Financial Statement Analysis Tools: Unlocking the secrets hidden within balance sheets and income statements might sound dull, but trust us, it’s a wild ride! From spreadsheets that hum with calculated data to sophisticated platforms that practically predict the future (well, almost), the world of financial analysis is surprisingly exciting. This journey will explore the various tools and techniques that transform raw financial data into actionable insights, empowering businesses to make smarter, more profitable decisions. Prepare for a rollercoaster of ratios, trends, and maybe even a little bit of spreadsheet magic.

We’ll cover a range of tools, from the familiar comfort of Excel to specialized software designed for the financial analyst who appreciates a good pivot table. We’ll delve into the art of ratio analysis, where numbers dance to tell tales of profitability and liquidity. Trend analysis and forecasting will unveil the future (or at least a reasonable guess), and benchmarking will let you see how your company stacks up against the competition. We’ll even touch on the more advanced techniques, because who doesn’t love a good regression analysis? But don’t worry, we’ll keep it fun (relatively speaking).

Introduction to Financial Statement Tools

Analyzing financial statements can feel like navigating a dense jungle armed only with a rusty spoon. Fortunately, a plethora of tools exist to transform this daunting task into a manageable, and dare we say, even enjoyable experience. From simple spreadsheets to sophisticated software platforms, the right tool can significantly enhance your analytical prowess and reveal hidden treasures (or, you know, potential liabilities) within a company’s financial records.

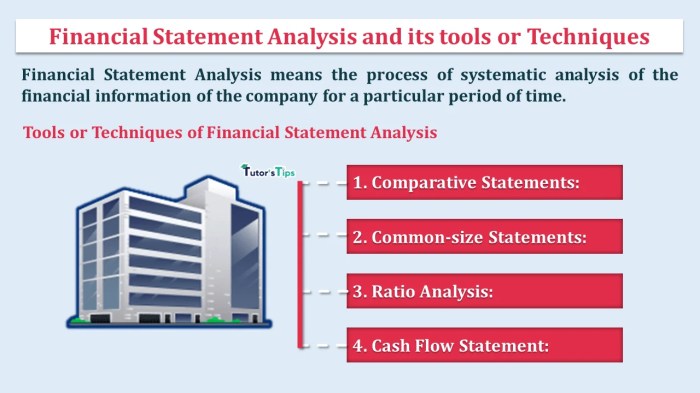

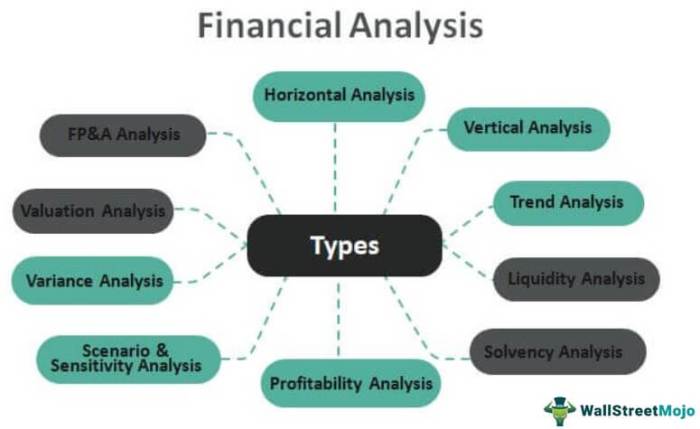

Types of Financial Statement Analysis Tools

The world of financial statement analysis tools offers a diverse range of options, each catering to different needs and levels of expertise. Choosing the right tool depends heavily on factors like budget, technical skills, and the complexity of the analysis required. Broadly speaking, these tools fall into several categories: spreadsheet software, dedicated financial analysis platforms, and specialized industry tools.

Spreadsheet Software

Spreadsheet software, like Microsoft Excel or Google Sheets, forms the bedrock of many financial analyses. Their versatility is undeniable; you can build custom formulas, create charts and graphs, and perform basic calculations with relative ease. However, for large-scale analyses or complex scenarios, their limitations become apparent. Manual data entry can be time-consuming and error-prone, and advanced analytical functions often require significant expertise in spreadsheet formulas. Think of it as a trusty, if somewhat creaky, bicycle – perfectly adequate for short trips, but less ideal for a cross-country journey.

Dedicated Financial Analysis Platforms

These platforms are designed specifically for financial analysis, offering a range of pre-built functions and features that streamline the process. They typically automate data entry, provide advanced analytical capabilities (such as ratio analysis, trend analysis, and forecasting), and generate professional-quality reports. Examples include Bloomberg Terminal, FactSet, and Capital IQ. These are the high-performance sports cars of the financial analysis world – powerful, efficient, and capable of handling complex tasks with ease, but they come with a hefty price tag.

Specialized Industry Tools

Certain industries have unique analytical needs, leading to the development of specialized tools. For example, the banking sector might use tools specifically designed for credit risk assessment, while the real estate industry might employ software for property valuation and portfolio management. These tools often incorporate industry-specific data and metrics, providing a deeper level of insight than general-purpose platforms.

Comparison of Popular Financial Statement Analysis Tools

The following table compares four popular tools, highlighting their strengths and weaknesses. Note that pricing can vary significantly based on features and subscription levels.

| Tool | Strengths | Weaknesses | Pricing Model |

|---|---|---|---|

| Microsoft Excel | Widely available, versatile, relatively inexpensive. | Manual data entry can be time-consuming, limited advanced analytical functions. | One-time purchase or subscription |

| Google Sheets | Collaborative features, cloud-based accessibility, free basic version. | Limited advanced analytical functions compared to dedicated platforms. | Free (basic) or subscription |

| Bloomberg Terminal | Comprehensive data coverage, advanced analytical tools, real-time data. | Extremely expensive, steep learning curve. | Subscription-based, high cost |

| FactSet | Robust analytical capabilities, extensive financial data, excellent reporting features. | High cost, complex interface. | Subscription-based, high cost |

Ratio Analysis Techniques

Ratio analysis: the financial detective work that separates the wheat from the chaff (or, in less agrarian terms, the profitable from the bankrupt). It’s a powerful tool, and while it might seem daunting at first, think of it as a financial puzzle – once you understand the pieces, the picture becomes clear. This section delves into the fascinating world of calculating and interpreting key ratios, turning those dry financial statements into insightful narratives.

Ratio analysis uses the data presented in financial statements to create meaningful comparisons and derive conclusions about a company’s performance and financial health. By examining the relationships between different line items, we can gain insights that are not immediately apparent from simply looking at the numbers in isolation. It’s like having X-ray vision for your company’s finances!

Liquidity Ratios

Liquidity ratios assess a company’s ability to meet its short-term obligations. A company with strong liquidity can easily pay its bills, while a company with weak liquidity might struggle to stay afloat. Imagine it like this: a company’s liquidity is its financial “breathing room.”

Key liquidity ratios include the Current Ratio (Current Assets / Current Liabilities) and the Quick Ratio ((Current Assets – Inventory) / Current Liabilities). A current ratio of 2:1 generally indicates good liquidity, while a quick ratio above 1:1 suggests the company can meet its short-term obligations even without quickly selling inventory. For example, a company with $100,000 in current assets and $50,000 in current liabilities has a current ratio of 2:0, suggesting a healthy liquidity position. However, if a significant portion of those current assets is tied up in slow-moving inventory, the quick ratio might paint a less optimistic picture.

Solvency Ratios

Solvency ratios, on the other hand, focus on a company’s ability to meet its long-term obligations. This is about the company’s overall financial stability – its ability to weather storms and remain in business over the long haul. Think of it as the company’s long-term survival kit.

Important solvency ratios include the Debt-to-Equity Ratio (Total Debt / Total Equity) and the Times Interest Earned Ratio (EBIT / Interest Expense). A high debt-to-equity ratio might indicate excessive reliance on debt financing, increasing financial risk. Conversely, a high times interest earned ratio suggests the company comfortably covers its interest payments. For instance, a debt-to-equity ratio of 1:1 means the company’s debt and equity are equally balanced, while a times interest earned ratio of 5 means the company’s earnings before interest and taxes are five times its interest expense.

Profitability Ratios

Profitability ratios measure a company’s ability to generate profits. These ratios tell the story of how efficiently a company is turning its resources into profit. It’s the ultimate measure of success – the bottom line, made insightful.

Key profitability ratios include Gross Profit Margin (Gross Profit / Revenue), Net Profit Margin (Net Income / Revenue), and Return on Equity (Net Income / Total Equity). A high gross profit margin indicates efficient cost control in production, while a high net profit margin shows strong overall profitability. Return on Equity shows how effectively the company is using its shareholders’ investments to generate profits. For example, a company with a net profit margin of 10% earns $0.10 for every dollar of revenue, showcasing its profitability.

Efficiency Ratios

Efficiency ratios, also known as activity ratios, measure how efficiently a company is managing its assets and liabilities. They assess how well a company is using its resources to generate sales and profits. Think of these as the company’s operational efficiency report card.

Important efficiency ratios include Inventory Turnover (Cost of Goods Sold / Average Inventory) and Accounts Receivable Turnover (Net Credit Sales / Average Accounts Receivable). A high inventory turnover indicates efficient inventory management, minimizing storage costs and avoiding obsolescence. A high accounts receivable turnover suggests effective credit collection practices. For example, an inventory turnover of 10 means the company sells and replaces its inventory 10 times a year, demonstrating efficient inventory management.

Step-by-Step Guide to Performing Ratio Analysis

To perform ratio analysis, one needs access to a company’s financial statements (balance sheet, income statement, and cash flow statement). Many financial statement tools, such as spreadsheet software or dedicated financial analysis programs, can greatly simplify this process. Let’s use a spreadsheet as an example.

Step 1: Input the financial statement data into the spreadsheet. Organize the data clearly and accurately, ensuring all numbers are correctly entered. Step 2: Create formulas to calculate the ratios. Use cell references to make the formulas dynamic and easy to update. For example, the formula for the current ratio would be “=A1/B1”, where A1 is the cell containing current assets and B1 contains current liabilities. Step 3: Analyze the calculated ratios. Compare the ratios to industry averages, historical data, or competitor data to assess the company’s performance. Step 4: Interpret the results and draw conclusions. Consider the context of the ratios and the overall financial picture of the company before making any definitive statements. Step 5: Document your findings. Create a clear and concise report summarizing your analysis and conclusions, supporting your interpretations with data and context.

Trend Analysis and Forecasting: Financial Statement Analysis Tools

Predicting the future is a tricky business, even for seasoned financial analysts. While we can’t predict the next lottery winner (sadly!), we *can* use trend analysis and forecasting to get a much clearer picture of a company’s financial health and potential future performance. Think of it as peering into a slightly hazy crystal ball – you won’t see everything perfectly, but you’ll definitely see more than with your naked eye.

Trend analysis involves examining financial data over time to identify patterns and predict future outcomes. It’s like being a financial detective, piecing together clues from past performance to anticipate what might happen next. This isn’t about making wild guesses; it’s about using methodical techniques to spot consistent movements in revenue, expenses, profits, and other key metrics. The better the data and the more sophisticated the techniques, the clearer the picture becomes.

Methods for Identifying Trends in Financial Data

Identifying trends requires a keen eye and a systematic approach. We’re not talking about just looking at numbers and hoping for inspiration; we need a solid methodology. One common approach involves visually inspecting charts and graphs of key financial data. Plotting data points over time allows us to observe upward or downward trends, seasonal fluctuations, or other patterns. For example, a graph showing consistent year-over-year revenue growth indicates a positive trend, while a graph depicting declining profit margins might signal a warning sign. Another approach involves calculating moving averages. A simple moving average smooths out short-term fluctuations in data, making long-term trends easier to identify. A three-year moving average, for instance, averages the data for the past three years, providing a less volatile representation of the trend. More sophisticated techniques, such as regression analysis, can also be employed to quantify the relationship between variables and project future values.

Time Series Analysis and Forecasting Techniques

Time series analysis is a powerful statistical tool specifically designed for analyzing data points collected over time. This method goes beyond simple visual inspection and moving averages, employing sophisticated statistical models to uncover hidden patterns and make forecasts. One common technique is exponential smoothing, which assigns exponentially decreasing weights to older data points, giving more emphasis to recent observations. Another approach involves ARIMA (Autoregressive Integrated Moving Average) models, which are more complex but can capture intricate patterns in the data, leading to more accurate predictions. These models consider past values, past errors, and seasonal components to create forecasts. For example, a company forecasting its sales for the next quarter might use an ARIMA model that considers previous quarters’ sales, seasonal trends (e.g., higher sales during the holiday season), and any external factors like economic indicators.

Visualizing Financial Trends with Charts and Graphs

A picture is worth a thousand numbers, and in financial analysis, this is especially true. Let’s consider a hypothetical example of a company’s annual revenue over five years. We could represent this data using a line graph. The x-axis would represent the years (Year 1, Year 2, Year 3, Year 4, Year 5), and the y-axis would represent the revenue in millions of dollars. The line would connect the data points, showing the trend visually. If the line slopes upwards consistently, it indicates revenue growth. If the line shows fluctuations, it may indicate seasonal variations or other factors influencing revenue. A bar chart could also be used, with each bar representing the revenue for a particular year. This type of chart provides a clear visual comparison of revenue across the years. Adding a trendline to the chart, a line that best fits the data points, can further highlight the overall direction of the trend. For example, a trendline showing an upward slope with a positive regression coefficient would clearly indicate positive revenue growth. Furthermore, a scatter plot could be used to analyze the relationship between two variables, such as advertising expenditure and revenue. This visual representation helps to identify potential correlations and inform strategic decisions. The resulting graph would show individual data points, each representing a year’s advertising expenditure and corresponding revenue. A line of best fit could be added to illustrate the relationship between the two variables.

Benchmarking and Comparative Analysis

Comparing your company’s financial performance to others is like comparing apples to oranges… except the apples might be genetically modified super-apples and the oranges might be infused with liquid gold. It’s complex, but crucial for understanding your company’s strengths and weaknesses. Benchmarking and comparative analysis provide the magnifying glass needed to see the details.

Benchmarking and comparative analysis involve measuring a company’s financial performance against its peers or competitors. This helps identify areas for improvement and informs strategic decision-making. Think of it as a financial performance reality check – are you outperforming, underperforming, or just…performing?

Methods for Comparing Financial Performance

Several methods exist for comparing a company’s financial performance against industry peers. These methods offer different perspectives and levels of detail, each with its own set of advantages and disadvantages. Choosing the right method depends on the specific goals of the analysis and the availability of data.

- Industry Average Comparison: This involves comparing a company’s financial ratios to the average ratios of all companies within its industry. This provides a general benchmark, but it may not be entirely accurate if the industry is diverse or the company operates in a niche market. For example, a small, innovative tech startup might not be fairly compared to a large, established player in the same industry sector.

- Competitor Comparison: This involves comparing a company’s financial ratios to those of its direct competitors. This approach offers a more targeted benchmark, as it focuses on companies with similar business models and operating environments. However, obtaining reliable financial data for competitors can be challenging, particularly for privately held companies.

- Time Series Analysis: While not strictly benchmarking, analyzing a company’s financial performance over time provides valuable context for comparing current results to past performance. This helps to identify trends and patterns that might otherwise be missed in a single-year comparison. For example, consistent improvement in profitability over several years is a stronger indicator of success than a single year of high profits.

Advantages and Disadvantages of Benchmarking Techniques

Each benchmarking technique has its strengths and weaknesses. Understanding these is crucial for selecting the appropriate method and interpreting the results correctly. Misinterpreting the data can lead to flawed strategies and wasted resources.

| Benchmarking Technique | Advantages | Disadvantages |

|---|---|---|

| Industry Average Comparison | Provides a general benchmark; readily available data for many industries. | May mask significant variations within the industry; less precise than competitor comparison. |

| Competitor Comparison | Highly targeted benchmark; provides insights into specific competitive advantages and disadvantages. | Data availability can be limited; may not be suitable for industries with few direct competitors. |

| Time Series Analysis | Provides context for current performance; reveals trends and patterns over time. | Doesn’t provide a direct comparison to external benchmarks; may not be sufficient on its own. |

Comparative Analysis Case Study: Acme Corp vs. Beta Industries, Financial Statement Analysis Tools

Let’s imagine Acme Corp and Beta Industries, two companies in the widget manufacturing industry. We’ll use a simple profitability ratio, the Gross Profit Margin (Gross Profit / Revenue), to illustrate comparative analysis. Assume Acme Corp has a gross profit margin of 30% and Beta Industries has a 35%. This suggests Beta Industries is more efficient in managing its production costs. However, further investigation might reveal that Beta Industries uses lower-quality materials, resulting in lower-quality widgets and potentially affecting long-term profitability. A more comprehensive analysis, incorporating other ratios like Return on Assets (ROA) and Debt-to-Equity Ratio, would paint a more complete picture. This example highlights the need for holistic analysis rather than relying on single metrics.

Data Visualization and Reporting

Presenting financial data effectively is not just about crunching numbers; it’s about crafting a compelling narrative that even your accountant’s pet hamster could understand. Data visualization transforms complex financial information into easily digestible insights, making it far more engaging and persuasive than a wall of spreadsheets. Think of it as the difference between a delicious cake and a pile of flour, sugar, and eggs.

Effective data visualization requires careful consideration of the audience and the message. A simple bar chart might suffice for a quick overview, while a more sophisticated dashboard could be necessary for a comprehensive analysis. The key is clarity, accuracy, and a touch of visual flair – think less “boring bar chart,” more “data masterpiece.”

Effective Data Visualization Techniques

The right chart can make all the difference. Choosing the wrong one is like trying to bake a cake with a hammer – it’s not going to end well. Here are some techniques for effectively visualizing financial data:

- Bar Charts: Ideal for comparing different categories of data, such as revenue across different product lines or expenses across different departments. A well-designed bar chart clearly highlights the relative magnitudes of different data points, making comparisons easy.

- Line Charts: Perfect for showing trends over time, such as revenue growth or profit margins over several years. A line chart effectively illustrates the direction and rate of change, revealing patterns that might otherwise be missed.

- Pie Charts: Useful for displaying the proportion of different components that make up a whole, such as the allocation of assets or the composition of revenue streams. However, use them sparingly; too many segments can become confusing.

- Scatter Plots: These are excellent for exploring the relationship between two variables, such as sales and marketing spend. Identifying patterns or correlations in a scatter plot can lead to valuable insights for strategic decision-making.

Example Data Visualization Using a Hypothetical Tool

Let’s imagine we’re using a fictional data visualization tool called “Chartastic Pro.” We’ll analyze the financial performance of “Acme Corp” over the last five years.

Revenue Growth

Chartastic Pro generates a line chart showing Acme Corp’s revenue from 2019 to 2023. The chart clearly displays a steady upward trend, with a significant jump in revenue in 2022. The X-axis represents the year, and the Y-axis represents revenue in millions of dollars. The line itself is a vibrant, yet professional, shade of green, indicating positive growth. Data labels clearly show the revenue for each year, eliminating any ambiguity.

Profit Margin Analysis

Another chart, a bar chart this time, compares Acme Corp’s profit margins across different product lines (A, B, and C) in 2023. Product line A boasts the highest profit margin, represented by a tall, bright blue bar, while product line C shows a comparatively lower margin, indicated by a shorter, lighter blue bar. This visual immediately highlights which product lines are the most profitable and where improvements might be needed.

Sample Financial Report

The Acme Corp Financial Report for 2023, created using Chartastic Pro, includes the following sections:

- Executive Summary: A concise overview of Acme Corp’s financial performance in 2023, highlighting key achievements and challenges.

- Revenue Analysis: This section includes the line chart showing revenue growth over the past five years, accompanied by a detailed explanation of the factors driving revenue growth (e.g., new product launches, successful marketing campaigns).

- Profitability Analysis: This section features the bar chart comparing profit margins across product lines, along with a discussion of strategies to enhance profitability in less-profitable areas.

- Key Financial Ratios: A table presenting key financial ratios (e.g., return on assets, debt-to-equity ratio) alongside industry benchmarks, providing context for Acme Corp’s financial health.

- Appendix: This section includes detailed financial statements (income statement, balance sheet, cash flow statement).

The report concludes with a clear and concise summary of the key findings and recommendations for future actions. It’s a beautifully designed document, easily digestible, and leaves the reader with a clear understanding of Acme Corp’s financial position. No more boring reports!

Advanced Analytical Techniques

Let’s ditch the dusty old balance sheet and embrace the thrilling world of advanced analytics! While basic ratio analysis is like spotting a single, slightly-off-kilter domino, advanced techniques are the high-speed camera capturing the entire chain reaction. They allow us to delve deeper into the financial intricacies of a company, uncovering hidden patterns and predicting future performance with a level of accuracy that would make Nostradamus jealous (almost).

Advanced techniques like regression analysis and statistical modeling move beyond simple comparisons. They help us uncover the *why* behind the numbers, not just the *what*. Imagine trying to understand the relationship between advertising spend and sales revenue using only basic ratios – you’d be missing a whole lot of the story. These advanced methods allow us to quantify those relationships, providing a much more nuanced understanding of the company’s performance drivers. This leads to more informed decision-making, whether you’re an investor, a creditor, or even the CEO trying to justify that new company yacht.

Regression Analysis in Financial Statement Analysis

Regression analysis allows us to model the relationship between multiple financial variables. For instance, we can use it to predict future sales based on past advertising spending, economic growth, and competitor actions. This goes far beyond simply comparing year-over-year changes; it allows us to quantify the impact of each variable on the dependent variable (in this case, sales). A strong positive correlation between advertising and sales, for example, would suggest that increased marketing efforts translate directly into increased revenue. Conversely, a negative correlation with competitor actions might indicate the company is losing market share. The power of regression lies in its ability to disentangle the complex interplay of these factors, offering a more comprehensive view than any simple ratio could ever provide. The resulting regression equation can be used to generate forecasts and assess the potential impact of various scenarios. For example, a business might use this to model the impact of a 10% increase in advertising expenditure on projected sales.

Implementing Regression Analysis using Statistical Software

Before diving in, it’s crucial to understand that the quality of your regression model is heavily reliant on the quality of your data. Garbage in, garbage out, as they say. Ensure your data is clean, consistent, and relevant to your research question. Using flawed data will lead to unreliable and potentially misleading results. This step involves identifying and handling missing values, outliers, and ensuring the data is properly formatted for your chosen software.

- Data Preparation: Gather relevant financial data, ensuring data quality and consistency. This could involve cleaning data, handling missing values, and transforming variables as needed (e.g., converting percentages to decimals).

- Model Specification: Define the dependent variable (what you want to predict, e.g., sales) and independent variables (factors influencing the dependent variable, e.g., advertising spend, economic indicators). This requires a solid understanding of the underlying economic relationships. An incorrect specification can lead to biased and inaccurate results.

- Model Estimation: Use statistical software (like R, Python with Statsmodels, or even Excel’s Data Analysis Toolpak) to estimate the regression coefficients. This involves running the regression analysis and obtaining the estimated equation. The software will provide you with statistics like R-squared (a measure of how well the model fits the data), p-values (to test the significance of the individual variables), and the regression coefficients themselves.

- Model Evaluation: Assess the goodness of fit, the significance of the coefficients, and the overall validity of the model. This includes checking for multicollinearity (high correlation between independent variables) and heteroscedasticity (unequal variance of the errors).

- Interpretation and Forecasting: Interpret the regression coefficients to understand the relationship between the independent and dependent variables. Use the estimated equation to generate forecasts and analyze different scenarios.

For example, if our regression analysis shows that a 1% increase in advertising spend leads to a 0.5% increase in sales (holding other factors constant), we can use this information to make informed decisions about marketing budgets. This type of precise quantification is impossible with basic ratio analysis alone. Remember, while advanced techniques are powerful, they’re tools. Proper interpretation and a healthy dose of skepticism are always necessary.

Ethical Considerations and Limitations

Financial statement analysis, while a powerful tool for understanding a company’s financial health, isn’t without its ethical pitfalls and inherent limitations. Like a particularly mischievous accounting pixie, it can lead you astray if you’re not careful, resulting in misinterpretations and potentially disastrous decisions. Navigating this landscape requires a keen awareness of potential biases and a commitment to responsible data handling.

The reliability of financial statement analysis hinges entirely on the accuracy of the underlying data. Garbage in, garbage out, as the old saying goes – a principle as true in finance as it is in baking a cake (though thankfully, the consequences are usually less sugary). Even minor inaccuracies can snowball, leading to skewed ratios, flawed trends, and ultimately, misguided conclusions. Imagine basing your investment strategy on a balance sheet where a million-dollar typo lurks innocently within the accounts receivable. The resulting analysis would be about as reliable as a three-legged stool.

Data Accuracy and Interpretation Biases

Maintaining data accuracy is paramount. This involves verifying the source of the financial statements, ensuring they are prepared in accordance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), and checking for any inconsistencies or anomalies. Furthermore, analysts must be mindful of their own biases. Cognitive biases, such as confirmation bias (favoring information that confirms pre-existing beliefs) or anchoring bias (over-relying on the first piece of information received), can significantly distort interpretation. A seasoned analyst, therefore, approaches data with healthy skepticism, cross-referencing information from multiple sources and actively seeking to challenge their own assumptions. For example, an analyst might be overly optimistic about a company’s future prospects due to a recent successful product launch, potentially overlooking crucial negative factors like increasing competition or rising input costs.

Transparency and Responsible Use of Analytical Findings

Transparency is the bedrock of ethical financial statement analysis. Analysts should clearly articulate their methodologies, assumptions, and limitations. This allows others to scrutinize the analysis and assess its validity. Furthermore, the findings should be presented objectively, avoiding any manipulative or misleading representations. For instance, selectively highlighting positive aspects while ignoring negative ones constitutes unethical behavior. Responsible use also implies acknowledging the limitations of the analysis. Financial statements provide a snapshot in time and do not predict the future with certainty. Analysts should avoid presenting their findings as definitive predictions, instead emphasizing the uncertainties and potential risks involved. An example would be to avoid stating that “Company X will definitely outperform the market next year” based solely on financial statement analysis, opting instead for a more cautious statement like “Company X’s financial indicators suggest potential for strong performance next year, although this is subject to various market and economic uncertainties.”

End of Discussion

So, there you have it: a whirlwind tour through the exciting world of financial statement analysis tools. While the process may seem daunting at first, mastering these tools can unlock a treasure trove of insights, leading to better decision-making and ultimately, greater financial success. Remember, the numbers don’t lie, but they can certainly be interpreted in many fascinating ways. Embrace the power of data, and may your spreadsheets always be balanced (and beautifully formatted).

Question & Answer Hub

What are the limitations of using automated financial analysis tools?

While powerful, automated tools can’t replace human judgment. They rely on the data inputted, so inaccurate data leads to inaccurate results. Furthermore, they might miss subtle nuances or context-specific information that a human analyst would catch.

How can I choose the right financial analysis tool for my needs?

Consider your budget, technical skills, the size and complexity of your data, and the specific analyses you need to perform. Free tools are great for simple tasks, while more advanced software offers greater functionality but comes with a price tag.

Are there any free financial statement analysis tools available?

Yes! Spreadsheet software like Google Sheets and Microsoft Excel offer many built-in functions for financial analysis. However, for more advanced features, you might need to explore specialized, potentially paid, options.