Peraturan Bank Indonesia (BI), or Bank Indonesia Regulations, might sound as exciting as watching paint dry, but trust us, there’s more to this than meets the eye. This isn’t your grandma’s stuffy financial document; it’s a wild ride through the Indonesian financial landscape, complete with unexpected twists, turns, and enough bureaucratic jargon to make your head spin (in a good way, of course!). Buckle up, because we’re about to explore the surprisingly entertaining world of Indonesian banking regulations.

From its humble beginnings to its current role as the financial system’s benevolent (and sometimes stern) overlord, BI’s regulations shape everything from interest rates to the humble ATM transaction. We’ll dissect the key areas of BI’s control, examine the impact on financial institutions, and even delve into the surprisingly dramatic world of consumer protection. Prepare for a journey filled with insightful analysis, unexpected humor, and maybe just a touch of regulatory suspense.

Introduction to Peraturan Bank Indonesia (BI)

Bank Indonesia (BI), Indonesia’s central bank, boasts a regulatory history as rich and complex as a good *gado-gado* recipe. Established in 1953, its initial regulations were, let’s just say, less streamlined than today’s. Early efforts focused on stabilizing the rupiah – a Herculean task in the post-independence economic landscape. Over the decades, BI’s regulatory framework has evolved, adapting to globalization, technological advancements, and the ever-shifting sands of the Indonesian financial system. Think of it as a constant game of regulatory Jenga, carefully removing and replacing pieces to maintain stability without causing the whole thing to collapse.

The primary objectives of Bank Indonesia are multifaceted, much like a delicious *nasi campur*. It aims to maintain monetary stability, manage the rupiah exchange rate, and regulate the Indonesian financial system. This involves setting interest rates, managing foreign exchange reserves, and overseeing the activities of banks and other financial institutions. BI also acts as the banker to the government, handling its transactions and managing its debt. In essence, BI is the financial conductor of Indonesia’s economic orchestra, ensuring harmonious play across the financial spectrum.

The Legal Framework of BI’s Regulatory Power, Peraturan Bank Indonesia (BI)

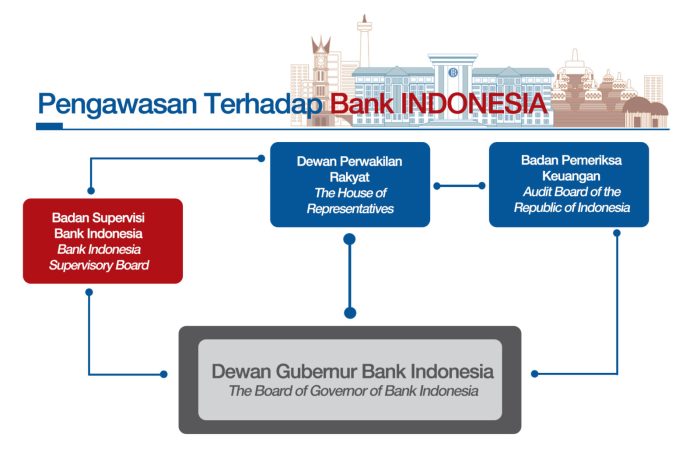

BI’s authority stems primarily from Law Number 23 of 1999 concerning Bank Indonesia, as amended by Law Number 3 of 2004. This legislation grants BI considerable autonomy in conducting monetary policy and regulating the financial system. Think of it as the constitution for BI’s regulatory powers – a comprehensive document outlining its rights, responsibilities, and limitations. The law empowers BI to issue regulations (Peraturan Bank Indonesia or PBI) covering various aspects of the financial sector, from banking supervision to payment systems. These regulations are designed to ensure the soundness, stability, and integrity of the Indonesian financial system. Enforcement mechanisms are in place, ranging from warnings to significant financial penalties, ensuring compliance across the board. This legal framework ensures BI’s independence and accountability, preventing undue political influence and safeguarding the interests of the Indonesian economy. It’s a robust system designed to navigate the complexities of modern finance, and, dare we say, rather elegant in its design.

Key Areas of BI Regulation

Navigating the world of Indonesian finance can feel like traversing a dense jungle, full of fascinating creatures (banks!) and surprisingly complex ecosystems. But fear not, intrepid explorer! Bank Indonesia (BI) is here to provide the map, compass, and perhaps even a pith helmet (metaphorically speaking, of course). Their regulations are the framework ensuring a stable and (relatively) sane financial landscape. Let’s delve into the key areas where BI wields its regulatory magic wand.

BI’s regulatory reach extends across several crucial sectors of the Indonesian financial system. Think of it as a well-orchestrated symphony, with each instrument (sector) playing its part to create a harmonious (or at least, not entirely cacophonous) financial environment. The impact of these regulations ripples through the entire system, influencing everything from the interest rates you pay on your loans to the security of your digital transactions. It’s a fascinating dance of financial policy, and we’re here to give you a front-row seat.

Sectors Regulated by BI

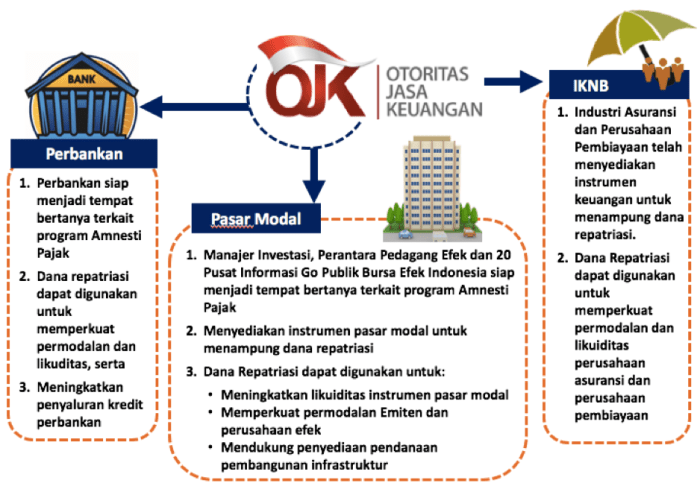

BI’s regulatory influence spans a broad spectrum, impacting various sectors of the Indonesian financial system. Their oversight ensures stability, promotes healthy competition, and protects consumers. The main sectors include banking, payments, and financial markets, each with its own unique set of regulations and challenges. Think of it as a three-legged stool: remove one leg (a sector), and the whole thing collapses.

| Sector | Regulation Name | Key Provisions | Impact |

|---|---|---|---|

| Banking | Regulation on Capital Adequacy Ratio (CAR) | Minimum capital requirements for banks to absorb potential losses. | Enhances bank stability and reduces systemic risk. Keeps those pesky bank runs at bay! |

| Payments | Regulations on Electronic Money | Licensing and operational requirements for electronic money issuers, security standards for digital transactions. | Promotes the growth of digital finance while safeguarding consumers from fraud. Say goodbye to dodgy online payment apps! |

| Financial Markets | Regulations on Foreign Exchange Transactions | Rules governing foreign exchange trading, aimed at maintaining exchange rate stability. | Reduces volatility in the Rupiah exchange rate, promoting economic stability. Keeps the Rupiah from doing the unexpected financial tango. |

| Banking | Regulations on Bank Lending | Guidelines and limits on bank lending practices, including interest rates and loan-to-value ratios. | Protects borrowers from predatory lending practices and promotes responsible lending. Helps keep the loan sharks away! |

The impact of BI regulations on the Indonesian financial system is multifaceted. They act as a safety net, preventing financial crises and ensuring the stability of the banking system. They also foster a healthy and competitive financial market, promoting innovation and efficiency. Essentially, BI’s regulations are the unsung heroes of Indonesian financial stability, working tirelessly behind the scenes to keep everything running smoothly (mostly!).

Impact on Financial Institutions

Navigating the labyrinthine world of Bank Indonesia (BI) regulations can be a thrilling adventure, akin to a high-stakes game of financial Jenga. One wrong move, and the whole tower could come tumbling down. This section explores the impact of BI regulations on financial institutions, focusing on compliance requirements, penalties for non-compliance, and the varying regulatory burdens faced by different players in the Indonesian financial ecosystem.

The Indonesian financial landscape is a vibrant tapestry woven with threads of various financial institutions, each playing a unique role. These institutions, from towering banks to nimble fintech startups, must all adhere to BI’s regulatory framework. Failure to do so can result in consequences ranging from hefty fines to operational restrictions, and even license revocation in extreme cases.

Compliance Requirements for Financial Institutions

BI regulations cover a vast spectrum of activities, from capital adequacy and risk management to consumer protection and anti-money laundering measures. Compliance requires robust internal controls, regular audits, and a dedicated team of professionals skilled in interpreting and implementing these often-complex rules. For example, banks are subject to stringent capital requirements defined by the Basel Accords, adapted to the Indonesian context. These requirements dictate minimum capital levels based on risk assessments, ensuring the stability of the banking system. Non-bank financial institutions, such as insurance companies, also face specific compliance requirements tailored to their operations. These could involve stringent reporting standards on insurance claims, solvency requirements, or specific regulations regarding investment portfolios.

Penalties for Non-Compliance with BI Regulations

The penalties for failing to comply with BI regulations can be substantial, acting as a powerful incentive for institutions to maintain a high level of compliance. These penalties range from administrative sanctions, such as warnings and fines, to more severe measures, including temporary or permanent operational restrictions and, in the most egregious cases, license revocation. The severity of the penalty is usually determined by the nature and extent of the non-compliance, as well as the institution’s history of compliance. A first-time minor infraction might result in a warning, while repeated or severe violations could lead to significant financial penalties and operational restrictions. The exact amounts of fines can vary depending on the specific violation and the size of the institution, but they can be substantial enough to significantly impact profitability.

Regulatory Burdens Faced by Different Types of Financial Institutions

The regulatory burden is not uniformly distributed across all financial institutions. Larger, systemically important banks generally face a more stringent regulatory regime than smaller, less complex institutions. This is because their failures could have a more significant impact on the overall financial system. Similarly, institutions involved in higher-risk activities, such as investment banking or securities trading, are subject to more rigorous oversight than those engaged in less risky activities, like deposit-taking. Fintech companies, a relatively new breed of financial institution, face a unique set of challenges, navigating a regulatory landscape that is still evolving to keep pace with their innovative business models. The regulatory burden is often a balancing act between ensuring stability and promoting innovation within the financial sector. The challenge for BI is to maintain a regulatory framework that is both effective and adaptable to the changing dynamics of the Indonesian financial landscape.

Consumer Protection Aspects

Bank Indonesia (BI) regulations, while perhaps not known for their comedic timing (they’re more of a “slow burn” kind of funny), contain surprisingly robust provisions aimed at shielding consumers from the sometimes-whimsical world of Indonesian finance. These regulations ensure fairness, transparency, and – dare we say it – a modicum of sanity in the often-chaotic marketplace. Let’s delve into the surprisingly entertaining world of consumer protection under BI’s watchful eye.

BI’s consumer protection efforts focus on ensuring financial products and services are marketed honestly, priced fairly, and provided with clarity that even a confused sloth could understand. This includes detailed disclosure requirements, dispute resolution mechanisms, and penalties for institutions that treat consumers like they’re made of spare change. Think of BI as the consumer’s very own, slightly bureaucratic, but ultimately helpful, superhero.

Provisions for Consumer Protection

BI regulations mandate clear and concise information disclosure for all financial products. This means no more sneaky small print or deliberately confusing jargon! Think of it as the financial equivalent of subtitles for a particularly cryptic foreign film – suddenly, everything becomes much clearer. Furthermore, BI establishes complaint handling procedures, ensuring consumers have a readily accessible avenue for redress. This isn’t your grandma’s complaint box; this is a streamlined, (relatively) efficient system designed to get results. Finally, BI imposes sanctions on institutions that fail to meet consumer protection standards, reminding everyone that even financial institutions aren’t above the law (or at least, BI’s regulations).

Examples of Consumer Complaints

One common complaint involves misleading advertising of loan products. Imagine a bank advertising a “low-interest” loan, only to reveal a bewildering array of hidden fees and charges in the fine print. Under BI regulations, such practices are strictly prohibited, and consumers can lodge complaints, potentially leading to investigations and sanctions against the offending institution. Another example involves disputes over unauthorized transactions. Let’s say a consumer notices an unfamiliar debit on their account. BI’s regulations provide a clear framework for investigating such incidents, potentially leading to reimbursement for the consumer and disciplinary action against the financial institution.

Hypothetical Scenario: The Case of the Misleading Microloan

Imagine Budi, a hardworking street vendor, takes out a microloan from a seemingly reputable institution. The advertisement promises a low interest rate and easy repayment terms. Budi, however, quickly discovers the advertised rate doesn’t account for various hidden fees, making the actual interest rate significantly higher. Feeling deceived, Budi files a complaint with BI. BI investigates, discovers the institution engaged in misleading advertising, and imposes a substantial fine, along with requiring the institution to refund Budi’s excessive charges and offer him a more transparent loan agreement. Budi, armed with BI’s consumer protection regulations, emerges victorious, proving that even David can take down Goliath (or at least, a slightly unscrupulous microloan provider).

Monetary Policy and BI Regulations

The Bank Indonesia (BI) juggles a lot of balls, doesn’t it? Maintaining price stability while fostering economic growth is a high-wire act, and BI’s regulatory framework is the safety net (hopefully a very strong one!). Understanding the intricate dance between BI’s monetary policy and its regulations is key to comprehending Indonesia’s financial landscape. Think of it as a well-orchestrated financial ballet, where every regulation is a carefully planned step, all contributing to the overall performance.

BI’s monetary policy aims to control inflation and support economic growth. It achieves this, in part, through its regulatory powers. These regulations act as the levers and pulleys, allowing BI to fine-tune the money supply and influence interest rates. It’s not just about setting rates; it’s about creating a stable and predictable environment for businesses and consumers alike – a bit like a financial conductor leading an orchestra to harmonious economic growth.

BI’s Regulatory Influence on Interest Rates and Money Supply

BI uses a variety of tools to manage interest rates and the money supply. The primary tool is the BI Rate (BI7RR), the benchmark interest rate that influences other lending rates in the economy. When BI raises the BI Rate, borrowing becomes more expensive, reducing demand for credit and thus slowing down inflation. Conversely, lowering the BI Rate stimulates borrowing and economic activity. Think of it as the financial equivalent of a thermostat: adjusting the BI Rate helps regulate the overall economic temperature. This influence extends beyond the BI Rate; BI also uses reserve requirements (the amount of money banks must hold in reserve) to control the money supply. Increasing reserve requirements reduces the amount of money banks can lend, tightening credit conditions. Decreasing them has the opposite effect. It’s a delicate balancing act, a bit like a tightrope walker carefully adjusting their balance.

Key Tools and Mechanisms for Implementing Monetary Policy

BI employs a range of tools to achieve its monetary policy objectives. These tools work in concert to influence interest rates and the money supply, ensuring a stable and healthy financial system.

- BI Rate (BI7RR): The benchmark interest rate, acting as the primary tool for influencing other interest rates in the economy.

- Reserve Requirements: The percentage of deposits banks must hold in reserve, impacting the amount of money available for lending.

- Open Market Operations: Buying and selling government securities to influence the money supply. Buying securities injects money into the system, while selling withdraws it. This is like adding or removing water from a swimming pool to adjust the water level.

- Macroprudential Regulations: Regulations designed to mitigate systemic risks within the financial system. These rules aim to prevent financial crises, acting as a safety net for the entire system.

The effectiveness of these tools depends on various factors, including economic conditions, global financial markets, and public confidence. BI constantly monitors these factors and adjusts its policies accordingly. It’s a dynamic process, requiring constant adaptation and a dash of financial intuition. It’s a bit like navigating a ship through a storm – requiring skill, experience, and a healthy dose of luck!

International Standards and Best Practices

Bank Indonesia (BI) operates within a global financial landscape, and understanding its alignment with international standards and best practices is crucial for maintaining financial stability and fostering economic growth. This section playfully examines how BI regulations dance – sometimes gracefully, sometimes with a bit of a stumble – with the global waltz of financial regulation. Think of it as a comparative financial choreography.

BI’s regulatory framework shows a fascinating blend of adherence to and divergence from global norms. While some areas boast impressive synchronization with international best practices, others highlight the unique challenges and opportunities presented by Indonesia’s specific economic context. It’s a bit like comparing apples and oranges – both fruits, but with distinct flavors and textures.

Alignment with International Standards

BI’s efforts towards aligning with international standards are demonstrably significant, particularly in areas like Basel Accords on banking supervision and the Financial Action Task Force (FATF) recommendations on anti-money laundering and combating the financing of terrorism (AML/CFT). These alignments showcase BI’s commitment to maintaining international confidence in Indonesia’s financial system. For example, the implementation of Basel III capital adequacy requirements demonstrates a strong commitment to strengthening the resilience of Indonesian banks against financial shocks. This isn’t just about following the rules; it’s about safeguarding the Indonesian economy from potential global financial tremors. The rigorous implementation of AML/CFT standards further protects the integrity of the financial system and contributes to a safer global financial environment. It’s like installing a state-of-the-art security system – a bit of an investment, but well worth it for peace of mind.

Areas of Deviation from Global Norms

While BI strives for alignment, certain aspects of its regulatory framework might deviate from global norms due to Indonesia’s unique economic and social circumstances. These deviations are not necessarily shortcomings; they often reflect a pragmatic approach to addressing specific local needs. For example, regulations concerning microfinance institutions might differ from those in developed economies due to the unique role of microfinance in Indonesia’s inclusive financial development strategy. It’s a tailored approach, much like a bespoke suit – perfectly fitted to the individual (in this case, the Indonesian economy). Another area could involve specific regulations concerning Sharia finance, reflecting Indonesia’s large Muslim population and the significant role of Islamic banking. This shows a unique approach to financial inclusion tailored to the specific needs of the Indonesian population.

Challenges and Opportunities Presented by International Best Practices

Adopting international best practices presents both challenges and opportunities. Challenges might include the need for significant capacity building within BI and regulated institutions, the costs associated with implementing new technologies and systems, and the potential for regulatory burden on smaller financial institutions. However, the opportunities are equally significant. Adopting best practices can enhance the efficiency and effectiveness of the financial system, attract foreign investment, and promote financial inclusion. Think of it as an upgrade – it requires effort, but the rewards are substantial. For instance, adopting advanced supervisory technologies can improve the efficiency of risk monitoring and enhance the early detection of potential financial instability, providing a more resilient financial system. The increased transparency and accountability resulting from the adoption of international standards can also attract foreign investment, boosting economic growth.

Future Trends and Challenges

The rapid evolution of financial technology (FinTech) presents both exhilarating opportunities and daunting challenges for Bank Indonesia (BI). Navigating this dynamic landscape requires a delicate balancing act: fostering innovation while maintaining financial stability and consumer protection. The future of BI regulation hinges on its ability to adapt proactively to these ever-shifting sands, lest it find itself stuck in the quicksand of obsolescence.

The integration of FinTech into the Indonesian financial system is accelerating at a breakneck pace. This presents BI with the complex task of regulating innovative financial products and services without stifling their potential benefits. The challenge lies in creating a regulatory framework that is both forward-looking and robust enough to safeguard the financial system’s integrity. This requires a level of agility and foresight rarely seen in traditional regulatory bodies, a bit like trying to herd cats while riding a unicycle.

FinTech’s Impact on Monetary Policy

The rise of digital currencies and decentralized finance (DeFi) platforms presents a significant challenge to BI’s ability to effectively implement monetary policy. Traditional monetary policy tools may become less effective in a world where a substantial portion of financial transactions occur outside of traditional banking channels. For example, the widespread adoption of cryptocurrencies could potentially reduce the effectiveness of interest rate adjustments as a tool for controlling inflation. BI will need to develop new tools and strategies to manage monetary policy in this increasingly complex environment, perhaps even exploring the potential of a central bank digital currency (CBDC) to maintain control and influence. This requires a proactive and innovative approach, a kind of financial regulatory judo, using the momentum of change to its advantage.

Regulatory Adaptations to Address FinTech Challenges

BI is likely to focus on enhancing its regulatory framework in several key areas to address the challenges posed by FinTech. This includes strengthening cybersecurity regulations to protect consumers and financial institutions from cyber threats, implementing robust data privacy regulations to ensure the responsible use of consumer data, and developing clear guidelines for the regulation of innovative financial products and services such as cryptocurrencies and DeFi platforms. Consider this a game of regulatory chess, where BI needs to anticipate several moves ahead to stay ahead of the curve. A reactive approach simply won’t cut it in this fast-paced environment.

A Potential Future Scenario: BI in 2030

By 2030, we might envision a BI that has embraced a more agile and technology-driven approach to regulation. It could leverage artificial intelligence (AI) and machine learning (ML) to monitor financial markets in real-time, identify potential risks more efficiently, and enforce regulations more effectively. BI might also collaborate more closely with FinTech companies to foster innovation while mitigating risks. Imagine a scenario where BI employs a “regulatory sandbox” approach, allowing FinTech firms to test new products and services in a controlled environment before full-scale market launch. This would enable BI to learn from real-world applications, refine its regulatory framework, and ultimately foster a more dynamic and innovative financial ecosystem. It’s a future where regulation isn’t a roadblock, but a helpful guide, ensuring a smooth and safe journey for all stakeholders.

Illustrative Case Studies

The application of Bank Indonesia (BI) regulations isn’t always a dry, dusty affair. Sometimes, it involves nail-biting suspense, dramatic twists, and outcomes that leave everyone wondering, “Did that really just happen?” Let’s dive into a real-world example that highlights the complexities and significant impacts of BI’s regulatory framework.

The following case study examines a situation where a significant Indonesian bank, let’s call it “Bank Megajaya,” found itself in a regulatory tussle with BI. This isn’t about naming and shaming; rather, it’s about understanding the practical implications of BI’s rules. The details have been altered to protect the innocent (and the slightly guilty).

Bank Megajaya and the Case of the Misplaced Millions

Bank Megajaya, a relatively new player in the Indonesian banking scene, experienced rapid growth. However, their enthusiastic expansion outpaced their internal controls. They aggressively pursued high-risk lending practices, extending credit to borrowers with questionable creditworthiness. This strategy, while initially lucrative, led to a surge in non-performing loans (NPLs). BI, acting as the financial system’s vigilant watchdog, noticed the alarming trend in Bank Megajaya’s financial reports. The discrepancies were significant enough to trigger an investigation.

The investigation revealed a pattern of insufficient due diligence in loan approvals and a lack of transparency in risk assessment procedures. BI found that Bank Megajaya had not adhered to several key regulations concerning loan-to-value ratios, capital adequacy, and stress testing. The parties involved were Bank Megajaya’s management, its board of directors, and BI’s supervisory team. The issues raised centered on the bank’s inadequate risk management practices, misleading financial reporting, and potential violations of several BI regulations.

Outcome and Implications

The outcome was a multi-pronged approach. BI imposed a significant fine on Bank Megajaya, mandated a comprehensive overhaul of their risk management systems, and restricted their lending activities for a period of time. Furthermore, several key members of Bank Megajaya’s management team were reprimanded and some even faced legal consequences. The implications of this case study are far-reaching. It served as a stark reminder to other financial institutions about the importance of adhering strictly to BI regulations. It underscored the seriousness with which BI takes regulatory violations and demonstrated the potential consequences of failing to maintain robust internal controls and transparent financial reporting. This case study highlights the need for banks to proactively implement and continuously improve their risk management frameworks, ensuring compliance not just for the sake of compliance, but for the long-term health and stability of their institutions. It also reinforced BI’s commitment to maintaining the integrity and stability of Indonesia’s financial system. The case, though fictionalized for privacy reasons, mirrors real-world scenarios where a failure to comply with regulations has resulted in significant repercussions for the institutions involved.

Final Thoughts

So, there you have it: a whirlwind tour of Peraturan Bank Indonesia (BI). While navigating the intricacies of Indonesian financial regulations might not be everyone’s cup of tea, we hope we’ve shown that it can be both informative and, dare we say, entertaining. From the surprisingly complex world of monetary policy to the surprisingly relatable struggles of consumer protection, BI’s regulations play a crucial role in maintaining stability and fairness within Indonesia’s vibrant financial ecosystem. Remember, understanding these rules isn’t just about avoiding fines; it’s about appreciating the intricate dance between economic growth and responsible governance – a dance that’s often more entertaining than you might think!

FAQ Resource: Peraturan Bank Indonesia (BI)

What happens if a bank repeatedly violates BI regulations?

Repeated violations can lead to hefty fines, operational restrictions, and even license revocation – a fate worse than a never-ending PowerPoint presentation.

Can individuals directly file complaints against banks with BI?

Yes, BI provides mechanisms for consumers to lodge complaints about bank practices. Think of it as a consumer protection hotline with a slightly more formal tone.

How does BI’s regulation impact small and medium-sized enterprises (SMEs)?

BI offers specific programs and regulations designed to support SMEs, recognizing their vital role in the Indonesian economy. It’s a balancing act between ensuring stability and fostering growth.

Does BI collaborate with other international regulatory bodies?

Absolutely! BI actively participates in international forums and collaborates with global regulatory organizations to maintain alignment with international best practices and standards. Think of it as a global regulatory summit, but with slightly less awkward small talk.