Risk Management Framework Indonesia: Prepare yourselves, dear readers, for a thrilling expedition into the often-overlooked, yet undeniably crucial, world of Indonesian risk management! We’ll navigate the treacherous waters of legislation, dodge the unpredictable currents of economic shifts, and even scale the dizzying heights of technological advancements. Buckle up, it’s going to be a wild ride!

This exploration will delve into the core principles, methodologies, and practical applications of risk management within the Indonesian context. We’ll examine the historical evolution of frameworks, dissect various risk categories (political, economic, you name it!), and explore effective mitigation strategies. Think of it as a comprehensive survival guide for anyone venturing into the dynamic Indonesian business landscape. Expect insightful case studies, practical tips, and maybe even a chuckle or two along the way.

Overview of Indonesian Risk Management Frameworks

Navigating the sometimes-treacherous waters of Indonesian business requires a sturdy ship and a keen eye for potential hazards. This, my friends, is where risk management comes in – not just a suggestion, but a vital life raft in the archipelago of commerce. Let’s explore the Indonesian approach to keeping things afloat.

In the Indonesian context, risk management is the systematic process of identifying, analyzing, evaluating, treating, monitoring, and communicating risks to achieve organizational objectives. It’s less about predicting the future (though that’s a fun party trick) and more about preparing for a range of possibilities, from the mildly inconvenient to the potentially catastrophic. Think of it as strategic preparedness, with a dash of Indonesian resilience thrown in for good measure.

Key Legislation and Regulatory Bodies

Indonesia’s risk management landscape is shaped by a diverse array of legislation and regulatory bodies, each playing a crucial role in ensuring a safer and more stable business environment. The sheer number might seem daunting, but fear not! We’ll focus on the key players. The primary legislation influencing risk management practices often depends on the specific industry and the type of risk involved. For example, financial institutions are subject to a different set of regulations compared to manufacturing companies. However, overarching principles of good governance and transparency apply across the board. Many regulations are aligned with international best practices, reflecting Indonesia’s growing integration into the global economy.

Examples of Best Practices Adopted by Indonesian Organizations

Many Indonesian organizations have embraced proactive risk management, recognizing its value in long-term success. For instance, leading companies in the banking and finance sectors have implemented robust internal control systems and comprehensive risk assessment frameworks. These systems go beyond simply identifying potential problems; they involve developing detailed mitigation plans and regularly testing their effectiveness. Furthermore, a growing number of organizations are incorporating environmental, social, and governance (ESG) factors into their risk management strategies, reflecting a broader societal awareness of sustainability issues. These practices are often coupled with strong internal communication strategies, ensuring that risk awareness is integrated into the organizational culture.

Evolution of Risk Management Frameworks in Indonesia

The Indonesian approach to risk management has evolved significantly over time, mirroring global trends while adapting to the country’s unique context. Initially, risk management was often a reactive process, focusing primarily on compliance with regulations. However, in recent years, there’s been a clear shift towards a more proactive and integrated approach. This evolution has been driven by factors such as increased globalization, the growing complexity of business operations, and a greater emphasis on corporate governance. The introduction of more sophisticated risk management tools and techniques has further accelerated this transformation. The increasing focus on ESG considerations also represents a notable development, reflecting a growing awareness of the interconnectedness of environmental, social, and economic risks. This evolution reflects Indonesia’s growing maturity in understanding and managing risk, moving from a compliance-driven approach to a more strategic and integrated one.

Key Components of an Indonesian Risk Management Framework

Navigating the sometimes-treacherous waters of Indonesian business requires a sturdy vessel – and that vessel is a robust risk management framework. This isn’t just about avoiding pitfalls; it’s about proactively charting a course to success, even amidst the occasional typhoon of unforeseen circumstances. Think of it as strategic risk-surfing, if you will, with a healthy dose of “insyaAllah” (God willing) thrown in for good measure.

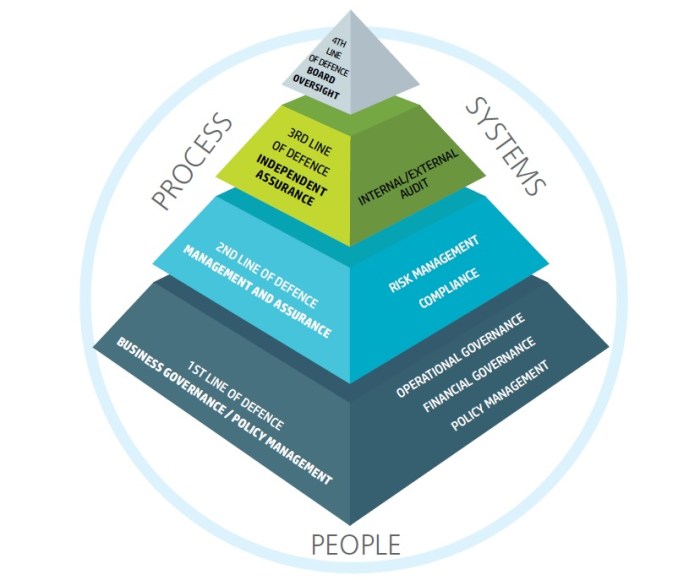

Effective risk management in Indonesia hinges on a few core principles. Firstly, it needs to be deeply embedded within the organization’s culture, not just a dusty document gathering cobwebs in a filing cabinet. Secondly, it must be adaptable and responsive to the ever-shifting landscape of the Indonesian economy and regulatory environment. Thirdly, and perhaps most importantly, it must be collaborative, involving stakeholders at all levels, from the top brass to the frontline staff. After all, everyone has a unique perspective on potential risks, and a collaborative approach ensures a more comprehensive view. Think of it as a delicious “gado-gado” of risk insights, each ingredient contributing to a flavorful and nutritious whole.

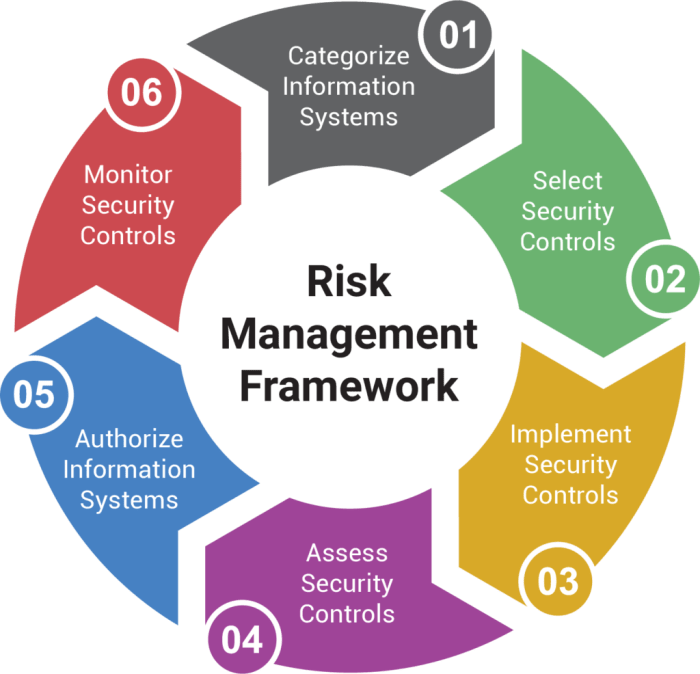

Stages in the Indonesian Risk Management Process, Risk Management Framework Indonesia

The risk management process in Indonesia, like a good Indonesian drama, unfolds in several captivating acts. These stages ensure a systematic approach to identifying, assessing, responding to, and monitoring risks, preventing minor bumps from turning into major catastrophes.

The first act, Risk Identification, involves meticulously identifying potential risks that could impact the organization’s objectives. This could involve brainstorming sessions, analyzing historical data, conducting surveys, or even consulting with fortune tellers (just kidding… mostly). The second act, Risk Assessment, involves evaluating the likelihood and potential impact of each identified risk. This requires careful consideration of various factors and the use of appropriate quantitative or qualitative methods. Act three, Risk Response, focuses on developing and implementing strategies to mitigate or eliminate identified risks. This could involve avoiding the risk altogether, transferring the risk to a third party, reducing the likelihood or impact of the risk, or simply accepting the risk and setting aside funds to deal with the consequences. Finally, the fourth act, Risk Monitoring, involves regularly tracking and reviewing the effectiveness of implemented risk responses and making adjustments as needed. This is an ongoing process, ensuring the framework remains relevant and effective.

Comparison of Risk Management Methodologies in Indonesia

| Methodology | Description | Advantages | Disadvantages |

|---|---|---|---|

| ISO 31000 | International standard for risk management, widely adopted globally, including Indonesia. Provides a comprehensive framework. | Globally recognized, structured approach, adaptable to various contexts. | Can be complex to implement, requires significant resources and expertise. |

| COSO ERM | Framework focusing on enterprise-wide risk management, often used by larger organizations. | Holistic approach, considers strategic, operational, reporting, and compliance risks. | Can be overly complex for smaller organizations, requires significant upfront investment. |

| Scenario Planning | Involves developing and analyzing various scenarios to anticipate future events and their potential impacts. | Proactive approach, helps anticipate and prepare for unexpected events. | Can be time-consuming and resource-intensive, requires significant expertise in forecasting. |

| Key Risk Indicator (KRI) Monitoring | Utilizes specific metrics to track and monitor key risks. | Provides early warning signals, allows for timely intervention. | Requires careful selection of KRIs, can be challenging to interpret data. |

The Role of Technology in Enhancing Risk Management Processes in Indonesia

Technology is no longer a luxury but a necessity in modern risk management, especially in a dynamic environment like Indonesia. From sophisticated data analytics platforms to AI-powered risk assessment tools, technology can significantly enhance the effectiveness and efficiency of the entire risk management process. Imagine having a digital assistant that can automatically identify and assess risks, predict potential problems, and even suggest mitigation strategies. Sounds futuristic, but it’s becoming increasingly common. Furthermore, technology facilitates better communication and collaboration among stakeholders, enabling quicker response times and more informed decision-making. The use of cloud-based platforms also enhances data security and accessibility, allowing for seamless risk monitoring across various locations and departments. It’s like having a high-tech “wayang kulit” (shadow puppet show) that projects real-time risk data, offering a clearer picture than ever before.

Specific Risk Categories in Indonesia

Navigating the Indonesian business landscape is like riding a rollercoaster – exhilarating, unpredictable, and occasionally terrifying. Understanding the specific risk categories is crucial for survival, and hopefully, for thriving. This section delves into the common perils faced by businesses operating within the archipelago, offering a glimpse into the vibrant (and sometimes volatile) world of Indonesian risk.

Indonesia presents a unique blend of opportunities and challenges. Its diverse geography, rapidly growing economy, and complex political landscape contribute to a multifaceted risk profile. Ignoring these risks is akin to sailing a ship without a map – exciting initially, but potentially disastrous in the long run. Let’s chart a course through these potential hazards.

Political Risks in Indonesia

Political risk in Indonesia encompasses a range of factors, from regulatory changes and policy uncertainty to potential social unrest and political instability. The impact of these risks varies across sectors. For example, changes in mining regulations could significantly impact resource extraction companies, while shifts in foreign investment policies affect multinational corporations. Regions with stronger local governance generally exhibit lower political risk than those with weaker institutions. The relatively stable political climate in recent years has contributed to increased foreign direct investment; however, potential future shifts in political leadership or policy could introduce new challenges.

Mitigation strategies for political risks include thorough due diligence, engaging with local stakeholders, and developing robust contingency plans that address potential political shifts. Diversification of investments and strong relationships with government officials can also significantly reduce the impact of political risks.

- Thorough Due Diligence: Conducting comprehensive research on political landscapes and potential policy changes.

- Stakeholder Engagement: Building strong relationships with local communities, government agencies, and other key stakeholders.

- Contingency Planning: Developing flexible strategies to adapt to unexpected political changes or instability.

- Investment Diversification: Spreading investments across different sectors and regions to minimize exposure to any single risk.

- Government Relations: Cultivating strong relationships with relevant government officials to understand and anticipate potential policy shifts.

Economic Risks in Indonesia

Indonesia’s dynamic economy, while presenting significant opportunities, also carries inherent risks. Fluctuations in commodity prices, exchange rate volatility, and inflation can significantly impact various sectors. For example, the agricultural sector is highly susceptible to price fluctuations, while the manufacturing sector is vulnerable to exchange rate changes. Generally, regions with more developed infrastructure and diversified economies tend to exhibit lower economic vulnerability. The recent global economic slowdown, for instance, had a noticeable impact on Indonesia’s export-oriented industries.

Mitigating economic risks requires a proactive approach. This includes hedging against currency fluctuations, diversifying revenue streams, and closely monitoring macroeconomic indicators. Robust financial planning and risk assessment are essential tools in navigating economic uncertainty.

- Hedging Strategies: Employing financial instruments to mitigate currency fluctuations and commodity price volatility.

- Revenue Diversification: Expanding into multiple markets and product lines to reduce dependence on single revenue streams.

- Macroeconomic Monitoring: Closely tracking key economic indicators such as inflation, interest rates, and GDP growth.

- Financial Planning: Developing detailed financial models and contingency plans to manage economic uncertainty.

- Risk Assessment: Regularly assessing and updating risk profiles to identify and address potential vulnerabilities.

Social Risks in Indonesia

Social risks encompass a broad range of factors, including social unrest, labor relations, and changes in consumer preferences. These risks can significantly impact businesses operating in Indonesia. For instance, labor disputes can disrupt operations, while changes in consumer behavior can affect demand for certain products or services. Regions with higher levels of social inequality or political polarization may face greater social risks. The rise of social media and its influence on public opinion also presents a new dimension to social risk management.

Mitigating social risks requires proactive engagement with local communities, fostering strong employee relations, and adapting to evolving consumer preferences. Understanding local customs and sensitivities is crucial for businesses to navigate the social landscape successfully.

- Community Engagement: Actively engaging with local communities to build trust and address concerns.

- Employee Relations: Maintaining strong and positive relationships with employees to prevent labor disputes.

- Consumer Trend Analysis: Monitoring consumer behavior and adapting products and services to meet evolving demands.

- Cultural Sensitivity: Demonstrating respect for local customs and traditions in all business operations.

- Social Media Monitoring: Tracking social media trends and addressing potential reputational risks proactively.

Risk Assessment and Mitigation Techniques

Navigating the sometimes-treacherous waters of Indonesian business requires a robust risk management framework. While understanding the various frameworks is crucial, the real magic lies in effectively assessing and mitigating those risks. Think of it as Indonesian martial arts – knowing the forms is important, but mastering the application is key to success.

Risk assessment, the art of identifying and evaluating potential threats, comes in two flavours: qualitative and quantitative. Qualitative assessments focus on the likelihood and impact of risks using descriptive terms like “high,” “medium,” and “low,” perfect for a quick overview. Quantitative assessments, on the other hand, assign numerical values to these factors, allowing for more precise calculations and comparisons. Imagine a delicious satay – qualitative tells you it’s “tasty,” while quantitative might tell you it contains 300 calories and 20 grams of protein. Both provide valuable information, just in different ways.

Qualitative Risk Assessment Methods

Qualitative risk assessment relies heavily on expert judgment and experience. It’s a valuable tool for situations where precise data is scarce, but it’s subjective and prone to bias. A common approach is to use a risk matrix, a simple table that plots likelihood against impact, resulting in a categorized risk level. For instance, a small Indonesian bakery might use a risk matrix to assess the risk of a power outage, considering factors like frequency of outages and potential financial loss. The resulting risk level would guide the choice of mitigation strategies. Another approach involves brainstorming sessions with stakeholders to identify and evaluate potential risks. This method benefits from diverse perspectives, but requires skilled facilitation to avoid groupthink.

Quantitative Risk Assessment Methods

Quantitative risk assessment utilizes numerical data to provide a more objective evaluation. This often involves statistical analysis, probability distributions, and financial modeling. Consider a large Indonesian telecommunications company assessing the risk of a cyberattack. They might use historical data on cyberattacks, vulnerability assessments, and cost estimations to quantify the potential financial losses and operational disruptions. This numerical approach offers a more precise evaluation than qualitative methods, enabling more informed decision-making. Techniques like Monte Carlo simulations can model various scenarios and probabilities, providing a more comprehensive understanding of the risk profile.

Risk Mitigation Strategies in Indonesia

Once risks are assessed, it’s time to mitigate them. Several strategies are commonly employed in Indonesia.

Risk avoidance involves completely eliminating the risk by not engaging in the activity that creates it. For example, an Indonesian company considering expansion into a politically unstable region might decide against it, thus avoiding the political risks entirely.

Risk reduction aims to decrease the likelihood or impact of a risk. For instance, implementing stricter security measures in a factory can reduce the risk of theft or accidents. Investing in employee training and implementing better safety procedures are common reduction techniques.

Risk transfer involves shifting the risk to a third party, typically through insurance or outsourcing. An Indonesian construction company might transfer the risk of construction delays by purchasing insurance against inclement weather.

Risk acceptance means acknowledging the risk and deciding to bear the consequences. This is usually employed when the cost of mitigation outweighs the potential impact of the risk. A small warung (street food stall) owner might accept the risk of minor theft, as the cost of implementing robust security measures would be prohibitive.

Examples of Risk Assessment Tools and Techniques

Indonesian organizations employ a range of tools and techniques for risk assessment. These include SWOT analysis (Strengths, Weaknesses, Opportunities, Threats), PESTLE analysis (Political, Economic, Social, Technological, Legal, Environmental), and various risk registers. Many companies also utilize specialized risk management software to facilitate the assessment and tracking of risks. The choice of tool depends on the organization’s size, industry, and the complexity of the risks being assessed. A simple spreadsheet might suffice for a small business, while a sophisticated software solution might be necessary for a large multinational corporation.

Application of a Risk Assessment Methodology: Hypothetical Scenario

Let’s consider a hypothetical Indonesian coffee exporter named “Java Joe’s.” They face risks related to fluctuating coffee bean prices, climate change affecting crop yields, and potential disruptions to their supply chain. Using a qualitative risk assessment approach, Java Joe’s could create a risk matrix plotting the likelihood and impact of each risk. For example, fluctuating prices might be considered high likelihood and high impact, while supply chain disruptions might be medium likelihood and medium impact. This assessment would guide Java Joe’s in developing mitigation strategies, such as hedging against price fluctuations, investing in drought-resistant coffee plants, and diversifying their supply chain. They might also explore insurance options to transfer some of the financial risks associated with crop failures.

Risk Monitoring and Reporting

Keeping a watchful eye on your risk management strategy isn’t just a good idea; it’s the difference between a smoothly sailing ship and one that’s sprung a leak (and possibly capsized in a sea of liabilities!). Effective risk monitoring and reporting are crucial for ensuring your Indonesian business stays afloat and profitable. This involves a continuous cycle of observation, analysis, and adjustment, all geared towards minimizing potential damage.

The process of monitoring and evaluating the effectiveness of risk management strategies involves a proactive, rather than reactive, approach. It’s not enough to simply create a risk register and then forget about it; it requires regular review and updating. Think of it like a gardener tending to their plants – constant attention ensures healthy growth, while neglect leads to wilting (and possibly a very sad garden). This continuous monitoring allows for timely identification of emerging risks, changes in the likelihood or impact of existing risks, and the effectiveness of implemented mitigation strategies. Regular checks ensure that the initial risk assessment remains relevant and that any necessary adjustments are made promptly. This includes tracking key risk indicators (KRIs), reviewing risk registers, and conducting regular risk reviews with relevant stakeholders. Failing to do so could lead to costly surprises and a general feeling of “oh dear, what have we done?”.

Risk Reporting to Stakeholders

Regular risk reporting is vital for maintaining transparency and accountability within an organization. It allows stakeholders – from the board of directors to individual employees – to understand the current risk landscape, the effectiveness of mitigation strategies, and any potential threats to the organization’s objectives. Imagine trying to run a marathon blindfolded; you’d probably trip over a lot of things. Similarly, without transparent risk reporting, decision-making becomes hampered and the organization is more vulnerable to unexpected events. This reporting should be tailored to the audience, providing concise and relevant information in a clear and understandable format. Regular updates, perhaps monthly or quarterly, keep everyone informed and allow for proactive adjustments. A lack of communication can breed uncertainty and even mistrust.

Effective Risk Reporting Formats in Indonesian Companies

Many Indonesian companies utilize a variety of reporting formats, often adapting them to suit their specific needs and organizational structure. Common formats include dashboards that visually represent key risk indicators, detailed reports outlining specific risks and mitigation strategies, and presentations summarizing the overall risk profile. Some companies even use interactive tools and software to allow for real-time monitoring and reporting. The key is to choose a format that is easily understandable, readily accessible, and tailored to the specific information needs of each stakeholder group. For example, a simple traffic light system (red, amber, green) might be used for the board, while a more detailed report might be provided to the risk management team.

Sample Risk Register Template

A well-designed risk register is the cornerstone of effective risk management. It serves as a central repository for all identified risks, their likelihood, impact, and mitigation strategies. Here’s a sample template suitable for Indonesian businesses:

| Risk | Likelihood (Low, Medium, High) | Impact (Low, Medium, High) |

|---|---|---|

| Supply chain disruption due to natural disasters | High | High |

| Cybersecurity breach leading to data loss | Medium | High |

| Changes in government regulations affecting operations | Medium | Medium |

| Loss of key personnel | Low | Medium |

| Fluctuations in the Rupiah exchange rate | Medium | Medium |

Case Studies of Risk Management in Indonesia

Navigating the vibrant and sometimes unpredictable landscape of Indonesian business requires a robust risk management framework. Let’s delve into some real-world examples of Indonesian organizations successfully tackling risk, showcasing both triumphs and the occasional stumble (because even the best-laid plans… you know). We’ll examine the strategies employed, the challenges overcome, and the invaluable lessons learned along the way. Prepare for a rollercoaster ride of risk management adventures!

Successful risk management in Indonesia isn’t a one-size-fits-all affair. The approaches vary significantly depending on industry, company size, and the specific risks faced. However, common threads of proactive planning, clear communication, and a willingness to adapt emerge as key success factors. The following case studies illustrate this diversity and highlight the importance of tailoring a risk management strategy to the specific context.

Bank Central Asia’s (BCA) Approach to Cybersecurity Risk

BCA, one of Indonesia’s largest private banks, faced the ever-present threat of cybersecurity breaches. Their response wasn’t just installing firewalls and hoping for the best; instead, they invested heavily in employee training, implementing multi-factor authentication, and regularly conducting penetration testing to identify vulnerabilities. This proactive approach, coupled with a robust incident response plan, allowed them to effectively mitigate potential losses and maintain customer trust. The challenge lay in keeping up with the ever-evolving threat landscape, requiring continuous investment in technology and training. Their success can be attributed to a commitment to staying ahead of the curve and a culture of cybersecurity awareness throughout the organization.

Telkomsel’s Management of Natural Disaster Risks

Operating in a geographically diverse and disaster-prone nation, Telkomsel, Indonesia’s largest mobile operator, faces significant risks from earthquakes, floods, and volcanic eruptions. Their risk management strategy centers around robust infrastructure redundancy, geographically dispersed data centers, and comprehensive disaster recovery plans. This includes pre-positioning emergency supplies and establishing clear communication protocols to ensure service continuity during emergencies. A major challenge was coordinating with local authorities and communities to ensure effective response and recovery. Their success highlights the importance of collaboration and preparedness in managing geographically specific risks.

A Small and Medium Enterprise (SME) Example: A Family-Owned Textile Business

While large corporations often have dedicated risk management teams, smaller businesses often rely on the ingenuity and resourcefulness of their owners. Consider a family-owned textile business in Yogyakarta. Facing fluctuating cotton prices, they implemented a hedging strategy, purchasing cotton futures contracts to mitigate price volatility. They also diversified their product line to reduce reliance on a single product, and developed strong relationships with their suppliers to ensure a reliable supply chain. Their success demonstrates that even with limited resources, effective risk management is achievable through careful planning and strategic partnerships. The challenge, however, was balancing the need for risk mitigation with the limitations of their financial resources.

Comparison of Approaches

The case studies reveal diverse approaches. BCA focused on technological solutions and employee training for cybersecurity, while Telkomsel prioritized infrastructure resilience and community collaboration for natural disaster management. The SME example highlights the importance of financial hedging and diversification for smaller businesses. Each approach reflects the specific risks and resources of the organization. The common thread, however, is proactive planning, continuous monitoring, and adaptability to changing circumstances.

Final Summary

So, there you have it – a whirlwind tour of Indonesia’s risk management landscape! From navigating complex legislation to mastering mitigation strategies, we’ve covered the essential elements needed to thrive in this vibrant yet challenging environment. Remember, effective risk management isn’t just about avoiding problems; it’s about seizing opportunities. By understanding and proactively addressing potential risks, Indonesian businesses can unlock their full potential and achieve remarkable success. Now go forth and conquer (responsibly, of course!).

FAQ: Risk Management Framework Indonesia

What are the common penalties for non-compliance with Indonesian risk management regulations?

Penalties vary depending on the specific regulation and severity of the violation, but can range from hefty fines to operational suspensions and even legal action. It’s best to consult legal professionals for precise details.

How often should Indonesian businesses review their risk management frameworks?

Regular reviews are crucial, ideally at least annually, or more frequently if significant changes occur within the business or its environment. Think of it like a car’s MOT – essential for continued smooth operation!

Are there specific certifications related to risk management in Indonesia?

While there isn’t one universally mandated certification, various professional bodies offer relevant qualifications that enhance credibility and demonstrate expertise. Researching options tailored to specific sectors is recommended.