Investment Tracking Tools Review: Let’s face it, managing investments can feel like navigating a minefield of spreadsheets and cryptic financial jargon. But fear not, intrepid investor! This review unveils the world of investment tracking tools, revealing how these digital saviors can transform your financial life from a chaotic mess into a beautifully organized symphony of profits (hopefully!). We’ll explore everything from the basics of tracking your stocks and bonds to the advanced features that’ll make even seasoned investors green with envy.

This comprehensive review will cover various types of investment tracking tools, from simple spreadsheets to sophisticated software, helping you determine which tool best suits your needs and investment style. We’ll analyze key features, compare user interfaces, and discuss crucial aspects like security and data privacy. Get ready to ditch the guesswork and embrace the power of organized investing!

Introduction to Investment Tracking Tools

Investing can feel like navigating a minefield blindfolded – unless you have the right tools. Investment tracking tools are your trusty compass and map in this financial wilderness, helping you monitor your portfolio’s performance and make informed decisions. They’re essentially software or applications designed to monitor and analyze your investments, providing you with a clear picture of your financial health.

Investment tracking tools offer a plethora of benefits, regardless of your experience level. For beginners, they provide a simple, organized way to keep track of even small investments, fostering good financial habits from the start. Intermediate investors can leverage more advanced features for detailed analysis and strategic planning. Advanced investors might find the tools invaluable for complex portfolio optimization and tax planning. Think of it like this: beginners get a simple ledger, intermediate investors get a spreadsheet with formulas, and advanced investors get a sophisticated financial modeling program.

Types of Investments Trackable by Investment Tracking Tools

Investment tracking tools aren’t limited to just one type of investment. Their versatility is a key strength. A wide range of asset classes can be monitored, offering a holistic view of your financial landscape. For example, you can track the performance of individual stocks, the yield on your bonds, the growth of your mutual funds, the appreciation of your real estate holdings, and even the value of alternative investments like cryptocurrency (though always proceed with caution in this volatile area). The ability to consolidate all these disparate investments into a single dashboard is a significant advantage. Imagine trying to manage all that information using spreadsheets alone – a nightmare!

Benefits for Different Investor Types

Let’s delve into the specific benefits for different investor profiles. Beginners will appreciate the simplified view of their portfolio, allowing them to easily understand their gains and losses. This fosters confidence and encourages responsible investing. Intermediate investors can benefit from features like performance analysis, allowing them to compare their returns against benchmarks and identify areas for improvement. Advanced investors can utilize advanced features like tax-loss harvesting optimization and portfolio rebalancing tools, which can significantly enhance returns and minimize tax liabilities. For example, an advanced investor might use a tool to automatically rebalance their portfolio when certain assets deviate from their target allocation, ensuring a consistent risk profile.

Key Features of Investment Tracking Tools

Investing can feel like navigating a financial jungle, but thankfully, we’ve got machetes in the form of investment tracking tools. These digital beasts tame the wildness of your portfolio, offering features that transform the process from a headache to a (relatively) painless experience. Let’s explore the key features that make these tools indispensable for the modern investor, whether you’re a seasoned pro or just starting out.

A robust investment tracking tool is more than just a pretty spreadsheet; it’s your financial command center. Essential features go beyond simply listing your holdings; they provide crucial insights and automation to streamline your investment journey.

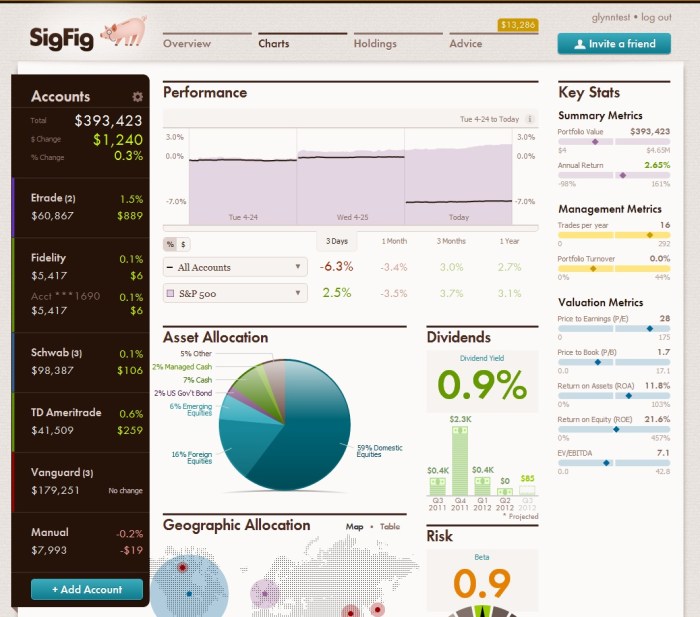

Portfolio Performance Visualization

Imagine trying to understand your investment performance by sifting through countless bank statements and brokerage confirmations. Sounds exhausting, right? Portfolio performance visualization is where the magic happens. These tools create clear, concise charts and graphs, illustrating your portfolio’s growth (or, let’s be honest, sometimes its shrinkage) over time. You can easily see which investments are performing well, which are lagging, and get a bird’s-eye view of your overall financial health. Think of it as your portfolio’s personal trainer, providing visual feedback on your progress (or lack thereof).

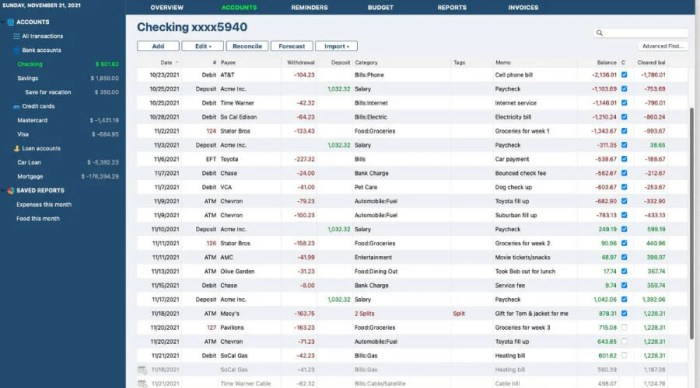

Transaction Recording

Manually recording every buy and sell transaction is a recipe for errors and frustration. Investment tracking tools automate this process, seamlessly importing data from your brokerage accounts. This eliminates the tedious task of manual entry, reducing the risk of human error and freeing up your time for more enjoyable pursuits (like daydreaming about early retirement).

Expense Tracking

Investing isn’t just about gains; it’s also about understanding the costs involved. Many tools allow you to track expenses associated with your investments, such as brokerage fees, transaction costs, and even tax implications. This detailed view of your expenses helps you make informed decisions and optimize your investment strategy. Knowing exactly where your money is going is the first step to making it work harder for you.

Tax Reporting Capabilities

Tax season is a dreaded time for many, but investment tracking tools can significantly alleviate the stress. Many tools generate reports summarizing your capital gains and losses, making tax preparation much smoother. These reports are often formatted to be easily imported into your tax software, saving you valuable time and potentially reducing the risk of costly errors. This feature alone might be worth the price of admission.

Security and Data Privacy

Protecting your financial data is paramount. Reputable investment tracking tools employ robust security measures, such as encryption and multi-factor authentication, to safeguard your sensitive information. Look for tools that comply with industry standards and have a proven track record of data security. Your peace of mind is worth more than any potential feature upgrade.

Comparison of Investment Tracking Tools

Choosing the right tool depends on your individual needs and preferences. Here’s a comparison of five popular options, highlighting key features, pricing, and user ratings (Note: Pricing and ratings are subject to change and may vary based on the specific plan and user reviews):

| Tool Name | Key Features | Pricing | User Rating (Example) |

|---|---|---|---|

| Personal Capital | Portfolio analysis, retirement planning, net worth tracking, expense tracking | Free (basic); Premium plans available | 4.5 stars |

| Mint | Budgeting, expense tracking, investment tracking, bill payment | Free | 4 stars |

| Yahoo Finance | Portfolio tracking, stock quotes, financial news | Free | 3.8 stars |

| Morningstar | Portfolio tracking, stock research, mutual fund analysis | Free (basic); Premium plans available | 4.2 stars |

| Quicken | Comprehensive financial management, including investment tracking, budgeting, and tax preparation | Paid (subscription based) | 4 stars |

Types of Investment Tracking Tools

Choosing the right investment tracking tool can feel like navigating a minefield of spreadsheets and algorithms. Fear not, intrepid investor! This section will illuminate the various types of tools available, helping you choose the perfect weapon in your financial arsenal. We’ll explore the strengths and weaknesses of each, ensuring you’re armed with the knowledge to conquer your portfolio.

Investment tracking tools come in various shapes and sizes, each with its own unique strengths and weaknesses. The best tool for you will depend on your individual needs, technical skills, and investment portfolio complexity. Let’s dive into the details!

Spreadsheet-Based Tools

Ah, the humble spreadsheet. A digital bastion of simplicity and control. Many investors swear by their trusty Excel or Google Sheets for tracking investments. While seemingly basic, they offer a surprising amount of flexibility.

- Pros: Highly customizable, free (or inexpensive), excellent for learning the fundamentals of portfolio management, allows for complex calculations and custom formulas. Examples include Microsoft Excel and Google Sheets.

- Cons: Requires manual data entry (tedious!), prone to human error, limited automatic updates, lack of sophisticated features found in dedicated software.

Dedicated Investment Tracking Software

Stepping up from spreadsheets, dedicated software packages offer a more robust and automated approach to investment tracking. These programs often boast advanced features and integrations, making them ideal for serious investors with larger portfolios.

- Pros: Automated data imports (reducing manual input), advanced charting and reporting capabilities, often includes tax reporting features, more sophisticated analysis tools. Examples include Quicken Premier and Personal Capital (for US investors).

- Cons: Typically more expensive than spreadsheets, steeper learning curve, may require specific technical skills, some programs may lack flexibility for highly customized tracking.

Mobile Apps

The modern investor is on the go, and mobile apps provide a convenient way to keep tabs on investments anytime, anywhere. These apps often offer a streamlined user experience, perfect for quick checks and updates.

- Pros: Convenient access from any mobile device, often offer push notifications for important updates, user-friendly interfaces, many offer free basic functionality. Examples include Mint, Robinhood (for US investors), and several brokerage-specific apps.

- Cons: Limited functionality compared to desktop software, potential for security concerns (depending on the app), reliance on internet connectivity, may lack advanced features for complex portfolios.

Web-Based Platforms

Web-based platforms offer a blend of the convenience of mobile apps and the power of dedicated software. They’re accessible from any device with an internet connection and often provide a wealth of features.

- Pros: Accessible from any device with internet access, usually offer a wide range of features, often include community features and educational resources, automatic updates. Examples include many brokerage platforms and dedicated investment tracking websites.

- Cons: Reliance on internet connectivity, potential security risks (similar to mobile apps), may have subscription fees, user interface can be overwhelming for beginners.

Comparative Table

Let’s summarize the key differences in a handy table. Remember, the “best” tool depends entirely on your individual needs and preferences!

| Feature | Spreadsheet | Dedicated Software | Mobile App |

|---|---|---|---|

| Cost | Low/Free | Medium/High | Low/Medium |

| Automation | Low | High | Medium |

| Features | Basic | Advanced | Limited |

| Accessibility | Desktop | Desktop | Mobile |

Choosing the Right Investment Tracking Tool

Selecting the perfect investment tracking tool is like choosing a financial superhero sidekick – you need one that complements your unique abilities and doesn’t leave you feeling more confused than before. The wrong tool can lead to more headaches than a portfolio of penny stocks, while the right one can streamline your financial life, leaving you with more time to enjoy your hard-earned gains (or strategize your next move).

Factors influencing the choice of an investment tracking tool are multifaceted and as individual as your investment strategy itself. Budget constraints, the complexity of your investments, your technical prowess (or lack thereof!), and the need for seamless integration with other financial tools all play a crucial role. Ignoring these factors can be as financially unwise as investing in a company solely based on a catchy jingle.

Budget Considerations

The cost of investment tracking tools varies wildly, from free basic options to premium services with bells and whistles that would make a Vegas casino jealous. Free tools often offer limited features, suitable for investors with simple portfolios and minimal tracking needs. Paid services, however, can provide advanced features like automated tax reporting, portfolio optimization suggestions, and even access to financial advisors, justifying the cost for more complex portfolios or investors who value convenience. Consider your investment size and the level of detail you need to track; a simple spreadsheet might suffice for a small portfolio, while a sophisticated platform is essential for a complex, diversified one.

Investment Complexity and Tool Functionality

The complexity of your investment portfolio dictates the level of sophistication required from your tracking tool. A simple portfolio consisting primarily of stocks and bonds might be adequately managed with a basic tool or even a spreadsheet. However, if your portfolio includes options, futures, real estate, or other alternative investments, you’ll need a tool capable of handling the nuances of these asset classes. For example, a tool that excels at tracking stocks might fall short when it comes to accurately calculating the returns on a complex real estate investment trust (REIT).

Technical Proficiency and User-Friendliness, Investment Tracking Tools Review

Technical skills are a significant factor. Some tools boast advanced features but come with a steep learning curve. If you’re not comfortable navigating complex interfaces or dealing with technical jargon, opt for a user-friendly tool with intuitive navigation and clear instructions. Conversely, if you’re tech-savvy, you might appreciate a tool that allows for customization and advanced analysis. Remember, the goal is efficient tracking, not a coding marathon.

Integration with Other Financial Tools

Seamless integration with other financial tools is a significant advantage. Ideally, your investment tracking tool should easily connect with your brokerage accounts, bank accounts, and tax software to automate data entry and reporting. This reduces manual data entry, minimizing errors and saving valuable time. Consider whether the tool integrates with the specific platforms you use; otherwise, you might find yourself stuck with manual data entry – a task about as enjoyable as balancing your checkbook using an abacus.

Evaluating Investment Tracking Tools

Before committing to a specific tool, thoroughly evaluate available options. Start by reading user reviews on reputable platforms like G2 or Capterra. Pay close attention to comments regarding ease of use, accuracy, customer support, and feature functionality. Next, compare the features of several tools using comparison websites or creating your own spreadsheet. Prioritize features that align with your specific needs and investment strategy. Don’t be swayed by flashy marketing; focus on practical functionality and reliability.

Illustrative Examples of Investor Tool Selection

A young investor starting with a small portfolio of index funds might find a free, basic tool like Personal Capital (free version) sufficient for their needs. A seasoned investor with a complex portfolio of stocks, bonds, real estate, and private equity might opt for a more comprehensive, paid service such as Morningstar Premium or even a professional-grade platform tailored to institutional investors. A retiree focused solely on fixed-income investments might find a simple spreadsheet or a dedicated bond tracking tool adequate for their needs. The choice ultimately depends on individual needs and resources.

Advanced Features and Integrations: Investment Tracking Tools Review

Let’s face it, basic investment tracking is for amateurs. If you’re serious about growing your wealth (and avoiding a future spent counting pennies), you need tools that go beyond simply showing you your current balance. We’re talking about features that practically manage your portfolio for you – almost. Almost being the key word, as you still need to make the actual investment decisions.

The truly impressive investment tracking tools offer a suite of advanced features designed to optimize your portfolio and simplify your financial life. These features move beyond simple record-keeping, delving into sophisticated strategies to maximize your returns and minimize your headaches. Imagine a financial assistant that’s both incredibly efficient and surprisingly witty – that’s the power we’re discussing.

Automated Portfolio Rebalancing

Automated portfolio rebalancing is a game-changer for investors who want to maintain a target asset allocation without constantly monitoring and adjusting their holdings. This feature automatically buys and sells assets to keep your portfolio aligned with your desired risk profile. For example, if your stock allocation drifts above your target percentage, the software might automatically sell some stocks and buy bonds to bring it back in line. This consistent rebalancing helps reduce emotional decision-making, a known enemy of long-term investment success. Imagine a robot diligently keeping your portfolio on track, while you focus on more important things like deciding which artisanal coffee to enjoy.

Tax-Loss Harvesting Optimization

Tax-loss harvesting is a clever strategy to offset capital gains taxes. By selling losing investments and replacing them with similar assets, investors can reduce their overall tax burden. Advanced investment tracking tools can automate this process, identifying tax-loss harvesting opportunities and executing trades to minimize your tax liability. Think of it as a sophisticated tax dodge, completely legal and perfectly optimized. A good tool will calculate the potential tax savings and help you decide if it’s worth the slight hassle. Consider a scenario where you have a loss of $5,000 in one stock and a gain of $3,000 in another. A tax-loss harvesting tool could help you sell the losing stock to offset the gain, thus lowering your tax bill.

Financial Planning Integrations

Integrating your investment tracking tool with other financial management applications can create a truly holistic view of your financial health. Linking your investment account to budgeting apps, tax software, and retirement planning tools allows for a comprehensive overview of your financial picture. This integrated approach eliminates the need for manual data entry and reduces the risk of errors. This is akin to having all your financial ducks in a perfectly organized row – a beautiful sight indeed. For example, linking your investment account to your budgeting app allows you to see how your investment income contributes to your overall financial goals.

Illustrative Examples of Investment Tracking in Action

Investment tracking tools aren’t just for Wall Street wizards; they’re for anyone who wants a clearer picture of their financial future. From the seasoned investor meticulously managing a complex portfolio to the novice carefully saving for their first home, these tools offer invaluable insights and control. Let’s peek into the lives of a few individuals and see how these tools transform their investment journeys.

Retiree Tracking Retirement Income

Let’s meet Agnes, a delightful retiree who relies on a diversified portfolio for her income. Agnes uses an investment tracking tool with strong reporting features. This allows her to easily monitor the performance of her investments across various asset classes, including bonds, dividend-paying stocks, and real estate investment trusts (REITs). The tool automatically calculates her portfolio’s total value and generates regular income reports, showing exactly how much she can safely withdraw each month without depleting her principal. This gives Agnes peace of mind, knowing she can maintain her lifestyle comfortably.

- Agnes uses the tool’s customized reporting features to create a monthly income statement, showing dividend payouts, interest earned, and rental income.

- The tool’s tax reporting functionality simplifies tax preparation, automatically categorizing investment income for easy tax filing.

- Agnes utilizes the tool’s alert system to notify her of any significant changes in her portfolio’s value or income streams, enabling proactive adjustments to her withdrawal strategy if needed.

Young Professional Tracking Growth Stocks

Meet Ben, a young professional with a keen interest in growth stocks. Ben utilizes an investment tracking tool that integrates directly with his brokerage account, providing real-time updates on his portfolio’s performance. The tool allows him to track key metrics such as price-to-earnings ratios (P/E), earnings per share (EPS), and revenue growth, helping him make informed decisions about buying, selling, and holding his investments. The tool’s charting capabilities help him visually analyze the performance of individual stocks and identify potential trends. Ben’s strategy is long-term growth, so this detailed tracking helps him to avoid impulsive decisions based on short-term market fluctuations.

- Ben leverages the tool’s portfolio allocation analysis to ensure his investments align with his risk tolerance and long-term financial goals.

- He uses the tool’s stock screening features to identify potential investment opportunities based on specific criteria, such as high growth potential and strong financial performance.

- The tool’s performance benchmarking feature allows Ben to compare his portfolio’s performance against relevant market indices, providing valuable context for his investment decisions.

A Typical Investment Tracking Tool Dashboard

Imagine a clean, uncluttered dashboard. At the top, a large, clear display shows the total portfolio value, with a percentage change from the previous day and week, displayed in a visually appealing color-coded format (green for gains, red for losses, naturally). Below this, a pie chart provides a concise overview of asset allocation, showing the percentage of the portfolio invested in different asset classes (e.g., stocks, bonds, real estate). Individual asset performance is shown in a tabular format, listing each asset, its current value, percentage change, and any upcoming dividend payments. A separate section displays recent transactions, including buy and sell orders, with dates and amounts clearly indicated. Finally, a customizable section allows the user to display key performance indicators (KPIs) relevant to their individual investment strategy. The overall design is intuitive and easy to navigate, providing a quick and comprehensive snapshot of the investor’s financial health. The colour scheme is calming – think soft greens and blues – to avoid overwhelming the user with too much visual stimulation.

Epilogue

So, there you have it – a whirlwind tour of the exciting world of investment tracking tools! From beginner-friendly apps to powerful software designed for seasoned pros, the right tool can significantly simplify your investment journey. Remember to consider your budget, investment complexity, and technical skills when making your selection. Ultimately, the goal is to find a tool that empowers you to confidently monitor, analyze, and optimize your portfolio, leading to smarter financial decisions and, dare we say it, a more relaxed you. Happy investing!

Common Queries

What if I only have a few investments? Do I still need an investment tracking tool?

Even with a small portfolio, a tracking tool can provide valuable organization and clarity, preventing oversight and simplifying tax preparation.

Are investment tracking tools secure?

Reputable tools employ robust security measures, including encryption and multi-factor authentication. However, always research a tool’s security features before entrusting your financial data.

Can I import data from my brokerage account?

Many tools offer direct import functionality from various brokerage accounts, streamlining data entry and reducing manual effort. Check the tool’s compatibility with your specific brokerage.

What about international investments?

Some tools cater specifically to international investments, offering features like multi-currency support and tax reporting for global portfolios. Be sure to check for this functionality if needed.