Financial Planning Process Review: Let’s face it, nobody *loves* poring over spreadsheets and balance sheets, but a well-structured financial plan is the difference between a comfortable retirement and ramen noodle dinners until you’re 90. This review process isn’t just about numbers; it’s about ensuring your financial future aligns with your dreams (and maybe even a slightly more luxurious retirement than ramen). We’ll explore how to analyze your current financial health, identify areas for improvement, and create a roadmap to achieve your financial goals. Think of it as a financial tune-up for your life.

This comprehensive guide delves into the intricacies of reviewing a financial plan, from gathering and analyzing data to developing actionable recommendations and communicating them effectively to clients. We’ll cover everything from identifying appropriate KPIs to crafting compelling visuals that make complex financial information easily digestible. Get ready to unleash your inner financial guru!

Defining the Scope of a Financial Planning Process Review

Let’s face it, financial planning isn’t exactly a barrel of laughs for everyone. But a periodic review? That’s where the real fun (or at least, the real *financial* security) begins. Think of it as a financial spring cleaning – getting rid of the dust bunnies of bad investments and polishing up your pathway to prosperity.

A comprehensive financial plan, much like a well-oiled machine, needs regular maintenance. It typically includes components such as investment strategies (because who wants to be a broke millionaire?), retirement planning (because lounging on a beach with a piña colada requires funding), debt management (because interest rates aren’t exactly known for their generosity), estate planning (so your loved ones don’t have to fight over your prized collection of rubber ducks), tax planning (because Uncle Sam always wants his cut), and risk management (because life throws curveballs, and we need to be prepared to catch them).

Circumstances Necessitating a Financial Planning Process Review

Significant life events, like a marriage, divorce, birth of a child, job change, inheritance, or even a particularly unfortunate incident involving a runaway shopping cart and a prized porcelain collection, can dramatically alter your financial landscape. These events necessitate a review to ensure your plan still aligns with your updated goals and risk tolerance. Failing to do so is like navigating with a map from 1985 – you might get somewhere, but it probably won’t be where you intended to go.

Types of Financial Planning Reviews

Financial reviews aren’t a one-size-fits-all affair. An annual review provides a regular pulse check on your progress, ensuring everything is on track. A mid-life review, typically around age 40-50, is a more comprehensive overhaul, taking into account long-term goals like retirement and legacy planning. Post-event reviews, triggered by significant life changes (see above – runaway shopping carts included!), help you adapt to new circumstances and readjust your strategies accordingly. Think of them as financial tune-ups, major overhauls, and emergency repairs, respectively.

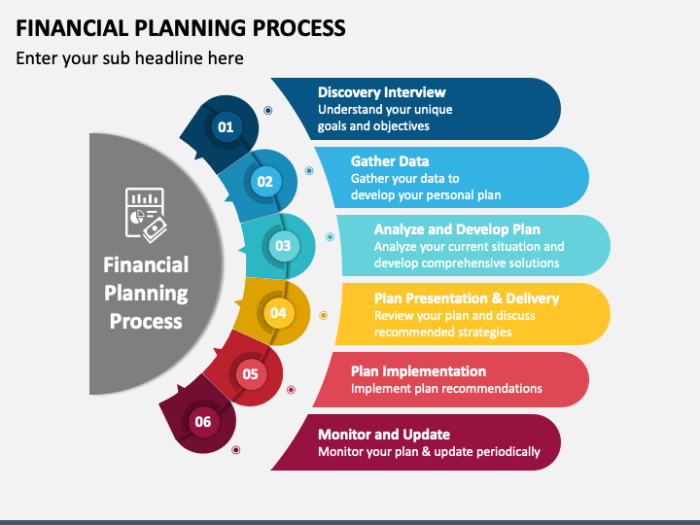

Initiating a Financial Planning Process Review

The process of initiating a review begins with gathering all relevant financial documents – bank statements, investment accounts, tax returns, insurance policies – essentially, anything that tells the story of your financial life. Next, schedule a meeting with your financial advisor (if you have one; if not, it might be time to find one). This meeting will involve a thorough discussion of your current situation, goals, and any changes in circumstances. Finally, your advisor will analyze your data, make recommendations, and help you implement any necessary adjustments. It’s like getting a financial checkup – a little uncomfortable at times, but ultimately beneficial for your long-term health.

Data Gathering and Analysis for the Review

Embarking on a financial planning process review is like embarking on a treasure hunt – except the treasure isn’t gold doubloons, but a clearer picture of your client’s financial well-being. This involves a meticulous process of data gathering and analysis, akin to a financial archaeologist carefully excavating a buried fortune (metaphorically speaking, of course!). Let’s delve into the nitty-gritty details.

Sources of Financial Data

The quest for financial data requires a multi-pronged approach, venturing into various sources to unearth the complete financial picture. Think of it as assembling a financial jigsaw puzzle; each piece, from bank statements to tax returns, contributes to the overall image. We need a comprehensive view to provide accurate and effective advice. Key sources include bank statements, investment account statements, tax returns, pay stubs, insurance policies, and real estate documents. Don’t forget the often-overlooked, yet crucial, information gleaned from client interviews.

Client Information Questionnaire

A well-structured questionnaire is essential for efficient data collection. It’s like a finely tuned instrument, carefully designed to extract the necessary information without overwhelming the client. The questionnaire should be clear, concise, and organized logically, leading the client through a smooth and informative process. Here’s a sample questionnaire structure:

| Section | Details |

|---|---|

| Personal Information | Name, address, contact details, date of birth, marital status. |

| Income | Salary, bonuses, investment income, rental income, other sources. |

| Expenses | Housing, transportation, food, entertainment, debt payments. Consider using categories to ensure completeness. |

| Assets | Cash, investments, real estate, personal property. Provide space for detailed descriptions of each asset. |

| Liabilities | Mortgages, loans, credit card debt. Include interest rates and payment amounts. |

| Financial Goals | Retirement planning, education funding, major purchases. Encourage detailed descriptions of each goal, including timelines and desired outcomes. |

| Risk Tolerance | Assess the client’s comfort level with investment risk. Use a scale or descriptive questions. |

Data Verification Methods

Once the data is gathered, it’s crucial to ensure its accuracy and completeness. This is akin to a detective meticulously verifying leads before making an arrest – a crucial step to avoid costly mistakes. Methods include comparing information across multiple sources, contacting financial institutions for verification, and reconciling data with tax returns. Discrepancies should be investigated thoroughly to ensure data integrity. This painstaking process is vital for building a reliable foundation for our financial planning recommendations.

Financial Data Analysis Techniques

Analyzing the gathered data involves employing various techniques to gain insightful understanding of the client’s financial situation. This is where the magic happens, transforming raw data into actionable strategies.

Cash Flow Analysis

Cash flow analysis involves tracking the inflow and outflow of funds. It’s like examining a river’s flow – understanding where the water comes from and where it goes. This helps identify areas where expenses can be reduced and savings increased. A simple formula is:

Net Cash Flow = Total Income – Total Expenses

. Analyzing trends over time reveals patterns and potential issues.

Asset Allocation Analysis

Asset allocation involves determining the proportion of assets invested in different asset classes, such as stocks, bonds, and real estate. It’s like creating a balanced portfolio, ensuring diversification and alignment with risk tolerance. An example of a balanced portfolio might be 60% stocks, 30% bonds, and 10% real estate, but this depends heavily on individual circumstances.

Debt Management Analysis

Debt management analysis involves evaluating the client’s debt burden and developing strategies for repayment. This is like mapping out a debt reduction strategy, charting a course to financial freedom. Key metrics include the debt-to-income ratio (DTI) and the average interest rate on debt. A high DTI indicates potential financial strain, requiring careful consideration.

Assessing Client Goals and Objectives: Financial Planning Process Review

Unveiling the client’s financial aspirations is like deciphering a treasure map – only instead of “X marks the spot,” it’s “Financial Freedom awaits!” This crucial step requires finesse, empathy, and perhaps a little bit of detective work. We’re not just gathering numbers; we’re building a roadmap to their future.

Effective methods for clarifying client financial goals and objectives involve more than just asking, “So, what do you want?” It’s about engaging in a conversation, actively listening, and employing various techniques to unearth their deepest financial desires. Think of it as a financial therapy session, but with a happy ending (hopefully involving significant wealth accumulation).

Methods for Clarifying Client Financial Goals and Objectives

A multi-pronged approach is essential. Open-ended questions, such as “What does your ideal retirement look like?” provide a broad starting point. Visual aids, like pie charts illustrating current asset allocation or hypothetical future scenarios, can be incredibly powerful tools for visualization. Furthermore, using questionnaires and goal-setting worksheets provides a structured framework for the client to articulate their aspirations in a tangible way. Finally, remember the power of active listening; truly hearing the client’s concerns and aspirations is key to building trust and understanding.

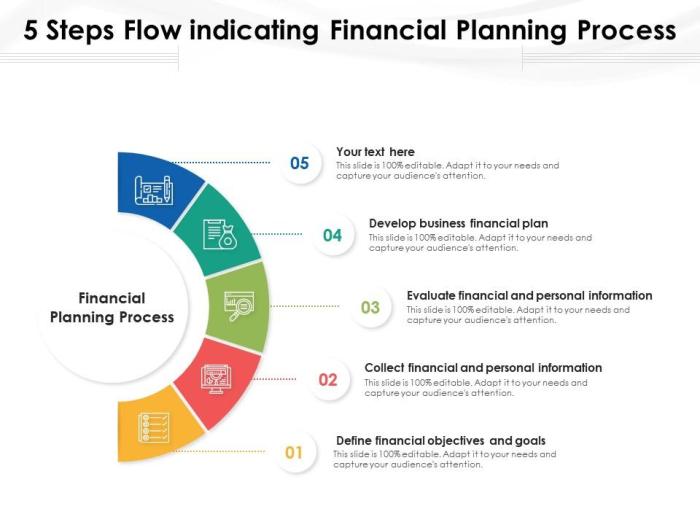

Short-Term versus Long-Term Financial Goals: A Comparison

Short-term goals, typically achieved within one to three years, are like stepping stones on the path to long-term success. Examples include paying off high-interest debt or saving for a down payment on a house. These provide immediate gratification and build momentum. Long-term goals, on the other hand, are the grand vision, often spanning decades. Retirement planning, funding a child’s education, or building a substantial investment portfolio fall into this category. The key difference lies in the time horizon and the level of planning required. While short-term goals offer quick wins, long-term goals require a more strategic and disciplined approach, often involving complex investment strategies and consistent saving habits.

Prioritizing Client Goals Based on Importance and Feasibility

Prioritization is key; not all goals are created equal. A framework for this involves a two-pronged approach: First, assign a weighting to each goal based on its importance to the client. This is subjective and depends entirely on the individual’s values and priorities. Second, assess the feasibility of each goal considering the client’s current financial situation and resources. A simple matrix can be used to visualize this. For example, a high-importance, high-feasibility goal might be aggressively paying down high-interest debt. A low-importance, low-feasibility goal might be purchasing a private island (unless, of course, the client is already a billionaire!).

Aligning Client Goals with Their Current Financial Situation

This involves a realistic assessment of the client’s current financial health. We must bridge the gap between dreams and reality. This might involve adjusting the timeline for certain goals, exploring additional income streams, or recommending lifestyle changes. For example, a client dreaming of early retirement might need to increase their savings rate or delay their retirement date to achieve their goal. It’s about creating a financially sound plan that respects both the client’s aspirations and their current financial constraints – a delicate dance between ambition and pragmatism.

Evaluating the Effectiveness of the Current Plan

So, the rubber meets the road. We’ve defined the scope, gathered the data, and even patted ourselves on the back for understanding our client’s goals. Now, the moment of truth: how well is the current financial plan actually performing? This isn’t about pointing fingers; it’s about identifying opportunities for improvement – think of it as a financial tune-up, not a complete engine overhaul (unless, of course, the engine is, shall we say, *precariously* close to sputtering out).

Evaluating a financial plan’s effectiveness requires a systematic approach, combining quantitative analysis with a dash of qualitative insight (because, let’s face it, numbers alone can be awfully boring). We need to assess whether the plan is on track to meet the client’s objectives, considering market fluctuations, unexpected life events (because life has a habit of throwing curveballs), and the occasional rogue squirrel attacking the nut stash.

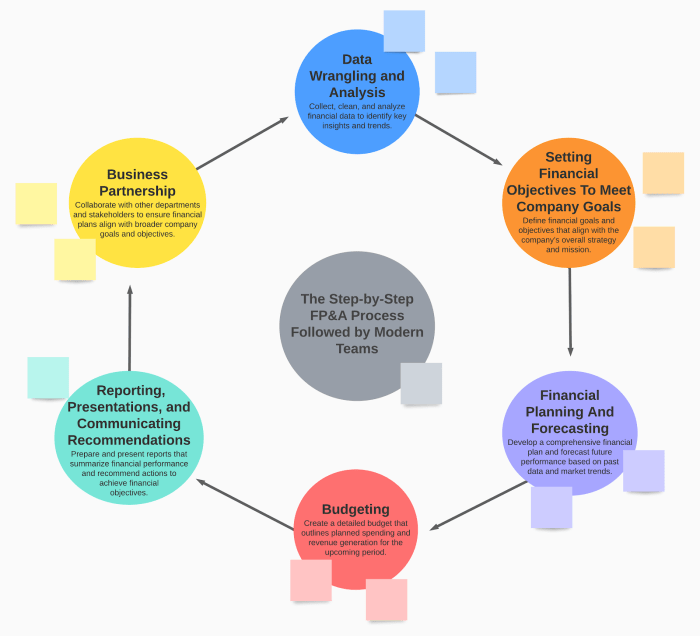

Step-by-Step Procedure for Evaluating Plan Performance

A well-structured evaluation process is crucial for identifying areas for improvement. Think of it as a detective investigating a financial case – meticulously gathering clues and following the money trail.

- Benchmarking: Compare the plan’s performance against relevant benchmarks, such as market indices or peer group averages. For example, if the client’s investment portfolio is underperforming the S&P 500 index consistently, it may indicate a need for portfolio adjustments.

- Goal Progress Tracking: Regularly monitor the progress towards achieving the client’s stated financial goals. Are they on track to retire at the desired age? Are they saving enough for their children’s education? This requires careful tracking of assets, liabilities, and cash flow.

- Risk Assessment Review: Re-evaluate the client’s risk tolerance and the level of risk associated with their current investment strategy. Market conditions and the client’s life stage may necessitate adjustments to their risk profile. For instance, a client nearing retirement might need to shift towards a more conservative investment strategy.

- Fee Analysis: Scrutinize the fees associated with various financial products and services. Are these fees reasonable and competitive? High fees can significantly impact long-term returns.

- Scenario Analysis: Conduct “what-if” scenarios to assess the plan’s resilience to various economic and life events. For example, how would the plan fare if the client experienced a job loss or a prolonged period of market downturn? This helps to identify potential vulnerabilities and develop contingency plans.

Key Performance Indicators (KPIs) for Plan Effectiveness

Using relevant KPIs is essential for objective assessment. These are the metrics that tell the story of the plan’s success (or areas needing attention).

- Net Worth Growth: The overall increase or decrease in the client’s assets minus liabilities. A consistent positive trend is a good sign.

- Investment Portfolio Return: The percentage return on investments, compared to benchmarks and inflation.

- Savings Rate: The percentage of income saved each year. A higher savings rate generally leads to faster progress towards financial goals.

- Debt-to-Income Ratio: The ratio of total debt to annual income. A lower ratio indicates better financial health.

- Emergency Fund Progress: The amount saved in an emergency fund, relative to the client’s target.

Identifying Areas for Improvement

Once the KPIs have been analyzed, areas needing attention will often become apparent. This is where the detective work really pays off.

For instance, a low investment portfolio return might suggest the need for diversification or a shift in investment strategy. A high debt-to-income ratio could indicate the need for debt reduction strategies. A shortfall in the emergency fund could highlight the need for increased savings.

Evaluation Report

Presenting the findings in a clear and concise manner is crucial for effective communication. A well-structured table helps to highlight key findings and facilitate informed decision-making.

| Metric | Current Value | Target Value | Variance |

|---|---|---|---|

| Net Worth | $500,000 | $750,000 | -$250,000 |

| Investment Portfolio Return | 6% | 8% | -2% |

| Savings Rate | 15% | 20% | -5% |

| Debt-to-Income Ratio | 0.3 | 0.2 | 0.1 |

| Emergency Fund | $10,000 | $20,000 | -$10,000 |

Developing Recommendations and Action Plans

Transforming the insightful findings of our evaluation into a dynamic roadmap for financial success requires a delicate blend of analytical prowess and creative problem-solving. Think of it as translating ancient financial hieroglyphs into a modern, actionable strategy – exciting, right? We’ll move from the realm of analysis to the land of concrete solutions, ensuring your financial future is as bright as a freshly minted penny.

The key here is to translate the somewhat dry evaluation findings into tangible, actionable recommendations. This isn’t about simply stating problems; it’s about crafting specific, measurable, achievable, relevant, and time-bound (SMART) solutions that directly address the identified issues and propel your financial plan forward. Think of it as a financial rescue mission, but instead of a dramatic helicopter rescue, we’re using carefully crafted recommendations.

Prioritized List of Recommended Changes

The prioritized list of recommended changes will be structured to address the most critical aspects of the financial plan first, focusing on those areas with the highest potential impact and the greatest urgency. This isn’t a random jumble; it’s a carefully considered sequence designed to maximize positive outcomes and minimize potential disruption. We’ll use a scoring system, factoring in risk, return, and feasibility, to rank each recommendation.

- Recommendation 1 (Highest Priority): Diversify investments to reduce portfolio volatility. This involves shifting a portion of the portfolio from high-risk, high-reward assets into more conservative investments, thereby lowering overall risk. For example, reducing exposure to a single company’s stock and increasing allocation to diversified index funds.

- Recommendation 2 (Medium Priority): Increase emergency fund to 6 months of living expenses. This will provide a crucial financial safety net, mitigating the impact of unexpected job loss or major medical expenses. This could involve increasing automatic transfers to a dedicated savings account.

- Recommendation 3 (Low Priority): Explore options for tax optimization. This involves examining the client’s current tax situation and identifying strategies to reduce their tax liability, such as maximizing tax-advantaged accounts or adjusting investment strategies. This could involve consultations with a tax professional.

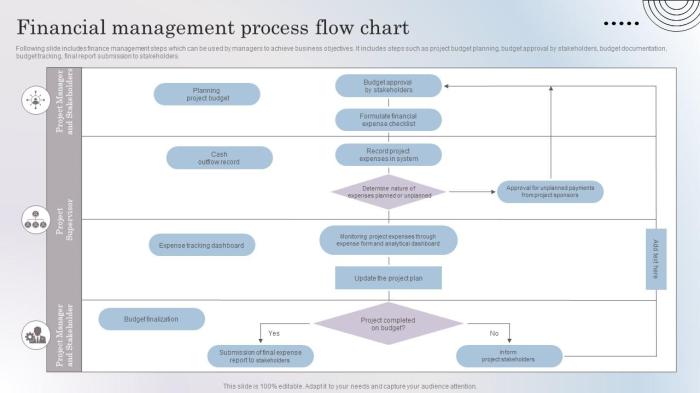

Implementation Plan

A meticulously crafted implementation plan is the blueprint for success. It details the steps needed to implement each recommendation, assigns responsibilities, and sets realistic timelines. This ensures a smooth transition from analysis to action, minimizing potential disruptions and maximizing the chances of achieving the desired financial outcomes. It’s like a well-orchestrated symphony, where each instrument (action item) plays its part at the right time.

| Recommendation | Action Steps | Timeline | Responsible Party |

|---|---|---|---|

| Diversify investments | Rebalance portfolio, transfer funds, adjust investment allocations | Within 3 months | Financial Advisor/Client |

| Increase emergency fund | Increase automatic transfers, adjust budgeting | Within 6 months | Client |

| Explore tax optimization | Consult tax professional, review tax documents | Within 1 year | Client/Tax Professional |

Risk Mitigation Strategies

Implementing financial recommendations always carries inherent risks. However, by proactively identifying and mitigating these risks, we can ensure a smoother transition and maximize the likelihood of achieving the desired outcomes. This isn’t about avoiding risk altogether (that’s impossible!), but about intelligently managing it.

- Market Volatility Risk: Diversification strategies are employed to reduce exposure to market downturns. Regular portfolio reviews and adjustments help adapt to changing market conditions. For example, shifting to more conservative investments during periods of high volatility.

- Implementation Delays: Clear timelines and regular progress checks help to maintain momentum and avoid unnecessary delays. This includes setting deadlines and regular meetings to review progress.

- Unexpected Expenses: Maintaining a robust emergency fund serves as a buffer against unforeseen expenses, reducing the impact on the overall financial plan. This also includes contingency planning for unexpected events.

Communicating the Review Results and Next Steps

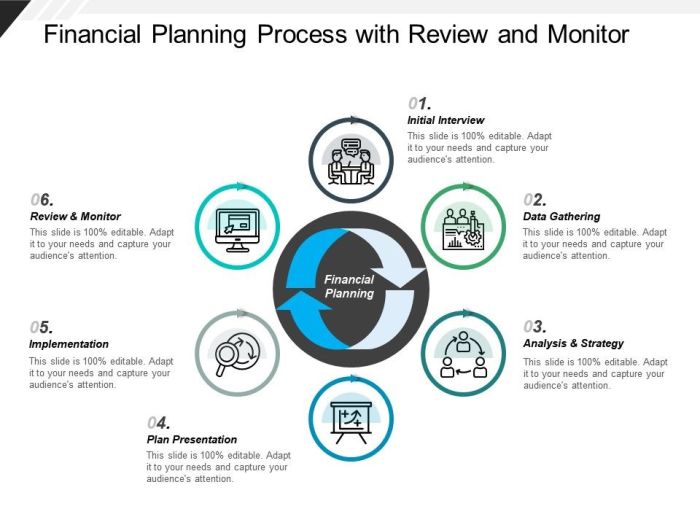

Presenting your financial planning review findings to a client isn’t just about reciting numbers; it’s about crafting a narrative that resonates with their financial aspirations (and maybe even elicits a chuckle or two). Think of it as a financial fairy tale, with a happy ending (or at least a clearly defined path to one). The key is clear, concise communication that transforms complex jargon into understandable, actionable steps.

Effective communication hinges on tailoring the message to the client’s understanding and comfort level. Remember, you’re not presenting a doctoral thesis; you’re providing a roadmap to their financial future. Using analogies, real-world examples, and visual aids (like charts and graphs that don’t induce migraines) can significantly enhance comprehension and engagement. Think less Wall Street, more friendly neighborhood financial advisor.

Methods for Communicating Review Findings

To ensure your client understands the review’s findings, a multi-faceted approach is vital. A simple email summary just won’t cut it. Consider a combination of methods, including a formal written report, a face-to-face meeting (with snacks!), and perhaps even a follow-up phone call to address any lingering questions. The written report should be comprehensive but easily digestible, using bullet points, clear headings, and concise language. The meeting provides an opportunity for a more personal and interactive discussion, allowing for immediate clarification and fostering a stronger client relationship. The follow-up call offers a chance to reiterate key points and answer any further questions that may have arisen after the initial meeting. Think of it as a financial triple-threat: written documentation, personal interaction, and post-game analysis.

Explaining Complex Financial Concepts

Let’s face it, terms like “asset allocation” and “tax-advantaged growth” can sound like they belong in a secret society’s handbook. Instead of throwing jargon at your client, translate these concepts into everyday language. For instance, instead of saying “diversification minimizes risk,” you could say, “Think of it like not putting all your eggs in one basket – it spreads the potential losses across different investments.” Similarly, instead of explaining “tax-advantaged growth,” you could use an analogy like: “Imagine a magical savings account where the government gives you a discount on your taxes – that’s the power of tax-advantaged growth.” Remember, simple analogies can make even the most complex financial strategies easy to grasp.

Presenting Recommendations and Action Plans

Presenting your recommendations should be akin to unveiling a treasure map to your client’s financial goals. Prioritize clarity and actionability. Use bullet points to Artikel key recommendations, and provide a clear timeline for implementing each step. For example, instead of saying, “We recommend adjusting your portfolio allocation,” you could say, “Let’s shift 15% of your portfolio from bonds to equities over the next three months to align with your long-term growth goals.” This approach makes the plan concrete and actionable, reducing the client’s apprehension about implementing the changes. Visual aids, such as a simple flowchart outlining the steps, can further enhance clarity and understanding.

Obtaining Client Agreement and Ensuring Ongoing Monitoring

Securing your client’s buy-in is crucial. Don’t just present the plan; engage in a collaborative discussion. Address any concerns or objections openly and honestly. Remember, this isn’t a dictatorship; it’s a partnership. To ensure ongoing monitoring, schedule regular review meetings, perhaps quarterly or annually, depending on the client’s needs and the complexity of their financial situation. This demonstrates your commitment and provides opportunities to adjust the plan as circumstances change – think of it as financial course correction, keeping them on track to their financial destination. Documenting the agreed-upon next steps in writing reinforces commitment and provides a clear record for both parties.

Illustrating Key Concepts with Visual Aids

A picture is worth a thousand words, or in our case, a thousand spreadsheets. Visual aids are crucial for making complex financial concepts digestible and, let’s be honest, more engaging than a dense report. They transform abstract numbers into compelling narratives, allowing clients to truly grasp the impact of our recommendations. We’ll demonstrate this with a hypothetical portfolio and cash flow analysis.

Portfolio Asset Allocation Before and After Review, Financial Planning Process Review

Before the review, our hypothetical client, let’s call him Barnaby, held a portfolio heavily weighted towards high-risk investments, reflecting his adventurous spirit (and perhaps a bit of youthful exuberance). This allocation, while potentially rewarding, exposed him to significant volatility. After a thorough review, we adjusted his portfolio to better align with his risk tolerance and long-term goals. The following illustrates the transformation:

| Asset Class | Before Review (%) | After Review (%) | Rationale for Change |

|---|---|---|---|

| Equities (US Large Cap) | 60 | 40 | Reduced exposure to market volatility; still maintains growth potential. |

| Equities (International) | 10 | 15 | Increased diversification to reduce reliance on the US market. |

| Bonds (Corporate) | 5 | 10 | Increased allocation to provide stability and income; mitigated risk. |

| Bonds (Government) | 0 | 5 | Added for enhanced stability and reduced risk. |

| Real Estate (REITs) | 15 | 10 | Slightly reduced exposure; maintained diversification benefits. |

| Cash | 10 | 20 | Significantly increased to act as a buffer against market downturns and provide liquidity. |

This visual representation clearly shows the shift from a risk-heavy portfolio to a more balanced approach. The increased allocation to bonds and cash provides a safety net, while the strategic adjustment of equity holdings ensures Barnaby’s portfolio remains positioned for growth, albeit with reduced volatility. Imagine this data displayed as a pie chart – the before-and-after comparison would be instantly clear, even to a financial novice.

Hypothetical Client Cash Flow Statement Analysis

Barnaby, bless his heart, had a cash flow statement resembling a rollercoaster – exhilarating highs and terrifying lows. The review pinpointed key areas for improvement.

| Category | Before Review | After Review (Proposed) | Solution |

|---|---|---|---|

| Income | $6,000 (irregular) | $6,500 (stable) | Negotiated a more consistent freelance contract, explored supplemental income streams. |

| Expenses | $7,500 (high discretionary spending) | $5,500 (reduced discretionary spending) | Budgeting and expense tracking implemented; identified areas for significant savings. |

| Net Cash Flow | -$1,500 (negative) | $1,000 (positive) | Combination of increased income and reduced expenses. |

This table shows a dramatic improvement in Barnaby’s net cash flow. A bar chart visualizing the income and expense categories before and after the implemented solutions would powerfully illustrate the positive impact of our recommendations. This visual representation allows Barnaby to see the tangible results of improved financial management and understand the value of our services. The shift from negative to positive cash flow is a clear win, and the visual representation makes it undeniably clear.

Outcome Summary

Ultimately, a thorough Financial Planning Process Review isn’t just about tweaking numbers; it’s about ensuring your financial plan remains a dynamic and effective tool that adapts to life’s ever-changing circumstances. By following the steps Artikeld above, you can confidently navigate the complexities of financial planning, ensuring your financial future remains secure and aligned with your aspirations. So ditch the financial anxieties, embrace the process, and watch your financial well-being flourish!

Expert Answers

What if my financial situation is unexpectedly complicated?

Don’t panic! A comprehensive review can handle even the most intricate financial landscapes. The process is designed to adapt to individual circumstances, so be prepared to provide thorough information, and don’t hesitate to ask for clarification.

How often should I review my financial plan?

Ideally, annual reviews are recommended to ensure your plan stays on track. However, major life events (marriage, birth, job change, inheritance) warrant an immediate review. Think of it as regular maintenance for your financial engine.

What if I don’t understand the jargon?

Clear communication is key! A good financial planner will explain everything in plain English, ensuring you understand every aspect of the review and recommendations. Don’t be afraid to ask questions; after all, it’s your financial future we’re discussing.