Financial Statement Analysis Tools are your secret weapon in the often-bewildering world of corporate finance. Unlocking the mysteries hidden within balance sheets, income statements, and cash flow statements, these tools transform complex data into actionable insights. From simple ratio calculations to sophisticated predictive modeling, the right tools empower you to make informed financial decisions, navigate potential pitfalls, and ultimately, boost your bottom line. This exploration will equip you with the knowledge and understanding to wield these powerful tools effectively.

We’ll cover a range of analytical techniques, from the fundamentals of ratio analysis to the more advanced realms of trend analysis and statistical modeling. We’ll also examine popular software solutions, comparing their features and functionalities to help you choose the perfect tool for your needs. Get ready to transform your understanding of financial statements – and your financial future!

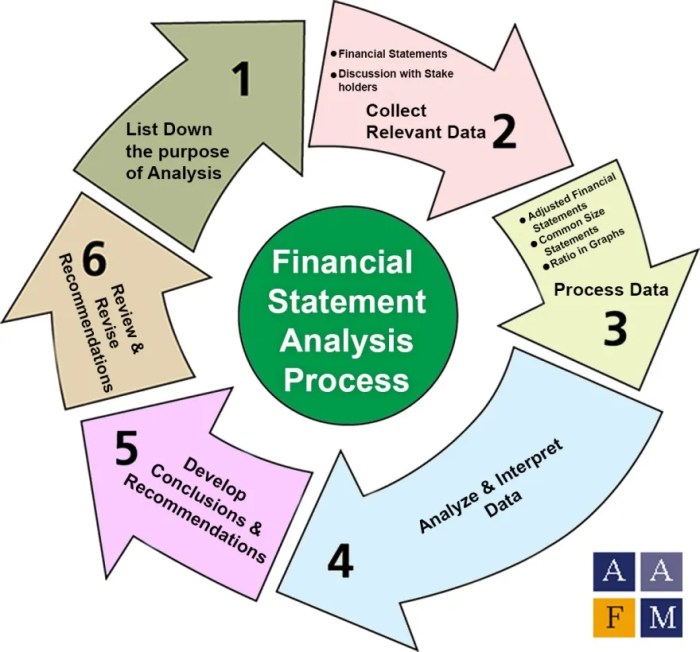

Introduction to Financial Statement Tools

Navigating the labyrinthine world of financial statements can feel like trying to decipher hieroglyphics while riding a unicycle – challenging, to say the least. Fortunately, we’re not alone in this fiscal tightrope walk. A plethora of tools exist to help us tame these financial beasts and extract meaningful insights. These tools range from simple spreadsheets to sophisticated software packages, each offering a unique approach to unraveling the mysteries within a company’s financial records.

Types of Financial Statement Analysis Tools

The landscape of financial statement analysis tools is surprisingly diverse. At one end of the spectrum, we have the trusty spreadsheet (Excel, Google Sheets, etc.), the workhorse of many a financial analyst. These allow for basic calculations, charting, and data manipulation, forming the foundation for many analyses. Moving up the ladder, we encounter dedicated financial analysis software, offering more advanced features like automated ratio calculations, benchmarking against industry peers, and sophisticated forecasting models. Finally, some integrated Enterprise Resource Planning (ERP) systems incorporate powerful financial reporting and analysis modules, providing a holistic view of a company’s financial health within a broader business context. Think of them as the Swiss Army knives of financial analysis.

Key Features and Functionalities of Popular Software Solutions

Popular financial statement analysis software often boasts a suite of features designed to streamline the analysis process. For instance, many programs automate the calculation of key financial ratios (like profitability, liquidity, and solvency ratios), saving analysts countless hours of manual calculation. They frequently include features for creating visually appealing charts and graphs, making complex data more accessible and understandable. Advanced functionalities might include scenario planning tools, allowing analysts to model the impact of different economic conditions or strategic decisions on a company’s financial performance. Consider the power of forecasting future cash flows based on different growth assumptions – a capability many of these programs excel at.

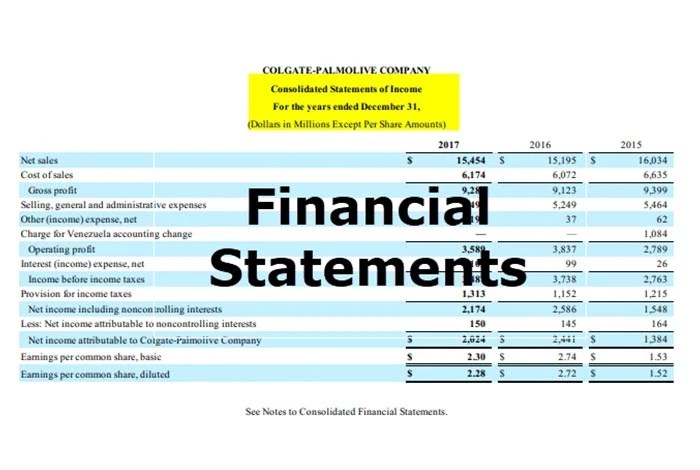

Applying Tools to Analyze Financial Statement Components

Let’s delve into how these tools can be used to dissect the three primary financial statements: the balance sheet, the income statement, and the cash flow statement. A spreadsheet might be sufficient for calculating basic ratios from data extracted from these statements. For example, calculating the current ratio (Current Assets / Current Liabilities) to assess short-term liquidity is easily done in a spreadsheet. However, more sophisticated software can go further. It can compare a company’s current ratio to industry averages, highlighting potential strengths or weaknesses. Analyzing the cash flow statement using dedicated software might reveal trends in operating cash flow, providing valuable insights into a company’s ability to generate cash from its core operations. The income statement, when analyzed with such software, can be broken down into detailed segments, identifying key drivers of profitability and highlighting areas for potential improvement.

Comparison of Financial Statement Analysis Tools

| Tool | Strengths | Weaknesses | Cost |

|---|---|---|---|

| Microsoft Excel | Widely available, flexible, relatively inexpensive. | Requires manual calculations for many ratios, limited advanced analytical features. | Low (typically included in Microsoft Office suite) |

| Bloomberg Terminal | Extensive data access, advanced analytical tools, real-time market data. | Extremely expensive, steep learning curve. | High (subscription-based) |

| Alteryx | Powerful data blending and preparation capabilities, robust analytics. | Requires specialized skills, can be complex to learn. | Medium to High (license-based) |

| SAP Analytics Cloud | Integrated with SAP ERP systems, strong reporting and visualization features. | Primarily geared towards large enterprises, high implementation costs. | High (subscription-based) |

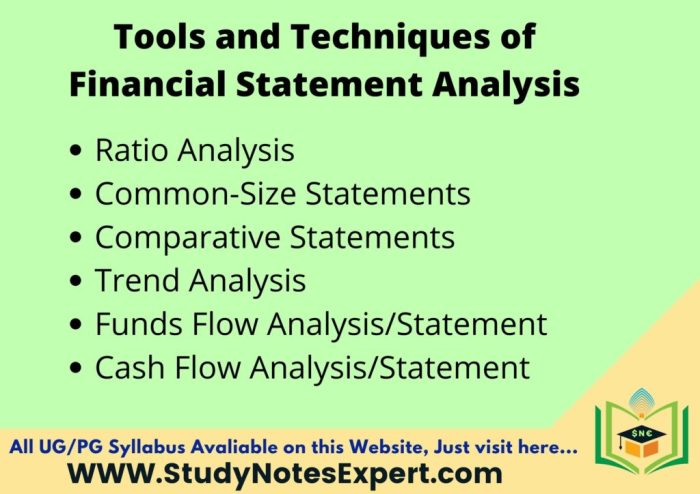

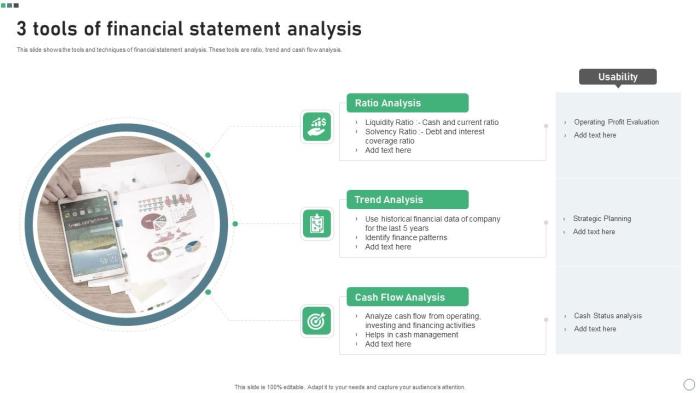

Ratio Analysis Techniques

Ratio analysis: the financial detective work that uncovers the hidden truths within a company’s numbers. Forget magnifying glasses – we’re wielding calculators and spreadsheets here! By cleverly combining figures from the balance sheet and income statement, we can paint a far more detailed picture of a company’s financial health than a simple glance at the bottom line ever could.

Ratio analysis provides a standardized way to compare a company’s performance across time, against its competitors, and against industry benchmarks. It’s like having a financial X-ray machine, allowing us to peer inside and see the strengths and weaknesses of a business’s financial structure. Think of it as a financial blood test, except instead of cholesterol, we’re looking at profitability, liquidity, and solvency.

Liquidity Ratios

Liquidity ratios gauge a company’s ability to meet its short-term obligations. A company with strong liquidity can comfortably pay its bills as they come due, while a company struggling with liquidity might find itself facing cash flow problems. We’ll examine two key ratios: the current ratio and the quick ratio. The current ratio compares current assets to current liabilities:

Current Ratio = Current Assets / Current Liabilities

. A higher ratio generally indicates better liquidity. The quick ratio is similar but excludes inventories, providing a more conservative measure of immediate liquidity:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

. Imagine a company that sells perishable goods; their inventory might not be as readily convertible to cash as, say, a company selling software.

Profitability Ratios

Profitability ratios measure a company’s ability to generate earnings from its operations. These ratios reveal how efficiently a company is using its assets and managing its expenses to produce profits. Key ratios include gross profit margin, operating profit margin, and net profit margin. These margins are calculated by dividing the respective profit (gross, operating, or net) by revenue. For example, a high gross profit margin suggests that the company is effectively managing its cost of goods sold. A low net profit margin, however, might indicate high operating expenses. Think of it like this: a high gross profit margin is like having a great recipe, but a low net profit margin means you’re paying too much for the ingredients or your restaurant is in a bad location!

Solvency Ratios

Solvency ratios assess a company’s ability to meet its long-term obligations. These ratios provide insights into the company’s financial leverage and its ability to withstand economic downturns. Key solvency ratios include the debt-to-equity ratio and the times interest earned ratio. The debt-to-equity ratio compares a company’s total debt to its shareholder equity:

Debt-to-Equity Ratio = Total Debt / Shareholder Equity

. A high ratio suggests high financial risk. The times interest earned ratio measures a company’s ability to cover its interest expense:

Times Interest Earned = Earnings Before Interest and Taxes (EBIT) / Interest Expense

. A low ratio signals potential difficulties in meeting interest payments.

Efficiency Ratios

Efficiency ratios, also known as activity ratios, measure how effectively a company is managing its assets and resources. These ratios help to assess the efficiency of various business processes. Key ratios include inventory turnover, accounts receivable turnover, and asset turnover. Inventory turnover, for instance, indicates how quickly a company is selling its inventory:

Inventory Turnover = Cost of Goods Sold / Average Inventory

. A high turnover suggests efficient inventory management, while a low turnover might indicate slow-moving inventory or potential obsolescence. Similarly, high accounts receivable turnover implies efficient credit collection, whereas a low turnover might indicate difficulties in collecting payments from customers.

A Step-by-Step Guide to Ratio Analysis

Let’s analyze “Hypothetical Widgets Inc.” Assume their financial statements show: Current Assets = $100,000; Current Liabilities = $50,000; Inventory = $20,000; Total Debt = $80,000; Shareholder Equity = $120,000; EBIT = $40,000; Interest Expense = $5,000; Revenue = $200,000; Cost of Goods Sold = $80,000.

Step 1: Calculate the ratios. Using the formulas above, we find: Current Ratio = 2; Quick Ratio = 1.6; Debt-to-Equity Ratio = 0.67; Times Interest Earned = 8; Inventory Turnover = 4.

Step 2: Compare the ratios to industry benchmarks. Let’s say the industry average for the current ratio is 1.5. Hypothetical Widgets Inc.’s ratio of 2 suggests superior liquidity.

Step 3: Analyze trends. By comparing these ratios to previous years’ data (if available), we can identify trends and potential risks. For example, a declining current ratio over time might signal worsening liquidity.

Industry Variations in Ratio Analysis

The usefulness of specific ratios varies significantly across industries. For example, a high inventory turnover is crucial for grocery stores (perishable goods), but less critical for a company selling heavy machinery. Similarly, the debt-to-equity ratio might be higher in capital-intensive industries like manufacturing than in service industries. Context is key! Analyzing ratios without considering the specific industry can lead to misleading conclusions.

Data Visualization and Interpretation

Turning raw financial data into insightful visuals is like transforming a pile of accounting ledgers into a captivating financial blockbuster. Instead of endless spreadsheets, we’ll unlock the storytelling power of charts and graphs, revealing the hidden narratives within your numbers. Prepare for a visual feast!

Effective data visualization is crucial for making sense of complex financial information. By presenting data in a clear and concise manner, we can quickly identify trends, spot anomalies, and communicate financial performance effectively to a wide range of audiences, from seasoned investors to your slightly bewildered aunt Mildred.

Chart Selection for Financial Data

Choosing the right chart type is paramount. A poorly chosen chart can obscure the story your data is trying to tell, leading to misinterpretations and potentially disastrous investment decisions. The wrong chart is like wearing a clown suit to a job interview – it just doesn’t work.

For example, line charts are ideal for showcasing trends over time, such as revenue growth or profit margins. Imagine a gracefully ascending line representing years of consistent profitability – a beautiful sight for any investor. Bar charts, on the other hand, are perfect for comparing different categories, such as expenses across various departments. A vibrant bar chart clearly highlighting the cost of that extravagant company retreat will be a talking point at the next board meeting. Pie charts effectively illustrate proportions, such as the allocation of assets within a portfolio. A perfectly segmented pie chart can clearly demonstrate the balance between risky and conservative investments, leaving no room for misunderstanding.

Creating Visualizations that Highlight Key Trends, Financial Statement Analysis Tools

Let’s face it, data without context is just a collection of numbers. The art of visualization lies in highlighting the key trends and patterns that tell a compelling story. Think of it as financial storytelling; the numbers are your words, and the charts are your stage.

For instance, a line chart displaying revenue growth over several quarters, alongside a line representing the industry average, can clearly illustrate whether a company is outperforming or underperforming its competitors. Adding a trendline to such a chart could help forecast future performance, but remember, forecasting is an art, not a science. For example, predicting the dot-com bubble’s burst would have been extremely difficult despite the available data. Similarly, the global financial crisis of 2008 highlighted the limitations of relying solely on past trends for future predictions. Therefore, always accompany predictions with appropriate caveats and acknowledge the inherent uncertainties.

Communicating Complex Financial Information Effectively

Complex financial data doesn’t have to be intimidating. With the right visualization, even the most intricate financial models can be easily understood. Imagine explaining a complex derivative to your grandmother using only numbers; it’s a nightmare. But with a clear visual, even she might understand (maybe).

For example, a heatmap can effectively represent correlations between different financial variables, making it easier to identify potential risks or opportunities. A well-designed dashboard, combining several charts and graphs, can provide a comprehensive overview of a company’s financial health, allowing for a quick assessment of its performance. This is akin to providing a financial “executive summary” at a glance. Remember, clarity is key – avoid overwhelming your audience with too much information at once.

Best Practices for Creating Clear and Informative Financial Visualizations

Creating effective financial visualizations is not just about aesthetics; it’s about clear communication. Here are some essential best practices:

Creating clear and informative financial visualizations requires careful planning and execution. The goal is to present complex information in a way that is easily understood and interpreted, avoiding any ambiguity or misrepresentation. This involves a meticulous selection of appropriate chart types, careful labeling of axes and data points, and the use of clear and concise titles. Furthermore, it’s crucial to avoid the temptation to manipulate data to create a desired outcome; honesty and accuracy are paramount. A misleading graph is like a deceptive salesperson – it might initially impress, but the consequences can be severe.

- Use clear and concise titles and labels.

- Choose appropriate chart types for the data.

- Maintain consistent scales and units.

- Highlight key trends and patterns.

- Avoid clutter and unnecessary details.

- Ensure the visualizations are accessible to your target audience.

Advanced Analytical Techniques

So, you’ve mastered the basics of financial statement analysis – bravo! But the world of finance is a thrilling rollercoaster, not a gentle pony ride. To truly understand the financial health of a company, you need to harness the power of advanced techniques. Think of it as upgrading from a bicycle to a Formula 1 car – more speed, more precision, and a whole lot more fun (if you’re into that sort of thing).

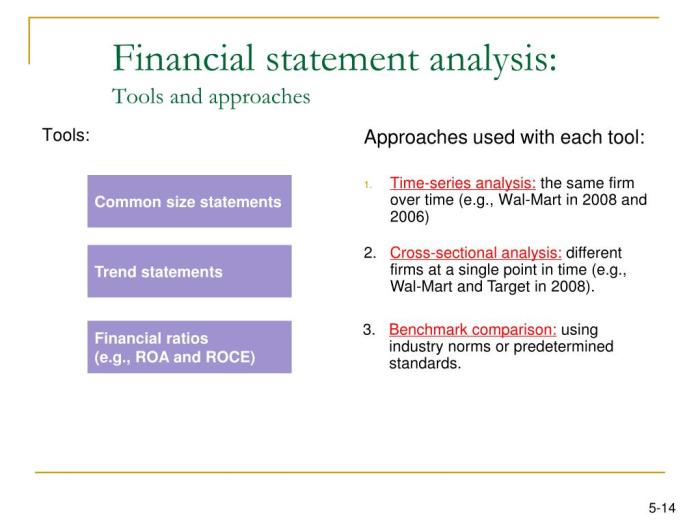

Trend analysis, common-size statements, and benchmarking are your new best friends. These techniques allow you to move beyond simple snapshots and delve into the dynamic narratives hidden within a company’s financial history. Regression analysis adds predictive power, allowing you to gaze into the crystal ball (metaphorically speaking, of course; we don’t endorse actual crystal ball gazing). Statistical modeling provides a robust framework for assessing risk and making informed decisions, helping you navigate the treacherous waters of financial uncertainty.

Trend Analysis

Trend analysis involves examining financial data over several periods to identify patterns and predict future performance. Imagine plotting a company’s revenue over the past five years; a clear upward trend suggests growth, while a downward trend… well, let’s just say it’s time to adjust your investment strategy. Analyzing trends in key ratios like profitability, liquidity, and solvency can reveal valuable insights into a company’s operational efficiency and long-term viability. For example, a consistent decline in gross profit margin might signal rising costs or declining pricing power, prompting further investigation.

Common-Size Statements

Common-size statements express financial statement items as percentages of a base figure. For the balance sheet, total assets are the base; for the income statement, revenue takes the lead. This allows for easy comparison across different companies, regardless of their size. Imagine comparing Apple and a small tech startup – comparing raw numbers is like comparing apples and oranges (pun intended!). Common-size statements normalize the data, allowing you to focus on the relative proportions of different items. For instance, a high percentage of accounts receivable relative to sales might indicate potential collection problems.

Benchmarking

Benchmarking compares a company’s performance against its industry peers or competitors. It’s like a financial Olympics, where you’re not just aiming for personal bests, but also competing against the best in the game. By identifying best practices and areas for improvement, benchmarking can guide strategic decision-making and enhance competitiveness. This could involve comparing key ratios such as return on assets (ROA) or return on equity (ROE) against industry averages to assess a company’s relative performance.

Regression Analysis in Forecasting

Regression analysis is a powerful statistical technique used to model the relationship between a dependent variable (e.g., sales revenue) and one or more independent variables (e.g., advertising expenditure, economic growth). By identifying these relationships, you can forecast future financial performance with a degree of accuracy. For example, a company might use regression analysis to predict future sales based on past sales data and anticipated changes in advertising spending. The accuracy of these predictions depends on the quality of the data and the appropriateness of the chosen model. Remember, however, even the best models are just educated guesses, not guaranteed futures.

Statistical Modeling in Risk Assessment

Statistical modeling plays a crucial role in assessing and managing financial risk. Techniques like Monte Carlo simulation can be used to model the probability of various outcomes, such as project success or investment returns. This allows businesses to make more informed decisions by quantifying the uncertainties involved. For instance, a bank might use statistical models to assess the credit risk of loan applicants, helping them to determine the appropriate interest rates and loan amounts.

DuPont Analysis: A Step-by-Step Guide

DuPont analysis breaks down return on equity (ROE) into its component parts: profit margin, asset turnover, and financial leverage. This provides a deeper understanding of the drivers of profitability.

- Calculate the Return on Equity (ROE): ROE = Net Income / Average Shareholder’s Equity

- Calculate the Profit Margin: Profit Margin = Net Income / Revenue

- Calculate the Asset Turnover: Asset Turnover = Revenue / Average Total Assets

- Calculate the Equity Multiplier (Financial Leverage): Equity Multiplier = Average Total Assets / Average Shareholder’s Equity

- Reconcile the DuPont Formula: Notice that ROE = Profit Margin * Asset Turnover * Equity Multiplier. This decomposition shows how each factor contributes to the overall ROE.

For example, if a company has a ROE of 15%, a profit margin of 5%, an asset turnover of 1.5, and an equity multiplier of 2, we can see that the high equity multiplier (leverage) is a significant contributor to the ROE. This provides valuable insights into the company’s financial strategy and potential risks.

Case Studies and Practical Applications

Financial statement analysis isn’t just a theoretical exercise dreamt up by accountants to keep us all awake at night; it’s a vital tool for understanding a company’s financial health and making informed decisions. Let’s dive into a real-world example to see how these tools can unearth hidden truths (and maybe even prevent a few financial meltdowns).

Let’s examine the case of “Widget Wonders Inc.”, a fictional but realistically portrayed company specializing in, you guessed it, widgets. Their recent financial statements revealed some unsettling trends, which we’ll analyze using various tools.

Widget Wonders Inc.: A Case Study in Financial Statement Analysis

Widget Wonders, despite boasting impressive revenue growth, was experiencing a concerning decline in profitability. A closer look at their balance sheet and income statement, coupled with ratio analysis, revealed the root cause. Specifically, the use of the Debt-to-Equity ratio and the Inventory Turnover ratio provided crucial insights.

The Debt-to-Equity ratio, calculated as Total Debt / Total Equity, indicated a dangerously high level of debt financing. This meant that Widget Wonders was relying heavily on borrowed funds, increasing their financial risk and potentially jeopardizing their long-term stability. A high Debt-to-Equity ratio, in this context, was a flashing red light, suggesting potential insolvency issues if the company’s revenue streams were to falter.

Furthermore, the Inventory Turnover ratio, calculated as Cost of Goods Sold / Average Inventory, showed a significant decrease. This indicated that Widget Wonders was holding onto excessive inventory, tying up capital that could have been used more productively. This sluggish inventory turnover contributed directly to reduced profitability, as storage costs mounted and the risk of obsolescence increased. The high inventory levels also suggested potential issues with production planning or sales forecasting.

Interpreting Results and Drawing Actionable Insights

By combining the insights gained from both the Debt-to-Equity and Inventory Turnover ratios, a clear picture emerged: Widget Wonders was over-leveraged and inefficient in its inventory management. This combination was the perfect storm brewing a financial crisis. The high debt burden limited the company’s financial flexibility, making it difficult to adapt to changing market conditions or invest in growth opportunities. The excessive inventory, meanwhile, was draining resources and impacting profitability.

The analysis suggested several actionable insights: Firstly, Widget Wonders needed to implement stricter inventory management practices, perhaps through improved forecasting techniques or just-in-time inventory strategies. Secondly, they should actively explore ways to reduce their debt burden, potentially through refinancing or asset sales. Finally, they needed to enhance their financial planning and forecasting capabilities to prevent similar situations from recurring.

Key Takeaways and Broader Implications

The Widget Wonders case study highlights the importance of comprehensive financial statement analysis.

- Early detection of financial distress: Ratio analysis, in particular, can uncover hidden problems before they escalate into full-blown crises.

- Informed strategic decision-making: By analyzing financial data, companies can make data-driven decisions that enhance profitability and sustainability.

- Improved resource allocation: Identifying inefficiencies, such as excessive inventory, allows for better resource allocation and increased profitability.

- Enhanced risk management: Understanding a company’s financial risk profile is crucial for proactive risk management and avoiding potential financial pitfalls. This includes identifying high levels of debt and understanding the company’s ability to service it.

- Proactive problem solving: Rather than reacting to financial issues, companies can proactively address them, preventing major problems down the line.

Software and Technology Integration

Let’s face it, manually crunching numbers from financial statements is about as exciting as watching paint dry. Fortunately, the digital age has gifted us with a plethora of tools to automate this often tedious process, freeing up valuable time for more strategic activities – like, say, planning your next vacation. Software and technology integration is no longer a luxury, but a necessity for efficient and accurate financial statement analysis.

The integration of specialized financial statement analysis software with other business intelligence systems creates a powerful synergy. Imagine a system that automatically pulls data from your accounting software, performs complex calculations, generates insightful visualizations, and seamlessly integrates with your CRM and forecasting tools. This interconnectedness provides a holistic view of your business’s financial health, revealing patterns and trends that might otherwise remain hidden in the spreadsheet abyss.

Automation’s Impact on Efficiency and Accuracy

Automation significantly enhances both the efficiency and accuracy of financial analysis. Imagine the time saved by eliminating manual data entry and calculation errors. Software can process vast datasets in seconds, performing complex calculations that would take hours, even days, to complete manually. This speed allows for more frequent analysis, enabling businesses to react quickly to changing market conditions and make more informed decisions. Moreover, automation minimizes the risk of human error, ensuring greater accuracy in financial reporting and forecasting. For example, a company using automated systems for inventory management can quickly identify discrepancies and adjust their ordering processes, leading to improved cash flow management and reduced costs. This, in turn, improves the accuracy of their financial projections and makes them better prepared for potential challenges.

Choosing Financial Statement Analysis Software: Key Features

Selecting the right software is crucial for maximizing the benefits of technology integration. Choosing the wrong tool can be like trying to build a skyscraper with a child’s toy set – it’s just not going to work. Therefore, careful consideration of the following features is paramount:

- Data Import Capabilities: The software should seamlessly integrate with your existing accounting and ERP systems, effortlessly importing data in various formats (CSV, Excel, etc.).

- Ratio Analysis Functionality: Automatic calculation of key financial ratios, including liquidity, profitability, and solvency ratios, is a must-have. The software should also allow for customization and the creation of user-defined ratios.

- Data Visualization Tools: The ability to create charts, graphs, and dashboards that visually represent key financial metrics is essential for easy interpretation and communication of findings.

- Benchmarking Capabilities: The software should allow comparison of your company’s financial performance against industry peers or historical data, providing valuable context and insights.

- Reporting and Forecasting Tools: The generation of comprehensive financial reports and the ability to create accurate financial forecasts are crucial for strategic planning and decision-making.

- Security and Compliance: The software should adhere to relevant data security and compliance standards to protect sensitive financial information.

Last Point

Mastering financial statement analysis is no longer a daunting task. With the right tools and techniques at your disposal, you can navigate the complexities of financial data with confidence. From understanding liquidity ratios to visualizing key trends, the journey we’ve taken has equipped you with the skills to unlock valuable insights. Remember, the key lies in selecting the appropriate tools for your specific needs and interpreting the data with a critical and insightful eye. Now go forth and conquer those financial statements!

Commonly Asked Questions: Financial Statement Analysis Tools

What are the limitations of financial statement analysis tools?

While powerful, these tools rely on the accuracy of the input data. Garbage in, garbage out. They also can’t account for qualitative factors, such as management quality or unforeseen market events, that can significantly impact a company’s performance. Finally, over-reliance on any single tool or metric can lead to a skewed perspective.

How often should I analyze financial statements?

The frequency depends on your needs and the volatility of the business. For publicly traded companies, quarterly analysis is common. For smaller, privately held businesses, annual analysis might suffice. However, regular monitoring, perhaps monthly or even weekly for key metrics, provides a more dynamic view.

Are there free financial statement analysis tools available?

Yes, several free tools exist, often with limited functionality compared to paid software. Spreadsheet software like Excel or Google Sheets can be used for basic analysis, while some open-source options offer more advanced features. However, the limitations of free tools should be considered carefully.