Sustainable Investing Indonesia presents a fascinating paradox: a nation brimming with potential for green growth yet grappling with significant environmental and social challenges. This exploration delves into the unique opportunities and hurdles facing investors seeking to contribute to Indonesia’s sustainable development. We’ll examine key sectors ripe for green investment, analyze effective financial instruments, and dissect the crucial roles of various stakeholders in fostering a truly sustainable Indonesian economy. Prepare for a journey into the heart of Indonesia’s evolving investment landscape – a landscape where financial returns and positive social impact are inextricably linked.

From the burgeoning renewable energy sector to the complexities of responsible palm oil production, we will dissect the multifaceted nature of sustainable investing in Indonesia. We will analyze successful case studies, highlighting both triumphs and setbacks, to provide a comprehensive understanding of the current state of play and future possibilities. The journey ahead will require navigating regulatory frameworks, understanding ESG factors specific to Indonesia, and fostering collaboration between investors, corporations, and the government.

Defining Sustainable Investing in the Indonesian Context

Sustainable investing in Indonesia presents a fascinating paradox: a nation brimming with potential, grappling with significant environmental and social challenges. It’s a bit like trying to build a magnificent skyscraper on a foundation made of slightly wobbly stilts – thrilling, potentially rewarding, but requiring careful planning and execution. This exploration delves into the unique landscape of sustainable investing in Indonesia, highlighting its distinctive opportunities and hurdles.

Unique Challenges and Opportunities for Sustainable Investing in Indonesia

Indonesia, an archipelago of breathtaking biodiversity and vibrant culture, faces considerable environmental pressures. Deforestation, unsustainable palm oil production, and plastic pollution are just a few of the pressing issues. However, these challenges also present immense opportunities for sustainable investments. The burgeoning renewable energy sector, the growing demand for sustainable products, and the increasing awareness of ESG factors among Indonesian businesses all point towards a promising future for responsible investing. It’s a chance to not only generate financial returns but also contribute to a more sustainable and equitable Indonesia. Think of it as a double-dip of delicious ethical ice cream – good for the planet and your portfolio!

Key Environmental, Social, and Governance (ESG) Factors Relevant to Indonesian Investments

Environmental considerations in Indonesia are paramount. Water scarcity, air pollution in urban centers, and the impact of climate change on agriculture are all major concerns. Socially, issues such as fair labor practices, especially in the garment and agricultural sectors, and equitable access to education and healthcare are crucial. Governance factors include corporate transparency, corruption, and the effectiveness of regulatory frameworks. Investing sustainably in Indonesia requires a thorough understanding and careful consideration of these interwoven factors. It’s a bit like a complex game of Jenga – one wrong move, and the whole thing could topple.

Comparison of Sustainable Investing Practices in Indonesia with Other Developing Nations

Indonesia’s sustainable investing landscape is evolving rapidly, though still lagging behind some other developing nations in terms of regulatory maturity and investor awareness. Compared to countries like India, which boasts a more established green bond market, Indonesia is catching up. However, Indonesia’s unique biodiversity and focus on natural resource management offer a compelling case for targeted sustainable investments. Think of it as a friendly competition – Indonesia might not be leading the pack yet, but it has a distinct competitive advantage in certain areas.

Regulatory Frameworks and Policies Governing Sustainable Investing in Indonesia

Indonesia is actively developing its regulatory framework for sustainable finance. While still under development, various initiatives are underway to encourage responsible investing. This includes initiatives from the Financial Services Authority (OJK) and other government bodies promoting ESG disclosures and green financing. It’s a work in progress, but the momentum is building.

| Regulatory Body | Policy/Framework | Focus | Status |

|---|---|---|---|

| OJK (Financial Services Authority) | Sustainable Finance Roadmap | Promoting sustainable finance initiatives across various sectors. | Ongoing |

| Ministry of Environment and Forestry | Various regulations on environmental protection | Protecting Indonesia’s natural resources and biodiversity. | Active |

| Government of Indonesia | National Action Plan for Sustainable Development Goals (SDGs) | Integrating sustainability into national development policies. | Active |

| Various Stock Exchanges | ESG Reporting Guidelines | Encouraging listed companies to disclose their ESG performance. | Developing |

Key Sectors for Sustainable Investing in Indonesia

Indonesia, a land of vibrant culture and breathtaking biodiversity, also presents a compelling landscape for sustainable investing. With a burgeoning economy and a growing awareness of environmental and social responsibility, several sectors are ripe for impactful investments that can generate both financial returns and positive societal change. Let’s dive into the most promising areas, acknowledging both their potential and inherent challenges.

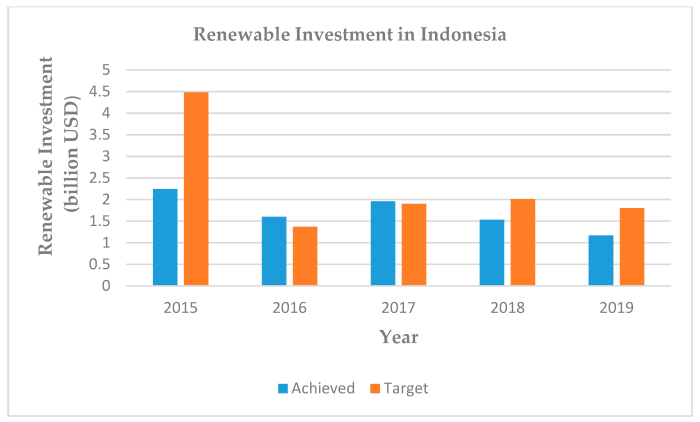

Renewable Energy

Indonesia’s abundant natural resources, from geothermal energy to solar and wind power, offer immense potential for renewable energy development. The country’s ambitious target to increase renewable energy’s share in its energy mix presents a significant opportunity for investors. However, challenges remain, including the need for robust grid infrastructure upgrades to handle the influx of renewable energy and navigating complex regulatory landscapes. Investing in renewable energy in Indonesia not only helps reduce carbon emissions but also contributes to energy security and economic diversification. This is particularly crucial given Indonesia’s dependence on fossil fuels.

Sustainable Agriculture and Forestry

Indonesia’s vast agricultural lands and forests represent both significant economic opportunities and environmental concerns. Sustainable agricultural practices, such as promoting organic farming, improving water management, and reducing deforestation, are crucial for long-term food security and biodiversity conservation. However, the sector faces challenges such as land tenure issues, climate change impacts (like droughts and floods), and the need for better agricultural technology adoption. Investing in sustainable agriculture and forestry can contribute to food security, protect biodiversity, and improve the livelihoods of rural communities. Sustainable palm oil production, for example, is a key focus area.

Sustainable Tourism

Indonesia’s stunning natural beauty and rich cultural heritage make it a global tourism hotspot. Sustainable tourism initiatives that prioritize environmental protection, community empowerment, and responsible resource management can ensure the long-term viability of this crucial sector. However, challenges include managing the environmental impact of tourism, ensuring equitable distribution of tourism benefits, and mitigating the potential for overtourism in popular destinations. Investing in eco-tourism projects, community-based tourism initiatives, and sustainable infrastructure development can boost the economy while protecting Indonesia’s invaluable natural and cultural assets.

Green Technologies and Infrastructure

Indonesia’s rapid urbanization and industrialization create a significant demand for green technologies and sustainable infrastructure. This includes investments in green buildings, smart transportation systems, and waste management solutions. The sector, however, faces hurdles such as high upfront investment costs for green technologies and the need for policy support to incentivize adoption. Investing in this area can drive innovation, create jobs, and improve the quality of life in Indonesian cities.

Examples of Successful Sustainable Investment Projects in Indonesia

Several successful sustainable investment projects illustrate the potential of this sector.

- Renewable Energy: The development of geothermal power plants in Java, harnessing Indonesia’s volcanic activity for clean energy generation.

- Sustainable Agriculture: Investments in certified sustainable palm oil plantations, promoting responsible land management and reducing deforestation.

- Sustainable Tourism: Community-based ecotourism projects in areas like Raja Ampat, empowering local communities and protecting marine biodiversity.

- Green Infrastructure: The construction of green buildings in major cities, incorporating energy-efficient designs and sustainable materials.

Financial Instruments and Investment Strategies

Sustainable investing in Indonesia is blossoming, offering a vibrant array of financial instruments and strategies for those seeking both financial returns and positive social and environmental impact. Let’s dive into the exciting world of making money while making a difference, because frankly, who doesn’t want a win-win?

Navigating this landscape requires understanding the diverse tools available and crafting a strategy aligned with Indonesia’s unique development needs. While the potential for high returns is enticing, a clear-eyed approach is essential. We’ll explore the financial instruments, devise a sample SDG-focused strategy, and compare the performance of sustainable versus traditional investments, all while keeping things engaging (and hopefully, slightly humorous).

Types of Financial Instruments for Sustainable Investing in Indonesia

Indonesia’s sustainable finance market offers a diverse range of instruments, each catering to different investment goals and risk appetites. The options are more exciting than a batik fabric market on a busy Saturday!

- Green Bonds: These bonds specifically finance environmentally friendly projects, such as renewable energy, sustainable agriculture, and green buildings. Think of them as debt instruments with a conscience – they help fund projects that improve the environment and, potentially, your portfolio.

- Social Bonds: Focusing on social development, these bonds finance projects addressing social issues like affordable housing, education, and healthcare. These bonds are like the superheroes of the finance world, tackling crucial social problems while offering a return on investment.

- Sustainability-Linked Bonds (SLBs): These bonds link the issuer’s financial performance to the achievement of pre-defined sustainability targets. It’s a bond that’s motivated to do good – the better the sustainability performance, the better the returns.

- Impact Investing: This approach focuses on investments that generate measurable social and environmental impact alongside financial returns. Impact investing isn’t just about making money; it’s about making a meaningful difference, one investment at a time. This could involve venture capital in green technology startups or investing in community development projects.

- Equities in Sustainable Companies: Investing directly in the shares of companies committed to environmental, social, and governance (ESG) principles. This offers a direct stake in the success of businesses actively working towards a more sustainable future. Think of it as picking the winners in the race to a greener world.

An SDG-Focused Investment Strategy for Indonesia

A successful strategy needs a clear focus. Let’s design one aligned with Indonesia’s development priorities, specifically focusing on SDGs relevant to the country’s context.

This hypothetical strategy focuses on achieving multiple SDGs simultaneously. It prioritizes investments that contribute to clean energy (SDG 7), sustainable cities and communities (SDG 11), responsible consumption and production (SDG 12), and climate action (SDG 13). The strategy would diversify across different asset classes, including green bonds financing renewable energy projects, equities in companies promoting sustainable agriculture, and impact investments in community-based initiatives promoting waste reduction. Risk management is crucial, incorporating robust due diligence processes to assess the environmental and social impact of potential investments. Regular monitoring and reporting are vital to track progress towards SDG targets and financial returns.

Performance Comparison: Sustainable vs. Traditional Investments in Indonesia

While historical data on sustainable investments in Indonesia is still relatively limited compared to mature markets, emerging evidence suggests that sustainable investments can perform competitively with, or even outperform, traditional investments over the long term. This is partly due to the growing global awareness of ESG factors and the increasing demand for sustainable products and services. However, it’s important to acknowledge that the performance of sustainable investments can vary depending on the specific investment strategy, market conditions, and the quality of the underlying assets. A comprehensive analysis would require detailed historical data and rigorous statistical modelling – which, thankfully, is beyond the scope of this fun and informative overview.

Case Study: A Successful Sustainable Investment in Indonesia

While specific financial details of private investments are often confidential, we can illustrate a successful approach using a hypothetical case study. Imagine a company investing in a large-scale solar power project in rural Indonesia. This project contributes to SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action). The investment provides clean energy to previously underserved communities, creates local jobs, and generates a financial return for the investor. The success of this project is measured not only by financial profitability but also by its positive social and environmental impact, quantified through metrics like the amount of greenhouse gas emissions reduced, jobs created, and improved access to electricity. This holistic approach demonstrates the potential for impactful and profitable sustainable investments in Indonesia.

Challenges and Opportunities for Sustainable Investing in Indonesia

Sustainable investing in Indonesia, while brimming with potential, faces a landscape strewn with both exhilarating opportunities and surprisingly hilarious hurdles. Think of it as a thrilling treasure hunt where the treasure is a greener, more prosperous Indonesia, but the map is written in riddles and guarded by mischievous bureaucratic goblins. Let’s delve into the exciting – and occasionally frustrating – details.

Barriers to Widespread Adoption of Sustainable Investing Practices

Several factors hinder the widespread adoption of sustainable investing practices in Indonesia. A lack of standardized ESG (Environmental, Social, and Governance) reporting makes comparing companies like comparing apples and…well, very different, possibly genetically modified, apples. This lack of transparency makes it difficult for investors to make informed decisions, leading to a sort of investment Wild West where everyone’s guessing the value of the next sustainable gold rush. Furthermore, limited investor awareness and understanding of sustainable investing concepts contribute to a hesitancy to embrace this approach. It’s like trying to sell a revolutionary new spice to a chef who only uses salt and pepper. Finally, a lack of robust regulatory frameworks and enforcement mechanisms creates a fertile ground for greenwashing, leaving investors vulnerable to companies promising sustainability but delivering…well, less than promised.

Potential Solutions to Overcome Barriers

Overcoming these challenges requires a multi-pronged approach, a coordinated attack on the aforementioned bureaucratic goblins. The Indonesian government can play a crucial role by establishing clearer ESG reporting standards and enforcing them with the seriousness of a tax auditor. Investor education initiatives, perhaps involving catchy jingles and interactive workshops, can increase awareness and understanding of sustainable investing. Imagine a series of public service announcements featuring adorable Komodo dragons advocating for responsible business practices! Simultaneously, promoting corporate transparency through incentives and penalties will encourage companies to honestly showcase their sustainability efforts, transforming the Wild West into a well-regulated investment oasis.

The Role of International Collaborations and Partnerships

Indonesia’s journey towards sustainable investing can be significantly accelerated through international collaborations. Think of it as a global team effort to save the planet, one investment at a time. Foreign investors can bring in valuable expertise, financial resources, and best practices. International organizations can provide technical assistance and capacity building, while partnerships with universities and research institutions can foster innovation and knowledge sharing. These collaborations can help Indonesia leapfrog some of the challenges faced by other countries, turning potential pitfalls into stepping stones towards success.

Visual Representation of Interconnected Factors

Imagine a vibrant, interconnected web. At the center sits “Sustainable Investing in Indonesia.” Radiating outwards are key factors: “Government Policies” (represented by a strong, steady hand holding a compass), “Investor Awareness” (a bright, inquisitive lightbulb), “Corporate Transparency” (a shining beacon of honesty), “International Collaborations” (a network of interconnected global nodes), and “Financial Instruments & Investment Strategies” (a sophisticated, yet accessible, toolbox). Each factor is connected to the others, demonstrating the complex interplay between these elements. A stronger government hand leads to increased transparency, which in turn boosts investor confidence and attracts international collaborations, creating a positive feedback loop driving sustainable investment growth. Conversely, a weak link in any of these factors can significantly hinder progress, emphasizing the importance of a holistic approach.

The Role of Stakeholders in Sustainable Investing

Sustainable investing in Indonesia isn’t just a trend; it’s a thrilling game of economic Jenga, where removing the wrong block (unsustainable practice) can bring the whole tower crashing down. But build it right, and the rewards are magnificent – a more prosperous and environmentally sound Indonesia. To make this happen, a coordinated effort from all stakeholders is crucial – it’s not a solo game.

The success of sustainable investing hinges on the active participation and responsibility of various stakeholders. Each player holds a unique set of cards, and the skillful interplay of these cards determines the outcome. Let’s examine the roles and responsibilities of these key players.

Investor Responsibilities in Sustainable Investing

Investors, from individual “green” fund managers to massive pension funds, wield considerable power. Their investment choices directly influence which companies thrive and which struggle. Responsible investors actively screen for ESG (Environmental, Social, and Governance) factors, ensuring their money supports companies committed to sustainability. They may also engage directly with companies to encourage better practices, sometimes even using their voting rights to push for change. This isn’t just about making money; it’s about using financial leverage for positive impact. Imagine a domino effect: one investor’s responsible choice inspires others, leading to a wave of sustainable investments.

Corporate Social Responsibility (CSR) and Sustainable Investing Decisions

Corporate Social Responsibility (CSR) initiatives are no longer optional extras; they are becoming crucial for attracting sustainable investments. Companies demonstrating a genuine commitment to environmental protection, social equity, and good governance are far more attractive to investors seeking long-term value. For instance, a palm oil company with robust sustainability policies – proving they are not contributing to deforestation – is likely to receive higher valuations than one with a questionable track record. The market is increasingly rewarding responsible behavior, making CSR a vital component of a company’s overall strategy.

Government’s Role in Fostering Sustainable Investing, Sustainable Investing Indonesia

The Indonesian government plays a pivotal role, akin to the referee in our economic Jenga game. They can create the right playing field by implementing supportive policies, such as tax incentives for sustainable investments, stricter environmental regulations to discourage harmful practices, and transparent disclosure requirements to improve data availability. Imagine the government introducing a “green bond” market – this would significantly boost the availability of financing for sustainable projects. A well-designed regulatory framework acts as a powerful catalyst for sustainable investment growth.

Civil Society’s Contribution to Sustainable Investing

Civil society organizations (CSOs), including NGOs and advocacy groups, act as the watchful eyes and critical voices in the ecosystem. They monitor corporate activities, hold companies accountable for their environmental and social impact, and advocate for stronger regulations. Their reports and campaigns can significantly influence public opinion and investor decisions. Think of them as the dedicated scorekeepers, highlighting both successes and failures, and ensuring transparency. Their work helps to build trust and confidence in the sustainable investment market.

Successful Collaborations in Promoting Sustainable Investing

Several successful collaborations showcase the power of stakeholder synergy. For example, partnerships between the Indonesian government and international development agencies have facilitated the development of green financing mechanisms. Furthermore, collaborative initiatives involving investors, corporations, and CSOs have led to the development of industry-specific sustainability standards, creating a common language and a shared understanding of best practices. These partnerships, much like a well-oiled machine, demonstrate that collective action leads to far greater results than individual efforts.

Improved Transparency and Data Availability

Better data is the key to unlocking the full potential of sustainable investing in Indonesia. Improved transparency in corporate reporting, coupled with readily accessible ESG data, empowers investors to make informed decisions. Imagine a centralized database providing comprehensive information on a company’s environmental footprint, social impact, and governance structure – this would significantly reduce information asymmetry and increase investor confidence. This is like giving all players in the Jenga game a clear view of the tower’s structure – enabling better strategic moves and reducing the risk of collapse.

Conclusive Thoughts: Sustainable Investing Indonesia

In conclusion, Sustainable Investing Indonesia offers a compelling blend of risk and reward. While challenges abound, the potential for positive impact – both financially and socially – is immense. By understanding the unique context, embracing innovative investment strategies, and fostering strong stakeholder collaboration, Indonesia can unlock its sustainable development potential and pave the way for a more prosperous and environmentally responsible future. The journey towards a truly sustainable Indonesia requires a collective effort, and the rewards will be substantial for those who dare to participate in this transformative endeavor. This is not just about financial returns; it’s about shaping a better tomorrow.

Answers to Common Questions

What are the biggest risks associated with sustainable investing in Indonesia?

Risks include regulatory uncertainty, corruption, volatile commodity prices, and potential for “greenwashing” (misrepresenting sustainability efforts).

How can individual investors participate in sustainable investing in Indonesia?

Through ethically screened mutual funds, investing in companies with strong ESG ratings, or directly purchasing green bonds if available.

What role does the Indonesian government play in promoting sustainable investing?

The government sets regulatory frameworks, incentivizes green investments, and promotes sustainability initiatives through various ministries and agencies.

What is the future outlook for sustainable investing in Indonesia?

The outlook is positive, driven by increasing awareness of ESG factors, growing demand for sustainable products, and government support. However, challenges remain, requiring ongoing efforts to improve transparency and address systemic issues.