Emergency Fund Planning Guide: Navigating the unpredictable world of finances requires a sturdy safety net, and that net is your emergency fund. This guide isn’t just about squirreling away cash; it’s about strategically building a financial fortress capable of withstanding life’s unexpected curveballs, from a burst appendix to a sudden job loss. We’ll explore the best strategies for determining the right amount to save, choosing the ideal savings vehicles, and maintaining your fund so you can face financial emergencies with confidence, not panic.

We’ll cover everything from defining what constitutes an emergency expense (hint: that new TV probably doesn’t qualify) to developing a personalized savings plan that fits your lifestyle and financial goals. We’ll also look at real-world scenarios to illustrate the stark difference between being prepared and being caught off guard. Get ready to ditch the financial anxieties and embrace the peace of mind that comes with a well-funded emergency fund.

Defining Emergency Funds

Let’s face it, life throws curveballs. One minute you’re serenading your cat with opera, the next you’re facing a surprise plumbing bill that could rival the national debt. That’s where the humble emergency fund swoops in to save the day (and your sanity). Think of it as your financial superhero cape, ready to be deployed when unexpected expenses strike.

An emergency fund is a dedicated savings account specifically designed to cushion the blow of unforeseen financial hardships. Its purpose is simple: to provide a safety net so you don’t have to resort to desperate measures like maxing out credit cards or taking out high-interest loans when disaster strikes. It’s about maintaining financial stability and avoiding the crippling stress of unexpected costs.

Unexpected Expenses Covered by Emergency Funds

Unexpected expenses are, well, unexpected. They’re the uninvited guests at the party of your financial life. Examples include medical emergencies (because who *really* budgets for a sudden appendicitis?), car repairs (that mysterious clunking sound never bodes well), home repairs (a leaky roof is never convenient), job loss (finding a new job takes time and effort), and even unexpected travel costs (that flight your grandmother needed to catch). The key is that these are expenses you didn’t plan for, and they often hit when you least expect them.

Emergency Funds vs. Other Savings Accounts

While all savings accounts aim to grow your money, emergency funds have a distinct purpose and therefore different characteristics compared to other savings vehicles. A general savings account might be for a down payment on a house or a future vacation. It’s money you’re actively saving for a *specific* goal. Conversely, your emergency fund is for *anything* unexpected that throws your budget into chaos. The key difference lies in accessibility and intended use. You want your emergency fund easily accessible, unlike a long-term investment that may have penalties for early withdrawal.

Comparison of Savings Accounts for Emergency Funds

Choosing the right savings account for your emergency fund is crucial. You need easy access to your money without sacrificing too much in terms of interest. Below is a comparison of different account types, keeping in mind that interest rates and fees can change, so always check with your financial institution for the most up-to-date information.

| Account Type | Interest Rate (Example) | Accessibility | Fees |

|---|---|---|---|

| High-Yield Savings Account | 1.5% – 2.5% (This is an example and varies greatly depending on the bank and the time.) | Easy access via ATM, online banking, debit card | May have monthly maintenance fees (check with the bank) |

| Money Market Account | Often slightly higher than savings accounts, but may have minimum balance requirements | Easy access, but may have limitations on the number of withdrawals per month | May have monthly maintenance fees or minimum balance requirements |

| Checking Account (with high interest) | Interest rates are typically lower than savings accounts | Immediate access via debit card, checks, or online banking | May have monthly maintenance fees or minimum balance requirements |

| Certificates of Deposit (CDs) | Generally higher interest rates than savings accounts, but with penalties for early withdrawal | Limited accessibility, usually only after the CD matures | May have early withdrawal penalties |

Determining Your Emergency Fund Target

So, you’ve bravely faced the question of what an emergency fund *is*. Congratulations! Now comes the slightly less thrilling, but equally crucial, task of figuring out how much you actually need to stash away. Think of it as a financial life raft – you don’t want to be adrift on a tiny inflatable when a tsunami hits, do you?

Determining the right size for your emergency fund is less about precise calculation and more about sensible risk assessment. It’s about finding the sweet spot between feeling financially secure and not letting your savings account become a black hole swallowing all your fun money. We’ll explore several methods to help you navigate this delicate balancing act.

Methods for Calculating Emergency Fund Size

Several approaches exist for calculating your ideal emergency fund size. The most common methods revolve around your expenses and income stability. One popular approach is the 3-6 month expense method. This suggests having enough saved to cover 3 to 6 months of your essential living expenses. Another method focuses on a specific dollar amount, perhaps aiming for $1000, $5000, or even $10,000, depending on individual circumstances. A more sophisticated approach might involve a dynamic calculation based on your debt levels, income volatility, and family size.

Factors Influencing Emergency Fund Amount

Several factors significantly influence the appropriate size of your emergency fund. Income stability plays a critical role; if your income is consistently reliable, a smaller emergency fund might suffice. However, if your job involves high risk or fluctuating income, a larger cushion is advisable. Job security also comes into play; those in secure positions might need less than freelancers or gig workers. Family size also matters, as larger families often have higher expenses and therefore require a larger emergency fund. Existing debts further complicate the equation; if you already have significant debt, you’ll likely want a larger emergency fund to handle unexpected expenses without exacerbating your debt burden.

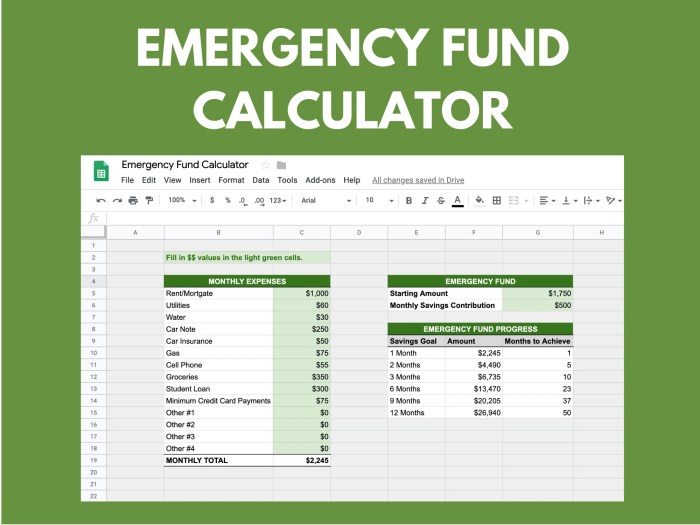

Step-by-Step Guide to Determining a Realistic Savings Goal

Let’s craft a personalized emergency fund plan. First, meticulously track your monthly essential expenses (rent/mortgage, utilities, groceries, transportation, minimum debt payments). Next, multiply this total by 3, then 6. This provides your 3-month and 6-month emergency fund targets. Now, honestly assess your job security and income stability. If you’re in a high-risk profession, aim for the higher end of this range (or even beyond!). Finally, consider your existing debts and family size, adjusting your target accordingly. For example, a single person with a stable job might aim for 3 months’ worth of expenses, while a family with irregular income might target 6 months or even more.

Savings Strategies to Achieve the Emergency Fund Target

Once you have a realistic savings goal, several strategies can help you reach it.

- Automate your savings: Set up automatic transfers from your checking account to your savings account each month. This makes saving effortless and consistent.

- Cut unnecessary expenses: Identify areas where you can reduce spending, such as dining out, entertainment, or subscriptions. Even small cuts can make a big difference over time.

- Increase your income: Consider a side hustle or part-time job to supplement your income and accelerate your savings.

- Prioritize saving: Treat your emergency fund contributions as non-negotiable expenses, similar to rent or mortgage payments.

- Use high-yield savings accounts: Maximize your returns by placing your emergency fund in a high-yield savings account or money market account.

Remember, building an emergency fund is a marathon, not a sprint. Celebrate your progress along the way, and don’t be discouraged by setbacks. The peace of mind that comes with having a financial safety net is priceless.

Building Your Emergency Fund: Emergency Fund Planning Guide

So, you’ve bravely faced the existential dread of defining what constitutes an emergency fund and, even more bravely, determined how much you actually need. Congratulations! You’re officially less likely to be caught in a financial blizzard wearing only flip-flops. Now, let’s tackle the thrilling task of actually *building* that safety net. Think of it as constructing a magnificent, impenetrable fortress against the unforeseen – but with less moat and more high-yield savings.

High-yield savings accounts and money market accounts are your primary weapons in this financial battle. Let’s examine their strengths and weaknesses.

High-Yield Savings Accounts and Money Market Accounts

High-yield savings accounts (HYSA) are like the trusty workhorses of the savings world. They offer better interest rates than regular savings accounts, allowing your money to grow (albeit slowly, but steadily, like a determined tortoise). Money market accounts (MMA) are slightly more sophisticated, often offering check-writing capabilities and potentially higher interest rates, but sometimes with minimum balance requirements.

| Feature | High-Yield Savings Account | Money Market Account |

|---|---|---|

| Interest Rate | Generally higher than regular savings accounts, but can fluctuate. | Potentially higher than HYSA, but may fluctuate and depend on market conditions. |

| Access to Funds | Easy access; typically via debit card or online transfers. | Easy access; often with check-writing capabilities, but may have limitations. |

| Fees | Usually minimal or nonexistent, but check for monthly maintenance fees. | May have minimum balance requirements and potential fees for falling below the minimum. |

| FDIC Insurance | Usually FDIC-insured up to $250,000 per depositor, per insured bank. | Usually FDIC-insured up to $250,000 per depositor, per insured bank. |

Obstacles to Building an Emergency Fund and Strategies to Overcome Them

Let’s be honest, building an emergency fund isn’t always a walk in the park. Life throws curveballs (and sometimes entire bowling balls). Common obstacles include unexpected expenses, low income, and, let’s face it, the siren song of instant gratification.

Here are some strategies to navigate these treacherous waters:

- Tackle Unexpected Expenses Strategically: Instead of panicking and raiding your meager savings, create a buffer for smaller unexpected expenses. Think of it as a “mini-emergency fund” within your larger fund. This prevents minor issues from derailing your larger savings goal.

- Budgeting Brilliance: A meticulously crafted budget is your secret weapon. Track your income and expenses ruthlessly. Apps like Mint or YNAB (You Need A Budget) can be your trusty sidekicks in this quest.

- Increase Your Income (if possible): Explore side hustles, freelance work, or even a part-time job. Every extra dollar counts in this noble endeavor.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account. This is like a financial self-imposed tax, but one you’ll thank yourself for later.

- Resist the Urge to Splurge: We all deserve treats, but prioritize your emergency fund. Think of it as investing in your future peace of mind – far more valuable than that avocado toast (though, admittedly, delicious).

Sample Emergency Fund Budget Allocation

This is just a sample, tailor it to your unique financial situation. Remember, consistency is key!

| Income (Monthly) | Expenses (Monthly) | Savings Allocation (Monthly) |

|---|---|---|

| $4,000 | $3,000 (rent, utilities, food, etc.) | $1,000 (25% of income) |

Managing and Maintaining Your Emergency Fund

So, you’ve bravely conquered the beast that is building your emergency fund. Congratulations! But the adventure doesn’t end there. Think of your emergency fund not as a destination, but as a delightfully sturdy, well-stocked life raft – one you’ll hopefully never need, but are eternally grateful to have should the metaphorical kraken of unexpected expenses rear its ugly head. Maintaining your emergency fund is crucial to ensuring it remains your financial safety net.

Regular contributions are the key to keeping your emergency fund robust and ready for action. Think of it like a muscle: use it (wisely!), but keep exercising it to stay strong. Consistent contributions, even small ones, ensure that your fund grows steadily, providing a buffer against unforeseen circumstances. This consistent growth mitigates the impact of unexpected expenses and prevents you from having to scramble for funds when you need them most. Ignoring regular contributions is akin to letting your life raft slowly deflate – not a good look.

Regular Contributions to the Emergency Fund

The importance of regular contributions cannot be overstated. Consider automating your contributions through your bank’s bill pay feature or setting up automatic transfers from your checking account. This removes the temptation to spend the money and ensures consistent growth. Even small, regular contributions are more effective than sporadic large ones. Imagine contributing $50 a week versus $1000 every three months; the consistent approach provides a more reliable safety net over time. The psychological benefit of automating this is substantial too – it’s one less financial decision to make each month!

Tracking Progress Towards Savings Goals

Tracking your progress is vital to maintaining motivation and ensuring you stay on track. Use budgeting apps, spreadsheets, or even a simple notebook to monitor your emergency fund’s growth. Visualizing your progress, perhaps with a chart or graph, can be surprisingly motivating. For instance, if your goal is $10,000 and you’ve saved $5,000, seeing that halfway point in a clear visual can be a huge morale booster. Consider setting smaller, intermediate goals along the way, celebrating each milestone achieved. This helps you stay focused and avoid feeling overwhelmed by the larger overall target.

Maintaining Discipline and Avoiding Unnecessary Withdrawals

Maintaining discipline is crucial. The emergency fund is, after all, for emergencies. Before dipping into it, ask yourself: Is this truly an emergency? A new pair of shoes, while tempting, rarely qualifies. A broken washing machine, however, is a different story. Develop a clear definition of what constitutes an “emergency” for your household and stick to it. If you find yourself tempted to use the funds for non-emergencies, remember the peace of mind that a healthy emergency fund provides. That peace of mind is invaluable and far outweighs any fleeting desire for something non-essential.

Managing Unexpected Expenses and Utilizing the Emergency Fund

A flowchart can help you navigate unexpected expenses rationally and effectively.

Imagine this flowchart: Start with “Unexpected Expense?” Yes/No. If No, continue regular contributions. If Yes, proceed to “Is it a True Emergency?” Yes/No. If No, explore alternative solutions (e.g., borrowing from a friend, delaying purchase). If Yes, assess the cost. Next, “Sufficient Funds in Emergency Fund?” Yes/No. If Yes, withdraw necessary funds. If No, explore alternative financing options (e.g., loan, credit card). Finally, replenish the emergency fund as soon as possible.

This structured approach helps ensure responsible and efficient use of your emergency fund, minimizing unnecessary withdrawals while ensuring you’re prepared for genuine emergencies.

Reviewing and Adjusting Your Emergency Fund Plan

Life, as they say, is what happens when you’re busy making other plans. And those plans, especially financial ones, need regular check-ups, much like your teeth (or perhaps your increasingly bewildered pet hamster). Failing to review your emergency fund plan is like leaving your umbrella at home on a sunny day – you’ll be singing a soggy song when the heavens open. Regular review ensures your financial safety net remains strong and adaptable.

Periodic review of your emergency fund plan is crucial for maintaining its effectiveness. A static plan, ignoring the dynamic nature of life, is a recipe for financial stress. Think of it as a living document, constantly evolving to meet your changing needs and circumstances. Neglecting this vital aspect can leave you financially vulnerable when unexpected events strike, leaving you scrambling like a squirrel in a hurricane.

Life Events Requiring Emergency Fund Adjustments, Emergency Fund Planning Guide

Significant life events often necessitate adjustments to your emergency fund target. A new baby, for example, dramatically increases expenses related to childcare, healthcare, and diapers (a bottomless pit, truly). Similarly, unexpected home repairs, a job loss, or a medical emergency can significantly deplete your savings, requiring a reassessment of your emergency fund goals. Even positive life events, like a marriage or a significant promotion, can necessitate adjustments to your plan as your income, expenses, and responsibilities shift. Consider a scenario where a couple merges households: their combined income might justify a larger emergency fund, while a sudden job loss for one partner might require a more conservative approach.

Adjusting the Savings Plan Based on Changes

Changes in income, expenses, or life circumstances demand a flexible approach to your emergency fund strategy. A decrease in income necessitates a reduction in spending or an increase in the savings period to reach your target. Conversely, an increase in income provides an opportunity to accelerate your savings and perhaps even increase your emergency fund target. Imagine receiving a generous bonus – this could significantly boost your savings progress, allowing you to reach your goal sooner or build a larger safety net. Similarly, a change in expenses, such as moving to a cheaper apartment or reducing monthly subscriptions, can free up funds for faster emergency fund growth.

Annual Emergency Fund Plan Review Checklist

It’s recommended to conduct a thorough review of your emergency fund plan annually. This process should involve a careful assessment of your current financial situation and any significant changes that have occurred during the year.

Here’s a checklist to guide your annual review:

- Review Current Emergency Fund Balance: Compare your current balance against your target. Are you on track? Are there any unexpected dips that need investigation?

- Assess Income and Expenses: Have your income or expenses changed significantly? Consider both predictable changes (like annual raises or planned home renovations) and unpredictable events (like unexpected medical bills or job loss).

- Evaluate Life Circumstances: Have there been any significant life changes? Marriage, birth of a child, major illness, or job change all impact your financial needs.

- Re-evaluate Emergency Fund Target: Based on the above, does your current emergency fund target still adequately cover your potential expenses? Consider adjusting your target upward or downward as needed.

- Adjust Savings Strategy: Modify your savings plan to reflect your revised target. This might involve increasing or decreasing your monthly contributions or adjusting your savings timeline.

- Review Investment Strategy (if applicable): If you’ve invested any portion of your emergency fund, ensure the investment remains appropriate for the emergency fund’s purpose (liquidity and low risk).

Illustrating Emergency Fund Scenarios

Let’s face it, life throws curveballs. Sometimes those curveballs are gentle, like a slightly off-center pitch. Other times, they’re fastballs aimed directly at your financial well-being. Having an emergency fund is your financial catcher’s mitt, ready to snag those unexpected expenses before they send you into a financial tailspin. We’ll examine two scenarios, one where a robust emergency fund saves the day, and one where its absence leads to… well, let’s just say less-than-ideal circumstances.

A Well-Funded Emergency Fund Prevents Financial Hardship

Imagine Sarah, a diligent planner with a six-month emergency fund totaling $18,000. She earns $60,000 annually, so her fund represents 30% of her annual income – a healthy cushion. Then, BAM! Her car’s transmission gives up the ghost, requiring a $4,000 repair. Simultaneously, her aging washing machine decides to stage a dramatic flood in her laundry room, necessitating a $1,500 replacement. Without blinking an eye, Sarah dips into her emergency fund. The repairs are covered without incurring debt, and her life continues relatively uninterrupted. She experiences a minor inconvenience, certainly, but avoids the crippling stress and financial repercussions of significant debt. Her remaining emergency fund balance is $12,500, still a substantial safety net. The emotional cost of avoiding a financial crisis is immeasurable, and the peace of mind is priceless.

A Lack of Emergency Fund Leads to Financial Hardship

Now meet Mark. Mark, bless his heart, is a bit less… proactive. He doesn’t have an emergency fund. He earns roughly the same as Sarah, $60,000 annually. Then, disaster strikes. His refrigerator conks out, costing $1,200 to replace. A week later, a plumbing issue necessitates a $2,500 repair. Faced with these unexpected expenses, Mark is forced to use high-interest credit cards, accumulating $3,700 in debt with a 20% APR. This debt, coupled with the initial expenses, throws his budget into disarray. He’s now struggling to meet his monthly obligations, impacting his credit score and causing considerable stress. The situation could potentially lead to further financial problems, such as late payments on other bills, ultimately creating a downward spiral.

Comparison of Scenarios

The difference between Sarah and Mark’s experiences is stark. Sarah, with her meticulously planned emergency fund, navigated unexpected expenses with relative ease. Mark, lacking this crucial safety net, found himself grappling with debt and significant financial stress. This highlights the importance of proactive financial planning and the undeniable value of an emergency fund. The cost of not having an emergency fund far outweighs the effort required to build and maintain one. The peace of mind and financial security it provides are invaluable, ensuring that unexpected life events don’t become financial catastrophes.

Wrap-Up

Building an emergency fund isn’t about deprivation; it’s about empowerment. By proactively planning for the unexpected, you’re taking control of your financial future. This guide has armed you with the knowledge and strategies to create a robust emergency fund, transforming potential financial disasters into manageable bumps in the road. Remember, a well-planned emergency fund isn’t just a safety net; it’s a springboard for future financial success. So, go forth and build that financial fortress!

Clarifying Questions

What if I already have some savings? Do I still need an emergency fund?

Yes! While existing savings are helpful, an emergency fund is specifically designed for unexpected expenses and should be kept separate. Think of it as your dedicated “in case of emergency” stash.

How often should I review my emergency fund plan?

At least annually, or more frequently if there are significant life changes (job loss, marriage, children, etc.). Regular review ensures your plan remains aligned with your current needs and financial situation.

What if I can’t afford to save as much as the recommended amount?

Start small! Even saving a little each month is better than nothing. Gradually increase your contributions as your financial situation improves. Consistency is key.

Can I use my emergency fund for things like home repairs?

Yes, unexpected home repairs are exactly the type of emergency your fund is designed for. However, carefully consider if the repair is truly urgent or if it can be postponed until you’ve built up more savings.