Financial Planning Firms Comparison: Navigating the often-bewildering world of financial planning can feel like trying to decipher a pirate’s treasure map written in Klingon. This guide, however, promises to illuminate the path, transforming your financial future from a murky swamp into a sun-drenched, financially secure beach. We’ll delve into the nuances of different firm types, from the independent mavericks to the commission-based buccaneers, revealing the secrets to choosing a firm that’s right for *your* treasure.

This exploration will cover key factors to consider when comparing firms, including fee structures (are we talking gold doubloons or pirate’s booty?), credentials, investment strategies, and client communication. We’ll even dissect the technology and resources offered, because even pirates need a decent Wi-Fi connection these days. Prepare for a voyage of financial discovery, one that will leave you feeling far more confident about charting your financial course.

Introduction to Financial Planning Firms

Navigating the world of personal finance can feel like trying to assemble IKEA furniture without the instructions – frustrating, confusing, and potentially leading to a wobbly outcome. Thankfully, financial planning firms exist to help you avoid a financial meltdown. They offer a range of services designed to guide you toward your financial goals, whether it’s buying a yacht (a realistic one, of course) or simply ensuring a comfortable retirement. But choosing the right firm can be a challenge in itself, so let’s shed some light on the industry.

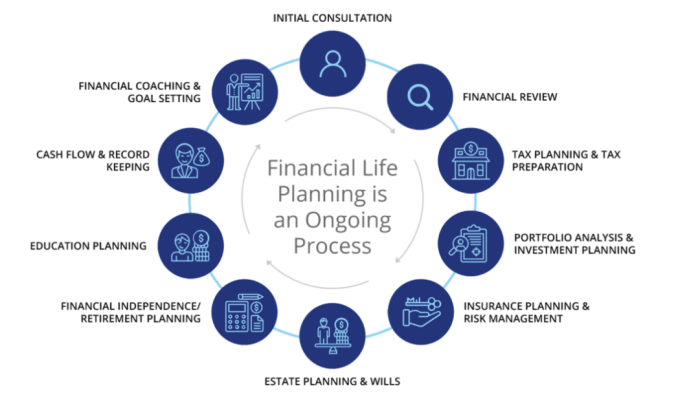

Financial planning firms provide a wide array of services to individuals and businesses, helping them manage their money more effectively. These services range from simple investment management to complex estate planning, and the complexity often depends on the type of firm and the client’s needs. The industry itself is a diverse landscape, with firms varying significantly in their structure, fees, and the services they offer. Understanding these differences is key to finding the perfect financial match.

Types of Financial Planning Firms

Financial planning firms aren’t all created equal. Just like there are different types of coffee (and let’s be honest, some are far superior to others), there are different models for how financial planners operate. This impacts their fees, their advice, and ultimately, their suitability for your specific needs. Choosing the wrong type could be as disastrous as ordering a decaf when you desperately need a double espresso.

- Independent Financial Advisors: These advisors aren’t tied to any specific financial product or company. They act as fiduciaries, meaning they are legally obligated to act in your best interest. Think of them as your financial Sherpas, guiding you through the sometimes treacherous terrain of investment options without any hidden agendas.

- Fee-Only Financial Planners: These planners charge a set fee for their services, typically based on an hourly rate or a percentage of assets under management. Transparency is their middle name. No hidden commissions or kickbacks; what you see is what you get. This model eliminates potential conflicts of interest.

- Commission-Based Financial Planners: These planners earn commissions on the financial products they sell you. While this model can be perfectly acceptable, it’s crucial to understand that their compensation is directly tied to the products they recommend. This potential conflict of interest necessitates extra vigilance on your part.

Services Offered by Financial Planning Firms

The services offered by financial planning firms are as varied as the financial goals of their clients. From the mundane (budgeting) to the magnificent (retirement planning), a good financial planner can help you achieve your dreams – or at least avoid a financial nightmare.

- Financial Planning: This encompasses a broad range of services, including retirement planning, investment management, tax planning, and estate planning. It’s the big picture stuff, the overarching strategy for your financial well-being.

- Investment Management: This involves selecting and managing investments to achieve your financial goals. This can include stocks, bonds, mutual funds, and other assets. Think of this as the tactical execution of your overall financial plan.

- Retirement Planning: This focuses on helping you save enough money to live comfortably in retirement. It involves considering factors such as your expected income, expenses, and life expectancy. This is arguably the most important service, especially if you’re hoping for more than just ramen noodles in your golden years.

- Tax Planning: This involves minimizing your tax liability through legal and ethical means. It’s all about keeping more of your hard-earned money in your pocket, rather than Uncle Sam’s.

- Estate Planning: This focuses on preserving and distributing your assets after your death. This includes wills, trusts, and other legal documents.

Key Factors to Consider When Comparing Firms: Financial Planning Firms Comparison

Choosing a financial planner is a big decision – it’s like picking a financial Sherpa to guide you up the mountain of your financial future. You wouldn’t choose a Sherpa based solely on their Instagram feed, would you? Similarly, selecting a financial planning firm requires careful consideration of several key factors to ensure a successful and rewarding climb.

Selecting the right financial planning firm is akin to choosing the right tool for a job. A hammer is great for nails, but not so much for delicate surgery. Similarly, different firms specialize in different areas and cater to different needs. Therefore, understanding your financial goals and needs is the first step in finding the perfect match.

Firm’s Fee Structure and Transparency

Transparency in fees is paramount. Imagine buying a car without knowing the final price – a recipe for financial disaster! Financial planners employ various fee structures, and understanding these structures is crucial. Hidden fees are the bane of a client’s existence, so be wary of any firm that’s less than forthcoming about its pricing. A reputable firm will clearly Artikel all fees upfront, avoiding any surprises down the line. This includes not just the planner’s fees but also any commissions or other charges associated with the recommended products or services.

Potential Conflicts of Interest

Conflicts of interest are the financial planning equivalent of a rogue ninja in your dojo. They can strike unexpectedly and derail your progress. For instance, a firm that heavily promotes its own proprietary products may prioritize its profits over your best interests. Similarly, a planner receiving commissions on the sale of specific investments might steer you toward those investments, even if they aren’t the most suitable for your financial goals. Always inquire about potential conflicts and how the firm manages them.

Experience and Qualifications

Choosing a firm with experienced and qualified planners is akin to choosing a seasoned captain to navigate your financial ship through stormy seas. Look for firms with planners holding relevant certifications, such as Certified Financial Planner (CFP®) or Chartered Financial Analyst (CFA®). These designations indicate a commitment to professional development and adherence to ethical standards. Furthermore, inquire about the team’s experience in handling situations similar to your own financial circumstances.

Client Reviews and Testimonials

Before committing to a firm, it’s wise to investigate their reputation. Client reviews and testimonials can provide valuable insights into a firm’s strengths and weaknesses. While not all reviews are unbiased, a pattern of positive feedback can be a strong indicator of a firm’s competence and client satisfaction. Conversely, a preponderance of negative reviews should raise a red flag.

Investment Philosophy and Approach

A firm’s investment philosophy and approach should align with your risk tolerance and financial goals. Do they favor a passive or active investment strategy? What is their approach to diversification? Understanding their investment philosophy is crucial to ensuring your portfolio aligns with your long-term objectives. A firm with a philosophy that clashes with your risk tolerance could lead to unexpected losses and considerable stress.

Fee Structure Comparison

| Fee Structure | Description | Pros | Cons |

|---|---|---|---|

| Hourly | Charges based on the time spent providing services. | Transparency, predictable cost for specific tasks. | Can be expensive for complex planning, unclear total cost upfront. |

| Percentage | Charges a percentage of assets under management (AUM). | Simple to understand, aligns incentives with client growth. | Can be costly for large portfolios, less suitable for smaller accounts. |

| Flat Fee | Charges a fixed fee for a defined scope of services. | Predictable cost, suitable for specific projects. | May not be flexible for evolving needs, potential for scope creep. |

Firm Credentials and Experience

Choosing a financial planning firm is a bit like choosing a surgeon – you want someone with the right qualifications and a proven track record. After all, you’re entrusting them with your financial future, which, let’s face it, is more valuable than most antique stamp collections. So, let’s delve into the crucial aspects of firm credentials and advisor experience. Ignoring these could lead to more financial headaches than a particularly aggressive tax audit.

The experience and qualifications of a financial planning firm and its advisors are paramount. A firm’s reputation is built on the expertise and success of its team, and understanding their background helps ensure you’re in capable hands. Think of it as choosing a team for your fantasy football league – you wouldn’t pick players based solely on their jersey color, would you?

Professional Certifications

Professional certifications, such as the Certified Financial Planner (CFP) designation or Chartered Financial Analyst (CFA) charter, signify a commitment to rigorous education and ethical standards. These aren’t just fancy letters after a name; they represent years of study, examinations, and a pledge to uphold a high level of professional conduct. Think of them as the gold stars of the financial world – a clear indicator of competence and dedication. A firm with advisors holding multiple CFP or CFA certifications demonstrates a higher level of expertise and commitment to professional development. For example, a firm boasting several CFP professionals would suggest a greater emphasis on comprehensive financial planning compared to a firm without such certifications. This doesn’t mean a firm without these certifications is automatically bad, but it does suggest a difference in approach and level of qualification.

Advisor Experience

Experience matters, and not just in the realm of vintage wine collecting. The length of time an advisor has been working in the industry provides valuable insight into their practical knowledge and ability to navigate market fluctuations. A seasoned advisor will likely have witnessed multiple economic cycles and possess a deeper understanding of long-term financial strategies. For instance, an advisor with 20 years of experience will likely have a broader perspective on market trends and risk management compared to a newer advisor. However, experience isn’t everything; a younger advisor with innovative approaches and specialized knowledge can also be a valuable asset. It’s a balance; you want a blend of experience and fresh perspectives.

Verifying Credentials and Client Testimonials

Don’t just take a firm’s word for it. You can independently verify their credentials through professional organizations like the Certified Financial Planner Board of Standards for CFP professionals or the CFA Institute for CFA charterholders. Websites of these organizations often allow searching for advisors by name and verifying their certification status. Client testimonials, while subjective, can provide valuable insights into a firm’s approach, communication style, and overall client experience. However, always approach testimonials with a healthy dose of skepticism. Look for testimonials that are detailed and specific, rather than generic praise. A website displaying only glowing reviews should raise a red flag; no firm is perfect, and a lack of critical feedback could indicate a lack of transparency. Consider searching for independent reviews on sites like Yelp or Google reviews to gain a more balanced perspective.

Investment Strategies and Philosophies

Choosing a financial planning firm involves more than just finding friendly faces; it’s about finding a firm whose investment philosophy aligns with your own financial temperament. Are you a thrill-seeker, ready to ride the roller coaster of high-risk, high-reward investments? Or are you more of a cautious investor, preferring the steady climb of a well-maintained staircase? The answer to this question dictates your choice of firm.

Different firms employ diverse investment approaches, each with its own set of risks and potential rewards. Understanding these approaches is crucial to finding a suitable match. Think of it like choosing a dance partner – you wouldn’t waltz with someone who only knows breakdancing, would you?

Types of Investment Strategies

Financial firms often categorize their investment strategies based on risk tolerance and investment goals. Some common approaches include value investing, growth investing, and index fund investing. Value investors seek undervalued companies with strong fundamentals, aiming for long-term growth. Growth investors focus on companies with high growth potential, even if it means accepting higher risk. Index fund investing involves mirroring a specific market index, offering diversification and lower management fees. Each approach has its own inherent risk profile and potential return. A firm specializing in high-growth tech stocks will naturally have a different risk profile than one focusing on dividend-paying blue-chip companies.

Aligning Investment Strategies with Client Goals

The importance of aligning investment strategies with individual client goals cannot be overstated. Imagine trying to fit a square peg into a round hole; it’s just not going to work. Similarly, a high-risk, high-reward strategy is inappropriate for a client nearing retirement who prioritizes capital preservation. A thorough understanding of a client’s risk tolerance, time horizon, and financial objectives is essential for developing a suitable investment plan. For instance, a young professional with a long time horizon might tolerate more risk than a retiree relying on their investments for income. A firm’s ability to tailor strategies to individual needs is a key indicator of its competence.

Assessing a Firm’s Risk Tolerance and Investment Philosophy

Assessing a firm’s risk tolerance and investment philosophy requires careful examination of their investment approach, portfolio construction methods, and past performance. Reviewing the firm’s investment policy statement (IPS) provides valuable insight into their overall investment philosophy and risk management practices. Look for transparency in their approach and a clear articulation of how they manage risk. Past performance, while not indicative of future results, can offer a glimpse into a firm’s investment style and consistency. It’s important to note that consistent outperformance of market benchmarks is rare and should be viewed with a healthy dose of skepticism. Instead, focus on the firm’s ability to consistently meet its stated investment objectives within the specified risk parameters.

Client Communication and Service

Choosing a financial planner is like choosing a life partner – you’ll be spending a considerable amount of time together, so compatibility is key. And just like a successful marriage, open and honest communication is the bedrock of a thriving financial advisor-client relationship. Without clear, consistent communication, your financial future could become a tangled mess, leaving you feeling more confused than a squirrel in a maze.

A strong financial planning firm understands this and prioritizes client communication above all else. They know that financial jargon can be as confusing as a tax code, so they strive to explain things in plain English, ensuring you understand your options and feel confident in your decisions. It’s not just about receiving statements; it’s about feeling heard, understood, and empowered.

Examples of Excellent Client Service

Exceptional client service isn’t just about prompt responses to emails (although that’s a good start!). It’s about the overall experience. Imagine a firm that proactively reaches out to discuss market fluctuations and their impact on your portfolio, not just when something goes wrong. Or picture a planner who takes the time to understand your life goals beyond just numbers – your dreams of early retirement, your children’s education, or even your plans for a world tour. This personalized approach demonstrates a genuine commitment to your well-being, going beyond the transactional nature of simply managing investments. Another example would be a firm that offers multiple communication channels, from phone calls and emails to secure video conferencing and even regular newsletters summarizing market trends in easy-to-understand language. This accessibility ensures you’re always in the loop and feel comfortable reaching out with any questions or concerns.

Desirable Characteristics of a Responsive Financial Planning Firm

A truly responsive financial planning firm possesses several key characteristics:

- Proactive Communication: They don’t wait for you to contact them; they reach out regularly with updates and insights.

- Clear and Concise Explanations: They avoid jargon and explain complex concepts in a way that’s easy to understand.

- Multiple Communication Channels: They offer a variety of ways to contact them, ensuring accessibility.

- Personalized Service: They take the time to understand your individual needs and goals.

- Prompt Response Times: They respond to your inquiries and concerns in a timely manner.

- Regular Meetings and Reviews: They schedule regular meetings to review your progress and make adjustments as needed. Think of it as a financial check-up, not just an annual physical.

- Accessible Client Portal: A secure online portal allows you to access your account information, documents, and communicate with your advisor 24/7. Think of it as your personal financial dashboard.

Technology and Resources

Choosing a financial planning firm is serious business, but let’s be honest, sometimes the tech they use can be the deciding factor. After all, who wants to feel like they’re stuck in a financial time warp? We’re comparing firms based not just on their expertise, but also on their ability to keep up with the digital age. Think of it as choosing between a sleek, modern sports car and a rusty old jalopy – both might get you there, but the journey will be vastly different.

The technology and resources a firm employs significantly impact the client experience and the efficiency of the financial planning process. Access to robust online portals, secure data storage, and sophisticated analytical tools are all crucial elements to consider. A firm’s technological prowess reflects its commitment to innovation and its ability to adapt to the ever-evolving financial landscape. Remember, we’re not just looking for spreadsheets and calculators here; we’re talking about seamless integration, real-time data, and a user-friendly experience.

Online Portals and Client Dashboards

Online portals and client dashboards offer a wealth of benefits, transforming the client experience from a series of sporadic meetings into a continuous, interactive journey. These platforms provide clients with 24/7 access to their financial information, allowing them to monitor their progress, review documents, and communicate with their advisors securely. Imagine having your entire financial life neatly organized in one place, accessible from anywhere with an internet connection – no more frantic searches for misplaced statements! This transparency fosters trust and empowers clients to actively participate in their financial planning. Furthermore, the use of such portals streamlines communication, reducing the need for lengthy email chains or phone calls, saving both time and frustration.

Comparison of Technology Features

Below is a comparison of technology features offered by various hypothetical financial planning firms. Please note that these are illustrative examples and do not represent any specific firm. The features listed are representative of the range of technologies available in the market.

| Firm Name | Client Portal Features | Data Security | Analytical Tools |

|---|---|---|---|

| Firm A | Secure document storage, account aggregation, goal tracking, messaging | 256-bit encryption, multi-factor authentication | Portfolio performance analysis, retirement projections, tax optimization tools |

| Firm B | Basic account access, limited document viewing, email communication | 128-bit encryption, password protection | Basic portfolio reporting, limited goal tracking |

| Firm C | Comprehensive financial dashboard, goal setting tools, budgeting features, automated financial reporting | 256-bit encryption, multi-factor authentication, biometric security | Advanced portfolio analytics, scenario planning, tax optimization software integration |

| Firm D | Secure messaging, document sharing, account aggregation, personalized financial news feeds | 256-bit encryption, multi-factor authentication, regular security audits | Portfolio analysis, risk assessment tools, customized financial reports |

Illustrative Examples of Firm Comparisons

Choosing a financial planning firm is like choosing a life partner – you need to find the right fit. While you won’t be exchanging vows with your financial advisor (hopefully!), the relationship will be long-term and deeply impactful. Let’s examine two fictional firms to illustrate the crucial differences you should consider.

Firm A, “Growth Guardians,” and Firm B, “Steady Sails Financial,” represent contrasting approaches to investment management. Understanding these differences will help you pinpoint your ideal match.

Growth Guardians and Steady Sails Financial: A Comparative Analysis, Financial Planning Firms Comparison

Growth Guardians focuses on aggressive growth strategies, aiming for maximum capital appreciation. Steady Sails Financial, conversely, prioritizes capital preservation and steady, albeit slower, returns. This fundamental difference shapes their investment portfolios, client profiles, and overall approach to financial planning.

Investment Portfolios: A Tale of Two Approaches

Growth Guardians’ typical portfolio is heavily weighted towards equities, including a significant allocation to growth stocks and emerging markets. Imagine a vibrant, multicolored pie chart, where a large slice (perhaps 70%) is a bright, optimistic green representing stocks, a smaller, but still noticeable, orange slice (20%) represents bonds, and a tiny sliver of blue (10%) represents cash. This portfolio boasts a high risk profile, but the potential for significant returns is equally high. Think of it as a rollercoaster – thrilling, but with some stomach-churning dips.

Steady Sails Financial, on the other hand, favors a more conservative approach. Their typical portfolio is characterized by a larger allocation to fixed-income securities, such as government bonds and high-quality corporate bonds. Visualize a calmer pie chart; a substantial blue slice (60%) represents bonds, a smaller green slice (30%) represents stocks, primarily in established, dividend-paying companies, and a more substantial beige slice (10%) representing cash. This portfolio is designed for stability and lower volatility, sacrificing some potential for explosive growth for increased security. This is more like a comfortable cruise ship – steady progress, but less excitement.

Risk Tolerance and Client Profiles

Growth Guardians’ clientele tends to be younger, with a higher risk tolerance and a longer time horizon. These are individuals comfortable with market fluctuations, understanding that higher potential returns often come with higher risk. Think of young entrepreneurs or tech professionals willing to ride the waves of the market.

Steady Sails Financial attracts clients closer to retirement or with a lower risk tolerance. These are individuals prioritizing capital preservation and income generation over aggressive growth. Imagine retirees seeking a secure income stream or individuals approaching a major life event like purchasing a home.

Choosing the Right Firm for Your Needs

Finding the perfect financial planning firm is like finding the perfect pair of shoes – you need the right fit for your feet (and your financial goals!). It’s not a one-size-fits-all situation, and choosing wisely can save you from a lot of future headaches (and potentially, a lot of money). This process involves careful consideration and a bit of detective work, but the reward – a secure financial future – is well worth the effort.

Selecting a financial planning firm that truly aligns with your individual needs and goals requires a systematic approach. Think of it as a carefully orchestrated financial symphony, where each instrument (the firm’s services) plays its part in creating a harmonious financial future for you. Ignoring this crucial step could lead to a cacophony of financial woes.

Firm Selection Process: A Step-by-Step Guide

This guide provides a structured approach to selecting a financial planning firm, ensuring a smooth and efficient process. Each step is designed to help you navigate the complexities of financial planning with confidence and clarity.

- Define Your Financial Goals: Before you even start looking, clearly articulate your short-term and long-term financial objectives. Are you saving for retirement, a down payment on a house, or your child’s education? Knowing your goals will help you identify firms with the expertise to support them.

- Identify Potential Firms: Use online resources, referrals, and professional networks to create a shortlist of firms that seem like a good fit. Consider geographic location and firm size as well. A smaller firm might offer more personalized attention, while a larger firm might have access to a broader range of resources.

- Conduct Thorough Research: Investigate each firm’s background, including their credentials, experience, and investment strategies. Check for any disciplinary actions or complaints filed against them with relevant regulatory bodies. Remember, due diligence is your best friend.

- Schedule Initial Consultations: Most firms offer free initial consultations. This is your chance to meet the advisors, discuss your financial situation, and ask questions. Pay attention to how comfortable you feel with their communication style and overall approach.

- Compare Fees and Services: Carefully compare the fees charged by different firms. Fees can vary significantly, so understanding the pricing structure is crucial. Also, compare the range of services offered – some firms specialize in certain areas, while others offer a broader spectrum of financial planning services.

- Make Your Decision: After careful consideration, select the firm that best meets your needs, preferences, and financial goals. Remember, the best firm for one person might not be the best for another. Trust your gut feeling.

Checklist of Questions for Potential Firms

Asking the right questions is essential to ensuring a successful partnership with a financial planning firm. This checklist provides a framework for a productive and informative conversation.

- What are your firm’s investment philosophies and strategies?

- What is your fee structure, and how are your fees calculated?

- What is your experience in working with clients similar to me?

- What technology and resources do you utilize to manage client accounts?

- How do you communicate with clients, and how often can I expect to hear from you?

- What is your process for addressing conflicts of interest?

- Can you provide references from current or past clients?

- What is your firm’s succession plan, ensuring continuity of service?

End of Discussion

Ultimately, choosing the right financial planning firm is a deeply personal journey. It’s about finding a firm that not only understands your financial goals but also speaks your language – whether that’s fluent “fiscal responsibility” or the more colloquial “making my money work for me.” By carefully considering the factors Artikeld in this comparison, you can confidently navigate the treacherous waters of financial planning and steer your financial ship towards a prosperous future. Remember, a well-chosen financial planner is not just a navigator; they’re your co-captain on the high seas of wealth creation.

Essential Questionnaire

What is the difference between a fee-only and a commission-based financial planner?

Fee-only planners charge fees directly for their services, avoiding potential conflicts of interest from commissions. Commission-based planners earn income through commissions on the financial products they sell.

How can I verify a financial planner’s credentials?

Check for professional certifications (CFP, CFA, etc.) and verify their registration with relevant regulatory bodies. Look for online reviews and testimonials, but always approach these with a healthy dose of skepticism.

What questions should I ask potential financial planning firms?

Inquire about their fee structure, investment philosophy, experience, client communication practices, and technology offerings. Don’t hesitate to ask about their approach to risk management and their track record.

How often should I meet with my financial planner?

This depends on your individual needs and the complexity of your financial situation. Some clients meet annually, others quarterly, while some may need more frequent consultations.