Financial Crisis Management Strategies are crucial for navigating the treacherous waters of economic downturn. This guide delves into the proactive identification of early warning signs, the development of robust crisis management plans, and the implementation of effective liquidity and debt management techniques. We’ll explore various risk mitigation strategies and delve into the intricacies of post-crisis recovery and restructuring, ensuring your business is not just surviving, but thriving even amidst financial turmoil. Prepare yourself for a journey through the fascinating, and sometimes terrifying, world of financial resilience!

From understanding leading indicators to negotiating with creditors, we cover the essential elements for building a financial fortress. We will illustrate real-world scenarios, offering practical advice and actionable strategies for businesses of all sizes. Whether you’re a seasoned executive or a budding entrepreneur, this comprehensive guide will equip you with the knowledge and tools necessary to confidently face any financial storm.

Identifying Early Warning Signs of a Financial Crisis

Predicting financial crises is like predicting the weather in Scotland – you can make an educated guess, but be prepared for a sudden downpour of unexpected events. However, by diligently monitoring key indicators, we can significantly improve our odds of spotting trouble brewing before it turns into a full-blown financial hurricane. This involves understanding the subtle signals the market sends before the inevitable crash.

Financial indicators, much like the clues in a particularly convoluted murder mystery, can be categorized into three main types: leading, lagging, and coincident. Leading indicators are the early birds, chirping warnings before the actual crisis hits. Lagging indicators, on the other hand, are the slowpokes, confirming the crisis *after* the damage has been done (think of them as the police arriving at the crime scene after the culprit has fled). Coincident indicators, well, they happen at the same time as the crisis, offering a real-time snapshot of the situation – a bit like watching the news report on the crisis as it unfolds.

Key Financial Indicators Preceding a Crisis

A decline in asset prices (like stocks or real estate) is often an early sign. Think of it as the canary in the coal mine – a significant drop suggests underlying problems. Rapid increases in debt levels, particularly among corporations or consumers, paint a worrying picture of over-leveraging. This is akin to building a house of cards – the higher it gets, the more precarious it becomes. A sharp rise in credit spreads, the difference between the interest rate on risky debt and safe debt, signifies growing risk aversion in the market. Investors are getting spooked, and that’s rarely a good sign. Finally, a contraction in economic activity, indicated by falling GDP growth or industrial production, is a clear sign that the economy is slowing down and potentially heading for a crisis.

Leading, Lagging, and Coincident Indicators in Financial Instability

Leading indicators, like a premonition, give us a heads-up. Examples include changes in consumer confidence, yield curves inversions (when short-term interest rates exceed long-term rates), and volatility in financial markets. Lagging indicators, sadly, only confirm what has already happened. These include things like unemployment rates, bankruptcies, and changes in the money supply. Coincident indicators, like a simultaneous explosion of fireworks, provide real-time data about the crisis itself. These include things like GDP growth, industrial production, and retail sales. Think of them as the “live” feed of the crisis.

Monitoring Financial Indicators: A Hypothetical Company Example

Let’s imagine a hypothetical company, “Acme Corp.” To monitor its financial health, Acme Corp. would follow a step-by-step process:

- Data Collection: Gather relevant financial data, both internal (sales figures, cash flow statements, debt levels) and external (interest rates, GDP growth, consumer confidence indices).

- Indicator Selection: Choose specific leading, lagging, and coincident indicators relevant to Acme Corp.’s industry and business model. For example, if Acme Corp. is in the real estate sector, they should closely monitor housing starts and property prices.

- Trend Analysis: Analyze the trends of selected indicators over time, identifying any significant deviations from historical norms or established patterns. This involves creating charts and graphs to visualize the data.

- Early Warning System: Establish thresholds or trigger points for each indicator. If an indicator crosses a pre-defined threshold, it triggers an alert, prompting further investigation and potential corrective action.

- Scenario Planning: Develop contingency plans to address potential risks identified through the monitoring process. This involves creating different scenarios based on the severity of the crisis and outlining the steps needed to mitigate the impact.

Early Warning Signs Across Different Crisis Types

| Crisis Type | Leading Indicators | Lagging Indicators | Coincident Indicators |

|---|---|---|---|

| Liquidity Crisis | Short-term borrowing difficulties, widening credit spreads, declining cash flow | Bankruptcies, asset fire sales, credit rating downgrades | Sharp decrease in liquidity, inability to meet short-term obligations |

| Solvency Crisis | Falling profitability, increasing debt-to-equity ratio, declining asset values | Defaults on debt obligations, business closures, significant job losses | Inability to meet long-term debt obligations, negative net worth |

| Systemic Crisis | Contagion effects across financial institutions, widespread loss of confidence, sharp decline in asset prices | Widespread bank failures, government intervention, deep recession | Severe market turmoil, widespread credit crunch, collapse of financial institutions |

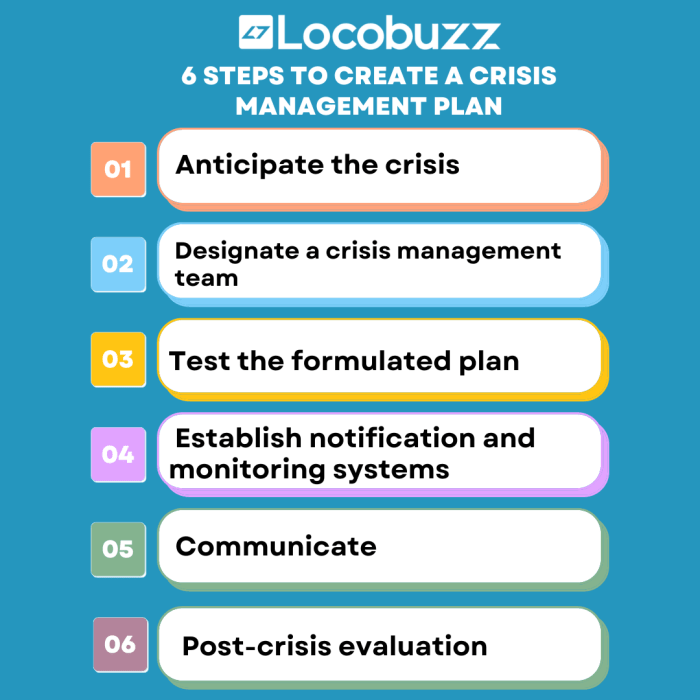

Developing a Crisis Management Plan: Financial Crisis Management Strategies

Let’s face it, nobody *wants* a financial crisis. It’s like finding a surprise spider in your perfectly organized sock drawer – unpleasant and disruptive. But just like having a plan for dealing with eight-legged intruders, a robust crisis management plan can be the difference between a minor inconvenience and a complete meltdown for your SME. This isn’t about predicting the apocalypse; it’s about proactive preparation for the unexpected bumps in the road.

A comprehensive crisis management plan for a small-to-medium-sized enterprise (SME) should be more than a dusty document gathering cobwebs in a forgotten corner. It’s a living, breathing document, regularly reviewed and updated to reflect the evolving financial landscape and the specific vulnerabilities of your business. Think of it as your financial first-aid kit, ready for any emergency.

Crisis Management Team Composition and Responsibilities

A dedicated crisis management team is not a luxury; it’s a necessity. This team acts as your financial SWAT team, each member possessing specialized skills and responsibilities to effectively tackle a crisis. A typical team might include a designated leader (often the CEO or CFO), a communications specialist, a legal representative, and a financial expert. Clear roles and responsibilities, documented in the plan itself, are crucial to prevent confusion and ensure a coordinated response. For instance, the communications specialist would be responsible for crafting and disseminating accurate and timely information to stakeholders, while the financial expert would analyze the crisis’s impact and develop mitigation strategies. The team’s effectiveness depends on clear lines of authority and a pre-established chain of command – no time for democratic debates during a financial earthquake!

Effective Communication Strategies During a Financial Crisis, Financial Crisis Management Strategies

Communication is king (or queen, or monarch of your choosing) during a financial crisis. Transparency, honesty, and speed are paramount. Imagine a situation where rumors are spreading faster than wildfire. A well-defined communication strategy ensures your message is heard loud and clear, above the din of speculation. This strategy should Artikel communication channels (e.g., email, phone calls, press releases, social media) and target audiences (employees, investors, customers, suppliers). It should also include pre-approved messaging templates to ensure consistent and accurate information dissemination, avoiding the potential for contradictory or confusing statements. Regular updates, even if the news is not entirely positive, help maintain trust and manage expectations. Think of it as damage control with a dash of proactive PR.

Potential Crisis Scenarios and Mitigation Strategies

Preparation is key to successfully navigating a financial crisis. Anticipating potential scenarios and devising corresponding mitigation strategies is essential for minimizing the impact.

- Scenario: Sudden drop in sales due to economic downturn. Mitigation: Implement cost-cutting measures, explore alternative revenue streams, renegotiate supplier contracts.

- Scenario: Loss of a major client. Mitigation: Diversify client base, proactively seek new business opportunities, strengthen existing client relationships.

- Scenario: Cyberattack leading to data breach. Mitigation: Invest in robust cybersecurity measures, develop a data breach response plan, notify relevant authorities and affected parties.

- Scenario: Liquidity crisis (insufficient cash flow). Mitigation: Secure lines of credit, explore alternative financing options, prioritize essential expenses.

- Scenario: Key personnel leaving the company. Mitigation: Develop succession plans, invest in employee training and development, foster a positive work environment.

Remember, a well-structured crisis management plan isn’t a guarantee against financial hardship, but it is your best defense against chaos. It’s a roadmap to help you navigate turbulent waters and emerge stronger on the other side.

Liquidity Management Techniques

Navigating the choppy waters of a financial downturn requires more than just a life vest; it demands a sophisticated understanding of liquidity management. Think of liquidity as your financial oxygen – essential for survival. Running out is, shall we say, less than ideal. This section will explore various techniques to ensure your business remains afloat, even when the economic tide goes out.

Maintaining sufficient liquidity during a financial crisis is paramount. It allows businesses to meet their short-term obligations, seize unexpected opportunities (because even in a crisis, some doors open!), and ultimately, survive. Failing to manage liquidity effectively can lead to insolvency, even for otherwise fundamentally sound companies. It’s like having a perfectly good car but running out of gas right before a crucial meeting – a very expensive oversight.

Short-Term and Long-Term Financing Options

Short-term financing options, like revolving credit lines and commercial paper, offer immediate relief but often come with higher interest rates. These are your emergency funds – readily available but potentially costly. Long-term financing, such as bonds and term loans, provide more stable funding but require more planning and may not be easily accessible during a crisis. Think of it as having a savings account versus a high-interest credit card: the savings account is more stable, but the credit card offers quicker access to funds in a pinch.

Assessing the Adequacy of a Company’s Liquidity Position

A company’s liquidity position is assessed through various financial ratios, primarily focusing on the current ratio (current assets/current liabilities) and the quick ratio ((current assets – inventory)/current liabilities). A healthy current ratio generally exceeds 1.5, indicating sufficient short-term assets to cover liabilities. The quick ratio, which excludes inventory (as it’s not always readily convertible to cash), provides a more conservative measure. Imagine a bakery – the current ratio includes the flour and sugar, but the quick ratio only considers the cash in the till and the readily sellable baked goods.

Emergency Funding Decision-Making Process

The following flowchart illustrates the decision-making process for accessing emergency funding:

The flowchart would visually depict a decision tree. Starting with “Liquidity Stress Detected?”, it would branch to “Yes” and “No”. The “Yes” branch would lead to a series of decisions: “Explore internal options (e.g., reducing expenses, delaying non-critical investments)?” If “Yes,” the process continues to assess the sufficiency of internal measures. If “No” or insufficient, it branches to “Explore external options (e.g., lines of credit, government assistance programs)?” Each external option would have a sub-branch evaluating feasibility and cost. The “No” branch from the initial question would simply indicate “Continue monitoring.” The flowchart visually represents a structured approach to managing liquidity issues.

Debt Management Strategies

Navigating the treacherous waters of a financial crisis often involves a delicate dance with creditors. Think of it as a high-stakes poker game, where your chips are your assets, and your bluffs are… well, let’s just say they need to be carefully considered. Effective debt management is crucial for survival, and the strategies employed can significantly impact the outcome.

Debt management during a financial crisis requires a proactive and strategic approach. Ignoring the problem only exacerbates it, like ignoring a leaky faucet until your house floods. A well-defined plan, coupled with clear communication and negotiation, can significantly improve your chances of weathering the storm.

Negotiating with Creditors

Negotiating with creditors during a financial crisis is a delicate art, requiring a blend of firmness and diplomacy. It’s about finding common ground, not engaging in a shouting match. The goal is to reach an agreement that is mutually beneficial, allowing you to manage your debt while preserving your creditor’s interests. This often involves presenting a realistic plan for repayment, demonstrating your commitment to resolving the situation, and potentially offering concessions such as extending repayment terms or reducing interest rates. For example, a business might negotiate a temporary reduction in loan repayments with its bank, providing a detailed forecast showing a return to profitability within a specific timeframe. A successful negotiation hinges on providing credible evidence of your ability to eventually meet your obligations.

Debt Restructuring Options and Implications

Several debt restructuring options exist, each with its own implications. One common approach is debt consolidation, combining multiple debts into a single loan with potentially lower interest rates. This simplifies repayment and can offer psychological relief, but it’s crucial to carefully evaluate the terms of the new loan to ensure it truly offers long-term benefits. Another option is debt settlement, where you negotiate with creditors to pay a lump sum less than the total amount owed. This can significantly reduce your debt burden but may negatively impact your credit score. Finally, bankruptcy, while a last resort, remains a legal option for individuals and businesses overwhelmed by debt. It provides a fresh start, but carries significant long-term consequences. The choice of restructuring method depends on the specific circumstances, the nature of the debt, and the individual’s financial situation. For instance, a small business might choose debt consolidation to streamline its payments, while an individual with overwhelming medical debt might explore debt settlement or, in extreme cases, bankruptcy.

Factors to Consider When Choosing Between Debt Consolidation and Liquidation

The decision to consolidate debt or pursue liquidation is a critical one, requiring a thorough assessment of the financial landscape. Debt consolidation, as previously mentioned, simplifies repayment but might not address the underlying issues contributing to the debt. Liquidation, on the other hand, involves selling assets to pay off debts. This can provide immediate relief but results in the loss of valuable assets. Factors to consider include the amount of debt, the value of assets, the potential for future income, and the long-term financial goals. A business facing insolvency might weigh the potential benefits of asset liquidation against the possibility of negotiating a debt restructuring plan with creditors to maintain operations. Similarly, an individual might choose debt consolidation if they have a stable income and believe they can manage the consolidated debt, while liquidation might be a necessary option if they lack sufficient income and their assets exceed their liabilities.

Maintaining Positive Relationships with Lenders and Investors

Maintaining a healthy relationship with lenders and investors is paramount, even during challenging times. Open and honest communication is key. Regular updates on your financial situation, even if negative, can build trust and foster cooperation. Proactive engagement, demonstrating a commitment to resolving the situation, is crucial. It’s about building a collaborative relationship, not a confrontational one. This approach can often lead to more favorable terms and increased support during times of crisis. A company diligently reporting its financial performance to its investors, even when facing temporary setbacks, will likely maintain a stronger relationship and access to future funding compared to a company that avoids communication. Similarly, an individual consistently communicating with their lenders about their financial difficulties can often negotiate more favorable repayment plans.

Risk Mitigation and Prevention

Proactive risk management isn’t just a good idea; it’s the difference between a smoothly sailing financial ship and one that’s sprung a leak (and possibly sinking faster than a lead balloon). Ignoring potential financial hazards is like playing financial Russian roulette – eventually, you’ll lose. A robust risk mitigation strategy is your financial life raft, ensuring your business stays afloat even in the choppiest of economic waters.

A proactive approach to risk management involves anticipating potential problems before they materialize, rather than reacting after the damage is done. This prevents costly and time-consuming damage control, allowing for a more stable and predictable financial future. Think of it as preventative maintenance for your financial engine – much cheaper than a complete overhaul!

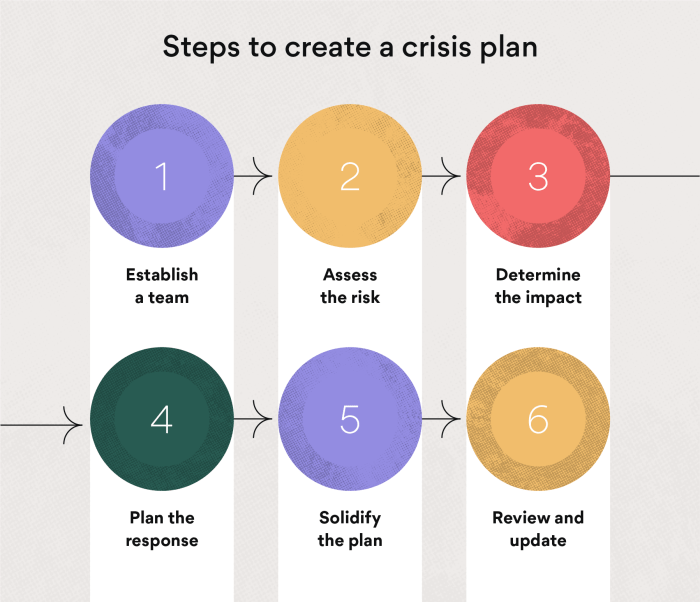

Framework for Identifying, Assessing, and Mitigating Financial Risks

A comprehensive framework for managing financial risks requires a systematic approach. First, you need to identify potential risks. Then, you assess the likelihood and potential impact of each risk. Finally, you develop and implement mitigation strategies to reduce the likelihood or impact of these risks. This process should be iterative, regularly reviewed and updated to reflect changing circumstances and new information. Think of it as a financial health check-up – regular and thorough.

Types of Financial Risk and Their Impact

Financial risks come in various flavors, each with its own unique set of challenges. Market risk, for example, encompasses the potential for losses due to fluctuations in market prices, such as interest rates, exchange rates, or equity prices. A sudden drop in the stock market could significantly impact a company’s portfolio. Credit risk, on the other hand, involves the possibility of borrowers defaulting on their loans or obligations. This can lead to substantial financial losses for lenders. Operational risk refers to the potential for losses due to failures in internal processes, people, or systems. A major IT failure, for example, could disrupt operations and lead to significant losses. Each risk type requires a tailored mitigation strategy.

Risk Mitigation Techniques

The best risk mitigation strategy is context-dependent. However, here are some common techniques categorized by risk type:

Market Risk Mitigation: Effective market risk mitigation requires a deep understanding of market dynamics and the ability to anticipate potential shifts.

- Diversification: Don’t put all your eggs in one basket. Spreading investments across different asset classes reduces the impact of any single market downturn.

- Hedging: Using financial instruments like derivatives to offset potential losses from adverse market movements. For example, buying put options to protect against stock price declines.

- Scenario Planning: Developing different scenarios (best, worst, and most likely) to assess the potential impact of various market conditions on the business.

Credit Risk Mitigation: Minimizing credit risk involves carefully assessing the creditworthiness of borrowers and implementing appropriate controls.

- Credit Scoring: Using statistical models to assess the creditworthiness of potential borrowers.

- Collateral: Requiring borrowers to provide collateral to secure loans, reducing the lender’s exposure to loss.

- Diversification of Lending Portfolio: Spreading loans across various borrowers and industries to reduce the impact of defaults.

Operational Risk Mitigation: Reducing operational risk requires a focus on robust internal controls and procedures.

- Redundancy: Having backup systems and processes in place to ensure business continuity in case of failures.

- Employee Training: Ensuring employees are properly trained and understand their roles and responsibilities.

- Regular Audits: Conducting regular audits to identify and address potential weaknesses in internal controls.

Post-Crisis Recovery and Restructuring

Recovering from a financial crisis is like emerging from a particularly aggressive game of financial whack-a-mole – exhausting, but ultimately, you can win. The key is a well-structured plan that addresses both the immediate bleeding and the long-term health of the business. This isn’t about simply patching holes; it’s about building a stronger, more resilient organization.

The process of post-crisis recovery and restructuring involves a multi-faceted approach, demanding careful assessment, decisive action, and a dash of optimism (because let’s face it, optimism is essential when staring down a mountain of debt). It’s a journey, not a sprint, and each step is crucial to a successful outcome.

Steps Involved in Recovering from a Financial Crisis

The initial phase focuses on stabilization – stemming the losses and securing short-term funding. This might involve negotiating with creditors for payment extensions or exploring government assistance programs. Next, a thorough assessment of the business’s assets, liabilities, and operational efficiency is necessary to identify areas for improvement and cost reduction. This often involves painful but necessary decisions like streamlining operations or divesting non-core assets. Finally, the business needs to develop a robust plan for future growth, focusing on sustainable revenue streams and improved profitability. Think of it as rebuilding the foundation before constructing a new, stronger structure.

Financial Restructuring Methods

Financial restructuring involves reorganizing a company’s debt and capital structure to improve its financial health. Several methods exist, each tailored to the specific circumstances. Debt refinancing, for example, involves replacing existing debt with new debt at more favorable terms. Debt consolidation combines multiple debts into a single loan, simplifying repayment and potentially lowering interest rates. Debt reduction, often achieved through asset sales or cost-cutting measures, aims to decrease the overall debt burden. Finally, bankruptcy, while a last resort, can provide a structured framework for debt repayment and business reorganization, offering a chance for a fresh start. The choice of method depends on the severity of the crisis and the company’s specific situation.

Examples of Successful Business Turnarounds

Many companies have successfully navigated financial crises. Ford Motor Company, for example, faced significant challenges during the 2008 financial crisis but implemented cost-cutting measures, streamlined operations, and invested in fuel-efficient vehicles, ultimately achieving a remarkable turnaround. Similarly, Chrysler, after declaring bankruptcy, successfully restructured its operations and emerged as a stronger, more competitive automaker through a strategic alliance with Fiat. These examples highlight the importance of decisive leadership, strategic planning, and adaptability in overcoming financial distress.

Assessing the Long-Term Impact of a Financial Crisis

The aftermath of a financial crisis requires a long-term perspective. A comprehensive analysis should assess the impact on various aspects of the business, including market share, brand reputation, customer relationships, and employee morale. Key performance indicators (KPIs) should be carefully monitored to track progress and identify any lingering issues. The crisis may necessitate changes to the business strategy, potentially requiring diversification of revenue streams or expansion into new markets. Long-term financial planning becomes even more crucial, emphasizing sustainable growth and risk mitigation to prevent future crises. Regular stress testing of the financial model can help identify potential vulnerabilities and allow for proactive mitigation strategies. Essentially, it’s about learning from the past to build a more resilient future.

Illustrating Financial Crisis Scenarios

Let’s face it, financial crises aren’t exactly known for their lightheartedness. But to understand them, we need to explore some hypothetical – and, let’s be honest, slightly melodramatic – scenarios. Think of it as a financial thriller, except instead of explosions, we have plummeting stock prices.

A hypothetical scenario involving a large multinational corporation, “GlobCorp,” perfectly illustrates the cascading effects of a financial crisis. Imagine GlobCorp, a seemingly invincible titan of industry, heavily reliant on short-term debt to finance ambitious expansion projects. Suddenly, a global economic downturn hits, drying up credit markets. The initial impact is a sharp decline in sales and profits, making it difficult for GlobCorp to meet its debt obligations. Credit rating agencies downgrade GlobCorp’s creditworthiness, leading to higher borrowing costs. As panic sets in, investors flee, causing a further drop in the company’s stock price. GlobCorp, once a symbol of success, is now teetering on the brink of collapse. Suppliers cut off credit lines, fearing non-payment. Ultimately, GlobCorp is forced to seek emergency government assistance or face bankruptcy. This domino effect highlights the interconnectedness of the financial system and the speed at which a crisis can unravel a seemingly stable entity.

A Visual Representation of GlobCorp’s Deteriorating Financial Health

Imagine a graph charting GlobCorp’s key financial indicators. The x-axis represents time, showing the progression of the crisis. The y-axis displays various metrics: stock price, credit rating, debt-to-equity ratio, and cash flow. Initially, all indicators are trending upwards, showcasing GlobCorp’s robust performance. However, as the crisis unfolds, the lines begin to plummet. The stock price dives sharply, mirroring investor panic. The credit rating falls from AAA to junk status, represented by a dramatic downward slope. The debt-to-equity ratio skyrockets, illustrating the increasing financial leverage and risk. Cash flow turns negative, indicating GlobCorp’s inability to generate sufficient funds to cover its obligations. The visual representation would dramatically showcase the rapid deterioration of GlobCorp’s financial health, a clear visual metaphor for the company’s impending doom. It’s a financial horror movie, but without the popcorn.

A Visual Representation of a Successful Recovery from a Financial Crisis

Now, let’s paint a more optimistic picture. This visual representation charts the recovery of “ResilientCo,” a company that navigated a similar crisis but emerged victorious. The graph, similar to the previous one, shows the same key financial indicators over time. Initially, the lines show a sharp decline, mirroring the initial impact of the crisis. However, as ResilientCo implements its crisis management plan, the downward trend begins to slow. The implementation of cost-cutting measures, asset sales, and debt restructuring is reflected in the gradual stabilization of the debt-to-equity ratio and improved cash flow. A successful negotiation with creditors leads to a slight improvement in the credit rating. Most importantly, as investor confidence returns, the stock price begins to recover, although not immediately reaching its pre-crisis peak. The visual narrative illustrates the resilience of ResilientCo and highlights the effectiveness of a well-executed crisis management plan. It’s a financial comeback story – think Rocky, but with spreadsheets.

Concluding Remarks

Mastering Financial Crisis Management Strategies isn’t just about surviving a financial crisis; it’s about transforming challenges into opportunities. By proactively identifying risks, developing robust plans, and implementing effective mitigation strategies, businesses can not only weather the storm but emerge stronger and more resilient. Remember, preparation is key – the time to plan is *before* the crisis hits. So, arm yourself with knowledge, build your strategies, and face the future with confidence. The financial world may be unpredictable, but your preparedness doesn’t have to be.

Clarifying Questions

What is the difference between a liquidity crisis and a solvency crisis?

A liquidity crisis refers to a short-term inability to meet immediate financial obligations, while a solvency crisis indicates a long-term inability to meet debts and obligations.

Can insurance policies help mitigate financial risks?

Yes, various insurance policies, such as business interruption insurance or credit insurance, can help mitigate specific financial risks, providing a financial safety net during crises.

What role does communication play in crisis management?

Open and transparent communication with stakeholders (employees, investors, creditors) is vital during a crisis. Honest communication builds trust and helps manage expectations.

How can a company assess its long-term financial health after a crisis?

Post-crisis assessment involves analyzing key financial ratios, cash flow projections, and market conditions to determine the long-term viability and stability of the business.