Digital Payment Systems Comparison: Prepare to be amazed! This isn’t your grandpappy’s checkbook; we’re diving headfirst into the wild, wild west of online money transfers. From the sleek simplicity of contactless payments to the slightly more complicated (but equally fascinating) world of international transactions, we’ll dissect the ins and outs of how we pay for things in the digital age. Get ready for a rollercoaster ride of financial facts and figures, with enough twists and turns to make your head spin (but in a good way, we promise!).

We’ll explore the various types of digital payment systems, comparing their strengths and weaknesses with the precision of a Swiss watchmaker. We’ll examine the user experience, because let’s face it, a clunky payment system is nobody’s idea of a good time. Security and fraud prevention will also be under the microscope – because nobody wants their hard-earned cash vanishing into the digital ether. And finally, we’ll gaze into the crystal ball of the future, predicting the trends that will shape the landscape of digital payments in the years to come. Buckle up, it’s going to be a wild ride!

Types of Digital Payment Systems

The world of digital payments is a vibrant, ever-evolving ecosystem, a chaotic ballet of bits and bytes where money dances from account to account with breathtaking speed (or frustrating slowness, depending on your internet connection). Let’s delve into the fascinating, and sometimes bewildering, array of systems that make this financial fandango possible. Prepare for a whirlwind tour!

Categorization of Digital Payment Systems by Technology

Digital payment systems can be broadly categorized based on the underlying technology they employ. Understanding these distinctions is crucial to grasping the nuances of each system’s functionality, security, and overall user experience. Think of it as choosing the right tool for the job – a sledgehammer isn’t ideal for delicate surgery, and vice versa.

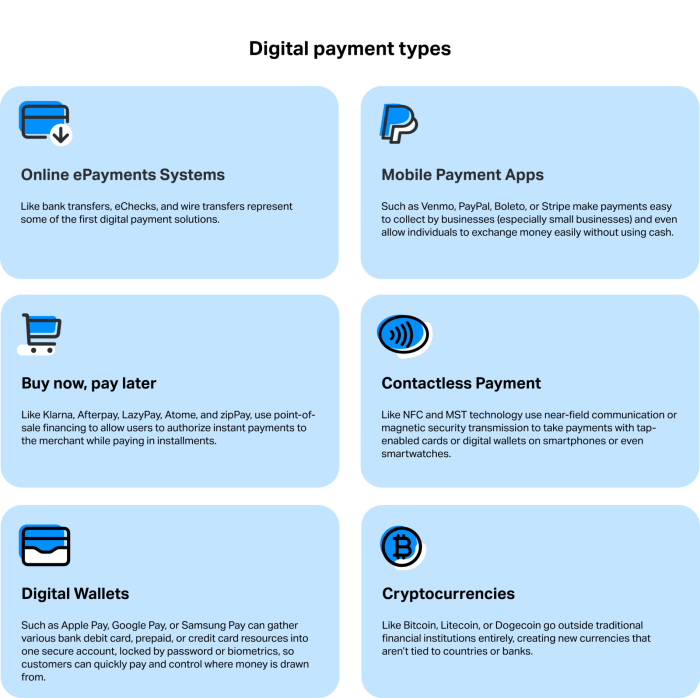

Mobile Wallets

Mobile wallets, like Apple Pay, Google Pay, and Samsung Pay, leverage near-field communication (NFC) technology and secure elements within smartphones to facilitate contactless payments. The infrastructure requires a compatible smartphone, a functioning NFC reader at the point of sale, and a linked bank account or credit/debit card. Security features include tokenization (replacing actual card details with unique tokens) and biometric authentication (fingerprint or facial recognition). However, vulnerabilities include potential compromise of the mobile device itself or flaws in the NFC communication protocol.

Online Banking

Online banking platforms, offered by most financial institutions, allow users to initiate payments directly through their online accounts. The infrastructure is relatively simple, requiring only an internet connection and a secure website or app. Security is often layered, involving multi-factor authentication, encryption, and fraud detection systems. Vulnerabilities include phishing scams, malware infections, and weak passwords.

Contactless Payments

Contactless payments encompass a broader category including mobile wallets, but also includes dedicated contactless cards and wearables (smartwatches, payment rings). The infrastructure relies on NFC technology and compatible payment terminals. Security features are similar to mobile wallets, but vulnerabilities can arise from compromised cards or poorly secured payment terminals.

Peer-to-Peer (P2P) Payment Systems

P2P systems, such as Venmo, PayPal, and Zelle, facilitate person-to-person transfers of funds. These systems generally require a linked bank account or credit/debit card and a smartphone or computer with internet access. Security features often include password protection, email verification, and fraud monitoring. Vulnerabilities can include unauthorized access to accounts through social engineering or compromised credentials.

Cryptocurrency-Based Systems

Cryptocurrency systems, using digital currencies like Bitcoin or Ethereum, operate on decentralized blockchain technology. The infrastructure is decentralized and requires specialized wallets and exchanges. Security relies on cryptographic techniques and the immutability of the blockchain. However, vulnerabilities include the volatility of cryptocurrency values, the risk of scams, and potential regulatory uncertainty.

Comparison Table of Digital Payment Systems

The following table provides a comparative overview of five popular digital payment systems, focusing on transaction fees, processing times, and user accessibility. Remember, these are general observations and specific costs and speeds can vary.

| Payment System | Transaction Fees | Processing Time | User Accessibility |

|---|---|---|---|

| PayPal | Varies, often dependent on transaction type and user status | Near-instantaneous to a few business days | Widely accessible, globally used |

| Venmo | Generally free for peer-to-peer transfers, fees may apply for business transactions | Near-instantaneous | High accessibility among younger demographics |

| Apple Pay | Typically no fees charged to the consumer | Near-instantaneous | Limited to Apple devices and participating merchants |

| Google Pay | Typically no fees charged to the consumer | Near-instantaneous | Widely accessible, compatible with Android and other devices |

| Credit/Debit Card (Contactless) | Fees vary depending on card type and merchant agreements | Near-instantaneous | Extremely wide accessibility, almost universally accepted |

User Experience and Adoption

The world of digital payments is a thrilling rollercoaster of innovation, convenience, and the occasional frustrating glitch. Understanding why users embrace (or reject) a particular system is crucial for its success. It’s not just about the technology; it’s about crafting a seamless, enjoyable, and trustworthy experience that makes users feel like they’re gliding through a payment process, not wrestling a grumpy badger.

Factors influencing user adoption are complex, a delightful blend of psychology, technology, and plain old human preference. Think of it as a recipe: a pinch of security, a dash of ease of use, a generous helping of trust, and a sprinkle of social influence. Get the balance wrong, and you end up with a payment system nobody wants to touch.

Factors Influencing User Adoption

Several key factors contribute to the success or failure of a digital payment system. Security is paramount; users are understandably wary of handing over their financial information. Ease of use is equally important; a system that’s difficult to navigate will quickly lose users. Trust, built through reputation and security measures, is essential. Finally, social influence plays a role; if friends and family are using a particular system, it’s more likely that others will adopt it too. Consider the rapid adoption of Venmo, driven partly by its social sharing features. The integration of digital payment systems with existing platforms and services also plays a significant role. For example, seamless integration with e-commerce websites or popular messaging apps greatly enhances user adoption.

The Role of User Interface Design

A user-friendly interface is the lifeblood of a successful digital payment system. Imagine trying to pay your bills using a system with a confusing layout, cryptic instructions, and an overwhelming number of steps. It’s a recipe for frustration and abandonment. A well-designed interface, on the other hand, guides users through the payment process effortlessly, making it intuitive and enjoyable. Think of the elegant simplicity of Apple Pay, which contrasts sharply with systems that overload users with unnecessary information or complex navigation. The use of clear visual cues, intuitive navigation, and concise language are key to creating a positive user experience.

Comparison of User Experiences

Comparing the user experience across different systems reveals interesting patterns. Some systems, like PayPal, offer a wide range of features but can feel cluttered and overwhelming to new users. Others, like Apple Pay, prioritize simplicity and ease of use, but might lack the advanced features offered by more comprehensive platforms. Security concerns vary; some systems boast robust encryption and fraud protection, while others might leave users feeling vulnerable. Overall satisfaction is often tied to the combination of security, ease of use, and the overall speed and efficiency of the payment process.

Best Practices for Designing a User-Friendly Digital Payment System

Designing a user-friendly digital payment system requires careful consideration of several key factors. Below are some best practices:

- Prioritize simplicity and ease of use: Avoid unnecessary steps or complex features.

- Ensure clear and concise instructions: Use plain language and avoid jargon.

- Implement robust security measures: Protect user data with strong encryption and fraud prevention techniques.

- Provide excellent customer support: Offer multiple channels for assistance, including FAQs, live chat, and email.

- Regularly update and improve the system: Address user feedback and incorporate new technologies.

- Test the system thoroughly: Conduct usability testing to identify and fix any issues.

- Promote transparency: Be upfront about fees and charges.

Security and Fraud Prevention

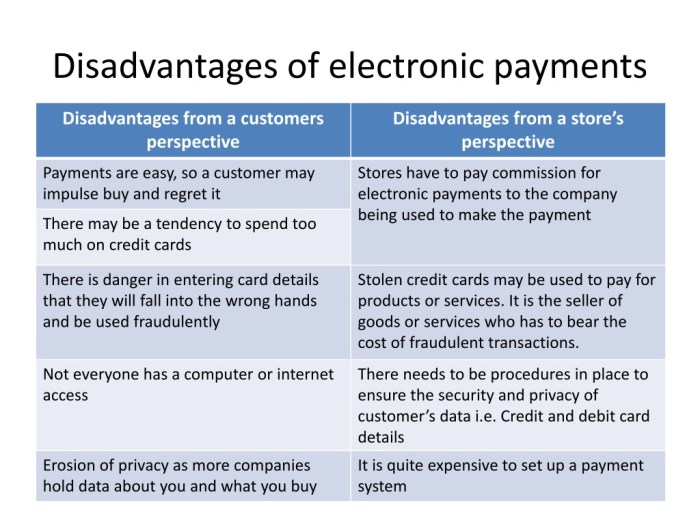

The digital payment revolution has brought unparalleled convenience, but with it comes a thrilling rollercoaster ride of security concerns. Think of it as a high-stakes game of cat and mouse, where innovative payment systems are constantly evolving to outsmart increasingly sophisticated fraudsters. The stakes are high – your hard-earned money! Let’s delve into the thrilling world of digital payment security.

Digital payment systems face a multitude of security threats, ranging from the relatively simple to the incredibly complex. These threats can lead to significant financial losses and damage to reputation for both consumers and businesses. Understanding these threats is the first step towards effective prevention.

Common Security Threats in Digital Payment Systems

Phishing scams, malware infections, data breaches, and man-in-the-middle attacks are just a few of the common threats. Phishing attempts to trick users into revealing sensitive information, while malware can secretly steal data or control devices. Data breaches, often involving large-scale hacks, expose vast amounts of personal and financial information. Man-in-the-middle attacks intercept communications between users and payment processors, allowing fraudsters to steal transaction details. These are just a few of the many ways that digital payment systems can be compromised. The sophistication of these attacks continues to evolve, demanding equally sophisticated countermeasures.

Fraud Prevention Mechanisms

A variety of methods are employed to combat these threats. These mechanisms act as a multi-layered defense system, protecting against various attack vectors. The effectiveness of these mechanisms varies depending on the specific system and its implementation.

- Encryption: This scrambles sensitive data, making it unreadable without the correct decryption key. Think of it as a secret code only the sender and receiver can understand. Different encryption algorithms offer varying levels of security, with some being more resistant to cracking than others. For example, AES (Advanced Encryption Standard) is a widely used and robust encryption method.

- Tokenization: This replaces sensitive data, such as credit card numbers, with non-sensitive substitutes called tokens. This prevents the actual card number from being transmitted during transactions, reducing the risk of exposure. If a token is compromised, the actual card number remains safe.

- Biometrics: This uses unique biological characteristics, such as fingerprints or facial recognition, for authentication. This adds an extra layer of security, making it harder for unauthorized individuals to access accounts even if they obtain login credentials. However, biometric systems are not foolproof and can be vulnerable to spoofing attacks.

- Two-Factor Authentication (2FA): This requires users to provide two forms of identification before accessing their accounts. This could involve a password and a code sent to their mobile phone. 2FA significantly reduces the risk of unauthorized access, even if one form of identification is compromised.

Comparison of Security Protocols

Encryption, tokenization, and biometrics each offer unique strengths and weaknesses. Encryption is fundamental to securing data in transit and at rest. Tokenization is effective in protecting sensitive data from exposure, while biometrics provides a strong authentication mechanism. The optimal approach often involves a combination of these protocols, creating a layered security system that is more robust than relying on any single method. For example, a system might use encryption to protect data transmitted over a network, tokenization to handle sensitive data within the system, and biometrics for user authentication. The effectiveness of these measures depends heavily on their proper implementation and ongoing maintenance.

Regulatory Frameworks and Compliance Requirements

The regulatory landscape for digital payment security is complex and constantly evolving. Regulations like PCI DSS (Payment Card Industry Data Security Standard) set stringent requirements for businesses that handle credit card information. Compliance with these regulations is crucial to avoid penalties and maintain consumer trust. Other regulations, such as GDPR (General Data Protection Regulation) in Europe, focus on protecting personal data, including financial information. These frameworks aim to establish minimum security standards and promote responsible data handling practices within the digital payment ecosystem. Staying compliant with these ever-changing rules is a significant challenge for businesses in the digital payment space.

International Transactions and Currency Conversion

Venturing into the thrilling world of international digital payments is like navigating a global financial jungle – exciting, potentially lucrative, but fraught with hidden fees and exotic exchange rates. Understanding the nuances of these transactions is key to avoiding a financial ambush. This section delves into the complexities of international money transfers, comparing various digital payment systems and their approaches to currency conversion.

International transactions introduce a whole new layer of complexity to digital payments. The simple act of sending money abroad involves not only transferring funds but also converting currencies, a process that often comes with its own set of fees and potential pitfalls. Understanding how different payment systems handle these conversions and the associated costs is crucial for making informed choices.

Currency Conversion in International Transactions and its Impact on Fees

Currency conversion is the linchpin of international digital payments. The process involves converting the sender’s currency into the recipient’s currency at a specific exchange rate. This rate, however, isn’t always straightforward. Payment processors often add a markup to the mid-market exchange rate (the average of the buy and sell rates), resulting in additional costs for the sender. These markups, combined with any explicit transaction fees, can significantly impact the final amount received by the recipient. The size of these markups varies greatly depending on the payment system, the currencies involved, and the transaction amount. For example, a transfer of $1000 USD to EUR might incur a 3% markup with one system and only a 1% markup with another, leading to a substantial difference in the recipient’s final amount.

Comparison of International Payment Systems

The following table compares three popular international payment systems, highlighting their features, fees, and transaction speeds. Keep in mind that fees and exchange rates can fluctuate, so it’s always advisable to check the current rates before making a transfer.

| Payment System | Features | Typical Fees | Transaction Speed |

|---|---|---|---|

| Wise (formerly TransferWise) | Transparent fees, mid-market exchange rates, multi-currency accounts | Variable, typically lower than traditional banks | 1-3 business days, often faster |

| PayPal | Widely accepted, user-friendly interface | Variable, depending on the currency and transaction amount; can include markups on exchange rates | Usually within a few days, can vary |

| Western Union | Extensive global reach, various transfer options | Higher fees compared to online alternatives, significant markups on exchange rates | Speed varies depending on the transfer method chosen; can be immediate for some options but often slower |

Future Trends in Digital Payment Systems: Digital Payment Systems Comparison

The world of digital payments is hurtling towards a future faster than a greased piglet at a county fair. Forget clunky card readers – prepare for a payment landscape so innovative, it’ll make your current system look like a rotary phone. This section delves into the exciting (and sometimes slightly terrifying) trends shaping the future of how we exchange money.

Emerging technologies are poised to revolutionize digital payment systems, offering both unprecedented convenience and, let’s be honest, a few potential headaches. The convergence of blockchain, artificial intelligence, and biometrics is creating a payment ecosystem that is simultaneously more secure and more personalized than ever before.

Blockchain’s Impact on Payment Systems

Blockchain technology, best known for its role in cryptocurrencies, offers the potential to significantly enhance the security and transparency of digital payments. Its decentralized nature eliminates the need for intermediaries, reducing transaction fees and processing times. Imagine a world where international transfers happen instantly, without hefty bank charges – that’s the promise of blockchain. For example, Ripple, a blockchain-based payment network, is already facilitating faster and cheaper cross-border transactions for several financial institutions. While still nascent in widespread adoption, the potential for increased efficiency and reduced fraud is undeniable.

Artificial Intelligence and Personalized Payments

AI is no longer a futuristic fantasy; it’s already subtly (and sometimes not so subtly) shaping our lives. In the realm of digital payments, AI powers fraud detection systems, analyzes spending patterns to offer personalized financial advice, and even enables chatbots to handle customer service inquiries. Companies like PayPal are leveraging AI to improve their fraud prevention capabilities, identifying suspicious transactions in real-time. The future will see even more sophisticated AI-driven systems predicting spending habits, offering customized payment options, and ultimately making our financial lives smoother (and potentially more tempting to overspend!).

Biometric Authentication: A Secure Future?

Forget passwords and PINs – the future of authentication is biometric. Fingerprint scanners, facial recognition, and even voice recognition are becoming increasingly common methods for verifying identity and authorizing payments. Apple Pay and Google Pay already utilize biometric authentication on many devices. While this offers unparalleled security, concerns around data privacy and potential vulnerabilities remain. The challenge lies in balancing the enhanced security with the need to protect sensitive biometric data from malicious actors.

Predicted Impact of Future Trends

The convergence of these technologies will significantly reshape both the consumer experience and the financial industry. The following points highlight the predicted impact:

- Enhanced Security: Blockchain and AI will drastically reduce fraud and enhance transaction security.

- Increased Efficiency: Faster transaction processing times and reduced fees, particularly for international transactions.

- Personalized Experience: AI-powered systems will offer tailored financial advice and customized payment options.

- Greater Convenience: Seamless integration with everyday life through biometric authentication and other innovative solutions.

- Increased Competition: New fintech companies will emerge, challenging traditional financial institutions.

- Regulatory Challenges: Governments will need to adapt regulations to keep pace with technological advancements.

Regulatory Landscape and Compliance

Navigating the world of digital payments isn’t just about speed and convenience; it’s also a thrilling rollercoaster ride through a complex web of regulations. Think of it as a financial jungle gym, where each bar represents a different law, and falling off means hefty fines (and possibly jail time!). This section explores the regulatory bodies, laws, and the overall impact of compliance on the design and operation of digital payment systems.

The regulatory landscape for digital payments is a fascinating patchwork quilt of differing approaches across the globe. Each country, and sometimes even individual states or regions, has its own unique set of rules, creating a thrilling (and sometimes terrifying) challenge for businesses operating internationally. This variation stems from differing priorities – consumer protection, financial stability, anti-money laundering efforts – all vying for attention in the fast-paced digital arena.

Key Regulatory Bodies and Their Roles

Numerous organizations worldwide oversee digital payment systems, each playing a crucial role in maintaining stability and trust. For example, in the United States, the Federal Reserve System (the Fed) plays a significant role in regulating banks and payment systems, ensuring the stability of the financial system. Meanwhile, the Consumer Financial Protection Bureau (CFPB) focuses on protecting consumers from unfair, deceptive, or abusive practices. In Europe, the European Central Bank (ECB) and national central banks play a similar role, alongside the European Banking Authority (EBA) which coordinates banking regulation across the EU. These organizations set standards, monitor compliance, and intervene when necessary, acting as the referees in this high-stakes financial game.

Regulations Impacting Digital Payment Systems in the US and the EU

The United States and the European Union represent contrasting approaches to digital payment regulation. In the US, a patchwork of federal and state laws governs digital payments. The Electronic Fund Transfer Act (EFTA) protects consumers using electronic fund transfers, while the Gramm-Leach-Bliley Act (GLBA) addresses data privacy and security. These laws, while comprehensive, can sometimes create a fragmented regulatory landscape.

The EU, on the other hand, takes a more harmonized approach with directives like the Payment Services Directive (PSD2), which aims to increase competition and innovation in the payment sector by opening up access to customer account information and payment initiation services. PSD2 introduces strong customer authentication (SCA) requirements, adding another layer of security while also potentially impacting user experience. The differences highlight the varying priorities and approaches to regulating this rapidly evolving sector.

Comparison of Regulatory Approaches, Digital Payment Systems Comparison

Comparing regulatory approaches reveals a tension between fostering innovation and ensuring consumer protection. The US approach, with its multitude of laws and agencies, can lead to a more fragmented, yet potentially more responsive, regulatory environment. The EU’s approach, with its harmonized directives, promotes a level playing field across member states but may be slower to adapt to rapid technological changes. Each approach has its strengths and weaknesses, and the “best” approach remains a subject of ongoing debate amongst regulators and industry players alike. It’s a constant game of catch-up between the regulators and the ever-evolving technology.

Compliance Requirements and Their Impact on Digital Payment System Design

Compliance requirements significantly influence the design and operation of digital payment systems. For example, SCA requirements under PSD2 necessitate multi-factor authentication, adding complexity to the user experience but enhancing security. Similarly, anti-money laundering (AML) regulations require robust know-your-customer (KYC) procedures, impacting the onboarding process for new users. Compliance necessitates significant investment in technology and processes, potentially increasing the cost of entry for new players in the market. The regulatory landscape acts as a constant force shaping the very architecture and functionality of digital payment systems, making them more secure but also potentially more complex.

Case Studies of Successful and Unsuccessful Systems

The world of digital payments is a thrilling rollercoaster of innovation and occasional spectacular crashes. To truly understand the dynamics at play, we need to examine both the triumphant success stories and the cautionary tales of those who dared to dream – and perhaps dreamt a little too big, or perhaps just a little too naively. This section delves into specific examples, dissecting their strategies and highlighting the crucial factors that separated the winners from the also-rans.

PayPal’s Triumphant Rise

PayPal’s success is a textbook case study in seizing a market opportunity and executing a brilliant strategy. Initially launched as Confinity, a company focused on secure online payments, it quickly realized the potential of peer-to-peer transactions. Their integration with eBay provided a massive boost, creating a network effect that propelled their growth exponentially. Key factors contributing to their success include user-friendly interface, robust security measures (relatively speaking, for the time), and strategic partnerships. The acquisition of X.com and the subsequent merger solidified their position, creating a dominant force in the online payment landscape. Their focus on expanding services beyond basic transactions, including credit and debit card integration, further cemented their dominance. They cleverly navigated the regulatory landscape, adapting to changing laws and regulations. Their global reach is also a testament to their adaptability and foresight.

The Rise and Fall (and Rise?) of Square

Square, initially conceived as a simple card reader for small businesses, demonstrates the power of elegant simplicity and targeted marketing. By providing a low-cost, easy-to-use solution for merchants who were previously underserved by traditional payment processors, Square rapidly gained traction. Their focus on mobile technology and seamless integration with existing business operations were key to their early success. However, their journey hasn’t been entirely smooth sailing. Competition from established players and the challenges of expanding into new markets have presented significant hurdles. Square’s evolution into a broader financial technology company, encompassing lending and other services, showcases their attempt to diversify and mitigate risks associated with over-reliance on transaction fees. This diversification strategy, though risky, highlights their adaptive nature and ongoing efforts to maintain relevance.

The Cautionary Tale of Google Wallet (and its successors)

Google Wallet, despite Google’s immense resources and technological prowess, serves as a cautionary tale. While technically proficient, it struggled to gain significant market share. Several factors contributed to its underperformance. A confusing user interface, lack of widespread merchant acceptance compared to established players like PayPal, and perhaps a lack of a clear, compelling value proposition compared to existing solutions, hindered its adoption. Although Google has iterated and introduced other payment systems, including Google Pay, the initial struggles highlight the importance of user experience and a compelling value proposition, even for tech giants. The challenges faced by Google Wallet underscore the need for more than just technological innovation; successful payment systems require a holistic approach, considering user needs, market dynamics, and regulatory compliance.

Key Learnings from Case Studies

| System | Success Factors | Failure Factors | Key Learnings |

|---|---|---|---|

| PayPal | User-friendly interface, strategic partnerships (eBay), network effect, robust security (for the time), diversification | Early security vulnerabilities, initial competition | Strategic partnerships and network effects are crucial for rapid growth. Adaptability and diversification are key to long-term success. |

| Square | Simplicity, focus on mobile technology, targeted marketing, ease of use for small businesses | Competition from established players, challenges in expanding into new markets | Focus on a niche market can provide initial traction, but diversification is crucial for long-term sustainability. |

| Google Wallet (Initial Version) | Technological proficiency, integration with Google ecosystem | Confusing user interface, lack of widespread merchant acceptance, unclear value proposition | Technology alone is insufficient; user experience, market acceptance, and a compelling value proposition are essential. |

Ultimate Conclusion

So, there you have it – a whirlwind tour of the fascinating world of digital payment systems. From the ancient (relatively speaking) days of online banking to the cutting-edge innovations of blockchain technology, the journey has been nothing short of exhilarating. While the future remains unwritten, one thing is certain: the evolution of digital payments will continue to reshape the way we interact with money, promising both incredible convenience and (hopefully) ever-increasing security. May your transactions always be swift, secure, and utterly delightful!

Question & Answer Hub

What is the safest digital payment system?

There’s no single “safest” system; security depends on individual practices and the system’s specific security measures. Look for systems with strong encryption, two-factor authentication, and robust fraud detection.

Are digital payments truly anonymous?

Generally, no. Most digital payment systems require some form of identification, though the level of anonymity can vary depending on the system and your usage.

What happens if there’s a dispute over a digital payment?

Dispute resolution processes vary by payment system. Most offer avenues for chargebacks or reversals if there’s a legitimate issue, but the process can be complex.

How do I protect myself from digital payment fraud?

Use strong passwords, enable two-factor authentication, be wary of phishing scams, and only use reputable payment platforms. Regularly review your account statements.