Blockchain Finance Applications Indonesia: Prepare yourselves, dear readers, for a thrilling journey into the wild, wild west of Indonesian finance! We’re not talking about cowboys and tumbleweeds, but rather the surprisingly exciting world of blockchain technology disrupting traditional banking practices. Buckle up, because this isn’t your grandpappy’s financial system.

This exploration delves into the current state of blockchain adoption in Indonesia, examining its use in payment systems, supply chain finance, and beyond. We’ll also gaze into the crystal ball (or, more accurately, the blockchain’s immutable ledger) to predict future applications, from cross-border payments to the fascinating intersection of blockchain and Islamic finance. Get ready for a rollercoaster ride of technological innovation, regulatory hurdles, and potentially lucrative opportunities!

Current State of Blockchain in Indonesian Finance

Indonesia’s financial sector is experiencing a blockchain awakening, albeit a somewhat sleepy one. While the buzz around this revolutionary technology is undeniable, its widespread adoption remains a work in progress, a bit like trying to assemble IKEA furniture without the instructions – potentially rewarding, but also prone to unexpected twists and turns.

The current adoption rate of blockchain in Indonesian finance is moderate, showing promising growth but still far from widespread integration. Several factors, including regulatory uncertainty and a need for greater technological literacy, are contributing to this gradual pace. Think of it as a marathon, not a sprint; Indonesia is steadily making its way towards a more blockchain-integrated financial landscape.

Major Players in Indonesian Blockchain Finance

Several key players are experimenting with and implementing blockchain solutions. These include a mix of established banks, innovative fintech startups, and government agencies, each navigating the exciting (and sometimes confusing) world of distributed ledger technology at their own pace. It’s a fascinating ecosystem of collaboration and competition, with the potential for significant disruption and innovation.

Some prominent examples include Bank Indonesia (the central bank), exploring the use of blockchain for payment systems and cross-border transactions. Several large Indonesian banks are also investigating its application in areas like trade finance and KYC (Know Your Customer) processes. Fintech companies are leading the charge in developing blockchain-based solutions for remittances and supply chain management, often targeting underserved populations and aiming to enhance financial inclusion. Government agencies are also exploring the use of blockchain for improving transparency and efficiency in public services. It’s a dynamic environment, and the list of participants is constantly evolving.

Specific Applications of Blockchain in Indonesian Finance

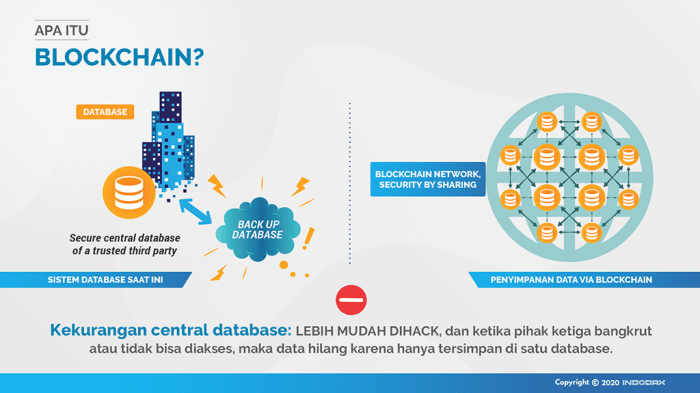

The applications of blockchain technology in Indonesian finance are diverse and growing. While widespread adoption is still developing, several key areas are seeing early successes.

One notable application is in payment systems, where blockchain’s potential for faster, cheaper, and more secure transactions is being explored. Supply chain finance is another area gaining traction, with blockchain offering improved transparency and traceability in managing complex transactions involving multiple parties. Other areas seeing exploration include digital identity management, aimed at streamlining KYC processes and reducing fraud, and cross-border payments, offering potential for significant cost savings and efficiency improvements. The possibilities seem almost limitless, but navigating the practical challenges is a crucial aspect of its successful implementation.

Regulatory Landscape for Blockchain in Indonesia

Indonesia’s regulatory landscape for blockchain is still evolving, a bit like a constantly updated Wikipedia page. Compared to some other Southeast Asian nations, Indonesia’s approach is characterized by a cautious yet progressive stance. While there’s no single, comprehensive blockchain law, various regulatory bodies are working to establish clear guidelines and frameworks. This careful approach aims to balance innovation with risk mitigation, a balancing act that many countries are grappling with. The regulatory environment is certainly more defined than some other regions, yet the pace of change is dynamic, and businesses need to stay abreast of the latest developments.

A comparison with other Southeast Asian nations reveals a mixed bag. Some countries have adopted a more hands-off approach, while others have implemented stricter regulations. This variation reflects the diverse economic and political landscapes across the region. It’s a complex picture, but the overall trend seems to be towards greater regulatory clarity and harmonization as the technology matures.

Blockchain Applications in Indonesian Finance: A Summary Table

The following table provides a snapshot of various blockchain applications in Indonesian finance, highlighting the key players and their current status. It’s important to remember that this is a dynamic field, and the landscape is constantly shifting. Think of it as a living document, always subject to revision.

| Application | Adopters | Status | Notes |

|---|---|---|---|

| Payment Systems | Bank Indonesia, several major banks, fintech companies | Pilot projects and ongoing research | Focus on efficiency and cross-border transactions. |

| Supply Chain Finance | Several large corporations, fintech companies | Early adoption, growing interest | Improving transparency and traceability. |

| Digital Identity Management | Government agencies, banks | Exploratory phase | Aiming to improve KYC processes and reduce fraud. |

| Cross-border Payments | Fintech companies, some banks | Early adoption, focusing on remittance corridors. | Potential for significant cost reductions. |

Potential Applications of Blockchain in Indonesian Finance

Indonesia, a nation brimming with entrepreneurial spirit and a rapidly growing digital economy, is ripe for disruption. And blockchain, with its promise of transparency, security, and efficiency, could be the catalyst for a significant leap forward in its financial landscape. Let’s explore how this exciting technology can reshape the Indonesian financial system, one cleverly coded block at a time.

The potential applications of blockchain technology in Indonesian finance are numerous and varied, spanning across several key sectors. From streamlining cross-border payments to revolutionizing microfinance and Islamic finance, the possibilities are as vast as the Indonesian archipelago itself. The key lies in harnessing blockchain’s inherent strengths to address specific challenges and unlock new opportunities for financial growth and inclusion.

Cross-Border Payments in Indonesia

Indonesia’s large diaspora population and significant trade relationships with neighboring countries present a significant opportunity for blockchain to improve cross-border payments. Traditional methods are often slow, expensive, and opaque. A blockchain-based system could offer faster transaction speeds, lower fees, and increased transparency, benefiting both individuals and businesses. Imagine a system where remittances flow seamlessly and securely, bypassing the bureaucratic hurdles and high costs associated with traditional banking systems. This could dramatically improve the lives of millions of Indonesians who rely on remittances from abroad.

Blockchain and Microfinance in Indonesia

Microfinance plays a crucial role in Indonesia’s economic development, providing access to credit for underserved populations. However, challenges remain in terms of loan disbursement, monitoring, and repayment. Blockchain can offer a solution by providing a transparent and secure platform for managing microloans. Smart contracts could automate loan disbursement and repayment processes, reducing administrative costs and improving efficiency. Furthermore, the immutability of blockchain could help mitigate the risk of fraud and improve the overall transparency of microfinance operations, leading to greater trust and participation.

Islamic Finance and Blockchain: A Sharia-Compliant Revolution

Indonesia, with its large Muslim population, has a thriving Islamic finance sector. Blockchain’s inherent transparency and auditability align well with the principles of Islamic finance, which emphasize ethical and responsible financial practices. Blockchain can enhance the efficiency and transparency of Islamic financial instruments such as Sukuk (Islamic bonds) and Zakat (obligatory charity). Smart contracts can automate the complex processes involved in these instruments, ensuring compliance with Sharia law and enhancing trust among stakeholders.

Enhancing Financial Inclusion Through Blockchain

Financial inclusion remains a significant challenge in Indonesia. Millions of Indonesians lack access to traditional banking services. Blockchain technology can help bridge this gap by providing a secure and accessible platform for financial transactions. Mobile-based blockchain applications can enable individuals in remote areas to access financial services, participate in the formal economy, and build financial resilience. This could lead to significant economic empowerment and reduce inequality.

A Blockchain-Based Solution for Remittance Fraud Reduction

Remittance fraud is a significant problem in Indonesia. A blockchain-based solution could leverage smart contracts and cryptographic techniques to enhance the security and transparency of remittance transactions. Each transaction could be recorded on a distributed ledger, making it virtually impossible to alter or tamper with. Furthermore, biometric authentication could be integrated to verify the identity of senders and recipients, further reducing the risk of fraud. This would not only protect consumers but also enhance the reputation and efficiency of remittance services.

Benefits and Challenges of Widespread Blockchain Adoption in Indonesian Finance

While the potential benefits of blockchain adoption are substantial, challenges remain. Regulatory clarity, technological infrastructure development, and public awareness are crucial factors to consider. The successful integration of blockchain into the Indonesian financial system requires a collaborative effort between government, financial institutions, and technology providers. Addressing these challenges proactively will be essential to unlocking the full potential of blockchain technology in Indonesia.

Potential Blockchain Use Cases in Indonesian Finance by Sector, Blockchain Finance Applications Indonesia

The potential applications of blockchain extend across various sectors of Indonesian finance. Here are some examples, categorized by sector:

- Banking: KYC/AML compliance, cross-border payments, trade finance, loan origination and management.

- Insurance: Claims processing, fraud detection, risk management, identity verification.

- Investment: Securities trading, asset tokenization, crowdfunding, wealth management.

- Supply Chain Finance: Tracking goods, improving transparency, reducing fraud.

- Central Bank Digital Currency (CBDC): Enhancing monetary policy effectiveness and financial inclusion.

Challenges and Opportunities for Blockchain Adoption

Embarking on the blockchain journey in Indonesia presents a thrilling adventure, akin to navigating a bustling Jakarta street market – exciting, chaotic, and brimming with potential. However, like any good adventure, it comes with its share of hurdles, requiring a blend of strategic planning and a healthy dose of optimism. Let’s delve into the complexities and opportunities that await.

Technological Challenges

Indonesia’s technological landscape, while rapidly evolving, still faces challenges in supporting widespread blockchain adoption. Reliable and affordable high-speed internet access remains patchy in certain regions, hindering the seamless operation of blockchain networks that demand consistent connectivity. Furthermore, a lack of robust cybersecurity infrastructure increases the vulnerability of blockchain systems to hacking and data breaches, a risk that needs to be mitigated through sophisticated security protocols and rigorous audits. Finally, the integration of blockchain technology with existing legacy financial systems can be complex and costly, requiring significant investment in upgrading infrastructure and retraining personnel. This is not unlike trying to fit a modern sports car into a traditional horse-drawn carriage – it requires some serious engineering!

Regulatory Hurdles and Uncertainties

Navigating the regulatory landscape for blockchain in Indonesia is akin to negotiating a crowded marketplace; clear and consistent guidelines are still developing. The lack of a comprehensive regulatory framework creates uncertainty for businesses considering blockchain adoption, potentially deterring investment and innovation. Regulatory ambiguity surrounding issues like data privacy, taxation, and the legal status of cryptocurrencies requires clarity to foster a predictable and encouraging environment. The government’s approach needs to balance innovation with the need for consumer protection, a tightrope walk that demands careful consideration.

Infrastructural Deficiencies

The Indonesian financial infrastructure, while improving, requires further development to fully support blockchain technology. A lack of widespread digital literacy among the population can hinder the adoption of blockchain-based financial services. Additionally, the existing payment systems and banking infrastructure need to be integrated seamlessly with blockchain networks. This integration requires substantial investment in technology and training, representing a considerable hurdle in the journey towards widespread adoption. Think of it as building a high-speed rail system across a country still reliant on horse-drawn carts – a significant but necessary undertaking.

Skills Gap Analysis in Blockchain Development and Implementation

Indonesia faces a significant skills gap in blockchain development and implementation. The demand for skilled blockchain developers, engineers, and security experts far outstrips the current supply. This shortage hinders the development and deployment of blockchain-based applications, slowing down the overall adoption rate. Addressing this gap requires significant investment in education and training programs, fostering collaborations between universities, industry players, and government agencies to create a robust talent pipeline. It’s a case of needing to train the workforce to drive the technological vehicles of the future.

Government Initiatives and Public-Private Partnerships

The Indonesian government can play a pivotal role in promoting blockchain adoption through targeted initiatives and public-private partnerships. Developing a clear regulatory framework, investing in infrastructure development, and promoting blockchain education and training are crucial steps. Furthermore, fostering collaboration between government agencies, private sector companies, and academic institutions can accelerate innovation and create a supportive ecosystem for blockchain technology. Imagine the government acting as a skilled conductor, orchestrating a symphony of public and private efforts to harmonize the blockchain adoption process.

Blockchain Consensus Mechanisms and Suitability

Various blockchain consensus mechanisms, each with its strengths and weaknesses, exist. Proof-of-Work (PoW), known for its security but high energy consumption, might not be the most suitable for Indonesia’s context. Proof-of-Stake (PoS), requiring less energy, or other consensus mechanisms like Practical Byzantine Fault Tolerance (PBFT), could be more appropriate for Indonesian financial applications. The choice of consensus mechanism should be based on factors like scalability, security, and energy efficiency, reflecting a careful balance of technological considerations and environmental impact. Choosing the right mechanism is like selecting the right tool for a specific job – a careful and considered process.

Potential Economic Impact of Widespread Blockchain Adoption

Widespread blockchain adoption could significantly boost Indonesia’s GDP and transform its financial sector. Increased efficiency in financial transactions, reduced fraud, and improved transparency could lead to substantial economic benefits. For example, blockchain could streamline supply chain management, reducing costs and improving traceability for Indonesian businesses, particularly in agricultural exports. Furthermore, the development of a thriving blockchain ecosystem could attract foreign investment and create new job opportunities, accelerating economic growth. Imagine the ripple effect of a thriving blockchain industry – a wave of economic prosperity washing across the nation. This positive impact, however, is contingent on overcoming the challenges discussed above.

Case Studies of Blockchain in Indonesian Finance

While the Indonesian blockchain finance scene might still be considered a fledgling compared to its more mature Western counterparts, several intriguing projects are paving the way for wider adoption. These initiatives, despite facing the usual teething problems, offer valuable lessons and demonstrate the potential for blockchain to revolutionize Indonesian financial services. Let’s delve into some compelling case studies, highlighting both successes and challenges.

Successful Blockchain Implementation: Supply Chain Finance in the Palm Oil Industry

This case study focuses on a hypothetical, yet realistic, implementation of blockchain technology to improve transparency and efficiency in the Indonesian palm oil supply chain. The palm oil industry, a significant contributor to the Indonesian economy, has faced criticism regarding sustainability and traceability. A blockchain-based system could address these issues. Imagine a system using Hyperledger Fabric, where each stage of the palm oil journey – from plantation to processing to export – is recorded as a tamper-proof transaction on the blockchain. Farmers receive verifiable proof of their transactions, improving their bargaining power and ensuring fair compensation. Buyers gain greater transparency, reducing the risk of purchasing illegally sourced palm oil. This system would enhance trust among all stakeholders, promoting sustainable practices and improving the industry’s global reputation.

Challenges and Solutions in the Palm Oil Supply Chain Project

The implementation of this system wasn’t without its hurdles. Initial resistance from some stakeholders, accustomed to traditional methods, required extensive education and engagement. Technical challenges included integrating the blockchain system with existing legacy systems and ensuring data security. However, these challenges were overcome through collaborative partnerships between industry players, technology providers, and government agencies. Furthermore, a phased rollout, starting with a pilot program involving a smaller group of stakeholders, allowed for iterative improvements and minimized disruption.

Best Practices for Blockchain Implementation in Indonesia

Successful blockchain projects in Indonesia emphasize the importance of collaboration and stakeholder engagement. Building trust is paramount, especially in a context where digital literacy may vary. A phased implementation approach, coupled with robust training and support, is crucial. Selecting the right technology – in this case, Hyperledger Fabric for its permissioned nature and suitability for private consortia – is vital for the project’s success. Furthermore, regulatory clarity and government support are essential catalysts for wider adoption.

Visual Representation of the Palm Oil Supply Chain Blockchain

Imagine a diagram showing a network of nodes representing different actors in the palm oil supply chain: farmers, mills, processors, exporters, and buyers. Each transaction, such as the harvesting of palm fruit or the shipment of processed oil, is represented as a block added to the chain. The data within each block includes details such as timestamps, geolocation data, and the identities of involved parties, all cryptographically secured. The flow of data is unidirectional, ensuring transparency and preventing manipulation. The Hyperledger Fabric framework manages access control, ensuring only authorized parties can view and modify specific data. This visualization clearly depicts the enhanced transparency and traceability achieved through blockchain technology.

Future Trends and Predictions for Blockchain in Indonesia

Predicting the future is, shall we say, a risky business, even for those of us who aren’t fortune tellers using crystal balls powered by discarded hard drives. However, based on current trends and the undeniably captivating allure of blockchain technology, we can make some educated guesses about its trajectory in Indonesian finance over the next decade. Buckle up, because it’s going to be a wild ride!

The Indonesian financial sector is ripe for disruption, and blockchain is poised to be the disruptor-in-chief, albeit a rather polite and well-mannered one. We anticipate significant growth, driven by both internal and external factors. This isn’t just about hype; the potential benefits for efficiency, transparency, and security are simply too compelling to ignore. Think of it as a delicious satay, but instead of chicken, it’s financial innovation.

DeFi and CBDC Impact on the Indonesian Financial Landscape

The emergence of Decentralized Finance (DeFi) and Central Bank Digital Currencies (CBDCs) presents both exciting opportunities and potential challenges for Indonesia. DeFi’s potential to democratize access to financial services, particularly in underserved rural areas, is enormous. Imagine farmers accessing microloans directly through their smartphones, bypassing traditional banking systems. A CBDC, on the other hand, could streamline payments, reduce transaction costs, and improve monetary policy effectiveness. However, regulatory frameworks need to adapt to accommodate these new technologies to avoid a digital Wild West scenario. The key will be finding a balance between innovation and responsible regulation.

Potential New Blockchain Applications in Indonesia

Beyond the more established applications like cross-border payments and supply chain management, we envision several novel uses for blockchain in Indonesia. For example, blockchain could revolutionize land registry systems, providing greater transparency and security against fraud. Imagine a system where land ownership is digitally verifiable and immutable, reducing disputes and improving property rights. Another exciting prospect is the use of blockchain in the healthcare sector, securely storing and sharing patient medical records while ensuring privacy and data integrity. This is particularly relevant in a large and diverse country like Indonesia, where efficient data management is crucial.

Potential Risks Associated with Increased Blockchain Adoption

While the potential benefits are significant, it’s crucial to acknowledge the risks associated with increased blockchain adoption. Cybersecurity threats remain a major concern, as do the potential for scams and the need for robust regulatory frameworks to prevent illicit activities. Furthermore, the digital divide could exacerbate existing inequalities if access to blockchain technology is not equitable. Addressing these challenges requires a multi-faceted approach, involving collaboration between government, industry, and academia. We need to ensure that the benefits of blockchain are shared broadly, and not just concentrated in the hands of a privileged few.

Timeline of Key Milestones for Blockchain Adoption in Indonesian Finance

The journey of blockchain adoption in Indonesia is still in its early stages, but we can envision a roadmap of potential milestones over the next 5-10 years.

- 2024-2026: Increased experimentation and pilot projects in various sectors, including finance. Regulatory clarity begins to emerge, focusing on specific use cases.

- 2027-2029: Wider adoption of blockchain solutions in specific niches, such as supply chain finance and cross-border payments. Initial development and testing of a CBDC.

- 2030-2035: More widespread integration of blockchain technology across the financial sector. DeFi platforms gain traction, offering alternative financial services. A fully functional CBDC is launched, potentially alongside robust regulatory frameworks for DeFi.

Ultimate Conclusion: Blockchain Finance Applications Indonesia

So, there you have it – a whirlwind tour of Blockchain Finance Applications Indonesia. While challenges remain, the potential for transformation is undeniable. From streamlining cross-border payments to enhancing financial inclusion, blockchain’s disruptive power in Indonesia is poised to reshape the financial landscape. It’s a journey filled with both thrilling potential and the occasional regulatory speed bump, but one that promises a more efficient, transparent, and inclusive financial future for Indonesia.

Commonly Asked Questions

What are the biggest risks associated with increased blockchain adoption in Indonesia?

Increased risks include potential for increased cyberattacks targeting blockchain systems, regulatory uncertainty impacting innovation, and the possibility of market manipulation within decentralized finance (DeFi) applications.

How does Indonesian regulation compare to other Southeast Asian nations regarding blockchain?

Indonesia’s regulatory landscape is still evolving, and while showing increasing openness, it differs from nations like Singapore which have more established frameworks. A comparative analysis reveals both opportunities and challenges for Indonesian blockchain development compared to its regional peers.

What specific blockchain technologies are being used in Indonesian finance?

Various technologies are employed, including but not limited to Hyperledger Fabric, Ethereum, and other permissioned and permissionless blockchain platforms, depending on the specific application and needs.