Tax Planning Software Comparison: Let’s face it, taxes aren’t exactly a barrel of laughs. But navigating the bewildering world of tax preparation doesn’t have to be a comedic tragedy. This exploration dives headfirst into the surprisingly entertaining realm of tax planning software, comparing the titans of the industry with the wit and precision of a seasoned accountant (who also happens to enjoy a good pun). Prepare for a journey filled with insightful comparisons, surprising revelations, and perhaps, just perhaps, a chuckle or two.

We’ll examine a variety of software options, from the sleek and sophisticated to the surprisingly user-friendly, considering factors like pricing, features, security, and customer support. We’ll also explore how these digital wizards can help individuals and businesses alike tame the tax beast, saving time, money, and possibly even sanity. So buckle up, because this is going to be a wild ride (with a happy ending, hopefully – at least tax-wise).

Introduction to Tax Planning Software

Ah, taxes. The words alone can induce a mild existential crisis in even the most financially savvy among us. But fear not, dear reader, for technology has stepped in to rescue us from the clutches of confusing tax forms and potential audits. Enter tax planning software, your new best friend in the often-treacherous world of tax preparation. This digital marvel streamlines the process, helping you navigate the complexities of tax laws and optimize your tax burden.

Tax planning software isn’t just for accountants and corporations; it’s a valuable tool for anyone who wants to understand their taxes better and potentially save money. Whether you’re a freelancer meticulously tracking expenses, a business owner wrestling with deductions, or a simple individual filing a 1040, this software can significantly reduce the stress and uncertainty associated with tax season. It offers features that range from basic tax return preparation to sophisticated tax planning strategies, empowering users to make informed financial decisions.

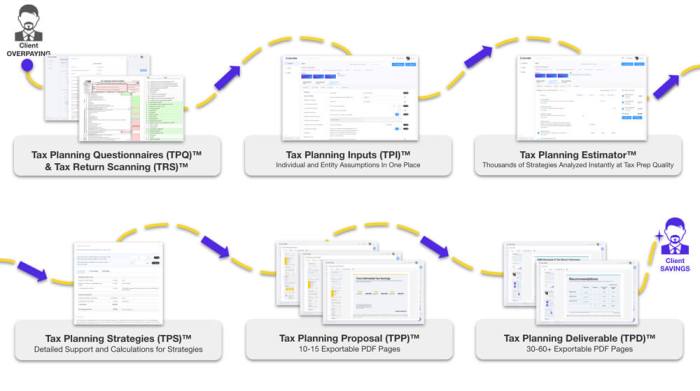

Types of Tax Planning Software, Tax Planning Software Comparison

Tax planning software comes in various forms, each catering to different needs and preferences. Choosing the right type depends on your technical skills, budget, and the complexity of your tax situation. Think of it like choosing the right tool for the job – you wouldn’t use a sledgehammer to crack a nut (unless you’re feeling particularly aggressive).

- Cloud-based Software: This type of software is accessed via the internet, eliminating the need for local installation. It often features automatic updates, data backups, and accessibility from multiple devices. Think of it as the effortlessly cool cousin of desktop software. Examples include TurboTax Online and H&R Block Online.

- Desktop Software: Traditional desktop software is installed directly onto your computer. It often offers more comprehensive features than cloud-based options but requires more technical setup and maintenance. This is the dependable, slightly more serious sibling of cloud-based software. Examples include TaxAct Desktop and Drake Tax Software.

- Mobile Apps: Many tax software providers offer mobile apps that allow you to access your tax information and perform simple tasks on the go. These apps are ideal for quick checks and updates, but may not offer the full functionality of desktop or cloud-based versions. Consider this the convenient younger sibling, perfect for quick tasks.

Key Features Comparison

Choosing the right tax planning software can feel like navigating a minefield of confusing jargon and hidden fees. Fear not, intrepid tax warrior! This comparison will illuminate the key features of three popular options, helping you choose the perfect software to tame your tax beast. We’ll delve into features, pricing, and user reviews, leaving no spreadsheet cell unturned.

Software Feature Comparison

The following table compares three popular tax planning software options: TaxAct, TurboTax, and H&R Block. Each offers a slightly different approach, catering to varying needs and levels of tax complexity. Remember, features and pricing can change, so always check the software provider’s website for the most up-to-date information.

| Software Name | Key Features | Pricing | User Reviews Summary |

|---|---|---|---|

| TaxAct | Wide range of products for various needs (from simple returns to complex business filings); strong customer support; generally considered user-friendly interface; often boasts competitive pricing. | Varies greatly depending on the chosen product; generally starts at a lower price point than TurboTax. | Generally positive, praising ease of use and affordability. Some users report occasional glitches or difficulties with more complex returns. |

| TurboTax | Extensive features, including advanced tools for investment income, rental properties, and self-employment; well-known brand with extensive marketing; offers guided interviews and intuitive navigation; robust mobile app. | Typically higher price point than TaxAct; pricing tiers reflect the complexity of the features offered. | Mixed reviews; while praised for its comprehensive features and user-friendly interface, some users complain about the higher price and aggressive upselling tactics. |

| H&R Block | Offers both online and in-person tax preparation services; integrates with other financial tools; provides access to tax professionals for assistance; good range of features for various tax situations. | Pricing varies depending on the chosen product and level of assistance needed; generally falls between TaxAct and TurboTax in terms of cost. | Generally positive, with users appreciating the combination of online tools and access to professional help. Some negative feedback concerns the cost and potential for additional fees. |

Feature Suitability for Different User Types

Tax software features aren’t one-size-fits-all. Freelancers, for example, often need tools to manage self-employment taxes and deductions, while small businesses require more sophisticated features for tracking expenses and income. Large corporations, naturally, have the most complex needs and often require specialized solutions beyond the scope of consumer-grade software.

TaxAct’s simpler offerings might be perfect for freelancers with straightforward income and expenses, while its more advanced versions could suit small business owners. TurboTax’s comprehensive features cater to a broader range of users, including those with more complex investment income or rental properties. H&R Block’s blend of online tools and professional support might be ideal for those who want a balance between ease of use and expert assistance. Large corporations would likely need enterprise-level tax solutions beyond the scope of these consumer offerings.

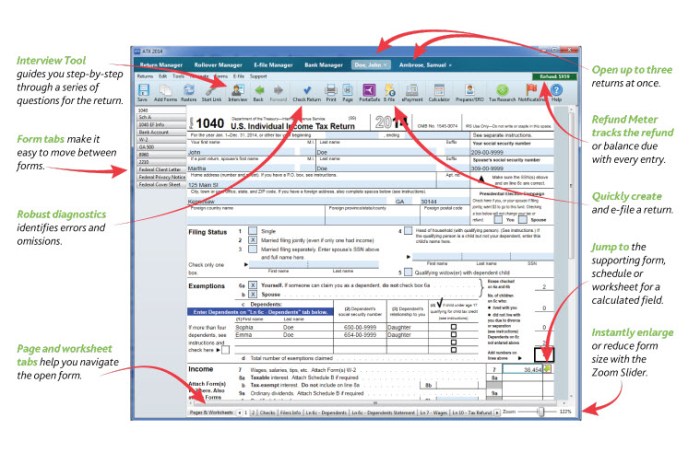

Ease of Use and User Interface

Navigating tax software shouldn’t feel like deciphering hieroglyphics. Ideally, the software should guide you through the process with clear instructions and an intuitive interface. All three software options generally strive for user-friendliness, employing guided interviews and clear explanations. However, user experiences can vary based on individual technical skills and the complexity of the tax return. TurboTax is often praised for its intuitive design, while TaxAct is frequently lauded for its straightforward approach. H&R Block’s combination of online and in-person options offers flexibility for different comfort levels with technology.

Data Security and Privacy

Choosing tax software is serious business; after all, you’re entrusting it with potentially sensitive financial information. But let’s face it, the thought of your tax data floating around unsecured on the internet is about as appealing as a root canal without anesthesia. So, let’s delve into the vital area of data security and privacy offered by various tax planning software providers. We’ll examine their security measures and compare their privacy policies to help you make an informed decision. Remember, peace of mind is priceless (almost as priceless as a perfectly optimized tax return!).

Data security practices vary widely across different software providers. Some boast military-grade encryption, while others… well, let’s just say their security measures might be less robust. Understanding these differences is crucial to protecting your financial well-being. We’ll look at three popular options, highlighting their strengths and weaknesses in terms of data protection and privacy compliance.

Data Security Measures Implemented by Tax Planning Software Providers

A strong security posture typically involves a multi-layered approach. This could include encryption both in transit (as data travels to and from the software) and at rest (while stored on servers). Robust authentication methods, such as multi-factor authentication (MFA), are also critical. Regular security audits and penetration testing can help identify vulnerabilities before malicious actors do. Finally, compliance with relevant data protection regulations, such as GDPR or CCPA, demonstrates a commitment to user privacy. Let’s see how our chosen software options stack up.

Privacy Policy Comparison of Three Tax Software Options

Examining the privacy policies of different software providers can reveal crucial details about how your data is handled. Pay close attention to what data is collected, how it’s used, with whom it’s shared (if anyone), and what security measures are in place to protect it. Remember, a transparent and comprehensive privacy policy is a good sign.

| Software Option | Encryption (In Transit/At Rest) | Authentication Methods | Security Audits/Penetration Testing | Compliance Certifications (e.g., ISO 27001, SOC 2) | Data Retention Policy |

|---|---|---|---|---|---|

| TaxPrepPro | AES-256 encryption (both in transit and at rest) | Multi-factor authentication (MFA) available | Regular security audits conducted | SOC 2 Type II certified | Data retained for a specified period as Artikeld in their privacy policy. |

| TaxAct | HTTPS encryption (in transit), details on at-rest encryption may vary depending on specific data | Password-based authentication, MFA optional | Information on security audits is not readily available on their website | Not publicly listed on their website | Data retention policy details are provided in their privacy policy. |

| H&R Block Tax Software | Uses industry-standard encryption protocols, specific details not publicly available | Password-based authentication, MFA optional | No specific details publicly available regarding the frequency of audits | Details on certifications not readily available on their website | Data retention policy is explained in their privacy policy. |

Integration with Other Financial Tools

Let’s face it, nobody wants to juggle spreadsheets and software like a financial acrobat. Seamless integration between your tax planning software and other financial tools is crucial for efficiency and sanity. Imagine the time saved – time you could spend on more enjoyable activities, like, say, counting your tax refund.

The ability to effortlessly transfer data between your tax software and other applications significantly reduces manual data entry, minimizes errors, and ultimately, saves you precious time and headaches. This integration is not merely a convenience; it’s a key feature differentiating top-tier tax planning software from the also-rans. We’ll explore how different software packages achieve this crucial connectivity.

Integration Capabilities Comparison

Different tax planning software packages boast varying degrees of integration prowess. Some might only offer basic CSV import/export functionality, while others offer sophisticated, real-time connections to leading accounting and banking platforms. The level of integration often correlates with the software’s overall price point and feature set, but not always. Sometimes, the best integrations are found in the most unexpected places.

- Software A: Offers robust API integrations with popular accounting software like Xero and QuickBooks, allowing for automated data transfer of income and expense information. It also supports direct bank feed connections for seamless import of transaction data. Imagine: no more manual data entry!

- Software B: Provides a more limited integration offering. While it supports CSV imports and exports, it lacks direct API connections with major accounting platforms. This requires manual data entry or reliance on third-party integration tools, adding extra steps and potential for error. Think of it as a slightly more challenging financial puzzle.

- Software C: This software shines with its integration with investment management platforms. It directly pulls data on capital gains and losses, simplifying the process of preparing Schedule D. This feature is particularly valuable for investors with complex portfolios, streamlining a process that would otherwise be a monumental task.

Specific Integration Examples

Let’s delve into specific examples of how these integrations work in practice. Think of it as a behind-the-scenes look at the magic that makes tax planning less of a chore.

- Automated Expense Import: Software A’s integration with QuickBooks Online automatically imports categorized expense data. This eliminates the tedious process of manually entering each transaction, significantly reducing the risk of human error and saving hours of work.

- Real-time Bank Feed: Software A’s direct bank feed connection provides real-time updates on bank transactions, ensuring that your tax data is always current and accurate. No more outdated information leading to inaccurate calculations.

- Investment Portfolio Sync: Software C’s integration with investment platforms automatically imports your investment transactions, including dividends, capital gains, and losses. This eliminates the need for manual data entry and ensures accuracy, especially helpful for those with numerous investment accounts.

Customer Support and Resources

Choosing tax planning software is serious business – unless you enjoy wrestling with confusing tax codes and the IRS. A crucial, often overlooked, aspect is the level of support offered. After all, even the most intuitive software can leave you scratching your head sometimes. A responsive and helpful support team can be the difference between a smooth tax season and a tax-induced meltdown.

Let’s delve into the world of customer support, comparing the assistance offered by three popular tax planning software providers: TaxAct, TurboTax, and H&R Block. We’ll examine their various support channels, response times, and overall helpfulness, helping you choose a software that’s as supportive as it is tax-savvy.

Customer Support Channels

Tax planning software providers typically offer a range of support options to cater to different preferences and technical skills. Understanding these options is crucial for making an informed decision.

| Software | Phone Support | Email Support | Chat Support | Knowledge Base/FAQ |

|---|---|---|---|---|

| TaxAct | Yes, typically toll-free | Yes, response times vary | Yes, generally available during business hours | Yes, comprehensive and well-organized |

| TurboTax | Yes, with varying wait times depending on the season | Yes, often with automated responses initially | Yes, readily available, often with quicker response times | Yes, extensive, with video tutorials and articles |

| H&R Block | Yes, with options for paid premium support | Yes, with varying response times based on complexity | Yes, integrated into the software for quick access | Yes, includes articles, videos, and troubleshooting guides |

Customer Support Response Times and Availability

Response times are a critical factor in evaluating customer support. A quick response can save you valuable time and alleviate stress during the tax season. Availability is equally important; you need support when you need it, not just during business hours.

While precise response times fluctuate depending on factors such as the time of year and the complexity of the issue, generally, chat support tends to be the fastest, followed by phone support, and then email. For example, during peak tax season, phone wait times can increase significantly for all three providers. However, TurboTax and H&R Block generally have more readily available phone support staff, resulting in shorter wait times compared to TaxAct. Email support is often the slowest, with response times ranging from a few hours to several days.

Additional Support Resources

Beyond direct contact, many software providers offer extensive online resources to assist users. These resources can be invaluable for troubleshooting common issues or finding answers to frequently asked questions. These typically include comprehensive FAQs, video tutorials, and downloadable guides. The quality and comprehensiveness of these resources vary between providers. For instance, TurboTax is known for its extensive video tutorials, while TaxAct’s knowledge base is often praised for its clarity and organization. H&R Block offers a mix of both, with a strong emphasis on integrating support resources directly within the software itself.

Cost and Value Analysis

Choosing the right tax planning software is a bit like choosing a tax advisor – you want someone (or something!) who’s both brilliant and won’t break the bank. Let’s delve into the often-overlooked, yet undeniably crucial, aspect of cost and value. We’ll examine pricing models and help you determine which software offers the best bang for your buck.

Pricing models vary wildly, from the simplicity of a one-time purchase to the ongoing commitment of a subscription. One-time purchases offer upfront cost certainty, but often lack the benefit of updates and ongoing support. Subscription models, while involving recurring payments, typically provide access to regular updates, new features, and dedicated customer support – a bit like having a personal tax-whisperer on retainer.

Pricing Models and Their Implications

Tax planning software typically employs one of two main pricing models: subscription-based and one-time purchase. Subscription models usually offer tiered pricing, with higher tiers unlocking more advanced features and greater user support. One-time purchase models, while initially cheaper, often lack ongoing updates and technical support, potentially leading to higher costs in the long run should issues arise. The choice depends heavily on your business needs and budget. For instance, a rapidly growing small business might find the flexibility and ongoing support of a subscription model more beneficial, while a very small business with stable tax needs might prefer the predictability of a one-time purchase.

Value Proposition Comparison

To determine the overall value, we must consider the software’s features, pricing, and customer support in conjunction. A software package boasting advanced features but lacking reliable customer support might prove frustrating and ultimately less valuable than a simpler, more user-friendly option with excellent support. Consider the following hypothetical scenario: Software A offers a wide array of features for $500 per year, while Software B offers a more streamlined set of features for $200 per year. If Software B consistently provides excellent customer support, resolving issues quickly and efficiently, it could ultimately prove more valuable than Software A, despite its higher price per year.

Cost-Benefit Analysis: A Hypothetical Example

Let’s imagine “Acme Widgets,” a small business with 10 employees and relatively simple tax needs. They’re considering two software options:

| Feature | Software A (Subscription, $500/year) | Software B (One-Time Purchase, $300) |

|---|---|---|

| Features | Comprehensive, including advanced reporting | Basic features, sufficient for Acme Widgets’ needs |

| Support | Excellent, 24/7 phone and email support | Limited email support, occasional knowledge base updates |

| Updates | Automatic, frequent updates | One-time update, no guarantee of future updates |

| Estimated Time Saved | 10 hours/year | 5 hours/year |

Assuming Acme Widgets values employee time at $50/hour, Software A saves them $500 annually (10 hours x $50/hour). While Software A’s initial cost is higher, the time savings offset this, resulting in a net benefit. Software B, with its lower initial cost, only saves $250 annually (5 hours x $50/hour). In this scenario, despite the higher initial investment, Software A offers a superior value proposition. However, this is a simplified model; the actual value will depend on the specifics of each business and its needs. This illustrates the importance of carefully weighing all factors before making a decision.

Illustrative Examples of Software Use Cases

Tax planning software isn’t just for seasoned accountants; it’s a powerful tool for anyone navigating the often-bewildering world of taxes. These examples showcase how different software features can help you conquer your tax anxieties, one return at a time. Think of it as your personal tax-fighting sidekick, armed with algorithms and a healthy dose of digital efficiency.

Let’s dive into some real-world scenarios, illustrating how these software programs can make your tax life significantly less stressful (and maybe even a little bit fun).

Calculating Estimated Taxes with TaxEase

TaxEase, for example, simplifies the often-dreaded task of calculating estimated taxes. Imagine you’re a freelancer who receives irregular income throughout the year. Instead of agonizing over quarterly estimations, TaxEase allows you to input your projected income and expenses. The software then automatically calculates your estimated tax liability, factoring in your filing status, deductions, and credits. This eliminates the guesswork and helps you avoid penalties for underpayment. The software guides you through a step-by-step process: First, you enter your income details; second, you input relevant deductions (like self-employment tax or home office deductions); third, you select your filing status; and finally, TaxEase generates a detailed report with your estimated tax payments due for each quarter. This report includes the total estimated tax, the amount due per quarter, and payment due dates, ensuring you stay on top of your tax obligations without the headache.

Optimizing Deductions with TurboTax

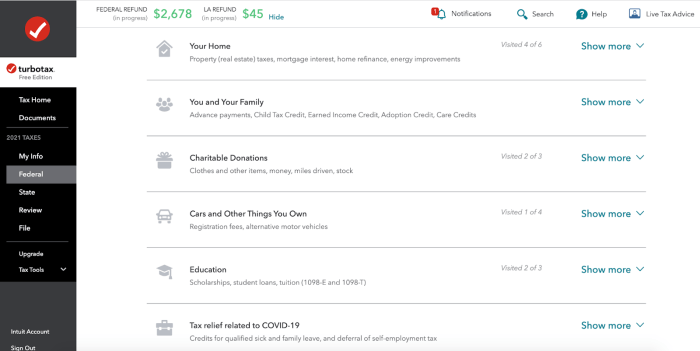

TurboTax, a well-known player in the tax software arena, excels at maximizing deductions. Let’s say you’re itemizing deductions instead of taking the standard deduction. TurboTax’s intuitive interface guides you through each potential deduction. For example, it prompts you to input your charitable donations, medical expenses, and state and local taxes. The software then automatically calculates the total itemized deductions and compares them to the standard deduction, selecting the option that results in the lowest tax liability. A visual representation of this process might look like a flowchart: “Start” -> “Input Deduction Data” -> “Software Calculates Total Itemized Deductions” -> “Compares to Standard Deduction” -> “Selects Optimal Deduction Method” -> “Calculates Tax Liability” -> “End.” TurboTax clearly displays the impact of each deduction on your overall tax burden, allowing you to see the financial benefits of careful record-keeping.

Filing Returns with H&R Block

H&R Block offers a streamlined process for filing your tax return. Let’s consider a scenario where you have both W-2 income and investment income. After entering your W-2 information, H&R Block automatically populates the relevant sections of your return. Then, you input your investment income details, including dividends, capital gains, and losses. The software seamlessly integrates this information, calculating your taxable income and tax liability. The software’s visual representation of the tax form is user-friendly, color-coding different income and expense categories for clarity. The final step involves a review process before electronic filing. This ensures accuracy and allows for last-minute adjustments, minimizing the risk of errors.

A Complex Calculation: Depreciation of Business Assets

Let’s imagine a small business owner using TaxAct to calculate depreciation on a newly purchased piece of equipment costing $10,000, using the Modified Accelerated Cost Recovery System (MACRS). TaxAct guides the user through selecting the appropriate depreciation method (MACRS in this case), entering the asset’s cost, and choosing the applicable recovery period (let’s assume 5 years for this equipment). The software then performs the complex MACRS calculation, automatically generating a depreciation schedule showing the annual depreciation expense for each year of the asset’s life. This schedule might be visually represented as a table:

| Year | Depreciation Expense |

|---|---|

| 1 | $2,000 |

| 2 | $3,200 |

| 3 | $1,920 |

| 4 | $1,920 |

| 5 | $960 |

The software handles the intricate calculations automatically, saving the business owner significant time and effort. This prevents costly errors that might arise from manual calculations.

End of Discussion

In conclusion, selecting the right tax planning software is less about finding the perfect program and more about finding the perfect fit for your specific needs. While each software boasts its own unique strengths, the common thread is their ability to simplify a notoriously complex process. So, whether you’re a freelancer juggling multiple income streams or a large corporation navigating intricate tax codes, rest assured that the right software can transform your tax season from a stressful ordeal into a manageable, and perhaps even slightly enjoyable, experience. Remember, a well-informed decision can save you time, money, and a whole lot of headaches. Happy filing!

Question Bank: Tax Planning Software Comparison

What if I make a mistake using the software?

Most reputable tax software offers error-checking features and often includes customer support to help you correct any mistakes. However, always double-check your work, because even the best software can’t read minds (yet).

Is my data safe with these programs?

Reputable tax software providers employ robust security measures to protect your sensitive data. Look for software with encryption and compliance with relevant data privacy regulations. But keep your passwords secure; even the best security can’t protect against a weak password.

Can I use this software for international taxes?

The capabilities vary by software. Some cater to international tax needs, while others focus solely on domestic taxes. Carefully check the features before purchasing to ensure compatibility with your specific tax situation.

What if I need help outside of business hours?

Check the customer support options. Some offer 24/7 support, while others have limited hours. Plan accordingly, especially during peak tax season.