Financial Advisor Services Review: Embark on a hilarious yet informative journey into the sometimes bewildering world of financial advisors! We’ll dissect everything from choosing the right advisor (avoiding those who only speak in jargon) to understanding their often-cryptic fee structures. Prepare for a rollercoaster of knowledge, peppered with enough wit to keep you awake, even if your portfolio isn’t.

This review explores the diverse landscape of financial advisory services, from the meticulously crafted investment strategies of seasoned professionals to the surprisingly effective (and sometimes surprisingly hilarious) algorithms of robo-advisors. We’ll examine the qualifications, certifications, and potential pitfalls, providing you with the tools to navigate this complex world with confidence – and maybe even a chuckle or two. After all, who says managing your finances can’t be entertaining?

Defining Financial Advisor Services: Financial Advisor Services Review

Navigating the world of personal finance can feel like traversing a particularly treacherous jungle – filled with thorny tax codes, unpredictable market swings, and the ever-present threat of unforeseen expenses. Fortunately, there are skilled guides to help you machete your way through this financial wilderness: financial advisors. But what exactly *do* they do, and how do you choose the right one for your unique needs? Let’s unravel the mysteries.

Financial advisor services encompass a broad spectrum of assistance designed to help individuals and families achieve their financial goals. This often includes, but is certainly not limited to, investment management (helping you grow your money wisely), financial planning (creating a roadmap for your financial future), tax planning (minimizing your tax burden legally, of course!), retirement planning (securing your golden years, or at least your slightly tarnished silver ones), and estate planning (making sure your hard-earned wealth goes where you intend it to). Think of them as your financial Sherpas, leading you towards the summit of financial success (or at least a comfortable base camp).

Types of Financial Advisors and Their Fee Structures

The financial advisory world isn’t a monolith; advisors employ different approaches and charge different fees. Understanding these differences is crucial to finding the right fit. Choosing a financial advisor is like choosing a tailor – you want someone who understands your specific needs and can create a bespoke financial plan.

- Fee-Only Advisors: These advisors charge a flat fee or an hourly rate for their services. Transparency is their middle name. No hidden commissions or kickbacks here. Think of them as the honest, straightforward tailors of the financial world.

- Commission-Based Advisors: These advisors earn commissions based on the financial products they sell you. While this can be a cost-effective approach if they recommend products that align with your needs, it’s crucial to be aware of potential conflicts of interest. Imagine them as the slightly less scrupulous tailors, who might subtly encourage you to buy more fabric than you actually need.

- Hybrid Advisors: These advisors combine elements of both fee-only and commission-based models. They might charge a fee for financial planning and then earn commissions on investment products. This is like having a tailor who charges a flat fee for the design but then earns commission on the fabric.

Financial Advisor Qualifications and Certifications

Choosing a qualified advisor is paramount. Several prestigious certifications signal a high level of expertise and ethical commitment. While these certifications don’t guarantee success, they significantly increase the likelihood of a positive experience. Think of them as the gold stars on a tailor’s certificate of merit.

| Certification | Description | Requirements | Benefits |

|---|---|---|---|

| Certified Financial Planner (CFP) | A comprehensive certification covering all aspects of financial planning. | Rigorous education, examination, experience, and ethical requirements. | Demonstrates a high level of competency and commitment to ethical practice. |

| Chartered Financial Analyst (CFA) | Focuses on investment management and analysis. | Extensive coursework, examinations, and professional experience. | Indicates expertise in investment management and portfolio construction. |

| Chartered Financial Consultant (ChFC) | A broad certification covering various aspects of financial planning, with a strong emphasis on insurance and estate planning. | Specific coursework, examinations, and experience requirements. | Highlights expertise in insurance and estate planning strategies. |

Client Needs and Expectations

Choosing a financial advisor is a big decision, akin to selecting a captain for your financial ship. You wouldn’t trust just anyone to navigate the treacherous waters of investments, retirement planning, and estate management, would you? Understanding client needs and expectations is therefore paramount to finding the right match – a financial advisor who speaks your language (financially speaking, of course!).

Clients consider a variety of factors when selecting a financial advisor. It’s not simply about finding someone who’s good with numbers; it’s about finding a trusted partner who understands their unique circumstances and goals. This involves considering factors like experience, expertise, fees, communication style, and overall compatibility. The perfect advisor is more than just a number cruncher; they’re a financial sherpa guiding you towards your financial summit.

Client Profiles and Financial Needs

Different life stages and financial situations demand different approaches to financial planning. Young professionals, for example, might prioritize debt management and building a solid financial foundation for the future, perhaps focusing on saving for a down payment on a house or investing for long-term growth. Retirees, on the other hand, are concerned with income generation, managing healthcare costs, and preserving their assets for future generations. High-net-worth individuals (HNWIs) often have complex financial situations requiring sophisticated strategies for wealth preservation, tax optimization, and philanthropic endeavors. Think of it like this: a young professional needs a financial trainer, a retiree needs a financial pensioner (in the best possible way!), and an HNWI requires a financial orchestra conductor.

Client Onboarding Process Flowchart

Imagine the client onboarding process as a well-oiled machine, smoothly guiding new clients through the initial stages of their financial journey. The following flowchart depicts a simplified but effective process:

[Descriptive Flowchart]

The flowchart begins with the initial consultation, where the client’s needs and goals are assessed. This is followed by a comprehensive financial planning analysis, where the advisor gathers relevant information and develops a personalized plan. Next comes the presentation of the financial plan, followed by the client’s review and approval. Finally, the implementation phase begins, with ongoing monitoring and adjustments as needed. Think of it as a carefully choreographed dance, with each step leading seamlessly to the next. The advisor is the lead dancer, guiding the client through the steps towards their financial goals.

Review Platforms and Resources

Navigating the world of financial advisors can feel like traversing a dense jungle – full of potential riches, but also lurking dangers. Thankfully, unlike actual jungles, we have the internet! Finding the right advisor requires careful research, and luckily, there are plenty of online resources to help you avoid becoming the latest victim of a financial advisor’s questionable investment strategies (we’ve all seen those infomercials, haven’t we?).

Online platforms offer a wealth of information, allowing you to compare advisors, read reviews, and get a feel for their approach before even picking up the phone. This pre-screening process is crucial, saving you time and potentially a lot of heartache (and money). Think of it as your financial due diligence, but with less paperwork and more user-friendly interfaces.

Reputable Online Platforms and Resources

Several reputable websites provide comprehensive information and reviews on financial advisors. These platforms often allow users to filter advisors based on location, specialization (retirement planning, estate planning, etc.), and fee structures. This makes the search process much more efficient than simply relying on word-of-mouth, which, let’s be honest, can be about as reliable as a three-legged stool. Remember, a good review site will offer a diverse range of perspectives, preventing you from being swayed by overly positive (or negative) reviews.

- BrokerCheck: Operated by the Financial Industry Regulatory Authority (FINRA), BrokerCheck provides background information on brokers and investment advisors, including disciplinary actions and customer complaints. It’s like the financial equivalent of a background check – essential for peace of mind.

- The Advisor Perspectives Website: This site offers independent research and analysis on various financial advisory firms, helping you compare their services and performance. It’s a more analytical approach, perfect for those who prefer data-driven decisions.

- NerdWallet: While not exclusively focused on financial advisors, NerdWallet provides reviews and comparisons of various financial products and services, including advisors. Their user-friendly interface makes it a good starting point for beginners.

Evaluating Online Reviews: Criteria for Assessment

Reading reviews is like reading tea leaves – you need to know how to interpret the patterns. Not all reviews are created equal; some are glowing endorsements from friends and family, while others might be fueled by a particularly bad experience (and a whole lot of caffeine). Consider these factors when assessing online reviews:

- Reviewer Credibility: Look for reviews from verified users who provide specific details about their experience. Vague, generic reviews are less helpful than those that highlight specific instances of excellent (or terrible) service.

- Potential Biases: Be aware that reviews can be biased. Extremely positive reviews might be fake, while overly negative reviews could stem from unrealistic expectations or personal conflicts. Look for a balance of positive and negative feedback to get a more holistic view.

- Review Date: Older reviews may not reflect the advisor’s current practices. Focus on more recent reviews to gauge their current performance and client satisfaction levels.

- Consistency of Feedback: Do multiple reviewers mention similar positive or negative aspects of the advisor’s service? Consistent feedback across several reviews is a strong indicator of the advisor’s true character (or lack thereof).

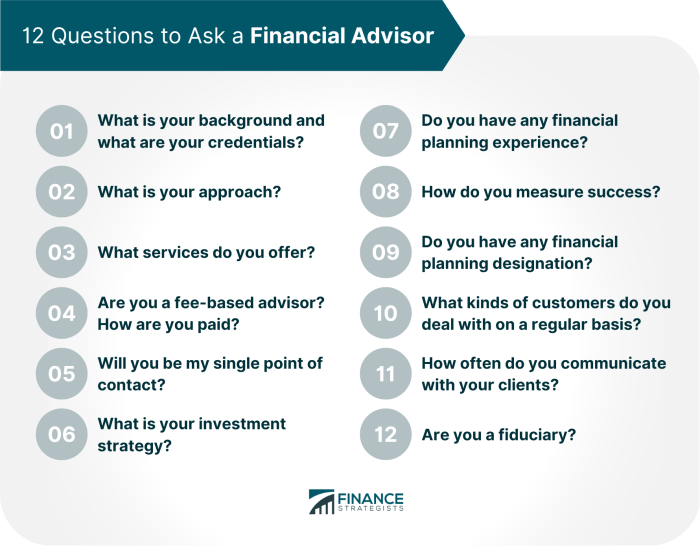

Questions to Ask Potential Financial Advisors

The initial consultation is your opportunity to grill your potential financial advisor. Don’t be shy! Ask tough questions to ensure they’re the right fit for your needs and investment goals. Remember, this is a partnership, and a good advisor will be happy to answer all your questions (and then some).

- Fee Structure Transparency is Emphasized: Advisors should clearly explain their fees, including any commissions, advisory fees, or other charges. Hidden fees are a major red flag.

- Investment Philosophy and Strategy is Discussed: Advisors should articulate their investment philosophy and how it aligns with your risk tolerance and financial goals. Avoid advisors who promise unrealistic returns.

- Client References are Provided: Reputable advisors will be happy to provide references from satisfied clients. Speaking with past clients can provide valuable insights into their experience.

- Regulatory Compliance is Confirmed: Ensure the advisor is properly licensed and registered with the relevant regulatory bodies. This verifies their legitimacy and protects you from potential scams.

- Conflict of Interest Policies are Reviewed: A good advisor will disclose any potential conflicts of interest, ensuring transparency and building trust.

Service Quality and Performance Metrics

Measuring the success of a financial advisor is less about predicting the future (unless you’re a time-traveling Nostradamus with a brokerage account) and more about consistently delivering on promises. It’s a delicate dance between achieving financial goals and maintaining a client’s sanity – a feat worthy of a standing ovation, frankly. Let’s delve into the metrics that separate the financial wizards from the… well, less wizardly.

Key performance indicators (KPIs) for financial advisors aren’t just numbers on a spreadsheet; they’re the heartbeat of a successful advisory practice. They provide a clear picture of performance, allowing for adjustments and celebrations (the champagne is always on ice, right?). These metrics provide both a quantitative and qualitative assessment, allowing for a holistic view of service quality.

Key Performance Indicators (KPIs) for Financial Advisors

Several key performance indicators are crucial for evaluating a financial advisor’s success. These metrics paint a comprehensive picture of their performance, helping to identify areas of strength and weakness. Ignoring them is like navigating a financial ocean without a map – potentially disastrous!

- Return on Investment (ROI): This classic metric measures the profitability of investments, indicating how effectively the advisor manages client portfolios. A higher ROI generally signifies better performance, though it must be considered in the context of risk tolerance.

- Portfolio Volatility: Measuring the fluctuations in a portfolio’s value over time. Lower volatility generally indicates a more stable investment strategy, although it might mean lower potential returns. It’s all about finding the sweet spot between risk and reward.

- Client Retention Rate: This measures the percentage of clients who remain with the advisor over a specific period. High retention suggests strong client relationships and satisfaction with the advisor’s services. A high retention rate speaks volumes about the quality of the service and the advisor-client bond.

- Client Acquisition Cost (CAC): This indicates the expense of acquiring a new client. A lower CAC suggests efficient marketing and outreach strategies, which contribute to the financial health of the practice.

- Net Promoter Score (NPS): This measures client loyalty and willingness to recommend the advisor’s services. A higher NPS signifies higher client satisfaction and positive word-of-mouth marketing – invaluable for growth.

Methods for Assessing Investment Portfolio Performance

Evaluating the performance of investment portfolios requires a multifaceted approach, going beyond simply looking at the final numbers. It’s about understanding the strategy, the risks taken, and the overall alignment with client goals. Think of it as a financial detective story – uncovering the clues to success (or uncovering areas for improvement).

- Benchmarking: Comparing portfolio performance against relevant market indices (like the S&P 500) to determine whether the advisor’s strategies outperformed or underperformed the market. This provides context for the results.

- Sharpe Ratio: This measures risk-adjusted return, considering the portfolio’s volatility in relation to its returns. A higher Sharpe ratio suggests better risk-adjusted performance.

- Alpha and Beta: Alpha represents the excess return generated by the advisor’s investment strategy compared to the benchmark. Beta measures the portfolio’s volatility relative to the market; a beta of 1 indicates that the portfolio moves in line with the market.

- Portfolio Turnover Rate: This shows how frequently the advisor buys and sells assets within the portfolio. High turnover can indicate active management, but also potentially higher transaction costs.

Measuring Client Satisfaction

Happy clients are the lifeblood of any successful financial advisory practice. Measuring their satisfaction goes beyond simply asking, “Are you happy?” It requires a more nuanced approach, utilizing various methods to gain a comprehensive understanding of their experience.

- Surveys and Feedback Forms: These provide direct feedback from clients regarding their experiences with the advisor’s services. Structured questionnaires allow for quantifiable data, while open-ended questions allow for more qualitative insights.

- Client Reviews and Testimonials: Online reviews and testimonials offer valuable insights into client satisfaction. Positive reviews can enhance the advisor’s reputation and attract new clients, while negative reviews provide opportunities for improvement.

- Regular Client Meetings and Communication: Maintaining open communication with clients and proactively addressing concerns fosters strong relationships and helps identify potential issues before they escalate.

- Client Retention Rate (as mentioned above): A high client retention rate is a strong indicator of client satisfaction, suggesting clients are pleased with the advisor’s services and value the relationship.

Potential Risks and Challenges

Choosing a financial advisor is a big decision, akin to selecting a captain for your financial ship. While a skilled advisor can navigate you to prosperity, unforeseen storms – in the form of risks and challenges – can arise. Understanding these potential pitfalls is crucial to ensuring a smooth and successful financial voyage.

Navigating the world of financial advice requires awareness of inherent risks. These risks aren’t necessarily indicators of malpractice, but rather inherent complexities within the financial landscape and the advisor-client relationship itself. Failing to understand these potential challenges can lead to unexpected outcomes, potentially jeopardizing your financial well-being.

Conflicts of Interest and Fiduciary Responsibilities

Financial advisors, like all humans, are susceptible to conflicts of interest. These conflicts can arise when an advisor’s personal gain might influence their recommendations. For instance, an advisor might recommend a specific investment product that generates a higher commission for them, even if a different, less lucrative option might be better suited for the client’s needs. The concept of “fiduciary duty” is paramount here. A fiduciary is legally obligated to act in the best interest of their client, placing the client’s needs above their own. However, not all advisors operate under a fiduciary standard. Understanding the difference is crucial. For example, a broker might offer advice but isn’t legally bound to act as a fiduciary, whereas a Registered Investment Advisor (RIA) typically is.

Due Diligence in Advisor Selection

Choosing a financial advisor requires thorough due diligence, similar to purchasing a significant asset. Don’t rush into a relationship; take your time to investigate. Check their credentials, experience, and disciplinary history. Look for advisors who are registered with relevant regulatory bodies, and scrutinize their fee structures for hidden charges or excessive commissions. Websites like the SEC’s Investment Advisor Public Disclosure (IAPD) database offer valuable information to aid in your research. Consider seeking multiple opinions before making a commitment. Remember, the right advisor will understand your needs, communicate clearly, and be willing to answer your questions thoroughly.

Legal and Regulatory Frameworks

The financial advisory industry operates under a complex web of laws and regulations designed to protect investors. These regulations vary by jurisdiction and the type of advisor. Key legislation in the United States includes the Investment Advisers Act of 1940, which governs investment advisors, and the Securities Exchange Act of 1934, which regulates brokers and dealers. These laws aim to ensure transparency, prevent fraud, and maintain ethical standards within the industry. Understanding the regulatory landscape empowers clients to hold their advisors accountable and navigate the system effectively. Ignoring these frameworks can leave you vulnerable to unscrupulous practices. Knowing the basics protects your interests and helps you ask the right questions.

Illustrative Case Studies

Case studies offer a fascinating glimpse into the often-chaotic, sometimes hilarious, world of financial advising. They illustrate both the triumphs and the tribulations, reminding us that even the most meticulously crafted financial plan can encounter unexpected market gyrations (or, let’s be honest, client-induced hiccups).

Positive Client-Advisor Relationship: The Case of Penelope and Prudence, Financial Advisor Services Review

Penelope, a successful but slightly disorganized entrepreneur, approached Prudence, a financial advisor known for her calm demeanor and uncanny ability to decipher even the most baffling tax codes. Penelope’s goal was simple: financial freedom before 50, a seemingly audacious target given her penchant for impulsive Etsy purchases. Prudence, however, saw potential. She developed a meticulously crafted plan, incorporating a diversified investment portfolio, a strict budgeting system (with a small “fun fund” cleverly integrated), and regular check-ins to ensure Penelope stayed on track. The results were remarkable. Penelope, surprisingly disciplined, stuck to the plan. Her investments performed well, exceeding expectations, and she achieved her goal of financial freedom three years ahead of schedule. This success wasn’t solely due to market performance; Prudence’s consistent guidance and support were instrumental in keeping Penelope focused and motivated. The relationship was a testament to the power of clear communication, trust, and a shared vision.

Negative Client-Advisor Relationship: The Case of Barnaby and the Bear Market

Barnaby, a nervous investor, approached a financial advisor who promised quick riches with high-risk investments. Barnaby’s goal was simple: to double his savings in a year. The advisor, however, lacked transparency and failed to adequately assess Barnaby’s risk tolerance. The strategy involved highly speculative investments, ignoring Barnaby’s aversion to volatility. Predictably, the market took a downturn, resulting in significant losses for Barnaby. The advisor’s communication was poor, offering little explanation or support during the market dip. Barnaby felt abandoned and betrayed, losing not only money but also trust in the financial advisory industry. This case study highlights the critical importance of matching investment strategies with client risk profiles and maintaining open communication throughout the investment process. It serves as a stark reminder that the promise of quick riches often comes with considerable risk, and a lack of transparency can be devastating.

Future Trends in Financial Advisor Services

The financial advisory landscape is undergoing a seismic shift, driven by technological advancements, evolving client expectations, and a rapidly changing regulatory environment. It’s less a gentle ripple and more a tsunami of innovation, leaving some advisors clinging to the shore while others ride the wave to success. Buckle up, because the future is both exciting and potentially terrifying.

The rise of technology is arguably the most significant trend reshaping the industry. This isn’t just about using spreadsheets more efficiently; it’s about a fundamental reimagining of how financial advice is delivered and consumed. From robo-advisors managing portfolios to AI-powered chatbots answering client queries, technology is changing the game, and not always in a way that’s immediately obvious.

The Increasing Influence of Technology and Robo-Advisors

The integration of technology, particularly artificial intelligence (AI) and machine learning (ML), is revolutionizing how financial advisors operate and interact with clients. Robo-advisors, automated portfolio management systems, are becoming increasingly popular, especially among younger, tech-savvy investors seeking low-cost, efficient investment solutions. While robo-advisors excel at managing basic portfolios, human advisors still hold a crucial role in providing personalized financial planning, complex tax strategies, and navigating life’s unpredictable events – like unexpectedly winning the lottery (we can only dream!). The future likely involves a hybrid model, leveraging technology for efficiency while retaining the human touch for complex situations. For example, Fidelity’s offering combines robo-advisory tools with access to human financial advisors, catering to a broad spectrum of client needs and technological comfort levels. This blended approach seems poised to dominate the market.

Predictions for the Future of Financial Advisor Services

Demographic shifts, particularly the aging population and the growing millennial and Gen Z investor base, are creating new demands for financial services. The increasing need for retirement planning and wealth management services will drive demand for specialized advisors. Regulatory changes, such as increased transparency and stricter compliance requirements, will also influence the industry. For instance, the SEC’s ongoing focus on fiduciary duty will likely lead to more advisors adopting a fiduciary standard, prioritizing client interests above all else – a move that, while ethically sound, may require adjustments to business models. Predicting the future is a risky business, but we can reasonably expect a continued rise in fee-based advisory models, a greater emphasis on holistic financial planning (considering everything from investments to estate planning), and a stronger focus on personalized, client-centric services.

Technological Advancements and Their Impact

Technological advancements are dramatically reshaping the client experience and the advisor’s role. Clients expect seamless digital interactions, 24/7 access to their accounts, and personalized financial insights delivered through user-friendly platforms. Advisors, in turn, can leverage technology to automate routine tasks, freeing up time to focus on higher-value activities like strategic financial planning and building client relationships. Imagine a future where AI analyzes market trends, identifies potential risks, and proactively adjusts portfolios, allowing advisors to spend more time understanding their clients’ life goals and aspirations – a future where advising isn’t just about numbers, but about building genuine connections and helping people achieve their dreams. This technological evolution is not just about efficiency; it’s about elevating the advisory profession to a higher plane of personalized service and strategic guidance.

Summary

So, there you have it: a whirlwind tour through the world of financial advisor services. Remember, finding the right advisor is like finding the right pair of shoes – comfortable, supportive, and hopefully not going to bankrupt you. While this review offers a comprehensive overview, remember to always do your due diligence. And, if all else fails, just remember that laughter is the best medicine (and possibly a surprisingly effective stress reliever when dealing with your finances).

Clarifying Questions

What’s the difference between a fee-only and a commission-based advisor?

Fee-only advisors charge a set fee for their services, while commission-based advisors earn a commission on the products they sell you. Think of it like this: fee-only is like paying a plumber an hourly rate, while commission-based is like paying a plumber based on how many pipes they sell you (whether you need them or not!).

How do I check if a financial advisor is legitimate?

Check their credentials (CFP, CFA, etc.), verify their registration with relevant regulatory bodies, and look for online reviews (but be wary of fake ones!). And, crucially, trust your gut – if something feels off, it probably is.

What questions should I ask a potential financial advisor?

Ask about their fees, experience, investment philosophy, and how they handle conflicts of interest. Don’t be afraid to ask the tough questions – your financial future depends on it!