Financial Data Analytics Tools Review: Dive into the wild, wild west of financial data crunching! This isn’t your grandpappy’s spreadsheet; we’re talking algorithms that predict the future (almost), tools that tame terabytes of data, and software so powerful it practically brews your morning coffee (okay, maybe not that last one). Prepare for a whirlwind tour of the most exciting (and sometimes bewildering) tools shaping the financial world.

We’ll explore the evolution of these analytical powerhouses, examining how they’ve transformed everything from risk assessment to fraud detection. From analyzing market trends to predicting the next big thing (or avoiding the next big crash!), we’ll uncover the secrets behind the data and the tools that unlock it. Get ready for a deep dive into the features, functionalities, and sometimes frustrating realities of using these indispensable tools.

Introduction to Financial Data Analytics Tools

The world of finance is drowning in data – a veritable ocean of numbers swirling with opportunities and risks. Navigating this deluge requires powerful tools, and that’s where financial data analytics tools come in. These aren’t just spreadsheets anymore; they’re sophisticated systems capable of uncovering hidden patterns, predicting market movements (with varying degrees of success, of course!), and ultimately, helping financial institutions make smarter, more profitable decisions. Think of them as the financial equivalent of a highly caffeinated, data-obsessed Sherlock Holmes.

Financial data analytics tools have evolved dramatically. From humble beginnings as simple statistical packages, they’ve blossomed into complex ecosystems incorporating machine learning, artificial intelligence, and cloud computing. This evolution has been driven by the ever-increasing volume and velocity of financial data, coupled with a growing need for real-time insights and predictive capabilities. The days of relying solely on gut feeling are, thankfully, numbered.

Types of Financial Data Analyzed

These tools analyze a wide array of financial data, providing a holistic view of the market and individual entities. Market data, including stock prices, interest rates, and exchange rates, forms the backbone of many analyses. Transactional data, encompassing everything from credit card purchases to high-frequency trading activity, provides granular detail on individual behaviors and market trends. Risk data, encompassing credit scores, default rates, and market volatility, helps institutions assess and manage potential losses. Finally, alternative data, such as social media sentiment or satellite imagery of retail parking lots (yes, really!), is increasingly being used to gain a competitive edge.

Comparison of Financial Data Analytics Tools

The market offers a plethora of tools, each with its own strengths and weaknesses. Choosing the right one depends heavily on your specific needs and budget. Below is a comparison of four popular options. Note that pricing can vary greatly depending on the specific features and number of users.

| Tool | Features | Pricing | Target Users |

|---|---|---|---|

| Bloomberg Terminal | Comprehensive market data, analytics, and trading tools; extensive news and research; sophisticated charting capabilities. | High (subscription-based) | Professional investors, traders, and financial analysts. |

| Tableau | Powerful data visualization and business intelligence platform; excellent for creating interactive dashboards and reports; relatively easy to learn. | Mid-range (subscription-based, tiered pricing) | Financial analysts, business intelligence teams, and data scientists. |

| Python with relevant libraries (pandas, scikit-learn) | Highly customizable and flexible; allows for advanced statistical modeling and machine learning; requires programming expertise. | Low (open-source libraries, potential costs for cloud computing) | Data scientists, quantitative analysts, and experienced programmers. |

| Alteryx | User-friendly data preparation and analytics platform; strong capabilities for data blending and automation; intuitive drag-and-drop interface. | Mid-range (subscription-based, tiered pricing) | Data analysts, business users, and citizen data scientists. |

Key Features of Popular Financial Data Analytics Tools

The world of financial data analytics is a thrilling rollercoaster—a dizzying blend of complex algorithms and breathtaking visualizations. But fear not, intrepid data explorer! Navigating this landscape is made significantly easier with the right tools. Let’s delve into the core functionalities of three leading players, examining their strengths, weaknesses, and integration capabilities with the same rigorous (yet entertaining) scrutiny we’d apply to a particularly dodgy derivative.

Choosing the right tool depends heavily on your specific needs and budget. Some tools excel at specific tasks, while others offer a more all-encompassing solution. We’ll focus on three popular options: Tableau, Power BI, and Python with relevant libraries (like Pandas and Scikit-learn). Each brings its own unique flavor to the data analysis party.

Tableau: The Visual Master

Tableau is renowned for its intuitive drag-and-drop interface and stunning visualization capabilities. Its strength lies in its ability to transform raw data into easily digestible, insightful dashboards and reports. Think of it as the Michelangelo of data visualization—capable of creating masterpieces even from the most chaotic of datasets. However, its ease of use comes at a cost. While the initial learning curve is gentle, mastering its advanced features requires dedication. Its integration with other software is generally seamless, boasting robust connectors for various databases and cloud platforms. But the price tag can be a significant hurdle for smaller businesses. Tableau’s data cleaning capabilities are adequate, but for truly messy data, you might find yourself needing to pre-process it elsewhere. Forecasting features are present but not as sophisticated as those offered by some competitors.

Power BI: The Microsoft Marvel

Power BI, Microsoft’s entry into the data analytics arena, is a powerful and versatile tool. It integrates seamlessly with the Microsoft ecosystem, making it a natural choice for businesses already heavily invested in Microsoft products. Its data visualization capabilities are strong, although perhaps not as visually striking as Tableau’s. Power BI excels in its robust reporting features and ability to create interactive dashboards. Data cleaning functionalities are quite good, offering a variety of tools for data transformation and manipulation. Its forecasting capabilities are improving steadily, leveraging machine learning algorithms for predictive modeling. However, its strength in integration within the Microsoft ecosystem can also be seen as a weakness, potentially limiting its compatibility with other systems.

Python with Pandas and Scikit-learn: The Programmer’s Paradise

For those comfortable with coding, Python, coupled with powerful libraries like Pandas and Scikit-learn, offers unparalleled flexibility and customization. Pandas provides robust data manipulation capabilities, allowing for intricate data cleaning and transformation. Scikit-learn offers a wide array of machine learning algorithms for sophisticated forecasting and predictive analytics. The visualization aspect relies on libraries like Matplotlib and Seaborn, which, while powerful, require a steeper learning curve than the drag-and-drop interfaces of Tableau and Power BI. Integration with other systems is highly dependent on the programmer’s skill and the APIs available. This approach offers the greatest control and customization, but demands significant programming expertise. Think of it as building a bespoke suit versus buying one off the rack—far more customizable, but requiring a skilled tailor (programmer).

Comparative Feature Table

This table offers a concise comparison of the three tools across key functionalities. Remember, the “best” tool depends entirely on your specific requirements and technical expertise. Choosing wisely is key to avoiding a data analysis disaster!

| Feature | Tableau | Power BI | Python (Pandas/Scikit-learn) |

|---|---|---|---|

| Data Cleaning | Adequate, but may require pre-processing for complex datasets | Good, offers various data transformation tools | Excellent, highly customizable using Pandas |

| Data Visualization | Excellent, intuitive drag-and-drop interface, stunning visuals | Strong, interactive dashboards and reports | Highly customizable, requires coding (Matplotlib, Seaborn) |

| Forecasting | Present, but less sophisticated than some competitors | Improving steadily, leveraging machine learning | Excellent, wide array of machine learning algorithms available (Scikit-learn) |

| Reporting | Strong, easily create interactive dashboards and reports | Very strong, integrates well with Microsoft ecosystem | Highly customizable, requires coding |

| Integration | Good, robust connectors for various databases and cloud platforms | Excellent within Microsoft ecosystem, limited outside | Highly dependent on programmer’s skill and APIs |

Data Processing and Management Capabilities

Wrestling financial data into submission? It’s a messy business, akin to taming a pack of hyperactive squirrels armed with spreadsheets. But fear not, intrepid data analyst! Financial data analytics tools offer a range of capabilities to tame this chaotic beast, transforming raw data into insightful nuggets of gold. Let’s delve into the fascinating world of data processing and management.

Data cleaning and preprocessing are the foundational steps, akin to preparing ingredients before baking a delicious financial pie. These tools employ various methods to identify and correct inconsistencies, errors, and inaccuracies. This often involves handling missing values, removing duplicates, and standardizing data formats. Imagine it as a meticulous chef meticulously inspecting each ingredient before it enters the recipe. The result? A more accurate and reliable analysis, free from the bitter taste of bad data.

Data Cleaning and Preprocessing Methods, Financial Data Analytics Tools Review

These tools typically employ a variety of techniques for data cleaning. For instance, they might use algorithms to detect and impute missing values based on patterns in the existing data. Outliers, those pesky data points that stray far from the norm, can be identified using statistical methods such as the Z-score or interquartile range. Duplicate entries are readily identified and removed, ensuring data integrity. Data transformation often involves scaling or normalizing data to improve model performance, a bit like adjusting the oven temperature for perfect baking.

Data Transformation and Feature Engineering

Once the data is clean, the real fun begins: transforming it into a format suitable for analysis. This involves techniques such as scaling (standardizing values to a specific range), encoding categorical variables (transforming text into numerical representations), and creating new features (combining existing variables to generate more insightful metrics). For example, one might create a new feature representing the “return on investment” by combining profit and investment cost. This process is akin to a sculptor carefully shaping a raw block of marble into a masterpiece.

Handling Missing Data and Outliers

Missing data is a common problem in financial datasets, often arising from incomplete records or data entry errors. These tools offer several strategies for dealing with this. Simple imputation methods, such as replacing missing values with the mean or median, are commonly used. More sophisticated methods, such as k-nearest neighbors imputation, consider the values of similar data points to estimate the missing value. Outliers, while sometimes genuine, can skew results. Robust statistical methods, less sensitive to outliers, can be employed, or outliers can be removed if deemed inappropriate. The key is careful consideration of the context and potential impact on the analysis.

Supported Data Formats

The ability to seamlessly handle diverse data formats is crucial. A good financial data analytics tool should support a wide range of formats to accommodate the varied sources of financial data.

- CSV (Comma Separated Values)

- Excel (XLS, XLSX)

- JSON (JavaScript Object Notation)

- XML (Extensible Markup Language)

- SQL Databases

- Parquet

- HDF5 (Hierarchical Data Format version 5)

The variety ensures compatibility with numerous data sources, minimizing the need for extensive data conversion and preprocessing before analysis. This saves valuable time and effort, allowing analysts to focus on the more intellectually stimulating aspects of their work, such as interpreting results and making insightful conclusions. Choosing a tool with broad format support is akin to selecting a versatile Swiss Army knife – always ready for any data challenge that arises.

Advanced Analytics Techniques Supported

Financial data analytics tools aren’t just for number-crunching novices; they’re powerhouses capable of sophisticated statistical modeling and machine learning. These tools allow even financially-challenged analysts (pun intended!) to delve into the complexities of advanced analytics, making sense of market trends and identifying lucrative opportunities – or avoiding costly pitfalls. Let’s explore how these tools facilitate advanced techniques.

These tools go beyond simple descriptive statistics. They provide the computational muscle and user-friendly interfaces needed to perform complex analyses, transforming raw data into actionable insights. Imagine predicting stock prices with alarming accuracy or identifying fraudulent transactions before they impact your bottom line. That’s the magic (and the serious financial implications) of advanced analytics in finance.

Statistical Modeling Capabilities

Many financial data analytics tools offer robust statistical modeling capabilities, empowering analysts to uncover hidden relationships within their data. Regression analysis, for example, allows for the examination of the relationship between a dependent variable (like stock price) and one or more independent variables (like interest rates or economic indicators). Time series analysis is another crucial tool, enabling the forecasting of future values based on historical data. This is invaluable for predicting future cash flows, assessing market volatility, and making informed investment decisions. For instance, a tool might use an ARIMA model to predict future sales based on past sales data, allowing a company to optimize inventory and resource allocation.

Machine Learning Algorithm Implementation

The integration of machine learning algorithms represents a significant leap forward in financial data analytics. These tools often provide user-friendly interfaces for implementing algorithms like decision trees, support vector machines, and neural networks. These algorithms can be trained on historical financial data to identify patterns, predict future outcomes, and automate decision-making processes. For example, a fraud detection system might use a neural network to analyze transaction data and flag suspicious activities based on learned patterns of fraudulent behavior. This proactive approach can significantly reduce financial losses.

Applications in Risk Management and Fraud Detection

The applications of these advanced analytics techniques in risk management and fraud detection are particularly impactful. Sophisticated algorithms can analyze vast datasets to identify potential risks, assess creditworthiness, and predict the likelihood of defaults. In fraud detection, machine learning models can identify unusual patterns in transactions, flagging potentially fraudulent activities for further investigation. For example, a bank might use a machine learning model to detect unusual spending patterns on a customer’s credit card, preventing potential financial losses due to fraud.

Comparative Analysis of Advanced Analytics Capabilities

Let’s compare the advanced analytics capabilities of three hypothetical, yet representative, tools (Tool A, Tool B, and Tool C):

| Tool | Statistical Modeling | Machine Learning Algorithms | Risk Management/Fraud Detection Features |

|---|---|---|---|

| Tool A | Regression, Time Series Analysis (ARIMA, GARCH), Hypothesis Testing | Decision Trees, Random Forests, Logistic Regression | Credit scoring, portfolio risk assessment, anomaly detection |

| Tool B | Regression, Time Series Analysis (ARIMA), ANOVA | Support Vector Machines, Neural Networks, K-Means Clustering | Fraud detection (transaction monitoring), risk profiling |

| Tool C | Regression, Time Series Analysis (Exponential Smoothing), Principal Component Analysis | Naive Bayes, Decision Trees, Gradient Boosting | Regulatory compliance reporting, market risk analysis |

User Interface and Experience

Navigating the world of financial data analytics tools can feel like traversing a dense jungle – thrilling, potentially rewarding, but also fraught with the risk of getting hopelessly lost. The user interface (UI) and overall user experience (UX) are crucial factors in determining whether a tool becomes a trusted ally or a frustrating nemesis. A well-designed interface can unlock the power of data analysis, while a poorly designed one can bury even the most insightful findings under layers of confusion.

The UI and UX of financial data analytics tools vary dramatically, impacting both efficiency and the overall enjoyment (yes, enjoyment!) of the analytical process. Some tools prioritize a clean, intuitive design, while others present a more complex, feature-rich environment that requires a steeper learning curve. This section will delve into the UI and UX aspects of two popular tools, highlighting their strengths and weaknesses to aid in your selection process.

User Interface Design and Navigation in Tableau and Power BI

Tableau and Power BI represent two leading contenders in the financial data analytics arena, each boasting a distinct approach to UI design and navigation. Tableau, often praised for its elegant visual interface, utilizes a drag-and-drop methodology, allowing users to intuitively build visualizations. Its interface is generally considered more visually appealing, prioritizing a clean and uncluttered workspace. Power BI, on the other hand, adopts a more ribbon-based approach, reminiscent of Microsoft Office applications. This can feel more familiar to users already proficient in the Microsoft ecosystem but might initially seem less visually striking to newcomers. Both offer extensive customization options, allowing users to tailor the interface to their preferences. However, the sheer number of options in Power BI can sometimes feel overwhelming for beginners.

Ease of Use and Learning Curve Comparison

The ease of use and the associated learning curve differ significantly between various financial data analytics tools. Tableau’s drag-and-drop interface, coupled with its extensive online resources and tutorials, generally results in a gentler learning curve for beginners. However, mastering its advanced features requires dedicated effort. Power BI, with its familiarity for Microsoft Office users, also offers a relatively accessible entry point, but its breadth of features can make it a more challenging tool to fully master. Other tools, such as R or Python-based solutions, demand a strong programming background and a significant time investment to achieve proficiency. For instance, a user comfortable with Python might find the learning curve for a dedicated Python-based financial analytics package relatively manageable compared to someone without programming experience.

User Support and Documentation Availability

Comprehensive user support and well-structured documentation are paramount in mitigating the frustration associated with a steep learning curve. Both Tableau and Power BI provide extensive online documentation, including tutorials, FAQs, and community forums. Tableau’s online community is particularly vibrant, offering a wealth of user-generated content and support. Power BI leverages Microsoft’s extensive support infrastructure, providing multiple avenues for assistance. However, the level of support and the ease of accessing relevant information can vary depending on the specific tool and its licensing model. Some tools might offer premium support packages with dedicated technical assistance, while others rely heavily on community-based support.

User Interface Features: Strengths and Weaknesses

The following table summarizes key UI features of Tableau and Power BI, highlighting their respective strengths and weaknesses:

| Feature | Tableau | Power BI |

|---|---|---|

| Drag-and-drop interface | Strength: Intuitive and easy to learn for beginners. | Weakness: Less intuitive than Tableau’s approach for visual exploration. |

| Visual appeal | Strength: Clean and aesthetically pleasing design. | Weakness: Can feel cluttered, especially with complex dashboards. |

| Customization options | Strength: Highly customizable to individual preferences. | Strength: Extensive customization options, but can be overwhelming for beginners. |

| Learning curve | Weakness: Advanced features can have a steep learning curve. | Weakness: Breadth of features leads to a longer learning curve than Tableau for some users. |

| Integration with other tools | Strength: Seamless integration with various data sources. | Strength: Strong integration within the Microsoft ecosystem. |

Security and Compliance Considerations: Financial Data Analytics Tools Review

Protecting your financial data is serious business – think of it as guarding Fort Knox, but with spreadsheets instead of gold. Financial data analytics tools handle incredibly sensitive information, so robust security measures are absolutely paramount. Failure to do so can lead to hefty fines, reputational damage, and a whole lot of explaining to do to your boss (and maybe the authorities).

The security measures implemented in these tools vary, but generally revolve around safeguarding data at rest and in transit. This involves a multi-layered approach, combining technical safeguards with strong governance and compliance frameworks. Think of it as a well-trained security team, using various methods to protect the valuable assets.

Data Encryption and Access Control

Data encryption is the cornerstone of secure data handling. It’s like using a secret code to scramble your financial data, making it unreadable to unauthorized eyes. At rest, data is encrypted on servers and storage devices. In transit, it’s secured using protocols like HTTPS and TLS, which are like armored trucks transporting your sensitive information. Access control mechanisms, such as role-based access control (RBAC), ensure that only authorized personnel can access specific data. This is akin to having keycard access to different areas of Fort Knox, with each person only having access to their assigned vaults. Imagine the chaos if everyone had access to everything!

Compliance with Regulations

These tools must adhere to a variety of regulations, including GDPR (General Data Protection Regulation) in Europe, CCPA (California Consumer Privacy Act) in California, and other regional or industry-specific standards. Compliance involves implementing measures to ensure data privacy, security, and the ability for individuals to exercise their data rights. This includes procedures for data subject access requests, data rectification, and data deletion. Failure to comply can result in significant penalties. For example, non-compliance with GDPR can lead to fines of up to €20 million or 4% of annual global turnover – that’s enough to make anyone sweat.

Security Certifications and Compliance Standards

Leading financial data analytics tools often obtain certifications like ISO 27001 (Information Security Management Systems), SOC 2 (System and Organization Controls), and others. These certifications demonstrate a commitment to robust security practices and compliance with relevant standards. Think of these as badges of honor, showing that the tool has undergone rigorous audits and meets high security standards. The presence of these certifications provides an extra layer of assurance for users concerned about the security of their data. For example, a tool boasting ISO 27001 certification indicates that it has a well-defined and documented information security management system in place.

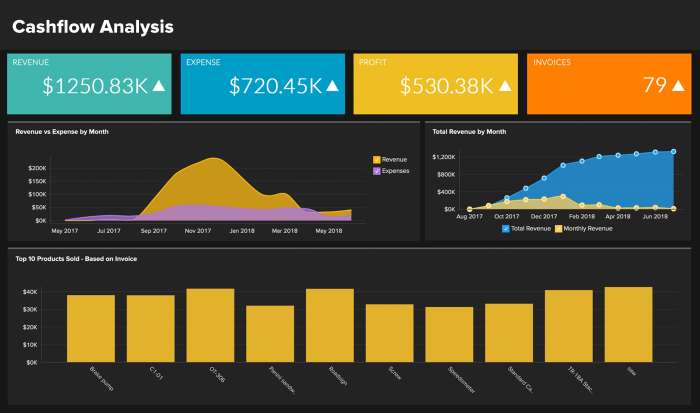

Case Studies and Real-World Applications

Financial data analytics tools aren’t just flashy dashboards; they’re the unsung heroes of efficient and profitable financial operations. These tools are transforming how financial institutions navigate the complexities of modern markets, moving beyond gut feelings and into the realm of data-driven decision-making. Let’s examine some real-world examples of their impact.

These case studies highlight how various financial organizations leverage advanced analytics to enhance their performance across multiple facets of their operations. The benefits, as you’ll see, extend far beyond mere cost reduction, impacting risk management, strategic planning, and ultimately, the bottom line.

Investment Banking: Algorithmic Trading Optimization

A major investment bank implemented a sophisticated financial data analytics platform to optimize its algorithmic trading strategies. By analyzing vast datasets of historical market data, the platform identified previously unrecognized patterns and inefficiencies in their trading algorithms. This led to a significant improvement in trade execution speed and a reduction in transaction costs. The bank also observed a marked increase in the profitability of its algorithmic trading operations.

The implementation resulted in a 15% reduction in transaction costs and a 10% increase in trading profitability within the first six months.

Portfolio Management: Risk Assessment and Diversification

A large asset management firm utilized a financial data analytics tool to enhance its portfolio risk assessment and diversification strategies. The tool enabled the firm to analyze market correlations and identify potential risks that traditional methods had overlooked. This allowed the firm to rebalance its portfolios more effectively, reducing overall portfolio volatility and improving risk-adjusted returns. The firm was also able to better tailor investment strategies to individual client risk profiles, leading to improved client satisfaction.

The improved risk assessment led to a 5% reduction in portfolio volatility and a 2% increase in risk-adjusted returns. Client satisfaction scores also increased by 8%.

Fraud Detection: Identifying Anomalous Transactions

A global payment processing company employed a financial data analytics platform with advanced machine learning capabilities to enhance its fraud detection system. The platform analyzed massive transaction datasets, identifying subtle patterns and anomalies indicative of fraudulent activity. This resulted in a significant reduction in fraudulent transactions and a substantial decrease in financial losses. The system also improved the accuracy of fraud detection, minimizing false positives and reducing the burden on human investigators.

The new system reduced fraudulent transactions by 20% and decreased financial losses by 15%. False positives were reduced by 30%.

Epilogue

So, there you have it – a whirlwind tour of the fascinating, sometimes frustrating, but ultimately indispensable world of financial data analytics tools. While the sheer number of options might seem daunting, understanding the nuances of each tool’s capabilities is key to making informed decisions and harnessing the power of data. Remember, the right tool can be the difference between a successful strategy and a financial flop – so choose wisely, my friend, and may your data always be in your favor!

Top FAQs

What is the average cost of these tools?

The cost varies wildly, from free open-source options to enterprise solutions costing tens of thousands of dollars annually. It depends heavily on features, scale, and support.

Are these tools user-friendly?

User-friendliness is subjective. Some tools boast intuitive interfaces, while others require significant technical expertise. Many offer training and support to ease the learning curve.

What level of coding is required?

This also varies. Some tools are point-and-click, while others require scripting or programming knowledge (e.g., Python, R). Check the tool’s documentation for specific requirements.