Retirement Savings Strategies Indonesia: Securing your golden years in the archipelago isn’t just about finding the right beach; it’s about crafting a robust financial plan that outlasts even the most stubborn sunset. This guide navigates the often-bewildering world of Indonesian retirement savings, offering insights into government programs, private investment options, and strategies tailored to various income levels. We’ll unravel the complexities of tax implications, inflation’s sneaky impact, and the crucial role of financial literacy in building a retirement nest egg that’s both comfortable and secure.

From understanding the current landscape of Indonesian retirement planning to mastering investment strategies and navigating the tax implications, we’ll equip you with the knowledge to confidently chart your course towards a financially secure retirement. We’ll delve into the specifics of various retirement savings vehicles, comparing their advantages and disadvantages, and offer tailored advice for different income brackets, ensuring that no matter your financial situation, you have a clear path forward.

Understanding Indonesian Retirement Landscape

Indonesia’s retirement landscape is, shall we say, a vibrant tapestry woven with threads of optimism and the occasional, slightly frayed, strand of anxiety. While the nation boasts a burgeoning middle class and increasing awareness of the need for retirement planning, the reality is that many Indonesians face a rather precarious future after their working years. Let’s delve into the specifics, shall we?

Current State of Retirement Savings in Indonesia

The current state of retirement savings in Indonesia presents a mixed bag. While formal pension schemes like the BPJS Ketenagakerjaan (Employment Social Security Agency) provide a safety net for many formal sector employees, a significant portion of the population, particularly those in the informal sector, lack adequate retirement savings. This informal sector, comprising a substantial chunk of the Indonesian workforce, often relies on informal savings methods or family support in their later years. This leads to significant financial vulnerability for a large portion of the population upon retirement. The level of awareness regarding long-term financial planning also varies greatly across different socioeconomic groups.

Challenges Faced by Indonesian Retirees

Indonesian retirees face a multitude of challenges, not least of which is the persistent issue of inflation outpacing the growth of their retirement savings. Many retirees rely on a combination of limited government pensions, personal savings, and family support, which may prove insufficient to maintain a comfortable standard of living. The rising cost of healthcare, particularly in old age, further exacerbates this financial strain. Additionally, a lack of financial literacy and access to appropriate financial products can leave retirees vulnerable to scams and poor investment decisions. Imagine trying to plan for retirement with a rapidly fluctuating Rupiah!

The Role of the Government in Retirement Planning

The Indonesian government plays a crucial role in retirement planning, primarily through the BPJS Ketenagakerjaan and BPJS Kesehatan (National Health Insurance). These programs offer a basic level of social security, providing retirement benefits and healthcare coverage. However, the adequacy of these benefits is often debated, particularly considering the increasing cost of living and healthcare. The government is also actively promoting financial literacy programs and encouraging the development of private pension schemes to supplement public programs. Think of it as a government-orchestrated financial juggling act, aiming for a balanced retirement budget for all.

Common Retirement Income Sources in Indonesia

Retirement income in Indonesia is often a patchwork quilt of different sources. Common sources include: BPJS Ketenagakerjaan pensions, personal savings (often in the form of informal savings or property), family support, and income from small businesses or investments. The reliance on family support, while culturally significant, highlights the inadequacy of formal retirement planning for many. The picture is complex and varies significantly depending on individual circumstances and employment history. It’s a testament to the resilience of the Indonesian spirit, but certainly not ideal.

Comparison of Retirement Savings Plans in Indonesia

| Plan Name | Features | Benefits | Risks |

|---|---|---|---|

| BPJS Ketenagakerjaan (JHT) | Mandatory for formal sector employees; lump-sum payout upon retirement or resignation. | Provides a safety net for formal sector workers; relatively low contribution rates. | Lump-sum payout may be quickly depleted; inadequate for long-term financial security; inflation risk. |

| Private Pension Funds (Dana Pensiun) | Voluntary; regular contributions; various investment options. | Potential for higher returns; professional management; tax benefits. | Higher initial investment required; market risk; potential for lower returns than expected. |

| Individual Savings Accounts (e.g., Tabungan) | Flexible; easy access; various interest rates available. | Simple and accessible; good for short-term savings. | Low returns compared to other options; high inflation risk; vulnerable to unexpected expenses. |

| Property Investment | Potential for capital appreciation; rental income. | Potential for significant long-term returns; tangible asset. | Illiquidity; high initial investment; property market fluctuations; management costs. |

Popular Retirement Savings Vehicles in Indonesia

Planning for retirement in Indonesia can feel like navigating a bustling Jakarta street market – exciting, overwhelming, and full of choices! But fear not, intrepid saver! Let’s explore the most popular retirement savings vehicles available, dissecting their pros and cons with the seriousness they deserve (and a touch of lightheartedness, because let’s face it, retirement should be fun).

Jamsostek (BPJS Ketenagakerjaan) Program: Advantages and Disadvantages

Jamsostek, or the Indonesian Manpower Social Security Agency, is a government-mandated program offering social security benefits, including retirement pensions. Participation is generally compulsory for employees in the formal sector. Think of it as the safety net – crucial for basic retirement needs.

- Advantages: Government backing provides a degree of security, and contributions are often partially employer-funded, easing the financial burden. It’s a simple, straightforward system.

- Disadvantages: The payout might not be sufficient for a comfortable retirement, especially considering Indonesia’s rising cost of living. The investment options are limited, and returns may not keep pace with inflation. Self-employed individuals or those in the informal sector often miss out on this safety net.

Privately Managed Pension Funds in Indonesia: Features and Benefits

For those seeking more control and potentially higher returns, privately managed pension funds offer a wider range of investment choices. These funds operate under regulatory oversight, offering various investment strategies to suit different risk tolerances.

- Features: These funds usually offer diversified portfolios, professional management, and potentially higher returns than Jamsostek. They provide greater flexibility in contribution amounts and investment strategies.

- Benefits: The potential for higher returns can lead to a more comfortable retirement. Many funds offer various investment options to align with individual risk profiles and financial goals.

Investment Options within Retirement Savings Vehicles

The investment landscape within Indonesian retirement savings vehicles is becoming increasingly diverse. While Jamsostek offers limited options, private pension funds provide a spectrum of choices, from conservative fixed-income instruments to more aggressive equity investments.

- Jamsostek: Primarily invests in low-risk government bonds and other fixed-income securities, ensuring capital preservation but potentially limiting growth.

- Private Pension Funds: Offer a wider range, including stocks, bonds, mutual funds, and potentially even real estate or infrastructure investments, allowing for diversification and potentially higher returns, but also increased risk.

Comparison of Investment Strategies for Retirement Savings in Indonesia

Choosing the right investment strategy is crucial. Consider your risk tolerance, time horizon, and financial goals.

| Strategy | Risk | Potential Return | Suitable for |

|---|---|---|---|

| Conservative | Low | Low | Risk-averse individuals nearing retirement |

| Moderate | Medium | Medium | Individuals with a longer time horizon and moderate risk tolerance |

| Aggressive | High | High | Younger individuals with a longer time horizon and higher risk tolerance |

Sample Portfolio Allocation for Retirement Investment Strategies

Remember, these are just examples; consult a financial advisor for personalized advice.

| Strategy | Fixed Income | Equities | Other |

|---|---|---|---|

| Conservative | 80% | 10% | 10% (e.g., money market funds) |

| Moderate | 50% | 40% | 10% (e.g., real estate investment trusts) |

| Aggressive | 20% | 70% | 10% (e.g., alternative investments) |

Retirement Planning Strategies for Different Income Levels

Planning for retirement in Indonesia, a land of vibrant culture and delicious Nasi Goreng, requires a nuanced approach. The strategies you employ will significantly depend on your current income bracket. Let’s explore how different income levels can navigate the sometimes-bewildering world of Indonesian retirement planning, ensuring a comfortable – and perhaps even luxurious – sunset to your working years. Remember, the earlier you start, the better your chances of achieving your retirement dreams!

Retirement Planning Strategies for Low-Income Earners in Indonesia

Low-income earners in Indonesia often face the greatest challenge in retirement planning. The key here is consistent saving and leveraging government-supported programs. Smart choices and disciplined saving habits can make a surprising difference.

- Maximize Government Programs: Take full advantage of government-sponsored pension schemes like the BPJS Ketenagakerjaan (Employment Social Security Agency) program. This provides a safety net, even if it’s a modest one. Understanding the nuances of these programs and contributing consistently is paramount.

- Start Small, Save Regularly: Even small, consistent contributions to a savings account or a simple investment plan are better than nothing. Think of it as building a foundation, brick by brick. Consistency is key; even IDR 100,000 a month adds up over time.

- Seek Financial Literacy: Access free or low-cost financial literacy programs offered by NGOs or government initiatives. Learning basic financial management skills is crucial for making the most of limited resources. Understanding compound interest, for example, can be a game-changer.

- Consider Micro-Insurance: Explore micro-insurance products, which offer affordable coverage against unexpected events that could derail retirement savings. These smaller-scale insurance options can provide a vital safety net.

Retirement Planning Strategies for Middle-Income Earners in Indonesia

Middle-income earners have more options, but careful planning is still crucial. Diversification and a longer-term perspective are vital for this group.

- Diversify Investments: Explore a mix of investment options, including mutual funds, government bonds (obligasi pemerintah), and potentially some exposure to stocks (but proceed with caution!). Diversification helps manage risk and potentially maximize returns.

- Increase Retirement Contributions: Contribute more than the minimum required to government-sponsored pension schemes. This will provide a larger safety net in retirement.

- Consider Private Pension Plans: Explore private pension plans (dana pensiun) offered by banks or financial institutions. These plans often offer more flexibility and potentially higher returns compared to basic government programs.

- Regularly Review and Adjust: Periodically review your investment portfolio and adjust it based on your financial goals and market conditions. This is not a “set it and forget it” situation.

Retirement Planning Strategies for High-Income Earners in Indonesia

High-income earners have the resources to explore a wider range of sophisticated retirement planning strategies. However, this also comes with a responsibility to manage more complex financial instruments effectively.

- Sophisticated Investment Vehicles: Explore more complex investment options such as private equity, real estate investment trusts (REITs), and international investments (with appropriate risk management). Professional financial advice is highly recommended.

- Estate Planning: Implement comprehensive estate planning to ensure a smooth transfer of wealth to heirs after retirement. This includes wills, trusts, and other legal arrangements.

- Tax Optimization Strategies: Utilize tax-advantaged retirement savings vehicles to minimize your tax burden and maximize savings. Consult with a tax advisor to explore available options.

- Charitable Giving: Incorporate charitable giving into your retirement planning. This can provide tax benefits and a sense of fulfillment.

Tax Implications and Incentives for Retirement Savings

Navigating the Indonesian tax system when it comes to retirement savings can feel like trying to assemble IKEA furniture without the instructions – challenging, but ultimately rewarding if you follow the right steps. Understanding the tax implications is crucial for maximizing your retirement nest egg and avoiding any unwelcome surprises from the taxman. Let’s delve into the delightful world of Indonesian tax benefits and incentives for retirement savings.

Indonesia offers a variety of tax incentives designed to encourage individuals to save for their retirement. These incentives aim to alleviate the financial burden of retirement planning and help ensure a more comfortable post-working life. However, the specifics can be complex, so let’s break down the key aspects to make it clearer than a perfectly brewed kopi susu.

Tax Benefits Associated with Various Retirement Savings Plans

The tax benefits associated with different retirement savings plans in Indonesia vary. For example, contributions to certain government-approved retirement funds often enjoy tax deductions, reducing your taxable income and therefore your overall tax liability. This means more money stays in your pocket – money that can then be invested to grow your retirement fund even further. This is a win-win situation, where the government encourages responsible saving, and you get to keep more of your hard-earned rupiah. Think of it as a smart financial move disguised as a tax break.

Tax Implications of Withdrawing Retirement Savings

Withdrawing your retirement savings isn’t entirely tax-free, although the government aims to make it as painless as possible. Generally, a portion of your withdrawals will be subject to income tax. However, the exact tax rate depends on several factors, including the type of retirement plan, the amount withdrawn, and your overall income. It’s advisable to consult a financial advisor or tax professional to accurately assess the tax implications of your specific retirement plan and withdrawal strategy, ensuring you’re not left with an unexpected tax bill larger than your planned retirement cruise.

Government Tax Incentives for Retirement Savings

The Indonesian government actively promotes retirement savings through various tax incentives. These incentives are designed to encourage individuals to save early and often, ensuring a more financially secure retirement. These incentives might include tax deductions on contributions to specific retirement schemes, tax exemptions on investment returns within certain limits, or even preferential tax rates on withdrawals under specific circumstances. These are government-sponsored carrots to encourage you to save for your golden years.

Tax Planning to Optimize Retirement Savings Growth, Retirement Savings Strategies Indonesia

Effective tax planning is essential to maximizing the growth of your retirement savings. This involves strategically structuring your investments and contributions to minimize your tax liability while maximizing the tax benefits available. For instance, choosing a retirement plan that offers the most advantageous tax treatment can significantly impact your overall retirement savings. This may involve seeking professional financial advice tailored to your specific circumstances. Think of it as a game of financial chess – strategically planning your moves to win the retirement game.

Tax Implications of Different Retirement Saving Options

Understanding the tax implications of each option is crucial for making informed decisions. The tax landscape can be complex, so here’s a simplified overview:

- Government-approved retirement funds (e.g., Dana Pensiun): Contributions are often tax-deductible, reducing your taxable income. Withdrawals may be subject to tax, but often at a lower rate than regular income.

- Private pension plans: Tax implications vary depending on the specific plan structure. Some plans may offer tax deductions on contributions, while others may not. Withdrawals may be taxed.

- Individual investment accounts (e.g., mutual funds): Investment returns may be subject to capital gains tax. Specific tax rules will apply depending on the investment vehicle.

- Traditional savings accounts: Interest earned may be subject to income tax, but rates vary based on bank and individual circumstances.

Factors Affecting Retirement Savings Success in Indonesia: Retirement Savings Strategies Indonesia

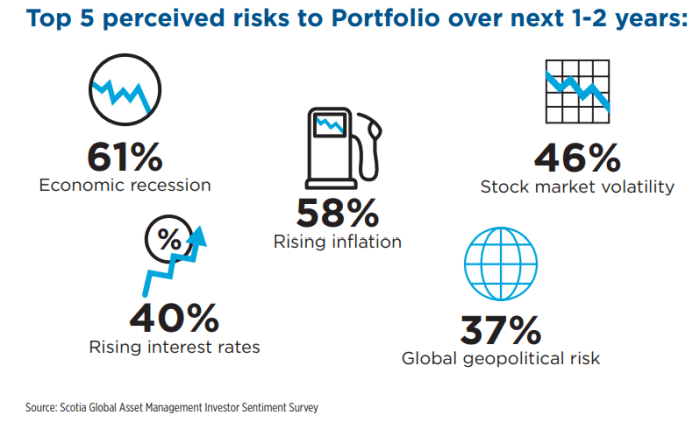

Planning for a comfortable retirement in Indonesia requires navigating a complex landscape of economic realities and personal circumstances. While diligently saving is crucial, several factors can significantly impact the success of your retirement plan, sometimes in unexpectedly hilarious ways. Let’s delve into the key players in this financial drama.

Inflation’s Impact on Retirement Savings

Inflation in Indonesia, like a mischievous gremlin, quietly nibbles away at the purchasing power of your hard-earned savings. Imagine meticulously saving Rupiah for years, only to find that your retirement nest egg buys significantly fewer Nasi Goreng than you anticipated. The Indonesian Central Bank regularly adjusts its benchmark interest rate to manage inflation, but this is a constant battle. For example, if inflation averages 5% annually, a million Rupiah saved today might only be worth 614,000 Rupiah in 10 years, effectively reducing your retirement fund’s real value. Careful consideration of inflation’s eroding effect is vital for setting realistic savings goals.

Life Expectancy and Retirement Planning

Indonesia’s life expectancy is on the rise, which is fantastic news for personal well-being! However, this longevity also means your retirement funds need to stretch further. Planning for a longer retirement requires a more substantial nest egg or a more conservative spending plan. Consider this: If you initially planned for a 15-year retirement but live for 25, your savings need to last 66% longer. This isn’t just about living longer; it’s about enjoying those extra years without financial stress – think of all the extra family gatherings and travel adventures you’ll need to fund!

Healthcare Costs in Retirement

Healthcare expenses can significantly impact retirement finances, potentially transforming a comfortable retirement into a financial tightrope walk. Medical costs in Indonesia, while varying widely based on location and treatment, can be substantial, especially for chronic conditions or unexpected illnesses. A comprehensive health insurance plan is not a luxury but a necessity, acting as a financial safety net against unexpected medical bills. Without adequate coverage, even a well-funded retirement could be jeopardized. Imagine this: Your dream retirement of leisurely fishing trips is suddenly threatened by the need to sell your boat to cover an unexpected hospital stay.

Unexpected Events Impacting Retirement Savings

Life, as they say, has a knack for throwing curveballs. Unexpected events, such as job loss, family emergencies, or unforeseen property damage, can significantly deplete retirement savings. A sudden job loss could force you to dip into your retirement fund prematurely, potentially compromising your long-term financial security. Similarly, a major family emergency, like needing to support a child through unexpected medical costs, could significantly strain your retirement savings. These events highlight the importance of having an emergency fund separate from your retirement savings to absorb such shocks. Think of it as your financial “get out of jail free” card.

Interplay of Inflation, Life Expectancy, and Healthcare Costs

Imagine a three-legged stool representing a successful retirement: One leg is the size of your savings, another is your life expectancy, and the last is the cost of healthcare.

Inflation steadily shortens the leg representing your savings, while increasing life expectancy lengthens the leg representing the duration your savings must last. Simultaneously, rising healthcare costs make the healthcare leg increasingly longer and heavier. The goal is to maintain a stable, balanced stool; otherwise, you risk a wobbly – and potentially disastrous – retirement. To achieve balance, you need a robust savings plan, adequate health insurance, and a realistic budget that accounts for inflation and a longer lifespan. This requires careful planning and possibly professional financial advice, to avoid a comical, yet financially devastating, retirement tumble.

Financial Literacy and Retirement Planning Education

Let’s face it: retirement planning in Indonesia can feel like navigating a labyrinth blindfolded while juggling durian. But fear not, dear reader! The key to unlocking a comfortable retirement isn’t just saving diligently; it’s understanding *how* to save effectively. This hinges on a crucial element: financial literacy. Without it, even the most robust savings plan can crumble like a poorly baked lapis legit.

Financial literacy plays a pivotal role in ensuring successful retirement planning. A solid understanding of personal finance empowers individuals to make informed decisions about their savings, investments, and overall financial well-being. This knowledge translates directly into better retirement outcomes, allowing individuals to confidently plan for their future needs and avoid costly mistakes. It’s the difference between a sunset cruise in Bali and… well, let’s not go there.

Resources for Improving Financial Literacy in Indonesia

Numerous resources are available to enhance financial literacy in Indonesia. These range from government initiatives and educational programs to private sector offerings and online platforms. Access to these resources, however, is not always equal, highlighting the need for wider dissemination and improved accessibility.

The government, through institutions like Otoritas Jasa Keuangan (OJK), plays a vital role in disseminating financial education. They often partner with NGOs and private companies to reach a wider audience. These collaborations frequently involve workshops, seminars, and online resources tailored to various income levels and educational backgrounds. For example, OJK’s website offers a wealth of information on investment strategies, retirement planning, and consumer protection. Furthermore, many banks and financial institutions provide free financial literacy workshops for their customers, covering topics such as budgeting, saving, and investing. Finally, numerous non-profit organizations actively contribute by providing free financial literacy training and counseling to underserved communities.

The Role of Government and Private Organizations

The Indonesian government and private organizations share the responsibility of fostering financial literacy. The government’s role is primarily regulatory and educational, setting standards and providing public awareness campaigns. Private organizations, including banks, insurance companies, and financial technology (fintech) firms, play a crucial role in providing practical financial products and services, often incorporating educational components into their offerings. This collaborative approach is essential for maximizing reach and impact. Imagine it as a well-oiled *gamelan* orchestra – each instrument (government, private sector, NGOs) plays its part to create a harmonious and effective financial literacy ecosystem.

Impact of Financial Literacy on Retirement Savings Behavior

The impact of financial literacy on retirement savings behavior is undeniable. Studies consistently show a strong positive correlation between financial knowledge and responsible saving habits. Individuals with higher levels of financial literacy are more likely to plan for retirement earlier, save more consistently, and diversify their investments more effectively. They are also less prone to making impulsive financial decisions that could jeopardize their long-term financial security. Essentially, financial literacy acts as a compass, guiding individuals toward making sound financial choices and securing a more comfortable retirement.

Strategies to Improve Access to Financial Education

Improving access to financial education requires a multi-pronged approach. This includes expanding the reach of government-led initiatives, particularly in rural areas and among lower-income populations. Leveraging technology, such as mobile applications and online learning platforms, can significantly increase accessibility. Furthermore, promoting financial literacy within the national curriculum could instill sound financial habits from a young age. Collaborations between government, private sector, and NGOs are crucial to ensure a comprehensive and effective approach. Ultimately, the goal is to equip all Indonesian citizens with the knowledge and tools necessary to build a secure financial future.

End of Discussion

Planning for retirement in Indonesia requires a multifaceted approach, blending an understanding of government programs with shrewd investment strategies and a proactive approach to financial literacy. While the journey may seem daunting, armed with the right knowledge and a well-defined plan, you can confidently navigate the complexities and secure a comfortable and fulfilling retirement. Remember, a little planning today can yield significant rewards tomorrow – so start building your Indonesian retirement dream, one smart decision at a time!

Popular Questions

What is the minimum retirement age in Indonesia?

The minimum retirement age varies depending on the specific retirement plan and employment type. There’s no single, universally applicable age.

Can I access my retirement savings before retirement age?

Early withdrawals are usually possible, but often incur penalties and may significantly reduce your final payout. The specific rules depend on the plan.

Are there any government subsidies or assistance programs for low-income retirees?

Yes, several government programs offer assistance to low-income retirees, though eligibility criteria vary. It’s best to research specific programs offered by the Indonesian government.

How can I protect my retirement savings from inflation?

Diversification is key! Consider investing in assets that historically outpace inflation, such as equities or inflation-linked bonds, as part of a balanced portfolio.