Retirement Planning Advisors Guide: Don’t let the terrifying prospect of retirement leave you shivering in your slippers! This comprehensive guide navigates the sometimes-bewildering world of financial planning for your golden years, transforming the daunting task into an exciting adventure. We’ll explore everything from shrewd investment strategies (because who doesn’t love a good return?) to the surprisingly fascinating world of estate planning (think of it as leaving a legacy, not just a pile of paperwork). Get ready to ditch the retirement anxieties and embrace the future with confidence—and maybe a margarita or two.

This guide unravels the mysteries of retirement planning, providing clear, concise, and (dare we say) entertaining information on everything from defining your retirement goals and identifying your needs to selecting the right investment vehicles and managing your income effectively. We’ll also delve into the crucial aspects of estate planning and healthcare considerations, ensuring you’re prepared for every stage of your retirement journey. We’ll even throw in a few real-world scenarios – both successful and less-so – to help illustrate the importance of careful planning. So, grab your favorite beverage, settle in, and let’s embark on this journey to a financially secure and fulfilling retirement!

Defining Retirement Planning

Retirement planning: It sounds awfully serious, doesn’t it? Like choosing between beige and off-white for your future rocking chair. But fear not, dear reader! It’s simply the art of strategically navigating the choppy waters of your financial future, ensuring a smooth (and hopefully luxurious) landing in the golden years. It’s about more than just saving money; it’s about crafting a life you genuinely enjoy, even after the alarm clock decides to take a permanent vacation.

Retirement planning encompasses a multifaceted approach to securing your financial well-being and lifestyle during your post-career years. It’s a holistic process that considers your current financial situation, desired lifestyle in retirement, potential health expenses, and the inevitable uncertainties life throws our way (like that rogue squirrel who keeps raiding your bird feeder). The ultimate goal? To achieve financial security and maintain your desired standard of living, even without the regular paycheck.

The Importance of Early Retirement Planning

Starting early offers a significant advantage due to the power of compounding. Imagine a snowball rolling downhill – it starts small, but gathers momentum, becoming larger and faster as it rolls. Similarly, the earlier you begin investing, the more time your money has to grow, benefiting from both investment returns and the reinvestment of those returns. Delaying retirement planning means missing out on years of potential growth, potentially leading to a smaller nest egg and a less comfortable retirement. For example, someone starting to save at age 25 will have significantly more accumulated wealth by retirement age compared to someone starting at age 45, even if both contribute the same amount annually. This difference is amplified by the effect of compound interest.

Key Factors Influencing Retirement Planning Decisions

Several crucial factors significantly influence the retirement planning process, shaping the overall strategy and the choices made.

Lifestyle plays a pivotal role. Do you envision a quiet life in a cozy cottage, or globe-trotting adventures? Your desired lifestyle directly impacts the amount of money you’ll need to save. A lavish lifestyle naturally requires a larger nest egg than a more modest one.

Health is another crucial factor, often overlooked. Unexpected health issues can significantly impact your retirement plans, potentially leading to substantial medical expenses. Planning for potential healthcare costs, including insurance premiums and potential long-term care, is vital. Think of it as buying insurance against the unexpected – far better to be prepared than scrambling when you least expect it.

Financial resources are the foundation upon which your retirement plan is built. This includes current savings, investments, pension plans, and other assets. A thorough assessment of your financial resources is essential to determine your retirement readiness and identify areas needing improvement. Consider it a financial health check-up – knowing your numbers is the first step to building a robust retirement plan.

Identifying Retirement Needs and Goals

Planning for retirement is less about predicting the future (because, let’s face it, squirrels could win the lottery tomorrow) and more about crafting a sensible roadmap based on your current situation and aspirations. This involves a frank assessment of your needs and a realistic projection of your future financial landscape. Think of it as financial archaeology – digging up your current financial situation and projecting it forward to unearth your retirement treasure (or at least, a comfortable nest egg).

Successfully navigating this process requires a clear understanding of your retirement goals and a realistic appraisal of your financial resources. Failing to do so can lead to a retirement that’s less “sun-drenched beach” and more “sun-drenched couch, worrying about bills.” Let’s avoid that scenario.

A Retirement Needs and Goals Questionnaire

This questionnaire is designed to help individuals clarify their retirement aspirations and assess their current financial standing. It’s less of an interrogation and more of a friendly chat with your future self.

The following questions should be answered honestly and thoughtfully, considering both short-term and long-term objectives. Remember, honesty is the best policy, even if your current financial situation resembles a particularly barren desert landscape.

| Question Area | Example Questions |

|---|---|

| Lifestyle | What kind of lifestyle do you envision in retirement? (e.g., travel extensively, relax at home, pursue hobbies) What are your essential monthly expenses (housing, food, transportation, healthcare)? Will your lifestyle change significantly in retirement? (e.g., reduced work-related expenses, increased healthcare costs) |

| Financial Resources | What are your current savings and investments? What is your expected retirement income from pensions, Social Security, or other sources? Do you own any assets (property, etc.)? What are your outstanding debts (mortgages, loans)? |

| Healthcare | What are your current healthcare expenses? Do you anticipate any significant changes in healthcare needs in retirement? (e.g., long-term care) Have you considered the costs of health insurance in retirement? |

| Inflation | Have you considered the impact of inflation on your retirement savings and expenses? How will you adjust your retirement plan to account for potential inflation? |

Setting Realistic Retirement Income Goals

Setting realistic income goals involves a delicate balance between ambition and practicality. It’s about determining a sustainable income stream that aligns with your desired lifestyle without jeopardizing your financial security. Think of it as building a financial sandcastle – ambitious, but sturdy enough to withstand the occasional wave of unexpected expenses.

This requires considering several factors, including your projected expenses, the longevity of your retirement, and the potential impact of inflation. A simple rule of thumb is to aim for a replacement rate of 70-80% of your pre-retirement income, but this should be adjusted based on individual circumstances. For example, a couple retiring with a pre-retirement income of $100,000 might aim for a retirement income of $70,000-$80,000. This assumes their expenses will decrease after retirement.

Assessing Current Financial Resources and Projecting Future Needs, Retirement Planning Advisors Guide

This step involves a thorough examination of your current financial situation and a projection of your future needs. Think of it as a financial crystal ball – not perfectly accurate, but offering a reasonable glimpse into your financial future.

This process requires gathering data on your current assets (savings, investments, property), liabilities (debts, loans), and income (salary, pensions, Social Security). This information will form the basis for projecting your future financial needs. Tools like retirement calculators can assist in this process, providing estimates of your future income and expenses. Remember to factor in potential changes such as inflation, healthcare costs, and potential longevity.

For example, someone with $500,000 in savings, expecting $20,000 annually in Social Security, and anticipating annual expenses of $40,000 would need to determine how to bridge the gap between income and expenses. This might involve drawing down savings, adjusting expenses, or finding additional sources of income.

Investment Strategies for Retirement

Planning for retirement is a bit like planning a ridiculously extravagant, decades-long party – you need a solid budget, a diverse guest list (investments!), and a foolproof plan to avoid running out of punch (money!) before the last guest leaves. This section dives into the thrilling world of investment strategies, ensuring your retirement party is the event of the century, not a premature, financially-induced hangover.

Choosing the right investment mix is crucial for building a comfortable retirement nest egg. It’s a delicate balancing act between risk and reward, much like trying to juggle chainsaws while riding a unicycle. Let’s examine some key players in the retirement investment game.

Investment Options Comparison

The following table compares various investment options, highlighting their risk levels and potential returns. Remember, past performance is not indicative of future results – unless you’re talking about a particularly reliable sourdough starter, in which case, proceed with confidence.

| Asset Class | Risk Level | Potential Return | Considerations |

|---|---|---|---|

| Stocks (Equities) | High | High | Potential for significant growth, but also substantial losses. Suitable for long-term investors with higher risk tolerance. Think rollercoaster – exhilarating, but potentially stomach-churning. |

| Bonds (Fixed Income) | Low to Moderate | Moderate | Generally considered safer than stocks, offering predictable income streams. Think comfortable rocking chair on the porch – less exciting, but reliable. |

| Mutual Funds | Low to High (depending on fund type) | Variable (depending on fund type) | Offer diversification across various asset classes. Think a well-stocked buffet – something for everyone, but requires careful selection. |

| Real Estate | Moderate to High | Moderate to High | Can provide both income (rent) and capital appreciation. Requires significant upfront investment and ongoing management. Think renovating a fixer-upper – potentially rewarding, but definitely demanding. |

Diversification and Risk Mitigation

Diversification is the art of spreading your investments across different asset classes to reduce the overall risk of your portfolio. It’s like not putting all your eggs in one basket – unless, of course, you’re a master basket weaver and have an exceptionally sturdy basket. A well-diversified portfolio aims to balance higher-risk, higher-return investments with lower-risk, lower-return options. This approach helps to cushion the blow if one investment underperforms, preventing a catastrophic collapse of your retirement dreams.

Calculating Required Rate of Return

Determining the required rate of return is essential to ensure you achieve your retirement goals. This involves estimating how much your investments need to grow annually to reach your desired retirement income. Think of it as reverse-engineering your retirement party – figuring out how much champagne you need to buy now to ensure enough bubbles for the big day.

A simplified calculation involves using the future value formula. While this doesn’t account for all market complexities, it offers a useful starting point:

Future Value (FV) = Present Value (PV) * (1 + Rate of Return)^Number of Years

To determine the required rate of return, you would need to rearrange the formula and solve for the rate of return. For example, if you need $1,000,000 in 20 years and have $200,000 today, you’d need to find the rate of return that makes the equation true. This requires more complex calculations or financial calculators, readily available online. Remember to consult with a financial professional for personalized guidance.

Retirement Savings Vehicles

Ah, retirement savings vehicles – the chariots that will carry you to the golden shores of financial freedom (or at least, a comfortable, slightly less stressful version of your current life). Choosing the right one is crucial, like picking the perfect steed for a quest – you wouldn’t want a donkey when you need a unicorn, would you? Let’s explore your options.

Several types of retirement savings accounts cater to different needs and risk tolerances. Understanding their nuances is key to maximizing your retirement nest egg. Think of it as a strategic game of financial Jenga – you need to carefully place each block (contribution) to avoid a disastrous collapse (retirement shortfall).

401(k) Plans

Offered by many employers, 401(k)s are a fantastic way to save for retirement while potentially benefiting from employer matching contributions – free money! It’s like getting a bonus for saving for your future. However, investment options are usually limited to those offered by your employer’s plan provider. Think of it as a curated menu – delicious, but not quite as expansive as a buffet.

- Contribution Limits: These change annually, so it’s crucial to check the IRS website for the most up-to-date information. For 2023, the maximum contribution was $22,500, with an additional $7,500 catch-up contribution allowed for those age 50 and older.

- Withdrawal Rules: Generally, withdrawals before age 59 1/2 are subject to a 10% early withdrawal penalty, plus your usual income tax. Exceptions exist for certain hardships, such as a first-time home purchase or medical expenses. But remember, these are exceptions, not the rule.

- Tax Implications: Contributions are typically pre-tax, reducing your current taxable income. However, withdrawals in retirement are taxed as ordinary income.

Traditional IRAs

Individual Retirement Accounts (IRAs) offer more flexibility than 401(k)s, allowing you to choose from a wider range of investments. Think of it as a buffet compared to a curated menu. But remember, with great flexibility comes great responsibility!

- Contribution Limits: Similar to 401(k)s, these are adjusted annually. For 2023, the maximum contribution was $6,500, with an additional $1,000 catch-up contribution for those age 50 and older.

- Withdrawal Rules: Similar penalties apply for early withdrawals as with 401(k)s.

- Tax Implications: Contributions are tax-deductible, reducing your taxable income in the year of contribution. Withdrawals in retirement are taxed as ordinary income.

Roth IRAs

Roth IRAs are the rebels of the retirement savings world. Contributions are made after tax, but withdrawals in retirement are tax-free. It’s a trade-off, but a potentially rewarding one. Imagine paying your taxes now for a tax-free retirement – a smart move for those who expect to be in a higher tax bracket in retirement.

- Contribution Limits: Identical to Traditional IRAs. For 2023, the maximum contribution was $6,500, with an additional $1,000 catch-up contribution for those age 50 and older.

- Withdrawal Rules: Withdrawals of contributions are always tax-free and penalty-free. Withdrawals of earnings before age 59 1/2 are subject to a 10% penalty, unless certain exceptions apply (like with 401(k)s).

- Tax Implications: Contributions are not tax-deductible, but qualified withdrawals in retirement are tax-free.

Managing Retirement Income

Retirement: the golden years, a time for leisurely pursuits, and… meticulously managing your dwindling funds. Let’s face it, the thrill of finally escaping the 9-to-5 grind can quickly fade if your finances resemble a particularly chaotic game of Jenga. Proper retirement income management is not about deprivation; it’s about strategic navigation to ensure a comfortable and enjoyable retirement.

Managing your retirement income effectively requires a proactive approach, combining careful planning with a dash of flexibility. Think of it as a well-orchestrated symphony, where each financial instrument plays its part in creating a harmonious retirement melody. Failing to plan is planning to fail, and in this case, failure could mean facing a less-than-ideal retirement.

Budgeting and Expense Management in Retirement

Creating a realistic retirement budget is crucial. It’s not just about tracking your spending; it’s about understanding your spending habits and making informed decisions about where your money goes. Consider your essential expenses (housing, healthcare, food) and your discretionary spending (travel, hobbies, entertainment). A helpful approach is to categorize expenses, track them for a few months, and then analyze the data to identify areas where you can potentially cut back or reallocate funds. For instance, you might discover that your monthly dining-out budget could be reduced by opting for more home-cooked meals, freeing up funds for travel later in the year. This is not about sacrificing enjoyment, but about making conscious choices to maximize your financial resources.

Adjusting to Changes in Income and Lifestyle

Retirement often brings unforeseen changes, both in income and lifestyle. Unexpected medical expenses, inflation, or even a change in living situation can significantly impact your financial plan. It’s vital to have a contingency plan in place to address these potential challenges. For example, maintaining a healthy emergency fund (ideally 3-6 months’ worth of expenses) can provide a safety net during unexpected events. Additionally, consider exploring options like part-time work or downsizing your home to supplement your income or reduce expenses if needed. Remember, flexibility is key. Adjusting your lifestyle to match your available income doesn’t mean sacrificing happiness; it means adapting to ensure long-term financial security. A couple who planned for a lavish cruise every year might adjust to a shorter, more budget-friendly trip, or a staycation. The key is to maintain the joy, just in a more cost-effective way.

Strategies for Effective Retirement Income Management

Several strategies can help ensure financial security throughout retirement. Diversifying your investment portfolio across various asset classes (stocks, bonds, real estate) can help mitigate risk. Regularly reviewing and adjusting your investment strategy based on market conditions and your changing needs is also crucial. Consider consulting a financial advisor to create a personalized plan tailored to your specific circumstances. Additionally, explore options like annuities or reverse mortgages, which can provide a steady stream of income or access to your home equity, respectively. Each of these strategies requires careful consideration of potential risks and benefits. It is advisable to seek professional financial advice before making any significant decisions.

Estate Planning and Legacy

Leaving behind a well-organized financial legacy isn’t just for the ultra-wealthy; it’s a crucial aspect of retirement planning for everyone. Think of it as the final, slightly dramatic, act of your financial life – ensuring your hard-earned assets are distributed according to your wishes and minimizing potential headaches for your loved ones. Failing to plan is, as they say, planning to fail, and that’s definitely not the comedic ending you want for your financial story.

Estate planning ensures your assets are distributed smoothly, preventing potential family feuds over who gets the antique pickle fork collection (assuming you have one, of course). It also provides a safety net for your dependents, safeguarding their financial future even after you’re enjoying your well-deserved retirement on a tropical beach (or wherever your retirement dreams take you). A well-crafted estate plan minimizes estate taxes, protects your assets from creditors, and allows you to specify how your possessions will be handled – preventing any unexpected plot twists in your family’s financial narrative.

Components of an Estate Plan

A comprehensive estate plan typically includes several key components working together like a well-oiled (and surprisingly entertaining) financial machine. These documents ensure your wishes are clearly articulated and legally binding, preventing any unwanted improvisations from unforeseen circumstances.

- Will: This legal document dictates how your assets will be distributed after your passing. Think of it as your final directorial cut of your financial film, ensuring the ending aligns perfectly with your vision. A will specifies who inherits your assets (your beneficiaries) and who will manage those assets for your minor children (your executor). Without a will, the state decides, and that’s rarely as exciting or well-planned as your own masterpiece.

- Trust: A trust is a legal entity that holds and manages assets for the benefit of others. Different types of trusts exist, each serving a specific purpose. For example, a revocable living trust allows you to change or revoke the terms during your lifetime, providing flexibility. An irrevocable trust, on the other hand, offers greater protection from creditors and taxes but sacrifices flexibility. Think of it as choosing between a flexible but slightly chaotic improv show versus a meticulously choreographed ballet – both have their merits.

- Power of Attorney: This document designates someone to make financial and/or healthcare decisions on your behalf if you become incapacitated. This is particularly crucial during retirement, ensuring your affairs are managed effectively if unexpected health issues arise. Choose wisely; this person will be handling your finances, so avoid appointing someone with a questionable track record of managing their own funds.

Minimizing Estate Taxes and Preserving Assets

Minimizing estate taxes is a significant aspect of estate planning, especially for high-net-worth individuals. While the specifics depend on your location and the value of your estate, several strategies can help. These are not foolproof, of course, but they’re like strategic moves in a financial chess game – well-planned and potentially very rewarding.

Strategies include gifting assets during your lifetime (within annual gift tax limits), utilizing charitable giving to reduce your taxable estate, and employing sophisticated tax planning techniques like trusts and life insurance strategies. Consult with a qualified estate planning attorney and tax advisor to determine the best approach for your specific situation. This isn’t a game you want to play solo; seeking professional advice is key to ensuring you’re making the most strategic moves.

Sample Estate Plan

It’s important to note that this is a simplified example and should not be considered legal advice. A personalized estate plan tailored to your unique circumstances is crucial.

Imagine a family with two adult children, substantial assets, and a desire to minimize estate taxes. Their estate plan might include:

- A will distributing assets to their children and specifying an executor.

- A revocable living trust to manage assets during their lifetime and streamline distribution after their passing.

- Durable power of attorney documents naming trusted individuals to manage their finances and healthcare decisions.

- A strategy involving annual gifts to their children and charitable donations to reduce their taxable estate.

Healthcare Considerations in Retirement: Retirement Planning Advisors Guide

Retirement: the golden years, a time for leisurely pursuits, and… potentially crippling medical bills? Let’s face it, healthcare costs are a significant, and often unpredictable, elephant in the room when planning for retirement. Failing to adequately address this can transform your idyllic sunset years into a financial scramble. Proper planning, however, can help you navigate this potential minefield with a bit more grace (and money) than you might expect.

Planning for healthcare costs in retirement requires a multi-faceted approach, encompassing everything from understanding Medicare to exploring supplemental insurance options and strategizing for long-term care. Ignoring these aspects could leave you financially vulnerable during a period when you’re least equipped to handle unexpected expenses. Fortunately, with careful consideration and proactive planning, you can significantly mitigate these risks.

Medicare and Supplemental Insurance

Medicare, the federal health insurance program for those 65 and older (and some younger individuals with disabilities), is a crucial component of retirement healthcare planning. However, it doesn’t cover everything. Original Medicare (Parts A and B) has significant out-of-pocket costs, including deductibles, co-pays, and coinsurance. Medicare Part D, which covers prescription drugs, also has its own cost-sharing complexities. To address these gaps, many retirees opt for supplemental insurance (Medigap) policies to help cover those costs. Medigap plans vary widely in coverage and cost, so careful comparison shopping is essential. Additionally, Medicare Advantage plans (Part C) offer an alternative to Original Medicare, often bundling coverage with additional benefits like vision and dental, but again, understanding the plan’s limitations and costs is paramount. Choosing the right Medicare plan requires careful consideration of individual health needs and financial resources. For example, a retiree with pre-existing conditions might find a Medicare Advantage plan more suitable, while a healthy retiree might be content with Original Medicare supplemented by a Medigap policy.

Managing Long-Term Care Expenses

Long-term care, encompassing assistance with daily living activities like bathing, dressing, and eating, can be incredibly expensive. Nursing homes, assisted living facilities, and in-home care services all come with substantial price tags. The cost can quickly deplete retirement savings if not properly planned for. Strategies for managing these expenses include purchasing long-term care insurance, which can help cover the costs of care, although premiums can be substantial and the policy’s details are crucial to understand. Alternatively, many retirees rely on a combination of personal savings, family support, and Medicaid (for those who qualify). However, Medicaid eligibility requirements are stringent, and relying solely on this option can be risky. Planning for long-term care is a critical aspect of retirement planning, requiring careful consideration of potential costs and available resources. For example, a couple might consider a reverse mortgage to access home equity to cover unexpected long-term care expenses.

Healthcare Considerations Checklist for Retirees

Before diving into the specifics of your retirement healthcare plan, consider this checklist to ensure you’re covering all bases. This is not an exhaustive list, but it’s a solid starting point for a comprehensive strategy. Remember to consult with financial and healthcare professionals for personalized advice.

- Review your current health insurance coverage and understand your out-of-pocket expenses.

- Research Medicare options and choose the plan that best suits your needs and budget.

- Explore supplemental insurance options (Medigap or Medicare Advantage) to fill gaps in Medicare coverage.

- Assess your potential need for long-term care and explore options for financing such care, including long-term care insurance.

- Develop a budget that includes projected healthcare costs throughout your retirement.

- Regularly review and update your healthcare plan as your needs and circumstances change.

Seeking Professional Advice

Navigating the often-bewildering world of retirement planning can feel like trying to assemble flat-pack furniture while blindfolded and juggling flaming torches. Fortunately, you don’t have to go it alone. A team of skilled financial professionals can help you build a robust and secure retirement plan, ensuring your golden years sparkle rather than fizzle.

The right financial advisor can be the difference between a comfortable retirement filled with travel and hobbies, and one spent nervously eyeing your dwindling savings. Choosing wisely is paramount, so let’s explore the various roles and the selection process.

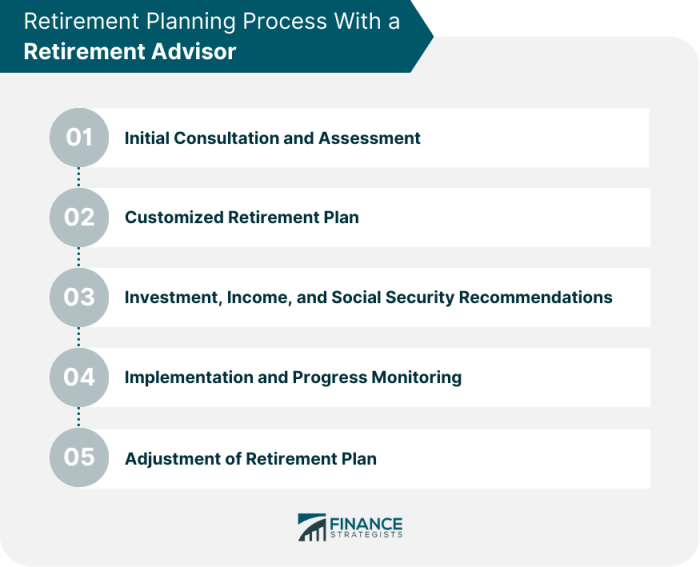

Roles of Financial Professionals in Retirement Planning

Several types of financial professionals can contribute to a comprehensive retirement strategy. Each brings unique expertise and perspectives, often working collaboratively to create a tailored plan. Understanding their roles is crucial for building your dream team.

- Financial Advisors: These professionals provide holistic financial planning, encompassing retirement, investment management, tax planning, and estate planning. They often act as the central point of contact, coordinating with other specialists.

- Certified Financial Planners (CFPs): CFPs are fiduciaries, meaning they are legally bound to act in your best interest. They undergo rigorous training and certification, offering a high level of expertise and ethical standards.

- Investment Advisors: These experts specialize in managing investments, helping you choose the right asset allocation to meet your risk tolerance and retirement goals. They may work independently or in conjunction with a financial advisor.

- Estate Planning Attorneys: Essential for ensuring your assets are distributed according to your wishes, these professionals draft wills, trusts, and other legal documents related to inheritance and estate tax planning.

- Tax Advisors/Accountants: They help you minimize your tax liability throughout your retirement years, ensuring you keep more of your hard-earned money. Understanding tax implications is critical for successful retirement planning.

Selecting a Qualified Retirement Planning Advisor

Finding the right advisor is like finding the perfect pair of shoes – comfortable, supportive, and a good fit for your personality and needs. Consider these factors:

- Fiduciary Duty: Prioritize advisors who are fiduciaries, legally obligated to act in your best interest.

- Experience and Credentials: Look for relevant certifications like CFP or Chartered Financial Analyst (CFA) and a proven track record.

- Fees and Compensation: Understand how the advisor is compensated – fees, commissions, or a combination – and ensure transparency.

- Investment Philosophy: Align your investment approach with the advisor’s philosophy. Do their strategies match your risk tolerance and long-term goals?

- Communication and Trust: Choose an advisor you feel comfortable communicating with, someone who listens to your concerns and explains complex concepts clearly.

Importance of Regular Plan Reviews and Adjustments

Your retirement plan shouldn’t be a static document; it’s a living, breathing entity that needs regular check-ups and adjustments. Life throws curveballs – job changes, market fluctuations, unexpected expenses – all of which can impact your retirement strategy.

Regular reviews (at least annually, or more frequently if significant life changes occur) allow you to:

- Monitor Progress: Track your progress towards your retirement goals and make necessary adjustments to your savings and investment strategies.

- Adapt to Market Conditions: Respond to changes in the market and adjust your investment portfolio to mitigate risk and maximize returns.

- Account for Life Changes: Incorporate significant life events, such as marriage, divorce, birth of a child, or changes in health, into your plan.

- Reassess Retirement Needs: Your needs and goals may evolve over time. Regular reviews help you ensure your plan remains aligned with your current aspirations.

Illustrating Retirement Scenarios

Retirement planning, much like a well-crafted soufflé, requires careful attention to detail and a dash of foresight to avoid a culinary (and financial) disaster. Let’s examine two contrasting scenarios – one a testament to meticulous planning, the other a cautionary tale of what can happen when retirement dreams are left to chance.

Successful Retirement: The “Golden Years” Actually Shine

Imagine Beatrice, a 65-year-old retiree who started planning for her golden years when she was a sprightly 25. She diligently contributed to a 401(k) throughout her career, consistently maximizing employer matching contributions. She also invested in a Roth IRA, strategically diversifying her portfolio across stocks, bonds, and real estate investment trusts (REITs). Beatrice’s investment strategy wasn’t a wild gamble; she opted for a balanced approach, aligning her risk tolerance with her long-term goals. She regularly rebalanced her portfolio to maintain this balance, adjusting as needed throughout her working life. In addition to her retirement accounts, Beatrice also owned her home outright, providing a significant asset and eliminating a major monthly expense. Upon retirement, Beatrice’s diversified investments generated a steady stream of income, supplementing her Social Security benefits. She enjoys a comfortable lifestyle, traveling extensively, pursuing her passion for pottery, and spending quality time with her grandchildren. Her financial security provides peace of mind, allowing her to focus on what truly matters – enjoying life to the fullest. This is not a fairy tale; careful planning and disciplined investing can indeed lead to a fulfilling retirement.

Unsuccessful Retirement: A Recipe for Disaster

Now, let’s meet Arthur, also 65, who believed retirement would simply “happen.” He never seriously considered a retirement plan, assuming his Social Security benefits would be enough. He lived paycheck to paycheck, rarely saving and accumulating significant debt along the way. Arthur’s lack of planning has left him facing a stark reality: his Social Security income barely covers his essential living expenses, and he’s forced to rely on a meager part-time job to make ends meet. He dreams of travel and leisure, but instead, he’s burdened by financial worries, his health is suffering from stress, and his retirement looks more like a struggle than a reward. Arthur’s situation highlights the critical importance of proactive retirement planning. A lack of planning can lead to a stressful and financially precarious retirement, limiting opportunities and impacting overall well-being. His story serves as a stark reminder that retirement isn’t something that just happens; it’s something that needs to be carefully planned and managed.

Last Point

Retirement planning doesn’t have to be a stressful, confusing ordeal. With careful planning, a dash of savvy, and perhaps a little help from a qualified advisor, you can navigate the complexities of securing your financial future and create a retirement that’s not just comfortable, but truly enjoyable. Remember, this isn’t just about numbers; it’s about securing your dreams and ensuring you have the freedom to pursue your passions in the years to come. So, embrace the journey, make informed decisions, and look forward to a retirement filled with sunshine, laughter, and perhaps a well-deserved nap or two. Now go forth and plan your fabulous retirement!

FAQ Compilation

What is the difference between a 401(k) and a Roth IRA?

A 401(k) is employer-sponsored, often with matching contributions, and taxes are deferred until retirement. A Roth IRA is funded with after-tax dollars, but withdrawals in retirement are tax-free.

How much should I save for retirement?

There’s no one-size-fits-all answer. A general rule of thumb is to aim for saving at least 10-15% of your pre-tax income, but your individual needs will vary based on factors like lifestyle and expected lifespan.

When should I start planning for retirement?

The sooner, the better! Starting early allows the power of compounding to work its magic, making it easier to achieve your retirement goals.

What if I don’t have a 401(k) or employer-sponsored retirement plan?

You can still save for retirement through other vehicles like Roth IRAs, traditional IRAs, and taxable brokerage accounts.

How do I find a qualified retirement planning advisor?

Look for a fiduciary advisor who acts in your best interest, has appropriate certifications (like a CFP), and comes highly recommended.