Pajak Pertambahan Nilai (PPN) Review: Embark on a hilarious yet informative journey into the often-bewildering world of Indonesia’s Value Added Tax! Prepare for a rollercoaster ride through rates, calculations, exemptions, and the occasional existential crisis over whether your morning kopi is truly tax-deductible. We’ll unravel the mysteries of PPN, leaving no loophole unexplored (except maybe the ones the government doesn’t want us to find).

This review delves into the intricacies of PPN, from its historical roots to its impact on the Indonesian economy. We’ll explore the various rates, calculation methods, and exemptions, providing clear examples and practical tips to navigate this crucial aspect of Indonesian business and finance. Get ready to laugh, learn, and maybe even slightly understand PPN.

Introduction to Pajak Pertambahan Nilai (PPN)

Pajak Pertambahan Nilai (PPN), or Value Added Tax in English, is Indonesia’s primary indirect tax. Think of it as a tax on consumption, levied at each stage of the production and distribution chain. It’s a bit like a tax on the value added at each step, hence the name. While it might sound complicated, it’s essentially a tax that ultimately ends up being paid by the final consumer. Let’s delve into its fascinating history and mechanics.

PPN’s implementation in Indonesia has a rather interesting backstory. Initially introduced in 1984 with a rate of 10%, it wasn’t always the smoothly functioning system we see today. Early years saw challenges with compliance and administration, a common hurdle for new tax systems. Over time, the rate has been adjusted and the system refined to improve efficiency and broaden its reach. Several amendments and revisions have been implemented to address evolving economic conditions and to ensure fairness. This ongoing evolution reflects the government’s commitment to optimizing revenue generation while striving for a more efficient tax system.

Objectives of the PPN System

The primary objectives of the Indonesian PPN system are threefold: to generate substantial revenue for the government, to stimulate economic activity by promoting a fair and efficient tax environment, and to ensure a more equitable distribution of the tax burden. The revenue generated fuels essential public services, from infrastructure development to healthcare and education. A well-functioning PPN system encourages businesses to operate transparently, contributing to a healthier and more predictable economic climate. The aim is to ensure that everyone contributes their fair share towards the nation’s development.

Goods and Services Subject to PPN

A wide range of goods and services are subject to PPN. This includes everything from imported luxury cars and fancy imported chocolates to everyday necessities like groceries (although certain basic food items may be exempt). Services, such as restaurant meals, hotel accommodations, and transportation, are also generally subject to PPN. It’s important to note that the specific goods and services subject to PPN, as well as any applicable exemptions or reductions, are subject to the prevailing regulations and are regularly reviewed and adjusted by the Indonesian government. For example, educational services often receive preferential treatment, while luxury goods typically bear a higher rate. The system aims for a balance between revenue generation and social considerations.

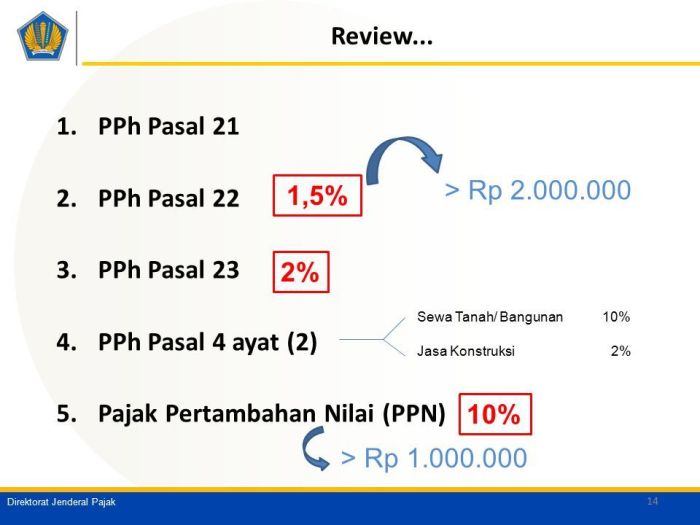

PPN Rates and Calculation Methods

Navigating the world of Indonesian PPN can feel like traversing a particularly tricky tax jungle, but fear not! With a little understanding, you’ll be calculating PPN like a seasoned pro (or at least, like someone who knows which way the taxman swings). Let’s delve into the rates and methods, armed with examples and a healthy dose of humor to keep things interesting.

Understanding PPN rates and calculation methods is crucial for businesses operating in Indonesia. Incorrect calculations can lead to penalties, so let’s get this straight!

PPN Rates in Effect

Indonesia currently employs a tiered system of PPN rates, making things just a *tad* more exciting. These rates apply to various goods and services, creating a delightful tapestry of tax complexities (we’re trying to be optimistic here).

| PPN Rate | Applicable Scenario | Example | Notes |

|---|---|---|---|

| 11% | Most goods and services | A restaurant meal costing IDR 100,000 would have a PPN of IDR 11,000 (100,000 x 0.11). | This is the standard rate for a wide range of transactions. |

| 10% (Reduced Rate) | Certain goods and services deemed essential (Specific list determined by regulation) | Basic food items, some healthcare services. Exact items are subject to change. Consult official regulations. | This rate aims to make essential goods more affordable. |

| 0% | Exports, certain goods and services as defined by law. | Export of Indonesian coffee beans. | This is a crucial aspect of international trade, ensuring Indonesian goods remain competitive. |

| Free from PPN | Specific goods and services as defined by law. | Certain educational services, healthcare services (depending on the service and provider). | The list of PPN-exempt goods and services is extensive and subject to change. Always refer to official sources for the latest information. |

PPN Calculation Methods

The calculation itself isn’t rocket science, thankfully. It’s simply a matter of applying the correct rate to the taxable base. However, determining that taxable base can sometimes feel like deciphering an ancient scroll.

The general formula is straightforward:

PPN = Taxable Base x PPN Rate

However, determining the “taxable base” requires careful consideration of the transaction. For example, import duties and other taxes might be added to the cost of goods before the PPN calculation.

PPN Calculation Examples

Let’s illustrate with some real-world scenarios, because theoretical examples are as exciting as watching paint dry.

Scenario 1: Sales of Goods

A company sells goods worth IDR 500,000. The PPN rate is 11%. The PPN amount is IDR 55,000 (500,000 x 0.11). The total amount the buyer pays is IDR 555,000 (500,000 + 55,000).

Scenario 2: Import of Goods

A company imports goods with a CIF value of IDR 1,000,000. Import duties of IDR 100,000 are added, resulting in a taxable base of IDR 1,100,000. Applying the 11% PPN rate, the PPN amount is IDR 121,000 (1,100,000 x 0.11). The total cost is IDR 1,221,000 (1,000,000 + 100,000 + 121,000).

Remember: these are simplified examples. Actual PPN calculations can be more complex, depending on the specifics of the transaction and relevant regulations.

Exemptions and Reductions in PPN

Navigating the world of Pajak Pertambahan Nilai (PPN), or Value Added Tax, can feel like traversing a particularly tricky tax maze. But fear not, intrepid taxpayer! While the intricacies of PPN calculations can be daunting, understanding exemptions and reductions can significantly lighten your tax burden. Think of it as finding the secret shortcuts in that tax maze – less paperwork, more money in your pocket. Let’s explore the delightful world of PPN relief.

Exemptions and reductions in PPN are designed to support specific sectors and activities deemed essential or deserving of tax breaks. These provisions offer a much-needed respite from the otherwise stringent PPN regulations, providing relief to businesses and individuals who meet specific criteria. It’s like receiving a tax-holiday, but with rules.

Goods and Services Exempted from PPN

Certain goods and services are completely exempt from PPN. This means that no PPN is levied on their sale or provision. These exemptions are generally intended to benefit essential goods or services, or to promote specific social or economic goals. Think of it as the government giving a high-five to essential services.

Examples of goods and services typically exempted include basic necessities like certain types of food, healthcare services, and education. The specific list of exempted goods and services can vary depending on the country’s specific regulations and policies. Always consult the most up-to-date official regulations to ensure accuracy.

Conditions for Obtaining PPN Reductions

PPN reductions, on the other hand, offer a partial exemption. Instead of a complete waiver, a reduced rate of PPN is applied. This is a more targeted approach, often used to encourage the consumption of specific goods or services considered beneficial to the economy or society. It’s a gentler nudge, rather than a full exemption.

The conditions for obtaining PPN reductions are usually quite specific and vary greatly depending on the type of good or service and the applicable regulations. These conditions might involve meeting certain quality standards, targeting specific demographics, or operating within designated sectors. Think of it as earning a discount coupon for responsible business practices.

Process of Claiming PPN Exemptions or Reductions

Claiming PPN exemptions or reductions usually involves meticulous documentation and adherence to strict procedural guidelines. It’s a process that requires careful attention to detail, ensuring that all the necessary forms are completed accurately and submitted on time. It’s like navigating a very specific, yet rewarding, treasure hunt.

This typically includes submitting applications, providing supporting documentation, and potentially undergoing audits. The specific process may vary depending on the relevant tax authority and the nature of the exemption or reduction being claimed. It’s a good idea to seek professional guidance if you’re unsure about any aspect of the process. Think of it as having a trusted sherpa to guide you through the tax mountain.

Examples of Businesses Qualifying for PPN Exemptions or Reductions

Several businesses can qualify for PPN exemptions or reductions. These often include businesses operating in essential sectors, such as healthcare providers offering specific services, educational institutions, and organizations involved in certain social welfare programs. It’s a reward system for those making a positive impact.

For instance, a hospital providing essential healthcare services might be exempt from PPN on certain medical treatments. Similarly, a school offering primary education might enjoy PPN exemptions on tuition fees. These exemptions are intended to make these vital services more accessible and affordable. It’s a win-win for everyone involved.

PPN Reporting and Compliance

Navigating the world of PPN reporting might seem like traversing a minefield of paperwork, but fear not! With a little understanding and a dash of organizational flair, you can conquer this bureaucratic beast and avoid the wrath of the taxman. This section details the procedures for submitting your PPN returns, the penalties for procrastination (or, let’s be honest, forgetfulness), and some common pitfalls to steer clear of.

Filing your PPN returns is a crucial step in maintaining your good standing with the Indonesian tax authorities. Think of it as your quarterly (or monthly, depending on your turnover) tax confession – a chance to be honest (and hopefully, not too broke). The process involves meticulous record-keeping, accurate calculations, and timely submission. Failure to comply can result in penalties that’ll make your wallet weep.

PPN Return Filing Procedures

The procedure for filing PPN returns involves several key steps. First, you must meticulously maintain detailed records of all your taxable transactions. This includes invoices issued and received, along with supporting documentation. Then, you’ll need to use the official tax software or online portal to prepare your return. This software will help you calculate your payable PPN based on your records. Finally, submit your return electronically by the deadline. Late submissions, of course, will incur penalties.

Penalties for Non-Compliance

Let’s talk penalties – the less-than-fun part of PPN compliance. These penalties can range from hefty fines to legal action, depending on the severity and duration of the non-compliance. For instance, late filing often results in a daily penalty based on the unpaid tax amount. More serious offenses, such as intentional tax evasion, can lead to significant fines and even criminal prosecution. Remember, honesty is always the best policy, especially when dealing with taxes.

PPN Reporting Process Flowchart

Imagine a flowchart as a visual roadmap to successfully navigating PPN reporting. It would start with “Record Keeping,” branching to “Calculate PPN Payable” using official software. This leads to “Prepare PPN Return,” followed by “Electronic Submission.” A “Yes” from the submission branch leads to “Compliance Achieved,” while a “No” (due to late submission or errors) branches to “Penalties Applied.” A simple, yet effective, visual representation of the process ensures that all necessary steps are followed.

Common PPN Reporting Errors and Avoidance Strategies

Even the most diligent taxpayers can stumble. Common errors include incorrect calculation of PPN, missing deadlines, and inadequate record-keeping. To avoid these pitfalls, invest in good accounting software, double-check your calculations, and set reminders for upcoming deadlines. Regularly review your records to ensure accuracy and consistency. Proactive measures, such as engaging a tax consultant for complex cases, can significantly reduce the risk of errors and penalties.

Impact of PPN on the Indonesian Economy

The Pajak Pertambahan Nilai (PPN), or Value Added Tax, is more than just a number cruncher for the Indonesian government; it’s a vital cog in the economic machine, influencing everything from the price of your morning kopi to the growth of major industries. Understanding its impact requires looking beyond the tax forms and into the broader economic landscape. Let’s delve into how this seemingly simple tax shapes Indonesia’s financial story.

PPN’s role in government revenue generation is paramount. It’s a significant contributor to the national budget, funding crucial public services like infrastructure development, healthcare, and education. Think of it as the silent funder of those vital improvements you see around you. A healthy PPN collection translates directly into a healthier nation, allowing for investments that propel economic growth and improve the quality of life for Indonesian citizens. Fluctuations in PPN revenue often serve as an early warning system for economic shifts, offering insights into consumer spending habits and overall economic health.

PPN’s Influence on Consumer Prices

The relationship between PPN and consumer prices is a delicate dance. While PPN increases the final price of goods and services, the extent of this increase varies depending on several factors, including the nature of the product, the supply chain, and the level of competition in the market. For instance, essential goods often have lower PPN rates or exemptions, mitigating the impact on low-income households. However, non-essential goods and luxury items bear the brunt of the tax, potentially influencing consumer purchasing decisions and overall spending patterns. This effect is often debated, with economists exploring the elasticity of demand for various products in response to PPN changes.

Comparison of the Indonesian PPN System with Other Countries

Indonesia’s PPN system, while broadly similar to VAT systems in other countries, possesses unique characteristics. For example, compared to the relatively high VAT rates in some European countries (e.g., 20% or more in many EU nations), Indonesia’s PPN rate is lower, although still significant. The specific exemptions and reductions offered in Indonesia also differ from those in other countries, reflecting the nation’s unique economic priorities and social considerations. Analyzing these differences allows for a better understanding of the relative impact of PPN on different economies and the potential for adjustments and improvements. A comparative study could reveal best practices and areas for optimization in the Indonesian system.

Impact of PPN on Different Sectors of the Indonesian Economy

The impact of PPN is far from uniform across all sectors. Understanding its effects requires a nuanced approach, recognizing the varied responses of different industries.

- Manufacturing: PPN directly impacts production costs and pricing strategies, potentially affecting competitiveness in both domestic and international markets. Companies might adjust pricing, output, or investment plans in response to PPN changes.

- Tourism: The tourism sector, a significant contributor to the Indonesian economy, is directly influenced by PPN on services such as accommodation and tours. Fluctuations in PPN rates can affect tourist spending and overall revenue generation for businesses in this sector.

- Retail: Retail businesses are at the forefront of PPN collection, acting as intermediaries between consumers and the government. They bear the administrative burden of PPN compliance and experience direct effects on pricing and sales volume.

- Agriculture: The agricultural sector often benefits from PPN exemptions or reductions for certain products, aimed at supporting food security and affordability for consumers. This targeted approach highlights the government’s ability to utilize PPN to achieve specific policy goals.

Recent Developments and Reforms in PPN

The Indonesian government, ever the master of fiscal acrobatics, regularly tweaks its PPN system. These changes, while sometimes causing initial head-scratching among businesses, often aim to improve tax collection, stimulate specific sectors, or simply keep the system relevant in a rapidly evolving economy. Let’s dive into some of the recent thrilling developments, shall we?

The rationale behind these adjustments is multifaceted. Increased tax revenue is a primary driver, of course. But equally important are efforts to simplify the system, reduce compliance burdens for businesses (yes, really!), and foster a more equitable distribution of the tax burden. The impact, as you might expect, is a mixed bag for businesses and consumers, depending on the specific reform.

PPN Reform Timeline, Pajak Pertambahan Nilai (PPN) Review

The following timeline highlights key developments, showcasing the dynamic nature of Indonesia’s PPN system. Think of it as a rollercoaster – exciting, sometimes bumpy, but ultimately aiming for a smoother ride.

2019: Expansion of the PPN base. Several previously exempted goods and services were brought under the PPN umbrella. This move aimed to broaden the tax base and increase revenue. The impact was felt most acutely by businesses in previously exempted sectors, who faced new compliance requirements. Consumers, however, might have seen price increases for some goods and services.

2020: Implementation of the electronic invoicing system (e-Faktur). This digital transformation aimed to streamline PPN reporting, reduce administrative burdens, and enhance transparency. While initially met with some resistance, the e-Faktur system has largely been successful in improving tax compliance and reducing tax evasion. The impact on businesses involved initial investment in new software and training, but long-term benefits include reduced administrative costs and improved efficiency.

2022: Revisions to PPN rates for certain goods and services. Some rates were adjusted to reflect changing economic conditions and government priorities. For example, rates for certain environmentally friendly products might have been reduced to encourage their consumption. The impact varied depending on the specific goods and services affected. Businesses dealing with these goods and services had to adapt their pricing strategies, while consumers saw changes in the prices of these items.

2023: Ongoing discussions regarding further simplification of PPN regulations. The government continues its efforts to make the PPN system more user-friendly and less burdensome for businesses. These ongoing efforts aim to improve ease of compliance, reduce administrative costs, and encourage greater participation in the tax system. The impact of these future reforms is still uncertain but is expected to bring further changes to businesses and consumers.

Impact on Businesses

The impact of PPN reforms on businesses is often a double-edged sword. While some reforms might increase compliance costs in the short term, they can also lead to long-term benefits such as improved efficiency and reduced administrative burdens. For example, the introduction of the e-Faktur system initially required businesses to invest in new technology and training, but ultimately resulted in streamlined reporting and reduced risk of errors. The government’s ongoing efforts towards simplification aim to further minimize the negative impact on businesses.

Impact on Consumers

Consumers are directly affected by PPN changes through price adjustments. Expansion of the PPN base or increases in PPN rates generally lead to higher prices for goods and services. Conversely, reductions in PPN rates or exemptions can lead to lower prices. The overall impact on consumers depends on the specific reforms implemented and their effect on the prices of goods and services they commonly consume. The government attempts to balance revenue generation with minimizing the impact on consumers, particularly those with lower incomes.

Future Outlook of PPN in Indonesia

Predicting the future of Indonesia’s PPN system is like predicting the next viral TikTok dance – wildly unpredictable, yet strangely captivating. While the current system has its quirks (let’s be honest, filing taxes is rarely anyone’s favorite pastime), it’s poised for some significant changes, both exciting and potentially challenging. The coming years will see a fascinating interplay between technological advancements, economic shifts, and evolving government priorities.

Potential Future Trends in PPN Policy

The Indonesian government is likely to continue its efforts to modernize the PPN system, aiming for increased efficiency and transparency. This might involve further digitalization, streamlining processes, and improving data analytics to better identify tax evasion. Think of it as upgrading from a rotary phone to a smartphone – a dramatic improvement in functionality and ease of use. We might also see a greater emphasis on harmonizing PPN regulations with international standards, facilitating smoother cross-border trade and investment. This could involve aligning with best practices observed in countries like Singapore or Malaysia, known for their efficient and user-friendly tax systems. Furthermore, expect ongoing debates and adjustments to PPN rates, influenced by macroeconomic factors and the government’s fiscal goals. Imagine it as a delicate balancing act, adjusting the scales to maintain economic stability while supporting key sectors.

Challenges Facing the PPN System

The Indonesian PPN system faces several persistent challenges. One significant hurdle is the informal economy, where businesses operate outside the formal tax system, leading to significant revenue losses. Visualize it as a vast, shadowy iceberg – a substantial portion remains hidden beneath the surface. Another major challenge is the complexity of the PPN regulations themselves, which can be daunting for small and medium-sized enterprises (SMEs). Picture a labyrinthine maze, where navigating the rules requires a PhD in tax law (and maybe a compass and a map). Finally, effective tax enforcement remains a challenge, with limited resources and capacity often hindering the ability to effectively collect taxes owed. This can be likened to a game of cat and mouse, where tax authorities try to keep up with increasingly sophisticated evasion techniques.

Potential Solutions to Address Challenges

Addressing these challenges requires a multi-pronged approach. Strengthening tax education and outreach programs for SMEs could simplify compliance and encourage participation in the formal economy. Imagine it as a friendly tax tutor, guiding businesses through the complexities and ensuring they understand their obligations. Investing in advanced technology, such as artificial intelligence (AI) and data analytics, can enhance tax enforcement and improve the detection of tax evasion. Think of it as equipping tax authorities with high-tech detective tools, making it harder for tax evaders to hide. Simplifying the PPN regulations, possibly by consolidating or clarifying existing rules, can significantly reduce the burden on taxpayers. This would be like transforming the tax code from a dense jungle into a well-maintained park, easy to navigate and understand. Furthermore, fostering a culture of tax compliance through public awareness campaigns and promoting ethical business practices is crucial. This is like planting the seeds of good citizenship, nurturing a society where tax compliance is seen as a civic duty.

A Descriptive Illustration of the Future of PPN in Indonesia

Imagine a future where filing PPN returns is as simple as using a user-friendly mobile app, where AI instantly identifies potential errors and discrepancies, and where tax evasion is a thing of the past. The informal economy has shrunk significantly, thanks to effective outreach programs and a supportive business environment. The PPN system is transparent, efficient, and contributes significantly to funding vital public services like healthcare and education. However, the path to this utopian vision is not without its obstacles. The government will need to continuously adapt to evolving economic conditions, technological advancements, and the ingenuity of tax evaders. Maintaining a delicate balance between simplification, efficiency, and effective enforcement will be key to the success of Indonesia’s future PPN system. It’s a continuous journey, not a destination, requiring constant innovation and adaptation.

Closing Notes

So, there you have it – a whirlwind tour through the captivating (and sometimes comical) landscape of Pajak Pertambahan Nilai. While PPN might seem like a bureaucratic beast, understanding its nuances can empower businesses and individuals alike. Remember, even the most complex tax system can be conquered with a healthy dose of humor and a dash of diligent research. Now go forth and conquer your PPN obligations – or at least, try not to cry when filing your returns.

Detailed FAQs: Pajak Pertambahan Nilai (PPN) Review

What happens if I accidentally underpay my PPN?

Prepare for a gentle (yet firm) nudge from the tax authorities. Expect a notice and potentially penalties, so accurate record-keeping is key. Think of it as a friendly reminder to be more precise next time!

Can I deduct PPN on business expenses?

Generally, yes! Keep your receipts, maintain meticulous records, and consult with a tax professional to ensure you’re claiming all eligible deductions. It’s a bit like a treasure hunt, but the treasure is… less tax.

Are there any resources available to help me understand PPN better?

Absolutely! The Indonesian tax authority website is a great starting point (though perhaps not the most thrilling read). Consulting a tax advisor or accountant is highly recommended for navigating the complexities of PPN.