Emergency Fund Planning Tips: Navigating the unpredictable waters of life requires a sturdy financial vessel – your emergency fund. This isn’t just about stashing cash; it’s about crafting a strategic plan to protect yourself from unexpected expenses, from a surprise medical bill to a sudden job loss. We’ll explore how to determine the right fund size, choose the best savings account, and develop a sustainable savings plan that won’t leave you feeling financially shipwrecked. Get ready to set sail towards financial security!

This guide provides a comprehensive roadmap to building a robust emergency fund. We’ll cover everything from calculating your ideal savings target based on your unique circumstances to selecting the most suitable savings vehicle and implementing practical strategies to boost your savings. We’ll also discuss the crucial aspects of protecting your hard-earned savings and regularly reviewing your plan to ensure it remains effective in the face of life’s inevitable curveballs. Prepare to transform your financial anxieties into confident financial preparedness!

Defining Your Emergency Fund Needs

So, you want to build an emergency fund? Excellent! Think of it as your financial parachute – the thing that saves you from a potentially catastrophic plummet into debt-ridden despair. Let’s get down to the nitty-gritty of figuring out just how big that parachute needs to be.

Determining the ideal size of your emergency fund is less about magic numbers and more about understanding your unique financial landscape. Factors like your monthly expenses, the stability of your job, and the number of dependents you have all play a crucial role. A single, freelance graphic designer will have vastly different needs than a tenured professor with a family of four. Let’s get this straight, there’s no one-size-fits-all solution, unless your size is “financially secure.”

Emergency Fund Size Calculation

While there’s no single perfect formula, a good starting point is to aim for 3-6 months’ worth of essential living expenses. This provides a buffer for unexpected events. “Essential” is the key word here; we’re talking rent/mortgage, groceries, utilities, transportation, and minimum debt payments – not that luxury handbag you’ve been eyeing.

To calculate your needed emergency fund size, add up your monthly essential expenses and multiply by the number of months of coverage you desire (3-6).

Example: Monthly expenses = $3,000; Desired coverage = 6 months; Emergency fund goal = $18,000.

Short-Term vs. Long-Term Emergency Funds

Think of your emergency fund as a two-tiered system. The short-term fund is your quick-access safety net for minor mishaps, while the long-term fund is for those major, life-altering events. The short-term fund should ideally cover 1-3 months of expenses and be readily accessible, like in a high-yield savings account. The long-term fund, which aims for 3-6 months (or even more), can be a bit less liquid, perhaps in a money market account or a certificate of deposit.

Types of Unexpected Expenses, Emergency Fund Planning Tips

Unexpected expenses can hit hard, like a rogue wave in a calm sea. Knowing what to prepare for is half the battle. Here’s a glimpse into the potential financial storms that await:

| Expense Type | Example | Estimated Cost | Frequency |

|---|---|---|---|

| Medical Bills | Unexpected surgery, serious illness | Varies greatly, potentially tens of thousands | Unpredictable |

| Job Loss | Layoff, company closure | Equivalent to several months of living expenses | Unpredictable, but increasing in certain sectors |

| Home Repairs | Roof damage, plumbing issues | Hundreds to thousands of dollars | Unpredictable, but more frequent with older homes |

| Car Repairs | Major engine failure, accident damage | Hundreds to thousands of dollars | Unpredictable, dependent on vehicle age and maintenance |

Choosing the Right Savings Account

Let’s face it, emergency funds aren’t exactly thrilling. They’re the financial equivalent of a beige cardigan – practical, essential, but not exactly a head-turner. However, choosing the right home for your emergency cash can make all the difference between a comfortable sigh of relief during a crisis and a frantic scramble for funds. Selecting the wrong account can be like storing your emergency supplies in a sieve – everything just leaks away!

Choosing the right savings account is crucial for maximizing your emergency fund’s growth while ensuring easy access when needed. This involves carefully considering interest rates, fees, accessibility, and security features. A poorly chosen account could cost you dearly, both in potential earnings and in convenience. Think of it as choosing the right tool for the job – a sledgehammer isn’t ideal for delicate surgery, and similarly, a low-yield savings account isn’t the best choice for your emergency fund.

Savings Account Comparison

The following table compares different savings account options. Remember, interest rates and fees can fluctuate, so always check the latest information from your chosen financial institution. It’s also wise to look for accounts with FDIC insurance (in the US) or equivalent protection in your country, offering a safety net against bank failures.

| Account Type | Interest Rate | Fees | Accessibility |

|---|---|---|---|

| High-Yield Savings Account | Generally higher than traditional savings accounts, often variable. | Typically low or nonexistent, but check for monthly maintenance fees. | Easy access via ATM, debit card, online transfers, etc. |

| Money Market Account (MMA) | Usually higher than traditional savings accounts, but often with minimum balance requirements. | May have higher minimum balance requirements and potential fees for falling below the minimum. | Generally easy access, but might have limitations compared to high-yield savings accounts. |

| Certificate of Deposit (CD) | Generally higher than savings accounts, but interest rate is fixed for the term. | Early withdrawal penalties can be substantial. | Limited accessibility; funds are locked in for a specified term (e.g., 6 months, 1 year, 5 years). |

High-Yield Savings Accounts: Advantages and Disadvantages

High-yield savings accounts offer the best combination of interest rate and accessibility for emergency funds. Think of them as the Goldilocks of savings accounts – not too hot (risky), not too cold (low-yielding), but just right.

Advantages: Higher interest rates compared to traditional savings accounts, allowing your emergency fund to grow faster. Easy accessibility; you can typically access your funds whenever you need them without penalty. Often insured by the FDIC (or equivalent) providing a degree of security.

Disadvantages: Interest rates can fluctuate, potentially lowering your returns. While typically low, some banks may charge small monthly maintenance fees.

Money Market Accounts: Advantages and Disadvantages

Money market accounts (MMAs) often offer slightly higher interest rates than high-yield savings accounts, but usually come with higher minimum balance requirements. They are like the slightly more sophisticated cousin of a savings account – a bit more demanding but potentially more rewarding.

Advantages: Potentially higher interest rates than basic savings accounts. May offer check-writing or debit card features.

Disadvantages: Often have higher minimum balance requirements. Fees may apply if you fall below the minimum balance. Accessibility may be slightly less convenient than a high-yield savings account.

Certificates of Deposit (CDs): Advantages and Disadvantages

CDs offer the highest interest rates but come with a significant catch: your money is locked in for a specified period. Think of them as a financial time capsule – you get a better return, but you can’t easily access the contents.

Advantages: Generally the highest interest rates available among savings options.

Disadvantages: Early withdrawal penalties can be substantial, negating any interest earned. Limited accessibility; your money is inaccessible until the maturity date. Not suitable for emergency funds unless you have a separate, readily accessible emergency fund.

Opening a High-Yield Savings Account

Opening a high-yield savings account is generally straightforward. First, research different banks and credit unions to compare interest rates and fees. Then, select an institution that meets your needs and offers the best rate for your situation. Next, you’ll need to provide personal information such as your name, address, Social Security number (or equivalent), and possibly your driver’s license. Finally, deposit your initial funds and begin building your emergency fund! Remember to regularly monitor your account and ensure it remains adequately funded.

Developing a Savings Plan

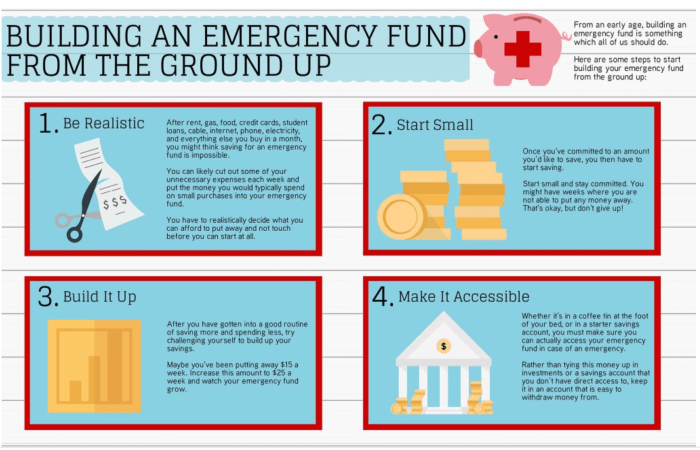

Building an emergency fund isn’t about wishing on a star; it’s about crafting a robust, realistic plan that’ll have you financially secure before you can say “unexpected plumbing emergency!” This involves setting specific goals, sticking to a budget (yes, we said it!), and employing some seriously savvy saving strategies. Think of it as a financial fitness plan, but instead of sculpted biceps, you’ll have a hefty emergency fund.

Creating a detailed savings plan requires a methodical approach, much like baking a delicious cake – you wouldn’t just throw ingredients together, would you? You need precise measurements and a step-by-step process to achieve the desired outcome. Similarly, a successful emergency fund requires a structured plan with specific targets and a timeline. This plan will guide your saving journey, ensuring consistent progress towards your financial safety net.

Realistic Savings Goals and Timelines

Setting realistic goals is paramount. Let’s say your target emergency fund is $10,000. Instead of aiming for that entire amount in one go (which would be as stressful as juggling chainsaws), break it down into smaller, more manageable chunks. For instance, you could aim for $1,000 per month for ten months. This makes the goal seem less daunting and provides a sense of accomplishment as you reach each milestone. You can even reward yourself with small, non-financial treats (like a movie night!) after each milestone is achieved. Remember, consistency is key.

Practical Strategies for Consistent Saving

Saving consistently requires a multi-pronged approach, akin to a well-trained army. Budgeting is your general, meticulously allocating resources. Reducing expenses is your reconnaissance team, identifying areas for cost-cutting. And increasing income acts as your reinforcements, bolstering your savings power.

Budgeting involves tracking your income and expenses. There are numerous apps and methods available, from simple spreadsheets to sophisticated budgeting software. The key is to understand where your money is going. Once you identify your spending habits, you can strategically cut back on non-essential expenses.

Reducing expenses involves identifying areas where you can cut back without sacrificing your quality of life. This could involve brewing coffee at home instead of buying it daily, opting for less expensive entertainment options, or renegotiating bills (like your internet or phone plan). Every little bit counts, and the cumulative effect can be substantial.

Increasing income involves exploring opportunities to earn more money. This could involve seeking a raise at your current job, taking on a part-time job, or starting a side hustle. The possibilities are vast and depend on your skills and interests.

Automated Savings Methods

Automated savings is your financial autopilot, ensuring consistent contributions to your emergency fund without requiring constant effort. Think of it as a robot diligently transferring money from your checking account to your savings account – a robot that never forgets and never sleeps! Most banks offer automatic transfers, allowing you to schedule regular transfers from your checking account to your savings account. You can set it up to transfer a specific amount each week or month, making saving effortless and consistent. For example, you could automatically transfer $200 from your checking account to your savings account every payday. This ensures that you save consistently, even if you’re busy or forgetful. This approach minimizes the risk of procrastination and ensures steady progress toward your financial goals.

Protecting Your Emergency Fund: Emergency Fund Planning Tips

Let’s face it, an emergency fund is like a superhero cape for your finances – it’s there to save the day when unexpected calamities strike. But a superhero cape is useless if it’s crumpled in a laundry basket, right? Similarly, your emergency fund needs proper protection to be truly effective. We’ve already tackled building your fund; now, let’s learn how to keep it safe and sound.

Keeping your emergency fund separate from your everyday spending money is paramount. Think of it like this: you wouldn’t keep your prized collection of vintage stamps in the same drawer as your grocery receipts, would you? The risk of accidental damage or loss is simply too high. Similarly, commingling your emergency funds with your regular spending account makes it far too easy to accidentally deplete your savings, leaving you vulnerable when a true emergency hits. The temptation to use it for non-emergencies is significantly higher if it’s easily accessible.

Separation of Emergency Funds from Spending Accounts

Maintaining a distinct emergency fund account safeguards your savings from impulsive spending. This separation provides a psychological barrier, making it less likely you’ll dip into your emergency funds for non-essential purchases. Consider using a high-yield savings account specifically designated for emergencies, and avoid linking it to your debit card for daily transactions. The added friction of transferring funds will help deter casual access. The goal is to make accessing the funds inconvenient enough to only do so in genuine emergencies.

Diversification of Savings Across Multiple Accounts

Diversifying your savings across multiple accounts is a smart strategy, similar to how investors diversify their portfolios. While it might seem excessive, it’s a powerful way to mitigate risk. Imagine keeping all your eggs in one basket – a single bank account. If that bank were to fail (although incredibly rare with FDIC insurance), you’d lose everything. By spreading your emergency fund across several accounts – perhaps a high-yield savings account, a money market account, and even a small portion in a certificate of deposit (CD) – you minimize the impact of any single account’s potential failure. This approach offers a significant layer of protection against unforeseen circumstances.

Securing Your Emergency Fund Against Theft or Loss

Protecting your emergency fund from theft or loss is crucial. Using FDIC-insured accounts is a vital step. The Federal Deposit Insurance Corporation (FDIC) insures deposits in banks and savings associations up to $250,000 per depositor, per insured bank, for each account ownership category. This means your money is protected even if the financial institution faces financial difficulties. Beyond FDIC insurance, consider reviewing your account statements regularly to detect any unauthorized transactions promptly. If you suspect any fraudulent activity, report it immediately to your financial institution and the relevant authorities. This proactive approach ensures the safety and security of your hard-earned emergency funds.

Reviewing and Adjusting Your Plan

Let’s face it, life throws curveballs. One minute you’re serenely building your emergency fund, the next you’re facing a plumbing disaster that costs more than a small car. Regularly reviewing and adjusting your emergency fund plan isn’t just a good idea; it’s financial survival training for the unpredictable rollercoaster that is adulting. Think of it as a financial tune-up, keeping your emergency vehicle in tip-top shape for when you need it most.

Regularly reviewing your emergency fund plan is crucial because your financial situation is rarely static. Job changes, unexpected medical bills, or even a sudden increase in your avocado toast consumption (we’ve all been there!) can dramatically alter your needs. Failing to adapt your plan to these changes could leave you vulnerable when an emergency strikes. Think of it like this: a perfectly planned backpacking trip can go sideways if you don’t check the weather forecast or pack for unexpected conditions. Similarly, a static emergency fund plan is unprepared for the unexpected.

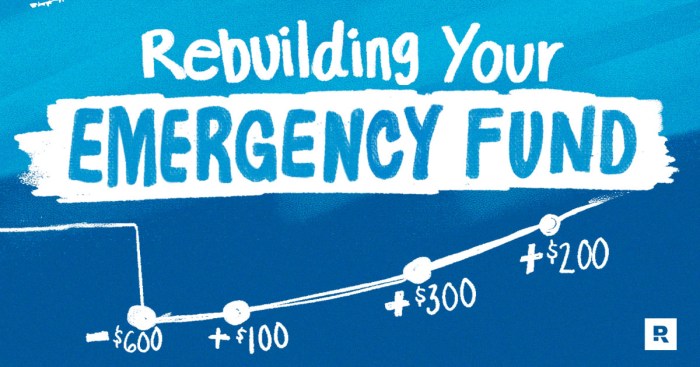

Handling Unexpected Events That Deplete Your Emergency Fund

Unexpected events, like a sudden job loss or a major car repair, can severely deplete, or even wipe out, your carefully constructed emergency fund. The key here isn’t to panic (easier said than done, we know!), but to react strategically. First, assess the damage. How much did the unexpected event cost? Then, reassess your immediate needs. Can you cut back on spending in other areas to replenish your fund? Consider seeking temporary financial assistance if necessary, such as negotiating a payment plan or exploring options like short-term loans (use with caution, of course!). Finally, once the immediate crisis has passed, revisit your emergency fund plan and adjust it to account for the unexpected event. Perhaps you need a larger emergency fund or a more robust savings plan. Remember the old adage, “An ounce of prevention is worth a pound of cure.”

Annual Emergency Fund Review Checklist

Regularly reviewing your emergency fund is vital for maintaining its effectiveness. Think of it as a yearly check-up for your financial health. Neglecting this crucial step can leave you unprepared for unforeseen circumstances. Below is a checklist of items to review annually:

- Current Emergency Fund Balance: Compare your current balance to your target savings goal. Are you on track? If not, what adjustments need to be made to your savings plan?

- Recent Expenses: Analyze your recent spending patterns. Identify areas where you can reduce expenses to increase your savings rate. Remember that unexpected expenses can significantly impact your savings goals. For example, a sudden medical bill or home repair could necessitate a reassessment of your savings plan.

- Income Changes: Have there been any changes to your income, such as a salary increase, bonus, or job change? Adjust your savings plan accordingly to take advantage of increased income or to account for a decrease.

- Debt Levels: Review your outstanding debt. High debt levels can strain your budget and reduce your ability to save. Consider strategies for debt reduction to free up more money for your emergency fund.

- Insurance Coverage: Review your insurance policies (health, auto, homeowners) to ensure adequate coverage. This can help mitigate the financial impact of unexpected events and reduce the need to dip into your emergency fund.

- Savings Account Interest Rates: Shop around for better interest rates on your savings accounts. Even a small increase in interest can add up over time.

Illustrating the Benefits of an Emergency Fund

Let’s face it, life throws curveballs. Sometimes those curveballs are metaphorical (like unexpectedly high vet bills for your prize-winning chihuahua, Princess Fluffybutt III), and sometimes they’re literal (like a rogue asteroid – though hopefully not). An emergency fund acts as your personal financial superhero cape, allowing you to gracefully sidestep, or even triumphantly swat away, these unexpected financial foes.

A well-stocked emergency fund isn’t just about avoiding debt; it’s about cultivating a sense of calm amidst the chaos. It’s the difference between panicked scrambling and confident action.

A Hypothetical Scenario: The Triumph of Penelope and Her Emergency Fund

Penelope, a freelance graphic designer, diligently saved three months’ worth of living expenses in her emergency fund. One day, her beloved laptop – her bread and butter – decided to spontaneously combust (not literally, but it was close). Repairs were exorbitantly expensive, threatening to derail her finances. However, Penelope, armed with her emergency fund, calmly paid for the repairs without needing to dip into credit cards or sacrifice her carefully planned budget. She was back to designing delightful logos within a week, her financial stability unmarred by the digital inferno. This allowed her to maintain her lifestyle, pay her bills on time, and avoid the crippling stress of unexpected debt. The moral of the story? Penelope’s emergency fund wasn’t just money; it was a shield against financial catastrophe, allowing her to weather the storm with grace and financial fortitude.

Long-Term Financial Security: Before and After

Let’s compare two individuals: Bartholomew, who lacked an emergency fund, and his financially savvy cousin, Beatrice, who had one.

| Bartholomew (No Emergency Fund) | Beatrice (With Emergency Fund) | |

|---|---|---|

| Unexpected Car Repair ($2,000) | Used high-interest credit card, incurring significant debt and interest payments. Experienced considerable financial stress. | Paid for repairs from emergency fund, maintaining financial stability and peace of mind. |

| Job Loss (3 Months) | Struggled to pay bills, fell behind on rent, and experienced significant emotional distress. Credit score plummeted. | Used emergency fund to cover living expenses for three months, allowing time to find a new job without compromising financial stability. |

| Long-Term Financial Health | Accumulated substantial debt, hindering long-term financial goals. | Maintained excellent credit score, achieved long-term financial goals on schedule. |

Emotional Benefits of a Financial Safety Net

Having an emergency fund isn’t just about numbers; it’s about emotional well-being. The peace of mind that comes from knowing you can handle unexpected expenses is invaluable. It reduces stress, improves sleep, and fosters a sense of control over your financial future. Instead of constantly worrying about “what ifs,” you can focus on your goals and enjoy life, knowing you have a financial safety net to catch you if you stumble. This increased financial confidence translates to better decision-making, both in your personal and professional life. It’s the financial equivalent of a warm hug on a cold day.

Closing Summary

Building an emergency fund isn’t just about avoiding financial ruin; it’s about cultivating peace of mind. By following these Emergency Fund Planning Tips, you’re not merely saving money; you’re investing in your future stability and resilience. Remember, a well-planned emergency fund is your financial life raft, providing a safe harbor during stormy financial seas. So, take the plunge, chart your course, and navigate towards a more secure financial future. Your future self will thank you!

Key Questions Answered

What if I already have some savings, but it’s not enough?

Start where you are! Even small, consistent contributions make a difference. Focus on gradually increasing your savings over time, adjusting your budget as needed.

Can I use my emergency fund for non-emergencies?

Resist the temptation! Using your emergency fund for non-emergencies defeats its purpose. Consider alternative financing options for planned expenses.

How often should I review my emergency fund plan?

At least annually, or more frequently if you experience significant life changes (job loss, marriage, etc.).

What if my emergency fund is depleted?

Rebuild it as quickly as possible. Re-evaluate your budget and explore ways to increase your income or cut expenses. Consider seeking financial advice if needed.