ESG Investing Strategies Review: Brace yourselves, dear reader, for a journey into the surprisingly hilarious world of ethical investing! We’ll delve into the complexities of Environmental, Social, and Governance factors, exploring how companies are judged not just by their profits, but also by their moral compass (or lack thereof). Prepare for witty insights, unexpected twists, and perhaps even a chuckle or two as we navigate the sometimes-absurd landscape of sustainable finance.

This review will unpack various ESG investment approaches, from the cautiously optimistic “integration” strategy to the delightfully judgmental “exclusionary” approach. We’ll examine the challenges of reliable ESG data – because let’s face it, sometimes even the good guys fudge the numbers – and explore how these factors influence portfolio construction and regulatory landscapes. Get ready for a rollercoaster ride of responsible investing!

Defining ESG Investing

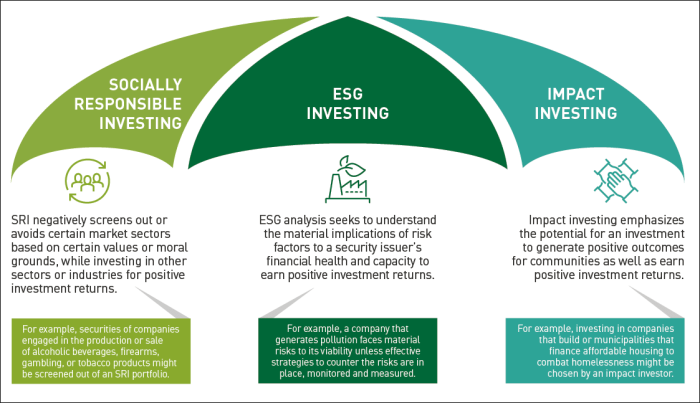

ESG investing, or Environmental, Social, and Governance investing, isn’t just a trendy buzzword; it’s a sophisticated approach to investing that considers a company’s impact on the world, not just its bottom line. Think of it as investing with your conscience – and hopefully, a healthy return. It’s about recognizing that a company’s long-term success is inextricably linked to its environmental responsibility, its treatment of employees and communities, and its ethical governance practices. Ignoring these factors is like driving a car without checking the tires – eventually, you’ll have a problem.

ESG investing considers a wide range of factors beyond traditional financial metrics. It’s about understanding the risks and opportunities associated with a company’s environmental footprint (think carbon emissions and waste management), its social impact (employee relations, diversity, and community engagement), and its governance structures (executive compensation, board diversity, and anti-corruption measures). The relative importance of each dimension can vary depending on the investor’s priorities and the specific industry, but a holistic approach is generally favored. It’s not a simple equation; it’s more like a complex recipe with several ingredients that need to be balanced for optimal results.

ESG Criteria Dimensions and Their Relative Importance

The three pillars of ESG – Environmental, Social, and Governance – are interconnected and influence each other. For instance, strong governance practices can lead to better environmental performance, while a company’s social responsibility can enhance its reputation and attract better talent. Investors often prioritize specific criteria based on their investment goals and risk tolerance. For example, an investor focused on climate change might prioritize environmental factors above others, while a socially conscious investor might weigh social factors more heavily. This is not a one-size-fits-all situation; it’s a tailored approach.

Examples of Companies with Strong and Weak ESG Profiles

Let’s consider a few examples. Patagonia, an outdoor clothing company, consistently demonstrates a strong ESG profile. Their commitment to sustainable materials, fair labor practices, and environmental activism resonates with consumers and investors alike. Their commitment to environmental protection is not just a marketing ploy; it’s woven into the fabric of their business model. Conversely, a company with a weak ESG profile might be one with a history of environmental violations, poor labor practices, or significant governance scandals. Such companies may face increased regulatory scrutiny, reputational damage, and ultimately, lower returns for investors. Imagine a company facing a major lawsuit due to environmental damage; that’s a clear sign of a weak ESG profile.

ESG Investment Strategies

Investing responsibly is no longer a niche pursuit; it’s becoming the mainstream. But navigating the world of ESG (Environmental, Social, and Governance) investing can feel like trying to herd cats wearing tiny sombreros. Fear not, intrepid investor! We’ll untangle the various strategies, revealing their strengths, weaknesses, and the occasional hilarious mishap along the way.

ESG Investment Approaches: A Comparison

Several approaches exist, each with its own unique flavor (some spicier than others). Understanding these differences is crucial for aligning your investment philosophy with your personal risk tolerance and desired impact. Think of it as choosing between a mild cheddar, a pungent blue cheese, or a fiery habanero – the right choice depends entirely on your palate.

| Strategy Name | Description | Investment Focus | Potential Risks |

|---|---|---|---|

| Integration | ESG factors are incorporated into traditional financial analysis. Think of it as adding a dash of ESG spice to your usual investment recipe. | Broad range of assets, focusing on companies with strong ESG profiles. | Potential for “greenwashing” (companies falsely claiming ESG credentials), difficulty in quantifying ESG impact. |

| Thematic | Investing in companies and projects directly addressing specific ESG themes, such as renewable energy or sustainable agriculture. This is the “all-in” approach, doubling down on a specific ESG area. | Companies and projects directly related to the chosen theme. | Higher concentration risk, potential for sector-specific downturns. Imagine investing heavily in only one type of chili pepper – if the harvest fails, your portfolio weeps. |

| Impact | Focuses on investments generating measurable positive social or environmental impact alongside financial returns. It’s about more than just money; it’s about making the world a slightly better place, one investment at a time. | Companies and projects with demonstrable positive social or environmental impact. | Difficulty in measuring impact, potential for lower financial returns compared to non-ESG investments. Measuring impact can be tricky; it’s like trying to quantify the joy of a perfectly ripe avocado. |

| Exclusionary (Negative Screening) | Avoids investing in companies involved in controversial activities, such as tobacco, weapons, or fossil fuels. It’s the “avoid the bad stuff” strategy. | Companies meeting specific exclusion criteria. | Potential for missing out on investment opportunities, limited universe of investable companies. Think of it as missing out on the best taco truck because it’s located in a questionable neighborhood. |

Examples of Successful ESG Investment Strategies

Successful ESG strategies aren’t just theoretical; they exist in the real world, proving that doing good can also be good for your portfolio (at least sometimes).

Let’s consider a hypothetical, but plausible, scenario: An impact investing fund focused on affordable housing in rapidly growing urban areas. By investing in developers committed to building sustainable, energy-efficient housing, the fund generates both financial returns and a significant positive social impact. The success here is measured not only by the fund’s financial performance but also by the number of affordable homes built and the positive impact on the community. This is not unlike a successful restaurant: it needs good food (financial returns) and a loyal customer base (social impact).

Another example might be a thematic strategy focused on renewable energy. Investing in companies developing and deploying solar, wind, and other renewable energy technologies has yielded strong returns in recent years, driven by increasing demand and supportive government policies. However, remember that the renewable energy sector is susceptible to policy changes and technological disruptions, adding a level of risk. Think of it like the wild west of energy: exciting, potentially lucrative, but also unpredictable.

Materiality and ESG Risk Assessment

Let’s face it, the world of ESG investing can feel like navigating a minefield blindfolded while juggling chainsaws. But fear not, intrepid investor! Understanding materiality and ESG risk assessment is your key to avoiding the metaphorical (and very real) explosions. This section will illuminate the path to a more informed and, dare we say, *profitable* investment strategy.

Materiality in ESG investing boils down to identifying the environmental, social, and governance factors that significantly affect a company’s financial performance. It’s not about ticking boxes; it’s about discerning what truly matters to the bottom line. Think of it as separating the wheat from the chaff – or, in this case, the genuinely impactful ESG issues from the fleeting trends. Ignoring material ESG factors is akin to ignoring a gaping hole in your ship – you might float for a while, but a swift and unpleasant sinking is almost guaranteed.

Defining Material ESG Factors

Material ESG factors are those that could reasonably be expected to influence the decisions of an investor. This isn’t just about environmental catastrophes; it includes things like a company’s labor practices, its governance structure, and its exposure to climate-related risks. For example, a company facing significant reputational damage due to unethical labor practices might experience a decline in sales and a drop in its stock price. Similarly, a company with weak governance might be more susceptible to fraud or mismanagement, impacting investor confidence and long-term value. Identifying these material factors requires a thorough understanding of the company’s operations, industry, and the broader regulatory environment.

Framework for ESG Risk Assessment in the Energy Sector

Let’s imagine we’re assessing a hypothetical energy company, “SolarShine Inc.” Our framework will involve a multi-stage process:

- Identify Key ESG Issues: For SolarShine Inc., this might include carbon emissions, water usage, community relations (local protests regarding solar farm construction), and supply chain transparency (ensuring ethical sourcing of materials).

- Materiality Assessment: We’ll use a matrix to weigh the likelihood and potential impact of each issue. A high likelihood and high impact issue, such as significant carbon emissions in a carbon-conscious market, would be deemed highly material. A low likelihood and low impact issue, such as minor water usage exceeding local standards by a negligible amount, would be less material.

- Risk Quantification: We’ll assign numerical values to the likelihood and impact, allowing for a quantitative assessment of the overall risk. This might involve using scenario planning and sensitivity analysis to determine the financial implications of different ESG scenarios.

- Mitigation Strategies: Based on the risk assessment, we’ll identify and evaluate potential mitigation strategies. For example, SolarShine Inc. could invest in carbon capture technology or engage in community outreach programs to address local concerns.

Impact of ESG Risks on Financial Performance, ESG Investing Strategies Review

The impact of ESG risks on financial performance can be significant and multifaceted. Let’s consider a few examples:

- Reputational Damage: A major oil spill (environmental risk) could lead to significant fines, decreased consumer trust, and a drop in the company’s share price. Think BP after the Deepwater Horizon disaster – a stark reminder of the financial consequences of environmental negligence.

- Regulatory Changes: Increasingly stringent carbon emission regulations (environmental risk) could force energy companies to invest heavily in renewable energy sources or face substantial penalties, impacting profitability. The EU’s Emissions Trading System (ETS) is a prime example of how regulatory changes can influence the financial performance of companies in the energy sector.

- Supply Chain Disruptions: Ethical sourcing concerns (social risk) could lead to disruptions in the supply chain, increasing costs and potentially damaging the company’s reputation. The recent focus on conflict minerals highlights the financial implications of ignoring social risks in the supply chain.

ESG Data and Reporting

Navigating the world of ESG data can feel like trying to assemble IKEA furniture without the instructions – frustrating, occasionally bewildering, and potentially leading to a wonky outcome. The sheer volume of data, coupled with inconsistencies in methodology, makes it a challenge even for seasoned investors. This section will shed light on the complexities of ESG data, highlighting the challenges and offering a glimpse into the brave new world of standardized reporting.

The reliability and comparability of ESG data are significant hurdles in effective ESG investing. Imagine trying to compare apples and oranges – or perhaps, apples grown using vastly different farming techniques. One orchard might boast organic practices, while another might rely heavily on pesticides. Similarly, ESG data providers use different methodologies, weighting factors, and data sources, making direct comparisons difficult, if not impossible. This lack of standardization creates significant uncertainty and makes it challenging to assess a company’s true ESG performance.

Challenges in Accessing Reliable and Comparable ESG Data

The lack of universally accepted standards and methodologies is a major obstacle. Data collection processes vary widely, leading to inconsistencies in the quality and comparability of the information. Some companies might be more forthcoming with their data than others, creating a bias in the overall dataset. Furthermore, the sheer volume of data points, covering a broad spectrum of environmental, social, and governance issues, can be overwhelming and difficult to analyze effectively. Finally, the “greenwashing” phenomenon, where companies exaggerate or misrepresent their ESG performance, further complicates the process of identifying reliable data. This makes it a bit like trying to find a needle in a haystack that’s also on fire.

Key ESG Data Providers and Methodology Comparison

Several key players dominate the ESG data landscape, each employing unique methodologies. Let’s consider three prominent examples: MSCI, Sustainalytics, and Refinitiv. While all three provide ESG ratings and scores, their methodologies differ significantly. MSCI, for example, utilizes a quantitative approach, relying heavily on publicly available data and a proprietary scoring system. Sustainalytics, on the other hand, employs a more qualitative assessment, incorporating expert judgment and analysis of company policies and practices. Refinitiv integrates a blend of quantitative and qualitative data, incorporating news sentiment and other alternative data sources. These differences in methodology inevitably lead to variations in the ESG scores assigned to the same company.

| Data Provider | Methodology | Strengths | Weaknesses |

|---|---|---|---|

| MSCI | Quantitative, data-driven | Large dataset, consistent methodology | May overlook qualitative factors |

| Sustainalytics | Qualitative, expert-driven | In-depth analysis, considers nuanced factors | Subjectivity, potentially less scalable |

| Refinitiv | Mixed quantitative and qualitative | Broad data coverage, incorporates alternative data | Complexity, potential for data inconsistencies |

Impact of Inconsistent ESG Data on Investment Decisions

Inconsistencies in ESG data can significantly influence investment decisions. For instance, a portfolio manager relying heavily on one data provider might overestimate or underestimate a company’s ESG performance, leading to suboptimal investment choices. This can manifest as either missing out on opportunities to invest in truly sustainable companies or inadvertently investing in companies with questionable ESG practices. Moreover, the lack of standardization can hinder the development of robust ESG benchmarks and indices, making it difficult to compare the performance of ESG-focused funds and portfolios. The resulting uncertainty can ultimately lead to less efficient capital allocation and potentially hinder the growth of the sustainable investment market. It’s a bit like navigating with a faulty GPS – you might arrive, but you might also end up somewhere completely unexpected.

ESG Performance Measurement and Benchmarking

Measuring and benchmarking ESG performance isn’t just about ticking boxes; it’s about navigating a thrilling, sometimes bewildering, landscape of data and methodologies. Think of it as a financial decathlon, but instead of hurdles and javelins, we’re dealing with carbon footprints and ethical sourcing. The goal? To understand how well a company is performing across environmental, social, and governance factors, and to compare that performance against its peers.

ESG performance measurement employs a variety of approaches, each with its own strengths and, let’s be honest, its quirks. Some rely on quantitative data, crunching numbers like emissions levels and board diversity. Others incorporate qualitative assessments, delving into a company’s supply chain practices or its commitment to human rights. The process often involves analyzing publicly available information, engaging directly with companies, and utilizing specialized ESG data providers – a bit like assembling a complex jigsaw puzzle where some pieces are missing, and others might be slightly… off.

ESG Rating Agencies and Indices

Several organizations provide ESG ratings and indices, offering investors a glimpse into a company’s ESG profile. These range from established giants like MSCI and Sustainalytics to newer entrants vying for a piece of the action. These ratings and indices are like different maps of the same terrain; some emphasize certain aspects over others, leading to variations in scores and rankings. For instance, MSCI’s ratings might focus heavily on carbon emissions, while Sustainalytics might place more weight on controversies related to human rights. A company might achieve a stellar rating from one agency but a less impressive one from another – it’s a testament to the subjectivity inherent in ESG assessment. The strengths lie in providing a standardized framework for comparison, while the weaknesses include the potential for bias, differing methodologies, and the limitations of relying solely on publicly available data. Imagine trying to judge a chef solely on their restaurant reviews; you’re missing out on the magic (or the disaster) happening in the kitchen.

Limitations of Using Solely ESG Ratings for Investment Decisions

Relying exclusively on ESG ratings for investment decisions would be like navigating a city using only a single, outdated map. While these ratings offer valuable insights, they are not a panacea. Firstly, the methodologies used by different rating agencies vary significantly, leading to inconsistencies in scoring. Secondly, ESG ratings often lag behind real-world events; a company’s ESG performance can change rapidly, but the ratings might not reflect those changes immediately. Thirdly, ratings primarily focus on publicly available information, often neglecting the “soft” aspects of ESG performance, such as a company’s internal culture or its relationships with stakeholders. Finally, even the most comprehensive ESG rating can’t fully capture the complex interplay of factors influencing a company’s long-term sustainability. Think of it like this: a high ESG rating might suggest a company is doing well on paper, but it doesn’t guarantee future success or predict how it will navigate unforeseen challenges. It’s a crucial piece of the puzzle, but not the whole picture.

The Role of ESG in Portfolio Construction

Integrating ESG factors into portfolio construction isn’t just a trend; it’s a sophisticated dance between financial performance and ethical considerations. Think of it as upgrading your investment strategy from a basic two-step to a dazzling tango – more complex, potentially more rewarding, and definitely more interesting. This section will explore how ESG considerations can be elegantly woven into various portfolio construction strategies, transforming them from mere collections of assets into ethically-conscious, potentially high-performing entities.

ESG considerations offer a powerful lens through which to view potential investments, allowing investors to align their portfolios with their values while potentially enhancing long-term returns. This isn’t about sacrificing profitability for virtue; it’s about identifying opportunities that offer both. By incorporating ESG data, investors can identify companies better positioned for future success, mitigating risks and capitalizing on emerging trends. Let’s delve into the practical application of ESG in different portfolio approaches.

ESG Integration in Passive Portfolio Strategies

Passive strategies, often associated with index tracking, might seem at odds with the active selection inherent in ESG investing. However, ESG integration can be seamlessly incorporated. For example, an investor could choose an index fund specifically designed to track a sustainability-focused index, thereby passively gaining exposure to companies with strong ESG profiles. This approach leverages the power of indexing while aligning the portfolio with ESG goals, minimizing the active management workload while still achieving ESG objectives. Such funds often screen out companies involved in controversial activities, offering a simple yet effective way to integrate ESG principles.

ESG Integration in Active Portfolio Strategies

Active management offers more flexibility in incorporating ESG factors. Fund managers can actively research companies, assessing their ESG performance alongside traditional financial metrics. This allows for a more nuanced approach, potentially identifying undervalued companies with strong ESG profiles or avoiding companies with significant ESG risks. Consider a fund manager focusing on companies with high environmental, social, and governance scores, believing that these companies are better positioned for long-term growth and less susceptible to reputational damage. This proactive selection process, informed by ESG data, can lead to enhanced portfolio performance and a stronger ethical alignment.

ESG Integration in Factor-Based Portfolio Strategies

Factor-based investing, which focuses on specific characteristics like value, momentum, or size, can be enhanced by incorporating ESG factors. For instance, a value investor might incorporate ESG scores into their valuation models, identifying undervalued companies with strong ESG profiles. Similarly, a momentum investor might use ESG data to predict future performance, potentially identifying companies with positive ESG momentum that are poised for further growth. By integrating ESG data into existing factor models, investors can potentially refine their factor exposures and improve overall portfolio performance. Imagine a factor model incorporating ESG scores alongside traditional financial metrics, resulting in a more comprehensive and potentially more accurate prediction of future returns.

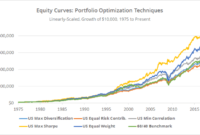

Portfolio Optimization Techniques Incorporating ESG Factors

Several optimization techniques can incorporate ESG factors. Mean-variance optimization, a common technique, can be modified to include ESG constraints or objectives. For instance, an investor might set a minimum ESG score for all portfolio holdings or minimize the portfolio’s overall carbon footprint. This allows for a portfolio that is optimized not just for financial return but also for ESG performance. Another approach involves using multi-objective optimization to balance financial returns with ESG goals, resulting in a Pareto frontier of optimal portfolios that represent different trade-offs between financial and ESG performance. This allows investors to select a portfolio that best aligns with their risk tolerance and ESG preferences.

Designing ESG-Integrated Portfolios for Specific Investor Profiles

A risk-averse investor might prioritize ESG factors that mitigate risks, such as environmental risks or governance issues. Their portfolio could focus on companies with strong ESG scores and stable financial performance, potentially reducing overall portfolio volatility. Conversely, a growth-oriented investor might focus on companies that are leading the charge in sustainable innovation, even if they involve higher risk. Their portfolio could include companies with strong ESG profiles in emerging sectors, such as renewable energy or sustainable agriculture, potentially achieving higher growth but accepting a higher level of risk. The key is to tailor the ESG integration to the specific risk appetite and investment objectives of the individual investor.

ESG and Regulatory Landscape: ESG Investing Strategies Review

The world of ESG investing isn’t just about doing good; it’s increasingly about navigating a complex and rapidly evolving regulatory landscape. Governments worldwide are scrambling to keep up with the burgeoning field, resulting in a fascinating (and sometimes bewildering) patchwork of rules and regulations. Think of it as a global game of regulatory whack-a-mole, but with far higher stakes than just losing a few tokens.

The impact of these regulations on investment strategies is significant, influencing everything from data collection and reporting to the very definition of what constitutes “ESG-compliant.” Ignoring these shifts is akin to playing poker without knowing the rules – you might get lucky, but the odds are decidedly against you.

Key Regulatory Developments and Their Impact

Recent years have witnessed a flurry of regulatory activity concerning ESG. The European Union, for instance, has been at the forefront, implementing the Sustainable Finance Disclosure Regulation (SFDR) and the Corporate Sustainability Reporting Directive (CSRD). These regulations mandate detailed disclosures on ESG risks and performance, pushing companies to be more transparent about their environmental and social impact. This increased transparency, while initially burdensome for some, ultimately aims to create a more level playing field for investors and reduce “greenwashing” – the practice of falsely portraying an investment as environmentally friendly. The impact on investment strategies is clear: investors must now factor in these new reporting requirements when assessing potential investments. Failure to do so could expose them to significant legal and reputational risks. Meanwhile, in the United States, while a single, overarching ESG regulatory framework remains elusive, various agencies are increasingly active, leading to a more piecemeal approach. This can lead to confusion but also allows for more targeted interventions in specific sectors.

The Role of Regulatory Bodies in Promoting Transparency and Standardization

Regulatory bodies play a crucial role in fostering transparency and standardization in ESG reporting. Without consistent standards, ESG data becomes akin to comparing apples and oranges – a frustrating exercise yielding little useful information. Organizations like the International Sustainability Standards Board (ISSB) are working towards creating globally consistent standards for ESG disclosures, aiming to bring much-needed order to the current chaotic landscape. Imagine the ISSB as the referee of a global ESG soccer match – ensuring fair play and a clear understanding of the rules. Their efforts are vital for building investor confidence and enabling more effective capital allocation towards truly sustainable projects. The successful implementation of these standards will not only benefit investors but also help to drive genuine improvements in corporate sustainability practices. However, the road to standardization is paved with challenges – differing national priorities and the sheer complexity of ESG issues make the task far from trivial. Yet, the benefits of a more standardized approach are undeniable, potentially unlocking a wave of sustainable investments and promoting a more responsible corporate world.

Future Trends in ESG Investing

The world of ESG investing, once a niche pursuit, is now hurtling towards a future brimming with both exciting opportunities and, let’s be honest, a few potential head-scratching moments. The rapid evolution of this field demands a peek into the crystal ball (or, more realistically, a thorough analysis of current trends) to understand where we’re headed. Buckle up, because it’s going to be a wild ride.

The next decade will witness a dramatic reshaping of the ESG landscape, driven by technological innovation, escalating climate concerns, and a growing demand for transparency. We’ll see a shift away from simple compliance towards a more integrated approach, where ESG considerations are deeply embedded in every aspect of investment decision-making. Think less “checking boxes” and more “building a better future, one investment at a time.”

Climate Change Mitigation as a Central Focus

Climate change is no longer a distant threat; it’s a present reality impacting businesses and investment portfolios globally. The focus is shifting from merely reducing carbon footprints to actively investing in solutions that mitigate climate change. This includes significant investments in renewable energy sources, carbon capture technologies, and climate-resilient infrastructure. For example, we’re already seeing a surge in green bonds financing projects aimed at transitioning to a low-carbon economy, and this trend is only set to accelerate. We can envision a future where investments in climate solutions are not just “responsible” but are considered essential for long-term portfolio success.

The Rise of Sustainable Finance

Sustainable finance is no longer a buzzword; it’s a powerful force reshaping the financial system. This encompasses a wide range of activities, from green bonds and sustainable loans to impact investing and ESG-integrated funds. The growth of sustainable finance is fueled by both regulatory pressures and increasing investor demand for investments aligned with their values. Consider the European Union’s Sustainable Finance Disclosure Regulation (SFDR), which is driving a wave of transparency and standardization across the continent. We expect this trend to spread globally, leading to a more harmonized and robust sustainable finance market.

Impact Investing’s Growing Influence

Impact investing, which aims to generate both financial returns and positive social and environmental impact, is poised for significant growth. This approach goes beyond simply avoiding “harmful” investments; it actively seeks out opportunities to create positive change. For instance, investments in companies developing innovative solutions for clean water access or affordable healthcare are prime examples of impact investing. The increasing availability of data and sophisticated measurement tools will further enhance the ability to track and measure the impact of these investments, making them increasingly attractive to both investors and businesses.

Technological Advancements Shaping ESG Investing

Technological advancements are revolutionizing ESG investing, offering both new opportunities and challenges. Artificial intelligence (AI) is being used to analyze vast amounts of ESG data, identify material risks, and improve the accuracy of ESG ratings. Blockchain technology has the potential to enhance transparency and traceability in supply chains, making it easier to verify ESG claims. Imagine a future where AI-powered platforms can instantly assess the ESG credentials of any company, providing investors with unparalleled insights. This level of transparency will be crucial in building trust and driving further adoption of ESG investing.

Future Trajectory of ESG Investing (Visual Description)

Imagine a graph charting the growth of ESG assets under management. The line starts relatively flat in the past, representing the early stages of ESG investing. Over the next 5-10 years, the line dramatically curves upwards, reflecting exponential growth driven by factors discussed above. The graph isn’t a straight line, however; it shows some fluctuations, representing market volatility and evolving regulatory landscapes. Ultimately, the graph shows a clear upward trend, demonstrating the long-term growth and mainstream acceptance of ESG investing. The trajectory suggests that ESG will move from a “nice-to-have” to a “must-have” for investors across all asset classes.

Conclusion

So, there you have it: a whirlwind tour of ESG investing strategies. While the quest for truly ethical and profitable investments might seem like a Sisyphean task at times (that rock keeps rolling back down!), the journey itself is filled with fascinating insights and the potential for significant positive impact. Remember, even in the world of finance, a little humor can go a long way – especially when it’s paired with a commitment to a sustainable future.

FAQ Compilation

What is “greenwashing” in the context of ESG investing?

Greenwashing is the practice of making misleading or unsubstantiated claims about a company’s environmental or social performance to appear more sustainable than it actually is. Think of it as the financial equivalent of wearing a “Save the Planet” t-shirt while simultaneously driving a gas-guzzling monster truck.

How can I assess the credibility of ESG ratings and data providers?

Assessing credibility requires careful scrutiny. Look for transparency in methodologies, a robust data collection process, and independent verification. Beware of ratings that seem suspiciously positive across the board – if it looks too good to be true, it probably is.

What are the potential downsides of solely relying on ESG scores for investment decisions?

ESG scores are just one piece of the puzzle. Over-reliance can lead to neglecting other crucial financial metrics, potentially sacrificing profitability for questionable ethical gains. A balanced approach is key – think of it as choosing your investments based on both heart and head.