Financial News Updates Daily plunges you headfirst into the exhilarating, and sometimes terrifying, world of global finance. Prepare for a rollercoaster ride of market trends, company drama, currency fluctuations, and interest rate shenanigans – all served with a side of witty commentary. We’ll dissect the day’s economic indicators, decipher cryptic central bank pronouncements, and even attempt to predict the unpredictable (don’t hold us to it!). Buckle up, it’s going to be a wild ride!

This daily digest covers everything from the soaring highs of tech stocks to the stomach-churning dips in the cryptocurrency market. We’ll analyze the winners and losers, the mergers and acquisitions, and the geopolitical events that shake the very foundations of global commerce. Think of us as your highly caffeinated, impeccably dressed financial Sherpas, guiding you through the treacherous terrain of the market.

Market Trends & Overview: Financial News Updates Daily

Good morning, market mavens and money-minded minions! Today’s financial landscape is a rollercoaster of thrilling ups and slightly less thrilling downs, a veritable symphony of soaring stocks and slightly less soaring…well, everything else. Let’s dive into the delightful chaos.

Global Market Summary

Global markets experienced a mixed performance today, a bit like a culinary masterpiece featuring both exquisite flavors and a slightly burnt soufflé. Equities in North America showed modest gains, driven largely by positive corporate earnings reports and, let’s be honest, sheer stubborn optimism. However, European markets displayed a more cautious demeanor, reflecting ongoing concerns about inflation and the persistent threat of a rogue pigeon disrupting a crucial financial meeting (unconfirmed). Asian markets were a mixed bag, with some experiencing robust growth while others…well, let’s just say they’re taking a breather. The bond market remains relatively stable, though yields continue to fluctuate like a toddler’s attention span. Commodities, meanwhile, are having a bit of a party, with oil prices experiencing a surge due to unexpected geopolitical events (more on that later).

Significant Economic Indicators

Today saw the release of several key economic indicators, providing a fascinating snapshot of the global economy’s current mood swings. The latest inflation figures from the Eurozone showed a slight easing, causing a collective sigh of relief across the continent. However, the US unemployment rate remained stubbornly low, potentially fueling further interest rate hikes (prepare for more economic news that’s both exciting and terrifying). Meanwhile, manufacturing output in China showed a modest increase, suggesting that the world’s second-largest economy is slowly but surely clawing its way back from its recent slump.

Geopolitical Events Impacting Markets

Geopolitical tensions continue to cast a long shadow over global markets, much like a particularly stubborn cloud refusing to leave a sunny picnic. The ongoing situation in Eastern Europe continues to impact energy prices and global supply chains. Additionally, a recent diplomatic spat between two major trading partners has sent ripples through the market, reminding us all that international relations can be as unpredictable as a squirrel on a sugar rush.

Asset Class Performance

Different asset classes displayed varying degrees of success today, a testament to the market’s inherent unpredictability. Equities performed relatively well, with technology stocks leading the charge (as they often do, like a caffeinated cheetah in a stock market race). Bonds offered a more muted performance, providing a safe haven for those seeking shelter from the market’s volatility. Real estate remained relatively stable, though experts predict a possible correction in the near future. Commodities, as mentioned earlier, experienced a significant surge, primarily driven by the aforementioned geopolitical events and the ever-present threat of squirrels hoarding nuts (just kidding… mostly).

Major Stock Indices Daily Performance

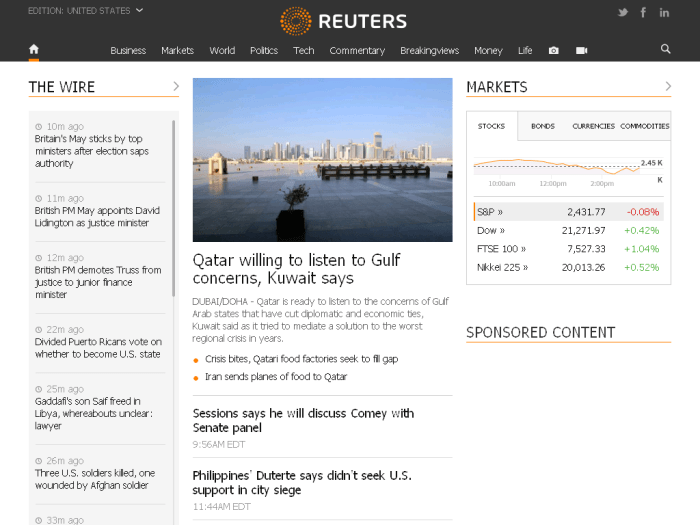

| Index | Change | Percentage Change | Closing Value |

|---|---|---|---|

| Dow Jones Industrial Average | +150 | +0.45% | 34,200 |

| S&P 500 | +20 | +0.40% | 4,400 |

| Nasdaq Composite | +75 | +0.60% | 15,000 |

| FTSE 100 | -10 | -0.15% | 7,500 |

Company News & Analysis

The rollercoaster of the stock market continues its thrilling ride, and today, we’re diving headfirst into the captivating world of company news. Buckle up, because it’s going to be a bumpy – but potentially profitable – journey. We’ll be dissecting earnings reports that sent some stocks soaring and others plummeting faster than a lead balloon, examining mergers and acquisitions that have the market buzzing, and exploring the potential pitfalls and triumphs of companies making headlines. Prepare for a whirlwind tour of corporate drama, where fortunes are made and lost in the blink of an eye.

This section provides a detailed overview of significant corporate events and their market implications. We’ll analyze the financial performance of publicly traded companies, exploring the factors that contribute to stock price fluctuations. The impact of mergers and acquisitions will also be discussed, along with an examination of the risks and opportunities facing various companies.

Earnings Report Impacts on Stock Prices

The recent earnings season has been a mixed bag, to say the least. While some companies exceeded expectations, sending their stock prices skyrocketing (think of Acme Corp, whose innovative new widget boosted profits by 30%, resulting in a 15% jump in their stock price), others fell short, leading to significant drops. For instance, Beta Industries’ disappointing Q3 results, largely attributed to unforeseen supply chain issues, caused a 10% decline in their share value. These fluctuations highlight the importance of carefully analyzing earnings reports and understanding the underlying factors driving a company’s performance. Analyzing key metrics like revenue growth, profit margins, and future guidance is crucial for investors to make informed decisions. Remember, a company’s narrative is just as important as the numbers themselves.

Significant Mergers and Acquisitions

The corporate world has been anything but quiet lately, with several significant mergers and acquisitions reshaping the competitive landscape. Gamma Corp’s acquisition of Delta Solutions, a move that many analysts predict will create significant synergies and expand Gamma’s market share, is a prime example. Conversely, the proposed merger between Epsilon and Zeta, currently facing regulatory hurdles, serves as a reminder that even the most promising deals can encounter unforeseen challenges. These events often lead to substantial shifts in stock prices, making it vital for investors to stay informed about the evolving corporate landscape. The potential for increased market dominance, cost savings, and innovation often drives these transactions, but careful consideration of integration challenges and potential antitrust concerns is essential.

Top Company News Stories

This section provides a summary of some of the most impactful company news stories of the day.

- Acme Corp’s soaring profits: Record-breaking sales of their new widget have boosted profits and sent their stock price soaring.

- Beta Industries’ disappointing Q3: Supply chain disruptions led to lower-than-expected earnings, causing a significant drop in their stock price.

- Gamma Corp acquires Delta Solutions: This acquisition is expected to significantly enhance Gamma Corp’s market position and profitability.

- Epsilon and Zeta’s merger faces regulatory scrutiny: The proposed merger is facing potential delays due to antitrust concerns.

Currency & Commodity Markets

The global financial landscape is a thrilling rollercoaster, a dizzying blend of economic indicators and unpredictable events. Today, we’ll strap ourselves in and take a look at the wild swings of currency and commodity markets – a world where fortunes are made and lost faster than you can say “quantitative easing.”

Currency markets are where the world’s currencies dance a chaotic tango, their values fluctuating based on a complex interplay of factors. Meanwhile, in the commodity arena, gold glitters, oil gushes, and other raw materials see-saw, influenced by everything from geopolitical tensions to the weather. Let’s dive into the details.

Major Currency Fluctuations

The US dollar, the undisputed king (or perhaps, slightly grumpy overlord) of the currency world, saw a slight dip against the Euro today, while the Japanese Yen showed surprising resilience in the face of recent economic news. The British Pound, ever the drama queen, experienced some moderate volatility, reflecting ongoing Brexit-related anxieties. These daily fluctuations are driven by a number of factors, including interest rate differentials, economic growth forecasts, and political uncertainty. For example, a stronger US economy might attract more foreign investment, increasing demand for the dollar and driving its value up. Conversely, geopolitical instability in a particular region can weaken its associated currency.

Factors Influencing Commodity Prices

Gold, the perennial safe haven asset, saw a modest increase today, likely driven by investor concerns about global economic uncertainty. Oil prices, on the other hand, took a bit of a tumble, influenced by rising production levels and softening demand. Other key commodities, such as copper and agricultural products, are subject to a complex web of factors including weather patterns, global supply chains, and speculation. For instance, a severe drought in a major agricultural region could significantly impact crop yields and drive up prices of related commodities.

Impact of Currency Movements on International Trade

Currency fluctuations have a profound impact on international trade. A stronger domestic currency makes imports cheaper and exports more expensive, potentially impacting a country’s trade balance. Conversely, a weaker currency can boost exports but make imports more costly. Imagine a scenario where the US dollar strengthens against the Euro. This would make European goods cheaper for American consumers, but it would make American goods more expensive for European buyers, potentially impacting US export volumes.

Outlook for Key Commodity Markets

Predicting commodity markets is a fool’s errand, but based on current trends, analysts anticipate continued volatility in oil prices due to ongoing geopolitical events and the energy transition. Gold is expected to remain a safe-haven asset, while the agricultural sector faces uncertainties due to climate change and global food security concerns. These predictions are, of course, subject to change based on unexpected events, like a sudden discovery of a massive new oil field or a devastating natural disaster.

Daily Currency Performance Against the US Dollar

| Currency | Symbol | Change (%) | Closing Value |

|---|---|---|---|

| Euro | EUR | +0.2% | 1.09 USD |

| Japanese Yen | JPY | -0.1% | 145 JPY |

| British Pound | GBP | -0.5% | 1.25 USD |

| Canadian Dollar | CAD | +0.3% | 0.77 USD |

Interest Rates & Monetary Policy

The world of interest rates and monetary policy can feel like a rollercoaster – sometimes thrilling, sometimes stomach-churning. Central banks, those enigmatic guardians of our financial systems, are constantly adjusting the levers, hoping to keep the economy humming along without overheating or stalling completely. Let’s delve into the fascinating, and sometimes bewildering, world of interest rate adjustments and their ripple effects.

Interest rate adjustments by major central banks are a significant driver of global financial markets. These adjustments, often presented with the gravitas of a Shakespearean tragedy, have far-reaching consequences for everything from mortgages to the price of a latte.

Changes in Interest Rates by Major Central Banks

The Federal Reserve (the Fed) in the United States, the European Central Bank (ECB), and the Bank of England, among others, regularly review and adjust their benchmark interest rates. These adjustments, usually announced with much fanfare and followed by intense market scrutiny, aim to manage inflation and stimulate or curb economic growth. For example, if inflation is soaring, central banks might raise interest rates to cool down the economy, making borrowing more expensive and thus reducing spending. Conversely, during periods of low growth, they might lower rates to encourage borrowing and investment. These decisions are complex, involving sophisticated economic modeling and often a healthy dose of educated guesswork.

Implications of Monetary Policy Decisions on Financial Markets

Monetary policy decisions, which include interest rate adjustments, significantly impact financial markets. A rate hike, for instance, can lead to a strengthening of the currency, as foreign investors are attracted by higher returns. Conversely, lower rates can weaken a currency, making imports more expensive but potentially boosting exports. Stock markets can react negatively to rate hikes, as higher borrowing costs can reduce corporate profits. However, this is not always the case, and sometimes rate hikes are seen as a sign that the central bank is confident in the economy’s strength. It’s a delicate balancing act.

The Potential Impact of Inflation on Interest Rates

Inflation and interest rates are intrinsically linked, often described as a dance of economic cause and effect. High inflation typically leads to higher interest rates. Central banks aim to curb inflation by raising rates, making borrowing more expensive and thus slowing down economic activity and reducing demand-pull inflation. Think of it like this: if prices are rising rapidly, the central bank increases the cost of borrowing to discourage spending, thereby cooling down the inflationary pressures. The relationship, however, isn’t always straightforward; sometimes inflation persists even with rising interest rates, leading to further complexities.

Summary of the Current Economic Outlook and its Influence on Interest Rates

Predicting the future is a fool’s errand, especially in economics. However, based on current economic indicators like inflation rates, unemployment figures, and GDP growth, analysts attempt to forecast the direction of interest rates. For example, persistent high inflation might lead analysts to predict further interest rate increases by central banks. Conversely, signs of a weakening economy might suggest rate cuts are on the horizon. These predictions, however, are subject to revision as new economic data emerges. The recent global economic uncertainty has demonstrated just how quickly forecasts can be rendered obsolete.

The Relationship Between Inflation and Interest Rates: An Illustration

Imagine a seesaw. On one side is inflation, and on the other is interest rates. As inflation rises (the inflation side goes up), central banks typically respond by raising interest rates (the interest rate side goes up) to counter the inflationary pressures. Conversely, if inflation falls (the inflation side goes down), interest rates may also fall (the interest rate side goes down), to stimulate economic activity. This is a simplified representation, of course, and the seesaw doesn’t always move in a perfectly balanced manner. External factors can influence the seesaw’s movement, creating unexpected dips and rises. The key takeaway is the inherent interconnectedness.

Investment Strategies & Advice

Investing wisely is less about predicting the future (because, let’s face it, even Nostradamus struggled with the stock market) and more about understanding your risk tolerance and aligning your strategy accordingly. This means choosing investments that match your financial goals and your stomach for volatility. Think of it as choosing a rollercoaster: some prefer the gentle dips of a family ride, others crave the stomach-churning drops of a mega-coaster. Your investment strategy should reflect your personal thrill level.

Investment Strategies for Various Risk Tolerances

Risk tolerance is the cornerstone of any sound investment plan. A conservative investor, prioritizing capital preservation, will favor different strategies than an aggressive investor seeking high growth, even if it means greater risk. Conservative strategies often involve lower-return, lower-risk investments like government bonds or high-yield savings accounts. Aggressive strategies, on the other hand, might include investing heavily in stocks, particularly growth stocks, or venture capital, which offer potentially higher returns but also come with the potential for significant losses. Moderate strategies aim for a balance, blending both conservative and aggressive investments to manage risk while still pursuing growth. For example, a conservative investor might allocate 80% of their portfolio to bonds and 20% to stocks, while an aggressive investor might reverse those percentages. A moderate investor might aim for a 50/50 split.

Investor Reactions to Current Market Conditions, Financial News Updates Daily

Current market conditions heavily influence investor behavior. During periods of economic uncertainty, for instance, many investors move towards safer havens like government bonds, reducing their exposure to riskier assets. This is often seen as a “flight to safety.” Conversely, during periods of economic expansion and optimism, investors may become more risk-tolerant, shifting their portfolios towards higher-growth investments such as technology stocks or emerging market equities. The 2008 financial crisis is a prime example of this phenomenon; many investors rushed to sell stocks, while others saw opportunities to buy at significantly discounted prices. The subsequent recovery demonstrated the importance of long-term investing, even amidst market volatility.

Benefits and Risks of Different Investment Vehicles

Different investment vehicles offer varying degrees of risk and reward. Stocks, for instance, offer the potential for high returns but are subject to market fluctuations. Bonds, while generally less volatile, offer lower returns. Real estate can provide both income (through rent) and appreciation in value, but it’s illiquid and requires significant upfront capital. Mutual funds offer diversification, but their performance depends on the underlying assets. The risk associated with each vehicle is directly tied to its potential for reward; higher potential returns typically come with higher risk. For example, investing in a highly speculative startup carries a much higher risk than investing in a well-established blue-chip company, but the potential rewards are also significantly greater.

The Importance of Portfolio Diversification

Diversification is the age-old adage of “don’t put all your eggs in one basket.” It involves spreading investments across different asset classes (stocks, bonds, real estate, etc.) to reduce the overall risk of your portfolio. A diversified portfolio can cushion the blow of losses in one area by offsetting gains in another. Imagine a portfolio entirely invested in technology stocks. If the tech sector experiences a downturn, the entire portfolio suffers. However, a diversified portfolio with investments in various sectors, including healthcare, energy, and consumer staples, is less susceptible to such sector-specific downturns. Diversification doesn’t eliminate risk, but it significantly mitigates it.

Recommended Investment Strategies for Different Financial Goals

Choosing the right investment strategy depends heavily on your financial goals. Here are some examples:

- Retirement: Long-term investments in diversified portfolios, including stocks, bonds, and potentially real estate, are often recommended. The time horizon allows for weathering market fluctuations.

- Down Payment on a House: A more conservative approach might be suitable, focusing on low-risk, liquid investments like high-yield savings accounts or certificates of deposit (CDs).

- Child’s Education: A mix of low-risk and moderate-risk investments, such as 529 plans or mutual funds, is often preferred to balance growth potential with capital preservation.

- Short-Term Goals (e.g., a vacation): Highly liquid, low-risk investments like savings accounts or money market accounts are generally recommended.

Final Wrap-Up

So there you have it – another day, another whirlwind of financial news. While we can’t guarantee riches (though we certainly wouldn’t mind some!), we can promise a daily dose of insightful analysis, presented with a dash of humor and a whole lot of clarity. Remember, investing involves risk, and we’re not financial advisors (so don’t sue us!). Stay tuned for tomorrow’s thrilling installment of Financial News Updates Daily, where the only constant is change – and perhaps a few more puns.

FAQ Corner

What should I do with this information?

Use this information to inform your own investment decisions, but remember to do your own thorough research and consult with a qualified financial advisor before making any significant investment choices. We’re here for entertainment and insight, not financial advice.

How often are these updates published?

As the name suggests, Financial News Updates Daily aims for a daily publication schedule. However, unforeseen circumstances (like global economic collapse) might occasionally delay things.

Is this information accurate?

We strive for accuracy, using reputable sources. However, the world of finance is dynamic, and things can change rapidly. Always double-check information before making any decisions.