Tax Audit Preparation Checklist: Facing a tax audit feels like a scene from a suspense thriller, doesn’t it? Suddenly, your meticulously organized (or not-so-meticulously organized) financial life is under a magnifying glass. Fear not, intrepid taxpayer! This comprehensive guide will equip you with the knowledge and tools to navigate this potentially stressful situation with the grace of a seasoned financial ninja. We’ll cover everything from gathering those elusive documents to mastering the art of the audit interview—all with a dash of humor to keep you sane.

This guide provides a step-by-step approach to preparing for a tax audit, covering the essential stages from initial document gathering to post-audit procedures. We’ll explore strategies for efficient organization, methods for reconciling financial records, and techniques for effective communication with auditors. We’ll even delve into common mistakes to avoid, saving you from potential audit nightmares. Prepare to become a tax audit pro!

Understanding Tax Audit Preparation

Facing a tax audit can feel like a visit from the taxman’s ghost, but with proper preparation, you can transform that spooky encounter into a surprisingly uneventful (and possibly even slightly amusing) experience. Thorough preparation is the key to navigating the audit process with confidence and minimizing any potential headaches. Think of it as prepping for a pop quiz – you wouldn’t walk in blind, would you?

The importance of meticulous preparation for a tax audit cannot be overstated. A well-organized approach allows you to present your financial records clearly and efficiently, demonstrating compliance with tax laws. This not only saves you time and stress but also significantly improves your chances of a smooth and favorable outcome. Conversely, inadequate preparation can lead to a prolonged and stressful audit, potentially resulting in additional taxes, penalties, and interest. Imagine the horror!

Potential Consequences of Inadequate Preparation

Insufficient preparation can lead to a cascade of unpleasant consequences. Delays in the audit process are almost guaranteed, extending the period of uncertainty and anxiety. Furthermore, the lack of readily available documentation can lead to the auditor drawing unfavorable conclusions, potentially resulting in assessments of additional taxes, penalties, and interest. These additional costs can quickly escalate, significantly impacting your financial well-being. In a worst-case scenario, inadequate preparation could even lead to legal action. Let’s avoid that scenario, shall we? Think of the potential legal fees – enough to make even the most seasoned accountant shudder.

Initiating the Tax Audit Preparation Process

A step-by-step approach to tax audit preparation is crucial. First, acknowledge the audit notice promptly. Don’t ignore it hoping it will go away – that’s like ignoring a ticking time bomb. Next, gather all relevant financial records. This includes tax returns, bank statements, receipts, invoices, and any other documentation that supports your income and expense claims. Think of it as assembling your financial army – the better organized your troops, the stronger your defense. Third, organize these documents chronologically and categorize them by type. This will make it easier for you (and the auditor) to find specific information quickly. Finally, consult with a tax professional. They can provide invaluable guidance and support throughout the audit process, helping you navigate the complexities of tax law and ensuring you are adequately prepared for any questions the auditor may ask.

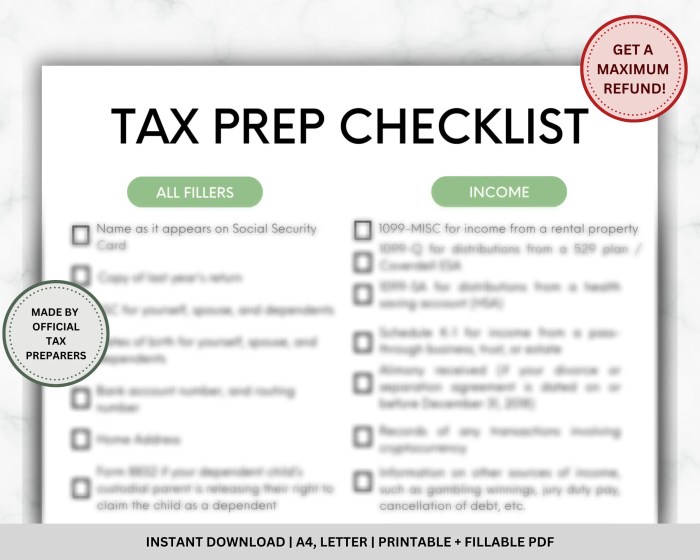

Gathering Necessary Documents: Tax Audit Preparation Checklist

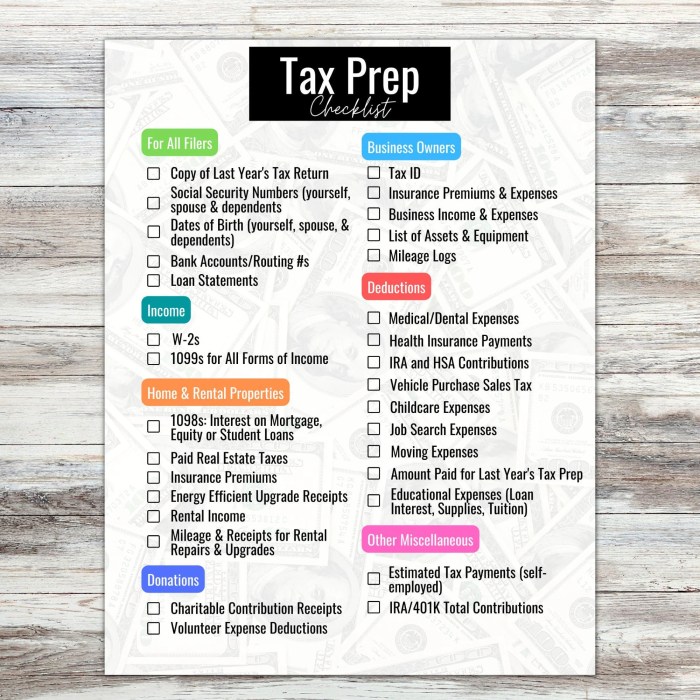

Ah, the paperwork. The bane of many a tax season, but also the key to a smooth audit. Think of it as a treasure hunt, but instead of gold, you’re finding receipts, bank statements, and the elusive W-2 that seems to vanish into thin air every year. Properly gathering your documents is the first step to avoiding a tax audit-induced existential crisis.

Gathering the correct documentation is paramount for a successful tax audit. A disorganized approach can lead to delays, penalties, and a whole lot of unnecessary stress. Remember, the IRS isn’t known for its sense of humor (unless you count their annual tax forms as a joke, which, let’s be honest, some of us do).

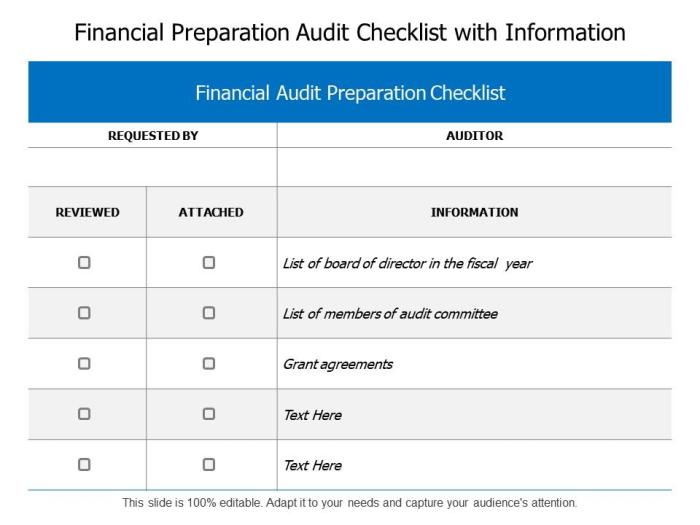

Essential Financial Documents Checklist

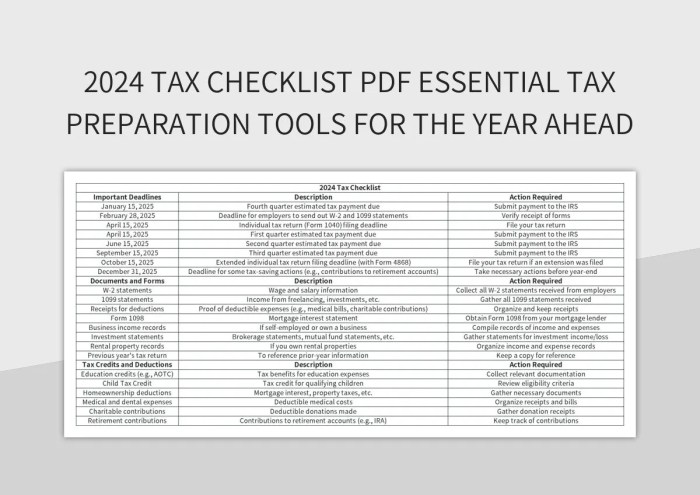

The following table provides a comprehensive list of documents typically required during a tax audit. We’ve categorized them for your convenience – because let’s face it, organization is half the battle.

| Document Type | Description | Location | Due Date (Example) |

|---|---|---|---|

| Tax Returns (Prior Years) | Copies of your previously filed tax returns. | Filing cabinet, cloud storage | Immediately upon request |

| W-2 Forms | Wage and tax statements from employers. | Payroll records, online portal | Immediately upon request |

| 1099 Forms | Forms reporting various types of income (dividends, interest, etc.). | Brokerage accounts, online banking | Immediately upon request |

| Bank Statements | Records of all bank transactions. | Online banking, physical statements | As requested by auditor |

| Receipts and Invoices | Proof of expenses, charitable donations, etc. | Organized folders, expense tracking app | As requested by auditor |

| Business Records (If Applicable) | Financial statements, profit and loss statements, etc. | Accounting software, business files | As requested by auditor |

| Property Tax Records | Documentation related to property ownership and taxes. | Local tax assessor’s office, personal files | As requested by auditor |

| Investment Records | Records of investment transactions, including capital gains and losses. | Brokerage statements, investment accounts | As requested by auditor |

Often Overlooked Documents

Let’s be honest, some documents are easier to forget than others. Think of it like a game of tax-document hide-and-seek. Here are some common culprits that often go missing in action:

Examples of commonly overlooked documents include canceled checks (especially for large payments or unusual transactions), home office expense documentation (requiring detailed records to support deductions), and documentation related to self-employment taxes (if applicable, including detailed records of income and expenses). Missing these could significantly delay your audit process.

Efficient Organization and Storage Strategies

The key to avoiding a tax-document meltdown is a well-organized system. Think of it as building a tax-proof fortress against the dreaded audit. Here are a few strategies to keep your financial documents in tip-top shape:

Consider using a cloud-based storage system, a dedicated filing cabinet, or a combination of both. Implement a consistent filing system with clear labels and categories. Regularly review and update your files to ensure accuracy and completeness. Digital document management software can also streamline the process. Remember, a well-organized system saves time and reduces stress during tax season (and audit season!).

Reconciling Financial Records

Ah, the joys of reconciliation! It’s not exactly a tax-season beach party, but getting your financial records to sing in harmony with your bank statements is crucial for a smooth audit. Think of it as a financial orchestra tuning up before a big performance – a little bit of tweaking here, a little bit of adjusting there, and suddenly, beautiful financial music emerges. Without it, your audit could sound like a cat fight in a tuba factory.

Reconciling bank statements with accounting records involves comparing every transaction recorded in your accounting software with the transactions listed on your bank statements. This meticulous process helps identify any discrepancies – those pesky little differences that can throw off your entire financial picture. Imagine trying to bake a cake with mismatched ingredients; the result would be…well, let’s just say it wouldn’t be pretty. Similarly, inaccurate financial records can lead to audit nightmares.

Bank Statement Reconciliation Procedures, Tax Audit Preparation Checklist

The process generally begins with obtaining your bank statement and comparing the beginning balance with the ending balance in your accounting records. Then, systematically match each transaction, noting any differences. For example, a check you wrote for $100 might be recorded as $1,000 in your books, leading to a significant discrepancy. These discrepancies are then investigated. Was it a simple typo? A missing transaction? A case of mistaken identity (for a transaction)? Once identified, you’ll need to make the necessary corrections in your accounting software, ensuring that both your books and the bank statement tell the same story. A spreadsheet can be a useful tool for this task, allowing for clear comparison and tracking of corrections.

Identifying and Correcting Discrepancies in Financial Data

Discrepancies can arise from a multitude of sources – human error (we’ve all been there!), timing differences (transactions recorded on different dates), bank charges (those sneaky little fees!), and even outright fraud. Identifying these discrepancies requires a systematic approach. Regularly reviewing your bank statements and comparing them to your accounting records is key. This might seem tedious, but it’s far less tedious than dealing with an audit based on inaccurate information. A common method is to use a reconciliation worksheet to systematically compare each transaction and highlight any differences. Software tools can automate much of this process, but human oversight remains crucial, particularly for identifying unusual or potentially fraudulent transactions.

Verifying the Accuracy of Expense Reports and Receipts

Expense reports and receipts are the backbone of many businesses’ financial records, and verifying their accuracy is paramount. Each expense report should be meticulously checked against supporting documentation, ensuring that all expenses are legitimate business expenses and that the amounts are accurate. For example, a receipt for a $500 dinner might raise eyebrows if the expense report only lists a $50 meal. Similarly, expenses should be properly categorized and coded according to your company’s accounting policies. A robust system for tracking and reviewing expense reports, including regular audits of a sample of reports, is crucial for maintaining accuracy and preventing fraud. Consider using software that integrates with expense reporting to streamline the verification process and flag potential issues.

Reviewing Tax Returns and Supporting Schedules

Ah, the tax return – that beautiful document that summarizes a year of financial triumphs (and, let’s be honest, some questionable spending choices). Reviewing it before an audit is like giving your financial house a pre-inspection; you want to catch any potential squeaky doors (or, you know, major tax discrepancies) before the inspector arrives. This process isn’t just about finding errors; it’s about understanding the narrative your return tells and ensuring it aligns perfectly with reality.

This section delves into the crucial task of meticulously examining your tax returns and their supporting schedules. We’ll explore potential audit triggers, compare different tax forms, and reveal common errors to avoid. Think of it as a pre-emptive strike against the dreaded audit letter – a strategic maneuver to ensure a smooth sailing experience.

Potential Audit Triggers in Tax Returns

Identifying areas that might pique an auditor’s interest is key. While no one wants an audit, understanding potential red flags allows for proactive mitigation. Certain inconsistencies or unusual patterns can raise eyebrows, prompting further investigation. For example, a significant and unexplained increase in deductions compared to previous years might trigger scrutiny. Similarly, large, round-number deductions, particularly those lacking substantial supporting documentation, could also invite closer examination. Another common red flag is a substantial discrepancy between reported income and the income reported by third parties, like banks or employers. These discrepancies require clear and concise explanations supported by relevant documentation.

Comparison of Tax Forms and Schedules

Different tax forms serve different purposes, and understanding their interplay is vital. For instance, Schedule C (Profit or Loss from Business) needs to align seamlessly with your business bank statements and records. Any discrepancy between the reported profit and your actual bank deposits could raise questions. Similarly, Schedule A (Itemized Deductions) requires detailed substantiation for each deduction claimed. Failing to provide adequate documentation for medical expenses, charitable contributions, or home office deductions is a recipe for an audit. Comparing and contrasting these forms helps identify inconsistencies and ensures a cohesive and accurate picture of your financial situation. It’s like putting together a complex jigsaw puzzle; each piece (form and schedule) must fit perfectly with the others.

Common Errors in Tax Returns and Their Avoidance

Let’s face it, mistakes happen. But some errors are more common than others. One frequent offender is misclassifying income or expenses. For instance, incorrectly reporting business expenses as personal expenses can lead to an audit. Another common mistake involves neglecting to report all sources of income. This includes forgetting to report interest income, dividends, or capital gains. Accurate record-keeping is paramount. Using accounting software can help prevent these issues by automatically tracking income and expenses. Furthermore, regularly reconciling your bank statements with your financial records will help ensure that all transactions are accounted for. Finally, seeking professional tax advice can help prevent costly errors and provide peace of mind. Remember, a little prevention goes a long way in avoiding the headache of an audit.

Preparing for the Audit Interview

The tax audit interview: It’s not exactly a picnic, but with the right preparation, it can be less like a root canal and more like a slightly awkward but ultimately harmless visit from your eccentric aunt Mildred. Remember, the goal is to present your financial information clearly and calmly, demonstrating your meticulous record-keeping and unwavering honesty (even if your handwriting suggests otherwise).

Effective communication is key to a successful audit interview. Think of yourself as a financial storyteller, weaving a narrative of your income and expenses. Clarity and conciseness are paramount; avoid jargon and unnecessary detail unless directly prompted. Imagine the auditor as a very patient (but slightly bored) detective; they’re looking for inconsistencies, not necessarily to trip you up.

Effective Communication During a Tax Audit Interview

Effective communication hinges on clear, concise explanations. Avoid overly technical language. Instead of saying “We utilized a LIFO inventory method,” try “We calculated our inventory value based on the last items purchased.” Similarly, instead of rambling explanations, focus on directly answering the auditor’s questions. If you need to clarify something, do so succinctly and then return to the main point. Think of it like a well-structured haiku: brief, impactful, and to the point. Remember, a well-prepared response shows confidence and reduces the likelihood of misinterpretations.

Responding to Auditor Questions Clearly and Concisely

Answering questions directly is crucial. If a question is unclear, politely request clarification. For example, instead of getting flustered, you could say, “Could you please rephrase that question? I want to ensure I understand completely before I respond.” This demonstrates professionalism and a commitment to accuracy. If you don’t know the answer, it’s perfectly acceptable to say so, but offer to find the information and get back to them within a reasonable timeframe. This shows responsibility and initiative. Avoid speculation; stick to the facts supported by your documentation.

Maintaining Professionalism and Composure Throughout the Process

Maintaining a calm and professional demeanor is essential. Even if the auditor’s questioning becomes intense, remember to breathe, maintain eye contact, and respond in a measured tone. Imagine the auditor is a particularly persistent but ultimately harmless squirrel trying to get at your meticulously organized acorn stash (your financial records). Your calm demeanor is your shield against the squirrel’s determined attempts to uncover anything amiss. Remember, politeness and respect go a long way, even when dealing with potentially stressful situations. Being prepared and organized significantly reduces stress and increases confidence. Think of it as bringing a well-organized toolbox to a minor car repair—you’re ready for anything.

Post-Audit Procedures

Ah, the audit is over! The confetti cannons have (hopefully) not been deployed, but the feeling of relief is palpable. Now comes the equally important, albeit less dramatic, task of post-audit procedures. Think of it as the post-game analysis, not the actual game itself. This stage ensures you’ve dotted every ‘i’ and crossed every ‘t,’ leaving no room for the tax authorities to come knocking again (unless they have a particularly strong affinity for your company’s charm, of course).

Post-audit procedures involve a series of steps to ensure you’ve correctly addressed all audit findings and filed all necessary documentation. It’s about tidying up loose ends, filing the right papers, and preparing for any potential future interactions with the tax authorities. Consider it the equivalent of meticulously cleaning your kitchen after a spectacular (and slightly chaotic) dinner party.

Document Organization and Filing

Organizing and filing all audit-related documents is crucial for future reference and potential appeals. This involves creating a comprehensive, well-organized system for storing all correspondence, documentation, and audit reports. Think of it as creating an audit time capsule—meticulously labeled and easily accessible. A well-organized filing system can save you considerable time and stress if any issues arise later. Consider using a color-coded system, a digital filing system with clearly named folders, or even a combination of both. Remember, even the most seasoned tax professionals appreciate a well-organized filing system.

Reviewing the Audit Report and Findings

Carefully reviewing the audit report and all findings is paramount. Don’t just skim it; truly understand the auditor’s conclusions and recommendations. Identify any discrepancies or points you disagree with. This is not a time for blind acceptance. Scrutinize each detail with the focus of a hawk searching for its next delicious meal. If anything is unclear, don’t hesitate to contact the auditor for clarification. After all, clarity is the spice of life, and especially of tax audits.

Appealing an Audit Decision

Should you disagree with the audit findings, understanding the appeals process is vital. Each tax authority has its own specific procedures, so familiarizing yourself with the relevant rules and regulations is essential. This might involve gathering additional supporting documentation, preparing a formal appeal letter, and possibly even seeking professional legal or tax advice. Think of it as crafting a persuasive legal brief—but hopefully, less dry and more engaging than your average legal document. Remember, a well-prepared appeal has a much higher chance of success than one thrown together at the last minute. Consider consulting a tax professional for guidance. They are the seasoned veterans of the tax battlefield, and their expertise could prove invaluable.

Illustrative Examples of Audit Scenarios

Preparing for a tax audit can feel like navigating a minefield of paperwork, but understanding potential scenarios can significantly reduce anxiety. Let’s explore three common audit situations, highlighting the necessary documentation and preparation steps. Remember, the specifics will vary depending on your individual circumstances and the tax authority’s focus.

The following scenarios illustrate the diverse range of situations that can trigger a tax audit. Each scenario highlights the key documents and preparation steps involved, along with potential outcomes. Consider these as potential templates, adapting them to your unique situation.

Individual Tax Audit: The Freelance Writer’s Dilemma

Imagine Sarah, a freelance writer, receives a notice for an audit. The IRS is questioning her deductions for home office expenses and business travel. Proper documentation is crucial here.

- Relevant Documents: Detailed records of income (client invoices, payment confirmations), home office expense records (mortgage interest, utilities, rent, allocated portions), travel receipts (flights, accommodation, mileage logs with business purpose clearly stated), bank statements showing income and expenses, and a copy of her tax return with supporting schedules.

- Preparation Steps: Organize all documents chronologically, categorize them by expense type, and prepare a detailed explanation for each deduction claimed. Cross-reference receipts with bank statements to establish a clear audit trail. Consider professional assistance if needed.

- Potential Outcomes: The audit could result in no changes if Sarah’s documentation is thorough and accurate. Alternatively, some deductions might be disallowed, leading to an increased tax liability and penalties. In a best-case scenario, a thorough preparation could lead to a quick and uneventful resolution.

Corporate Tax Audit: The Expanding Tech Startup

Next, consider “InnovateTech,” a rapidly growing tech startup facing a corporate tax audit. The focus is on research and development (R&D) tax credits claimed. This situation requires meticulous record-keeping.

- Relevant Documents: Detailed financial statements (balance sheets, income statements, cash flow statements), R&D expense reports (labor costs, materials, contract expenses, with clear allocation to specific projects), internal memos and documentation outlining the R&D process, contracts with external consultants, and patent applications.

- Preparation Steps: Compile all documentation related to R&D activities, ensuring compliance with relevant regulations. Prepare a comprehensive report detailing the R&D process, expenses, and the resulting innovations. It’s advisable to engage a tax professional specializing in corporate tax to assist in this complex area.

- Potential Outcomes: InnovateTech could face adjustments to its R&D tax credits, potentially leading to additional tax liabilities if the documentation is insufficient or if the claimed credits exceed permissible limits. Conversely, a well-prepared audit could reaffirm the legitimacy of their claims and lead to a successful conclusion.

Specific Transaction Audit: The Mysterious Art Sale

Finally, let’s look at a specific transaction audit. Imagine Arthur, an art collector, is audited regarding the sale of a valuable painting. The IRS questions the reported sale price and capital gains tax calculation.

- Relevant Documents: The sales contract, appraisal reports from reputable art experts, bank statements showing the transaction, photographs of the artwork, and any documentation related to the artwork’s history (provenance).

- Preparation Steps: Gather all documentation related to the sale, including the sales agreement and supporting evidence for the reported sale price. Be prepared to justify the valuation of the painting using credible appraisal reports and market data. Consider obtaining legal counsel for assistance.

- Potential Outcomes: Arthur could face an increased tax liability if the IRS determines the sale price was understated. A thorough preparation, however, might lead to a successful defense of the reported value and a smooth resolution. In a worst-case scenario, penalties could be assessed for underreporting income.

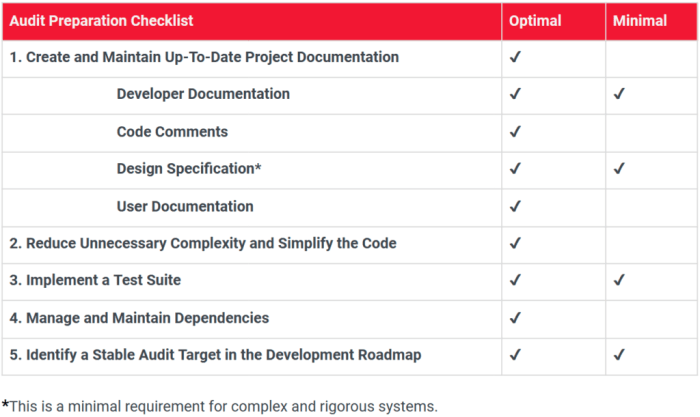

Utilizing Technology for Tax Audit Preparation

Embracing technology in tax audit preparation isn’t just about keeping up with the Joneses; it’s about keeping your sanity intact. Think of it as upgrading from an abacus to a supercharged calculator – the results are significantly faster and far less prone to human error (and let’s face it, who among us hasn’t accidentally added an extra zero to a tax form?). The right tools can transform a potentially grueling process into something…dare we say…enjoyable? Okay, maybe not enjoyable, but definitely less nightmarish.

The benefits of leveraging technology in tax audit preparation are numerous and substantial. Software solutions and digital tools streamline workflows, reducing the time spent on tedious tasks and minimizing the risk of costly mistakes. Improved accuracy, enhanced organization, and faster processing times translate to significant cost savings and reduced stress. The result? More time for things that actually matter, like contemplating the mysteries of the universe or perhaps, finally, getting around to organizing that sock drawer.

Tax Software and Digital Tools: A Powerful Combination

Tax preparation software offers a suite of features designed to simplify the entire process. From data entry and calculations to report generation and analysis, these programs automate many of the most time-consuming tasks. Consider the time saved by automatically calculating depreciation or generating accurate financial statements – time that can be better spent strategizing your audit defense or, you know, enjoying a well-deserved cup of coffee. Furthermore, many programs offer features like error detection and reconciliation tools, proactively identifying potential issues before they become major headaches. Beyond dedicated tax software, cloud-based storage and collaboration tools enhance organization and facilitate efficient communication with clients and auditors. Imagine the seamless exchange of documents and the effortless coordination of information – no more frantic email chains or lost files!

Improving Efficiency and Accuracy Through Technology

Let’s delve into specific examples. Imagine manually reconciling thousands of transactions. Sound fun? Tax software automates this process, comparing bank statements, credit card records, and accounting software data to pinpoint discrepancies quickly and accurately. This eliminates the possibility of human error, which is particularly crucial when dealing with potentially complex financial data. Similarly, many programs automatically generate various tax reports and schedules, ensuring consistency and reducing the risk of omissions or errors. The use of optical character recognition (OCR) software can further enhance efficiency by automatically extracting data from scanned documents, eliminating the need for manual data entry. This speeds up the entire preparation process significantly. A small business owner, for instance, might use OCR to scan invoices and receipts, automatically transferring the relevant information into their accounting software, freeing up hours of tedious manual input.

A Technology-Integrated Workflow for Tax Audit Preparation

A well-designed workflow effectively integrates technology throughout the audit preparation process. It starts with the initial data gathering stage, where clients can upload documents directly to a secure cloud storage system. The data is then imported into tax preparation software for analysis and reconciliation. The software automates calculations, identifies potential issues, and generates reports. Collaboration tools facilitate communication between the tax professional and the client, ensuring efficient exchange of information. Finally, the prepared documents are stored securely and readily accessible for the audit itself. This streamlined approach minimizes manual intervention, reduces errors, and accelerates the overall preparation process. Imagine the confidence you’ll have walking into that audit knowing your ducks are not just in a row, but digitally organized and meticulously cross-referenced.

Common Mistakes to Avoid During Preparation

Navigating the tax audit process can feel like a thrilling rollercoaster ride – lots of ups and downs, unexpected turns, and a healthy dose of suspense. But unlike a rollercoaster, a poorly prepared tax audit can leave you with more than just a mild headache. To ensure a smoother ride, let’s explore some common pitfalls and how to avoid them. Remember, a little foresight can save you a lot of heartache (and potentially, a hefty sum of money).

Preparing for a tax audit requires meticulous attention to detail. Overlooking even seemingly insignificant aspects can snowball into significant problems, potentially leading to penalties, interest charges, and a generally unpleasant experience. Avoiding these mistakes isn’t about being a tax genius; it’s about employing a systematic and organized approach.

Incomplete or Inaccurate Record Keeping

Maintaining comprehensive and accurate financial records is paramount. Failing to do so is like trying to navigate a maze blindfolded. Missing receipts, improperly categorized expenses, and inconsistent record-keeping practices will make it incredibly difficult to substantiate your tax return claims. This can lead to lengthy delays in the audit process, increased scrutiny from the auditing agency, and potentially, adjustments to your tax liability. The solution? Implement a robust record-keeping system, utilizing both physical and digital methods, ensuring all transactions are documented meticulously and categorized accurately. Consider using accounting software to streamline this process and provide an easily auditable trail.

Failure to Organize Documents

Imagine trying to find a specific needle in a haystack the size of a small country. That’s what a disorganized pile of tax documents feels like to an auditor. Having your documentation scattered, unlabeled, and generally chaotic makes the audit process significantly more time-consuming and frustrating for everyone involved. This can result in delays and potentially even an unfavorable interpretation of your financial situation. The solution? Develop a clear filing system, categorizing documents by type and date. Utilize folders, binders, or digital storage systems to keep everything neatly organized and easily accessible. Creating a comprehensive index of your documents can also be incredibly helpful.

Ignoring Minor Discrepancies

Small errors, like a misplaced decimal point or a slightly inaccurate figure, might seem insignificant, but they can quickly escalate into major problems. These seemingly minor discrepancies can raise red flags and trigger a more thorough review of your entire return. The cumulative effect of several minor errors can lead to significant adjustments and penalties. The solution? Meticulously review your tax return and supporting documentation before submitting it. Use spreadsheet software or accounting software to double-check calculations and ensure accuracy. Don’t be afraid to seek professional help if you’re unsure about any aspect of your tax preparation.

Lack of Professional Assistance

While many taxpayers attempt to handle tax preparation independently, seeking professional help, especially during an audit, is often beneficial. Navigating complex tax laws and regulations can be daunting, and a qualified tax professional can provide valuable guidance and support throughout the process. Failing to utilize professional assistance can lead to costly mistakes and an unnecessarily stressful experience. The solution? Consult with a reputable tax advisor or accountant. They possess the expertise to ensure your tax return is accurate, complete, and compliant with all applicable regulations. Their assistance during an audit can significantly reduce stress and increase the likelihood of a favorable outcome.

Concluding Remarks

So, there you have it: your comprehensive guide to conquering the tax audit beast. Remember, preparation is key. By following the steps Artikeld in this checklist, you’ll transform from a stressed-out taxpayer into a confident, organized individual ready to face any audit challenge. While we can’t guarantee a tax audit will be a picnic, we *can* guarantee you’ll be significantly better prepared to handle it with a smile (or at least a slightly less panicked expression). Now go forth and conquer!

FAQ Explained

What if I can’t find a specific document?

Don’t panic! Document your diligent search efforts. Contact the relevant institution (bank, client, etc.) for assistance in retrieving the missing information. Explain the situation and request a copy or a confirmation of the transaction.

How long does a tax audit typically take?

The duration varies significantly depending on the complexity of the case and the responsiveness of the taxpayer. It can range from a few weeks to several months, or even longer in more complex situations.

Can I represent myself during a tax audit?

Yes, you can represent yourself. However, if the audit is complex or involves significant financial implications, seeking professional tax advice is strongly recommended.

What happens if I disagree with the auditor’s findings?

You have the right to appeal the auditor’s findings. The process usually involves filing a formal appeal within a specified timeframe and providing supporting documentation.