Investment Tracking Tools Review: Let’s face it, managing investments can feel like navigating a minefield of spreadsheets and fluctuating numbers. But fear not, intrepid investor! This review dives headfirst into the world of investment tracking tools, exploring their benefits, features, and the sheer joy of finally understanding where your money is actually going (or, perhaps more accurately, *where it’s been*). We’ll uncover the secrets of various tools, from simple spreadsheets to sophisticated software, ensuring you find the perfect match for your investment style – whether you’re a seasoned pro or a curious newbie.

This comprehensive review covers the spectrum of investment tracking tools, categorizing them by functionality, highlighting key features (because let’s be honest, nobody wants to wade through endless jargon), and providing a practical guide to setup and usage. We’ll also delve into the crucial aspects of security, data privacy, and integration with other financial tools – because your financial future deserves nothing less than top-notch protection and organization. Get ready to conquer your investment tracking challenges with style and a healthy dose of amusement!

Introduction to Investment Tracking Tools

Let’s face it, keeping tabs on your investments can feel like herding cats – chaotic, unpredictable, and potentially leaving you with a few scratches. Investment tracking tools, however, offer a much-needed dose of order and clarity to the often-wild world of finance. They’re essentially your personal financial Sherpas, guiding you through the sometimes treacherous terrain of stocks, bonds, and other assets. These tools provide a centralized location to monitor your portfolio’s performance, simplifying a process that can otherwise feel overwhelmingly complex.

Using an investment tracking tool offers numerous benefits, ranging from the practical to the downright sanity-saving. Imagine having a clear, concise overview of your entire investment portfolio at a glance, instantly seeing gains, losses, and overall performance. No more frantic spreadsheet searches or frantic calls to your broker! Beyond the convenience, these tools provide valuable insights into your investment strategy, allowing for better decision-making and potentially improved returns. Think of it as having a financial crystal ball (albeit a slightly less mystical one).

Types of Investors Who Benefit from Investment Tracking Tools

The beauty of investment tracking tools lies in their versatility. They cater to a wide range of investors, from seasoned professionals to those just starting their investment journey. Experienced investors can use these tools to fine-tune their strategies, analyze performance across different asset classes, and identify potential areas for improvement. For novice investors, these tools provide a valuable learning experience, offering a clear and accessible way to understand how their investments are performing and how different market forces affect their portfolio. Even those with relatively simple portfolios will find the organization and insights invaluable. Essentially, anyone who wants a clearer picture of their financial landscape will find these tools beneficial.

Common Features of Investment Tracking Tools

Most investment tracking tools share a core set of features designed to streamline the investment management process. Many offer automated portfolio updates, pulling data directly from brokerage accounts to eliminate manual data entry (a huge time-saver!). They typically provide comprehensive performance reporting, including charts, graphs, and key metrics like annualized returns and risk assessments. The ability to track multiple accounts in one place is also a standard feature, providing a holistic view of your entire financial picture. Furthermore, many tools offer tax reporting features, simplifying tax season significantly. Imagine: no more scrambling for receipts and statements! Finally, many tools include features for setting financial goals and monitoring progress towards them, adding another layer of helpful organization.

Types of Investment Tracking Tools

Investing can feel like navigating a minefield of jargon and fluctuating numbers. Thankfully, we’re not stuck with quill pens and ledgers anymore! A plethora of investment tracking tools exist to help us, the humble investor, keep tabs on our financial adventures. Let’s explore the different types, their strengths, and who they’re best suited for. Think of it as a choose-your-own-adventure, but for your portfolio.

Spreadsheet-Based Tracking

Spreadsheet software, like Microsoft Excel or Google Sheets, provides a surprisingly powerful, and often free, way to track investments. The beauty of spreadsheets lies in their flexibility. You can customize them to precisely match your investment strategy, whether you’re a seasoned pro or a beginner cautiously dipping your toes into the market. However, building and maintaining a spreadsheet requires some technical know-how and a meticulous nature; otherwise, you risk inaccuracies that could impact your investment decisions.

- Pros: Customizable, free (or low-cost), granular control over data, excellent for learning the underlying mechanics of portfolio management.

- Cons: Requires technical skills, prone to human error, lacks automated features found in dedicated software, time-consuming to maintain for large portfolios.

- Target Users: Beginner investors who want to learn the ropes, investors with small, simple portfolios, those who enjoy a hands-on, customizable approach, and those comfortable with spreadsheet software.

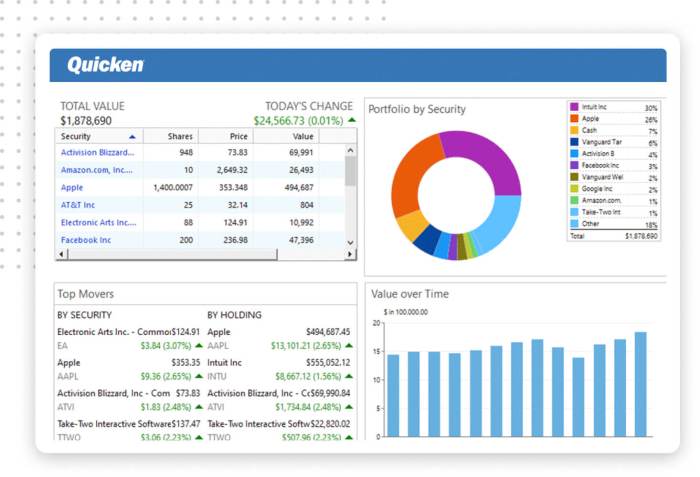

Software-Based Investment Tracking

Stepping up from spreadsheets, dedicated investment tracking software offers a more automated and user-friendly experience. These programs typically provide pre-built templates, automated data updates (often through direct connections to brokerage accounts), and sophisticated reporting features. Think of it as a spreadsheet on steroids, with a personal financial trainer built-in. However, these often come with a price tag, and the features may be more than you need if your portfolio is relatively small.

- Pros: Automated data updates, sophisticated reporting, user-friendly interface, often integrates with brokerage accounts.

- Cons: Can be expensive, features may be unnecessary for smaller portfolios, potential learning curve despite user-friendly design.

- Target Users: Investors with larger and more complex portfolios, those who value convenience and automation, and individuals who prioritize comprehensive reporting and analysis.

Mobile Investment Tracking Apps

For the investor on the go, mobile apps offer a convenient way to monitor investments anytime, anywhere. Many apps provide real-time data, basic portfolio analysis, and even allow for some trading functions. Think of them as your financial pocket pal, always ready to give you a quick update. However, these apps often lack the depth and sophistication of dedicated software or spreadsheets, especially when dealing with complex investment strategies.

- Pros: Convenient access to portfolio data, real-time updates, often free or low-cost, user-friendly interface.

- Cons: Limited functionality compared to software or spreadsheets, may lack advanced features, potential security concerns related to storing financial data on a mobile device.

- Target Users: Investors who need quick access to portfolio information, those with simpler investment strategies, and users who prefer a mobile-first approach to managing their finances.

Key Features to Consider When Choosing a Tool

Choosing the right investment tracking tool is like choosing the right pair of shoes – you need something comfortable, supportive, and stylish enough to wear every day (or at least, every time you check your portfolio). The wrong tool can lead to frustration, inaccurate data, and maybe even a few sleepless nights. Let’s explore the key features that will make your investment tracking journey a smooth, profitable ride.

Essential Features for Tracking Different Asset Classes

A good investment tracking tool should be as versatile as your investment portfolio. Whether you’re a seasoned investor juggling stocks, bonds, and real estate, or a newbie dipping your toes into the market with just a few shares, the tool needs to handle it all. This means seamless integration of different asset classes. Imagine trying to track your investments using spreadsheets – the horror! A robust tool will effortlessly accommodate stocks, bonds, mutual funds, ETFs, options, precious metals, cryptocurrencies, and even those quirky collectibles you’re secretly hoping will make you a millionaire. The ability to categorize and track performance individually, while also providing an overall portfolio view, is crucial for informed decision-making.

Security and Data Privacy Features

Your financial information is, well, your financial information. It’s as precious as a limited-edition Beanie Baby (if you were lucky enough to snag one back in the day). Therefore, robust security measures are non-negotiable. Look for tools that utilize encryption, two-factor authentication, and secure data storage practices. Read the privacy policy carefully – it’s probably more thrilling than the terms and conditions of your internet provider. Understanding how your data is protected is paramount to maintaining peace of mind. Consider tools that comply with industry-standard security protocols to ensure your investment details remain confidential and safe from prying eyes (and nefarious bots).

User Interface and User Experience, Investment Tracking Tools Review

Let’s face it, nobody wants to spend hours wrestling with a clunky, confusing interface. A good investment tracking tool should be intuitive and easy to navigate, even for a tech-challenged individual (like your Uncle Barry who still uses a rotary phone). Consider factors such as ease of data entry, clear and concise reporting, and the overall aesthetic appeal. A well-designed interface will make tracking your investments a breeze, rather than a chore. Think of it as the difference between a perfectly organized spice rack and a chaotic kitchen drawer – one is a joy to use, the other… not so much.

Investment Tracking Tool Comparison

| Feature | Tool A (Example: Personal Capital) | Tool B (Example: Mint) | Tool C (Example: Quicken) | Tool D (Example: YNAB) |

|---|---|---|---|---|

| Asset Classes Supported | Stocks, Bonds, Mutual Funds, Real Estate (limited) | Stocks, Bonds, Mutual Funds, Crypto (limited) | Stocks, Bonds, Mutual Funds, Real Estate (more robust) | Cash flow focused, limited asset tracking |

| Security Features | Encryption, Two-Factor Authentication | Encryption, Two-Factor Authentication | Encryption, Two-Factor Authentication | Encryption, Two-Factor Authentication |

| User Interface | Clean, intuitive dashboard | User-friendly, but can be cluttered | More complex interface, powerful features | Simple, straightforward interface |

| Pricing | Free (limited features), Premium subscription available | Free (limited features), Premium subscription available | Paid subscription | Paid subscription |

| Platform Compatibility | Web, Mobile (iOS and Android) | Web, Mobile (iOS and Android) | Web, Desktop (Windows and Mac) | Web, Mobile (iOS and Android) |

Setting Up and Using an Investment Tracking Tool

Embarking on the journey of using an investment tracking tool might seem like navigating a labyrinthine spreadsheet, but fear not, intrepid investor! With a little guidance, you’ll be charting your portfolio’s course with the precision of a seasoned navigator. This section will provide a clear, concise, and (dare we say) entertaining guide to setting up and utilizing your chosen tool. Think of it as your personal financial sherpa, guiding you to the summit of investment enlightenment.

The process of setting up and using an investment tracking tool varies slightly depending on the specific software or platform, but the fundamental steps remain remarkably consistent. Most tools offer intuitive interfaces designed to minimize the learning curve (although some might require a slightly steeper climb than others – we won’t name names). The key is to approach the process methodically and, of course, with a healthy dose of humor.

Creating an Account and Initial Setup

The first step, naturally, is to create an account. This usually involves providing basic personal information and choosing a secure password – something memorable yet impenetrable. Think of it as the digital equivalent of a Swiss bank vault, but hopefully with a friendlier user interface. After account creation, you’ll likely be prompted to personalize your settings, such as selecting your preferred currency, specifying your investment goals (retirement? early escape to a tropical island?), and potentially connecting your brokerage accounts. This initial setup is crucial for a seamless and efficient tracking experience.

Importing Existing Investment Data

Now for the fun part: importing your existing investments. Most tools offer several import options, including manual entry (for the truly dedicated), CSV file uploads (for those who prefer efficiency), and direct account linking (for the technologically savvy). Manual entry can be time-consuming, but it allows for meticulous control. CSV imports are usually faster, but require careful formatting. Direct account linking, when available, is the holy grail, automatically syncing your transactions – though be aware of potential security considerations and ensure you are connecting to reputable sources.

Imagine this: you’ve meticulously recorded every stock purchase, every bond acquisition, every ill-advised investment in novelty socks (we’ve all been there). Now, you can effortlessly upload this data, transforming your chaotic collection of receipts and spreadsheets into a beautifully organized portfolio overview. This is where the magic happens.

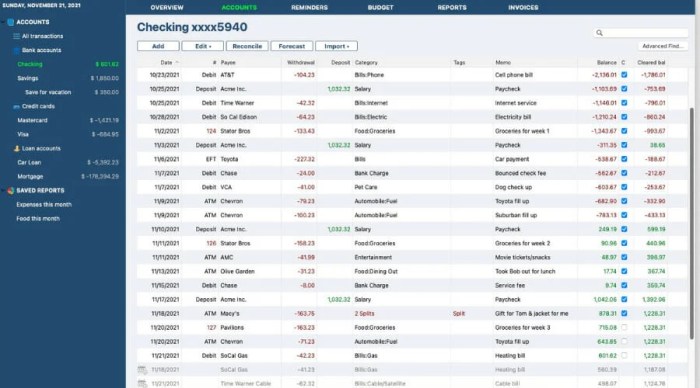

Tracking Transactions

Once your existing data is imported, the real work begins: tracking transactions. This involves diligently recording every buy, sell, dividend, and capital gains distribution. Most tools provide straightforward interfaces for this purpose, typically involving entering the date, security name, quantity, price, and transaction type. Some tools even automatically pull this information from linked brokerage accounts, saving you precious time and reducing the risk of manual errors.

Think of it like keeping a meticulous financial diary. Each entry, however small, contributes to the bigger picture, allowing you to monitor your performance, track your gains (and losses), and ultimately make more informed investment decisions. Remember, consistency is key. Regularly updating your transactions ensures the accuracy and reliability of your portfolio overview.

Advanced Features and Functionality

Investing isn’t just about buying low and selling high; it’s about strategically managing your portfolio for optimal growth and minimizing risks. While basic investment tracking tools provide a bird’s-eye view of your holdings, advanced features offer a whole new level of sophistication, transforming your investment journey from a chaotic scramble to a well-orchestrated ballet of financial finesse. These features are the secret weapons of savvy investors, helping them navigate the complexities of the market with greater confidence and precision.

Advanced investment tracking tools go beyond simple record-keeping. They provide powerful analytical capabilities that can significantly improve investment outcomes. These tools offer features like portfolio allocation analysis, tax optimization tools, and comprehensive performance reporting, enabling investors to make more informed decisions and achieve their financial goals more effectively. Imagine having a financial co-pilot that not only tracks your investments but also proactively suggests strategies for improvement – that’s the power of advanced features.

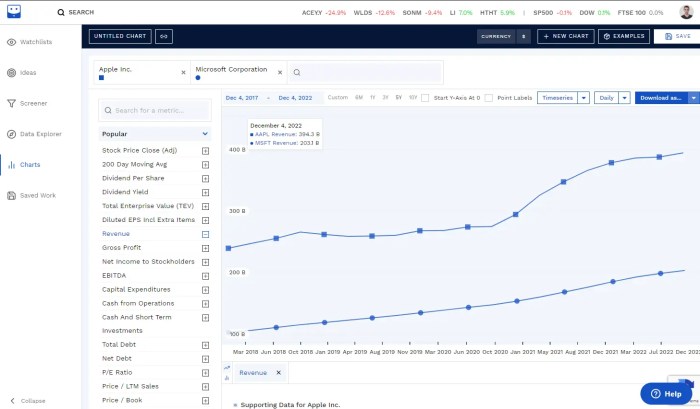

Portfolio Allocation Analysis

Portfolio allocation analysis examines the distribution of assets within your investment portfolio. It assesses the risk level, diversification, and potential returns based on your current asset allocation. This analysis typically involves calculating the percentage of your portfolio held in various asset classes (e.g., stocks, bonds, real estate, etc.) and comparing it to your investment goals and risk tolerance. For instance, an investor aiming for aggressive growth might have a higher allocation to equities, while a more conservative investor might favor a larger proportion of bonds. The tool then provides recommendations for rebalancing your portfolio to align with your desired risk profile and objectives. A well-balanced portfolio, as determined by this analysis, can significantly reduce risk while optimizing potential returns. Imagine the peace of mind knowing your portfolio is strategically aligned with your financial aspirations, rather than relying on gut feeling.

Tax Optimization Tools

Tax optimization tools are a godsend for investors, helping them minimize their tax liability while maximizing their investment returns. These tools analyze your portfolio’s performance and transactions to identify opportunities for tax-efficient investing. For example, the software might suggest harvesting capital losses to offset capital gains, strategically timing the sale of assets to minimize tax implications, or exploring tax-advantaged investment accounts like 401(k)s or IRAs. Let’s say you have a stock that has significantly depreciated in value. A tax optimization tool could advise you to sell it, realizing the loss and offsetting it against your capital gains, reducing your overall tax burden. This isn’t just about saving money; it’s about freeing up capital for future investments, accelerating your path to financial success.

Performance Reporting

Comprehensive performance reporting goes beyond simple account statements. These reports provide detailed analysis of your portfolio’s performance over time, including key metrics like annualized returns, Sharpe ratios, and alpha. This allows you to track your progress towards your financial goals, identify areas for improvement, and evaluate the effectiveness of your investment strategy. For example, a performance report might reveal that your investment in a particular sector has underperformed, prompting you to re-evaluate your allocation and potentially diversify into other sectors. This data-driven approach allows you to make adjustments based on objective metrics, rather than relying on subjective assessments. It’s like having a personal financial analyst at your fingertips, providing you with clear and concise insights into your investment performance.

Hypothetical Scenario: Maximizing Investment Outcomes

Let’s imagine Sarah, a 35-year-old investor with a $100,000 portfolio aiming for retirement in 20 years. Using an advanced investment tracking tool, Sarah analyzes her portfolio allocation and discovers it’s heavily weighted towards technology stocks, creating a higher-than-desired risk profile. The portfolio allocation analysis feature suggests rebalancing by shifting a portion of her investments into bonds and real estate to diversify and reduce risk. The tax optimization tool identifies opportunities to harvest capital losses from some underperforming stocks, offsetting gains from other investments and reducing her tax liability. Finally, the performance reporting feature allows her to track the impact of these adjustments over time, ensuring her portfolio stays aligned with her long-term goals. By leveraging these advanced features, Sarah significantly reduces her risk while potentially increasing her returns, setting herself on a stronger path towards a comfortable retirement.

Data Visualization and Reporting

Let’s face it, staring at endless spreadsheets of numbers is about as thrilling as watching paint dry. Thankfully, investment tracking tools understand this inherent human aversion to numerical tedium and offer a plethora of ways to transform raw data into digestible, even captivating, visual representations. The power of effective data visualization lies in its ability to unveil hidden trends, highlight potential risks, and ultimately, help you make smarter investment decisions. Without it, you’re essentially navigating the financial world blindfolded, hoping for the best – a strategy we strongly advise against.

Effective data visualization in investment tracking is paramount for quickly understanding complex financial information. By transforming raw data into charts and graphs, users can easily identify trends, patterns, and anomalies that might otherwise go unnoticed in spreadsheets. This allows for faster decision-making and a more comprehensive understanding of portfolio performance. Imagine trying to spot a subtle upward trend in a massive spreadsheet versus seeing it clearly illustrated on a line graph – the difference is night and day. The right visualization can be the difference between a minor adjustment and a major portfolio overhaul.

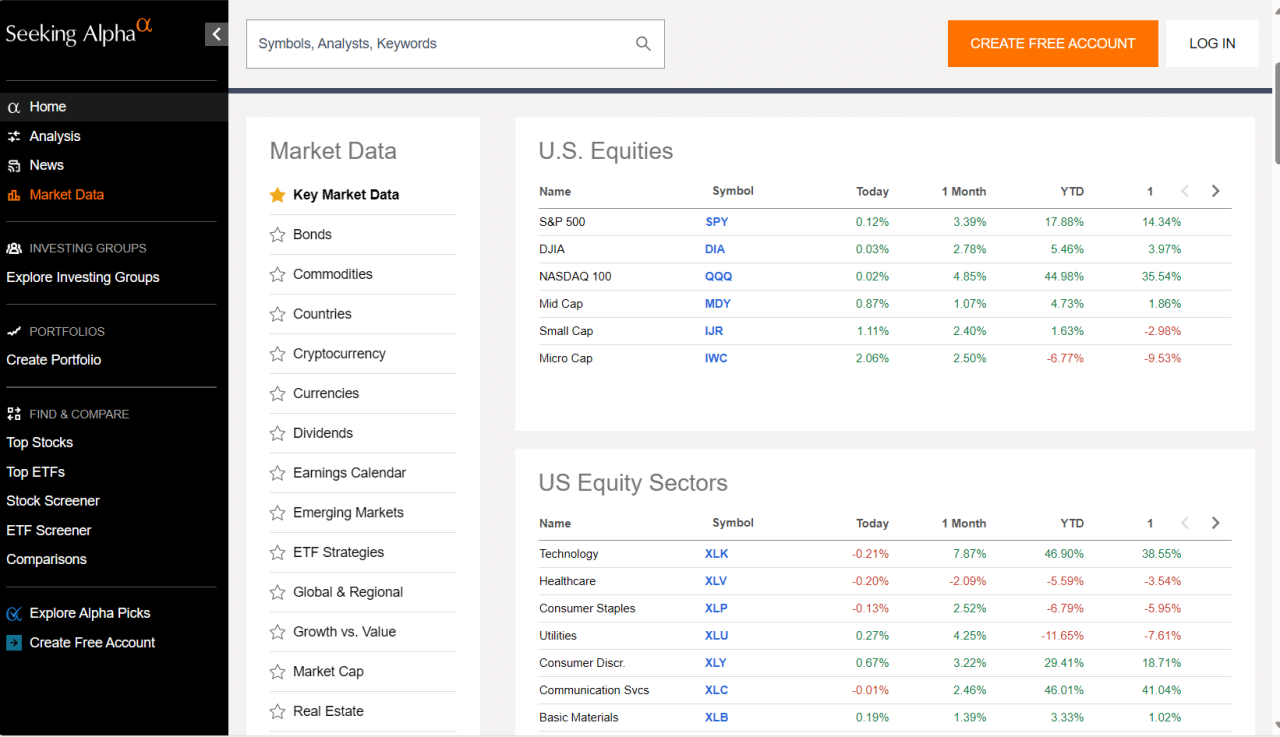

Chart Types and Reports

Investment tracking tools typically offer a range of chart types and report formats designed to present your investment data in a clear and insightful manner. These visual aids provide a snapshot of your portfolio’s performance, allowing for quick identification of areas needing attention. Common chart types include line graphs illustrating asset value over time, bar charts comparing the performance of different assets, pie charts showing asset allocation, and heatmaps highlighting risk exposure. Reports can range from simple summaries of portfolio performance to more complex analyses, including risk assessments, tax implications, and projected future returns. For example, a line graph clearly shows the growth or decline of your investments over time, while a pie chart provides an immediate understanding of how your assets are distributed across different investment categories.

Best Practices for Interpreting Investment Tracking Reports

Understanding how to interpret the information presented in your investment tracking reports is crucial for making informed decisions. Don’t just glance at the pretty pictures; dig a little deeper. Begin by understanding the time frame of the data presented. A short-term view might show volatility, while a long-term perspective reveals the overall trend. Pay attention to key metrics such as return on investment (ROI), risk-adjusted return, and Sharpe ratio. These provide a more comprehensive picture of your portfolio’s performance than simply looking at the total value. For instance, a high ROI might be misleading if accompanied by high volatility. The Sharpe ratio, which measures risk-adjusted return, offers a more nuanced perspective. Finally, always compare your portfolio’s performance to relevant benchmarks, such as market indices, to gauge how well your investments are performing relative to the overall market. Remember, context is king!

Cost and Pricing Models

Navigating the world of investment tracking tools can feel like venturing into a financial jungle – thrilling, potentially lucrative, and definitely requiring a keen eye for value. One of the most crucial considerations, often overlooked amidst the dazzling array of features, is the cost. Let’s dissect the various pricing models and help you avoid becoming another victim of unexpected expenses.

Understanding the different ways investment tracking tools charge for their services is essential for making an informed decision. While the core functionality might seem similar across platforms, the pricing structures can vary wildly, impacting your overall budget and potentially your sanity (nobody wants to be surprised by unexpected fees!). This section will clarify the common models and provide a framework for assessing their value proposition.

Subscription-Based Pricing

Subscription-based models are the most prevalent in the investment tracking software market. These typically involve recurring monthly or annual payments, offering access to the platform’s features for the duration of the subscription. The cost can vary significantly depending on the features included and the level of support offered. For example, a basic plan might offer core tracking functionalities, while premium plans include advanced analytics, portfolio optimization tools, and potentially prioritized customer support. This model is predictable, allowing for budgeting, but the long-term cost can be substantial depending on the chosen plan and subscription duration. Consider it like a gym membership – you pay regularly for ongoing access to the resources.

Freemium Pricing

Freemium models offer a basic version of the software for free, often with limitations on the number of accounts, transactions, or features. This allows users to experience the platform before committing to a paid subscription, which typically unlocks advanced features and removes limitations. While the free version might be sufficient for users with small portfolios or simple needs, it often lacks the robust capabilities and comprehensive reporting found in paid versions. Think of it like a sample pack of gourmet chocolates – tempting, but you’ll want the full box eventually.

One-Time Purchase Pricing

A less common approach, the one-time purchase model requires a single upfront payment for lifetime access to the software. This option can be appealing for users who prefer a set cost and avoid recurring expenses. However, it’s crucial to understand that this often means missing out on future updates, improvements, and potentially essential customer support. This is akin to buying a classic car – you own it outright, but maintaining it falls solely on you.

Factors to Consider When Evaluating Cost-Effectiveness

Evaluating the cost-effectiveness of an investment tracking tool requires a holistic approach. Simply focusing on the price tag is insufficient; you need to weigh it against the value received. This includes considering the features offered, the level of support provided, the ease of use, and the potential time saved through automation and improved organization. Consider your specific needs and investment portfolio size; a basic tool might suffice for a small portfolio, while a more sophisticated solution might be necessary for complex investment strategies. Remember, investing in a high-quality tool can save you time and potentially money in the long run by improving investment decisions.

Potential Hidden Costs

It’s easy to get caught up in the initial price, but many hidden costs can creep up unexpectedly. Being aware of these potential expenses is crucial for accurate budgeting.

- Data Import Fees: Some tools may charge extra for importing data from external sources.

- Integration Costs: Connecting the tool with other financial accounts or platforms might incur additional fees.

- Premium Support Charges: While basic support might be included, premium or expedited support often comes at an extra cost.

- Transaction Fees: Some tools may charge per transaction, especially if dealing with high volumes of trades.

- Upgrade Costs: Moving to a higher-tier plan with enhanced features can result in significantly higher costs.

Security and Data Protection

Protecting your investment data is as crucial as making the investments themselves. After all, what good is knowing your portfolio’s value if a mischievous goblin (or worse, a malicious actor) snatches your login details and wreaks havoc? Choosing a secure investment tracking tool isn’t just about convenience; it’s about safeguarding your financial future. Think of it as investing in a high-security vault for your digital assets – you wouldn’t leave the key under the welcome mat, would you?

Investment tracking tools handle sensitive financial information, so robust security measures are paramount. A lack of proper security can expose your data to identity theft, fraud, and significant financial losses. Imagine the horror of seeing your meticulously tracked portfolio wiped clean by a cyberattack – a truly terrifying prospect. This section will explore the vital security features you should demand from your chosen tool, ensuring your financial data remains as safe as Fort Knox (minus the armed guards, hopefully).

Data Encryption and Secure Storage

Data encryption is the bedrock of secure investment tracking. Think of it as a secret code that only the authorized user (that’s you!) can decipher. Strong encryption algorithms, like AES-256, scramble your data into an unreadable format, rendering it useless to unauthorized individuals. Secure storage, on the other hand, involves keeping your data in highly protected servers, often employing multiple layers of security, such as firewalls and intrusion detection systems. This is akin to storing your valuables in a bank vault – multiple locks, reinforced steel, and 24/7 surveillance, all working together to keep your assets safe. A reputable investment tracking tool will openly and transparently detail their encryption methods and data storage practices, providing you with peace of mind.

Multi-Factor Authentication (MFA) and Other Security Protocols

Multi-factor authentication adds an extra layer of security, like a second gatekeeper to your data. It requires more than just a password to access your account; it might involve a one-time code sent to your phone, a biometric scan, or a security token. This significantly reduces the risk of unauthorized access, even if your password is somehow compromised. Beyond MFA, look for tools that employ other security protocols such as regular security audits, penetration testing, and compliance with industry standards like SOC 2. These measures demonstrate a commitment to security that goes beyond the basics. Consider it akin to a well-guarded castle – multiple defensive layers to prevent any unwanted intruders.

Risks of Using Less Secure Tools

Using an investment tracking tool with inadequate security measures exposes you to a range of risks, from data breaches and identity theft to financial fraud. A compromised account could lead to unauthorized transactions, the alteration of your investment data, or even the complete loss of your portfolio information. This could not only cause significant financial losses but also lead to considerable stress and time spent rectifying the situation. The consequences of choosing a less secure tool can be far-reaching and devastating, so thorough due diligence is essential. It’s akin to leaving your wallet on a park bench – you might get lucky, but the risks are far too high.

Integration with Other Financial Tools

Let’s face it, managing your finances shouldn’t feel like navigating a labyrinth blindfolded. A good investment tracking tool is more than just a pretty graph; it’s a crucial cog in the well-oiled machine of your financial life. Integrating it with other financial tools can significantly streamline your processes and offer a more holistic view of your wealth. Think of it as upgrading from a rusty abacus to a high-powered financial supercomputer – albeit one that still requires occasional human intervention (because let’s be honest, robots haven’t quite mastered the art of impulse buying yet).

Integrating your investment tracking tool with other financial software offers a plethora of benefits, primarily by eliminating the tedious task of manually transferring data. This reduces the risk of errors, saves valuable time, and allows for a more comprehensive understanding of your overall financial picture. Imagine the joy of having all your financial information neatly organized in one place, readily accessible for analysis and decision-making. It’s like finding a lost sock in the dryer – pure, unadulterated bliss.

Integration with Accounting Software

Integrating your investment tracking tool with accounting software, such as QuickBooks or Xero, allows for seamless transfer of investment income and expenses. This simplifies tax preparation by providing a complete and accurate record of your investment activities. No more frantic searches for lost receipts or puzzling over spreadsheets filled with cryptic numbers! This integration ensures that your accounting records accurately reflect your investment performance, avoiding potential discrepancies and ensuring compliance with tax regulations. For example, dividend income automatically flows into your accounting software, eliminating manual data entry and reducing the risk of errors. This automated process also streamlines the year-end reporting process, saving you time and stress.

Integration with Budgeting Apps

Linking your investment tracking tool with budgeting apps like Mint or YNAB (You Need A Budget) provides a unified view of your income, expenses, and investment performance. This holistic perspective allows for better financial planning and goal setting. For instance, you can easily see how your investment returns contribute to your overall financial progress and adjust your budget accordingly. This integration facilitates informed decision-making by providing a clear picture of your financial health, helping you to make strategic choices aligned with your financial goals. Imagine the clarity: no more guessing games, just clear, concise data to guide your financial journey.

Integration with Tax Preparation Tools

Integrating your investment tracking tool with tax preparation software, such as TurboTax or H&R Block, simplifies the tax filing process. The seamless transfer of investment data eliminates the need for manual data entry, reducing the risk of errors and omissions. This integration helps to ensure accuracy and compliance with tax regulations, saving you time and potentially avoiding costly penalties. Imagine the peace of mind knowing your tax return is accurate and complete, without the headache of manually compiling investment data. It’s like finding a twenty-dollar bill in an old coat pocket – a pleasant surprise!

Hypothetical Case Study: The Case of the Organized Investor

Let’s imagine Sarah, a savvy investor who uses an investment tracking tool integrated with her accounting software, budgeting app, and tax preparation software. Previously, Sarah spent hours manually transferring data between different platforms, a process prone to errors. Now, with the integrations, she can easily track her portfolio performance, see how her investments contribute to her overall financial goals, and prepare her taxes with ease and accuracy. The time saved allows her to focus on more strategic investment decisions rather than tedious data entry. Her stress levels are significantly lower, and her financial picture is crystal clear. This improved efficiency and accuracy have allowed Sarah to achieve her financial goals faster and with greater confidence.

Final Wrap-Up: Investment Tracking Tools Review

Ultimately, choosing the right investment tracking tool is a deeply personal journey – much like finding the perfect pair of socks. (Comfort is key, right?) This review has hopefully illuminated the diverse landscape of available options, enabling you to make an informed decision based on your specific needs and investment strategy. Remember, a well-chosen tool can transform your investment management experience from a frustrating chore into a streamlined, even enjoyable, process. So go forth, armed with knowledge and a healthy sense of humor, and conquer your financial future!

Answers to Common Questions

What if I don’t have any investment experience? Can I still use these tools?

Absolutely! Many tools are designed for beginners and offer intuitive interfaces. Start with simpler tools and gradually explore more advanced features as your confidence grows.

Are these tools safe? What about data breaches?

Reputable tools employ robust security measures, including encryption and secure storage. However, always research a tool’s security practices before entrusting your sensitive financial data.

How much do these tools typically cost?

Pricing varies widely, from free options with limited features to premium subscriptions offering advanced analytics. Consider your needs and budget when selecting a tool.

Can I import data from my existing brokerage accounts?

Many tools support data import from various brokerage accounts, streamlining the setup process. Check the tool’s specifications to ensure compatibility with your accounts.