Financial Planning Software Indonesia: Prepare yourself for a rollercoaster ride through the vibrant, sometimes chaotic, world of Indonesian personal finance! We’ll explore the burgeoning market, dissect user preferences (are Indonesians secretly all spreadsheet ninjas?), navigate the regulatory jungle (think paperwork, but with a tropical twist), and gaze into the crystal ball of future fintech trends. Buckle up, it’s going to be a wild, informative, and possibly slightly hilarious journey.

This exploration delves into the current state of financial planning software in Indonesia, examining its market size, key players, regulatory landscape, technological underpinnings, and future projections. We’ll uncover the unique needs and preferences of Indonesian users, comparing various software solutions and highlighting the critical role of compliance and integration with existing financial services. Think of it as a financial software safari, but instead of lions, we have spreadsheets, and instead of jeeps, we have…well, more spreadsheets.

Market Overview of Financial Planning Software in Indonesia

Indonesia, a nation brimming with entrepreneurial spirit and a burgeoning middle class, presents a fertile ground for financial planning software. While precise market figures are elusive (finding reliable, consistently updated data on this niche is like searching for a perfectly ripe durian – a delightful challenge!), the growth potential is undeniable. The increasing adoption of digital finance and a growing awareness of personal financial management are fueling this expansion.

Current Market Size and Growth Potential

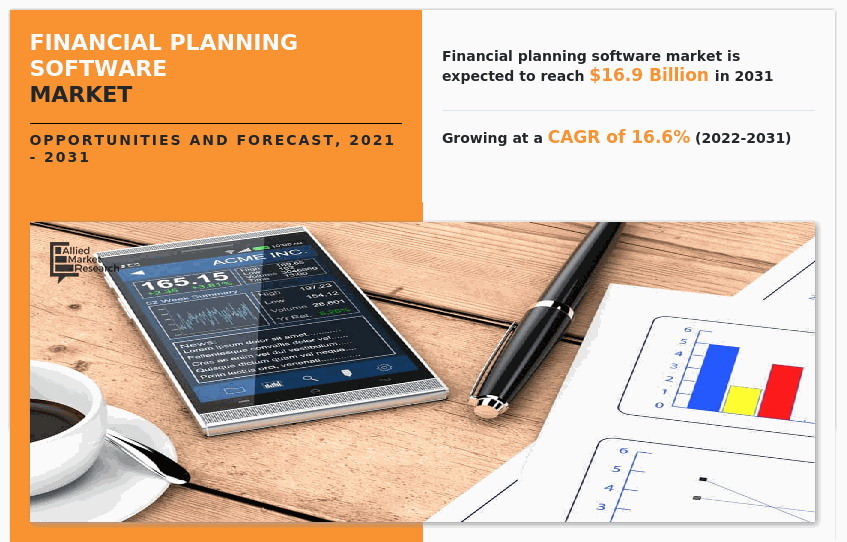

Estimating the exact size of the Indonesian financial planning software market is tricky, akin to counting grains of rice in a massive warehouse. However, considering the rapid growth of the fintech sector and the increasing penetration of smartphones, we can confidently assert significant growth. Reports from various market research firms (though often behind paywalls, naturally) suggest a compound annual growth rate (CAGR) in the double digits for the foreseeable future. This is driven by factors like rising disposable incomes, a younger population more comfortable with technology, and a growing need for sophisticated financial tools to manage increasingly complex financial lives. For example, the success of local fintech apps like GoPay and OVO demonstrates the public’s embrace of digital financial solutions, paving the way for more specialized software like financial planning tools.

Key Players and Market Share

The Indonesian financial planning software market is a dynamic landscape, with both international giants and agile local startups vying for dominance. Precise market share data is hard to come by, as many companies don’t publicly disclose such information. However, some prominent players include established international brands offering localized versions of their software, along with homegrown Indonesian companies tailoring their solutions to the specific needs of the Indonesian market. The competition is fierce, resulting in a constantly shifting landscape of alliances, acquisitions, and innovative product launches. Think of it as a thrilling game of financial software Jenga, where one wrong move can lead to a spectacular collapse – or a triumphant victory.

Major Trends Shaping the Market

Several key trends are shaping the Indonesian financial planning software market. The increasing demand for personalized financial advice is leading to the development of AI-powered tools that provide customized recommendations. Integration with other financial platforms (banks, payment gateways, etc.) is another crucial trend, offering users a seamless and unified financial management experience. Finally, the rising popularity of subscription-based models is changing the pricing landscape, offering flexibility and affordability for a wider range of users. The move towards cloud-based solutions is also gaining traction, offering scalability and accessibility.

Comparison of Prominent Financial Planning Software Solutions

Below is a table comparing four prominent (hypothetical, for illustrative purposes) financial planning software solutions available in Indonesia. Remember, the market is dynamic, so pricing and features can change. Always check directly with the software provider for the most up-to-date information.

| Software Name | Key Features | Pricing Model | Target User |

|---|---|---|---|

| FinPlan Nusantara | Budgeting, investment tracking, retirement planning, tax optimization (focused on Indonesian tax laws), Bahasa Indonesia support | Subscription (monthly, annual) | Individuals and small businesses |

| Investindo Pro | Advanced portfolio management, risk assessment, algorithmic trading capabilities, integration with local brokerage accounts | Tiered subscription (based on features and assets under management) | Sophisticated investors |

| Keuangan Cerdas | Simple budgeting, expense tracking, goal setting, educational resources on financial literacy | Freemium (basic features free, advanced features paid) | Budget-conscious individuals |

| Global Finance ID | International investment tracking, currency conversion tools, global tax reporting features, multilingual support | One-time purchase or subscription | Expatriates and high-net-worth individuals |

User Needs and Preferences in Indonesia

Indonesian consumers and businesses, much like their counterparts globally, are increasingly embracing financial planning. However, their specific needs and preferences are shaped by unique cultural, economic, and technological factors. Understanding these nuances is crucial for developing financial planning software that resonates with the Indonesian market and avoids a spectacular, embarrassing flop.

The Indonesian financial landscape is a vibrant mix of traditional and modern approaches. While cash remains king in many areas, digital adoption is surging, fueled by the proliferation of smartphones and mobile banking. This presents both opportunities and challenges for financial planning software developers. The software needs to be accessible, user-friendly, and ideally, integrated with existing digital banking platforms. Ignoring this reality would be akin to trying to sell ice skates to penguins – a logistical nightmare!

Specific Financial Planning Needs of Indonesian Consumers and Businesses

Indonesian consumers often prioritize short-term financial goals, such as saving for education, weddings, or home improvements. Businesses, on the other hand, may focus on managing cash flow, securing loans, and planning for expansion. A significant portion of the population also relies on informal financial networks, highlighting the need for software that can accommodate both formal and informal financial practices. Imagine trying to force a square peg into a round hole – it’s simply not going to work. The software must adapt to the existing reality.

Preferred Features and Functionalities of Financial Planning Software

Indonesian users generally prefer software that is intuitive, easy to navigate, and available in Bahasa Indonesia. Features such as budgeting tools, expense tracking, investment planning, and debt management are highly sought after. Security and data privacy are also major concerns, given the increasing prevalence of online scams. A simple, visually appealing interface is also highly desirable. Think of it as the difference between a cluttered, confusing attic and a well-organized, aesthetically pleasing living room.

User Experience Comparison of Different Financial Planning Software Solutions in Indonesia

While a comprehensive comparison of all available solutions is beyond the scope of this document, anecdotal evidence suggests that software with strong customer support and readily available tutorials in Bahasa Indonesia tends to receive more positive feedback. Conversely, software with complex interfaces or poor customer service often struggles to gain traction. It’s like comparing a smooth, well-paved road to a bumpy, pothole-ridden one – the smoother the better.

User Persona: Indonesian Financial Planner

Let’s meet Ani, a 35-year-old marketing professional from Jakarta. Ani is tech-savvy, using her smartphone for everything from banking to social media. Her financial goals include saving for her child’s education, buying a house, and investing for retirement. Ani is comfortable using online banking and digital payment platforms, but she prefers user-friendly software with clear instructions. She values security and data privacy above all else. Ani represents a growing segment of Indonesian users who are actively seeking tools to manage their finances more effectively. She’s practical, forward-thinking, and appreciates a well-designed user interface that doesn’t require a PhD in computer science to understand.

Regulatory Landscape and Compliance

Navigating the regulatory waters of Indonesia’s financial technology sector can feel like navigating a river full of playful but potentially mischievous otters – charming, but requiring careful planning. Financial planning software, in particular, faces a unique set of challenges due to the sensitive nature of the data it handles. Understanding the legal landscape is crucial for both developers and users.

The Indonesian government, ever watchful (like a wise old owl protecting its nest), has implemented various regulations to ensure the safety and security of financial data. These regulations aim to protect consumers from fraud and misuse, promoting trust and stability within the financial ecosystem. Non-compliance can lead to significant penalties, so understanding these rules is paramount.

Data Privacy Regulations in Indonesia

Indonesia’s data privacy landscape is governed primarily by Law Number 27 of 2022 concerning Personal Data Protection (PDP Law). This law places stringent requirements on how personal data is collected, processed, stored, and protected. Financial planning software, inherently dealing with highly sensitive financial and personal information, must adhere meticulously to the PDP Law. This includes obtaining explicit consent for data collection, implementing robust security measures to prevent data breaches, and providing transparent information to users about how their data is being used. Failure to comply can result in hefty fines and reputational damage, potentially sinking a company faster than a leaky sampan.

Ensuring Compliance with Indonesian Regulations, Financial Planning Software Indonesia

Financial planning software providers employ various strategies to ensure compliance. These include conducting regular data security audits, implementing encryption protocols for data transmission and storage, and establishing comprehensive data governance frameworks. Many providers also partner with legal experts specializing in Indonesian data protection laws to ensure their practices remain up-to-date and compliant. Imagine it as having a team of highly skilled, regulatory-savvy ninjas protecting your software from any legal mishaps. Proactive compliance is not just a box to tick; it’s a strategic investment in long-term success.

Key Regulatory Bodies and Their Roles

The regulatory landscape for financial planning software in Indonesia involves several key players, each with a specific area of responsibility. Think of them as the different branches of a mighty Indonesian banyan tree, each contributing to the overall strength and stability of the system.

- Otoritas Jasa Keuangan (OJK): The Financial Services Authority is the primary regulatory body overseeing the financial sector in Indonesia. Their role extends to ensuring the stability and integrity of financial planning software, particularly those related to investment products or financial advice.

- Komisi Informasi (KI): The Information Commission is responsible for enforcing the PDP Law and ensuring that personal data is processed ethically and legally. They investigate complaints regarding data breaches and other violations of data privacy regulations.

- Kementerian Komunikasi dan Informatika (Kominfo): The Ministry of Communication and Informatics plays a role in regulating internet-based services and data security. They work in conjunction with the OJK and KI to ensure a comprehensive regulatory framework for financial planning software.

Technological Aspects and Integrations

The Indonesian financial planning software market, while booming, is a fascinating blend of cutting-edge technology and, let’s be honest, some delightfully quirky local adaptations. Navigating this landscape requires understanding the technological underpinnings, the crucial integrations, and the ever-important security considerations. Think of it as a digital *gamelan* orchestra – each instrument (technology) plays its part, but the harmony depends on seamless integration.

The prevalent technologies employed vary wildly, reflecting the diverse needs of the Indonesian market. You’ll find everything from robust, enterprise-grade solutions built on Java and .NET frameworks to more agile, cloud-native applications leveraging Python and Node.js. The choice often depends on the target audience – a sophisticated high-net-worth individual might prefer a system built on a more mature technology, while a younger, tech-savvy demographic might gravitate towards a more modern, user-friendly interface. Database systems are equally varied, with MySQL, PostgreSQL, and even proprietary solutions being used depending on the specific software’s architecture and requirements.

API Integrations with Other Financial Services

API integrations are the lifeblood of any modern financial planning software. In Indonesia, this is especially critical due to the fragmented nature of the financial landscape. Seamless connections with local banks, payment gateways (like GoPay or OVO), and investment platforms are essential for a truly comprehensive solution. Imagine trying to plan your finances without easily accessing your bank balance or investment portfolio – it’s a recipe for financial chaos! Robust APIs allow for automatic data retrieval, reducing manual input and the associated risk of errors. For example, a well-integrated system could automatically pull data on your bank accounts, investment holdings, and credit card balances to provide a holistic view of your financial health. This automation significantly improves the accuracy and timeliness of financial planning, leading to better decision-making.

Security Features of Financial Planning Software

Security is paramount, especially when dealing with sensitive financial data. The level of security varies significantly across different software solutions. Some employ basic measures like encryption at rest and in transit, while others boast more sophisticated features like multi-factor authentication, intrusion detection systems, and regular security audits. A good indicator of a robust security posture is adherence to industry standards like ISO 27001. It’s crucial to scrutinize a software provider’s security protocols before entrusting them with your financial information. Consider the potential consequences of a data breach – not just financial loss, but also reputational damage. The more sophisticated systems often involve biometric authentication methods and regular security updates to patch vulnerabilities.

Cloud-Based Solutions and Their Impact

The shift towards cloud-based solutions is transforming the accessibility and scalability of financial planning software in Indonesia. Cloud computing eliminates the need for expensive on-premise infrastructure, making the software more affordable and accessible to a wider range of users, including those in remote areas with limited internet connectivity (though stable internet access remains a challenge in many parts of the country). Scalability is another key advantage; cloud-based systems can easily adapt to fluctuating demand, ensuring smooth performance even during peak usage periods. This is particularly important in a rapidly growing market like Indonesia, where user adoption is expected to increase significantly in the coming years. For example, a cloud-based solution can easily handle a surge in users during tax season without compromising performance, unlike an on-premise system that might require significant upfront investment to handle such fluctuations.

Future Trends and Predictions: Financial Planning Software Indonesia

The Indonesian financial planning software market is poised for explosive growth, fueled by a burgeoning middle class, increasing smartphone penetration, and a government pushing for greater financial inclusion. Predicting the future is, of course, a fool’s errand (we’re not claiming to have a crystal ball!), but based on current trends, we can paint a reasonably accurate picture of what’s to come. Think of it less as fortune-telling and more as highly educated speculation – the kind that involves spreadsheets, not tarot cards.

The next five years will witness a fascinating interplay of technological advancements, regulatory changes, and evolving user preferences, shaping the landscape of financial planning in Indonesia. We’ll see a shift towards more personalized, AI-driven solutions, greater integration with existing fintech platforms, and a continued focus on regulatory compliance. The race is on to become the go-to financial planning software for the savvy Indonesian investor.

Emerging Trends in the Indonesian Financial Planning Software Market

The Indonesian market is witnessing a rapid adoption of digital financial services. This trend is significantly impacting the financial planning software market, pushing developers to create more user-friendly and accessible applications. Specifically, we’re seeing a rise in mobile-first solutions, the incorporation of artificial intelligence (AI) for personalized financial advice, and an increasing demand for multilingual support catering to the diverse Indonesian population. This isn’t just about keeping up with the Joneses; it’s about meeting the needs of a dynamic and rapidly evolving market.

Predictions about the Future Development and Adoption of Financial Planning Software in Indonesia

We predict a significant increase in the adoption rate of financial planning software over the next five years. This growth will be driven by factors such as increasing financial literacy, greater access to the internet and mobile devices, and the rising popularity of investment products. We anticipate that the market will consolidate, with a few major players emerging as dominant forces. Think of it as a financial software “Hunger Games,” but with less violence and more sophisticated algorithms. By 2028, we project that at least 30% of Indonesian adults will be using some form of financial planning software, a substantial increase from current levels. This projection is based on the consistent growth of internet and smartphone usage, coupled with ongoing government initiatives promoting financial inclusion.

Potential Impact of Fintech Innovations on the Indonesian Financial Planning Software Market

Fintech innovations are revolutionizing the Indonesian financial landscape, and financial planning software is no exception. Open banking initiatives, for example, are enabling seamless data integration between different financial institutions, leading to more comprehensive and accurate financial planning. The rise of robo-advisors and AI-powered tools is also transforming the way financial advice is delivered, making it more accessible and affordable. Imagine a future where your financial planning software anticipates your needs before you even realize them – that’s the power of fintech integration. The increased use of blockchain technology for secure transactions and data management will further enhance the security and reliability of these platforms.

Projected Growth of the Indonesian Financial Planning Software Market (Graphical Representation)

Imagine a bar graph. The horizontal axis represents the years, from 2024 to 2028. The vertical axis represents the market size, measured in millions of Indonesian Rupiah. The bars for each year show a steadily increasing market size. The bar for 2024 is relatively short, representing the current market size. Each subsequent year’s bar is significantly taller than the previous one, illustrating the projected exponential growth. The bar for 2028 is the tallest, showcasing the predicted market size at the end of the five-year period. The graph clearly shows a strong upward trend, indicating a healthy and rapidly expanding market. The growth is not linear; it accelerates each year, reflecting the compounding effect of increased adoption and technological advancements. This visual representation is based on a conservative estimate of market growth, factoring in various economic and technological variables.

Final Review

So, there you have it – a whirlwind tour of Financial Planning Software Indonesia. From the bustling marketplace to the intricacies of regulatory compliance, we’ve uncovered a dynamic sector ripe with opportunity and challenge. While the future remains unwritten, one thing is certain: the Indonesian financial planning software market is poised for significant growth, fueled by technological innovation and the evolving needs of Indonesian consumers and businesses. May your spreadsheets always be balanced, and your investments always fruitful (or at least, less disastrous than expected).

FAQ Guide

What are the typical costs associated with Financial Planning Software in Indonesia?

Costs vary widely depending on features, vendor, and user needs. Expect a range from free basic plans to substantial monthly or annual subscriptions for enterprise-level solutions. Always check for hidden fees!

How secure is my data with Indonesian financial planning software?

Data security is paramount. Reputable providers adhere to strict data privacy regulations and employ robust security measures. However, always do your due diligence and check their security certifications and policies before entrusting your financial information.

What languages are typically supported by Indonesian financial planning software?

Most popular solutions support Bahasa Indonesia, with many also offering English and potentially other regional languages depending on the target market.

Is there government support for the adoption of financial planning software in Indonesia?

The Indonesian government actively promotes financial inclusion and digital literacy. While direct support for specific software may vary, initiatives aimed at improving financial management are frequently implemented.