Investment Tracking Tools Review: Forget spreadsheets and frantic calculations! This isn’t your grandpappy’s portfolio management. We’re diving headfirst into the wild, wonderful world of investment tracking tools – those digital saviors that promise to tame your financial jungle (and maybe even help you grow a money tree or two). Prepare for a rollercoaster ride of features, comparisons, and enough financial jargon to make your head spin (in a good way, we promise!).

From the novice investor nervously dipping their toe into the market to the seasoned pro juggling multiple asset classes, the right investment tracking tool can be the difference between a smooth sailing financial journey and a shipwreck of missed opportunities. This review will explore the top contenders, comparing their features, security, user experience, and – crucially – their ability to make your financial life less stressful (and maybe even a little bit fun).

Introduction to Investment Tracking Tools

Investing can be a thrilling rollercoaster—a wild ride of highs and lows, profits and… well, let’s just say “opportunities for growth.” Keeping track of it all, however, can feel less like a thrilling adventure and more like navigating a minefield blindfolded. That’s where investment tracking tools come in, offering a much-needed dose of organization and clarity to your financial escapades. These digital assistants provide a centralized hub to monitor your investments, analyze performance, and (hopefully) make smarter decisions.

Investment tracking tools offer a plethora of benefits, streamlining the often-daunting task of managing your portfolio. Imagine having a single, easily accessible dashboard that provides a real-time snapshot of your investments across various accounts. No more frantic spreadsheet juggling or sifting through countless emails—just a clear, concise overview of your financial landscape. This improved visibility allows for better informed decision-making, enabling you to react swiftly to market fluctuations and potentially optimize your investment strategy. Furthermore, these tools often provide insightful reporting and analytics, allowing you to understand your investment performance and identify areas for improvement. Essentially, they transform the often-opaque world of investing into something far more transparent and manageable.

Types of Investors Who Benefit from Investment Tracking Tools

The beauty of investment tracking tools lies in their versatility. They cater to a broad spectrum of investors, regardless of experience level or investment style. Beginners can utilize these tools to gain a fundamental understanding of their investment performance, fostering financial literacy and building confidence. Experienced investors, on the other hand, can leverage the advanced analytics and reporting features to fine-tune their strategies, identify potential risks, and maximize returns. Even investors following specific strategies, such as value investing or growth investing, can find tools tailored to their unique needs, providing specialized metrics and visualizations to support their approach. For example, a value investor might prioritize tools that highlight metrics like price-to-earnings ratios and dividend yields, while a growth investor might focus on tools that track revenue growth and market capitalization.

Common Features of Investment Tracking Tools

Most investment tracking tools share a core set of features designed to simplify the investment management process. A key feature is the ability to consolidate all your investment accounts into a single, unified view. This includes brokerage accounts, retirement accounts (401(k)s, IRAs), and even cryptocurrency holdings. Many tools also offer real-time portfolio valuation, providing an up-to-the-minute picture of your assets’ worth. Beyond basic tracking, many tools provide advanced features like performance analysis (tracking returns, identifying top and bottom performers), tax reporting (calculating capital gains and losses), and even automated alerts to notify you of significant market events or changes in your portfolio’s performance. Some even offer features like goal setting and retirement planning tools, integrating investment tracking with broader financial planning. Think of it as having your own personal financial analyst, available 24/7, without the hefty consulting fees.

Top Investment Tracking Tools

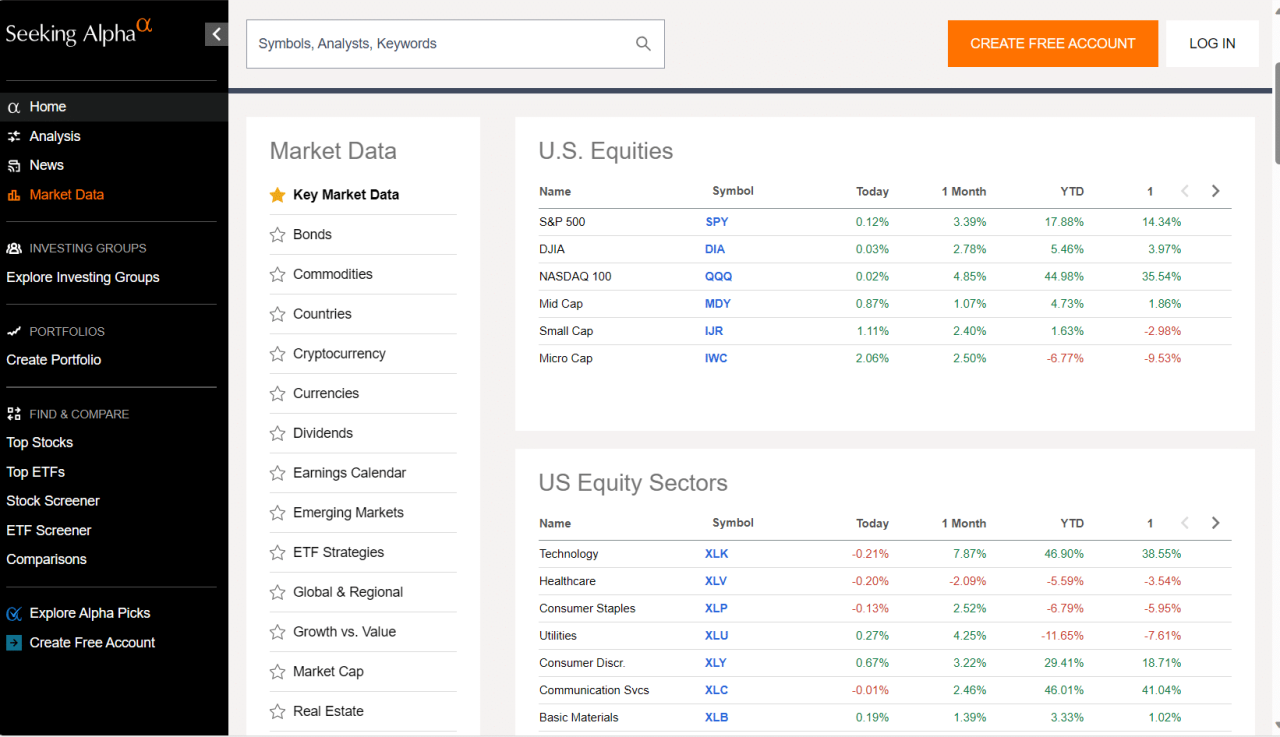

Choosing the right investment tracking tool can feel like navigating a minefield of spreadsheets and jargon. Fear not, intrepid investor! This section will provide a clear, concise, and (dare we say) entertaining comparison of some top contenders in the investment tracking arena. We’ll delve into their strengths, weaknesses, and suitability for various investment styles, so you can pick the perfect tool to keep your portfolio in tip-top shape.

Top Investment Tracking Tools: A Comparative Overview

Investing is serious business, but choosing the right tool doesn’t have to be. Below, we present a comparative overview of five popular investment tracking tools, highlighting their key features, pricing models, and user experiences. Remember, the “best” tool is subjective and depends on your specific needs and investment style.

| Tool Name | Key Features | Pricing | User Reviews Summary |

|---|---|---|---|

| Personal Capital | Retirement planning tools, investment performance analysis, fee analysis, net worth tracking. | Free for basic features; Premium subscription available with additional features. | Generally positive reviews, praising its comprehensive features and user-friendly interface. Some users find the premium features overpriced. |

| Mint | Budgeting tools, investment tracking, spending analysis, credit score monitoring. | Free | Mixed reviews. Users appreciate its ease of use and integration with various financial accounts. Some complain about occasional glitches and limited investment tracking capabilities compared to paid options. |

| Yahoo Finance | Real-time stock quotes, portfolio tracking, financial news, charting tools. | Free | Positive reviews for its free access to real-time data and comprehensive financial news. However, some users find the interface cluttered and the portfolio tracking features less sophisticated than dedicated investment tools. |

| Morningstar | Investment research, portfolio tracking, mutual fund analysis, stock screeners. | Free basic features; Premium subscription with enhanced research and analytics. | Mostly positive reviews for its in-depth investment research capabilities. Premium features are highly rated, but some users find the free version too limited. |

| Quicken | Comprehensive financial management, including budgeting, bill payment, investment tracking, tax preparation assistance. | Paid subscription; pricing varies based on features. | Reviews are mixed, with some praising its all-in-one approach to personal finance management. Others find the software complex and expensive, particularly for users primarily focused on investment tracking. |

Strengths and Weaknesses of Each Tool

Each tool possesses unique strengths and weaknesses, shaped by user feedback and expert analysis. For example, Personal Capital excels in retirement planning, while Mint shines in its simple budgeting integration. However, Mint’s investment tracking might pale in comparison to the depth offered by Morningstar’s premium subscription. Yahoo Finance provides free, real-time data, but its portfolio tracking lacks the sophistication of dedicated platforms like Quicken (though Quicken’s price point may be a deterrent). The choice ultimately depends on your individual priorities and budget.

Suitability for Different Investment Styles and Experience Levels

Beginners might find Mint or Yahoo Finance more approachable due to their user-friendly interfaces and free access. More experienced investors, particularly those with complex portfolios or a focus on retirement planning, might prefer the advanced features of Personal Capital or Morningstar’s premium offering. Quicken, with its comprehensive approach, could be suitable for users seeking an all-in-one solution, but its complexity might overwhelm those new to investing. Ultimately, the “best” tool is the one that best fits your individual needs and comfort level.

Key Features and Functionality of Investment Tracking Tools

Investing can feel like navigating a minefield blindfolded – unless you’ve got the right tools. Investment tracking tools aren’t just for seasoned Wall Street wolves; they’re for anyone who wants to keep tabs on their financial jungle, whether it’s a carefully cultivated portfolio or a slightly wilder collection of assets. These tools provide the clarity and control you need to make informed decisions, transforming your investment journey from a chaotic scramble to a more strategic, and dare we say, enjoyable experience.

Investment tracking tools offer a plethora of features designed to make your financial life less stressful and more profitable. These features range from the straightforward (like calculating your returns) to the surprisingly insightful (like helping you visualize your progress toward long-term goals). Let’s delve into the nitty-gritty, shall we?

Portfolio Performance Tracking and Reporting

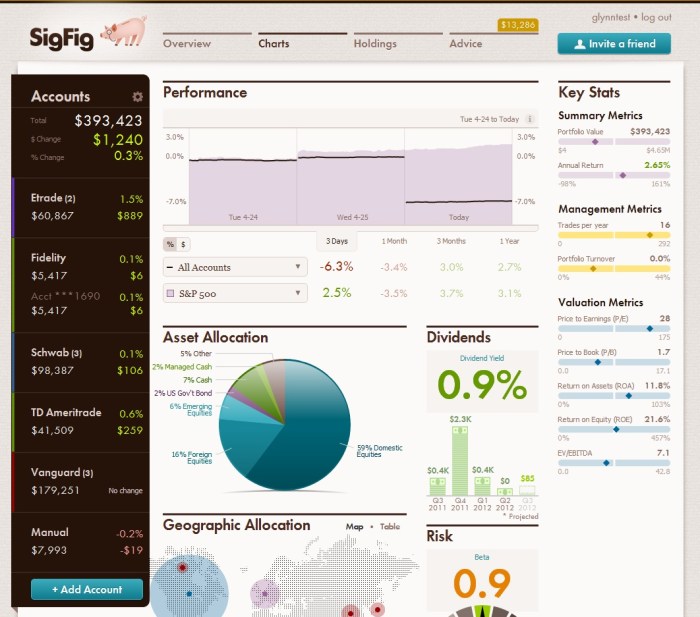

Accurate portfolio performance tracking is the cornerstone of successful investing. These tools automatically aggregate your holdings, calculate your overall returns (both realized and unrealized), and present this information in easily digestible reports. This allows you to monitor your progress over time, identify underperforming assets, and adjust your strategy accordingly. Imagine trying to manage your investments using a spreadsheet – the potential for errors and the sheer tedium are enough to make even the most enthusiastic investor reconsider their life choices. Instead, these tools provide clear, concise summaries, often with customizable charts and graphs, offering a bird’s-eye view of your financial landscape. The ability to generate reports, perhaps for tax purposes or simply for personal review, adds another layer of convenience and organization.

Handling Different Asset Classes

One of the most valuable aspects of these tools is their ability to handle a diverse range of asset classes. Whether you’re invested in stocks, bonds, real estate, cryptocurrencies, or a delightful mix of all of the above, a good investment tracking tool will seamlessly integrate all your holdings into a single, unified view. This eliminates the need for juggling multiple spreadsheets or applications, streamlining your workflow and reducing the risk of overlooking important details. For example, imagine tracking your performance across various sectors – the technology boom, the real estate market’s fluctuations, and the sometimes-volatile world of crypto. A comprehensive tool will allow you to see the big picture, understand the interplay between your different asset classes, and make better-informed decisions based on the overall health of your portfolio.

Goal Tracking

Let’s say Barnaby, a charming but slightly disorganized investor, dreams of buying a beachfront property in five years. Using the goal-tracking feature of his investment tracking tool, Barnaby can input his desired purchase price ($1.5 million, let’s say), his current savings, and his projected annual investment returns. The tool then projects how much Barnaby needs to save each year and how his portfolio needs to perform to reach his goal. If Barnaby’s projections show he’s falling short, the tool might suggest increasing his savings rate or adjusting his investment strategy to achieve his desired outcome. This feature is not just about hitting numerical targets; it’s about providing a visual roadmap to success, keeping Barnaby motivated and focused on his financial aspirations, all while keeping him from needing a therapist to deal with his investment anxiety.

Data Security and Privacy Considerations: Investment Tracking Tools Review

Investing your hard-earned cash is serious business, and so should be the security of your investment data. While the convenience of online investment tracking tools is undeniable, we must also address the elephant in the room: the potential risks associated with entrusting your financial life to a digital platform. Let’s delve into the crucial aspects of data security and privacy when choosing an investment tracking tool.

The bedrock of secure investment tracking lies in robust data encryption and security protocols. Think of it like this: your financial information is the crown jewels of your digital kingdom, and encryption is the impenetrable fortress protecting it. Strong encryption methods, such as AES-256, scramble your data into an unreadable mess for unauthorized eyes. Beyond encryption, multi-factor authentication (MFA), regular security audits, and compliance with industry standards like SOC 2 are essential components of a truly secure platform. Without these safeguards, your financial data is vulnerable to theft, manipulation, or even accidental exposure.

Data Encryption and Security Protocols, Investment Tracking Tools Review

Robust data encryption is paramount. Investment tracking tools should employ industry-standard encryption algorithms like AES-256 to protect data both in transit (while traveling between your device and the server) and at rest (while stored on the server). Imagine a bank vault: AES-256 encryption is like having multiple layers of steel, reinforced concrete, and laser grids protecting the vault’s contents. Furthermore, secure protocols such as HTTPS should be used to ensure all communication between the user and the platform is encrypted. A lack of robust encryption leaves your sensitive data vulnerable to interception and misuse by malicious actors. For example, a tool that only uses weak encryption could allow hackers to easily decipher your portfolio details, potentially leading to identity theft or fraudulent activities.

Best Practices for Selecting a Secure Investment Tracking Tool

Choosing a secure investment tracking tool requires careful consideration. First, look for tools that explicitly state their security protocols and encryption methods. Transparency is key. Don’t hesitate to contact the tool’s support team for clarification if needed. Second, check for independent security audits and certifications. These demonstrate a commitment to security beyond mere marketing claims. Third, opt for tools that offer multi-factor authentication (MFA). MFA adds an extra layer of security by requiring more than just a password to access your account, such as a code sent to your phone or email. Finally, prioritize tools that comply with relevant data privacy regulations, such as GDPR or CCPA, showing a commitment to responsible data handling.

Potential Risks of Storing Sensitive Financial Information Online

Storing sensitive financial information online, while convenient, carries inherent risks. The potential for data breaches, hacking, and unauthorized access is ever-present. Consider the high-profile data breaches that have occurred in recent years, affecting major financial institutions and resulting in significant financial and reputational damage for both the companies and their customers. Even the most secure systems are not completely impervious to sophisticated cyberattacks. A data breach could expose your personal information, such as your social security number, bank account details, and investment holdings, leading to identity theft, financial fraud, and other serious consequences. The risk, while manageable, is undeniably present.

User Experience and Interface Design

Let’s face it, even the most powerful investment tracking tool is useless if it’s harder to navigate than a labyrinth designed by a caffeinated squirrel. A smooth, intuitive user experience is paramount, transforming a potentially stressful activity into something almost… enjoyable. (Almost.) This section will dissect the user interfaces of three popular investment tracking tools, highlighting what makes them user-friendly – or, in some cases, less so.

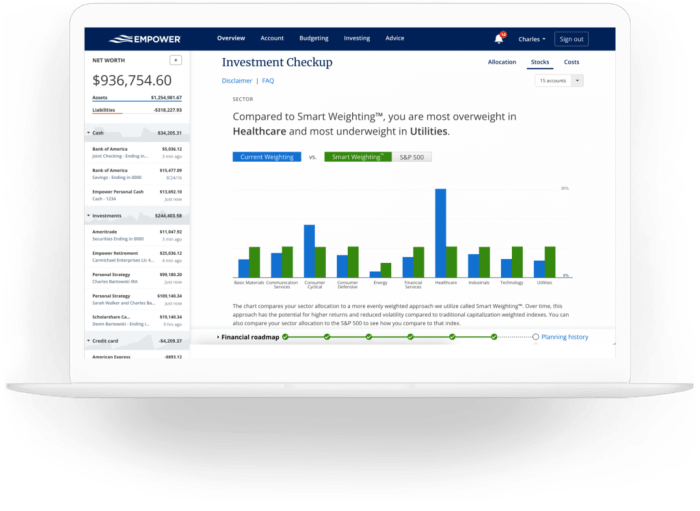

The user interface is the face of your investment tracking software, and a poorly designed one can lead to frustration, inaccurate data entry, and potentially, poor investment decisions. A well-designed interface, however, can significantly improve the overall user experience, making the process of tracking investments more efficient and enjoyable. We’ll explore key aspects such as ease of navigation, intuitive design, and features that enhance user satisfaction.

Comparison of User Interfaces

The following comparison examines the user interfaces of Personal Capital, Quicken, and YNAB (You Need A Budget). While all three offer investment tracking capabilities, their approaches to interface design differ significantly.

- Personal Capital: Personal Capital boasts a clean, modern design with a strong emphasis on visual representation of data. Its dashboard provides a clear overview of your net worth, asset allocation, and investment performance, using charts and graphs effectively. Navigation is generally intuitive, with a straightforward menu system. However, some users have reported that the sheer amount of data presented can feel overwhelming at times. The mobile app mirrors the desktop experience, offering seamless access on the go.

- Quicken: Quicken, a veteran in personal finance software, takes a more traditional approach. Its interface is functional but can feel somewhat cluttered compared to Personal Capital. Navigation can be slightly less intuitive, particularly for users unfamiliar with the software. However, its robust features and customizable options cater to users who prefer a more detailed and comprehensive approach to investment tracking. While a mobile app exists, its functionality is less comprehensive than the desktop version.

- YNAB (You Need A Budget): YNAB, while primarily a budgeting tool, also offers investment tracking capabilities. Its interface is known for its simplicity and ease of use, prioritizing a clear and straightforward approach to managing finances. The focus is less on visual representations of data and more on the practical aspects of budgeting and tracking spending, making investment tracking a secondary but integrated feature. The mobile app is well-designed and provides convenient access to budgeting and investment information.

Features Contributing to a Positive User Experience

Several features significantly contribute to a positive user experience in investment tracking tools. These features are not just bells and whistles; they’re essential for efficient and enjoyable usage.

- Mobile Accessibility: The ability to access and manage investments from a mobile device is crucial in today’s fast-paced world. Tools with robust mobile apps that mirror the desktop experience offer unparalleled convenience.

- Customer Support: Reliable customer support is invaluable when encountering technical issues or needing assistance with the software’s features. Responsive and helpful support can significantly improve the overall user experience.

- Intuitive Data Entry: Efficient and user-friendly data entry methods are critical. Tools that streamline the process of adding transactions and updating investment information minimize frustration and ensure accuracy.

- Customization Options: The ability to customize dashboards and views allows users to tailor the software to their specific needs and preferences, enhancing their overall experience.

Integration with Other Financial Platforms

Ah, the beautiful symphony of interconnected financial data! Integrating your investment tracking tool with other platforms is like adding a perfectly-pitched oboe to your already-amazing financial orchestra – it elevates the whole experience. No more manual data entry, no more frantic spreadsheet juggling; just a smooth, seamless flow of information that lets you truly appreciate the masterpiece of your portfolio.

The benefits of integrating your investment tracking tool with brokerage accounts and other financial management software are numerous. Primarily, it eliminates the tedious and error-prone process of manually inputting transaction data. This automated data transfer saves you valuable time and reduces the risk of human error, ensuring the accuracy of your investment records. Furthermore, a unified view of your finances provides a more holistic understanding of your financial health, making informed decision-making easier and more efficient. Imagine having all your financial ducks in a perfectly organized row – a truly breathtaking sight.

Integration Examples and Functionalities

Several popular investment tracking tools offer seamless integration with major brokerage accounts and financial software. For example, Personal Capital, a well-known financial dashboard, can directly connect to numerous brokerage accounts, automatically downloading transaction history, balances, and asset allocations. This allows users to see a comprehensive overview of their investments across all accounts in one place. Similarly, some tools integrate with accounting software like QuickBooks, enabling a streamlined process for tax preparation and financial reporting. The functionalities of these integrations often include automatic data synchronization, real-time updates, and the ability to categorize transactions for better analysis and reporting. Consider it the ultimate financial organization party, with all your data guests arriving on time and in perfect order.

Connecting a Tool to Different Brokerage Accounts

The process of connecting an investment tracking tool to various brokerage accounts typically involves a secure authentication process. Most tools utilize API (Application Programming Interface) connections to securely access account data. Users are usually required to log in to their brokerage accounts through the investment tracking tool, granting the tool permission to access their account information. This process often involves multi-factor authentication to ensure security and prevent unauthorized access. Once connected, the tool will automatically download and update the relevant data at regular intervals, depending on the tool’s settings and the brokerage account’s capabilities. Think of it as a carefully choreographed dance between your tool and your brokerage account – a graceful exchange of information that’s both secure and efficient.

Cost and Value Proposition of Investment Tracking Tools

Investing in investment tracking tools might seem like an investment in itself, but fear not, dear reader! Let’s dissect the cost versus benefit, ensuring you don’t end up feeling like you’ve been fleeced by a particularly cunning alpaca. Understanding the pricing models and features offered will help you choose the tool that best suits your financial needs and, crucially, your bank balance.

The world of investment tracking tools offers a diverse range of pricing strategies, each with its own quirks and advantages. Navigating this landscape requires a discerning eye and a healthy dose of skepticism – remember, not all that glitters is gold (or, in this case, a perfectly optimized portfolio).

Pricing Models of Investment Tracking Tools

Investment tracking tools employ various pricing models to cater to different user needs and budgets. These models typically fall into three main categories: subscription fees, one-time purchases, and freemium models. Subscription fees involve recurring payments, often monthly or annually, providing continuous access to the tool’s features. One-time purchases offer a single upfront payment for lifetime access, although updates and support might be limited. Freemium models offer a basic version for free, with premium features available through a paid subscription. Consider these models carefully – the “free” version might be like a delicious amuse-bouche, leaving you craving the full gourmet meal (and potentially emptying your wallet in the process).

Feature Justification Based on User Groups

The features that justify the cost of an investment tracking tool vary greatly depending on the user’s investment experience and portfolio complexity. For casual investors with a small portfolio, a free tool with basic tracking capabilities might suffice. However, more experienced investors with complex portfolios might find the advanced features of a paid tool – such as portfolio optimization, tax-loss harvesting analysis, and sophisticated reporting – essential. Think of it like this: a basic tool is like a trusty bicycle, perfectly adequate for short trips; a paid tool is like a luxury sports car, ideal for navigating complex financial terrains. The right choice depends on your investment journey.

Cost-Benefit Analysis: Paid vs. Free Tools

The decision between a paid and a free investment tracking tool hinges on a careful cost-benefit analysis. This involves weighing the cost of the subscription (or one-time purchase) against the benefits provided, such as enhanced features, improved accuracy, better user experience, and potentially time saved.

| Feature | Free Tool | Paid Tool (Example: $10/month) |

|---|---|---|

| Basic Portfolio Tracking | Yes | Yes (with potentially more sophisticated visualizations) |

| Advanced Analytics (e.g., portfolio diversification analysis) | No | Yes |

| Tax-Loss Harvesting Tools | No | Yes |

| Customer Support | Limited or nonexistent | Usually included |

| Data Security and Encryption | May be less robust | Typically more robust |

| Cost per year | $0 | $120 |

| Time saved per month (estimated) | 0 hours | 2 hours (assuming $60/hour valuation of time) |

| Annual Time Savings (Value at $60/hour) | $0 | $1440 |

| Net Annual Benefit (Value – Cost) | $0 | $1320 |

Note: The values in this table are illustrative and will vary depending on the specific tools and individual circumstances. The time saved is a subjective estimation and should be adjusted according to personal experience and the complexity of one’s portfolio. For a high-net-worth individual, the value of time saved could easily justify the higher cost of a premium tool. For someone with a small, simple portfolio, a free tool might be perfectly adequate.

Illustrative Examples

Let’s ditch the theoretical and dive headfirst into the exhilarating world of investment tracking, where spreadsheets become vibrant canvases of financial triumph (or, let’s be honest, sometimes humbling lessons). We’ll explore how a savvy investor might wield an investment tracking tool to navigate the choppy waters of the market, transforming data into actionable insights.

Imagine Amelia, a diligent investor who started using an investment tracking tool a year ago. She meticulously recorded all her investments, from her initial foray into tech stocks to her more conservative bond holdings. The tool, with its user-friendly interface, automatically updates her portfolio’s value daily, providing a comprehensive overview of her investment journey.

Portfolio Performance Visualization Over One Year

Amelia’s tool presents her portfolio’s performance visually through a dynamic line graph. The X-axis represents the twelve months, while the Y-axis displays the portfolio’s total value. The line itself starts at her initial investment amount and fluctuates throughout the year, reflecting gains and losses. Areas where the line slopes upwards are depicted in vibrant green, symbolizing periods of growth, while downward slopes are shown in a less cheerful red, highlighting periods of decline. Key milestones, such as significant purchases or sales, are marked with small flags along the line, providing context to the price fluctuations. At the end of the year, a clear summary box displays the overall percentage gain or loss, alongside the starting and ending portfolio values. This visualization allows Amelia to quickly grasp the overall trend of her investments over the entire year.

Portfolio Diversification Analysis

To understand the risk profile of her portfolio, Amelia utilizes a pie chart provided by her investment tracking tool. Each slice of the pie represents a different asset class (e.g., stocks, bonds, real estate). The size of each slice is directly proportional to the percentage of her total portfolio invested in that specific asset class. For instance, a large slice of vibrant blue might represent a significant allocation to technology stocks, while a smaller, muted grey slice could represent a smaller allocation to bonds. The tool also provides numerical breakdowns for each slice, allowing Amelia to pinpoint areas of over- or under-diversification. Furthermore, a risk assessment score, calculated based on the diversification, is displayed, offering a clear picture of her portfolio’s overall risk level.

Future Investment Planning and Goal Setting

Looking ahead, Amelia uses the tool’s built-in financial goal planning feature. She inputs her desired retirement age and desired retirement income. The tool then generates a personalized investment plan, projecting future portfolio growth based on various market scenarios. This projection is presented as a series of bar charts, each representing a different year until retirement. The height of each bar shows the projected portfolio value, with different colors representing contributions, investment returns, and potential withdrawals. The tool also suggests adjustments to her current investment strategy, recommending increases or decreases in specific asset classes to ensure she’s on track to meet her retirement goal. If she deviates from the projected path, the tool will provide alerts and suggestions for course correction. This proactive approach allows Amelia to adjust her strategy as needed and maintain confidence in achieving her financial goals.

Outcome Summary

So, there you have it – a whirlwind tour through the world of investment tracking tools. While the perfect tool might vary depending on your individual needs and investment style (and possibly your astrological sign), one thing remains clear: empowering yourself with the right technology can significantly simplify the complexities of investing. Whether you’re aiming for early retirement on a tropical island or simply want a clearer picture of your financial health, a well-chosen investment tracking tool can be your trusty sidekick on this exciting journey. Now go forth and conquer your financial goals (responsibly, of course!).

Query Resolution

What if I don’t have many investments? Do I still need a tracking tool?

Even a small portfolio benefits from organization. A tool simplifies tracking, allowing you to monitor progress and make informed decisions, even with a few investments.

Are these tools secure? I’m worried about my data.

Reputable tools employ robust security measures, including encryption and multi-factor authentication. However, always research a tool’s security practices before entrusting your financial information.

Can I use these tools for tax purposes?

Many tools generate reports useful for tax preparation, but they are not a substitute for professional tax advice. Consult a tax professional for accurate tax reporting.

What if I use multiple brokerage accounts?

Some tools integrate with multiple brokerage accounts, providing a consolidated view of your entire portfolio. Check for this feature when selecting a tool.