Economic Trends Forecast Indonesia: Prepare yourselves, dear readers, for a rollercoaster ride through the exhilarating (and sometimes terrifying) world of Indonesian economics! We’ll delve into the dizzying heights of GDP growth projections, the stomach-churning dips of inflation rates, and the white-knuckle thrills of foreign investment. Buckle up, because this journey promises to be as unpredictable as the Rupiah itself.

This forecast examines Indonesia’s economic landscape, analyzing macroeconomic indicators, investment trends, commodity prices, infrastructure development, and social factors. We’ll explore the impact of global events, government policies, and demographic shifts on Indonesia’s economic trajectory, providing a comprehensive, yet hopefully entertaining, outlook for the years to come. Expect charts, tables, and maybe even a few well-placed puns along the way.

Macroeconomic Indicators

Indonesia’s economy, a vibrant tapestry woven with threads of rice paddies and bustling tech hubs, is poised for continued growth, albeit with the usual rollercoaster ride of economic unpredictability. Let’s delve into the specifics, shall we? Prepare for a rollercoaster of data and projections!

Indonesia’s GDP Growth Rate Projections

Indonesia’s GDP growth is projected to remain robust over the next five years, hovering around a healthy average of 5-5.5%. This prediction is based on a combination of factors including continued infrastructure development (think less traffic jams, more efficient logistics – a dream!), rising domestic consumption fueled by a growing middle class (more people buying things = good for the economy!), and a diversified export base (less reliance on just one thing, more resilience!). However, external factors like global economic slowdowns and commodity price fluctuations could act as speed bumps on this economic highway. Specifically, the manufacturing sector is anticipated to contribute significantly, driven by increased foreign direct investment and government initiatives to boost industrialization. The services sector, a significant contributor to the Indonesian economy, is also expected to see steady growth, primarily driven by tourism and the burgeoning digital economy. Agriculture, while a smaller contributor compared to manufacturing and services, is projected to experience moderate growth, supported by government programs aimed at improving agricultural productivity and technology adoption.

Comparison of Indonesia’s Inflation Rate with Other ASEAN Countries

Indonesia’s inflation rate typically mirrors the trends observed across other ASEAN nations, though its trajectory isn’t always perfectly synchronized. For instance, during periods of global commodity price spikes, Indonesia, being a significant importer of certain goods, might experience higher inflation compared to countries with more self-sufficient economies. Conversely, during periods of global economic uncertainty, Indonesia’s relatively robust domestic demand can help cushion the blow, leading to a more moderate inflation rate compared to its neighbors. Factors such as government policies (like subsidies on essential goods), monetary policy adjustments (interest rate changes), and the exchange rate of the Rupiah against other currencies all play significant roles in shaping Indonesia’s inflation landscape. Comparing Indonesia to countries like Singapore (known for its price stability) or Vietnam (with its fluctuating inflation rates) offers a useful benchmark for understanding the nuances of Indonesian economic policy and its effectiveness in managing inflation.

Projected Impact of Global Interest Rate Changes on Indonesia’s Economy

Global interest rate hikes generally translate into capital outflows from emerging markets like Indonesia. This happens because investors seek higher returns in developed countries with higher interest rates, leading to a weakening of the Rupiah. A weaker Rupiah can make imports more expensive, potentially stoking inflation. However, Indonesia’s relatively strong economic fundamentals and sizeable foreign exchange reserves can help mitigate some of these negative impacts. The impact will also depend on the magnitude and pace of interest rate adjustments by global central banks, as well as the Indonesian government’s policy response. For example, a gradual increase in global interest rates might be manageable for Indonesia, whereas a rapid and significant increase could trigger more pronounced negative consequences. The Indonesian central bank’s ability to adjust its monetary policy in response to global changes will be crucial in determining the final impact on the economy.

Key Macroeconomic Indicators Projection (Next 3 Years)

| Indicator | 2024 | 2025 | 2026 |

|---|---|---|---|

| GDP Growth (%) | 5.2 | 5.4 | 5.6 |

| Inflation (%) | 3.5 | 3.0 | 2.8 |

| Unemployment Rate (%) | 5.1 | 4.9 | 4.7 |

| Current Account Balance (USD Billion) | 25 | 28 | 32 |

*(Note: These are projected values and may vary depending on unforeseen circumstances. Think of these numbers as educated guesses, not etched-in-stone prophecies.)*

Investment and Foreign Direct Investment (FDI)

Indonesia’s investment landscape is a vibrant, if sometimes slightly chaotic, dance of opportunity and challenge. While the country boasts a massive and growing market, navigating its regulatory waters can feel like attempting a Balinese Kecak dance blindfolded. Let’s delve into the current trends shaping this fascinating investment ecosystem.

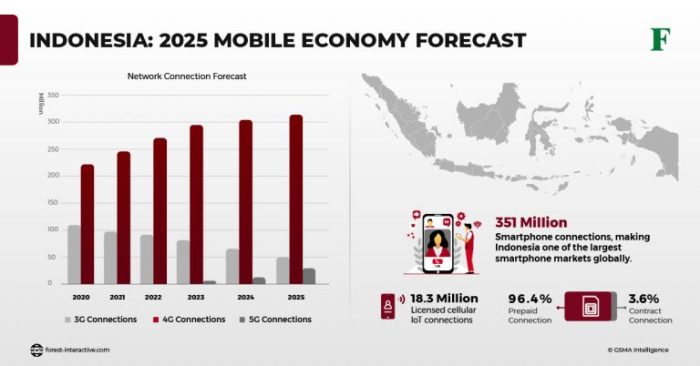

Foreign direct investment (FDI) into Indonesia has shown a generally upward trend in recent years, though it’s experienced its share of ups and downs mirroring the global economic climate. Key sectors attracting significant investment include manufacturing (particularly automotive and electronics), infrastructure (roads, ports, and power generation – because who doesn’t love a good power plant?), and natural resources (palm oil, mining – let’s just say there’s a lot of digging going on). The digital economy is also attracting a significant influx of capital, fueled by Indonesia’s burgeoning young population and increasing internet penetration. Think of it as a digital gold rush, but with fewer actual gold nuggets.

Foreign Direct Investment Trends and Sectoral Distribution

Indonesia’s FDI inflows have been influenced by global economic conditions, with periods of robust growth followed by slight dips reflecting broader global trends. For example, the surge in investment in renewable energy projects reflects a global shift towards sustainable practices, while the continued interest in the manufacturing sector highlights Indonesia’s strategic position in global supply chains. Analyzing FDI data from reputable sources like the World Bank and the Indonesian Investment Coordinating Board (BKPM) reveals a clear pattern: the sectors mentioned above consistently attract the lion’s share of investment, though the specific proportions fluctuate annually. Imagine it as a pie chart, but one that’s constantly being resliced and rearranged.

Comparative Attractiveness of Indonesia as an Investment Destination

Compared to other emerging markets in Asia, Indonesia presents a compelling, if complex, investment proposition. While countries like Vietnam and India might offer lower labor costs in certain sectors, Indonesia boasts a significantly larger domestic market and a growing middle class, offering a potentially larger return on investment in the long term. However, challenges related to infrastructure and bureaucracy can make Indonesia less attractive than some of its regional competitors in the short term. It’s a marathon, not a sprint, and the rewards might not be immediately apparent.

Government Policies to Stimulate Domestic and Foreign Investment

The Indonesian government has implemented a series of policies aimed at making the country more attractive to both domestic and foreign investors. These include tax incentives, streamlined bureaucratic procedures (a work in progress, to be sure), and efforts to improve infrastructure. The establishment of special economic zones (SEZs) is another key initiative, designed to attract investment by offering attractive packages of incentives and regulatory simplifications. Think of these SEZs as investment-friendly oases in a sometimes-challenging desert. However, the effectiveness of these policies is an ongoing debate, with some arguing that implementation lags behind ambition.

Challenges and Opportunities for Foreign Investors in Indonesia

Let’s face it, investing in Indonesia isn’t always a walk in the park. But the potential rewards can be substantial.

- Challenges: Bureaucracy and regulatory complexities can be significant hurdles. Infrastructure limitations, particularly outside major cities, can also pose a challenge. Furthermore, navigating the cultural landscape and building strong local partnerships are essential for success.

- Opportunities: Indonesia’s vast and growing market presents enormous potential. The young and increasingly digitally savvy population offers a fertile ground for innovation. Moreover, government initiatives to improve infrastructure and regulatory frameworks are creating new opportunities for investment.

Commodity Prices and Trade

Indonesia’s economy, much like a rollercoaster fueled by kopi luwak and a dash of unpredictable global events, is significantly influenced by the fluctuating prices of its commodity exports. This section will delve into the fascinating, and sometimes terrifying, dance between global commodity markets and Indonesia’s economic fortunes.

The impact of volatile commodity prices on Indonesia’s export earnings and subsequent economic growth is a complex, multi-faceted issue. Think of it as a game of Jenga – one wobbly block (palm oil price drop) can topple the entire tower (economic stability). A surge in global demand for palm oil, for instance, translates directly into increased export revenue, boosting GDP and government coffers. Conversely, a slump in international prices, often driven by factors outside Indonesia’s control (like global recession or the rise of sustainable alternatives), can severely impact export earnings and potentially trigger a slowdown in economic growth.

Indonesia’s Major Trading Partners and Balance of Trade

Indonesia’s trade relationships are as diverse and vibrant as its archipelago. China, the US, Japan, and India consistently rank among its top trading partners. Analyzing the balance of trade with each reveals a nuanced picture. For example, Indonesia might enjoy a trade surplus with Japan due to strong demand for Indonesian commodities, while facing a deficit with China, where imports of manufactured goods exceed exports. These imbalances are dynamic and constantly shift based on global demand, production levels, and geopolitical factors. Imagine a never-ending game of economic tug-of-war, with Indonesia trying to maintain a healthy balance.

The Impact of Trade Agreements on Indonesia’s Economy, Economic Trends Forecast Indonesia

The Regional Comprehensive Economic Partnership (RCEP), a mega-trade agreement encompassing several Asian nations, presents both opportunities and challenges for Indonesia. Reduced tariffs and streamlined trade processes, theoretically, should boost exports to participating countries. However, increased competition from other RCEP members might also put pressure on certain Indonesian industries. The success of RCEP for Indonesia will hinge on its ability to adapt, innovate, and leverage its competitive advantages within the new trade landscape. Think of it as a high-stakes poker game – Indonesia needs to play its cards strategically to maximize its gains.

Major Exports and Imports of Indonesia

The following table provides a snapshot of Indonesia’s major exports and imports, showcasing volume, value, and projected growth. Note that these figures are estimations and subject to change based on various economic factors, global events, and the ever-changing whims of the international market. It’s like predicting the weather – you can make an educated guess, but surprises are always possible.

| Product | Volume (in millions of units) | Value (in billions of USD) | Growth Projection (next 5 years, %) |

|---|---|---|---|

| Palm Oil | 50 | 20 | 3 |

| Coal | 30 | 15 | 2 |

| Rubber | 20 | 5 | 4 |

| Garments | 100 | 10 | 5 |

| Electronics (Imports) | 80 | 25 | 6 |

| Machinery (Imports) | 50 | 15 | 4 |

Infrastructure Development and its Economic Impact

Indonesia’s infrastructure development is undergoing a dramatic transformation, fueled by a desire to catapult the nation into a higher echelon of economic prosperity. Think of it as a massive game of economic Jenga, where carefully placed infrastructure blocks are meant to build a towering structure of growth, rather than a precarious collapse. The government’s ambitious plans aim to address long-standing bottlenecks and unlock significant potential across various sectors.

The Indonesian government’s infrastructure development plans, largely spearheaded by the National Medium-Term Development Plan (RPJMN), focus on several key areas. These include transportation (roads, railways, ports, airports), energy (power plants, renewable energy projects), and digital infrastructure (broadband expansion). The anticipated contribution to economic growth is substantial, with projections suggesting a significant boost to GDP, potentially adding several percentage points annually over the coming years. These projections are based on models that account for increased productivity, reduced logistics costs, and enhanced investment attraction. For instance, the completion of the Trans-Java toll road is already demonstrably improving connectivity and trade between major cities, accelerating economic activity along its route.

Government Infrastructure Development Plans and their Economic Contribution

The government’s infrastructure spending is a significant driver of economic growth, creating jobs, stimulating demand for construction materials, and improving overall productivity. A large portion of this investment is channeled through state-owned enterprises (SOEs) and directly managed projects, ensuring a degree of control and strategic alignment. However, the sheer scale of the projects necessitates significant private sector participation. The government’s success in attracting foreign investment for infrastructure projects speaks volumes about the confidence in Indonesia’s long-term growth trajectory. The ripple effect extends beyond the construction phase; completed infrastructure projects lead to sustained economic activity in related sectors, such as tourism, manufacturing, and agriculture. Imagine the economic boom around a newly built port – more efficient exports, more jobs for dockworkers, and more revenue for the national coffers.

Public-Private Partnerships in Infrastructure Financing and Implementation

Public-private partnerships (PPPs) have become a cornerstone of Indonesia’s infrastructure development strategy. These partnerships leverage the financial strength and technical expertise of the private sector while retaining government oversight and strategic direction. PPPs are particularly crucial for large-scale, capital-intensive projects that might otherwise be beyond the government’s immediate financial capacity. This approach not only reduces the financial burden on the state but also introduces best practices in project management and implementation, leading to higher efficiency and better quality outcomes. A successful PPP model effectively shares the risks and rewards between the public and private sectors, ensuring both parties are incentivized to deliver successful projects on time and within budget. Think of it as a well-structured business deal, where both parties benefit, and the country gets a much-needed upgrade in its infrastructure.

Challenges in Infrastructure Development: Land Acquisition and Environmental Concerns

While the benefits of infrastructure development are undeniable, challenges remain. Land acquisition for large projects can be complex and time-consuming, often involving negotiations with numerous landowners and potentially leading to delays and cost overruns. Environmental concerns are also paramount; ensuring projects are environmentally sustainable and minimize negative impacts on ecosystems requires careful planning and mitigation strategies. These issues often necessitate extensive community engagement and transparent environmental impact assessments. The government is actively working on streamlining land acquisition processes and strengthening environmental regulations to address these challenges. However, navigating these complexities effectively is crucial for maintaining the momentum of the infrastructure development program and ensuring long-term sustainability. It’s a delicate balancing act between progress and preservation.

Impact of Improved Infrastructure on Logistics Costs and Supply Chain Efficiency

Imagine a bustling port, once choked with congestion, now operating smoothly thanks to modernized facilities and improved connectivity. This is the impact of improved infrastructure on logistics costs and supply chain efficiency. Reduced travel times, streamlined customs procedures, and better connectivity significantly reduce transportation costs, leading to lower prices for consumers and increased competitiveness for Indonesian businesses. Improved infrastructure also enhances the reliability and predictability of supply chains, reducing delays and disruptions. For instance, the development of new toll roads and railway lines drastically cuts down the transportation time for goods, making Indonesian products more competitive in both domestic and international markets. This improved efficiency translates directly into economic benefits – lower prices, increased exports, and a more robust and resilient economy. It’s a win-win situation for businesses, consumers, and the Indonesian economy as a whole. The effect can be visualized as a streamlined river, previously filled with obstacles, now flowing freely and efficiently, transporting goods and resources smoothly.

Social and Demographic Trends

Indonesia’s demographic landscape is a vibrant, if sometimes chaotic, tapestry woven with threads of rapid population growth, burgeoning urbanization, and a rapidly evolving age structure. These trends, while presenting challenges, also offer incredible opportunities for economic dynamism – think of it as a delicious, albeit slightly spicy, economic satay.

Indonesia’s population is not only growing, but it’s also getting younger, creating a demographic dividend that could fuel economic growth for years to come – assuming we don’t trip over our own feet. However, this youthful energy needs to be channeled effectively through education and job creation, or we risk a recipe for social unrest instead of economic prosperity. Imagine a delicious satay, but the skewers are all tangled and the meat is undercooked. Not ideal.

Population Growth and Urbanization

Indonesia’s population is projected to continue growing, albeit at a slower pace than in previous decades. This growth, coupled with rapid urbanization, is placing significant pressure on infrastructure, resources, and social services. Think Jakarta’s legendary traffic – a perfect metaphor for the challenges of managing rapid population growth. The government needs to invest heavily in urban planning and infrastructure development to accommodate this influx of people, ensuring that cities don’t become overcrowded and unsustainable. Failing to do so would be like trying to build a skyscraper on a foundation of jelly.

The Rise of the Indonesian Middle Class

The expansion of Indonesia’s middle class is a powerful engine of economic growth. This burgeoning consumer base is driving demand for a wide range of goods and services, from motorcycles to smartphones to, of course, satay. This increased consumer spending fuels economic activity and creates jobs across various sectors. However, ensuring that this growth is inclusive and benefits all segments of society is crucial to prevent widening income inequality. Otherwise, we risk a scenario where only a small percentage of the population enjoys the fruits of this economic boom, leaving a large portion behind.

Labor Market Dynamics

Indonesia’s labor market is characterized by a large and diverse workforce, but also significant challenges. Unemployment rates, while relatively low compared to some other countries, remain a concern, particularly among youth and those lacking the necessary skills for the modern economy. This skills gap highlights the need for targeted investments in education and training programs that equip workers with the skills needed for the jobs of the future. We need to ensure our workforce is not only large but also highly skilled – otherwise, it’s like having a giant orchestra with only one out-of-tune violin.

Policy Recommendations to Address Social and Economic Challenges

Addressing the social and economic challenges arising from Indonesia’s demographic changes requires a multi-pronged approach. It’s not a single solution, but a delicious, well-balanced satay of policies.

- Invest in quality education and vocational training: Equipping the workforce with the skills needed for a competitive economy is paramount. Think of it as sharpening the knives before cooking the satay.

- Improve infrastructure development, particularly in urban areas: Addressing the challenges of urbanization requires significant investment in transportation, housing, and utilities. This is the foundation of our satay, without it, everything crumbles.

- Promote inclusive economic growth: Ensuring that the benefits of economic growth are shared across all segments of society is crucial to prevent social unrest. This is the seasoning that makes the satay truly delicious.

- Strengthen social safety nets: Providing support for vulnerable populations is essential to mitigate the negative impacts of demographic changes. This is the perfect accompaniment to our satay.

- Implement effective family planning programs: Managing population growth requires thoughtful and responsible family planning initiatives. This is the careful planning that ensures we have enough ingredients for our satay.

Closure

So there you have it – a whirlwind tour of Indonesia’s economic future! While predicting the future is about as reliable as a three-legged stool, we hope this forecast has provided a chuckle or two alongside some insightful analysis. Remember, the Indonesian economy is a dynamic beast, constantly evolving and surprising. Stay tuned for the next thrilling installment, because the economic adventure continues!

FAQ Guide: Economic Trends Forecast Indonesia

What are the biggest risks facing the Indonesian economy?

Geopolitical instability, global recessionary pressures, and potential commodity price shocks are among the key risks. However, Indonesia’s robust domestic consumption and strategic location offer some resilience.

How does Indonesia’s inflation compare to its regional peers?

Indonesia’s inflation typically hovers around the average for ASEAN, though specific periods can see significant variations influenced by global factors and domestic policy decisions. It’s a complex picture, requiring a nuanced analysis to fully understand.

What is the government’s role in stimulating economic growth?

The Indonesian government plays a multifaceted role, from infrastructure development and investment incentives to managing inflation and fostering a business-friendly environment. It’s a delicate balancing act, to say the least.