Investment Management Companies Review: Dive headfirst into the wonderfully complex world of managing other people’s money! This isn’t your grandma’s knitting circle; we’re talking high-stakes finance, regulatory hurdles that would make a mountain goat dizzy, and enough acronyms to make your head spin. Prepare for a rollercoaster ride through mutual funds, hedge funds, and private equity – oh my!

We’ll unpack the regulatory landscape (think: navigating a minefield of rules and regulations), dissect performance evaluation methods (because numbers don’t lie, but they can certainly be *interpreted* creatively), and explore various investment strategies, from the cautiously conservative to the wildly speculative. Buckle up, buttercup, it’s going to be a bumpy – but enlightening – ride.

Defining Investment Management Companies

Investment management companies, in their simplest form, are the financial wizards (or at least, they *claim* to be) who take your hard-earned cash and, ideally, turn it into a significantly larger pile of hard-earned cash (for you, of course, not for them… mostly). They navigate the often treacherous waters of the financial markets, employing various strategies to achieve specific investment objectives for their clients. Think of them as highly specialized financial shepherds, guiding your flock of investments towards greener pastures (or at least, pastures that aren’t completely overrun by weeds).

Investment management companies offer a wide range of services, from carefully crafting personalized portfolios tailored to individual needs to managing vast sums of money for institutional investors. The specific services offered often depend heavily on the type of company and its investment approach, making the world of investment management a fascinatingly complex ecosystem.

Types of Investment Management Companies

The world of investment management is far from monolithic. Several distinct types of companies cater to different investor profiles and investment strategies, each with its own unique characteristics and risk profiles. Understanding these distinctions is crucial for investors to make informed decisions about where to entrust their financial well-being.

- Mutual Funds: These are perhaps the most well-known type of investment company. Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, or real estate. They offer relatively low minimum investment requirements, making them accessible to a broad range of investors. Think of them as a financial buffet – a variety of options, all conveniently packaged together.

- Hedge Funds: Hedge funds are typically more exclusive and sophisticated investment vehicles, often employing complex trading strategies and leveraging significant amounts of debt. They are generally only accessible to high-net-worth individuals and institutional investors due to their high minimum investment requirements and often complex investment strategies. Picture them as the Michelin-starred restaurant of the investment world – exclusive, expensive, and potentially incredibly rewarding (or disastrous).

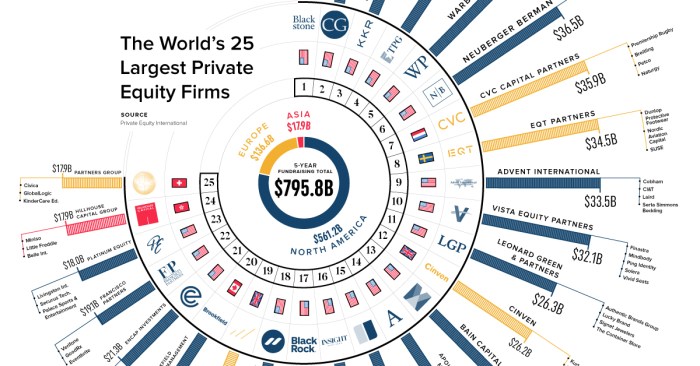

- Private Equity Firms: These firms invest in private companies, often providing capital for expansion, acquisitions, or buyouts. They typically have a longer-term investment horizon than other types of investment management companies and are known for their active involvement in the management of their portfolio companies. They’re like the venture capitalists who believe in a company’s potential and invest to help it grow into a giant – or at least, survive long enough to get a decent return.

Services Offered by Investment Management Companies

The services provided by investment management companies are as diverse as the companies themselves. However, several common themes emerge, regardless of the type of company or investment strategy employed. These services are designed to help investors achieve their financial goals, whether it’s securing a comfortable retirement, funding a child’s education, or simply growing their wealth.

- Portfolio Management: This is the core service offered by most investment management companies. It involves selecting and managing a portfolio of investments to meet a client’s specific financial goals and risk tolerance. This can range from simple buy-and-hold strategies to highly sophisticated quantitative models.

- Investment Research and Analysis: Many firms employ teams of analysts who conduct extensive research to identify attractive investment opportunities. This research often involves evaluating financial statements, market trends, and economic forecasts to inform investment decisions.

- Financial Planning and Advice: Some investment management companies offer comprehensive financial planning services, including retirement planning, tax planning, and estate planning. This holistic approach helps clients manage their entire financial picture, not just their investments.

- Custody Services: This involves the safekeeping of clients’ assets. Many investment management companies provide custody services, ensuring the security and integrity of their clients’ investments.

Regulatory Landscape for Investment Management Companies: Investment Management Companies Review

Navigating the world of investment management regulation can feel like trying to herd cats – adorable, but ultimately chaotic. Each jurisdiction boasts its own unique set of rules, creating a global regulatory patchwork that’s both fascinating and frustrating. Let’s unravel some of the complexities, shall we?

The regulatory landscape for investment management companies is a complex web woven from numerous threads of laws, rules, and guidelines. These regulations are designed to protect investors from fraud, mismanagement, and conflicts of interest, ensuring a level playing field and fostering trust in the financial markets. The specifics, however, vary significantly depending on location and the type of investment management firm.

Key Global and Jurisdictional Regulatory Bodies

Numerous organizations worldwide oversee investment management companies. These range from national-level regulators with extensive powers to international bodies that set standards and encourage cooperation. The effectiveness and scope of these bodies often influence investor confidence and market stability. Consider the impact of a robust regulatory framework versus one riddled with loopholes – the difference can be night and day, or perhaps more accurately, a thriving market versus a financial Wild West.

Core Regulatory Requirements and Compliance Standards

Investment management companies face a multitude of regulatory requirements. These typically include registration, licensing, capital adequacy rules, reporting obligations, and adherence to specific investment strategies and risk management practices. Failure to comply can result in significant penalties, including fines, suspension of operations, and even criminal charges. Think of it as a high-stakes game of regulatory Jenga – one wrong move, and the whole thing could come tumbling down.

Comparison of Regulatory Frameworks Across Countries

A comparison of regulatory frameworks across different countries reveals significant variations. The United States, for example, relies heavily on the Securities and Exchange Commission (SEC), while the United Kingdom utilizes the Financial Conduct Authority (FCA). These bodies, while sharing common goals, differ in their approaches to oversight, enforcement, and the specific regulations they impose. For instance, the level of detail required in reporting, the types of investments permitted, and the extent of investor protection can vary dramatically between jurisdictions. This creates both opportunities and challenges for firms operating internationally, requiring careful navigation of a complex and often ever-changing regulatory maze.

Performance Evaluation of Investment Management Companies

Evaluating the performance of investment management companies isn’t just about crunching numbers; it’s about deciphering the financial Rosetta Stone to understand whether they’re truly delivering on their promises (and hopefully, more than just empty promises!). This involves a multifaceted approach, considering various factors and using a range of metrics to paint a comprehensive picture. Think of it as a financial detective story, where the goal is to uncover the truth behind the returns.

Methodology for Evaluating Historical Performance

A robust methodology for evaluating the historical performance of investment management companies needs to account for several crucial elements. Firstly, defining the appropriate benchmark is paramount. Simply stating that a fund outperformed the market isn’t sufficient; we need to know *which* market and how the fund compares against similar investment strategies. Secondly, the time horizon matters significantly. Short-term performance can be misleading; a longer-term perspective provides a more reliable assessment of consistent skill and risk management. Thirdly, risk-adjusted returns should always be considered. A fund delivering high returns with exceptionally high volatility might be a thrilling rollercoaster, but hardly a comfortable ride for most investors. Finally, a thorough examination of the investment strategy itself helps explain the performance. Was it a lucky streak, or a well-executed plan?

Key Performance Indicators (KPIs)

Several key performance indicators are crucial for evaluating investment management company success. These KPIs provide a more nuanced understanding beyond simple return figures.

Consider these examples:

- Alpha: This measures the excess return generated by a fund compared to its benchmark, after adjusting for risk. A positive alpha suggests the fund manager’s skill in generating above-average returns. For example, an alpha of 2% indicates the fund outperformed its benchmark by 2% annually, after accounting for risk.

- Sharpe Ratio: This assesses risk-adjusted return by comparing excess returns to the standard deviation of returns. A higher Sharpe ratio suggests better risk-adjusted performance. A Sharpe ratio of 1.0 is generally considered good, while a ratio above 2.0 is excellent. Imagine comparing two funds; one with a 10% return and a 15% standard deviation versus another with a 7% return and a 5% standard deviation. The second fund might have a higher Sharpe ratio, despite the lower return, indicating superior risk-adjusted performance.

- Sortino Ratio: Similar to the Sharpe Ratio, but it only penalizes downside deviation, making it more suitable for risk-averse investors. This is particularly useful for evaluating funds that focus on capital preservation.

- Information Ratio: This measures the consistency of a fund’s performance relative to its benchmark, adjusting for tracking error. It helps determine if a fund manager consistently outperforms or underperforms their benchmark.

- Maximum Drawdown: This metric measures the largest percentage decline from a peak to a trough in a fund’s value. It indicates the fund’s vulnerability to market downturns. For example, a maximum drawdown of 20% suggests the fund’s value fell by 20% at its worst point during a specific period.

Comparison of Performance Measurement Approaches

Different approaches to performance measurement offer varying insights. Choosing the right approach depends on the investor’s risk tolerance and investment goals.

| Approach | Focus | Advantages | Disadvantages |

|---|---|---|---|

| Absolute Return | Total return generated | Simple to understand | Ignores risk; susceptible to market fluctuations |

| Relative Return | Return relative to a benchmark | Considers market conditions | Benchmark selection is crucial; doesn’t always reflect skill |

| Risk-Adjusted Return (Sharpe Ratio, Sortino Ratio) | Return relative to risk | Provides a more holistic view | Can be complex to calculate and interpret |

| Information Ratio | Consistency of outperformance | Highlights consistent skill | Sensitive to benchmark selection |

Investment Strategies and Approaches

Investing, much like choosing a flavor of ice cream, offers a bewildering array of options. While some might gravitate towards the familiar vanilla of index funds, others crave the adventurous thrill of a more exotic flavor profile. This section delves into the diverse world of investment strategies, examining their risk-reward dynamics and providing a framework for understanding their inherent complexities. We’ll avoid the overly technical jargon (mostly), opting instead for a clear and hopefully amusing explanation.

Investment strategies are essentially the blueprints that investment management companies use to build portfolios. These blueprints are designed to achieve specific financial goals, while simultaneously attempting to manage (or at least acknowledge) the inherent risks involved. The strategies themselves can be broadly categorized based on their underlying philosophies and approaches to market analysis.

Value Investing

Value investing, championed by the legendary Warren Buffett (who, incidentally, probably has a better ice cream selection than you), focuses on identifying undervalued securities. This involves painstaking research to uncover companies trading below their intrinsic worth, often due to temporary market mispricing or negative sentiment. Value investors patiently wait for the market to recognize the true value, leading to capital appreciation. The risk here is that the market may remain stubbornly irrational for longer than the investor’s patience allows. Think of it as waiting for a sale on a truly exceptional piece of furniture – the wait might be long, but the eventual reward is significant.

Growth Investing, Investment Management Companies Review

Growth investing, on the other hand, chases companies exhibiting rapid earnings growth and expansion potential. These companies often command higher valuations than their value counterparts, reflecting expectations of future performance. The risk here is higher, as growth stocks are often more volatile and susceptible to shifts in investor sentiment. A successful growth investor is like a savvy venture capitalist, spotting the next big thing before it explodes onto the scene. However, picking the wrong “next big thing” can lead to significant losses.

Index Funds

Index funds, the vanilla ice cream of the investment world, aim to mirror the performance of a specific market index, such as the S&P 500. They offer diversification and generally lower expense ratios compared to actively managed funds. The risk is lower than with value or growth strategies, as they track the market’s overall performance. It’s a relatively low-risk, passive approach that offers decent returns over the long term, perfect for investors who prefer a less hands-on approach.

Risk and Return Hierarchy

The relationship between risk and return is fundamental to understanding investment strategies. Generally, higher potential returns are associated with higher risk. We can visualize this as a hierarchy:

| Risk Level | Investment Strategy | Potential Return |

|---|---|---|

| High | Growth Investing (especially in emerging markets) | High |

| Medium | Value Investing | Medium to High |

| Low | Index Funds (broad market) | Medium to Low |

“Risk and return are two sides of the same coin; you can’t have one without the other.”

Fees and Costs Associated with Investment Management Companies

Navigating the world of investment management fees can feel like traversing a minefield of jargon and hidden charges. Rest assured, however, that understanding these costs is crucial to maximizing your returns and avoiding any unpleasant surprises. Think of it as understanding the fine print before signing on the dotted line – only with significantly more potential for financial gain (or loss!).

Investment management companies employ various fee structures, each designed (theoretically) to align their interests with yours. In reality, some structures are more transparent and investor-friendly than others. Let’s dissect these fee structures to illuminate the path to financial clarity.

Management Fees

Management fees are the bread and butter of most investment management companies. These are recurring charges levied as a percentage of the assets under management (AUM). They compensate the firm for its ongoing services, such as portfolio management, research, and administrative support. While seemingly straightforward, the percentage charged can vary wildly depending on the firm’s reputation, investment strategy, and the size of the managed assets. A higher AUM often translates to a lower percentage fee, reflecting economies of scale. Think of it as a bulk discount for your investment portfolio.

Performance Fees

Performance fees, also known as incentive fees, are only earned if the investment manager surpasses a predetermined benchmark or hurdle rate. This structure incentivizes the manager to actively seek superior returns, aligning their interests with those of the investor. However, these fees can significantly increase the overall cost if the investment strategy is exceptionally successful. It’s a high-stakes gamble, but with the potential for significantly higher rewards. The calculation often involves a percentage of the profits exceeding the benchmark. For example, a 20% performance fee on $1 million in profits above the benchmark would result in a $200,000 performance fee.

Other Fees

Beyond management and performance fees, several other charges can creep into the equation. These can include transaction costs (brokerage commissions, exchange fees), custody fees (for safekeeping of assets), and administrative fees. These ancillary charges can significantly eat into returns, especially for investors with smaller portfolios. It’s essential to scrutinize the fee schedule meticulously, asking clarifying questions about any unclear items. Don’t be afraid to negotiate, especially if you’re managing a substantial amount of assets.

Illustrative Fee Structures of Different Investment Management Companies

| Investment Management Company | Asset Class | Management Fee | Performance Fee |

|---|---|---|---|

| Fidelity Investments | Index Funds | 0.01% – 0.15% | N/A |

| Vanguard | Mutual Funds | 0.04% – 1.5% | N/A |

| BlackRock | Active Equity | 0.75% – 1.5% | Variable, typically 20% of profits above benchmark |

| Bridgewater Associates | Hedge Funds | Variable, typically 2% | Variable, typically 20% of profits above benchmark |

Note: The fee structures presented are illustrative and can vary depending on the specific fund, account size, and negotiated terms. Always consult the fund’s prospectus for the most accurate and up-to-date fee information.

Client Selection and Due Diligence

Choosing the right investment management company is akin to choosing a life partner – you’ll be entrusting them with a significant portion of your future, so a little due diligence is crucial. Don’t just jump into bed with the first flashy brochure that crosses your desk; take your time, do your research, and ensure a compatible match. After all, a poorly chosen investment manager can lead to sleepless nights and a significantly depleted bank account.

The process of selecting an investment management company and performing due diligence is a multifaceted endeavor requiring careful consideration of various factors. Failing to conduct thorough due diligence can expose investors to significant financial risks, including poor investment performance, fraud, and regulatory violations. Essentially, it’s like buying a used car without checking the engine – you might get lucky, but the odds are stacked against you.

Investment Management Company Selection Process

The selection process begins with defining your investment goals and risk tolerance. Are you aiming for aggressive growth, steady income, or a balanced approach? Understanding your own financial personality is the first step. Then, you can start researching potential firms, focusing on those that align with your investment objectives and risk profile. This could involve attending industry events, networking, or using online resources to identify potential candidates. Narrowing down the list based on initial screening criteria – such as asset under management (AUM), investment style, and regulatory compliance – is vital before moving to the next stage. Finally, conducting interviews and reference checks helps solidify your decision.

Importance of Due Diligence on Investment Management Companies

Due diligence is more than just a box to tick; it’s your financial safety net. It involves a thorough investigation of the investment management company’s track record, investment strategies, fees, and regulatory compliance. This process helps you assess the firm’s competence, integrity, and ability to meet your investment objectives. A robust due diligence process significantly reduces the risk of making a poor investment decision, safeguarding your financial future from potential pitfalls. Imagine it as a pre-nuptial agreement for your investments – better to have it and not need it, than need it and not have it.

Checklist for Evaluating Investment Management Companies

Before committing your hard-earned cash, consider the following factors:

A comprehensive checklist should encompass several key areas. It’s important to gather information from multiple sources to gain a holistic view of the firm.

| Factor | Description | Example |

|---|---|---|

| Investment Philosophy and Strategy | Understand their approach to investing and how it aligns with your goals. | A value-oriented firm might focus on undervalued stocks, while a growth-oriented firm might prefer companies with high growth potential. |

| Performance Track Record | Analyze past performance, but remember past performance is not indicative of future results. | Review performance data over multiple market cycles to assess consistency. |

| Team Expertise and Experience | Evaluate the qualifications and experience of the investment team. | Look for individuals with relevant certifications and a proven track record. |

| Fees and Expenses | Compare fees charged by different firms to ensure they are competitive and transparent. | Consider both management fees and expense ratios. |

| Regulatory Compliance and Risk Management | Verify that the firm is properly licensed and adheres to regulatory requirements. | Check for any regulatory violations or warnings. |

| Client References and Testimonials | Speak with existing clients to gain firsthand insights into their experiences. | Request references and conduct thorough interviews. |

Risk Management Practices of Investment Management Companies

Risk management isn’t just about avoiding losses; it’s about strategically navigating the thrilling rollercoaster of the financial markets while keeping your investors’ hard-earned cash (relatively) safe. Think of it as financial parkour – gracefully leaping over obstacles, rather than face-planting into them. Investment management companies employ a variety of strategies to achieve this precarious balance, ranging from sophisticated mathematical models to the old-fashioned wisdom of “don’t put all your eggs in one basket” (though, ironically, some strategies *do* involve a lot of eggs).

Investment management companies use robust risk management practices to protect investor capital and ensure the long-term viability of their operations. The failure to effectively manage risk can lead to significant financial losses, reputational damage, and even regulatory sanctions. Therefore, a well-defined risk management framework is not just a good idea; it’s a necessity in this high-stakes game.

Market Risk Management

Market risk, the ever-present bogeyman of investing, refers to the potential for losses stemming from fluctuations in market prices. This can be anything from a sudden drop in the stock market to a currency crisis in a far-off land unexpectedly impacting your portfolio. To mitigate this risk, investment management companies often employ diversification strategies, spreading investments across various asset classes and geographies. They also utilize sophisticated quantitative models to assess market volatility and adjust portfolios accordingly. For example, during periods of heightened market uncertainty, a company might reduce its exposure to equities and increase its holdings in safer assets like government bonds. This isn’t about predicting the future, but rather about minimizing potential damage from the inevitable surprises the market throws our way.

Credit Risk Management

Credit risk, the risk that a borrower will default on a loan or debt obligation, is a major concern for investment management companies, particularly those investing in fixed-income securities. To manage this risk, companies conduct thorough due diligence on potential borrowers, assessing their creditworthiness and financial stability. They might also use credit rating agencies to gauge the risk profile of different bonds. Diversification across different borrowers and industries helps to reduce the impact of a single default. Think of it like a carefully constructed Jenga tower – removing one block might not bring the whole thing down, as long as the foundation is solid and you haven’t built a lopsided monstrosity.

Operational Risk Management

Operational risk encompasses a wide range of potential problems, from internal fraud and cyberattacks to simple human error. To minimize these risks, investment management companies implement robust internal controls, including segregation of duties, regular audits, and comprehensive disaster recovery plans. Strong cybersecurity measures are crucial to protect sensitive client data and prevent unauthorized access. Think of this as the security system of the financial world – multiple layers of protection to keep the bad guys out (and the good guys from accidentally locking themselves out).

Technological Advancements and Investment Management

The marriage of finance and technology has produced a surprisingly adorable offspring: a faster, more efficient, and (dare we say it?) more fun investment management industry. Technological advancements are no longer a mere accessory; they are the engine driving innovation and shaping the future of how investments are managed and delivered. This section explores the profound impact of technology on this ever-evolving landscape.

Technology is fundamentally reshaping investment processes and client interactions. The old days of shuffling paper and making phone calls are fading faster than a meme’s relevance. Algorithmic trading, sophisticated data analytics, and personalized digital platforms are transforming how investment decisions are made, portfolios are managed, and clients are serviced. This evolution isn’t just about speed; it’s about accuracy, efficiency, and a more personalized client experience. Think of it as upgrading from a rotary phone to a smartphone – a significant leap in both functionality and user experience.

Algorithmic Trading and High-Frequency Trading

Algorithmic trading, using computer programs to execute trades based on pre-defined parameters, has revolutionized the speed and efficiency of trading. High-frequency trading (HFT), a subset of algorithmic trading, leverages incredibly fast computer systems to execute a large number of trades in fractions of a second. While some worry about the potential for market manipulation, HFT firms argue that their activities increase market liquidity and reduce transaction costs. These algorithms are not just simple “buy low, sell high” programs; they are complex systems that analyze vast amounts of data, identifying subtle patterns and opportunities that might be missed by human traders. For example, a HFT algorithm might detect a fleeting imbalance in buy and sell orders for a particular stock and capitalize on that opportunity within milliseconds.

Artificial Intelligence and Machine Learning in Investment Management

Artificial intelligence (AI) and machine learning (ML) are increasingly used to analyze market data, predict future trends, and manage risk. These technologies can process far more data than any human analyst could ever hope to, identifying complex patterns and correlations that might go unnoticed. AI-powered tools can assist in portfolio construction, risk management, and fraud detection. For instance, ML algorithms can be trained on historical market data to predict future price movements, allowing investment managers to make more informed decisions. Imagine an algorithm capable of analyzing news articles, social media sentiment, and economic indicators to anticipate market shifts – that’s the power of AI in action.

Robo-Advisors and Digital Platforms

Robo-advisors, automated investment platforms, have made investing more accessible to a wider range of individuals. These platforms use algorithms to create and manage diversified portfolios based on a client’s risk tolerance and investment goals. They often offer lower fees than traditional human advisors, making them an attractive option for those with smaller investment sums. The ease of use and transparency of these digital platforms have democratized investing, allowing individuals to participate in the markets with greater ease. For example, a user can easily set up an account, answer a few questions about their financial goals and risk tolerance, and have a personalized portfolio created and managed automatically.

Illustrative Case Studies of Investment Management Companies

The world of investment management is a vibrant tapestry woven with diverse strategies, philosophies, and, let’s be honest, varying degrees of success. To truly appreciate the nuances, let’s delve into the fascinating lives of three distinct investment management companies, each with its own unique approach to making (or sometimes, not making) money. Prepare yourselves for a rollercoaster ride of financial intrigue!

Vanguard Group: The King of Low-Cost Investing

Vanguard, a behemoth in the investment management world, is synonymous with low-cost index funds. Their investment philosophy centers on the belief that passively tracking market indices is the most efficient way to achieve long-term growth. This approach avoids the often-expensive and sometimes futile attempts at market-timing or stock-picking that characterize many active management strategies. Vanguard’s target market is incredibly broad, encompassing individual investors, retirement plans, and institutional clients. Their fee structure is famously transparent and aggressively competitive, often charging fractions of a percent annually. Their consistent performance, mirroring the market’s overall growth, speaks volumes about the power of simplicity and low costs. For example, their flagship S&P 500 index fund has consistently tracked the market’s performance, delivering strong returns over the long term with minimal expense ratios. This is a testament to their efficient operational structure and commitment to client value.

BlackRock: The Global Colossus

BlackRock, a titan among investment management firms, employs a far more diverse approach than Vanguard. While they offer index funds, they also engage in active management across a wide spectrum of asset classes, including equities, fixed income, and alternatives. Their global reach and vast resources allow them to leverage sophisticated quantitative models and research capabilities, giving them a distinct advantage in certain markets. BlackRock’s target market is similarly diverse, catering to both institutional and individual investors. Their fee structure varies widely depending on the investment strategy employed, ranging from the relatively low costs of index funds to the potentially higher fees associated with actively managed strategies and alternative investments. While performance has varied across their diverse offerings, their sheer size and influence in the market are undeniable. BlackRock’s success stems from its ability to adapt to changing market conditions and offer a broad range of investment solutions. They’ve successfully navigated various economic cycles, demonstrating resilience and adaptability.

Bridgewater Associates: The Quant Wizards

Bridgewater Associates, known for its unique “radical transparency” and quantitative approach, stands in stark contrast to both Vanguard and BlackRock. They are renowned for their sophisticated computer models and data-driven investment strategies, aiming to predict market movements with unparalleled precision. Their target market is primarily institutional investors, including endowments and pension funds, who can handle the complexities of their strategies and often higher minimum investment requirements. Bridgewater’s fee structure is generally higher than that of index funds, reflecting the complexity and expertise involved in their investment process. Their performance has been historically strong, though subject to periods of volatility. Their focus on rigorous data analysis and systematic approach sets them apart. They’ve successfully leveraged technology and data analytics to generate substantial returns over time, although not without periods of underperformance like any investment strategy.

Conclusive Thoughts

So, there you have it: a whirlwind tour of the investment management company universe. From the meticulous dance of regulatory compliance to the thrilling pursuit of optimal returns, we’ve uncovered the intricacies of this fascinating industry. While we can’t promise riches beyond your wildest dreams (though we certainly hope for your success!), we can promise a significantly improved understanding of how these companies operate, the risks they manage, and the choices you can make as an investor. Now go forth and invest wisely (or at least, more wisely than before!).

FAQ

What is the difference between a mutual fund and a hedge fund?

Mutual funds are typically more regulated, offer greater transparency, and are open to a wider range of investors. Hedge funds, on the other hand, often employ more complex strategies, have higher minimum investment requirements, and are subject to less regulatory oversight.

How can I find a reputable investment management company?

Thorough due diligence is key! Check their track record, regulatory compliance history, fee structure, and investment philosophy. Seek professional advice if needed – don’t be afraid to ask questions!

What are the biggest risks associated with investing?

Market risk (fluctuations in market value), credit risk (the risk of default by borrowers), and operational risk (risks related to internal processes) are all significant concerns. Diversification can help mitigate some of these risks.