Accounting Firms Review Update: Prepare yourselves, for we embark on a hilarious yet insightful journey into the wild world of online reviews for accounting firms! Forget dusty ledgers; we’re diving headfirst into the digital realm of five-star ratings and (hopefully fewer) one-star rants. This isn’t your grandpappy’s accounting firm; it’s a reputation-management battlefield, and we’re here to equip you with the weaponry (of wit and strategy) to conquer it.

This update explores the ever-evolving landscape of online reviews, from understanding current trends and analyzing review content for improvement to mastering the art of client communication and responding to both praise and criticism with aplomb. We’ll delve into the surprisingly dramatic world of online reputation management, offering practical strategies and humorous anecdotes to make the process less taxing (and more entertaining).

Industry Trends in Accounting Firm Reviews

The world of accounting firm reviews is a fascinating beast, constantly evolving with the digital landscape. Gone are the days of whispered recommendations; now, potential clients wield the power of online reviews to scrutinize firms with the intensity of a tax auditor examining a suspiciously large charitable donation. This shift necessitates a keen understanding of current trends for accounting firms seeking to thrive in this brave new world.

The current trends shaping online reviews for accounting firms are driven by increased client expectations, technological advancements, and the ever-growing influence of social media. Clients are more digitally savvy and expect transparency and readily available feedback. This means firms need to actively manage their online reputation to maintain a competitive edge. The sheer volume of reviews available also influences client decision-making, highlighting the importance of consistent positive feedback.

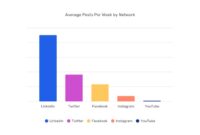

Review Platform Comparison

Accounting firms utilize a variety of platforms to manage their online reputation. Google My Business remains a dominant force, offering a readily accessible platform for clients to leave reviews directly on Google search results. Yelp, while initially conceived for restaurants, has also become a significant player, particularly for firms catering to smaller businesses and consumers. Industry-specific platforms and professional networking sites like LinkedIn also play a role, offering a different audience and often more professional tone to reviews. Google My Business tends to be more transactional and focused on immediate needs, whereas Yelp often showcases more detailed and experiential reviews. LinkedIn, on the other hand, prioritizes professional recommendations and referrals. The choice of platform depends heavily on the firm’s target clientele and marketing strategy.

Social Media’s Impact on Reputation Management

Social media has become an undeniable force in reputation management for accounting firms. Platforms like Facebook, Instagram, and even TikTok offer opportunities to engage with potential clients, showcase firm expertise, and respond directly to reviews (both positive and negative). A well-managed social media presence can humanize a firm, showcasing its culture and values. Conversely, a poorly managed presence can lead to reputational damage through negative comments or slow response times. For example, a firm that quickly and empathetically addresses a negative review on Facebook demonstrates proactive customer service, potentially turning a negative experience into a positive one. Ignoring negative feedback, however, can amplify its impact and damage the firm’s credibility.

Methods Used by Top-Performing Firms to Solicit and Manage Reviews

High-performing accounting firms employ a multifaceted approach to soliciting and managing online reviews. This often involves integrating review requests into their client workflow, perhaps sending automated emails after service completion. They also actively monitor their online presence, responding to both positive and negative reviews promptly and professionally. Furthermore, these firms often actively encourage clients to leave reviews, emphasizing the value of their feedback in improving services. Incentivizing reviews, however, should be done cautiously and ethically to avoid accusations of manipulation. A simple “We value your feedback!” coupled with a link to the review platform is often sufficient. The key is consistency and a genuine commitment to client satisfaction; this naturally translates to more positive reviews.

Analyzing Review Content for Improvement

Analyzing client reviews is less about finding a needle in a haystack and more about finding a whole bale of hay – some good, some bad, and some suspiciously smelling of old tax returns. The key is to sift through the fragrant pile efficiently, identifying trends and taking actionable steps to improve your firm’s reputation. This involves more than just counting positive versus negative comments; it’s about understanding the *why* behind the reviews.

Let’s dive into the delicious world of review analysis, where we’ll learn to turn negative feedback into a delicious recipe for success (and maybe even a few extra clients).

Common Themes and Recurring Issues in Accounting Firm Reviews

Identifying common themes requires a systematic approach. Instead of reading each review individually (which can be mind-numbingly tedious), use tools to categorize reviews based on s and sentiments. Common issues often revolve around responsiveness, communication clarity, fees, and the overall client experience. For example, you might find a recurring complaint about slow response times to emails, indicating a need for improved internal communication processes. Similarly, unclear explanations of fees could suggest a need for more transparent fee structures and better client education. Analyzing the frequency of these themes reveals areas needing immediate attention.

Categorizing and Prioritizing Negative Reviews, Accounting Firms Review Update

Not all negative reviews are created equal. A simple system for categorization might use a severity scale (low, medium, high) and an impact scale (low, medium, high). A low-severity, low-impact review might be a minor inconvenience (“The office could use a fresh coat of paint”), while a high-severity, high-impact review could severely damage your reputation (“They lost my tax documents and cost me thousands”). Prioritize high-severity, high-impact reviews first, addressing those issues promptly and transparently. This proactive approach demonstrates accountability and strengthens client relationships.

Tracking Review Trends Over Time

To measure the effectiveness of improvements, establish a system for tracking review trends. This could involve creating a spreadsheet or using specialized review management software. Track the number of positive, negative, and neutral reviews over time, and note the recurring themes. This longitudinal data provides valuable insights into the impact of implemented changes. For instance, if you implemented a new communication system and see a significant decrease in negative reviews related to responsiveness, you’ll have concrete evidence of your success. Regularly analyzing this data allows for continuous improvement.

Examples of Positive and Negative Reviews

Below is a table illustrating examples of positive and negative reviews, highlighting effective and ineffective communication.

| Review Source | Review Text Snippet | Sentiment | Action Taken |

|---|---|---|---|

| Google Reviews | “Incredibly helpful and responsive! They explained everything clearly and made the whole process stress-free.” | Positive | Acknowledge and thank the reviewer publicly. |

| Yelp | “They were constantly unavailable and their fees were much higher than quoted.” | Negative | Respond directly, apologize, investigate the fee discrepancy, and offer a solution or partial refund. |

| “The staff was friendly, but the turnaround time was painfully slow.” | Negative | Address the slow turnaround time issue internally, potentially by hiring additional staff or streamlining processes. Respond to the review acknowledging the feedback and outlining the steps being taken. | |

| Trustpilot | “I had a great experience working with [Firm Name]. They were professional, efficient, and answered all my questions thoroughly.” | Positive | Acknowledge the positive feedback and encourage future business. |

The Role of Client Communication in Reviews: Accounting Firms Review Update

Online reviews are the modern-day equivalent of word-of-mouth referrals, but with a much wider and more lasting reach. Ignoring them is like ignoring a booming, albeit slightly sarcastic, chorus of your clients’ opinions. Proactive client communication is the key to turning those opinions into glowing five-star reviews that’ll make your competitors green with envy (or at least, a slightly paler shade of green).

Proactive client communication significantly impacts online reviews by shaping client perception and encouraging them to share their experiences. When clients feel heard, valued, and understood, they’re far more likely to leave a positive review. Conversely, neglecting client communication can lead to negative reviews born from frustration and unanswered concerns – a recipe for disaster in the age of readily available online feedback. Think of it as a preemptive strike against negative reviews, a strategic maneuver to secure your firm’s reputation.

Effective Communication Strategies for Managing Client Expectations and Addressing Concerns

Managing client expectations and addressing concerns requires a multi-pronged approach, combining clear and consistent communication throughout the client lifecycle. This isn’t about simply sending out invoices; it’s about building a relationship based on trust and transparency. A well-defined communication plan should include regular updates on project progress, proactive responses to inquiries, and a clear process for handling complaints. Think of it as a well-orchestrated symphony of communication, with each instrument playing its part in harmony.

For instance, a weekly email update detailing project milestones keeps clients informed and reduces the likelihood of unexpected delays causing frustration. Similarly, establishing a dedicated communication channel (e.g., a client portal) for questions and concerns allows for efficient and timely responses, preventing small issues from escalating into major problems. A prompt and empathetic response to a complaint demonstrates your firm’s commitment to client satisfaction, turning a potentially negative experience into a positive one. Consider it damage control with a smile.

The Importance of Personalized Client Interactions in Fostering Positive Reviews

Generic communication is like sending a mass email to a list of strangers; personalized communication is like inviting a valued friend to dinner. The difference is palpable. Personalized client interactions foster positive reviews by making clients feel seen and appreciated. This doesn’t require extravagant gestures; small touches, such as addressing clients by name, remembering important details about their business, and tailoring your communication to their specific needs, can make a world of difference. It’s about showing you care, not just about their money, but about their success.

Consider using client relationship management (CRM) software to track important details and personalize your interactions. For example, recalling a client’s recent business expansion in a follow-up email demonstrates that you’re paying attention, building a stronger relationship and increasing the likelihood of a positive review. This is more than just a transaction; it’s building a relationship based on genuine care and attention.

Sample Email Template for Soliciting Reviews from Satisfied Clients

Soliciting reviews requires a delicate touch; you want to express gratitude without appearing pushy or demanding. A well-crafted email can significantly increase your chances of receiving positive feedback.

Subject: We’d Love to Hear About Your Experience with [Your Firm Name]!

Dear [Client Name],

We truly value your business and appreciate the opportunity to work with you on [Project Name]. We hope you were satisfied with our services.

If you have a moment, we would be grateful if you could share your experience by leaving a review on [Review Platform Link]. Your feedback helps us improve and serve our clients better.

Thank you for your time and consideration.

Sincerely,

The Team at [Your Firm Name]

Responding to Online Reviews (Positive & Negative)

Navigating the world of online reviews can feel like walking a tightrope – one wrong step and you’re plummeting into a PR nightmare. But fear not, fellow accountants! With the right approach, online reviews can be a powerful tool for building your firm’s reputation and attracting new clients. Mastering the art of responding, both to praise and criticism, is key to turning these digital interactions into valuable assets.

Responding to online reviews is a crucial aspect of online reputation management. A well-crafted response can solidify positive relationships and mitigate the damage of negative feedback. Ignoring reviews, on the other hand, is akin to ignoring a burning building – eventually, the flames will consume you. Let’s explore effective strategies for both positive and negative feedback.

Responding to Positive Reviews

Showing appreciation for positive reviews is more than just good manners; it’s smart business. A thoughtful response demonstrates your commitment to client satisfaction and fosters a sense of loyalty. It also provides an opportunity to subtly showcase your firm’s personality and values. For instance, instead of a generic “Thank you for your kind words!”, consider personalizing the response by referencing something specific from the review. This shows you’ve actually read the review and value the individual’s feedback.

Responding to Negative Reviews

Negative reviews can feel like a punch to the gut, but they’re also invaluable opportunities for improvement and showcasing your firm’s commitment to resolving issues. The key is to respond promptly, professionally, and empathetically. Acknowledge the client’s concerns, apologize for any shortcomings, and Artikel the steps you’re taking to address the situation. Avoid getting defensive or engaging in arguments. Remember, your goal is to demonstrate that you care and are committed to finding a solution.

Examples of Effective and Ineffective Responses

Effective Positive Response:

“Thank you so much, Sarah! We’re thrilled to hear you found our service efficient and thorough, especially regarding your tax preparation. We appreciate your business and look forward to assisting you again next year. We’re always striving to improve, so your feedback is invaluable.”

Ineffective Positive Response:

“Thanks!”

Effective Negative Response:

“Mr. Jones, we sincerely apologize for the inconvenience you experienced with the delayed filing of your return. We understand your frustration, and we’ve already taken steps to improve our internal processes to prevent this from happening again. We’d like to discuss this further with you directly to find a resolution that meets your needs. Please contact us at [phone number] or [email address].”

Ineffective Negative Response:

“I’m sorry you feel that way. Our firm has an excellent reputation.”

Best Practices for Managing Online Review Responses

A well-structured process for managing online reviews ensures consistency and professionalism. Here are some best practices:

- Establish a designated team or individual: Someone needs to be responsible for monitoring and responding to reviews.

- Set response time goals: Aim to respond to reviews within 24-48 hours.

- Develop response templates: Create templates for both positive and negative reviews to ensure consistency and efficiency, while still allowing for personalization.

- Maintain a professional tone: Even when dealing with negative reviews, remain calm, courteous, and professional.

- Address concerns directly and privately: If appropriate, offer to resolve issues privately via phone or email.

- Learn from negative feedback: Use negative reviews as an opportunity to identify areas for improvement within your firm.

Measuring the Impact of Review Management

So, you’ve diligently collected those glowing (and maybe a few less-than-glowing) reviews. But now comes the crucial question: are they actually *doing* anything? Let’s delve into the surprisingly satisfying world of quantifying the impact of your review management efforts. We’ll uncover how to measure the success of your strategy and show you the direct correlation between positive reviews and a healthier bottom line. Prepare for some serious number-crunching fun!

Review management isn’t just about pretty stars; it’s about translating those stars into tangible business benefits. This involves establishing clear metrics to track your progress and demonstrate the return on investment (ROI) of your efforts. Ignoring this crucial step is like baking a delicious cake and never tasting it – a missed opportunity for pure deliciousness (and profit!).

Key Performance Indicators (KPIs) for Review Management

To effectively measure the impact of your review management strategy, several key performance indicators (KPIs) can be tracked. These metrics offer a quantifiable assessment of your success and provide valuable insights for improvement. Think of KPIs as your trusty accounting compass, guiding you towards a sea of positive reviews and flourishing business.

- Average Star Rating: This provides a simple, yet powerful, overview of your overall online reputation. A higher average star rating usually indicates greater customer satisfaction and can influence potential clients’ decisions.

- Review Volume: The sheer number of reviews reflects the engagement level of your clients and the reach of your review collection strategy. More reviews often lead to higher visibility in search engine results.

- Review Response Rate: Responding to reviews, both positive and negative, demonstrates customer care and can significantly influence client perception. A high response rate shows you’re actively engaged with your clients’ feedback.

- Sentiment Analysis: This involves analyzing the emotional tone of reviews (positive, negative, or neutral) to gauge overall client sentiment. Tools can automate this process, offering insights into areas needing improvement.

- Website Traffic from Reviews: Tracking the number of visitors coming to your website from review platforms can demonstrate the effectiveness of reviews in driving traffic and potential leads.

Correlation Between Online Reviews and Business Growth

Improved online reviews directly correlate with increased client acquisition and retention. Positive reviews act as powerful social proof, influencing potential clients’ decisions and building trust. Conversely, negative reviews, if not handled properly, can deter potential clients and damage your reputation. Think of it like this: would you rather dine at a restaurant with glowing reviews or one riddled with complaints? The answer, my friend, is usually pretty clear.

Let’s consider a hypothetical example: An accounting firm with a consistently high average star rating (4.8 stars) and a significant number of positive reviews experiences a 15% increase in client inquiries and a 10% increase in new client acquisition compared to the previous year. This demonstrates a strong positive correlation between positive online reviews and business growth.

Visual Representation of Review Impact

Imagine a graph with “Number of Positive Reviews” on the X-axis and “Business Growth (e.g., revenue, new clients)” on the Y-axis. The graph would show an upward-sloping line, illustrating a positive correlation. As the number of positive reviews increases, so does business growth. For a more sophisticated visual, you could add another line representing the average star rating, showing how higher ratings contribute to even steeper growth. The graph clearly demonstrates that a strong review management strategy directly translates into a healthier, more profitable business. It’s a beautiful sight, isn’t it? A symphony of stars and soaring profits!

Final Conclusion

So, there you have it – a whirlwind tour through the captivating world of accounting firm reviews. Remember, managing your online reputation isn’t just about avoiding negative feedback; it’s about showcasing your firm’s brilliance (and maybe a little quirky charm) to attract new clients and build lasting relationships. Embrace the humor, learn from the (sometimes hilariously bad) reviews, and watch your firm’s online presence blossom into a five-star spectacle. After all, who wants to be known for their boring reviews?

Questions and Answers

What if a client leaves a factually incorrect negative review?

Respond professionally, acknowledging their concerns but gently correcting any inaccuracies with factual information. Consider contacting the review platform to flag the review if it violates their terms of service.

How often should we solicit reviews?

A good rule of thumb is to solicit reviews after a significant client interaction, such as completing a tax return or audit. Avoid bombarding clients; a thoughtful, timely request is far more effective than constant nagging.

What’s the best way to handle a truly awful review?

Deep breaths! Respond professionally and empathetically, expressing your desire to rectify the situation. Offer a private avenue for communication to address their concerns directly. Remember, even a terrible review can be a learning opportunity.