Cash Flow Management Tools: Ah, the sweet sound of money flowing smoothly – a symphony only a well-managed business can truly appreciate. Ignoring cash flow is like navigating a ship without a compass; you might eventually reach land, but the journey will be far more turbulent than necessary. This guide will equip you with the knowledge and tools to steer your financial vessel toward calmer waters, ensuring your business stays afloat and profitable.

We’ll delve into the core principles of cash flow management, exploring various tools, from simple spreadsheets to sophisticated software solutions. We’ll examine their strengths and weaknesses, providing you with a clear understanding of which tool best suits your business needs. Get ready to transform your financial anxieties into confident, data-driven decisions!

Defining Cash Flow Management

Cash flow management, my friends, is not just about having enough money to buy that ridiculously expensive espresso machine you’ve been eyeing. It’s the lifeblood of any business, the rhythmic pulse that keeps the whole operation humming along. It’s the art of ensuring that money comes in when it needs to, and goes out strategically, not haphazardly. Think of it as financial choreography – a well-executed dance between income and expenses.

Effective cash flow management hinges on a few core principles. Firstly, accurate forecasting is paramount. Predicting future cash inflows and outflows allows for proactive planning, preventing those nasty surprises that can send even the most seasoned entrepreneur scrambling. Secondly, diligent monitoring is crucial. Regularly reviewing your cash flow statement – which we’ll delve into shortly – is like having a financial checkup; it allows you to identify potential problems early on, before they become full-blown crises. Finally, disciplined budgeting and expense control are essential. Knowing where your money is going, and making sure it’s going where it should be, is the bedrock of healthy cash flow. Think of it as a financial diet: cut the fat, and nourish the essential parts of your business.

Components of a Cash Flow Statement

The cash flow statement, often referred to as the statement of cash flows, is a crucial financial document that provides a detailed picture of a company’s cash movements over a specific period. It’s broken down into three main sections, each offering a unique perspective on the flow of cash: operating activities, investing activities, and financing activities. Operating activities reflect cash generated from or used in the day-to-day operations of the business, such as sales, purchases, and salaries. Investing activities cover cash flows related to investments, such as purchasing or selling property, plant, and equipment (PP&E). Financing activities detail cash flows from funding sources, including debt, equity, and dividends. Understanding these components provides a comprehensive view of how cash is generated, used, and managed within a business.

Examples of Businesses with Excellent and Poor Cash Flow Management

Let’s look at some hypothetical (but realistically inspired) examples. Imagine “Acme Widgets,” a company known for its meticulous budgeting and proactive sales strategies. They forecast demand accurately, negotiate favorable payment terms with suppliers, and maintain a healthy cash reserve. This allows them to weather economic downturns and invest in growth opportunities. On the other hand, “Beta Gadgets,” known for its impulsive spending habits and poor forecasting, often finds itself scrambling for funds to meet payroll or pay suppliers. Their inconsistent cash flow leads to missed opportunities and potential financial instability. While these are simplified examples, they illustrate the stark contrast between effective and ineffective cash flow management. The success or failure of a business often hinges on its ability to effectively manage its cash flow.

Types of Cash Flow Management Tools

Navigating the often-treacherous waters of cash flow can feel like trying to herd cats wearing roller skates. Luckily, there’s a whole armada of tools designed to help you steer clear of financial shipwrecks. These tools, categorized by their primary function, offer varying levels of sophistication and assistance, ranging from simple spreadsheets to complex enterprise resource planning (ERP) systems. Choosing the right tool depends entirely on the size and complexity of your business, and your personal tolerance for spreadsheets.

Cash flow management tools are broadly categorized based on their core functionality. While some tools excel in a single area, many offer a combination of features, providing a more holistic approach to managing your finances. This blend of features can be a boon, but also a potential source of overwhelm if you don’t know what you need.

Budgeting Tools

Budgeting tools help you create and track your budget, providing a clear picture of your income and expenses. These tools often allow for categorization of expenses, helping you identify areas where you might be overspending (like that questionable subscription to “Exotic Cheese of the Month”). Simpler tools might involve basic spreadsheets or budgeting apps, while more sophisticated options incorporate features like forecasting and automated expense tracking.

Advantages include improved financial visibility and control, leading to better financial planning. Disadvantages can include the time investment required for initial setup and ongoing data entry, especially for businesses with complex financial structures. Additionally, relying solely on a budgeting tool without considering other aspects of cash flow, such as accounts receivable and payable, can provide an incomplete picture.

Forecasting Tools

Forecasting tools use historical data and predictive modeling to estimate future cash flow. Think of them as crystal balls for your finances, albeit ones that rely on data rather than mystical vapors. These tools are particularly helpful for businesses that need to plan for seasonal fluctuations or large capital expenditures.

The advantages are obvious: better preparedness for potential shortfalls and opportunities to optimize cash flow. Disadvantages include the reliance on accurate historical data; garbage in, garbage out, as they say. Also, forecasting is inherently uncertain; even the best tools can’t predict unexpected events like a sudden surge in demand for novelty rubber chickens.

Invoicing Tools

Invoicing tools streamline the process of creating and sending invoices to clients. These range from simple templates to sophisticated systems that integrate with accounting software. They often include features like automated payment reminders (because chasing payments is nobody’s idea of a good time), and tracking of outstanding invoices.

Advantages include reduced administrative burden, faster payment collection, and improved cash flow predictability. Disadvantages might include subscription fees for more advanced features, and the need to integrate the invoicing tool with other financial systems, which can sometimes be a headache.

Accounting Software

Accounting software packages often incorporate elements of budgeting, forecasting, and invoicing, providing a comprehensive solution for managing your finances. They can range from simple, user-friendly options for small businesses to complex enterprise resource planning (ERP) systems for larger corporations.

Advantages include a centralized system for managing all aspects of your finances, improved accuracy, and enhanced reporting capabilities. Disadvantages include the higher cost and complexity compared to more specialized tools. They can also require a steeper learning curve for users unfamiliar with accounting principles.

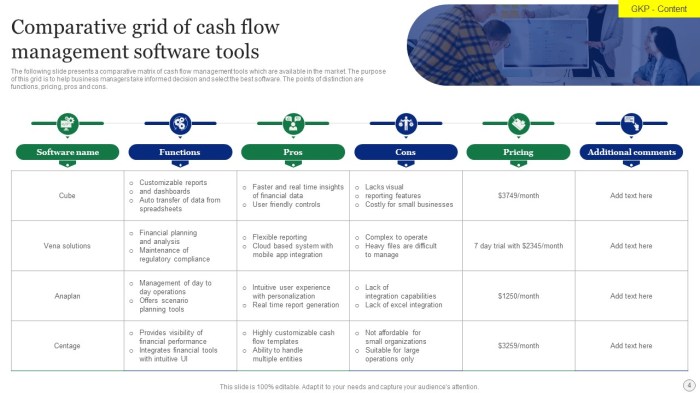

Comparison Table

| Tool Type | Features | Pricing | Target User |

|---|---|---|---|

| Spreadsheet (e.g., Excel) | Basic budgeting, simple forecasting, manual invoicing | Free (with software) | Small businesses, freelancers, individuals |

| Budgeting App (e.g., Mint) | Automated expense tracking, budgeting tools, basic reporting | Free or subscription-based | Individuals, small businesses |

| Invoicing Software (e.g., FreshBooks) | Automated invoicing, payment reminders, expense tracking | Subscription-based | Small to medium-sized businesses |

| Accounting Software (e.g., Xero) | Comprehensive accounting, budgeting, forecasting, invoicing, reporting | Subscription-based | Small to large businesses |

Implementing Cash Flow Management Tools

Implementing a new cash flow management tool can feel like navigating a minefield blindfolded – exciting, potentially rewarding, and fraught with the possibility of unexpected explosions (of frustration, mostly). But fear not, intrepid business owner! With a bit of planning and a dash of humor, you can successfully integrate a tool that will transform your financial forecasting from a hazy guesstimate to a precise, beautiful thing.

The successful implementation of a cash flow management tool hinges on careful planning and execution. It’s not just about choosing the right software; it’s about integrating it seamlessly into your existing workflow and ensuring your team embraces it. Think of it as introducing a new, highly efficient member to your team – you need to properly onboard them!

User Training and Support

Proper training is paramount to the successful adoption of any new software, and cash flow management tools are no exception. Imagine trying to assemble IKEA furniture without instructions – chaos ensues! A comprehensive training program should cover all aspects of the tool, from basic data entry to advanced reporting. Consider offering both group sessions and individual support to cater to different learning styles. Think of it as a financial boot camp – tough love, but ultimately rewarding. Follow-up support is equally crucial. Regular check-ins and readily available assistance will ensure that your team remains confident and proficient in using the tool, preventing those dreaded “help desk” calls from piling up. Think of your support system as the safety net in your financial trapeze act.

Potential Challenges and Solutions, Cash Flow Management Tools

Implementing new software is rarely a smooth sail. Expect some turbulence. One common challenge is data migration. Moving existing financial data into a new system can be time-consuming and prone to errors. To mitigate this, thoroughly clean and organize your existing data before the migration. Imagine it as decluttering your financial closet – a little bit of upfront work saves a lot of headaches later. Another challenge is resistance to change. Some employees may be resistant to adopting a new tool, especially if they are comfortable with the old methods. To overcome this, emphasize the benefits of the new tool, providing clear explanations of how it will simplify their tasks and improve their efficiency. Offer incentives, perhaps, like an extra long lunch break for the first team member to master a specific feature. Finally, integration with existing accounting software can be tricky. Ensure compatibility before purchasing a new tool to avoid compatibility nightmares. Think of this as a pre-nuptial agreement for your software – ensuring a harmonious relationship before you commit.

Budgeting and Forecasting with Cash Flow Tools

Budgeting and forecasting are like the dynamic duo of financial planning – one wouldn’t be nearly as effective without the other. A well-crafted budget provides a roadmap for your finances, while forecasting acts as your trusty crystal ball, peering into the future and predicting potential bumps in the road (or, hopefully, smooth sailing!). Cash flow management tools seamlessly integrate these two vital processes, allowing for more accurate predictions and proactive adjustments. Think of it as having a financial GPS that not only shows you where you are but also anticipates traffic jams before they happen.

Cash flow tools empower businesses and individuals to create detailed budgets and realistic financial forecasts. By inputting historical data, anticipated income, and projected expenses, these tools generate insightful reports, allowing for informed decision-making and strategic financial planning. This eliminates the guesswork and spreadsheets filled with cryptic formulas, offering a user-friendly interface that even a financial novice can master (with a little bit of practice, of course!).

Sample Budget Using a Cash Flow Management Tool

Let’s imagine we’re using a fictional, yet remarkably intuitive, cash flow tool called “Money Maestro.” We’ll create a simple monthly budget for a small bakery, “Crumbs of Joy.” Money Maestro allows us to input various income streams (sales of pastries, coffee, etc.) and expenses (rent, ingredients, salaries, utilities). The tool then automatically calculates net cash flow, projecting a surplus or deficit for the month. For example, if Crumbs of Joy anticipates $10,000 in revenue and $8,000 in expenses, Money Maestro would display a net cash flow of $2,000. This clear visual representation allows the bakery owner to quickly assess their financial health. Further, Money Maestro can categorize expenses, highlighting areas where costs might be reduced. Perhaps the cost of flour is unexpectedly high; the tool can flag this as an area for potential negotiation with suppliers.

Creating Realistic Financial Forecasts with Cash Flow Tools

Money Maestro, and similar tools, don’t just stop at budgeting. They extrapolate from the budget data to create forecasts. For instance, by analyzing past sales data, the tool might predict a 15% increase in sales during the holiday season. It can also factor in seasonal variations in ingredient costs, potentially predicting a rise in the price of strawberries in the summer. This forecasting capability is invaluable for proactive planning. Crumbs of Joy, for example, could use this information to adjust staffing levels or pre-order ingredients at a lower cost, mitigating potential financial strain. The tool might even suggest exploring alternative ingredients during periods of high cost for specific items, maintaining profitability without sacrificing quality (too much!).

Adjusting Budgets Based on Forecast Deviations

Forecasts are not set in stone; they’re living documents. Life, and the market, often throws curveballs. If Crumbs of Joy’s actual sales fall short of the forecast, Money Maestro can help identify the reasons. Perhaps a competitor opened nearby, or a local event negatively impacted foot traffic. The tool allows the bakery owner to adjust the budget accordingly – perhaps reducing marketing expenses or temporarily cutting back on less popular items. Conversely, if sales exceed expectations, the budget can be adjusted to reinvest profits, potentially upgrading equipment or expanding the menu. The beauty of these tools lies in their adaptability; they’re not rigid constraints but dynamic partners in financial management. The key is regular monitoring and timely adjustments based on the data provided by the tool. This iterative process ensures the budget remains relevant and the business stays on track.

Improving Cash Flow with Tools

Cash flow management tools aren’t just for passively tracking your finances; they’re powerful weapons in the arsenal of any business aiming for financial fitness. Used correctly, they can transform your cash flow from a source of anxiety into a reliable engine of growth. Let’s explore how to wield these tools for maximum impact.

Effective cash flow management hinges on leveraging the predictive and analytical capabilities of these tools. By understanding future cash inflows and outflows, businesses can proactively address potential shortfalls and capitalize on opportunities for growth. This proactive approach is far more effective than reacting to financial crises as they arise, which is akin to putting out fires instead of preventing them.

Cash Flow Projections and Informed Decision-Making

Cash flow projections, a cornerstone feature of most cash flow management tools, provide a crystal ball into your company’s financial future. These projections, based on historical data and anticipated transactions, allow for informed decision-making across various aspects of the business. For example, a projection showing a potential shortfall in Q4 might prompt a strategic shift in marketing or sales efforts, securing additional funding, or delaying non-essential expenditures. Conversely, a projection indicating a surplus could facilitate investment in expansion, research and development, or debt reduction. Imagine a scenario where a bakery uses its cash flow projection to predict a high demand during the holiday season. They can then adjust their ingredient orders and staffing levels accordingly, maximizing profits and avoiding stockouts or understaffing.

Strategies for Improving Cash Flow Using Tool Features

Many cash flow management tools offer specific features designed to boost cash flow. For instance, automated invoice generation and tracking can significantly speed up the accounts receivable process, reducing the time it takes to receive payments. Features that facilitate early payment discounts can incentivize customers to pay invoices sooner, improving cash flow predictability. Similarly, tools that provide detailed expense tracking and categorization allow businesses to identify areas where spending can be optimized, freeing up cash for more critical needs. A landscaping company, for instance, might use its tool’s expense tracking to discover that fuel costs are unexpectedly high. This insight allows them to explore alternative transportation options or negotiate better fuel prices, directly impacting their bottom line.

Effective Management of Accounts Receivable and Payable

Efficient management of accounts receivable and payable is crucial for maintaining healthy cash flow. Cash flow management tools streamline this process by automating invoice generation, tracking payments, and sending timely reminders. For accounts payable, these tools can help optimize payment schedules, taking advantage of early payment discounts where available and prioritizing payments based on urgency and terms. Consider a clothing retailer using its cash flow management tool to identify slow-paying customers. The tool can automate reminders, escalate overdue payments, and even provide insights to adjust credit terms for future transactions, minimizing losses and improving cash flow. Conversely, the tool can also help manage accounts payable by optimizing payment schedules to take advantage of early payment discounts while ensuring timely payments to vendors to maintain good relationships. This delicate balancing act is greatly simplified with the right tools.

Choosing the Right Tool

Selecting the perfect cash flow management tool is like choosing the right pair of shoes – you need something comfortable, supportive, and stylish (because let’s face it, even spreadsheets can be chic). The wrong choice can lead to wobbly finances and a serious case of accounting anxiety. This section will help you navigate the sometimes bewildering world of cash flow software and find your perfect fit.

Pricing models for cash flow management tools vary wildly, offering a spectrum of options to suit different budgets and business needs. Understanding these models is crucial to making an informed decision and avoiding unexpected costs.

Cash Flow Tool Pricing Models

Different software vendors employ diverse pricing strategies. Subscription models offer ongoing access for a recurring fee, often tiered based on features or user numbers. This provides predictable budgeting but may lead to higher overall costs in the long run. One-time purchase models, on the other hand, offer a single upfront payment for lifetime access, but usually lack ongoing support and updates. Freemium models offer basic functionality for free, with premium features available via a paid subscription. This allows businesses to test the waters before committing to a full-fledged subscription. Finally, some tools use a per-transaction fee model, charging based on the number of transactions processed. This can be advantageous for businesses with fluctuating transaction volumes but can be difficult to budget for. Choosing the right model depends entirely on your business’s size, financial capacity, and projected growth. For example, a rapidly expanding startup might prefer a scalable subscription model, while a small, established business might find a one-time purchase more suitable.

Key Features Based on Business Size and Needs

The features you need in a cash flow management tool will depend heavily on the size and complexity of your business. Small businesses might require simpler tools focused on basic tracking and reporting, while larger enterprises will need more sophisticated features like multi-user access, advanced forecasting capabilities, and integration with other business systems. For instance, a sole proprietor might only need a basic tool to track income and expenses, while a large corporation might require a system capable of managing cash flow across multiple departments and subsidiaries. Consider the specific needs of your business before making a selection.

Essential Features Checklist for Cash Flow Management Tools

Before committing to a particular tool, create a checklist of essential features. This structured approach will help ensure you choose a software that perfectly aligns with your needs and enhances your business operations.

- Intuitive Interface: The software should be easy to navigate and understand, even for users with limited accounting experience. A user-friendly interface minimizes training time and frustration.

- Automated Data Entry: Look for tools that can automatically import data from bank accounts and other financial sources, reducing manual data entry and the risk of errors. This can significantly save time and improve accuracy.

- Customizable Reporting: The tool should allow you to generate customized reports tailored to your specific needs, providing insights into your cash flow trends and helping you make informed financial decisions. Think profit and loss statements, cash flow projections, and balance sheets – all customizable to your preferences.

- Predictive Analytics: Advanced tools may offer predictive analytics, helping you forecast future cash flow and identify potential issues before they arise. This proactive approach allows for better financial planning and mitigation of potential problems.

- Integration Capabilities: The tool should integrate seamlessly with other business software, such as accounting software, CRM systems, and payroll software, to streamline your workflow and avoid data silos. This integration reduces redundancy and enhances efficiency.

- Security Features: Data security is paramount. Ensure the tool employs robust security measures to protect your sensitive financial information. This might include encryption, two-factor authentication, and regular security updates.

- Customer Support: Reliable customer support is crucial in case you encounter any issues or have questions about the software. Consider the availability and responsiveness of the support team before making your decision. A quick response time and multiple support channels are essential.

Integration with Other Systems

Integrating your cash flow management tools with other systems is like adding a turbocharger to your accounting engine – it dramatically boosts efficiency and provides a clearer, more holistic view of your financial health. Imagine a world where your sales data automatically updates your cash flow projections, or your inventory levels directly impact your predicted expenses. Sounds dreamy, right? Let’s explore the joys (and occasional minor headaches) of system integration.

The benefits of integrating your cash flow management tools with your accounting software and other business applications are numerous and often quite delightful. A seamless flow of data eliminates the tedious manual entry of information, reducing errors and freeing up valuable time for more strategic tasks. This unified view provides a much more accurate and real-time picture of your financial situation, allowing for quicker, more informed decision-making. Think of it as having a financial crystal ball, but instead of murky predictions, you get crisp, clear insights.

Challenges of Integration and Mitigation Strategies

Integration, while incredibly beneficial, isn’t always a walk in the park. Different software systems often speak different “languages,” requiring careful planning and potentially custom development to ensure compatibility. Data migration can be complex, requiring meticulous data cleansing and validation to prevent inaccuracies. Furthermore, security concerns need to be addressed to protect sensitive financial information.

To overcome these challenges, thorough due diligence is crucial. Start by carefully assessing the compatibility of your chosen tools. Look for tools with robust APIs (Application Programming Interfaces) that facilitate seamless data exchange. Consider working with a qualified IT consultant experienced in data integration to navigate complex technical issues. Implementing a phased approach, starting with smaller integrations and gradually expanding, can also help manage the complexity and minimize disruption. Remember, a well-planned integration is far less stressful than a rushed, chaotic one.

Examples of Successful Integrations

Let’s imagine a small business, “Bob’s Burgers,” using Xero (accounting software) and a cash flow forecasting tool like Float. The integration allows sales data from Xero to automatically populate Float’s forecasting model, eliminating manual data entry and providing Bob with a highly accurate prediction of his future cash flow. Any changes in sales are instantly reflected, allowing Bob to make proactive adjustments to his spending or financing needs. Another example could be a larger enterprise utilizing a comprehensive ERP (Enterprise Resource Planning) system like SAP, which integrates seamlessly with a specialized cash flow management module. This allows for a complete, real-time overview of cash flow across different departments and subsidiaries, providing executives with the big picture they need for strategic decision-making. This level of integration enables proactive risk management and optimized resource allocation, resulting in significant cost savings and improved profitability. Essentially, the integration is the glue that holds the whole business operation together financially, preventing any major financial mishaps.

Visualizing Cash Flow Data

Understanding your cash flow shouldn’t feel like deciphering ancient hieroglyphs. Fortunately, modern cash flow management tools offer a range of visualization options, transforming raw financial data into easily digestible insights. These tools empower you to see the bigger picture, spot trends, and make informed decisions, preventing those dreaded “uh-oh” moments.

Cash flow management tools employ various methods to visualize data, making complex financial information clear and accessible. These visualizations range from simple charts and graphs to comprehensive reports that provide a holistic overview of your financial health. Understanding these visualizations is crucial for interpreting key performance indicators (KPIs) and making strategic financial decisions.

Chart and Graph Representations of Cash Flow

Different tools utilize diverse chart types to illustrate cash flow. Line graphs effectively display cash flow trends over time, revealing patterns of growth, decline, or seasonality. Bar charts are ideal for comparing cash inflows and outflows over specific periods, such as monthly or quarterly. Pie charts provide a visual breakdown of the proportion of cash inflows from different sources and outflows to various expenses. Some sophisticated tools even use interactive dashboards that allow users to drill down into specific data points for more detailed analysis. Imagine a vibrant line graph, arcing smoothly upwards, indicating consistent positive cash flow – a beautiful sight for any business owner. Conversely, a jagged, downward-trending line graph would signal immediate attention is required.

Key Performance Indicators (KPIs) and Their Interpretation

Several key performance indicators are essential for assessing the health of your cash flow. These include the operating cash flow, which shows the cash generated from the core business operations; free cash flow, representing the cash available after all operating expenses and capital expenditures; and the cash conversion cycle, indicating the time it takes to convert inventory into cash. Analyzing these KPIs over time allows businesses to identify trends, predict future cash flow, and make proactive adjustments to improve their financial position. For instance, a consistently shrinking cash conversion cycle suggests improvements in inventory management and collection of receivables.

Visual Representation of Healthy vs. Unhealthy Cash Flow

Imagine two bar charts side-by-side. The first, representing healthy cash flow, shows tall, consistently positive bars for inflows significantly exceeding the shorter bars representing outflows. The colors are vibrant greens and blues, suggesting growth and stability. This chart paints a picture of a company comfortably meeting its obligations and even having surplus cash for investment or expansion. The second chart, depicting unhealthy cash flow, shows a stark contrast. The outflow bars are significantly taller than the inflow bars, with many bars representing negative cash flow. The color scheme is a somber red and grey, conveying a sense of financial distress. This chart visually represents a company struggling to cover its expenses, potentially facing liquidity issues, and requiring immediate action to address the shortfall. The difference is night and day – one suggests a thriving business, the other, a business needing a financial rescue.

Epilogue

Mastering cash flow management isn’t just about balancing the books; it’s about securing your business’s future. By leveraging the right tools and strategies, you can transform unpredictable cash flow into a predictable, reliable stream of income. Remember, a healthy cash flow isn’t just a sign of success; it’s the engine that drives it. So, ditch the financial fretting and embrace the power of proactive cash flow management. Your bank account (and your sanity) will thank you.

Key Questions Answered

What if my business is too small for sophisticated cash flow tools?

Even simple spreadsheets can be effective for small businesses. The key is to track income and expenses consistently.

How often should I review my cash flow?

Ideally, daily or weekly monitoring provides the most effective control, allowing for prompt adjustments.

Can cash flow management tools predict future cash flow with 100% accuracy?

No, forecasting involves estimations and projections based on historical data and current trends. Unexpected events can always impact accuracy.

What’s the difference between cash flow and profit?

Profit is your revenue minus expenses. Cash flow is the actual movement of money in and out of your business, considering timing of payments.