick by brick. Here are some key components:

A truly comprehensive plan will address areas such as retirement planning (including 401(k)s, IRAs, and Social Security), investment management (stocks, bonds, mutual funds, etc.), tax planning (minimizing your tax burden legally, of course!), estate planning (wills, trusts, etc.), risk management (insurance needs), and debt management. It’s a collaborative process, involving regular meetings and adjustments to your plan as your circumstances change.

Comparison of Advisor Service Models

Let’s illustrate the differences between advisor service models with a handy table:

| Service Model | Fee Structure | Client Suitability | Typical Services Offered |

|---|---|---|---|

| Fee-Only | Hourly rate, percentage of AUM, flat fee | Clients who value transparency and objectivity; those with significant assets | Financial planning, investment management, tax planning, retirement planning |

| Commission-Based | Commissions on products sold | Clients comfortable with potential conflicts of interest; those needing basic product recommendations | Insurance sales, mutual fund recommendations, annuity sales |

| Hybrid | Combination of fees and commissions | Clients who need a mix of advice and product sales; a middle ground between fee-only and commission-based | Financial planning, investment management, product sales (with potential commission) |

| Robo-Advisor | Annual percentage of AUM | Clients comfortable with automated advice; those with less complex needs and smaller portfolios | Automated portfolio management, tax-loss harvesting, rebalancing |

Review Platforms and Methods

Navigating the world of financial advisor reviews can feel like traversing a minefield of five-star ratings and suspiciously glowing testimonials. Fear not, intrepid investor! This section will illuminate the various online platforms where you can find reviews, the methods used to rate advisors, and the potential pitfalls to avoid. Think of it as your survival guide to the wild west of financial advice reviews.

The internet, that vast and wonderful (and sometimes bewildering) digital landscape, offers a plethora of platforms dedicated to rating financial advisors. These range from general review sites like Yelp and Google Reviews, which often include financial advisors alongside plumbers and pizza parlors, to specialized platforms focusing exclusively on financial professionals. Dedicated financial advisor review sites often boast more robust rating systems and more detailed profiles, but they also may be subject to their own unique biases. It’s a jungle out there, but we’ll help you navigate it.

Online Platforms for Financial Advisor Reviews

Many websites specialize in aggregating and displaying financial advisor reviews. These platforms often allow users to filter advisors based on location, specialization, fees, and other criteria. Some well-known examples include websites like BrokerCheck (operated by FINRA), which focuses on the regulatory aspects of advisors, and various independent review sites that collect user feedback. The sheer volume of options can be overwhelming, but remember that variety is the spice of life (and the key to finding the right advisor). Choosing the right platform often depends on your specific needs and preferences. For example, an investor focused on sustainable investing might find a platform specializing in ESG-focused advisors particularly useful.

Rating Criteria Used by Review Platforms

Review platforms employ various criteria to rate financial advisors. These typically include client satisfaction ratings, the advisor’s experience and qualifications, disciplinary history (if available), fees, and the breadth and depth of services offered. Some platforms use sophisticated algorithms to weigh these factors differently, while others simply present a simple average rating. Understanding how a platform calculates its ratings is crucial to interpreting the data effectively. For instance, a platform that heavily weighs client satisfaction might overlook a less-than-stellar disciplinary record. It’s important to look beyond just the star rating and delve into the specifics of the reviews themselves.

Benefits and Drawbacks of Using Online Reviews

Online reviews offer a valuable resource for prospective clients, providing insights into an advisor’s strengths and weaknesses directly from past clients. This peer-to-peer information can be incredibly helpful in making an informed decision. However, it’s crucial to approach online reviews with a healthy dose of skepticism. The very nature of online reviews means that they are often subject to bias, both positive and negative. A glowing five-star review might be a genuine expression of satisfaction, or it could be a carefully orchestrated marketing campaign. Conversely, a scathing one-star review could stem from a legitimate grievance, or it could be the result of a disgruntled client with an axe to grind.

Potential Biases in Online Financial Advisor Reviews

It’s essential to recognize that online reviews are not always objective. Several factors can introduce bias:

- Positive Bias: Advisors might incentivize positive reviews, either directly or indirectly.

- Negative Bias: Disgruntled clients are more likely to leave reviews than satisfied ones.

- Selection Bias: The individuals who leave reviews may not be representative of the advisor’s entire client base.

- Fake Reviews: Some advisors might even engage in the creation of fake positive reviews to boost their ratings.

- Platform Bias: The algorithms and weighting systems used by different platforms can lead to different ratings for the same advisor.

Remember, online reviews are a piece of the puzzle, not the entire picture. Always conduct thorough due diligence before entrusting your financial future to any advisor.

Analyzing Client Experiences: Financial Advisor Services Review

Navigating the world of financial advisors can feel like traversing a minefield of jargon and complex strategies. Understanding client experiences, both the triumphs and the tribulations, is crucial to finding the right advisor for your needs. This section delves into the highs and lows of the client-advisor relationship, offering insights into what makes a successful partnership – and what can send it careening off the rails.

Client experiences with financial advisors are as diverse as the clients themselves. While some find their advisor to be a trusted partner, guiding them towards financial security, others encounter frustrating communication breakdowns, unexpected fees, or disappointing investment performance. Examining these varied experiences provides valuable lessons for both clients seeking an advisor and advisors striving to improve their services.

Positive and Negative Client Experiences

Positive experiences often involve a strong advisor-client rapport built on trust and clear communication. Imagine a client, let’s call her Sarah, who felt completely comfortable discussing her long-term goals with her advisor, feeling understood and valued. Her advisor meticulously explained investment strategies, patiently answering all her questions, and regularly provided updates. Conversely, negative experiences can stem from a lack of transparency. Consider John, who felt misled by his advisor’s promises of high returns and was shocked by unexpectedly high fees. He felt ignored and frustrated by a lack of clear communication, leading to a significant loss of trust.

Common Issues Faced by Clients

Clients frequently encounter issues relating to communication, fees, and investment performance. Poor communication can leave clients feeling uninformed and frustrated. Unclear fee structures can lead to unexpected costs, while disappointing investment performance can erode trust and undermine the advisor-client relationship. These issues often intertwine, creating a complex web of problems. For instance, poor communication about fees can exacerbate the negative impact of underperforming investments.

Hypothetical Case Study: A Successful Client-Advisor Relationship

Let’s consider the case of Emily, a young professional aiming to save for retirement. She chose an advisor known for their transparent fee structure and personalized approach. Her advisor, David, took the time to understand Emily’s risk tolerance and long-term goals, creating a tailored investment plan. David provided regular updates, clearly explaining investment decisions and market fluctuations. He was always available to answer questions, fostering a strong sense of trust and collaboration. Emily’s investment portfolio performed well, and she felt confident in David’s expertise, resulting in a mutually beneficial and long-lasting relationship. This success stemmed from open communication, clearly defined expectations, and a shared understanding of Emily’s financial objectives.

Factors Contributing to a Positive Client Experience

Several key factors contribute to a positive client experience. These include clear and consistent communication, transparent fee structures, a personalized investment strategy tailored to the client’s individual needs and risk tolerance, readily available access to the advisor, and consistent monitoring of the investment portfolio. When these elements are in place, clients feel confident, informed, and secure in their financial future. The advisor-client relationship becomes a partnership based on trust, mutual respect, and a shared commitment to achieving financial goals. The success of this partnership is, ultimately, a testament to the power of effective communication and a client-centric approach.

Assessing Advisor Qualifications and Expertise

Choosing a financial advisor is a bit like choosing a captain for your financial ship – you want someone competent enough to navigate the choppy waters of the market without sending you straight to Davy Jones’ locker. Therefore, verifying their qualifications and expertise isn’t just a good idea; it’s essential for your financial well-being. Let’s delve into the fascinating world of advisor credentials and how to avoid the financial pirates lurking in the shadows.

Choosing the right financial advisor requires a discerning eye and a healthy dose of skepticism. Don’t just take their word for it; dig a little deeper to ensure they possess the knowledge and experience to effectively manage your hard-earned money. Remember, a little due diligence can save you a lot of future headaches (and potentially, a significant chunk of your portfolio).

Advisor Credentials and Certifications

Verifying an advisor’s credentials is paramount. Think of it as checking the authenticity of a vintage wine before you uncork it – you wouldn’t want to discover it’s a cheap imitation after taking a sip! Legitimate certifications demonstrate a commitment to professional standards and ongoing education, ensuring they possess a foundational understanding of financial principles. A lack of proper credentials, however, might indicate a lack of commitment to professional standards or even worse, a potential red flag.

Checklist for Evaluating Advisor Qualifications

Before entrusting your financial future to anyone, consider this checklist. It’s your roadmap to finding a truly qualified advisor, not just someone with a slick website and a charming smile.

- Professional Designations: Look for designations like Certified Financial Planner (CFP®), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA). These represent rigorous educational and examination requirements.

- Experience: How long have they been in the business? A longer track record generally suggests more experience in navigating various market conditions.

- Disciplinary History: Check with regulatory bodies like the SEC or FINRA for any disciplinary actions or complaints filed against the advisor. This is akin to checking a car’s history report before buying it – you wouldn’t want to purchase a lemon!

- Education and Background: Review their educational background and professional experience. A strong educational foundation is a crucial indicator of their knowledge and skills.

- Fees and Compensation Structure: Understand exactly how they are compensated. Transparency is key to building trust and avoiding potential conflicts of interest.

Comparison of Professional Designations

Different professional designations indicate different areas of expertise. Understanding these distinctions can help you find an advisor whose skills align with your specific financial needs. For instance, a CFP® focuses on holistic financial planning, while a CFA might specialize in investment management.

| Designation | Focus | Requirements |

|---|---|---|

| CFP® | Comprehensive financial planning | Rigorous education, examination, and experience requirements |

| CFA | Investment management and analysis | Advanced coursework and demanding examinations |

| CPA | Accounting and taxation | State licensing requirements and continuing education |

Red Flags in an Advisor’s Background

While most advisors are ethical and competent professionals, it’s crucial to be aware of potential red flags. These are warning signs that might indicate potential problems. Think of them as the “check engine” light on your financial dashboard – you definitely want to investigate further!

- High-Pressure Sales Tactics: A legitimate advisor will take the time to understand your needs before suggesting any specific investments.

- Guaranteed Returns: No legitimate investment guarantees a specific return. Beware of anyone promising unrealistic profits.

- Lack of Transparency: A trustworthy advisor will openly discuss their fees and compensation structure.

- Unsolicited Calls or Emails: Be wary of advisors who contact you out of the blue, particularly if they are pushing specific investments.

- Negative Online Reviews or Complaints: A quick online search can reveal valuable insights into an advisor’s reputation.

Understanding Fee Structures and Transparency

Navigating the world of financial advisor fees can feel like deciphering a particularly cryptic treasure map – filled with percentages, hourly rates, and enough jargon to make your head spin. But fear not, intrepid investor! Understanding fee structures is crucial to ensuring you’re getting the best bang for your buck (and avoiding any unwelcome financial surprises). Transparency is key, and we’ll illuminate the path to financial clarity.

Fee structures for financial advisors vary wildly, each with its own set of advantages and disadvantages. Choosing the right structure depends heavily on your individual financial situation, investment goals, and risk tolerance. Let’s examine some of the most common models.

Fee Structures Employed by Financial Advisors

Financial advisors typically utilize one of several fee structures, or sometimes a combination thereof. Understanding these differences is paramount to making an informed decision. A clear understanding of how your advisor is compensated will help you evaluate the value of their services.

- Hourly Fees: Think of this as paying for a consultant’s time, similar to a lawyer or accountant. You pay a set amount for each hour of the advisor’s work. This structure is often preferred for specific, limited projects like estate planning or tax optimization.

- Percentage-Based Fees (AUM): This is perhaps the most common structure, where advisors charge a percentage of your assets under management (AUM). This percentage usually ranges from 0.5% to 2%, depending on the advisor’s experience, the complexity of your portfolio, and the services provided. While convenient, it’s important to be aware that your fees increase directly with the value of your portfolio.

- Flat Fees: This model offers a fixed fee for a specific service, such as developing a financial plan or managing a retirement account. This provides predictability in your expenses, making budgeting easier. However, it might not be suitable for ongoing, evolving financial needs.

The Importance of Fee Transparency and Disclosure

Imagine buying a car without knowing the price – a recipe for financial disaster! Similarly, complete transparency regarding fees is non-negotiable when choosing a financial advisor. A reputable advisor will openly and clearly disclose all fees upfront, leaving no room for hidden charges or unexpected surprises. This includes all commissions, management fees, advisory fees, and any other expenses associated with their services. A lack of transparency should be a major red flag.

Interpreting and Comparing Different Fee Schedules

Comparing fee schedules requires a keen eye for detail. Don’t just look at the headline number; delve deeper. Consider what services are included for the fee. Does the fee cover all aspects of financial planning, or are there additional charges for specific services? For example, a lower percentage-based fee might seem attractive, but if it doesn’t include tax planning or retirement account management, the overall cost could be higher than a seemingly more expensive package. Always compare apples to apples.

Sample Fee Disclosure Statement

Below is an example of a clear and concise fee disclosure statement. Remember, this is a sample, and your advisor’s statement should reflect their specific services and fee structure.

Fee Disclosure Statement

Advisor: [Advisor’s Name/Firm Name]

Client: [Client’s Name]

Date: [Date]Fees:

• Annual Advisory Fee: 1% of Assets Under Management (AUM)

• Transaction Fees: $25 per trade (if applicable)

• Additional Fees: $100 per hour for specialized services (e.g., tax planning, estate planning consultations) (if applicable)Services Included:

• Financial planning

• Investment management

• Portfolio rebalancing

• Regular performance reportingPayment Terms: Fees are billed quarterly, in advance.

This statement Artikels the general fee structure. A more detailed breakdown will be provided prior to the commencement of services.

Investigating Advisor Performance and Track Record

Choosing a financial advisor is a bit like choosing a captain for your financial ship. You want someone with a proven track record, not just someone who promises smooth sailing. Investigating an advisor’s past performance is crucial, but it’s not a foolproof method, so let’s navigate this carefully.

Past performance, while undeniably tempting to rely on, isn’t a crystal ball predicting future triumphs. Market fluctuations, economic shifts, and even a change in the advisor’s investment strategy can dramatically alter results. Think of it like judging a chef based solely on one incredibly successful dish – they might be amazing, but they might also have had a lucky day. We need a more nuanced approach.

Methods for Assessing an Advisor’s Past Performance, Financial Advisor Services Review

Several methods exist for evaluating an advisor’s historical performance. These include examining their client portfolio returns, comparing their performance to relevant benchmarks (like the S&P 500), and analyzing their risk-adjusted returns. A thorough investigation will often involve reviewing performance data across multiple market cycles, both bull and bear, to gain a more comprehensive understanding of their capabilities. Consistency over time is a key indicator of skill, rather than just a few lucky years.

Limitations of Using Past Performance as an Indicator of Future Success

Past performance, while informative, is not necessarily indicative of future results. Market conditions change, investment strategies evolve, and even the most skilled advisors can experience periods of underperformance. Attributing past success solely to the advisor’s skill without considering external factors can be misleading. For example, a spectacular return during a bull market doesn’t automatically qualify an advisor as a genius; a shrewd investor might have made similar returns using a relatively passive strategy.

Metrics Used to Evaluate Investment Performance

Several key metrics are used to gauge investment performance. These include:

- Return on Investment (ROI): A simple but crucial metric, ROI measures the percentage gain or loss on an investment over a specific period. For example, an investment of $10,000 that grows to $12,000 shows a 20% ROI.

- Sharpe Ratio: This measures risk-adjusted return, showing how much extra return an investor receives for each unit of additional risk taken. A higher Sharpe ratio generally indicates better risk-adjusted performance.

- Standard Deviation: This metric quantifies the volatility or risk associated with an investment. A higher standard deviation indicates greater volatility, and therefore, higher risk.

- Alpha: This measures the excess return an investment generates compared to a benchmark, after adjusting for risk. A positive alpha suggests the advisor outperformed the benchmark.

Interpreting Key Performance Indicators (KPIs) Related to Financial Advisor Performance

Interpreting KPIs requires a holistic approach. Simply focusing on a single metric, such as high ROI, can be deceptive. Consider the context: was this high return achieved through excessive risk-taking? A more balanced approach involves analyzing several KPIs together. For instance, a high ROI coupled with a low Sharpe ratio might suggest the returns were achieved through excessive risk. Conversely, a consistently positive alpha alongside a moderate standard deviation indicates skillful risk management and superior performance. Remember, consistency and a robust risk management strategy are far more valuable than a few isolated periods of high returns.

Building Trust and Establishing a Strong Advisor-Client Relationship

A successful financial advisor-client relationship is more than just numbers; it’s a partnership built on mutual respect, clear communication, and, dare we say it, a touch of shared amusement at the rollercoaster that is the financial world. Think of it as a well-orchestrated financial tango – both partners need to be in sync and trust each other implicitly to avoid stepping on toes (or worse, losing a significant chunk of their savings).

The cornerstone of any successful advisor-client relationship is, unsurprisingly, trust. This isn’t just about believing your advisor’s competence; it’s about feeling understood, heard, and confident that they have your best interests at heart, even when the market takes an unexpected dip (which, let’s face it, it often does). A strong relationship allows for open dialogue, enabling proactive problem-solving and a shared vision for achieving financial goals.

Characteristics of a Successful Advisor-Client Relationship

A thriving advisor-client dynamic is characterized by several key traits. Open communication, where both parties feel comfortable discussing financial matters, big or small, is paramount. Mutual respect ensures that each party values the other’s perspective and expertise. Transparency, where the advisor’s actions and fees are clearly explained, builds confidence. Finally, shared goals ensure that both parties are working towards the same financial objectives, fostering a sense of collaboration rather than a hierarchical structure. Think of it as a team tackling a financial puzzle together, rather than a client passively receiving advice.

Effective Communication Strategies Between Advisors and Clients

Effective communication involves more than just sending quarterly reports. It’s about actively listening to the client’s concerns, explaining complex financial concepts in simple terms (avoiding jargon that sounds like a foreign language), and providing regular updates on the progress of their financial plan. Regular meetings, scheduled calls, and prompt responses to emails all contribute to building a strong communication channel. The advisor should be adept at tailoring their communication style to the client’s preferences and understanding, ensuring that everyone is on the same page, even if one party is more comfortable with spreadsheets and the other prefers a more conversational approach.

Best Practices for Building Trust and Rapport

Building trust is a gradual process. It begins with a thorough initial consultation where the advisor takes the time to understand the client’s financial situation, goals, and risk tolerance. Transparency in fees and investment strategies is crucial. Regularly sharing market updates and explaining any changes in the investment plan in a clear and concise manner builds confidence. Celebrating milestones together, whether big or small, reinforces the partnership aspect of the relationship. For example, a simple email congratulating a client on reaching a savings goal can go a long way in strengthening the bond. Furthermore, readily acknowledging mistakes and taking responsibility for them when they occur builds credibility and strengthens the relationship. It shows the advisor is human, accountable, and committed to rectifying any issues.

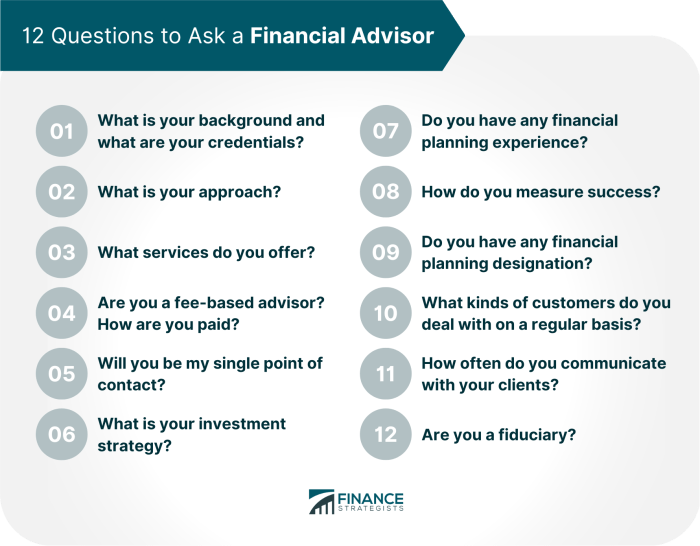

Questions to Ask a Potential Financial Advisor During an Initial Consultation

Before embarking on a financial journey with a new advisor, it’s vital to ask pertinent questions to assess their suitability. These questions should address the advisor’s experience, investment philosophy, fee structure, and client communication practices. Clarifying their conflict of interest policies and understanding their approach to risk management are also crucial steps. Finally, inquiring about their client retention rate and testimonials from existing clients provides valuable insight into their track record and the overall quality of their services. This proactive approach helps ensure a compatible and trustworthy partnership from the outset.

Closing Summary

So, there you have it – a whirlwind tour through the world of financial advisor services. Remember, finding the right advisor is a marathon, not a sprint. Take your time, do your research, ask the tough questions, and don’t be afraid to walk away if something feels off. With careful consideration and a healthy dose of skepticism, you can confidently navigate the financial landscape and build a secure financial future. Now go forth and conquer your finances!

Questions Often Asked

What is a fiduciary advisor?

A fiduciary advisor is legally obligated to act in your best interest. This is a higher standard of care than simply acting with “suitability,” which is a lower bar.

How often should I review my financial plan?

At least annually, or more frequently if there are significant life changes (marriage, job loss, etc.).

What’s the difference between a fee-only and commission-based advisor?

Fee-only advisors charge fees for their services, while commission-based advisors earn commissions from the products they sell you. Fee-only is generally considered more objective.

Can I fire my financial advisor?

Absolutely! You’re the client, and you have the right to end the relationship at any time, although contractual obligations may apply.